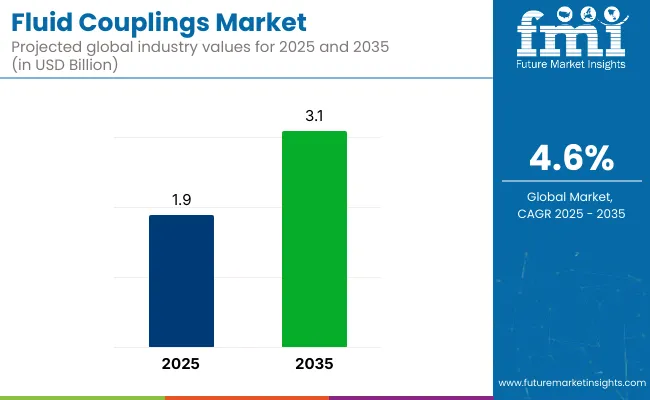

The global fluid couplings market is valued at USD 1.9 billion in 2025 and is expected to reach USD 3.1 billion by 2035, reflecting a CAGR of 4.6%. Growth is being driven by expanding industrialization, increasing adoption in mining and oil & gas sectors, and the need for smooth torque transmission in critical applications.

| Metric | Value |

|---|---|

| Estimated Size (2025) | USD 1.9 billion |

| Projected Value (2035) | USD 3.1 billion |

| CAGR (2025 to 2035) | 4.6% |

Rising automation in manufacturing, growing energy efficiency requirements in power plants, and integration of IoT-enabled monitoring technologies are further supporting market expansion, especially in Asia-Pacific. Additionally, advancements in scoop control mechanisms and variable fill technologies are expected to enhance operational flexibility and drive future demand.

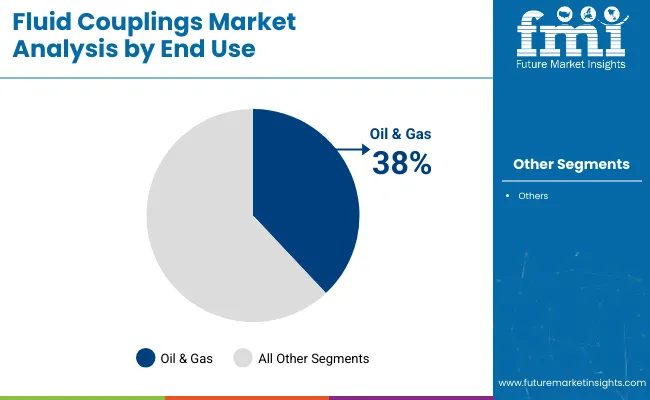

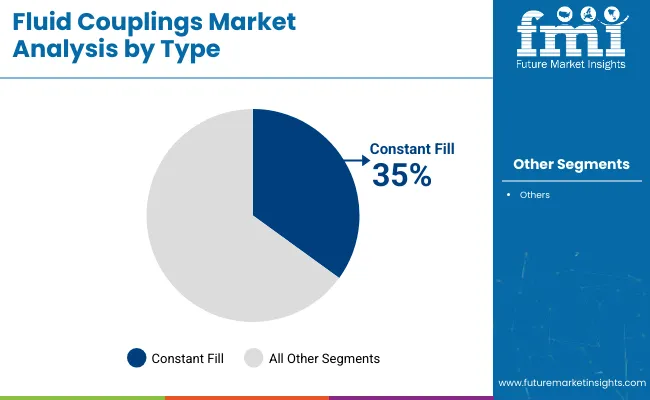

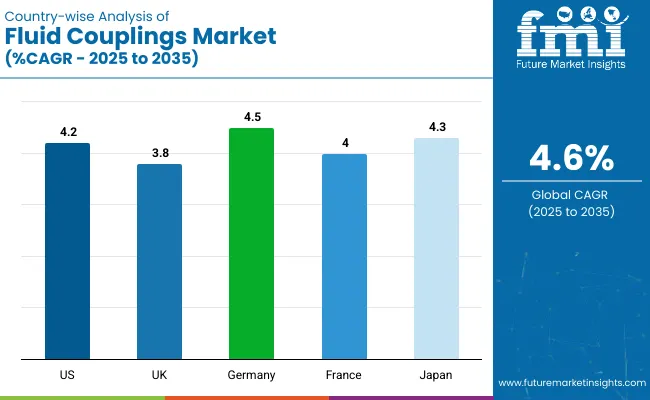

The AsiaPacific region is likely to dominate the fluid couplings market, with Japangrowingat a significant CAGR of 4.3%, due to its developed industrial base and technologically advanced nature. Meanwhile, Germany and the USA closely follow this growth with CAGRs of 4.5% and 4.2% respectively. Constant fill fluid couplings are projected to maintain their lead with 35% market share due to their cost-effectiveness and reliability in heavy-duty operations, while the oil & gas industry by end-use accounts for 38% market share.

The market represents around 6-8% of the broader power transmission equipment market, driven by its role in torque regulation and load management. Within the industrial machinery market, it holds about 3-5%, especially in sectors like mining, cement, and steel. In the automotive components market, its share is limited to 1-2%, largely within heavy vehicles. In energy and power generation, fluid couplings account for nearly 5-6%, particularly in turbines and conveyors.

Looking forward, the fluid couplings market is anticipated to see increased investments in automation, modular designs, and smart monitoring technologies to align with Industry 4.0 trends. Developments in hybrid materials combining steel and aluminum, as well as advanced scoop control mechanisms for precision operations, are likely to shape the market's innovation landscape. Strategic mergers, such as Chesapeake Energy’s merger with Southwestern Energy, are expected to further drive demand growth across end-use sectors during the forecast period.

The fluid couplings market has been segmented by end use, type, and region. By end-use, it includes oil & gas, chemical, metals & mining, power plants, and others (including marine, construction, and agriculture). By type,it includes constant fill fluid couplings, variable fill fluid couplings, slip fluid couplings, and scoop control fluid couplings. By region,it covers North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and Middle East and Africa.

The oil & gas segment is likely to remain the largest end-use sector, accounting for approximately 38% of the global market share in 2025. Growth is being driven by the increasing use of fluid couplings in drilling equipment, compressors, and offshore platforms to ensure reliable power transmission and overload protection. Expansion into deeper offshore reserves and shale exploration in North America and Asia-Pacific is further supporting segment growth during the forecast period.

Constant fill fluid couplings are projected to lead the market with nearly 35% share in 2025 due to their simplicity, cost-effectiveness, and ability to provide smooth torque transmission in heavy-duty applications. Their low maintenance requirements make them ideal for conveyors, mixers, and crushers used across mining, cement, and power generation industries. Their adoption is expected to continue rising with industrial automation trends globally.

Recent Trends in the Fluid Couplings Market

Challenges in the Fluid Couplings Market

In the fluid couplings market, Germany is projected to record the highest growth among the top countries with a CAGR of 4.5% from 2025 to 2035, driven by its robust industrial base and automation leadership. Japan follows with a 4.3% CAGR, supported by advanced manufacturing and power generation demand. The United States is set to grow at 4.2%, fueled by shale gas exploration and industrial automation. France and the United Kingdom trail slightly at 4.0% and 3.8%, respectively, with growth supported by energy and chemical industries but limited by smaller or slower-expanding industrial infrastructures.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The fluid couplings market in the USA is projected to grow at a CAGR of nearly 4.2% from 2025 to 2035. Growth is being supported by strong industrial sectors, widespread shale gas exploration, and increasing adoption in power generation and mining machinery. Demand is further driven by the country’s push for energy efficiency and the adoption of manufacturing automation across heavy industries.

The revenue from fluid couplings in the UK is expected to record a CAGR of 3.8% during the forecast period. Growth is driven by steady demand in the power generation and manufacturing sectors, though it is moderated by a smaller industrial base compared to Germany. The shift towards greener technologies and operational cost reduction supports ongoing market expansion.

The fluid couplings demandin Germany is anticipated to expand at a CAGR of about 4.5% from 2025 to 2035. Growth is driven by its strong industrial and manufacturing base, extensive use in automotive, steel, and chemical sectors, and continued investments in Industry 4.0 automation initiatives. The focus on energy-efficient equipment further supports market growth.

The sales of fluid couplings in France are estimated to grow at a CAGR of nearly 4.0% through the forecast period. Growth is supported by demand in nuclear and renewable energy power plants, as well as its chemical and petrochemical sectors. However, the market size remains modest compared to larger European and Asian counterparts.

The fluid couplings market inJapanis forecasted to grow at a CAGR of around 4.3% from 2025 to 2035. Demand is driven by the country’s advanced manufacturing sector and widespread use in power generation and heavy machinery. However, the slow adoption of advanced coupling technologies due to cost barriers remains a constraint for rapid growth.

The fluid couplings market is moderately consolidated, with a few global players accounting for a significant share of revenues alongside regional manufacturers. Companies such as Voith GmbH & Co. KGaA, Siemens AG, and Rexnord Industries LLC compete based on technological innovation, product reliability, and expanded global reach to maintain their market positions. Smaller firms like Ningbo Parmicro Fluids Technology Co., Ltd. and Fluid Hose & Coupling Inc. cater to regional and application-specific demands.

Company strategies increasingly focus on developing advanced fluid couplings with IoT integration for real-time monitoring, enhancing energy efficiency to meet strict environmental regulations, and expanding manufacturing footprints in Asia-Pacific to leverage cost advantages. Partnerships and acquisitions are pursued to strengthen distribution networks and product portfolios. Voith, Siemens, and Rexnord are investing in digitalization and hybrid material research, while Altra Industrial Motion focuses on diversified industrial applications to maintain a competitive advantage.

Recent Fluid Couplings Market News

In April 2025, VoithGmbHintroduced its Plug & Drive H₂ Storage System for heavy-duty trucks, a major step in sustainable transportation and hydrogen technology.

In April 2025, at Bauma 2025, ABB launched several next-generation products for hybrid and fully electric construction and mining vehicles.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 1.9 billion |

| Projected Market Size (2035) | USD 3.1 billion |

| CAGR (2025 to 2035) | 4.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 20 20- 2024 |

| Projections Period | 2025 - 2035 |

| Market Analysis Parameters | Revenue in USD billions/Volume in units |

| By Type | Constant Fill Fluid Couplings, Variable Fill Fluid Couplings, Slip Fluid Couplings, Scoop Control Fluid Couplings |

| By End Use | Oil & Gas, Chemical, Metals & Mining, Power Plants, Others (Marine, Construction, Agriculture) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia , Pacific, East Asia, Middle East and Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | ABB Group, Altra Industrial Motion Corporation, Fluid Hose & Coupling Inc., Hackforth Holding GmbH, Ningbo Parmicro Fluids Technology Co., Ltd., Rexnord Industries LLC, Siemens AG, Voith GmbH & Co. KGaA , Transfluid S.p.A., Vulkan Drive Tech |

| Additional Attributes | Dollar sales by value, market share analysis by segment, and country-wise analysis |

The market size is valued at USD 1.9 billion in 2025.

The market is forecasted to reach USD 3.1 billion by 2035, reflecting a CAGR of 4.6%.

Constant fill fluid couplings are expected to lead the market with a 35% market share in 2025.

The oil & gas industry is anticipated to dominate with 38% market share in 2025.

Germany is expected to be the fastest-growing market with a CAGR of 4.5% from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fluidized Conveying Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fluidized Bed Dryer Market Size and Share Forecast Outlook 2025 to 2035

Fluid Aspiration System Market Size and Share Forecast Outlook 2025 to 2035

Fluid Dispensing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fluid Conveyance Systems Market Growth - Trends & Forecast 2025 to 2035

Fluid Transfer Solutions Market – Demand & Forecast 2024-2034

Fluid Waste Disposal Systems Market

Fluid Bed Systems Market

Fluid Bed and Coating System Market

Fluid Catalytic Cracking Catalysts Market

IV Fluid Transfer Drugs Devices Market Trends – Growth & Forecast 2025 to 2035

Air Fluidized Therapy Beds Market Growth – Trends & Forecast 2025 to 2035

Microfluidic Modulation Spectroscopy Market Size and Share Forecast Outlook 2025 to 2035

Microfluidics Market Analysis - Technology, Trends & Forecast 2025 to 2035

I.V. Fluid Warmer Market

The Blood Fluid Warming System Market is segmented by product type, application, and end user from 2025 to 2035

Equine Fluid Therapy Market

Thermic Fluid Market Growth - Trends & Forecast 2025 to 2035

Deicing Fluid Market Growth - Trends & Forecast 2025 to 2035

Cutting Fluid Market Growth – Trends & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA