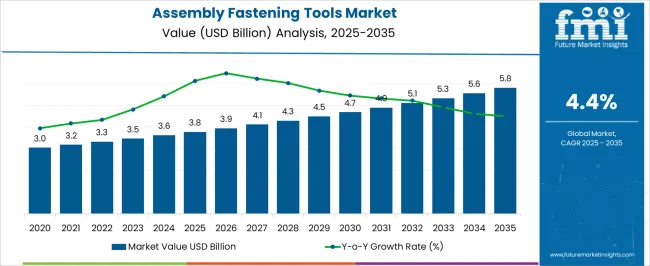

The assembly fastening tools market is estimated to be valued at USD 3.8 billion in 2025 and is projected to reach USD 5.8 billion by 2035, registering a compound annual growth rate (CAGR) of 4.4% over the forecast period. The incremental growth from USD 3.8 billion to USD 5.8 billion over the forecast period suggests the market is in the late growth stage of the adoption lifecycle, characterized by steady adoption across industrial, automotive, and construction applications. Early adopters have largely integrated advanced fastening solutions, including automated and ergonomic tools, driving initial market expansion, while the majority of end-users continue a gradual replacement of conventional manual fastening equipment.

The annual value increments, rising from USD 3.8 billion in 2025 to USD 5.8 billion in 2035, indicate stable but controlled adoption momentum. Market penetration is influenced by factors such as production efficiency demands, labor safety considerations, and the integration of smart fastening technologies.

Late majority adoption is expected to contribute significantly to value increases, while laggards in traditional sectors continue to have limited uptake. The market demonstrates characteristics of a mature but evolving industry, where technology-driven adoption and replacement cycles sustain growth. Incremental yearly increases suggest a balanced trajectory between market saturation and ongoing technology integration, confirming that the market is progressing steadily along its maturity curve while still offering opportunities for value expansion through enhanced automation and efficiency-focused solutions.

| Metric | Value |

|---|---|

| Assembly Fastening Tools Market Estimated Value in (2025 E) | USD 3.8 billion |

| Assembly Fastening Tools Market Forecast Value in (2035 F) | USD 5.8 billion |

| Forecast CAGR (2025 to 2035) | 4.4% |

The assembly fastening tools market represents a specialized segment within the global industrial tools and manufacturing equipment industry, emphasizing precision, efficiency, and operational reliability. Within the broader hand and power tools sector, it accounts for about 5.2%, driven by demand across automotive, aerospace, electronics, and general manufacturing applications. In the industrial assembly and fastening solutions segment, its share is approximately 6.1%, reflecting the adoption of electric, pneumatic, and torque-controlled fastening tools. Across the manufacturing automation and production line equipment market, it contributes around 4.8%, supporting consistent quality, reduced labor time, and productivity improvements.

Within the construction and maintenance tools category, it represents 3.9%, highlighting usage in structural assembly, repair, and infrastructure projects. In the overall precision tools and industrial equipment ecosystem, the market contributes about 4.5%, emphasizing durability, ergonomic design, and integration with automated assembly processes. Recent developments in the assembly fastening tools market have focused on automation, digital integration, and ergonomic innovation.

Groundbreaking trends include torque-sensing electric screwdrivers, smart fastening systems with data logging, and cordless pneumatic tools that enhance mobility on production lines. Key players are collaborating with automotive, aerospace, and electronics manufacturers to deploy high-precision, programmable fastening solutions. Adoption of IoT-enabled tools, predictive maintenance, and modular attachments is gaining traction to improve efficiency, safety, and traceability. The lightweight materials, energy-efficient motors, and vibration-reducing designs are shaping tool ergonomics.

The assembly fastening tools market is witnessing steady expansion, supported by growing automation in manufacturing processes and the increasing demand for precision fastening solutions. The current landscape reflects heightened adoption across automotive, aerospace, electronics, and heavy machinery sectors, driven by the need for efficiency, quality consistency, and reduced operational downtime. Technological advancements, including torque control, data integration, and ergonomic enhancements, are being integrated into fastening systems to meet stringent production standards.

The future outlook is shaped by the transition towards Industry 4.0-enabled smart tools, where connectivity and real-time monitoring will play pivotal roles in quality assurance. Rising infrastructure investments and defense modernization programs in various economies further underpin the market’s growth trajectory.

While competition from low-cost manual alternatives persists, the emphasis on safety compliance, productivity gains, and lifecycle cost efficiency is expected to secure long-term adoption. Overall, the market is positioned to benefit from sustained industrial growth, increased automation penetration, and the continuous evolution of fastening technologies.

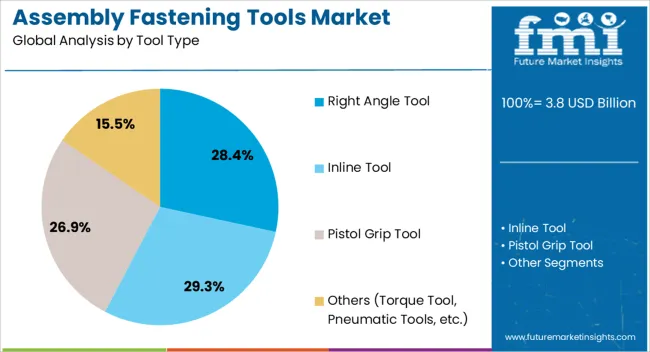

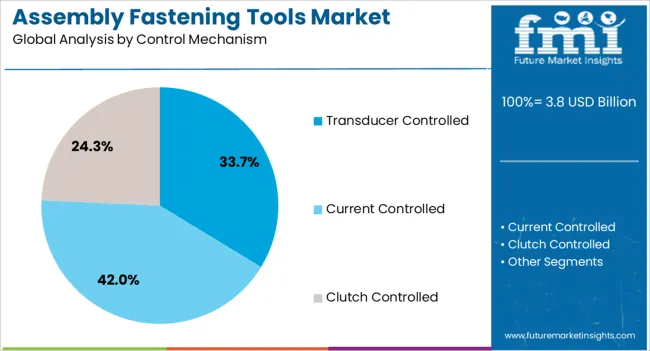

The assembly fastening tools market is segmented by tool type, control mechanism, end-use, distribution channel, and geographic regions. By tool type, assembly fastening tools market is divided into Right Angle Tool, Inline Tool, Pistol Grip Tool, and Others (Torque Tool, Pneumatic Tools, etc.). In terms of control mechanism, assembly fastening tools market is classified into Transducer Controlled, Current Controlled, and Clutch Controlled.

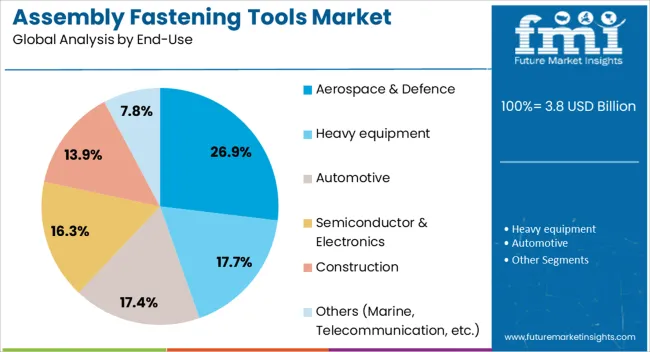

Based on end-use, assembly fastening tools market is segmented into Aerospace & Defence, Heavy equipment, Automotive, Semiconductor & Electronics, Construction, and Others (Marine, Telecommunication, etc.). By distribution channel, assembly fastening tools market is segmented into Direct, Company Owned Stores, Company Owned Websites, and Indirect. Regionally, the assembly fastening tools industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The right angle tool segment leads the tool type category with a share of approximately 28.4% in the assembly fastening tools market. Its market leadership is supported by the segment’s suitability for applications in confined spaces and assembly lines where accessibility and precision are critical. This tool configuration is extensively deployed in sectors requiring high torque and controlled fastening in tight or obstructed areas, making it indispensable in complex assembly environments.

Adoption has been further encouraged by ergonomic designs that reduce operator fatigue and enhance productivity during repetitive fastening tasks. Additionally, its compatibility with both manual and automated production setups has broadened its application scope.

Industrial manufacturers value the right-angle tool for its durability and operational reliability under demanding conditions, particularly in high-volume production settings. Continued innovation in weight reduction, torque accuracy, and integration with electronic monitoring systems is expected to sustain the segment’s competitive edge over the forecast period.

The transducer controlled segment holds the highest share of approximately 33.7% within the control mechanism category. This dominance is attributed to the segment’s ability to deliver highly accurate torque and angle measurement, ensuring compliance with stringent fastening standards. These tools are increasingly adopted in industries where product safety, reliability, and consistency are critical, such as automotive, aerospace, and precision electronics manufacturing.

The use of transducer technology enables real-time feedback and process monitoring, supporting quality control protocols and reducing the risk of assembly errors. Moreover, the integration of such systems with manufacturing execution systems (MES) facilitates data traceability and production analytics, aligning with Industry 4.0 objectives.

While the initial investment in transducer controlled tools is relatively high, the long-term benefits in terms of reduced rework, enhanced safety, and minimized warranty claims outweigh cost concerns. As manufacturers prioritize traceable and error-proof fastening solutions, this segment is expected to maintain its leadership position through the forecast horizon.

The aerospace and defence segment accounts for approximately 26.9% of the assembly fastening tools market in the end-use category. Its substantial share is driven by the critical role fastening plays in ensuring structural integrity and safety in high-performance environments. Assembly fastening tools deployed in this segment must adhere to rigorous quality and precision standards, as even minor fastening errors can have significant safety implications.

The demand is further reinforced by ongoing defense modernization programs, increasing aircraft production, and the maintenance, repair, and overhaul (MRO) activities of both military and commercial fleets. Aerospace and defence manufacturers favor advanced fastening solutions with torque control, process validation, and documentation capabilities to comply with strict regulatory requirements.

Additionally, the emphasis on lightweight materials and composite structures in modern aircraft design necessitates specialized fastening tools tailored to these materials. With expanding global aerospace manufacturing hubs and defense procurement programs, this segment is expected to sustain its prominence over the forecast period.

The market has been experiencing steady growth due to rising industrial automation, manufacturing expansion, and increased demand for precision in assembly processes. Tools including torque wrenches, screwdrivers, riveters, and pneumatic fasteners are employed across automotive, aerospace, electronics, and construction sectors to ensure secure and reliable component joining. Market adoption has been influenced by the need for consistent fastening quality, operational efficiency, and reduced labor intensity. Technological advancements in ergonomic design, digital torque monitoring, and cordless electric tools have enhanced performance and usability.

Advances in technology have significantly improved the efficiency and precision of assembly fastening tools. Digital torque wrenches, electronic screwdrivers, and automated fastening robots allow precise application of force and consistent fastening quality, reducing component failure and maintenance costs. Integration with data collection systems enables real-time monitoring of assembly processes, ensuring compliance with industry standards. Ergonomic designs reduce operator fatigue, while cordless and pneumatic tools enhance mobility and operational flexibility in assembly lines. Industry-specific solutions, such as torque-controlled tools for automotive or aerospace applications, have been developed to meet stringent quality requirements. These innovations have increased adoption rates across diverse manufacturing sectors, enabling faster production cycles, improved product reliability, and overall operational efficiency in modern assembly processes.

The expansion of industrial manufacturing, particularly in the automotive, electronics, and aerospace sectors, has been a significant driver for assembly fastening tools. Automotive production requires high-precision fastening for engine components, chassis assemblies, and electronic modules. Electronics manufacturers utilize micro-fasteners and torque-controlled tools for sensitive components, while aerospace applications demand specialized tools capable of maintaining strict safety and quality standards. The adoption of modular manufacturing and flexible assembly lines has further increased the need for versatile and portable fastening solutions. OEMs and contract manufacturers are increasingly deploying automated fastening systems to reduce labor costs and enhance assembly throughput. Industrial growth, coupled with the rising demand for reliable and durable assemblies, continues to stimulate the market globally.

Ergonomically designed assembly fastening tools have enhanced user comfort, reduced operator fatigue, and improved workplace safety. Lightweight materials, optimized handle designs, and balanced tool weight distribution have increased tool usability during extended assembly operations. Cordless and battery-powered options provide mobility and reduce downtime caused by tethered cables or pneumatic setups. Operator-focused features such as torque feedback, LED indicators, and adjustable settings allow accurate and consistent fastening, minimizing errors and rework. Training programs and tool standardization in industrial facilities further support efficient adoption. As manufacturers prioritize worker productivity and quality assurance, ergonomic and intelligent fastening solutions have become essential components in modern assembly operations, reinforcing market demand across multiple industrial segments.

Automation and connectivity are reshaping the assembly fastening tools market by integrating tools into smart manufacturing ecosystems. Automated robotic fastening systems equipped with sensors enable precision, repeatability, and seamless data integration with enterprise resource planning and quality management systems. Connectivity allows remote monitoring, predictive maintenance, and process optimization, ensuring minimal downtime and improved operational efficiency. Industries such as automotive, aerospace, and consumer electronics increasingly rely on networked fastening solutions to meet production demands and maintain product quality standards. Investment in smart factories and Industry 4.0 initiatives is driving the adoption of advanced fastening technologies. The integration of automation and digital connectivity is strengthening market expansion and shaping the future of assembly operations worldwide.

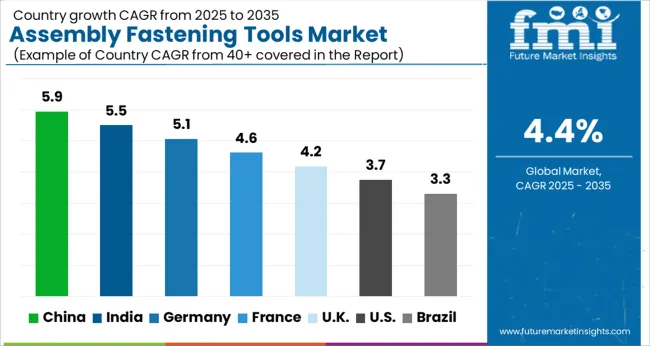

| Country | CAGR |

|---|---|

| China | 5.9% |

| India | 5.5% |

| Germany | 5.1% |

| France | 4.6% |

| UK | 4.2% |

| USA | 3.7% |

| Brazil | 3.3% |

The market is expected to expand at a CAGR of 4.4% between 2025 and 2035, driven by industrial automation and manufacturing modernization. China leads with 5.9%, reflecting rapid industrial growth and adoption of advanced fastening solutions. India follows at 5.5%, supported by the expansion of manufacturing sectors and rising demand for efficient assembly systems. Germany records 5.1%, propelled by precision engineering and automation trends. The UK holds 4.2%, influenced by industrial upgrades and productivity enhancement initiatives. The USA registers 3.7%, reflecting steady demand in automotive, electronics, and general manufacturing sectors. Growth is shaped by technological adoption, automation integration, and rising demand for efficient assembly solutions. This report includes insights on 40+ countries; the top markets are shown here for reference.

China recorded a 5.9% CAGR, driven by rapid industrialization, automotive production, and expansion of manufacturing facilities. Demand for automated and manual fastening tools increased in automotive, electronics, and construction sectors. Domestic manufacturers invested in high precision, energy efficient, and ergonomic tools to meet the needs of large scale production lines. Competitive strategies included partnerships with global tool providers, regional distribution networks, and localized after sales support. Adoption of smart assembly solutions integrating torque control and monitoring systems further enhanced operational efficiency. Companies also emphasized durability, ease of use, and compliance with quality standards to strengthen market penetration across industrial and commercial segments.

India demonstrated a 5.5% CAGR, supported by growth in automotive manufacturing, electronics assembly, and infrastructure projects. Manufacturers invested in ergonomic, precision, and automated fastening tools to meet diverse industrial requirements. Regional production hubs facilitated timely supply, while collaborations with global tool makers enabled technology transfer and advanced tool adoption. Competitive strategies emphasized after sales service, tool calibration, and training programs for operators. Industrial automation initiatives and quality improvement programs increased the uptake of energy efficient and digital monitoring fastening tools. Demand was highest in automotive assembly lines, electronics manufacturing, and large scale infrastructure projects where efficiency and reliability were critical.

Germany progressed at a 5.1% CAGR, shaped by high demand in automotive, aerospace, and precision engineering sectors. Manufacturers focused on energy efficient, ergonomic, and digitally monitored fastening tools to optimize assembly operations. Industrial automation and quality compliance with EU standards influenced production and adoption strategies. Competitive advantage was achieved through product reliability, tool calibration services, and integration with assembly line monitoring systems. Export demand to neighboring European countries further shaped production priorities. Adoption was highest in high volume automotive assembly and specialized engineering workshops where precision, durability, and ease of operation were critical to operational efficiency and product quality.

The United Kingdom expanded at a 4.2% CAGR, driven by automotive production, industrial manufacturing, and electronics assembly. Demand for precision, ergonomic, and automated fastening tools increased across production lines. Manufacturers focused on durability, energy efficiency, and tool calibration services to enhance adoption. Competitive differentiation relied on after sales support, rapid delivery, and technology integration. Adoption was highest in industrial assembly, automotive workshops, and electronics manufacturing hubs. Training programs and partnerships with production facilities ensured optimal use of tools. Innovation in torque control, digital monitoring, and energy efficient designs reinforced reliability and productivity across both large scale and specialized assembly operations.

The United States grew at a 3.7% CAGR, influenced by demand in automotive, aerospace, electronics, and construction sectors. Manufacturers invested in ergonomic, energy efficient, and digitally monitored fastening tools to meet production line requirements. Competitive strategies emphasized after sales service, tool calibration, and regional distribution networks. Adoption was highest in industrial hubs, automotive assembly lines, and aerospace manufacturing facilities. Automation initiatives and industrial productivity programs increased uptake of smart fastening tools integrated with torque monitoring and quality control systems. Companies focused on durability, reliability, and compliance with ANSI and ISO standards to strengthen their market presence and ensure long term customer satisfaction.

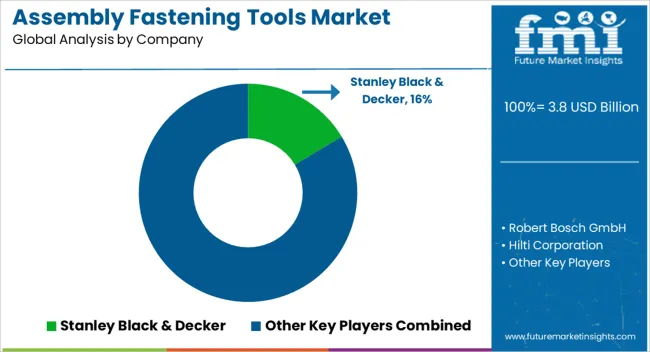

The market has been defined by global tool manufacturers and industrial specialists. Stanley Black & Decker, Robert Bosch GmbH, and Hilti Corporation have focused on high precision, durability, and ergonomic design. Strategies emphasize cordless solutions, torque accuracy, and integration with automated assembly lines. Makita Corporation and Atlas Copco have targeted productivity optimization, offering tools that combine speed, reliability, and reduced operator fatigue. Ingersoll Rand and Snap-on Incorporated have differentiated themselves through industrial-grade performance and modular systems for large-scale manufacturing.

Product brochures highlight electric, pneumatic, and battery-powered fastening tools designed for diverse applications. Emphasis is placed on high torque output, consistent fastening quality, and low maintenance requirements. Bosch and Hilti emphasize innovation in brushless motors, while Stanley Black & Decker promotes compact and lightweight designs suitable for both industrial and workshop environments. Competition revolves around efficiency, reliability, and adaptability.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.8 Billion |

| Tool Type | Right Angle Tool, Inline Tool, Pistol Grip Tool, and Others (Torque Tool, Pneumatic Tools, etc.) |

| Control Mechanism | Transducer Controlled, Current Controlled, and Clutch Controlled |

| End-Use | Aerospace & Defence, Heavy equipment, Automotive, Semiconductor & Electronics, Construction, and Others (Marine, Telecommunication, etc.) |

| Distribution Channel | Direct, Company Owned Stores, Company Owned Websites, and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Stanley Black & Decker, Robert Bosch GmbH, Hilti Corporation, Makita Corporation, Atlas Copco, Ingersoll Rand, and Snap-on Incorporated |

| Additional Attributes | Dollar sales by tool type and application, demand dynamics across automotive, aerospace, and industrial manufacturing sectors, regional trends in assembly automation adoption, innovation in torque control, ergonomics, and efficiency, environmental impact of material use and energy consumption, and emerging use cases in precision assembly, modular production lines, and robotic integration. |

The global assembly fastening tools market is estimated to be valued at USD 3.8 billion in 2025.

The market size for the assembly fastening tools market is projected to reach USD 5.8 billion by 2035.

The assembly fastening tools market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in assembly fastening tools market are right angle tool, inline tool, pistol grip tool and others (torque tool, pneumatic tools, etc.).

In terms of control mechanism, transducer controlled segment to command 33.7% share in the assembly fastening tools market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Assembly Machine Market Size and Share Forecast Outlook 2025 to 2035

Assembly Trays Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Assembly Trays Manufacturers

Assembly Automation Systems Market

Leaf Spring Assembly Market Size and Share Forecast Outlook 2025 to 2035

Semiconductor Assembly and Testing Service Market Size and Share Forecast Outlook 2025 to 2035

Industrial Hose Assembly Market Size and Share Forecast Outlook 2025 to 2035

Automotive Tie Rod Assembly Market

Automotive Air Vent Assembly Market

Automotive Tube Bending & Assembly Parts Market

Printed Circuit Board (PCB) Assembly Market Size and Share Forecast Outlook 2025 to 2035

Silicone Sealants for Photovoltaic Assembly Market Forecast and Outlook 2025 to 2035

Automotive Transmission Synchronizer Assembly Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Key Players in the Hand Tools Market Share Analysis

Power Tools Market Size and Share Forecast Outlook 2025 to 2035

Smart Tools Market Size and Share Forecast Outlook 2025 to 2035

Power Tools Industry Analysis in India - Size, Share, and Forecast Outlook 2025 to 2035

Baking Tools Market Size and Share Forecast Outlook 2025 to 2035

Kitchen Tools and Accessories Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA