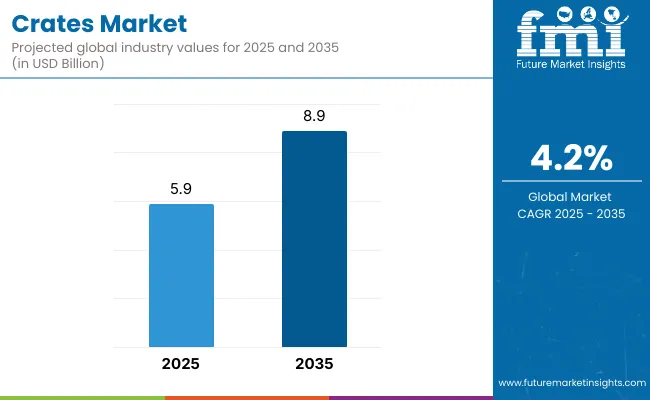

The crates market is projected to grow from USD 5.9 billion in 2025 to USD 8.9 billion by 2035, registering a CAGR of 4.2%. The 2024 sales value is estimated at USD 5.6 billion, with reusable plastic crates gaining strong adoption in cold chain and FMCG applications. Increasing demand for returnable transit packaging in food, beverage, agriculture, and industrial logistics is driving growth. These stackable and ventilated crates offer cost-efficient storage, load safety, and easy handling.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 5.9 billion |

| Industry Value (2035F) | USD 8.9 billion |

| CAGR (2025 to 2035) | 4.2% |

Smart crates integrated with RFID tags, IoT sensors, and GPS tracking are transforming supply chain visibility and inventory management. Material innovation is targeting lightweight yet high-strength polymers to reduce handling costs and environmental impact. Modular crate designs are allowing for collapsibility and multifunctional use. These advancements support circular economy goals and minimize single-use plastic waste.

Future demand will be propelled by modern retail expansion, agricultural export logistics, and government-backed sustainability regulations. Crate suppliers will differentiate through product customization, service models for pooling, and compliance with hygiene and food safety norms.

Emerging markets in Asia and Latin America are expected to present substantial growth opportunities. Industry players must invest in digital asset tracking, closed-loop systems, and cost-effective reusability to maintain competitiveness.

The below table presents the expected CAGR for the global crates market over several semi-annual periods spanning from 2025 to 2035.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 3.9% |

| H2 (2024 to 2034) | 4.1% |

| H1 (2025 to 2035) | 4.1% |

| H2 (2025 to 2035) | 4.3% |

In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 3.9%, followed by a slightly higher growth rate of 4.1% in the second half (H2) of the same decade. Moving into the subsequent period, from H1 2024 to H2 2034, the CAGR is projected to decrease slightly to 4.1% in the first half and remain relatively moderate at 4.3% in the second half.

In the first half (H1) the market witnessed a decrease of 10 BPS while in the second half (H2), the market witnessed an increase of 10 BPS.

The market has been segmented based on size, material, product type, sales channel, end use, and region. Size segments including less than 10 kg, 11 kg to 50 kg, and above 50 kg have been defined to suit varied load requirements for retail, industrial, and agricultural transport. Materials such as plastic (including HDPE, PP, and others), wooden, and metal have been used to provide durability, reusability, and application-specific compatibility.

Product types such as stackable, nestable, and collapsible crates have been incorporated to enhance space efficiency, transport handling, and storage optimization. Sales channels have been categorized into direct sales, distributors/wholesalers, retail stores, and online marketplaces to address diverse sourcing and distribution needs across buyer segments.

End-use industries have been segmented into food & beverages, including fruits & vegetables, dairy products, meat, poultry & seafood, confectionery, and others along with pharmaceuticals & medical devices, automotive parts, agriculture & allied industries, building & construction, logistics & transportation, and other industrial uses.

Regional segmentation has been structured across North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and the Middle East & Africa to reflect demand fluctuations, infrastructure expansion, and material regulations.

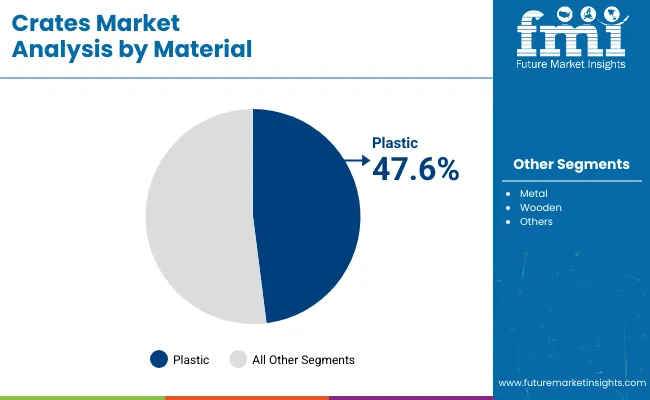

The plastic material segment is expected to account for the largest share of 47.6% in the crates market in 2025, driven by demand for durability, stackability, and moisture resistance. Polypropylene and HDPE crates have been adopted widely across industries due to their ability to withstand impact and resist chemicals. Standardized dimensions and nestable features have facilitated logistics efficiency. Washability and recyclability have also supported repeated commercial use across cold chains and storage environments.

Custom-molded plastic crates have been utilized to enhance product protection during transit while reducing weight and handling costs. Surface smoothness and air ventilation designs have been optimized for produce, bakery items, and dairy containers. Longer service life and compatibility with automation systems have been prioritized in industrial applications. Market expansion has been reinforced by operational savings and superior performance over traditional wooden crates.

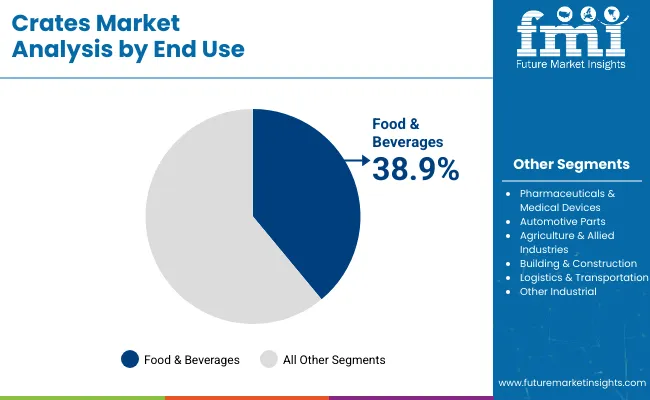

The food and beverages segment is projected to account for 38.9% of the crates market in 2025, owing to stringent hygienic transport requirements and quick-turnover inventory models. Crates have been adopted for secure movement of bottled drinks, fresh produce, bakery goods, and dairy items across distribution networks. Resistance to contamination and ease of sanitation have been emphasized to ensure food-grade standards. Efficient stackability and reduced handling time have improved overall supply chain throughput.

Demand for crates has been sustained by the foodservice sector, organized retail, and beverage bottlers requiring returnable packaging systems. Custom inserts and ventilation slots have been incorporated to maintain freshness and minimize spoilage. Robust construction and ergonomic designs have facilitated frequent loading and unloading in high-volume settings. Continued dominance has been supported by cost-effective reuse models and regional expansion of cold storage facilities.

Global Pharmaceutical Industry Growth to Drive the Market

The flourishing e-commerce industry creates a huge demand for storage and transport crates. Crates have become very important in this process as they offer durable, versatile options for moving goods from warehouses directly to the customers.

Other products in the online shops include electronics and groceries, and they have to be put in particular packaging so that they can reach their destinations without damage. The ability of crates to be customized in various shapes and dimensions Different crate sizes and dimensions enable efficient stacking and organization for fragile products. This leads to better utilization of the warehouse space available and safe shipping.

The global retail e-commerce revenue is estimated to reach up to USD 8.1 trillion by 2026, as per the study from E-commerce Tips. In addition, the growth of online retailing-which includes both online and physical sales-continues to drive up crate demand.

Because efficient packaging for multichannel sales sustains product integrity and satisfies customers. This rapid growth of online shopping emphasizes even greater reliance on crates as an effective storage and transportation method for the dynamic needs of the e-commerce sector.

Rising EV Demand Boosts Crate Usage for Logistics

The demand for crates is escalating rapidly with the ascending global demand for electric vehicles majorly from automotive and battery supply chains. As output volumes of EVs build up, manufacturers are asking for practical logistics solutions for transporting components such as batteries and motors.

The sale of electric cars went up by 25% as compared to the 2023 first half and will reach USD 17 million by the end of 2024, in accordance with the data from the International Energy Agency. Crates are used for safely moving the delicate automotive parts used in EV vehicles as they have the potential to lower the chances of damage in transportation.

To avoid rising shipping costs and better fuel efficiency, manufacturers are focusing more on lighter yet stronger designs. The more complex the supply chain in EVs becomes, standardized crates serve to offer better inventory management with operations streamlined. Therefore, an overall growing demand for EVs is propelling the crate's demand for safe storage and transport of automotive parts.

Regulatory Compliance Challenges May Strain the Crates Market

Strict regulations regarding packaging waste lead to significant costs and obstacles for companies in the global crate market. Since governmental and environmental organizations are increasingly strengthening their rules in line with sustainability such materials to be recyclable or biodegradable, this automatically adds to production costs.

In order to comply with these regulations, the end price of crates is increased as it requires additional investment for procuring recyclable, biodegradable materials and technologies. Additionally, the need for compliance also leads to innovation with sustainable packaging solutions which again incur high costs.

This attempt to make environmental consciousness crates might impact profit margins and operational efficiency, consequently causing hindrance to the growth of the crates market over the forecast period.

Tier 1 firms are market leaders who generate over USD 50 million in revenue annually and hold a substantial 12%-18% market share in the worldwide market. These industry leaders stand out for having a large product variety and a high production capacity. These industry giants stand out for having a wide geographic reach, a wealth of production experience in a variety of package styles, and a strong customer base.

They offer a variety of services, such as recycling and manufacturing, using state-of-the-art equipment, according to legal requirements, and offering the best possible quality. Among the well-known businesses in tier 1 are Myers Industries, IPL Plastics Inc., Schaefer Plastics North America, LLC, Tosca Ltd, Orbis Corporation, Schoeller Allibert, and Rehrig Pacific Company.

Mid-size businesses with annual revenue between USD 1 and USD 50 million that are based in certain areas and have a significant impact on the local market are considered Tier 2 enterprises. They are distinguished by having a significant international presence and in-depth industry expertise.

These market participants may not have cutting-edge technology or a broad worldwide reach, but they do guarantee regulatory compliance and have good technology. Among the well-known businesses in tier 2 are NEFAB GROUP, Alcomij, Monoflo International, Green Processing Company Inc., Craemer Group, Creopack Packaging, TranPak Inc, Peninsula Plastics Company Inc. and others.

Tier 3 includes most small enterprises operating locally and serving certain industries with less than USD 1 million in revenue. Due to their specialization in serving the demands of the local market, these companies are classified as belonging to the tier 3 sharing sector.

They only operate on a small scale and within a limited geographic area. Within this specific context, Tier 3 is categorized as an unstructured market, denoting an industry that is significantly less formalized and structured than its organized rivals.

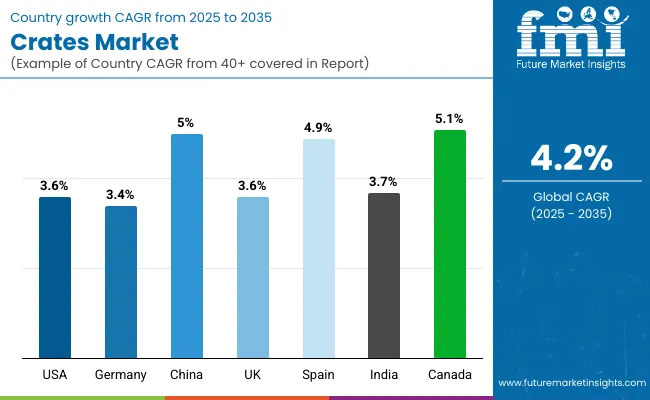

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 3.6% |

| Germany | 3.4% |

| China | 5.0% |

| UK | 3.6% |

| Spain | 4.9% |

| India | 3.7% |

| Canada | 5.1% |

The section below covers the future forecast for the crates market in terms of countries. Information on key countries in several parts of the globe, including North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe and MEA is provided.

Canada is anticipated to remain at the forefront in North America, with a CAGR of 5.1% through 2035. In Middle East & Africa, Other GCC is projected to witness a CAGR of 7.0% by 2035.

The crates industry in India is projected to grow at a CAGR of 3.7% compared to other countries in the South Asia and Pacific region by 2035.

According to Indian Brand Equity Foundation, agricultural exports from India have reached USD 53.12 billion last year, with a projected value by 2025 worth USD 24 billion. All these agricultural growths call for increased crates demand as transportation and storage of these perishables require efficiency.

With high production of fruits, vegetables, and milk products, there is an increased need for strong packaging solutions to avoid damage and wastage in transports. To be precise, crates are safe, stackable, reusable and help preserve delicate items. Besides, the trend toward organized retail and exports fuels the demand for standardized crates that enhance the ease of supply chain efficiency in this dynamic sector.

The building and construction industry offers a lot of opportunities for the crates market due to the necessity for protective packaging solutions for safe transport and handling of products The country is anticipated to record a CAGR of 3.6% during the evaluation period.

The rise in population in USA has resulted in augmented construction of residential and commercial buildings such as homes, schools, hospitals, and shopping malls. This growth asks for the demand for crates, mainly used to transport building materials and equipment.

The number of construction establishments surpassed 919,000 in the first three months in USA, as per the study from The Associated General Contractors of America, Inc. All these result in high material handling requirements, therefore, crates ensure safe and efficient logistics.

Shipping crates keep the commodities secure during shipment and keep them organized and securely kept on-site, hence maintaining a smooth flow of operations.

This, combined with the fact that the construction industry is likely to continue growing from here, means that there will be an increasing demand for such sturdily built and highly efficient crates, which shall be absolutely indispensable within the larger construction system for the USA in the longer run.

Leading companies in the crates market are creating and introducing new goods to the market. They are expanding their geographic reach and merging with other companies. Few of them are also working together to develop new products in partnerships with start-up businesses and regional brands.

Key Developments in Crates Market

The crates industry is projected to witness CAGR of 4.2% between 2025 and 2035.

Global crates industry is anticipated to reach USD 8.9 billion by 2035 end.

Middle East & Africa is set to record a CAGR of 5.2% in assessment period.

The key players operating in the crates industry are Myers Industries, IPL Plastics Inc., Schaefer Plastics North America, LLC, Tosca Ltd, Orbis Corporation, Schoeller Allibert, and Rehrig Pacific Company.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Crates And Pallets Packaging Market

Metal Crates Market

Plastic Crates Market Size and Share Forecast Outlook 2025 to 2035

Cardboard Crates Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Cardboard Crates Manufacturers

Folding Plastic Crates Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA