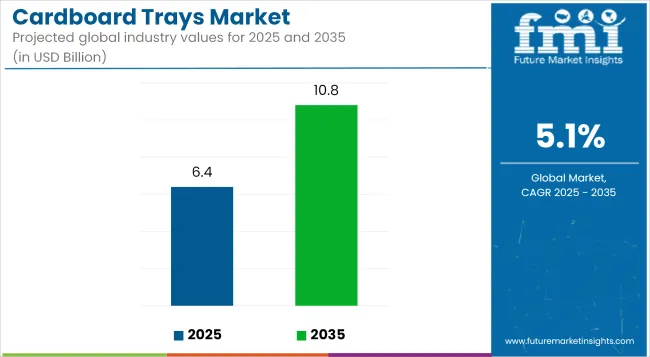

The cardboard trays market is projected to grow from USD 6.4 billion in 2025 to USD 10.8 billion by 2035, registering a CAGR of 5.1% during the forecast period. Sales in 2024 reached USD 6.0 billion. The market has been driven by rising demand for recyclable foodservice packaging and a shift away from plastic trays in retail and institutional sectors. Adoption has been particularly robust in meal kits, bakeries, and produce segments where lightweight yet rigid packaging formats are preferred for stacking and presentation.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 6.4 Billion |

| Projected Market Size in 2035 | USD 10.8 Billion |

| CAGR (2025 to 2035) | 5.1% |

Regulatory encouragement of fiber-based materials in food-contact applications has further spurred production upgrades, especially across North America and Europe. Supply chains have responded by automating corrugation lines to meet diverse format requirements in bulk and retail SKUs.

In 2023, leading global provider of fiber-based consumer packaging, Graphic Packaging International is helping grocer New Seasons Market to build on its commitment to the highest levels of environmental stewardship.

"We're constantly assessing the trade-offs between product preservation, upstream material impact, and downstream disposal opportunities in our packaging work, and our customers expect our leadership in this area," said Athena Petty, senior sustainability manager at New Seasons Market. "The decision to adopt PaperSeal packaging reflects the process we take when making decisions, and this change is a positive step to balance our impacts on people, the planet, and our business."

Eco-centric policies and food-safe certification requirements have accelerated the development of moisture-resistant, compostable cardboard trays. Barrier coatings using water-based and PLA layers have been introduced to improve tray integrity for chilled or greasy foods.

Manufacturers have invested in post-consumer fiber input and FSC-certified sourcing to meet brand compliance. Technology integration, such as on-line flexographic printing and digital embossing, has helped tailor trays for brand visibility without added plastic sleeves. Product lines are being diversified for use in QSR, ready-to-heat meals, and vending categories.

Cardboard trays market is expected to benefit from expanded applications in urban meal delivery and institutional catering channels. New market entrants are focusing on closed-loop collection infrastructure to create traceable recycled tray programs. Customization trends are reshaping product portfolios with compartmentalized designs, cut-out branding, and tamper-evident inserts.

Cost competition remains intense with thermoform plastic trays, although rising resin costs have favored fiber-based transitions. Emerging economies are being targeted for export-grade packaging formats amid e-commerce food shipments. Digital tooling for faster format swaps and AI-based quality control have provided competitive advantages in high-volume runs

The market is segmented based on material type, tray style, end-use industry, and region. By material type, the market includes corrugated cardboard, solid bleached sulfate (SBS) board, recycled paperboard, kraft paperboard, and coated paperboard. In terms of tray style, the market is categorized into die-cut trays, folded trays, slotted trays, compartmental trays, and sleeve trays.

By end-use industry, the market comprises food & beverage, bakery & confectionery, fruits & vegetables, pharmaceuticals, consumer electronics, and retail & e-commerce. Regionally, the market is analyzed across North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and the Middle East & Africa.

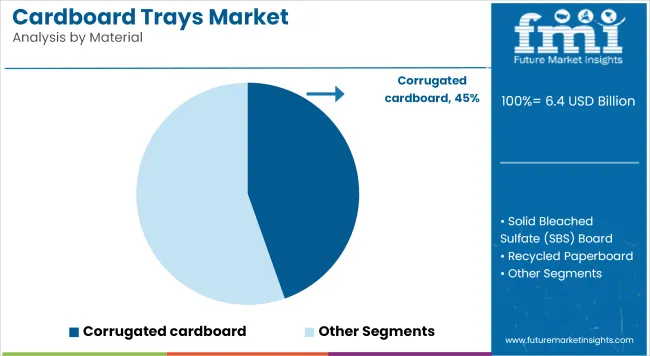

Corrugated cardboard has been projected to hold 44.6% of the global cardboard trays market in 2025 due to its high strength-to-weight ratio, recyclability, and cost-efficiency. It has been widely used for primary and secondary packaging, especially where cushioning and stacking strength are required. Multi-layered fluting options have been incorporated to suit various load-bearing needs across industrial and food packaging. Water-resistant and coated variants have been introduced to handle chilled or moisture-sensitive products.

High-volume tray production has been facilitated using die-cutting and folding automation, allowing for quick assembly and reduced labor time. Printability and brand customization have been made easier with flexographic and lithographic technologies applied directly to corrugated surfaces. Compatibility with food safety standards and sustainability certifications such as FSC has supported its preference across multiple industries.

Corrugated trays have been deployed widely in distribution and transport, with their rigidity aiding in shelf-ready packaging for retail outlets. Producers have opted for dual-purpose trays that serve both display and transit functions, reducing the need for secondary packaging. E-commerce platforms have preferred corrugated trays for their ability to protect fragile goods while being lightweight and recyclable.

Their structural integrity has allowed safe stacking during storage and shipping across varied supply chains. With innovations in water-based adhesives, improved coatings, and integration with paper-based cushioning inserts, corrugated trays have been optimized for both protection and sustainability.

As logistics networks expand and eco-conscious packaging mandates increase, demand for corrugated trays is expected to remain robust. Efficient recycling infrastructure across regions has further boosted acceptance of this material in circular economy models.

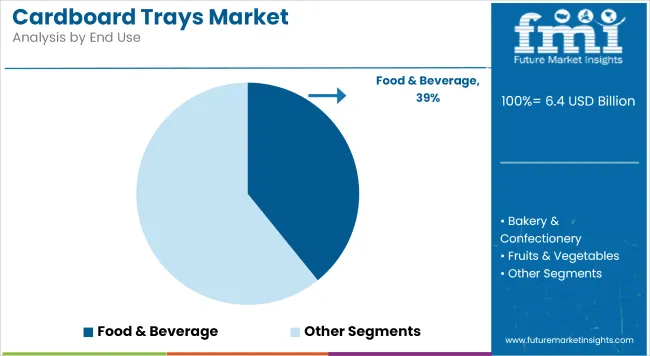

The food & beverage industry has been estimated to account for 39.2% of total demand in the cardboard trays market in 2025, driven by the rise in packaged and ready-to-consume products. Cardboard trays have been used for meat, produce, dairy, and frozen foods to provide containment, visibility, and stack ability.

Tray formats have been designed for both manual and automated processing lines, enhancing packing efficiency and hygiene standards. Compatibility with cold storage and microwavable coatings has broadened their utility across meal kits and prepared food formats. Single-use, recyclable trays have been favored for portion control and tamper-evidence in supermarket and deli packaging.

Branding opportunities through direct printing have been leveraged to improve shelf appeal and product communication. Regulatory bodies have encouraged the use of food-safe, non-toxic adhesives and coatings, further supporting the use of cardboard trays over plastic alternatives.

Meal delivery services and quick-service restaurants have adopted custom tray configurations to support takeaway and delivery packaging solutions. Dual-oven able and compostable trays have been introduced to meet customer expectations around heat resistance and sustainability.

Cold chain logistics providers have relied on sturdy tray formats to maintain product integrity from origin to consumption. Growing health awareness and preference for minimally packaged fresh food have also reinforced the appeal of paper-based trays. Retailers have mandated recyclable and FSC-certified packaging, encouraging widespread use of cardboard trays in their supply chains.

Rising Raw Material Costs and Supply Chain Disruptions

The growth of the Cardboard trays market is hindered by rising prices of raw materials including recycled paper, virgin pulp and biodegradable coatings. Whereas increasing demand for sustainable packaging, along with supply chain bottlenecks owing to geopolitical issues, labour shortages, and transportation costs have raised the cost of production and decreased profit margins.

Furthermore, the manufacturers are constrained in maintaining product integrity and food safety compliance because of the scarce and good quality food-grade paperboard material as well as scarcity of sophisticated production tooling.

To address these issues, companies need to streamline sourcing strategies, invest in supply chain resilience, adopt alternative materials such as agricultural waste-based packaging solutions, and eventually further production efficiency using automation and AI-driven inventory management.

Stringent Environmental Regulations and Compliance Issues

Governments globally are advancing towards stringent regulation regarding packaging waste, recyclability and carbon footprint reduction keeping a check on these issues will create a colossal challenge for the Cardboard trays market.

As sustainability mandates shift, taking the form of bans on single-use plastics, mandatory compostability standards and extended producer responsibility (EPR) programs that drive behavior toward sustainable packaging, manufacturers need to ensure that they are nimble and adaptable. Moreover, forest and wood certification such as Forest Stewardship Council (FSC) and Programme for the Endorsement of Forest Certification (PEFC) increase operational costs and administrative loads.

These regulations can be debilitating for companies, as they are also required to implement sustainable innovations that include recyclable and compostable materials, if any is produced, closed-loop packaging, alliance with waste authorities, and an educational campaign to teach consumers the added-value of using sustainable packaging.

Increasing Demand for Sustainable and Eco-Friendly Packaging

With growing customer consciousness about how their choices affect the environment, the organizations are making the transition to cardboard trays that reduce the plastic consumption and move toward eco-responsible biodegradable & it is also for recyclable packaging solutions. The food and beverage industry, such as fresh produce, ready-to-eat meals and bakery items, is driving the change from plastic trays to those made from fiber.

Fiber-reliant packaging is also being implemented by retailers and e-commerce providers to elevate sustainability credentials, increase recyclability and align with consumer demand for eco-friendly products. Cost-effective and eco-friendly plant coatings, oil or water-resistant treatments, minimal use of natural resources and/ or bio-targeted divesting with compostable adhesives are paving the way towards meeting sustainability processes in global markets.

Growth in E-commerce and Food Delivery Services

Due to the increasing demand for durable, lightweight, and cost-effective packaging solution such as cardboard trays, due to the growing online retail, grocery delivery, and food service applications. Today, the demand for quick-commerce, meal kit subscriptions, and contactless food delivery has spurred the demand for sustainable, protective, and customizable tray designs that keep food fresh and safe.

Advances in moisture-resistant cardboard, corrugated tray structures, anti-grease coatings and tamper-proof packaging ensure that packaging is more reliable and hygiene standards in food processing are maintained. Companies investing in high-speed tray production, customized branding, smart tracking systems, and sustainable printing technologies will benefit from the growing sector and improved long-term competitiveness.

Analysis from 2020 to 2024 and Opportunity Assessment for 2025 to 2035 between 2020 and 2024, the Cardboard trays market is projected to grow steadily owing to increasing demand for biodegradable packaging, ban on plastic based alternatives, and enhancing government regulations on environmental impact. But high costs of raw materials, uncertain supply chains, and uneven recycling infrastructure posed significant obstacles to market growth.

They considered cost corrections for raw materials, biodegradable trapping that utilized multi-layering, as well as ways to provide biodegradable coatings from plants on fruits and vegetables, and partnerships at various points along the supply chain that would lead to efficiencies in uptime, compliance with regulatory sustainability regimes, as well as food on safety at points of sale on their foray into markets across the world through partnerships.

Forecast by 2025 to 2035 is likely to see the emergence of smart packaging, AI-powered production automation, bio-based barrier coatings, and functional biodegradable tray designs. Additional investments in clean valued-added markets such as circular economy models, closed-loop recycling systems, sustainable forestry investments and carbon-neutral manufacturing will fuel both long-term market growth and regulatory alignment.

Another advancement will be edible wrapping, self-sealing cardboard trays, radio-frequency identification (RFID) tracking, and smart freshness signals that will change packaging standards. To have long-term industry leadership, participants that will be part of the future of Retrofit market are those that embrace digitalization, invest in innovative packaging solutions, put together sustainable supply chains and align with innovation and sustainability goals through the rest of the world.

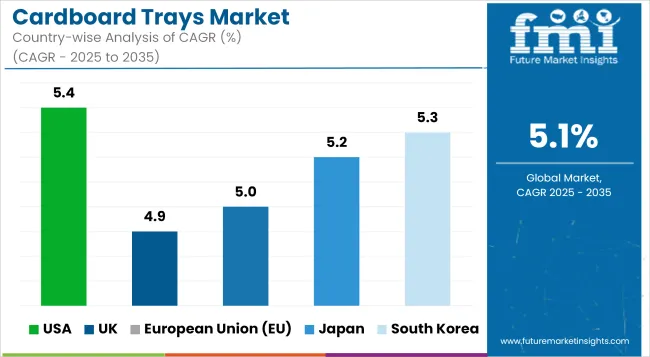

The Cardboard trays market across various sectors in the USA are driven by growing demand for sustainable and biodegradable packaging, increasing utilization in the food and beverage industry, and expanding e-commerce logistics. Major packaging manufacturers and improvements in recycled cardboard technology are major factors that continue to drive growth in the market.

The growing consumer inclination for sustainable packaging solutions is one of the major driving forces for the market growth. Moreover, features like automation in tray production, lighter weight designs, and products with an extended shelf-life such as a large range of trays with a long shelf-life are generating growing interest around product appeal for a wide variety of end-use, spanning food and non-food individuals alike.

The companies are also focusing on making low-cost, recyclable trays made of cardboard that correspond with sustainability goals. Plastic waste management in USA market, driven by growing initiatives for plastic reduction and circular economy

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.4% |

Robust government regulations on plastic waste wooing sustainable packaging in food & beverage applications is driving the cardboard tray market in key countries in the UK .The growing adoption of green packaging initiatives and corporate sustainability commitments is also driving demand.

Rising government initiatives and regulations that favor sustainable packaging alternatives, combined with innovation in biodegradable coatings and fibrous-reinforced cardboard help in expanding the market. Additionally, advances in heat-sealed, water-resistant and compostable cardboard trays are capturing interest.

Companies are considering customizable, lightweight product trays for fresh produce as well as bakery and other takeaway applications, too. The growing preference for plant-based and recyclable food packaging among consumers is also propelling the market growth in the UK. Plus, the emergence of eco-minded grocery chains and green supply chain initiatives is driving adoption.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.9% |

Germany, France, and Italy are the top players in the European Cardboard trays market due to stricter rule against single-use plastics, expanding preference for fiber-based packing, and a well-developed recycling infrastructure.

Rapid growth in the market is spurred by the European Union’s focus on circular economy policies and investments in compostable and biodegradable material. In addition, the implementation of moisture-resistant, food-grade cardboard trays and the advent of smart packaging technologies for freshness monitoring are optimizing product innovation. The growth of sustainably-minded meal preparation systems, minimalistic grocery zero-waste concepts, and capabilities for eco-oriented shipping/pick-up has further contributed to demand for recyclable tray solutions.

This also include the right packaging type to a the development of new renewable fiber sources such as biodegradable laminates and lightweight cardboard trays that are logistics optimized to be cheap, as they can be used across the European whole market. In addition, the rising implementation of eco-labeling laws and carbon footprint reduction efforts are expediting the transition to sustainable cardboard packaging.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.0% |

Japan's Cardboard trays market is characterized by a strong focus on environmental sustainability, an increase in demand for innovative packaging technologies, and a range of government-led initiatives to reduce waste. The growth of the market is propelled by the rising preference of consumers toward recyclable and compostable packaging.

Innovation is being driven by the country's focus on technological advancements and the adoption of water-resistant and heat-sealed trays made of cardboard. Additionally, stringent government regulations for plastic waste management along with the increasing awareness of consumers about eco-friendly alternatives is propelling the companies to develop high-quality food safe packaging.

And this trend can also be seen in Japan's path of packaging industry boiling from the emerging biodegradable bento box, compostable convenience food trays, recyclable e-commerce packaging products. Besides, an inclination towards minimalist and functional packaging designs, which minimizes the volume of materials used, is also contributing to adopting sustainable packaging.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.2% |

South Korea's expanding waste management policies, growing demand for sustainable packaging and lightweight, environmentally friendly options are contributing to the rapid growth of the cardboard trays market.

Market growth is the result of stringent government regulations regarding plastic usage and the growing adoption of biodegradable and compostable materials. The country is also emphasizing packaging optimization using advanced barrier coatings, plant-based laminates and recyclable adhesives to boost competitiveness.

Demand for molded fiber food packaging, stackable cardboard tray solutions, and sustainable takeaway trays is further driving market adoption. Food businesses are now layering in smart, biodegradable trays with digital tracking and freshness indicators. Increasing green consumer preference and sustainable dining trends in South Korea is propelling the demand for recyclable and compostable packaging solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.3% |

The Cardboard trays market is driven by factors such as rising demand for renewable sources of packaging as cardboard trays are environmentally-friendly and its lightweight which will cuts transportation costs. Companies are doing this by using recyclable materials, developing high-performance structural designs, and utilizing moisture-resistant coatings. The major trends include reusable trays, custom-printed trays, and innovative tray forming technology.

Other Key Players

The overall market size for Cardboard trays market was USD 6.4 Billion in 2025.

The Cardboard trays market expected to reach USD 10.8 Billion in 2035.

Increasing preference for sustainable & eco-friendly packaging, growth in food & beverage industry, rising demand from e-commerce and retail sectors, government regulations encouraging biodegradable packaging, packaging solutions acquiring recyclability will aid in propelling the demand for cardboard trays market.

The top 5 countries which drives the development of Cardboard trays market are USA, UK, Europe Union, Japan and South Korea.

Virgin and recycled fiber growth to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cardboard Flask Market Size, Share & Forecast 2025 to 2035

Cardboard Crates Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Cardboard Crates Manufacturers

Cardboard Filler Market Trends – Size, Demand & Forecast 2024-2034

Cardboard Tubs Market

Composite Cardboard Tube Packaging Market Size and Share Forecast Outlook 2025 to 2035

Composite Cardboard Tubes Market from 2025 to 2035

Breaking Down Market Share in Composite Cardboard Tube Packaging

Conductive Cardboard Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

ESD Trays Market Size and Share Forecast Outlook 2025 to 2035

Lab Trays Market Size and Share Forecast Outlook 2025 to 2035

Meat Trays Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Key Companies & Market Share in the Food Trays Sector

CPET Trays Market

Sieve Trays Market Size and Share Forecast Outlook 2025 to 2035

Pharma Trays Market Size, Share & Forecast 2025 to 2035

Correx Trays Market

Insert Trays Market

Syringe Trays Market

PET Food Trays Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA