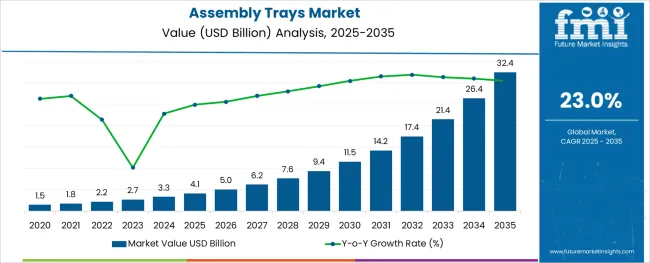

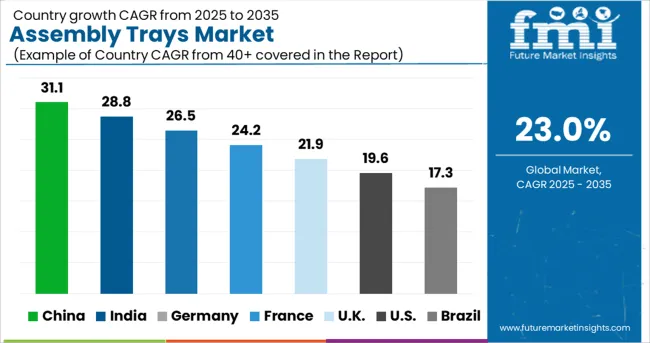

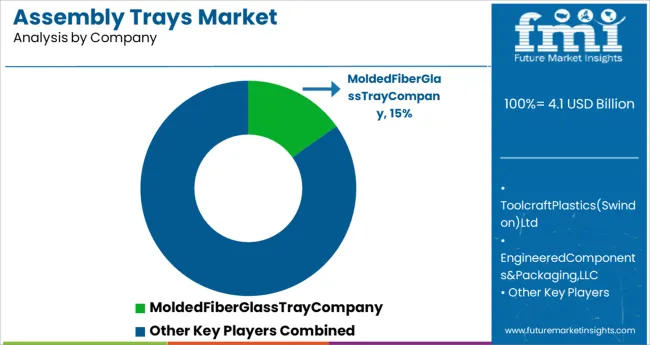

The Assembly Trays Market is estimated to be valued at USD 4.1 billion in 2025 and is projected to reach USD 32.4 billion by 2035, registering a compound annual growth rate (CAGR) of 23.0% over the forecast period.

The assembly trays market is experiencing notable expansion due to the growing focus on operational efficiency, workplace organization, and safe component handling in manufacturing environments. Industries such as automotive, electrical and electronics, and precision engineering are increasingly prioritizing organized assembly processes, which has elevated demand for reusable and durable trays.

Emphasis on lean manufacturing and modular workstations has led to greater integration of tray systems that facilitate part segregation, quick access, and protection during transport. Suppliers are investing in ergonomic designs, stackability features, and static control properties to meet the needs of automated and manual assembly lines.

Additionally, environmental concerns are encouraging the use of recyclable and long-life materials. With ongoing digital transformation in production systems and increasing product complexity, the market is expected to benefit from smart tray designs that support labeling, traceability, and compatibility with robotic handling systems across diverse sectors.

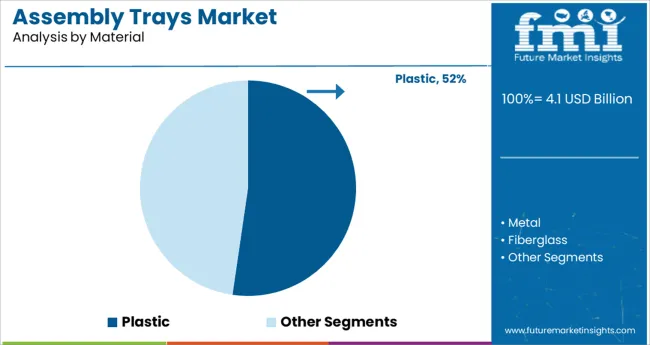

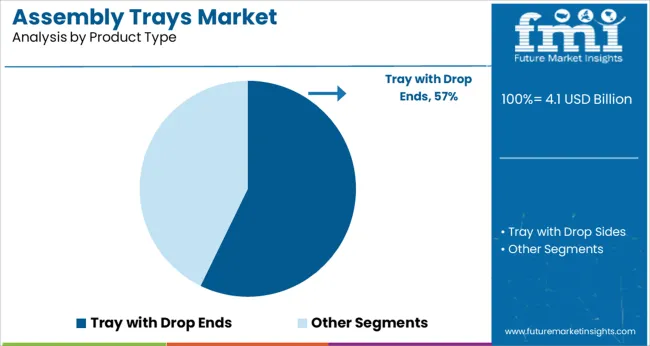

The market is segmented by Material, Product Type, and End Use and region. By Material, the market is divided into Plastic, Metal, and Fiberglass. In terms of Product Type, the market is classified into Tray with Drop Ends and Tray with Drop Sides.

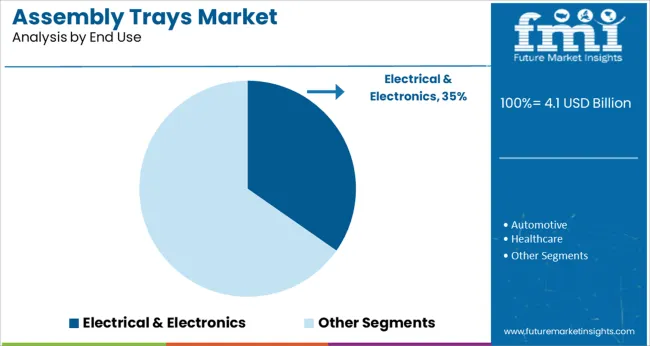

Based on End Use, the market is segmented into Electrical & Electronics, Automotive, Healthcare, Aerospace, and Others (Defence & Military, etc.). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Plastic assembly trays are anticipated to account for 52.3% of the total material-based revenue share in 2025, making it the most dominant material used in this market. This preference is driven by plastic’s lightweight nature, cost-effectiveness, and durability across a wide range of industrial applications.

Plastic trays offer strong resistance to chemicals, moisture, and wear, making them ideal for repetitive use in environments where cleanability and precision are essential. Additionally, plastic allows for easy molding into various geometries and surface textures, which supports customized designs tailored to specific component shapes and production workflows.

Its compatibility with anti-static and ESD-safe variants has further reinforced adoption in electronics and precision sectors. The recyclability and long service life of engineered plastics have positioned them as a preferred sustainable solution among manufacturers seeking reliable and eco-conscious packaging systems.

Tray with drop ends is projected to capture 57.2% of revenue share by 2025 under the product type category, solidifying its lead within the segment. This is attributed to the enhanced accessibility and ergonomic functionality offered by drop-end designs, which allow quick insertion and retrieval of delicate or irregular-shaped parts.

In high-volume assembly operations, these trays help reduce handling time while minimizing product damage. Their compatibility with automation systems, conveyors, and robotic arms has further increased their utility in modern production lines.

Manufacturers have increasingly opted for drop-end configurations due to their space-saving and stackable designs, which improve inventory management and storage efficiency. Additionally, the ease of integrating identification features such as barcodes or color coding has made drop-end trays a preferred option for operations requiring frequent part tracking and fast throughput.

The electrical and electronics segment is expected to hold a leading share of 34.7% in 2025 based on end use, driven by the rising complexity of electronic components and the demand for secure handling during assembly and testing. Miniaturized circuit boards, precision components, and static-sensitive devices require protective handling solutions, and assembly trays have become essential in organizing, transporting, and safeguarding these items.

The adoption of ESD-safe and conductive trays made from engineered plastics has become standard in electronics manufacturing environments to prevent electrostatic discharge damage. As production volumes increase in consumer electronics, semiconductors, and industrial automation equipment, the demand for trays that support efficiency, traceability, and quality control is also rising.

Manufacturers are customizing tray layouts to match assembly sequences and optimize workstation productivity. These operational enhancements and the growing push for defect-free assembly have reinforced the leading position of this end use segment in the assembly trays market.

Most electrical products get spoilt due to the generation of static electricity in them. It is also noticed that around 33% of electrical devices are damaged due to the absence of suitable packaging solutions.

Increasing demand for ESD assembly trays in the electrical and electronics industry drives sales of the assembly trays.

Additionally, the semiconductor and PCB industry is witnessing significant expansion which is a prominent application for assembly trays. Assembly trays are the ideal protective packaging solution for the packaging of ESD-prone electrical and electronics components.

Generally, countries import electronic components such as semiconductors and PCBs for the production of these electronic devices. Companies in the emerging regions are currently focusing on the domestic production of these electronic components in order to reduce the final cost of the product.

On the basis of geography, the global assembly trays market is segmented into North America, South Asia, Latin America, East Asia, Europe, Middle East & Africa & Oceania.

China is anticipated to represent tremendous growth in the assembly trays market share due to various factors like rapid growth in automation & electronics industry.

Europe assembly trays market is expected to witness judicious growth due to matured market in Germany, France & Italy.

MEA is expected to be the fastest growing market due to the rising penetration of electrical & electronics which tends to drive the sales of assembly trays.

The increase in demand for conveyor trolleys in automotive and electronics industry has boosted the demand for assembly trays in the developing countries such as India, Brazil, etc. These countries, excluding China, have negligible manufacturing facilities for the production of the electronics components.

Companies are investing heavily in backward integration at their PCBs in-house facilities. There has been a substantial rise in the number of manufacturers of these components in recent years.

Therefore, the increase in production of these components is anticipated to boost the assembly trays market in APAC regions. This, in turn, is likely to lead to high growth opportunities for the assembly trays market in these emerging markets.

The key players of the assembly trays market are focusing on enhancing and adopting strategies like enhancing the durability, sizes and its use to thrive business. This is driving the sales of assembly trays

Some of the key participating players indulged in the sales of assembly trays are:

This section includes a holistic view of the competitive landscape that includes various strategic developments such as key mergers & acquisitions, future capacities, partnerships, financial overviews, collaborations, new product developments, new product launches, and other developments.

These market players are anticipated to drive the assembly trays market by introducing new products and expanding geographically.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 23% from 2025 to 2035 |

| Base year for estimation | 2025 |

| Historical data | 2020 to 2024 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in million and CAGR from 2025 to 2035 |

| Report coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis |

| Segments covered | Product type, Material type, Load Capacity, End User, and Region |

| Regional scope | North America; Latin America; Europe; South Asia; East Asia; Oceania; Middle East & Africa (MEA) |

| Country scope | USA, Canada, Mexico, Brazil, Germany, Italy, France, UK, Spain, Russia, China, Japan, South Korea, India, Malaysia, Thailand, Indonesia, Australia & New Zealand, GCC, S. Africa, N. Africa |

| Key companies profiled | Molded Fiber Glass Tray Company; K. Goodwin Co.; Impala Plastics; W. Grainger Inc.; Conductive Containers Inc.; Desco Industries Inc. |

| Customization scope | Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. |

The global assembly trays market is estimated to be valued at USD 4.1 billion in 2025.

It is projected to reach USD 32.4 billion by 2035.

The market is expected to grow at a 23.0% CAGR between 2025 and 2035.

The key product types are plastic, metal and fiberglass.

tray with drop ends segment is expected to dominate with a 57.2% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Breakdown of Assembly Trays Manufacturers

Assembly Fastening Tools Market Size and Share Forecast Outlook 2025 to 2035

Assembly Machine Market Size and Share Forecast Outlook 2025 to 2035

Assembly Automation Systems Market

Leaf Spring Assembly Market Size and Share Forecast Outlook 2025 to 2035

Semiconductor Assembly and Testing Service Market Size and Share Forecast Outlook 2025 to 2035

Industrial Hose Assembly Market Size and Share Forecast Outlook 2025 to 2035

Automotive Tie Rod Assembly Market

Automotive Air Vent Assembly Market

Automotive Tube Bending & Assembly Parts Market

Printed Circuit Board (PCB) Assembly Market Size and Share Forecast Outlook 2025 to 2035

Silicone Sealants for Photovoltaic Assembly Market Forecast and Outlook 2025 to 2035

Automotive Transmission Synchronizer Assembly Market Size and Share Forecast Outlook 2025 to 2035

ESD Trays Market Size and Share Forecast Outlook 2025 to 2035

Lab Trays Market Size and Share Forecast Outlook 2025 to 2035

Meat Trays Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Key Companies & Market Share in the Food Trays Sector

CPET Trays Market

Sieve Trays Market Size and Share Forecast Outlook 2025 to 2035

Pharma Trays Market Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA