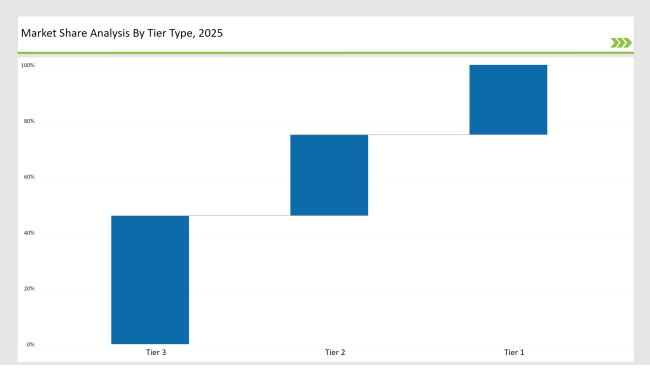

The market in cardboard crates is segmented into three tiers based on the tier of market presence and competitive strategy. Tier 1 companies like Smurfit Kappa, DS Smith, and Mondi Group have occupied 25% of the market share. Industry leaders like these companies enjoy the economies of scale advantage, maintain significant investment in R&D and large-scale global distribution.

Their emphasis on high-durability, light, and recycle-friendly cardboard packages allows them to dominate industries from food & beverages, logistics companies, and into e-commerce services. The evolving moisture-resistant material, high tensile strength of the materials that are biodegradable further contributes to their advancement.

Tier 2 market players include the likes of WestRock, International Paper, and Stora Enso, who make up about 29% of the market. These companies provide cost-effective, custom-designed cardboard crate solutions to middle-market businesses and local packaging distributors.

They have expertise in corrugated board manufacturing, sustainable forestry practices, as well as compliance with packaging regulations that have helped them expand into emerging markets.

Tier 3 regional manufacturers and niche startups will hold the remaining 46% of the market. These manufacturers will be producing innovative, cost-effective, and eco-friendly cardboard crates for local demands. These companies can rapidly respond to industry regulations that evolve and changing consumer preferences for green packaging.

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Smurfit Kappa, DS Smith, Mondi Group) | 11% |

| Rest of Top 5 (WestRock, International Paper) | 9% |

| Next 5 of Top 10 (Stora Enso, Nine Dragons Paper, Lee & Man Paper, Rengo Co., Oji Holdings) | 5% |

The cardboard crates market is dominated by Smurfit Kappa, DS Smith, Mondi Group, WestRock and International Paper. None of these companies had produced completely recyclable lightweight containers, enhanced the production process and expanded their product range so as to enter and capitalize on new market opportunities and the rise in demand for responsible packaging.

The market has experienced the rise in investments of biodegradable and high-strength corrugated material, which leads to a reduction in waste and longevity.

Year-on-Year Leaders

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Smurfit Kappa, DS Smith, Mondi Group |

| Tier 2 | WestRock, International Paper, Stora Enso |

| Tier 3 | Nine Dragons Paper, Lee & Man Paper, Rengo Co., Oji Holdings |

| Manufacturer | Latest Developments |

|---|---|

| Smurfit Kappa | Launched moisture-resistant, heavy-duty cardboard crates (May 2024) |

| DS Smith | Developed lightweight, recyclable corrugated packaging (April 2024) |

| Mondi Group | Introduced FSC-certified, biodegradable cardboard crates (March 2024) |

| WestRock | Focused on high-strength, customizable, and printable crates (June 2024) |

| International Paper | Increased production of eco-friendly, durable packaging (July 2024) |

Smurfit Kappa, DS Smith, Mondi Group, WestRock, and International Paper.

The top five manufacturers collectively control 38% of the market, while the top ten account for 47%.

Medium, as the top players hold between 30% and 60% of the industry share.

They contribute 12% of the market by offering specialized and regional solutions.

Sustainability, smart packaging solutions, and high-strength material advancements.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cardboard Flask Market Size, Share & Forecast 2025 to 2035

Cardboard Trays Market Size, Share & Forecast 2025 to 2035

Cardboard Filler Market Trends – Size, Demand & Forecast 2024-2034

Cardboard Tubs Market

Cardboard Crates Market Size and Share Forecast Outlook 2025 to 2035

Composite Cardboard Tube Packaging Market Size and Share Forecast Outlook 2025 to 2035

Composite Cardboard Tubes Market from 2025 to 2035

Breaking Down Market Share in Composite Cardboard Tube Packaging

Conductive Cardboard Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Crates Market Report - Industry Trends & Demand Forecast 2025 to 2035

Crates And Pallets Packaging Market

Metal Crates Market

Plastic Crates Market Size and Share Forecast Outlook 2025 to 2035

Folding Plastic Crates Market

Sales Analysis of Tourism Industry in the Middle East Size and Share Forecast Outlook 2025 to 2035

Semen Analysis Systems Market Size and Share Forecast Outlook 2025 to 2035

Stone Analysis Software Market – Trends & Forecast 2025 to 2035

Water Analysis Instrumentation Market Analysis – Size, Share, and Forecast 2025 to 2035

Spend Analysis Software Market

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA