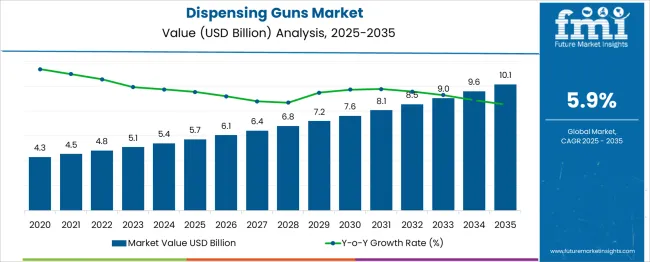

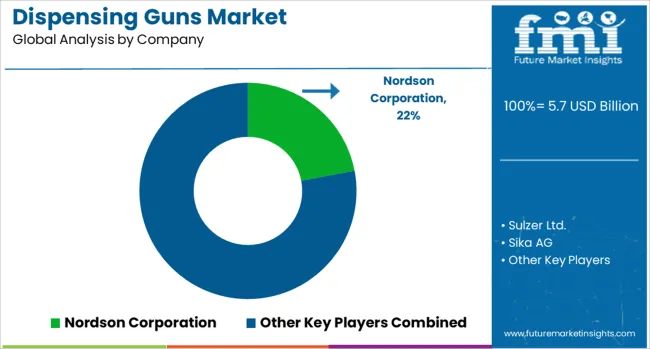

The Dispensing Guns Market is estimated to be valued at USD 5.7 billion in 2025 and is projected to reach USD 10.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.9% over the forecast period. This inflection point is projected to be driven by accelerated adoption in the construction and automotive sectors, where precision adhesive systems are being favored over legacy equipment.

The transition from manual to semi-automated and battery-assisted variants is expected to gain momentum around this stage, contributing to both volume and value growth. The second breakpoint is anticipated by 2032 when the market crosses the USD 9.0 billion mark. At this stage, digital integration, real-time pressure control, and IoT-enabled dispensing tools are likely to become standard in high-throughput industries. Suppliers lacking modular upgrade options are projected to lose relevance as users seek flexible configurations for fast material changeovers and reduced downtime. Between 2029 and 2032, product performance expectations are expected to increase, driven by precision requirements in electronics assembly, advanced composites, and packaging. These breakpoints indicate a shift toward value-led expansion rather than volume-driven growth, reshaping the competitive landscape and tightening market entry barriers for generic players.

| Metric | Value |

|---|---|

| Dispensing Guns Market Estimated Value in (2025 E) | USD 5.7 billion |

| Dispensing Guns Market Forecast Value in (2035 F) | USD 10.1 billion |

| Forecast CAGR (2025 to 2035) | 5.9% |

The dispensing guns market accounts for approximately 30–35 % of the overall dispensing systems segment, driven by demand for handheld tools used in controlled material application. It represents around 20–25 % of the adhesive and sealant application equipment market due to its use in bonding, sealing, and gap-filling processes. In the industrial automation tools sector, it contributes 15–18 %, supporting semi-automated and manual workflows across production environments. The construction equipment tools category sees a 10–12 % share, where dispensing guns are applied in insulation, waterproofing, and glazing. In the electronics and automotive assembly tool market, its share remains at 5–7 %, addressing high-precision needs in circuit encapsulation, gasketing, and component fastening. Dispensing guns are evolving with a focus on cordless and battery-powered models that improve usability and reduce operator strain.

Flow-rate control, real-time monitoring, and material usage tracking are becoming core features in electric variants. Industrial users are integrating these tools into robotic arms and automated lines for repeatable dispensing in high-speed production. Ergonomic enhancements, lighter materials, and noise-reducing components are being adopted to meet worker safety and productivity standards. Demand for low-waste applications in sealants and adhesives is shaping nozzle design and extrusion control. These developments reflect a transition toward precise, operator-friendly tools that perform consistently in assembly, construction, and industrial settings.

The market growth is being driven by rising automation in manufacturing and assembly processes, particularly in sectors such as construction, automotive, electronics, and aerospace. Growing attention toward improved material handling and reduced wastage has led to broader adoption of controlled dispensing technologies.

The need for greater accuracy and time efficiency in applying adhesives and sealants has fueled innovation in dispensing gun systems that are lightweight, durable, and compatible with advanced material formulations. Environmental considerations and compliance requirements are also prompting a shift toward cleaner and more sustainable application technologies.

In addition, increasing investments in construction and infrastructure development, particularly in emerging economies, are expected to sustain demand for high-performance dispensing solutions. As users demand tools that balance reliability with ease of use, manufacturers are continuing to enhance designs that support both manual operation and software-driven precision..

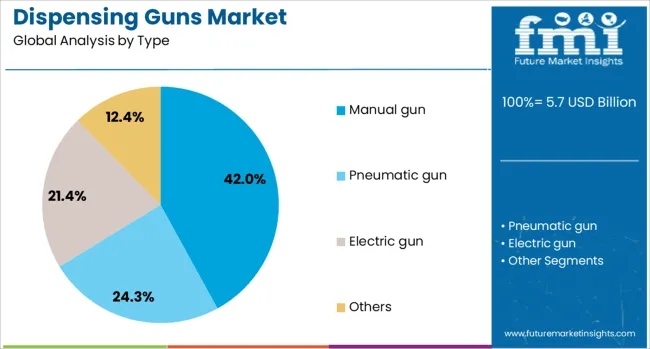

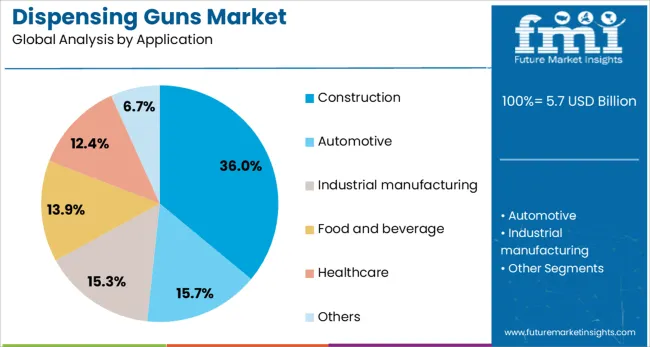

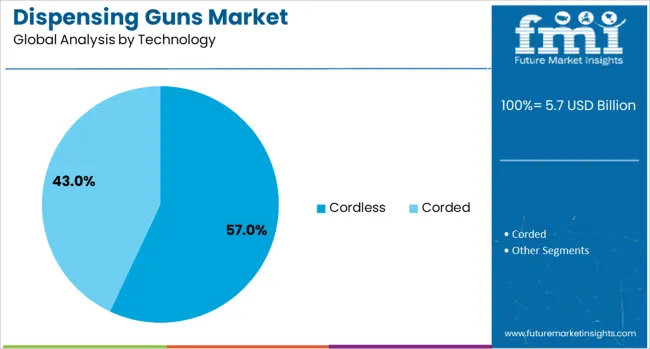

The dispensing guns market is segmented by type, application, technology, material, distribution channel, and geographic regions. The dispensing guns market is divided by type into Manual guns, Pneumatic guns, Electric guns, and Others. In terms of application, the dispensing guns market is classified into Construction, Automotive, Industrial manufacturing, Food and beverage, Healthcare, and Others. The dispensing guns market is segmented into Cordless and Corded.

The dispensing guns market is segmented by material into Metal and Plastic. The distribution channel of the dispensing guns market is segmented into Offline and Online. Regionally, the dispensing guns industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The manual gun segment is expected to account for 42% of the Dispensing Guns market revenue share in 2025, positioning it as the leading type. Its dominance has been driven by affordability, mechanical simplicity, and suitability for both professional and do-it-yourself applications. Manual guns have remained in demand in sectors where power supply limitations or mobility needs make cordless or pneumatic tools less feasible.

Their lightweight design and minimal maintenance requirements have contributed to strong user adoption, particularly in cost-sensitive markets. These dispensing guns have also been favored for their intuitive handling and low learning curve, which reduces training time and operational risks. In settings that require flexible, short-run applications or occasional use, manual dispensing tools have continued to deliver consistent performance.

The availability of rugged manual models compatible with modern adhesive systems has further supported their relevance. As businesses and contractors prioritize durable yet economical solutions, the manual gun type has maintained a strong position in the global dispensing landscape..

The construction application segment is projected to hold 36% of the Dispensing Guns market revenue share in 2025, making it the largest application area. This leadership has been supported by increased investments in commercial and residential infrastructure projects across developed and developing regions. Dispensing guns have played a vital role in applying sealants, adhesives, and bonding agents for structural insulation, waterproofing, flooring, and joint sealing tasks.

The ability to precisely control material flow has improved workmanship and reduced waste, aligning with quality and sustainability goals. Manual and cordless dispensing systems have both been widely adopted in the construction sector due to their portability, durability, and ease of use at job sites.

As green building standards and energy-efficient construction practices gain traction, demand has grown for precision application tools that enhance material performance and reduce thermal bridging. The reliability and versatility of dispensing guns in harsh and variable environments have reinforced their value in construction workflows..

The cordless segment is anticipated to capture 57% of the Dispensing Guns market revenue share in 2025, making it the most prominent technology type. Its widespread adoption has been attributed to the operational freedom and efficiency it offers across a variety of industrial and field-based applications. Cordless dispensing guns have eliminated the need for external power sources or compressed air, allowing workers to perform precise material applications in locations with limited access to utilities.

The inclusion of high-capacity lithium-ion batteries, lightweight housings, and ergonomic controls has made these tools ideal for extended use. Their ability to deliver consistent dispensing pressure and flow control has enhanced accuracy and reduced material waste.

The rise of cordless platforms that integrate with smart systems and digital interfaces has further supported their growth, especially in settings that require traceability and process optimization. The productivity benefits and enhanced worker mobility provided by cordless dispensing guns have positioned this technology as a critical component of modern assembly and construction operations..

Growth in the dispensing guns market has been driven by rising industrial demand for precise application of adhesives, sealants, and lubricants. The electronics, automotive, and construction sectors have adopted dispensing guns to enhance accuracy, reduce waste, and increase process efficiency. Electric and pneumatic models have gained preference due to ergonomic design and improved flow control. Expansion in emerging manufacturing hubs has contributed to increased usage of these tools, especially in applications requiring controlled material volumes and repeatability. Product compatibility with evolving materials has supported diversified industrial adoption.

Increasing complexity in assembly and bonding processes has elevated the need for dispensing guns offering precise material delivery. Over half of electronics manufacturing operations utilize dispensing guns for PCB assembly to meet fine tolerance requirements. In the automotive sector, pneumatic and electric guns have been widely implemented to ensure consistent sealant and adhesive placement during vehicle assembly. The construction industry has expanded adoption for insulation and weatherproofing sealants, where controlled flow rates enhance material efficiency. Ergonomic improvements and volume-adjustable features have supported higher productivity and operator comfort in high-throughput production lines.

High upfront costs of automated and battery-powered dispensing guns present challenges for small and medium enterprises. Maintenance requirements, including calibration and sensor upkeep, have been reported to increase downtime by approximately 20% in some manufacturing setups. Compliance with regional safety and ergonomic standards has driven product redesigns, increasing costs by 15% to 25% in regulated markets. Complex servicing protocols have limited adoption in resource-constrained environments. Additionally, regulatory requirements on volatile organic compound emissions have necessitated reformulation of materials, impacting dispensing gun compatibility and driving incremental R&D expenses.

Advancements in dispensing guns have focused on digital controls, real-time monitoring, and pressure feedback systems to optimize material use and minimize waste. Battery-powered models with wireless capabilities have improved operator mobility and reduced fatigue, particularly in automotive and construction applications. Integration of smart dispensing guns with factory automation systems has enabled improved process control and data-driven maintenance scheduling. Eco-friendly designs accommodating low-VOC materials have been introduced to meet environmental regulations. These innovations have collectively contributed to shorter cycle times and improved consistency in industrial adhesive and sealant applications.

Hybrid dispensing guns combining manual operation with electronic feedback have gained traction in precision-critical manufacturing. These tools allow dosage logging and wireless connectivity for enhanced process integration. Emerging markets have seen increased demand for modular, eco-conscious dispensing guns that support flexible manufacturing layouts. Distribution network expansions have facilitated accessibility in key regions, including Asia-Pacific and Latin America. The blending of ergonomic design with digitized control features has driven product development strategies focusing on usability, regulatory compliance, and operational reliability across diverse industrial sectors.

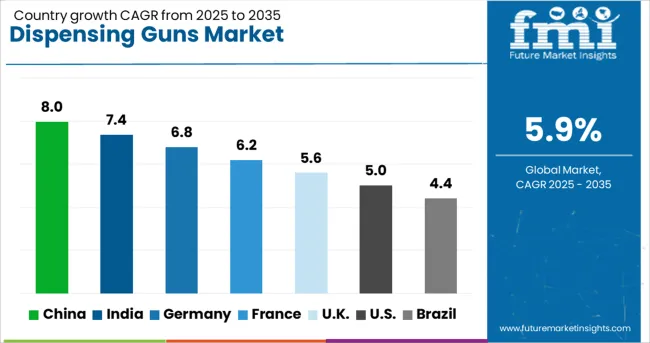

| Country | CAGR |

|---|---|

| China | 8.0% |

| India | 7.4% |

| Germany | 6.8% |

| France | 6.2% |

| UK | 5.6% |

| USA | 5.0% |

| Brazil | 4.4% |

Global demand for dispensing guns is projected to grow at a CAGR of 5.9% from 2025 to 2035. Among the five benchmark markets profiled out of 40+ analyzed, China leads with a CAGR of 8.0%, followed by India at 7.4%, Germany at 6.8%, the United Kingdom at 5.6%, and the United States at 5.0%. These values indicate a +36% premium for China, with India and Germany following at +25% and +15% respectively. The UK remains nearly aligned with the baseline at –5%, while the US falls –15% short. Demand growth in China and India is driven by increased automotive adhesives usage and expanding construction tooling demand. In contrast, the US and UK experience slower growth due to equipment life extension trends and moderated procurement in facility management sectors.

China is forecast to register a CAGR of 8.0% in the dispensing guns market between 2025 and 2035. Growth remains concentrated across manufacturing belts with rising adhesive and sealant application volumes. Multi-cartridge systems have gained traction in Tier 1 industrial parks for structural bonding operations. Demand is also supported by infrastructure rollout where concrete crack-repair kits with heavy-duty dispensing guns are being integrated into urban maintenance fleets. Local brands such as Wanshan and Kastar are introducing pneumatic variants tailored for high-throughput applications. Product compatibility with imported adhesives has been enhanced, enabling market competitiveness beyond entry-level equipment.

India is expected to experience a CAGR of 7.4% in the dispensing guns market from 2025 to 2035. Industrial adoption has intensified across automotive clusters and mid-scale electronics assembly. Demand is growing for manual twin-cartridge guns among MSMEs handling moderate-volume adhesive jobs. Kerala and Tamil Nadu have witnessed higher installation of sealant-dispensing kits in government-funded infrastructure projects. Domestic manufacturers such as GROZ and Metro Tool Company are expanding into hybrid mechanical-pneumatic systems. The presence of a strong chemical formulation industry is supporting product diversity in dispensing platforms.

Germany is forecast to grow at a CAGR of 6.8% in the dispensing guns market through 2035. Structural bonding tools are being adopted at elevated rates across industrial product lines focused on aerospace components and automotive interiors. The preference for precision-driven metering guns is growing, especially in polyurethane-based sealant processes. Engineering tool specialists such as COX Germany and Sulzer Mixpac have launched models integrated with ergonomic feedback sensors. Demand also benefits from policy-favored modular renovation schemes that incentivize low-waste application tools. System compatibility with low-VOC adhesives has become a procurement criterion in public projects.

The United Kingdom is projected to grow at a CAGR of 5.6% in the dispensing guns market from 2025 to 2035. Applications remain focused on retrofit and facility maintenance segments, where low-volume manual dispensing guns are used. The market is gradually shifting toward electric drive tools for larger restoration works in London and Birmingham. British firms such as Tajima Europe and PC Cox are refining lightweight designs compatible with contractor preferences. Adhesive tool usage in the commercial refurbishment sector has supported steady product movement, although gas-pressure systems continue to dominate in large-area bonding applications.

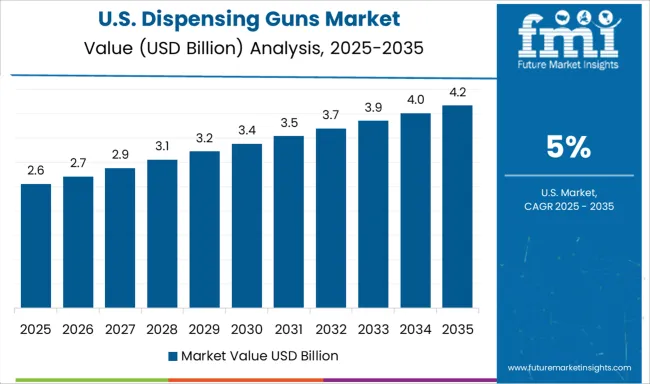

The dispensing guns market in the United States is expected to grow at a CAGR of 5.0% from 2025 to 2035. Industrial output recovery and construction retrofit cycles have provided consistent demand, although competitive pressure from imported semi-automated systems limits growth velocity. Product adoption remains high in HVAC and window installation trades, with greater interest in battery-powered dispensing tools for faster turnaround times. Milwaukee Tool and Albion Engineering have enhanced reliability standards across professional-grade devices. However, resistance from traditional contractors to shift away from manual systems continues to affect scale in smaller urban centers.

Nordson Corporation has focused on expanding its precision dispensing gun line for commercial adhesives and sealants, targeting automotive assembly and electronics manufacturing. Its strategy includes continuous upgrades to manual and pneumatic models to handle high-viscosity materials with reduced operator fatigue. The company has also enhanced its direct sales channels in North America and Europe to support custom dispensing system integration.

Sulzer Ltd has prioritized ergonomic dual-component guns suited for construction and repair work. Its Mixpac product series remains widely adopted for epoxy and resin applications due to consistent ratio control and user-friendly design. Sika AG has expanded its manual and battery-powered dispensing gun range to support on-site sealing and bonding, particularly in facade and flooring projects. Its distribution network has been strengthened through exclusive agreements with tool retailers in Europe and South America.

Albion Engineering Co. continues to focus on durable, contractor-grade guns for industrial sealants. Its product development centers around adjustable thrust ratios and tool longevity. Medmix, formerly part of Sulzer, has advanced its coaxial and side-by-side cartridge dispensing systems for use in dental and medical applications. A clear focus on dosing accuracy and disposable cartridge compatibility has allowed the company to gain share in regulated healthcare environments.

New ergonomic manual guns were launched to improve precision and user comfort, while air-powered models introduced quick-change cartridge technology, enhancing efficiency. Manual dispensing guns maintained a strong market presence due to cost-effectiveness.

Regional demand increased in North America and Europe, driven by regulations encouraging low-VOC adhesive use. The market continues to expand through product innovation and compliance with environmental standards, supporting diverse applications in construction, automotive, and industrial sectors.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.7 Billion |

| Type | Manual gun, Pneumatic gun, Electric gun, and Others |

| Application | Construction, Automotive, Industrial manufacturing, Food and beverage, Healthcare, and Others |

| Technology | Cordless and Corded |

| Material | Metal and Plastic |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Nordson Corporation, Sulzer Ltd., Sika AG, Albion Engineering Co., and Medmix |

The global dispensing guns market is estimated to be valued at USD 5.7 billion in 2025.

The market size for the dispensing guns market is projected to reach USD 10.1 billion by 2035.

The dispensing guns market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in dispensing guns market are manual gun, pneumatic gun, electric gun and others.

In terms of application, construction segment to command 36.0% share in the dispensing guns market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dispensing System Market Size and Share Forecast Outlook 2025 to 2035

Dispensing Robots Market Size and Share Forecast Outlook 2025 to 2035

Dispensing Trays Market Size, Share & Forecast 2025 to 2035

Dispensing Carboy Market Size and Share Forecast Outlook 2025 to 2035

Dispensing Caps Market Growth - Demand & Forecast 2025 to 2035

Key Players & Market Share in the Dispensing Spout Industry

Market Share Breakdown of Dispensing Carboy Providers

Dispensing Spout Market by Cap & Pump Type from 2024 to 2034

Dispensing Jug Market

Dispensing Tap Market

Dispensing Sprayers Market

Beer Dispensing Machine Market Trends - Growth, Demand & Analysis 2025 to 2035

Fluid Dispensing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Twist Dispensing Closures Market Size and Share Forecast Outlook 2025 to 2035

Pouch Dispensing Fitment Market

Hinged Dispensing Caps Market Size and Share Forecast Outlook 2025 to 2035

Competitive Landscape of Hinged Dispensing Caps Providers

Spouted Dispensing Closures Market

Product Dispensing Machinery Market

Aerosol Dispensing Systems Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA