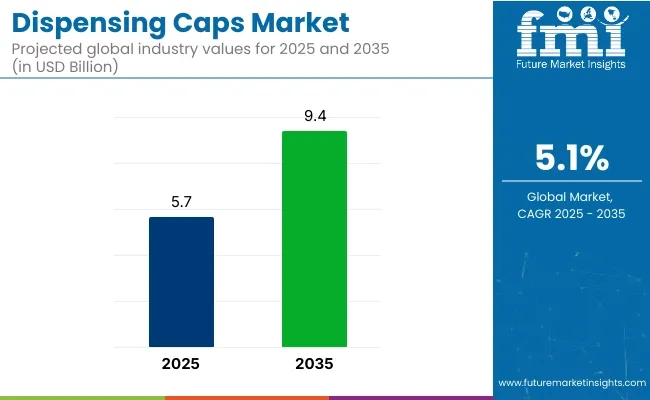

The dispensing cap market is projected to grow from USD 5.7 billion in 2025 to USD 9.4 billion by 2035, registering a CAGR of 5.1% during the forecast period. Sales in 2024 reached USD 5.3 billion, reflecting sustained demand across industries.

This expansion is driven by rising applications in food & beverage, personal care, and healthcare sectors seeking convenience, tamper evidence, and improved user experience. Additionally, sustainable alternatives and smart packaging technologies have been increasingly adopted by manufacturers to meet evolving consumer and regulatory expectations.

In 2023, PHOENIX Launched New Line of Dispensing Closures for the Consumer Healthcare Market. PHOENIX has been creating solutions for the packaging industry. Expanding their product portfolio, they are launching Mesa Nutra™, a new dispensing closure specifically developed for vitamins, minerals, and supplements.

“We have modernized the style of this dispensing closure to give our customers closure solutions that look great and enhance their brand packaging to help their products standout at retail,” said Jim Henkel PHOENIX Vice President, Sales. Mesa Nutra offers customization options, including embossed designs with one-color printing and can be produced in any color.

The adoption of eco-friendly materials, recyclable polymers, and tethered closures has played a vital role in reshaping the dispensing caps market. Product innovations now focus on minimizing plastic content without compromising dispensing control or product integrity.

Manufacturing advances, including precision injection molding and biopolymer integration, have improved efficiency and design flexibility. Additionally, compliance with Extended Producer Responsibility (EPR) mandates and circular packaging goals has encouraged companies to redesign caps for recyclability and post-consumer reuse. The integration of smart functionality such as tamper-evident and dosage-control features has further elevated product value while aligning with sustainability benchmarks.

Strong growth prospects have been forecasted for the dispensing caps market as product safety, hygiene, and user convenience continue to dominate consumer and regulatory expectations. Competitive advantage is expected to be gained by firms that prioritize lightweight materials, design versatility, and automation in manufacturing.

Regulatory frameworks such as the EU Packaging and Packaging Waste Directive (PPWD) and extended recycling mandates are likely to influence product innovations and supply chain strategies. As online retail and personal care consumption grow globally, demand for precision-engineered dispensing caps is projected to increase significantly, driving further innovation and global expansion.

The dispensing cap market is segmented based on product type, material type, end use, and region. By product type, the market includes flip-top closures, disc-top closures, and trigger closures. In terms of material type, the market is categorized into plastic comprising polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), polyvinyl chloride (PVC), polystyrene (PS), and polycarbonate and metal, which includes aluminum, stainless steel, and others.

By end use, the dispensing caps market is segmented into food & beverages, healthcare, cosmetics & personal care, chemical industries, automotive industries, and others. Regionally, the market is analyzed across North America, Latin America, Europe, South Asia, East Asia, and the Middle East and Africa.

Plastic dispensing caps have been projected to account for 61.3% of the global dispensing caps market by 2025, driven by their lightweight properties, low production cost, and adaptability across dispensing formats. Thermoplastic materials such as PP, PE, and PET have been widely used in manufacturing flip-top, push-pull, disc-top, and squeeze caps, catering to the varied flow control needs of liquid and semi-liquid products.

Injection molding and extrusion processes have been leveraged to enable mass production of consistent, tamper-evident, and custom-colored caps. Their compatibility with diverse container neck finishes and resistance to moisture and chemicals have enhanced adoption across food, personal care, and industrial applications. Ease of resealing and user-friendly operation have further contributed to their commercial appeal.

Environmental concerns have been addressed through the incorporation of recyclable resins and mono-material designs, supporting circular economy goals. Bio-based and recycled plastic variants have also been introduced to align with sustainability mandates in regulated regions. Light weighting strategies have been applied to minimize material usage while maintaining strength and functional reliability.

As global liquid packaging volumes continue to grow, plastic dispensing caps are expected to maintain their dominance due to cost-efficiency, versatility in design, and automation compatibility in high-speed capping lines. Preference for hygienic and convenient dispensing solutions is anticipated to reinforce plastic’s leadership across key market verticals.

The food & beverages segment is projected to hold 38.5% of the dispensing caps market by 2025, as manufacturers have increasingly relied on secure, tamper-evident, and portion-control caps for products such as sauces, condiments, edible oils, syrups, and dairy drinks. Consistent flow control, reseal ability, and hygiene have been prioritized in both household and foodservice packaging formats.

Dispensing caps have been applied across squeeze bottles, PET containers, and laminated tubes to offer clean and mess-free dispensing, enhancing the end-user experience. Regulatory labeling and consumer convenience have driven demand for customized cap shapes and integrated seal features, particularly in shelf-ready and takeaway packaging.

Fast-moving consumer goods (FMCG) brands have opted for colorful and ergonomically designed dispensing closures to differentiate products and increase impulse purchases. Food-safe materials and production in ISO- and FDA-compliant environments have ensured regulatory acceptance and extended shelf stability. Reclosable caps have supported preservation and waste reduction in multi-server product lines.

As packaged food consumption increases and e-commerce distribution expands in emerging markets, the demand for functional, protective, and brand able dispensing caps is expected to remain high. Innovations in cap linings, tamper bands, and child-resistant designs are projected to further strengthen adoption across the food and beverages sector.

Rising Raw Material Costs and Supply Chain Disruptions

The demand for dispensing caps is affected by the varying prices of various raw materials such as plastics, resins, and metals used to manufacture caps. Geopolitical issues, transportation constraints and environmental regulations on plastic usage lead to supply chain disruptions that add to decreased production efficiency.

These challenges must be tackled by manufacturers by adopting effective alternative materials, optimizing their sourcing strategies, and investing in localized manufacturing facilities so that they are less reliant on global supply lines.

Stringent Environmental Regulations on Plastic Waste

With governments around the world tightening regulations on plastic production and waste disposal, the Dispensing caps will also veer towards sustainable options. Laws and regulations banning single-use plastics and increasing scrutiny are forcing manufacturers to develop environmentally friendly materials, including biodegradable plastics, compostable resins and recycled content.

But there are still a long way to go to transition to sustainable materials whilst keeping products functional and affordable to produce. Hence, companies need to invest in R&D for developing eco-friendly dispensing cap innovations as per the respective regulation as well as growing consumer interest in environmentally sustainable brands.

Growing Demand for Sustainable and Recyclable Dispensing Caps

The need for increasingly sustainable dispensing caps manufactured from biodegradable, recyclable and plant-based materials is fueling the shift in the market. Food and Beverage, Personal Care, and Pharmaceutical brands are chasing water-soluble packaging as a means to improve their cachet on sustainability. As consumers and regulators push for sustainable packaging solutions, companies that invest in integrating recycled content, bio-based polymers, and closed-loop recycling systems will lead the industry.

Expansion of E-Commerce and Convenience Packaging Trends

Increasing penetration of e-commerce and changing consumer preferences towards convenient and user-centric packaging solutions are driving the demand for innovative dispensing caps. Flip-top closures, push-pull caps, and accurate dosing are gaining traction in the household care, personal care, and food & beverage sectors. The growing consumer preference for convenience-driven packaging solutions will drive demand for companies with ergonomic designs, leak-proof sealing and smart dispensing technologies.

The Dispensing caps market is likely to witness substantial growth with the emergence of sustainable packaging initiatives, rising e-commerce penetration and modernization of closure designs between 2020 and 2024. In response to these changing consumer and regulatory demands, companies turned their efforts towards lightweight cap designs, tamper-evident closures, and recyclable material integration.

Nevertheless, industry growth was impacted by factors like fluctuating resin prices, recycling limits and growing sustainability mandates. In turn, companies responded by investing into material innovation, scaling up its production processes digitally, and developing circular economy models.

Dreamy smart dispensing technologies, AI-based packaging automation, and next-gen biodegradable materials. The era of antimicrobial coatings, self-sealing mechanisms and IoT enabled dispensing systems will change the panorama. To complement this, custom and configurable cap designs, as well as the growth of refillable packaging solutions, will influence the dispensing caps market. The next phase of market expansion will be led by companies that prioritize sustainability, smart packaging and consumer-centric innovation.

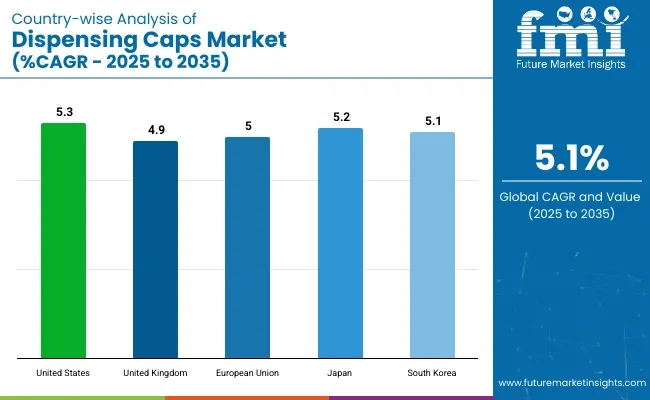

The Dispensing caps market in the United States is likely to be the largest, due to the growing demand for convenience packaging, and rising adoption of sustainable materials along with a strong presence of prominent packaging manufacturers. Market growth continues as companies develop easy to use and spill-resistant closures.

Increasing demand for innovative cap designs for flip-top, push-pull, and squeezable dispensing mechanisms widely support the market growth. Also, tamper-evident and child-resistant functionality is making products safer and more compliant. Companies are also working towards creating biodegradable and recyclable dispensing caps to comply with environmental regulations. Demand in the USA market is also driven by the growing penetration of dispensing caps in personal care, household cleaning, and food & beverage sectors.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.3% |

Rising demand for sustainable packaging solutions, demand for eco-friendly materials and increasing consumer demand for functional and ergonomic designs is anticipated to drive growth of the dispensing caps market in the United Kingdom. Additionally, the focus on plastic waste alternatives is helping the market build.

Increasing government regulations promoting recyclable and compostable packaging with growing innovations in precision dosing and one-hand operation dispensing caps help grow the market. Also, innovations such as flip-top caps, controlled flow spouts, and resealable closures have attracted immense traction.

To minimize material usage without compromising on product quality, companies are investing in dispensing caps that are lightweight yet strong. Growing demand for refillable packaging and minimalistic designs is benefiting the UK market. The growth of e-commerce is also fuelling Spice Up and the demand of spill-proof and travel-friendly packaging are accelerating the innovation in dispensing cap.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.9% |

By Region, Germany, France, and Italy are the major players of the European Dispensing caps market as they will be driven by strong regulatory provisions toward sustainable packaging solutions, growing demand for innovative closure solutions, and growing technological advancement of dispensing caps in cosmetics and pharmaceuticals.

Investments in bio-based and compostable cap materials fuel fast-moving market development, alongside the European Union's maintenance on circular economy initiatives. Moreover, the usage of anti-drip, vented, and precision-controlled dispensing caps are enhancing functionality and product differentiation. Market growth is also driven by dietary, beverage, and home care sectors' increased demand for custom-designed with brand-enhancing packaging solutions.

The adoption of smart packaging technologies, including metered dispensing systems and self-sealing mechanisms, is also driving increased uptake across the EU.] Additionally, strict plastic reduction policies are enabling a shift to recyclable dispensing caps faster.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.0% |

The growth of the Japan dispensing caps market is further attributed to the country’s emphasis on precision packaging, growing preference for ergonomic designs, and demand for leak-proof closures for food and personal care packaging. Market Dynamics the rise in demand for small, lightweight, and user-friendly dispensing systems is propelling growth of the market.

The technology-driven focus along with the collaboration of air-tight sealing, controlled flow devices, and multi-functional caps in the country is driving innovations. In addition, stringent government norms related to packaging waste reduction and rising consumer inclination towards refillable and sustainable packaging is promoting companies to manufacture high quality, environment friendly dispensing solutions.

The growing requirement for innovative dispensing caps in cosmetics, personal care, and health supplement packaging is further propelling the growth of the Japan dispensing cap market. Moreover, Japan's investment in smart packaging technologies and IoT-enabled dispensing systems is shaping the industry's future.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.2% |

Growing demand for sustainable and user-friendly packaging, high adoption of airless and spillage-free designs, as well as increasing emphasis on product safety and convenience are driving growth in the dispensing caps market in South Korea.

The market will be driven by stringent government formulations favoring the use of eco-friendly packaging material alongside growing investments in light-weight, high-barrier, and ergonomically dispensing caps. Also helping competitiveness is the country’s dedication to increasing dispensing precision via metered dosing, self-cleaning nozzles, and tamper-proof closures.

Moreover, the increasing number of innovative caps, particularly for cosmetic, pharmaceuticals, and beverage packaging will also propel the market adoption. Organizations are turning to hybrid materials, bioplastic alternatives and AI-based dispensing solutions in an effort to enhance performance and maintain sustainability. The growth of refillable packaging models and the increased demand for smart dispensing solutions in South Korea is further fuelling the demand for advanced dispensing caps.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.1% |

The dispensing caps market is witnessing strong growth and is expected to expand due to the increasing demand from food & beverage, healthcare, personal care and industrial packaging applications.

To this end, you are seeing companies invest in innovative cap designs, easy dispensing mechanisms and sustainable materials to improve convenience and minimize plastic waste. The major trends observed in the market are flip top closures, disc top caps, tamper evident and biodegradable dispensing solutions.

The overall market size for dispensing caps market was USD 5.7 billion in 2025.

The dispensing caps market expected to reach USD 9.4 billion in 2035.

Key drivers of the dispensing caps market include demand for convenient and controlled product utilization, growing usage in food, beverage, and personal care sectors, and an emphasis on sustainable and recyclable packaging solutions.

The top 5 countries which drives the development of dispensing caps market are USA, UK, Europe Union, Japan and South Korea.

Flip-top and disc-top closures drive growth to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hinged Dispensing Caps Market Size and Share Forecast Outlook 2025 to 2035

Competitive Landscape of Hinged Dispensing Caps Providers

Dispensing System Market Size and Share Forecast Outlook 2025 to 2035

Dispensing Robots Market Size and Share Forecast Outlook 2025 to 2035

Dispensing Guns Market Size and Share Forecast Outlook 2025 to 2035

Dispensing Trays Market Size, Share & Forecast 2025 to 2035

Dispensing Carboy Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in the Dispensing Spout Industry

Market Share Breakdown of Dispensing Carboy Providers

Dispensing Spout Market by Cap & Pump Type from 2024 to 2034

Dispensing Jug Market

Dispensing Tap Market

Dispensing Sprayers Market

Beer Dispensing Machine Market Trends - Growth, Demand & Analysis 2025 to 2035

Fluid Dispensing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Twist Dispensing Closures Market Size and Share Forecast Outlook 2025 to 2035

Pouch Dispensing Fitment Market

Spouted Dispensing Closures Market

Product Dispensing Machinery Market

Aerosol Dispensing Systems Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA