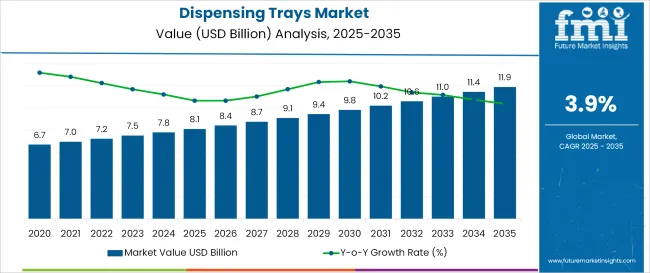

The dispensing trays market is projected to grow from USD 8.1 billion in 2025 to USD 11.9 billion by 2035, registering a CAGR of 3.9% during the forecast period. Sales in 2024 reached USD 7.7 billion. Growth has been driven by widespread usage across healthcare, diagnostics, dental, and pharmaceutical sectors, along with retail demand for precision dispensing in organized formats.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 8.1 billion |

| Market Value (2035F) | USD 11.9 billion |

| CAGR (2025 to 2035) | 3.9% |

The dispensing trays market is projected to expand at a modest pace through 2035, driven by institutional procurement from hospitals, diagnostic labs, and surgical centers. Tray systems designed for pre-packed, sterile procedures continue to see uptake as healthcare providers standardize infection control and reduce setup time.

While plastics remain the dominant material due to ease of molding and cost efficiency, pressure from waste regulations is nudging procurement teams toward recyclable and biodegradable options. End users increasingly prefer customized tray assemblies that align with procedure-specific needs and lean inventory models.

The market is segmented based on material type, product type, end users, and region. By material type, the market includes metal, paperboard, glass, biodegradable materials, and plastic-comprising polypropylene (PP), polystyrene (PS), polyvinyl chloride (PVC), high-density polyethylene (HDPE), and others.

In terms of product type, the market is categorized into custom procedure trays, first aid procedure trays, medicine dispenser trays, diagnostic and procedure trays, RFID-enabled smart trays, and others. By end users, the market comprises hospitals & clinics, medical institutions, food & beverage, cosmetics & personal care, and others. Regionally, the market is analyzed across North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and the Middle East & Africa.

Plastic remains the dominant material in the dispensing trays market, accounting for 41.2% of global revenue in 2025. Its cost efficiency, moldability, and compatibility with sterile packaging standards give it a functional edge over other substrates. Healthcare procurement favors plastics like PP and PS for their strength-to-weight ratio and clarity.

Demand is driven by institutional buyers prioritizing infection control, but growing environmental regulations act as a constraint, especially in the EU and parts of North America. Procurement officers in public hospitals increasingly factor in recyclability when tendering bulk orders.

The hidden disruptor lies in biodegradable plastics, projected to account for a small but growing portion of procurement tenders by 2030. Early adoption in Japan and Germany has triggered pilot-scale sourcing contracts, with cost markups ranging from 8%-15% over conventional trays.

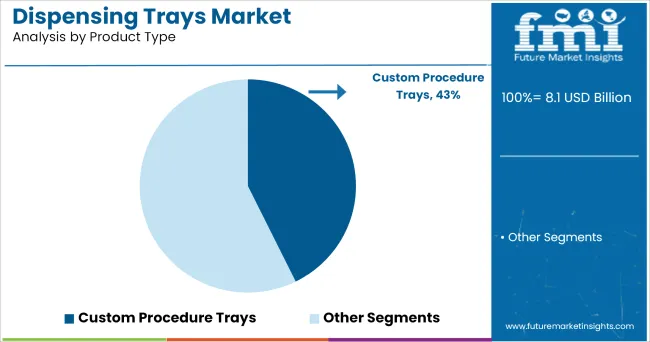

Custom procedure trays lead the product category with a 43% share in 2025, owing to their role in optimizing surgical efficiency and compliance. These trays are pre-configured for specific medical interventions, reducing prep time and minimizing instrument errors across high-throughput facilities.

Their uptake is driven by procurement trends favoring bundled solutions for repeat procedures such as orthopedic, cardiac, and diagnostic interventions. However, the upfront cost and supply rigidity in bulk ordering cycles present challenges for smaller clinics and mobile care providers.

A latent disruptor is the rise of RFID-enabled smart trays, now entering early-stage pilots in USA ambulatory centers. Though adoption remains below 2%, traceability features have reduced post-op material loss by 12% in test facilities, prompting attention from hospital chains aiming to standardize inventory.

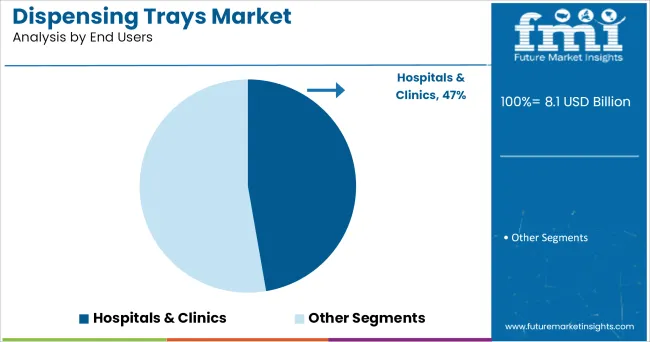

Hospitals and clinics are set to account for 47% of the global dispensing trays market in 2025, anchored by bulk procurement systems and infection control mandates. Their reliance on pre-sterilized, single-use trays ensures procedural uniformity and aligns with quality audits across surgical, diagnostic, and emergency care.

Demand is reinforced by rising day-care surgeries and expanded diagnostic services in secondary cities. However, procurement cycles are often budget-tied and delay transitions to biodegradable or tech-integrated tray systems. Non-hospital settings-such as outpatient labs and home healthcare providers-are gaining relevance but remain secondary in absolute volume.

An underexplored shift is visible in food service and personal care clinics repurposing medical-style trays for hygiene-controlled dispensing. Though these non-medical applications form a small share, they have posted 5-7% annual growth in select Southeast Asian markets, creating potential for volume spillover.

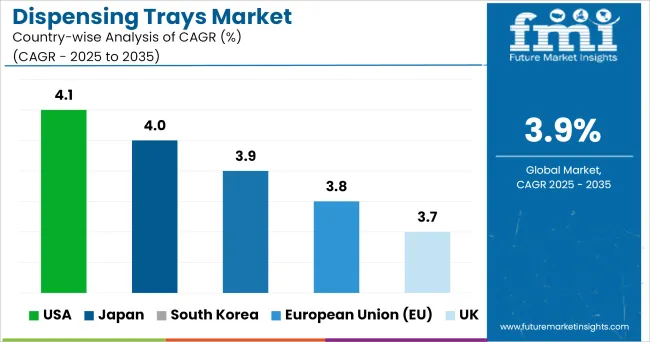

The dispensing trays market shows steady, healthcare-led growth across key economies, shaped by procurement structures, regulatory stringency, and procedural volumes. In the United States, strong institutional spending and integration of smart tray systems anchor long-term demand. The European Union remains committed to standardized tray protocols, though recyclability mandates are beginning to reshape supplier qualifications. Japan’s aging population is sustaining demand through high-frequency diagnostics and surgical interventions, while its early experimentation with biodegradable trays sets it apart.

South Korea continues to mirror Japanese trends but places stronger emphasis on modular tray formats suited for compact clinical environments. Meanwhile, the United Kingdom is pursuing leaner procurement frameworks in the NHS, with centralized sourcing that prioritizes safety compliance over customization. These five economies are expected to account for the bulk of absolute dollar growth through 2035, with shifting material preferences and end-user consolidation shaping the competitive field.

The USA dispensing trays market is projected to grow at a CAGR of 4.1% from 2025 to 2035. Growth is anchored in the dominance of group purchasing organizations (GPOs) and integrated delivery networks (IDNs), which increasingly bundle procedure-specific trays into long-term contracts. High-volume surgical centers continue to prefer disposable tray systems for compliance and workflow efficiency.

Demand for RFID-enabled trays is gaining traction within hospital chains, reflecting a broader shift toward digital inventory traceability. Regulatory oversight around sterile packaging is pushing vendors to offer verifiable barrier standards, solidifying competitive thresholds.

Japan’s dispensing trays market is expected to expand at a CAGR of 4.0% over the forecast period. With one of the highest procedural frequencies per capita globally, hospitals prioritize ready-to-use trays tailored to geriatric care. Procurement teams emphasize compact, multi-use formats that can withstand humid storage conditions and deliver thermal stability.

Long-standing policy incentives for single-use medical disposables continue to shape tray configurations. Early-stage adoption of biodegradable tray formats-especially in diagnostics-is quietly influencing supplier rotations across mid-sized regional clinics.

The dispensing trays market in South Korea is forecast to grow at a CAGR of 3.9% through 2035. The country’s healthcare system favors modular tray systems designed for space-limited urban clinics. Demand is shifting from rigid, pre-filled kits toward semi-customizable units that align with lean staffing models.

Government-backed innovation funds have enabled local suppliers to trial RFID tray variants in tertiary care hospitals, albeit at limited scale. A preference for durable plastics over eco-materials reflects cost sensitivity, but regulatory nudges around medical waste handling are starting to influence product selection.

Across the EU, the dispensing trays market is projected to grow at a CAGR of 3.8% between 2025 and 2035. The region’s unified procurement guidelines increasingly link public tenders to recyclability and material traceability thresholds.

Hospitals in Western Europe exhibit strong bias toward paperboard-backed trays in outpatient care, while Eastern Europe continues to rely on cost-effective plastic variants. Institutional buyers favor vendors offering compliance documentation aligned with MDR and CE markings. Innovation is concentrated in Northern Europe, where cross-functional tray kits for multi-step diagnostics are being piloted.

The UK dispensing trays market is set to grow at a CAGR of 3.7% over the next decade. NHS-driven frameworks have centralized tray sourcing, resulting in greater standardization but reduced variety across end users. There is growing institutional demand for procedure-specific kits tailored for mobile diagnostic units and community care programs.

Local suppliers struggle to meet rising expectations around compostable and recyclable substrates, prompting an influx of EU-based alternatives. Infection control remains the core procurement driver, but cost-per-procedure optimization has become a leading secondary filter.

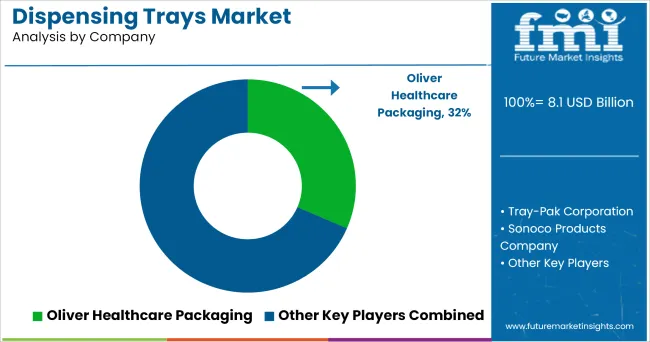

The leading players in the dispensing trays market are focusing on sterile barrier innovations, bulk institutional supply contracts, and portfolio expansion into RFID-integrated formats. Companies such as Oliver Healthcare Packaging and Thermo Fisher Scientific are scaling global production while aligning tray offerings with regional sterilization standards.

These Tier 1 firms operate under multi-year procurement agreements with hospital networks, giving them pricing leverage and first-mover access to regulatory pilot programs. Their focus remains on high-margin, procedure-specific kits that reduce hospital workload and meet traceability demands.

Tier 2 players-including Tray-Pak Corporation, Placon Corporation, and Rohrer Corporation-compete on design flexibility and mid-volume customization, often serving outpatient clinics and diagnostic chains. While they lack global manufacturing footprints, these companies are agile in adapting to non-standard tray needs and have stronger regional supply resilience. Many are now building partnerships with local recyclers to align with evolving material compliance thresholds in the EU and Japan.

Startup participation in this space remains limited due to high tooling costs and sterilization barriers. However, a few emerging players in South Korea and Germany are introducing niche, biodegradable tray formats and digitized inventory-ready kits. These entrants focus on lean manufacturing and cloud-linked tracking tags, though scalability remains a constraint. First-movers in smart tray subcategories may find licensing opportunities with larger players through 2035.

| Metric | Details |

|---|---|

| Current Total Market Size (2025) | USD 8.1 billion |

| Projected Market Size (2035) | USD 11.9 billion |

| CAGR (2025 to 2035) | 3.9% |

| Base Year | 2025 |

| Forecast Period | 2025 to 2035 |

| Historical Coverage | 2020 to 2024 |

| Units | USD Billion (Value), Units (Volume) |

| Segmentation | By Material Type; By Product Type; By End Users; By Region |

| Material Type Segments | Metal; Paperboard; Glass; Biodegradable Materials; Plastic; PP; PS; PVC; HDPE; Others |

| Product Type Segments | Custom Procedure Trays; First Aid Procedure Trays; Medicine Dispenser Trays; Diagnostic and Procedure Trays; RFID-enabled Smart Trays; Others |

| End User Segments | Hospitals & Clinics; Medical Institutions; Food & Beverage; Cosmetics & Personal Care; Others |

| Regional Coverage | North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East & Africa |

| Country Coverage | USA, Canada, UK, Germany, France, Italy, Japan, South Korea, China, India, GCC, ANZ, among others |

| Key Players | Oliver Healthcare Packaging, Thermo Fisher Scientific, Sonoco Products Company, Tray-Pak Corporation, Placon Corporation, Rohrer Corporation, West Pharmaceutical Services, Medline Industries, Nelipak Healthcare Packaging, Becton, Dickinson and Company |

| Additional Attributes | Pricing Analysis, Supply Chain, Regulatory Overview, Import/Export Trends, Opportunity Mapping |

The dispensing trays market is valued at USD 8.1 billion in 2025.

The market is projected to reach USD 11.9 billion by 2035.

The market is forecast to expand at a CAGR of 3.9% from 2025 to 2035.

Plastic is the leading material, accounting for 41.2% of the market in 2025.

Hospitals and clinics dominate, with 47% share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dispensing System Market Size and Share Forecast Outlook 2025 to 2035

Dispensing Robots Market Size and Share Forecast Outlook 2025 to 2035

Dispensing Guns Market Size and Share Forecast Outlook 2025 to 2035

Dispensing Carboy Market Size and Share Forecast Outlook 2025 to 2035

Dispensing Caps Market Growth - Demand & Forecast 2025 to 2035

Key Players & Market Share in the Dispensing Spout Industry

Market Share Breakdown of Dispensing Carboy Providers

Dispensing Spout Market by Cap & Pump Type from 2024 to 2034

Dispensing Jug Market

Dispensing Tap Market

Dispensing Sprayers Market

Beer Dispensing Machine Market Trends - Growth, Demand & Analysis 2025 to 2035

Fluid Dispensing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Twist Dispensing Closures Market Size and Share Forecast Outlook 2025 to 2035

Pouch Dispensing Fitment Market

Hinged Dispensing Caps Market Size and Share Forecast Outlook 2025 to 2035

Competitive Landscape of Hinged Dispensing Caps Providers

Spouted Dispensing Closures Market

Product Dispensing Machinery Market

Aerosol Dispensing Systems Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA