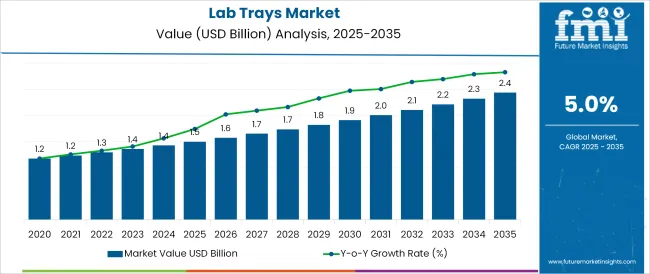

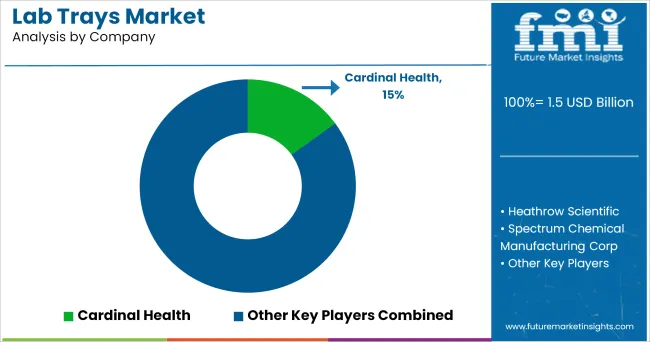

The Lab Trays Market is estimated to be valued at USD 1.5 billion in 2025 and is projected to reach USD 2.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

The lab trays market is experiencing notable growth as laboratories across healthcare, research, and industrial sectors intensify their focus on efficiency, hygiene, and sustainability. Increased demand for durable, easy to clean, and chemically resistant materials is shaping procurement decisions, while regulatory emphasis on sterilization and contamination control is driving innovation.

Laboratories are progressively replacing traditional, fragile materials with advanced polymers to meet operational and compliance needs. Growth is further supported by the expansion of diagnostic testing, rising research activity, and automation in laboratory workflows, all of which necessitate reliable and standardized tray solutions.

Future opportunities are expected to emerge from the integration of ergonomic designs, multi compartment configurations, and trays engineered for seamless sterilization. Ongoing investments in healthcare infrastructure and biopharmaceutical research are paving the path for broader adoption and the development of more specialized, application specific trays.

The market is segmented by Material, Number of Compartments, Classification, and End Use and region. By Material, the market is divided into Polypropylene, Paper & Paperboard, Polyethylene, Polystyrene, and Others. In terms of Number of Compartments, the market is classified into 10-15, Less than 10, 15-20, and More Than 20.

Based on Classification, the market is segmented into Sterilized and Non-Sterilized. By End Use, the market is divided into Healthcare & Clinical Research, Biotechnology, Academics, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

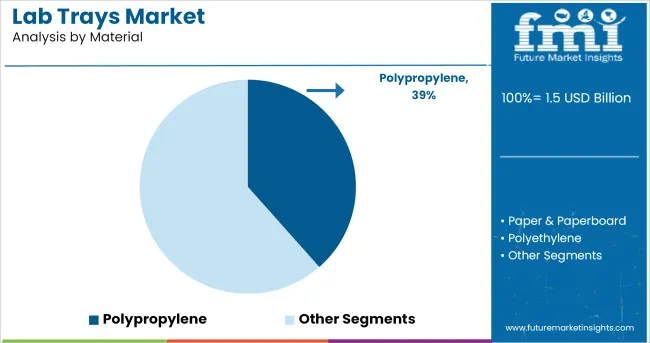

When segmented by material, polypropylene is projected to hold 38.5% of the total market revenue in 2025, maintaining its leadership position. This dominance is being reinforced by the material’s superior resistance to chemicals, durability under frequent sterilization cycles, and cost-effectiveness compared to alternative materials.

Laboratories have been favoring polypropylene due to its ability to withstand exposure to harsh reagents and autoclaving without degradation, thereby extending product life and reducing replacement costs. Its lightweight yet robust nature facilitates ease of handling and transport, which has also contributed to its widespread adoption.

The availability of polypropylene in a variety of configurations and finishes further supports its prevalence in both research and clinical settings, underscoring its continued primacy in the market.

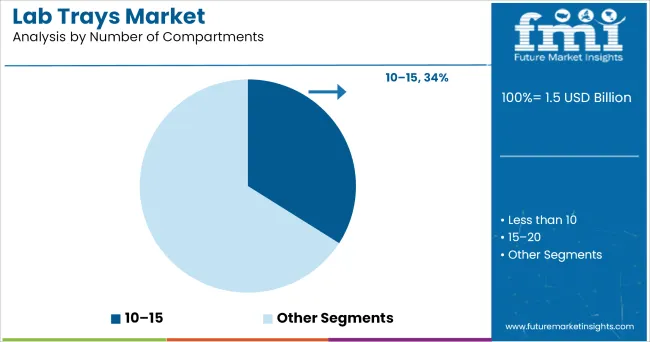

Segmented by the number of compartments, trays with 10-15 compartments are expected to command 34.0% of the market revenue in 2025, emerging as the leading configuration. This segment has gained prominence as it balances the need for sufficient sample separation with optimal tray size for standard laboratory workflows.

Laboratories have been adopting trays within this range as they allow for efficient organization of samples, reagents, and instruments without consuming excessive workspace. The compartmental design has been particularly valued for supporting multitasking environments where categorization and prevention of cross contamination are critical.

The preference for this segment is further sustained by its compatibility with automated systems and its ability to streamline processes while maintaining compliance with laboratory protocols.

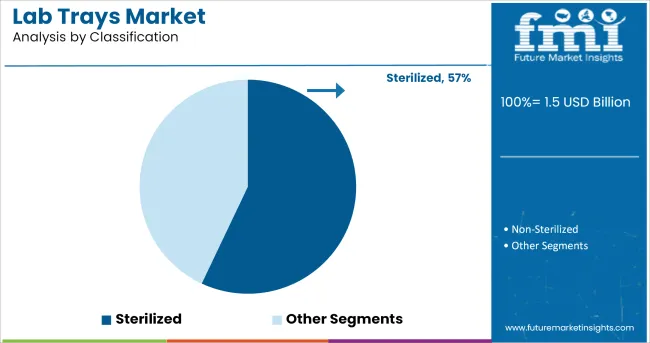

When segmented by classification, sterilized trays are projected to account for 57.0% of the market revenue in 2025, affirming their leadership within the category. This segment has achieved dominance due to the heightened emphasis on contamination control and adherence to stringent hygiene standards in laboratories handling sensitive biological and chemical materials.

The assurance of sterility upon delivery has reduced the burden on laboratory personnel and minimized risks associated with improper or inconsistent sterilization practices. The convenience and reliability of sterilized trays have become increasingly valued as laboratories prioritize operational efficiency and regulatory compliance.

Their widespread adoption has also been supported by the rising prevalence of diagnostic and research activities in highly controlled environments where sterility is a non-negotiable requirement.

Growing investments in research & development sectors, and government regulations pertaining equipment quality are encouraging the usage of sterile lab trays to avoid infections is estimated to fuel the market growth in the near future.

Based on the requirements, Lab trays are being utilized across various applications including chemical, medicine, biotech and other research laboratories, in clinics and hospitals at the time of operations. Each of the applications need specific sterilization process, which depends on the materials to be used in the trays and application for which the tray is to be used. Certain players are focusing on manufacturing of antimicrobial plates and trays which has superior resistance against dust and chemicals.

The unprecedented scenario created by the COVID-19 pandemic has impacted the supply chain across the globe. But this has also opened the door for innovations in order to respond to such challenges. Key players are now focusing on more agile and advanced supply chain networks to continue business operations despite unforeseen supply disruptions.

The emergence of new business supply chain models and continuous focus on innovative technologies either by optimization of existing supply chains or by exploring new modes of movement in terms of scalability, competitiveness, and sustainability, is a key trend in the industry.

Based on application, Healthcare and clinical research segments are estimated to hold majority of market share and is expected to continue their dominance in the coming assessment period owing to increasing demand. The COVID-19 pandemic has highlighted the pivotal role of the healthcare & research sector in the world.

The frenzy surrounding vaccine procurement has brought focus on scientific research & development efforts that seldom find mass media coverage. Thus the renewed emphasis on healthcare research is projected to boost the demand for this product in the upcoming decade.

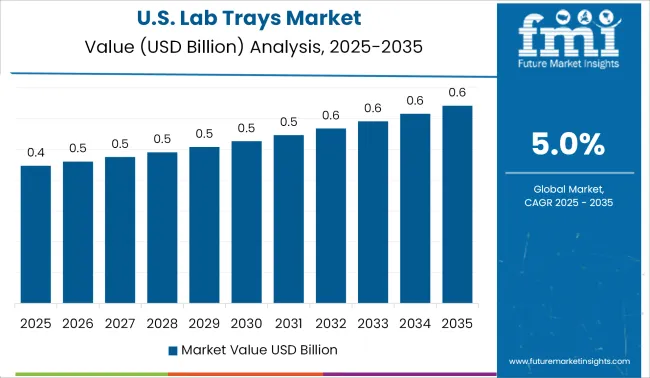

The demand for lab trays from the USA is expected to be significant owing to consistent investment & activities in life science and research across the country. Key players in the USA lab tray market have significant opportunity to gain maximum revenue in between the forecast period. In terms of value CAGR, the USA market is expected to expand at a CAGR of 3-5% in between the forecast period.

European countries are concentrating on the life science research sector to boost the biotechnology & healthcare industry. Europe is expected to hold more than one-third of the market share in the market owing to the increasing adoption of research activities in the region.

Furthermore, favourable initiatives taken by the regional governments to improve life science research activities is playing a key role in the development of the market. Among the European Union countries, Germany market is experiencing lucrative growth and is expected to expand at a CAGR of 2-4%.

Some of the leading manufacturers in the market includes

Globally, key players building new merger and acquisition strategies with the focus on strengthening supply chain network. Also, introducing of specific need based products is expected to be one of the key factor for key players to gain maximum share from the market. In the same line, in 2020, USA based, Becton, Dickinson and Company introduced innovative lab tray for low temperature sterilization processes.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global lab trays market is estimated to be valued at USD 1.5 billion in 2025.

The market size for the lab trays market is projected to reach USD 2.4 billion by 2035.

The lab trays market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in lab trays market are polypropylene, paper & paperboard, polyethylene, polystyrene and others.

In terms of number of compartments, 10–15 segment to command 34.0% share in the lab trays market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Recyclable Ovenable Trays Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Recyclable Ovenable Tray Providers

Labels Market Forecast and Outlook 2025 to 2035

Laboratory Information System Market Forecast and Outlook 2025 to 2035

Label Applicators Market Size and Share Forecast Outlook 2025 to 2035

Lab Mailers Market Size and Share Forecast Outlook 2025 to 2035

Labor Management System In Retail Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Centrifuge & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Lab Centrifuges Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Shakers Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Washers Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Rockers and Shakers Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Filtration Devices Market Size and Share Forecast Outlook 2025 to 2035

Lab Chip Devices Market Size and Share Forecast Outlook 2025 to 2035

Labeling and Coding Equipment Market Size and Share Forecast Outlook 2025 to 2035

Lab-On-Chips Market Size and Share Forecast Outlook 2025 to 2035

Laboratory and Medical Scale Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Furnaces Market Analysis - Size, Share, and Forecast 2025 to 2035

Labels, Tapes And Films Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Supplies Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA