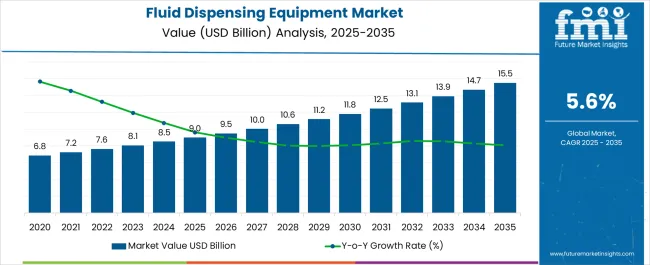

The fluid dispensing equipment market is projected to reach USD 9 billion in 2025 and is anticipated to grow to USD 15.5 billion by 2035, registering a CAGR of 5.6% over the forecast period. When plotted as a growth trajectory, the data from 2020 through 2035 follows a near-exponential trendline, showing gradual gains in the early years followed by faster acceleration beyond 2030. A linear trendline would underestimate the steepness of the later growth phase, as the market climbs from USD 11.2 billion in 2030 to USD 15.5 billion in 2035. A polynomial trendline fits well to capture the curvature, indicating that demand accelerates as adoption becomes more widespread across electronics, automotive, packaging, and medical device sectors.

Between 2025 and 2030, the curve shows a moderate slope as adoption rates remain steady, rising from 9 to around USD 11.2 billion. From 2030 to 2035, the slope steepens, illustrating that capital investments in automation and high-precision dispensing systems are expected to intensify. This pattern confirms that the market will not follow a linear path but rather an upward-curving trajectory consistent with compounding adoption and reinvestment cycles, making an exponential or second-order polynomial trendline the most accurate visual representation of its market progression.

| Item | Value |

|---|---|

| Market Value (2025) | USD 9 billion |

| Market Forecast Value (2035) | USD 15.5 billion |

| Market Forecast CAGR (2025 to 2035) | 5.6% |

The fluid dispensing equipment market is projected to follow an upward trajectory across the forecast horizon, showing no significant trough periods but displaying distinct phases of momentum. Early years portray moderate progression as adoption spreads steadily, representing the flatter portion of the curve where growth remains consistent but measured. The market begins to shift into a higher acceleration phase, marking the emergence of its peak growth years. These peak years stand out as the period when demand intensifies due to expanding automation infrastructure, wider integration of precision dispensing technologies, and heightened capital spending by manufacturing sectors. As the market does not experience any notable contractions or plateaus, only transitions from slower to faster growth phases. The curve illustrates how performance gradually builds before entering its strongest momentum period toward the later stages, which serve as the market’s peak growth window. This pattern emphasizes that the market is expected to move consistently upward without downturns, with its highest performance clustered around the final stretch of the forecast horizon.

Market expansion is being supported by the increasing complexity of electronic devices requiring precise application of adhesives, sealants, and other fluids during manufacturing processes. Modern electronics manufacturing relies on accurate dispensing of materials such as epoxy adhesives, underfill materials, and conformal coatings to ensure product reliability and performance. The miniaturization of electronic components and tighter manufacturing tolerances are driving demand for advanced dispensing equipment capable of handling micro-volume applications with exceptional precision.

The growing adoption of automation across manufacturing industries and increasing focus on production efficiency are driving demand for advanced fluid dispensing systems. Manufacturers are investing in automated dispensing solutions to reduce material waste, improve process consistency, and minimize human error in critical manufacturing operations. Industry 4.0 initiatives and smart manufacturing trends are encouraging the integration of intelligent dispensing systems with real-time monitoring and process optimization capabilities.

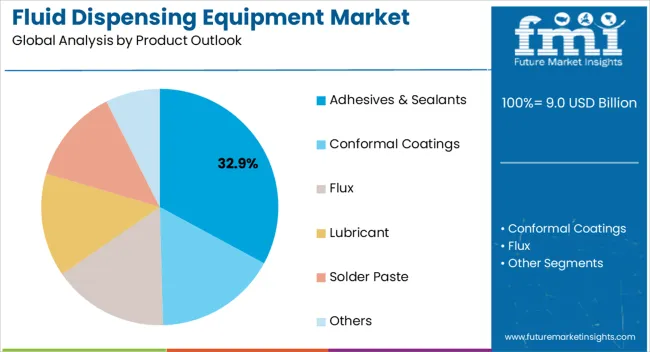

The market is segmented by product type, application, end-use industry, technology, and region. By product type, the market is divided into adhesives & sealants, epoxy adhesives, epoxy underfill, conformal coatings, flux, lubricant, solder paste, and others. Based on application, the market is categorized into electrical & electronics assembly, semiconductor packaging, printed circuit boards, medical devices, construction, transportation, and others. In terms of end-use industry, the market is segmented into electronics, automotive, aerospace, healthcare, and others. By technology, the market is classified into pneumatic, electric, and others. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Adhesives & sealants are projected to account for 32.9% of the fluid dispensing equipment market in 2025. This leading share is supported by the widespread use of adhesive dispensing equipment across multiple industries, including electronics, automotive, and aerospace manufacturing. The segment benefits from increasing demand for structural bonding applications and the growing adoption of advanced adhesive technologies that require precise dispensing control. Modern adhesive dispensing systems offer enhanced accuracy and consistency, making them essential for high-quality manufacturing processes.

Electrical & electronics assembly is expected to represent 34.6% of fluid dispensing equipment demand in 2025. This dominant share reflects the critical role of dispensing equipment in electronics manufacturing processes, including component attachment, encapsulation, and protective coating applications. The segment benefits from ongoing miniaturization trends in electronics and increasing complexity of electronic devices requiring precise material dispensing. Advanced dispensing systems enable manufacturers to achieve the tight tolerances and high reliability standards demanded in modern electronics production.

The fluid dispensing equipment market is advancing steadily due to increasing automation in manufacturing processes and growing demand for precision dispensing applications. The market faces challenges, including high initial equipment costs, need for specialized technical expertise, and varying material compatibility requirements across different applications. Technological innovation and integration of smart manufacturing capabilities continue to influence equipment development and market growth patterns.

The growing integration of smart technologies and Internet of Things (IoT) connectivity in fluid dispensing equipment is enabling real-time monitoring, predictive maintenance, and process optimization capabilities. Smart dispensing systems provide comprehensive data analytics, allowing manufacturers to optimize dispensing parameters, track material usage, and identify potential issues before they impact production quality. These advanced systems support Industry 4.0 initiatives by enabling seamless integration with manufacturing execution systems and enterprise resource planning platforms.

Advanced micro and nano dispensing technologies are being developed to meet the evolving requirements of high-tech industries, including semiconductor packaging and medical device manufacturing. These precision dispensing systems offer exceptional accuracy and repeatability for applications requiring extremely small volume dispensing with tight placement tolerances. The development of specialized dispensing tips, advanced control algorithms, and enhanced vision systems is enabling manufacturers to achieve unprecedented levels of precision in critical manufacturing processes.

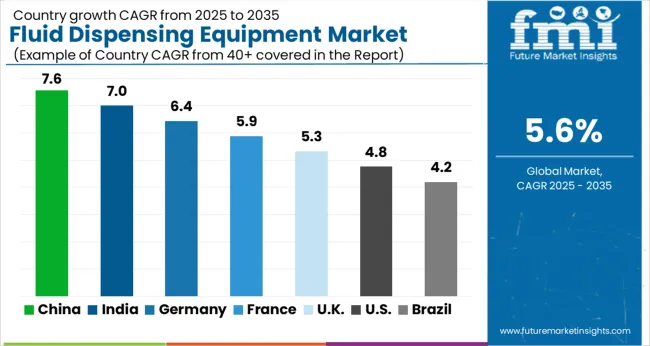

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| France | 5.9% |

| UK | 5.3% |

| USA | 4.8% |

| Brazil | 4.2% |

The global fluid dispensing equipment market is projected to grow at a CAGR of 6.0% between 2025 and 2035. China leads this expansion with a 7.6% CAGR, driven by rising industrial production, increasing automation in manufacturing lines, and growing demand for precision dispensing systems. India follows at 7.0%, supported by expanding electronics assembly operations, growing infrastructure projects, and higher adoption of automated dispensing solutions. Germany shows growth at 6.4%, emphasizing advanced manufacturing capabilities and precision engineering. France records 5.9%, fueled by rising demand from automotive and aerospace sectors. The UK grows at 5.3%, focusing on high-accuracy dispensing applications in electronics and medical device production. The USA stands at 4.8%, reflecting steady industrial automation investments, while Brazil follows at 4.2%, influenced by expanding industrial activities and adoption of automated production systems.

The report covers an in-depth analysis of 40+ countries, top-performing countries are highlighted below.

The fluid dispensing equipment market in China is projected to grow at a CAGR of 7.6% from 2025 to 2035, driven by expanding electronics assembly, automotive manufacturing, and battery production sectors. Precision dispensing systems are being integrated into automated assembly lines to improve product consistency and reduce material wastage. Local manufacturers are investing in high-speed robotic dispensers and jetting systems to support large-volume production environments. The demand for controlled fluid application in adhesives, sealants, lubricants, and coatings is increasing across various industrial domains. Export-oriented industries are upgrading their production setups to comply with stringent quality standards, which is creating strong demand for advanced dispensing solutions. The presence of domestic suppliers offering cost-effective and customizable equipment is also accelerating market growth across tier-1 and tier-2 manufacturing clusters.

The fluid dispensing equipment market in India is forecast to grow at a CAGR of 7.0% from 2025 to 2035, supported by growing electronics assembly, automotive component manufacturing, and pharmaceutical packaging industries. Automated dispensing systems are gaining adoption to enhance production efficiency and reduce operational errors. Indian manufacturers are increasingly adopting jet dispensers, positive displacement valves, and robotic dispensing platforms for mass production. Government-led initiatives encouraging domestic manufacturing of electronics and EV components are indirectly fueling demand for advanced dispensing systems. The growing preference for automated, contactless dispensing of adhesives, resins, and thermal interface materials is reshaping production strategies. Availability of cost-efficient systems and rising investments in modern production lines by contract manufacturers are also driving adoption.

Demand for fluid dispensing equipment in Germany is projected to grow at a CAGR of 6.4%, supported by the country's focus on advanced manufacturing technologies and precision engineering. German manufacturers are leading the development of innovative dispensing solutions for automotive, aerospace, and industrial applications. The market is characterized by a strong focus on research and development, with companies investing heavily in next-generation dispensing technologies. Industry 4.0 initiatives and smart factory implementations are driving demand for intelligent dispensing systems with advanced monitoring and control capabilities that enhance manufacturing efficiency and product quality. Industry 4.0 initiatives and smart factory implementations drive demand for intelligent dispensing systems, enhancing manufacturing efficiency.

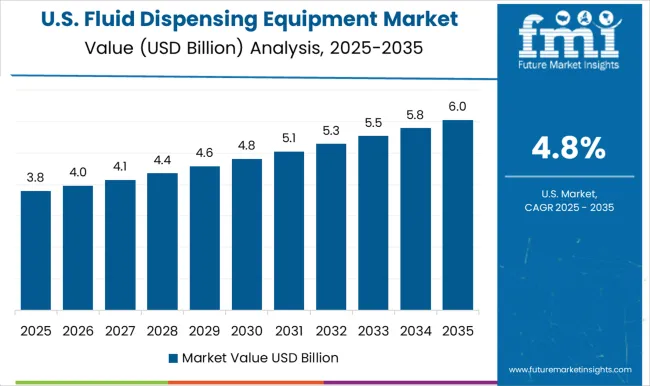

The fluid dispensing equipment market in the United States is projected to grow at a CAGR of 4.8% from 2025 to 2035, driven by rising automation in aerospace, automotive, and electronics manufacturing. Companies are shifting toward high-precision dispensing systems to improve throughput and minimize material waste. The adoption of digitally controlled jet dispensers and positive displacement valves is increasing in semiconductor packaging and EV battery assembly. The market is also witnessing growth from the medical device sector, where consistent adhesive application is critical for product reliability. Demand for smart dispensing systems equipped with sensors and real-time monitoring features is strengthening as manufacturers pursue operational efficiency. Strategic collaborations between technology developers and contract manufacturers are improving availability and customization of equipment.

Revenue from fluid dispensing equipment in France is projected to grow at a CAGR of 5.9% through 2035. The growth is driven by the country’s advanced manufacturing sector, with significant adoption in automotive, aerospace, and industrial machinery industries. French manufacturers emphasize high-precision dispensing solutions for adhesives, sealants, and coating applications, supporting complex assembly processes. Industrial modernization programs and government initiatives promoting technology adoption are facilitating broader deployment of automated dispensing systems across major industrial facilities. The market benefits from strong R&D capabilities, ensuring development of next-generation dispensing technologies that enhance production efficiency and maintain compliance with European quality and safety standards. Industrial modernization programs accelerate adoption of automated dispensing systems.

The UK fluid dispensing equipment market is projected to grow at a CAGR of 5.3% through 2035, supported by ongoing modernization of manufacturing facilities and adoption of automated production technologies. Key sectors driving demand include electronics assembly, automotive manufacturing, and aerospace applications, where precision and reliability are critical. British manufacturers are integrating advanced dispensing systems to optimize production efficiency, reduce labor costs, and ensure consistent quality across high-value components. Government programs and industrial automation initiatives are further supporting market expansion, encouraging adoption of innovative dispensing technologies that align with Industry 4.0 and smart factory implementations.

The fluid dispensing equipment market in Brazil is forecast to grow at a CAGR of 4.2% from 2025 to 2035, supported by growth in automotive component production, consumer electronics assembly, and pharmaceutical packaging. Local manufacturers are gradually transitioning from manual to automated dispensing systems to improve consistency and reduce rework. The adoption of semi-automatic dispensers is increasing among small and mid-sized enterprises due to cost advantages. Expansion of electronics manufacturing clusters and government-backed industrial modernization programs are fostering demand for advanced dispensing systems. Multinational companies are introducing modular dispensing solutions tailored for the Brazilian market, making high-precision technology more accessible to domestic producers.

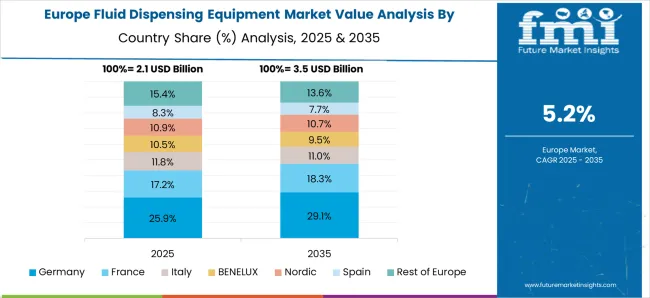

The fluid dispensing equipment market in Europe is projected to grow from USD 2.1 billion in 2025 to USD 3.4 billion by 2035, registering a CAGR of 4.8% over the forecast period. Germany is expected to maintain its leadership with 29.9% market share in 2025, supported by its strong automotive and electronics manufacturing sectors. France accounts for 27.3% of the European market, while the United Kingdom holds a 24.7% share. Italy represents 9.8% of the market, followed by Spain at 4.2%. The Rest of Europe region contributes 4.1% to the European market, attributed to growing industrial automation initiatives in Eastern European countries.

Competition remains intense among well-established equipment manufacturers, specialized dispensing technology providers, and emerging automation-focused companies. The market is shaped by continual investment in advanced precision control systems, high-speed dispensing technologies, modular platforms, and enhanced connectivity features aimed at improving manufacturing throughput, product quality, and operational efficiency. Companies are increasingly integrating smart sensors, machine vision, and data-driven control software into their systems to provide real-time monitoring, traceability, and adaptive process control.

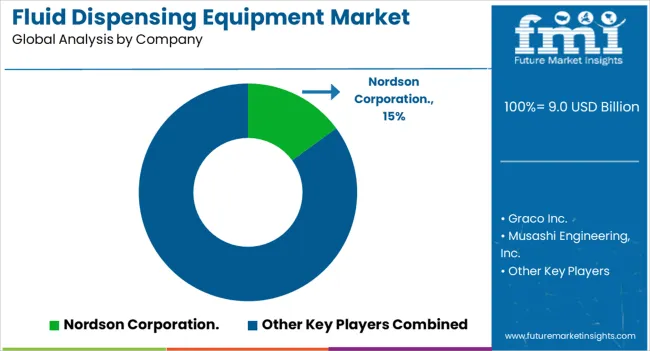

Nordson Corporation, based in the United States, stands out as a major leader, offering a comprehensive portfolio of fluid dispensing systems with advanced precision control, automation compatibility, and scalable platforms suited for electronics assembly, packaging, and industrial production. Graco Inc. operates globally and delivers a wide range of durable dispensing solutions for applications in automotive, construction, and heavy industrial sectors, known for their reliability and robust build quality. Musashi Engineering Inc., headquartered in Japan, is renowned for its ultra-precise dispensing technologies, particularly in electronics manufacturing and semiconductor packaging, where accuracy at micro-volume levels is critical.

Other notable participants include GPD Global, which focuses on high-tech dispensing systems with advanced programming capabilities for complex manufacturing needs, and Fisnar, which offers a wide range of benchtop and automated dispensing solutions tailored for electronics assembly and component manufacturing. IVEK Corporation specializes in high-precision fluid handling systems designed for laboratory, pharmaceutical, and industrial environments. Henkel Slovenija d.o.o. combines dispensing systems with its proprietary adhesive and sealant technologies to deliver fully integrated solutions for production lines.

OK International Inc., DOPAG India Pvt Ltd., and Valco Melton Inc. strengthen the competitive landscape by offering specialized dispensing equipment, automated production systems, and extensive global service networks to support diverse industrial applications. The competitive differentiation in this market often centers on system accuracy, dispensing speed, reliability under demanding conditions, integration with robotic automation, and ease of maintenance.

| Item | Value |

|---|---|

| Quantitative Units | USD 9 billion |

| Product Type | Adhesives & Sealants, Epoxy Adhesives, Epoxy Underfill, Conformal Coatings, Flux, Lubricant, Solder Paste, Others |

| Application | Electrical & Electronics Assembly, Semiconductor Packaging, Printed Circuit Boards, Medical Devices, Construction, Transportation, Others |

| End-use Industry | Electronics, Automotive, Aerospace, Healthcare, Industrial Manufacturing, Others |

| Technology | Pneumatic Dispensing, Electric Dispensing, Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil |

| Key Companies Profiled | Nordson Corporation, Graco Inc., Musashi Engineering Inc., GPD Global, Fisnar, IVEK Corporation, Henkel Slovenija d.o.o., OK International Inc., DOPAG India Pvt Ltd., Valco Melton Inc., Dymax, ViscoTec Pumpen- u. Dosiertechnik GmbH, ITW Dynatec, Anda Technologies USA INC., INTERTRONICS |

| Additional Attributes | Dollar sales by product type, application, and technology, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established equipment manufacturers and emerging technology providers, buyer preferences for automated versus manual dispensing solutions, integration with Industry 4.0 technologies and IoT connectivity, innovations in micro and nano dispensing capabilities, and adoption of smart dispensing systems with real-time monitoring and process optimization features for enhanced manufacturing efficiency. |

The global Fluid Dispensing Equipment Market is estimated to be valued at USD 9.0 billion in 2025.

The market size for the Fluid Dispensing Equipment Market is projected to reach USD 15.5 billion by 2035.

The Fluid Dispensing Equipment Market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in Fluid Dispensing Equipment Market are adhesives & sealants, _epoxy adhesives, _epoxy underfill, _others, conformal coatings, flux, lubricant, solder paste and others.

In terms of application outlook , electrical & electronics assembly segment to command 34.6% share in the Fluid Dispensing Equipment Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fluidized Bed Dryer Market Size and Share Forecast Outlook 2025 to 2035

Fluid Aspiration System Market Size and Share Forecast Outlook 2025 to 2035

Fluid Couplings Market Analysis - Size, Growth, and Forecast 2025 to 2035

Fluid Conveyance Systems Market Growth - Trends & Forecast 2025 to 2035

Fluid Transfer Solutions Market – Demand & Forecast 2024-2034

Fluid Waste Disposal Systems Market

Fluid Bed Systems Market

Fluid Catalytic Cracking Catalysts Market

Fluid Bed and Coating System Market

Fluidized Conveying Equipment Market Size and Share Forecast Outlook 2025 to 2035

IV Fluid Transfer Drugs Devices Market Trends – Growth & Forecast 2025 to 2035

Air Fluidized Therapy Beds Market Growth – Trends & Forecast 2025 to 2035

Microfluidic Modulation Spectroscopy Market Size and Share Forecast Outlook 2025 to 2035

Microfluidics Market Analysis - Technology, Trends & Forecast 2025 to 2035

I.V. Fluid Warmer Market

The Blood Fluid Warming System Market is segmented by product type, application, and end user from 2025 to 2035

Equine Fluid Therapy Market

Thermic Fluid Market Growth - Trends & Forecast 2025 to 2035

Deicing Fluid Market Growth - Trends & Forecast 2025 to 2035

Cutting Fluid Market Growth – Trends & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA