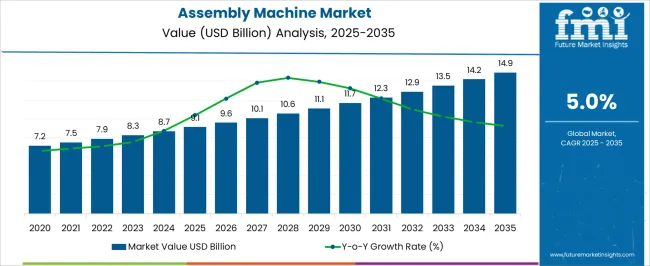

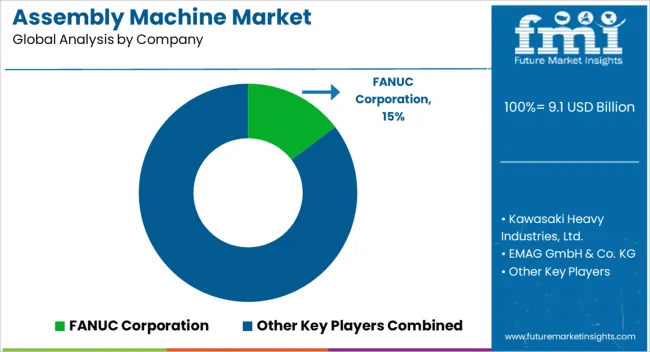

The Assembly Machine Market is estimated to be valued at USD 9.1 billion in 2025 and is projected to reach USD 14.9 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

The assembly machine market is projected to register consistent expansion, moving from USD 9.1 billion in 2025 to approximately USD 14.9 billion by 2035, at a compound annual growth rate (CAGR) of 5%. Between 2025 and 2030, the market advances steadily from USD 9.1 billion, supported by automation trends in automotive, electronics, and packaging sectors, as industries emphasize efficiency, reduced labor dependency, and improved production throughput. Rising adoption of semi-automatic and fully automated machines in manufacturing plants further accelerates this progress. From 2030 to 2035, the value climbs from USD 9.6 billion to USD 12.3 billion, driven by deployment of advanced robotic systems, growing demand for precision assembly, and integration of smart control software that enhances flexibility across diverse production lines. Heightened need for scalable, high-speed, and energy-efficient assembly solutions ensures that the assembly machine market retains strong relevance across multiple verticals. Global manufacturers continue to adopt modular and flexible machines that can handle shorter product life cycles, customized requirements, and high-volume throughput, making the segment central to the next phase of industrial growth.

| Metric | Value |

|---|---|

| Assembly Machine Market Estimated Value in (2025 E) | USD 9.1 billion |

| Assembly Machine Market Forecast Value in (2035 F) | USD 14.9 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The Assembly Machine market is undergoing a robust transformation as industries increasingly prioritize automation, accuracy, and scalable production systems. This shift is being driven by growing industrial digitization, increasing labor costs, and the global push for lean manufacturing. Assembly machines are becoming vital in reducing human error, minimizing cycle times, and enhancing throughput in high-volume production environments.

The market is also witnessing strong demand from sectors such as automotive, electronics, medical devices, and consumer goods, where precise and repeatable assembly operations are critical. With advancements in vision-guided systems, servo-controlled actuators, and programmable logic controls, manufacturers are moving toward integrated, modular solutions that offer flexibility and lower downtime.

Government incentives for industrial automation, coupled with the rising demand for smart factories and Industry 4.0 frameworks, are further reinforcing adoption across both developed and emerging economies. The future outlook for the Assembly Machine market remains strong, supported by continuous investments in intelligent automation and the need for customized, high-speed assembly solutions.

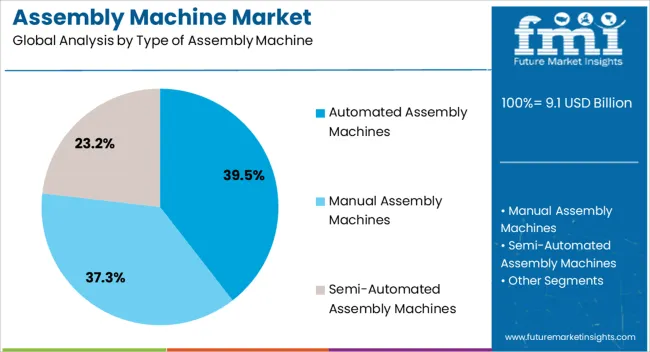

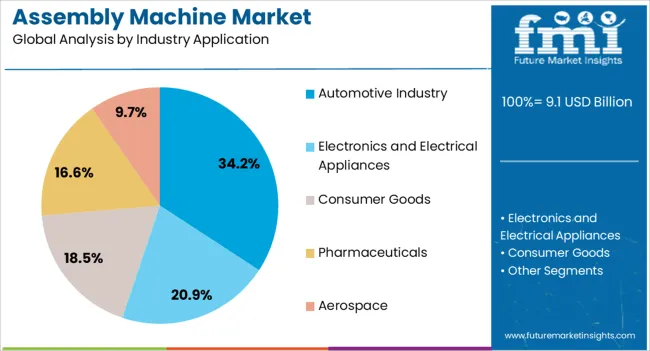

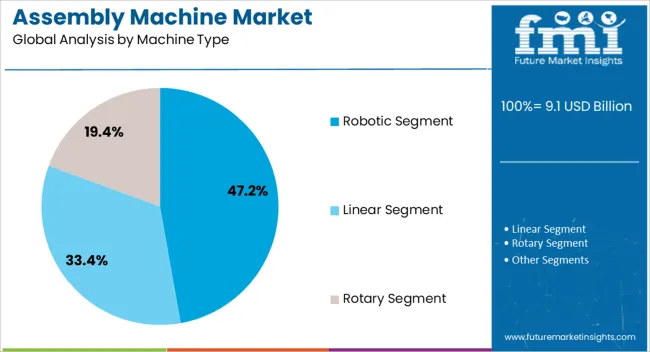

The assembly machine market is segmented by type of assembly machine, industry application, machine type, level of automation, end-user size, and geographic regions. By type of assembly machine, assembly machine market is divided into Automated Assembly Machines, Manual Assembly Machines, and Semi-Automated Assembly Machines. In terms of industry application, assembly machine market is classified into Automotive Industry, Electronics and Electrical Appliances, Consumer Goods, Pharmaceuticals, and Aerospace. Based on machine type, assembly machine market is segmented into Robotic Segment, Linear Segment, and Rotary Segment. By level of automation, assembly machine market is segmented into Fully Automated Systems, Partially Automated Systems, and Non-Automated Systems. By end-user size, assembly machine market is segmented into Large Enterprises, Medium Enterprises, and Small Enterprises. Regionally, the assembly machine industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The automated assembly machines segment is expected to account for 39.5% of the Assembly Machine market’s revenue share in 2025, establishing its dominance among machine types. This growth is being supported by the need to enhance manufacturing precision, reduce labor dependency, and increase overall productivity. These machines are preferred in environments where high-speed, repetitive tasks are essential, and quality assurance is non-negotiable.

The ability to integrate real-time sensors, vision systems, and error detection software has made automated assembly systems a critical part of modern production lines. Their modularity enables easy adaptation to product design changes, thereby reducing engineering time and accelerating product time-to-market.

The segment’s momentum is further propelled by the need for traceability and digital control within production systems, which automated machines fulfill through real-time data communication and programmable workflows As manufacturing operations continue to scale and diversify globally, automated systems are being adopted for their consistent output, operational stability, and long-term return on investment.

The automotive industry segment is projected to hold 34.2% of the Assembly Machine market’s revenue share in 2025, reflecting its strong reliance on precision and throughput in production. This dominance is driven by the rising complexity of vehicle assemblies, stringent quality standards, and the increasing demand for electric vehicles. The sector requires highly efficient assembly lines for components such as engines, drivetrains, battery packs, and interior modules, which automated machines are well equipped to handle.

The shift toward modular production and just-in-time inventory models has further accelerated the adoption of assembly systems that offer fast cycle times and low operational variability. Integration with robotic arms, torque-controlled tools, and real-time monitoring platforms allows manufacturers to maintain consistent quality across all assembly points.

Additionally, regulatory pressure to improve fuel efficiency and safety standards is pushing automakers to adopt automation for precise component placement and compliance assurance These factors are positioning assembly machines as a core enabler of operational excellence within the automotive industry.

The robotic segment is expected to represent 47.2% of the Assembly Machine market’s revenue share in 2025, underscoring its dominant position among machine types. Growth in this segment is being propelled by the widespread adoption of industrial robots across high-volume production environments. Robotic assembly systems are preferred for their agility, precision, and ability to handle complex multi-axis tasks that are difficult to replicate manually.

Their integration with advanced motion control systems and AI-powered vision technologies allows real-time adaptation to part variations and enhanced inspection capabilities. Manufacturers benefit from the high repeatability and reduced defect rates offered by robotic systems, especially in industries such as electronics, automotive, and aerospace.

These systems also offer significant space efficiency through compact footprints and flexible deployment, which has made them ideal for both greenfield and brownfield factory setups The segment’s prominence is further reinforced by the global emphasis on human-machine collaboration, where robotic assembly lines are enabling higher productivity while ensuring workplace safety and compliance.

Assembly machines are expanding as key enablers of industrial automation. Their flexibility, integration with digital tools, and rising global investments position them as critical assets in modern production systems.

Assembly machines are being adopted widely across automotive, electronics, medical devices, and packaging industries as companies seek higher efficiency, precision, and reduced labor dependency. Automotive production lines rely heavily on automated assembly for powertrain, body, and safety components, driving substantial growth. Electronics manufacturers use these machines for surface-mount technology and micro-assembly, especially for compact devices requiring accuracy. Medical device manufacturers depend on automated assembly for reliable production of diagnostic kits and surgical instruments. In packaging and food processing, these machines help accelerate throughput and minimize contamination risks. Their growing relevance across industries highlights the shift toward lean manufacturing practices, where consistent output and faster cycle times are prioritized by manufacturers worldwide.

The market is witnessing strong emphasis on modular assembly machines that allow manufacturers to adapt production lines quickly for varied product specifications. Flexible systems are being prioritized, as industries need frequent product changeovers without lengthy downtime. Integration of vision inspection systems and smart sensors is being preferred to ensure quality control in real time. Modular configurations also allow customization, making assembly equipment suitable for both high-volume production and small batch runs. This adaptability is particularly valuable for consumer electronics and medical devices, where rapid product innovation cycles demand flexibility. Companies adopting such systems are gaining a competitive edge by responding faster to changing consumer requirements while maintaining cost efficiency.

Automation is being integrated with advanced digital technologies to improve accuracy, efficiency, and monitoring capabilities of assembly machines. Robotic arms, vision-guided tools, and AI-powered analytics are increasingly incorporated to reduce defects and optimize cycle time. Predictive maintenance and real-time data collection are enabling continuous performance monitoring, lowering downtime risks. Digital twins and cloud-based control systems are gaining traction, allowing remote supervision and faster troubleshooting. This integration is helping industries maximize output while maintaining high product quality standards. The electronics and automotive industries, in particular, are accelerating the adoption of such digitally connected assembly systems to achieve higher productivity benchmarks and to address the growing complexity of their production processes.

Machine builders are investing heavily in developing energy-efficient and compact designs that reduce floor space while increasing productivity. Manufacturers are focusing on delivering equipment with customizable features to address the specific needs of diverse end-use industries. Partnerships between equipment providers and industrial firms are becoming frequent, aiming to develop tailor-made systems for specialized production environments. Investments in research and development are leading to faster cycle times, enhanced durability, and improved user interfaces for ease of operation. Growth opportunities are especially strong in emerging manufacturing hubs across Asia, where rising industrialization is fueling adoption. These investments are not only shaping the competitive landscape but also establishing assembly machines as indispensable assets in global production.

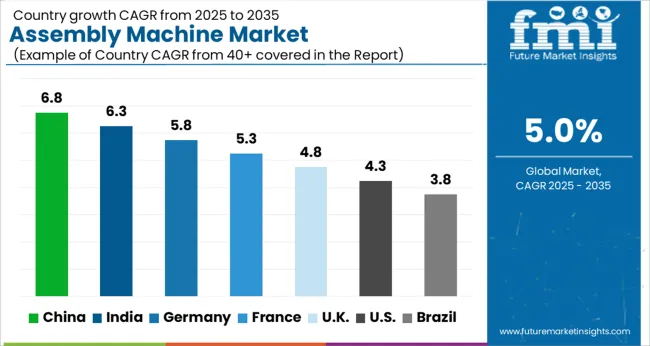

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The assembly machine market is projected to expand globally at a CAGR of 5.0% from 2025 to 2035, fueled by automation-driven manufacturing demand and higher adoption in precision-driven sectors. China leads with a CAGR of 6.8%, supported by large-scale industrial expansion, electronics production hubs, and rising automotive assembly operations. India follows at 6.3%, driven by its expanding industrial base, government-backed manufacturing initiatives, and strong demand from automotive and consumer goods industries. France grows at 5.3%, benefiting from automation investments in packaging, pharmaceuticals, and aerospace. The United Kingdom posts 4.8%, while the United States records 4.3%, both reflecting mature yet steady demand for automated assembly solutions across diverse industries. The report features insights for more than 40 countries, highlighting automation adoption strategies, regional investment drivers, and evolving demand trends shaping the future of assembly machines in global manufacturing.

China is projected at 6.8% CAGR during 2025–2035, above the global 5.0% average. During 2020–2024, growth was about 5.9%, backed by automotive assembly expansions, consumer electronics demand, and large-scale investment in EV battery production. The next phase is expected to be shaped by adoption of modular assembly lines, integration of collaborative robots, and vision-enabled systems for higher accuracy. Localization of components such as servo motors and feeders has improved cost efficiency and reduced commissioning time, giving manufacturers faster payback cycles. Contract manufacturing in electronics and medical devices is widening adoption of cleanroom-compatible assembly equipment. Provincial investment schemes and turnkey projects will continue to support demand across both high-volume and high-precision segments.

India is estimated at 6.3% CAGR during 2025–2035, compared to about 5.2% in 2020–2024. Early growth came from higher assembly line penetration in automotive components, white goods, and electrical equipment, supported by government-led manufacturing incentives. The outlook strengthens with rising localization of tooling, growing EMS capacity for smartphones, and pharmaceutical device assembly requiring precision systems. Automotive suppliers are increasing investments in e-axle and transmission assembly, which elevates the role of traceability and torque analytics. Service coverage across Tier-2 and Tier-3 cities is improving machine uptime, raising adoption even among SMEs. Integration of vision systems, robotics, and modular platforms is set to advance, sustaining competitiveness for both large OEMs and contract manufacturers.

France is projected at 5.3% CAGR for 2025–2035, modestly higher than the 4.5% growth during 2020–2024. Expansion was first supported by upgrades in packaging, cosmetics, and aerospace sub-assembly, with rising demand for flexible machines to handle multiple product formats. The upcoming phase is influenced by pharma and biotech investments in sterile device assembly, where validated inspection and servo precision are prioritized. Aerospace suppliers are embracing digital trace logs and automated fastening systems to meet quality benchmarks. Compact modular layouts are being adopted for brownfield plants to cut floor space needs. Financing tools and lifecycle service contracts are accelerating machine replacement cycles, creating a steady outlook for new orders in key high-value industries.

The United Kingdom is expected at 4.8% CAGR for 2025–2035, compared to about 3.8% in 2020–2024. Growth in the earlier period was slower due to Brexit-linked uncertainty and cautious capital spending. The projected improvement is linked to higher investments in pharmaceutical device assembly, food packaging automation, and regulatory-compliant production lines. Cobots combined with vision systems and torque control are raising first-pass yield in short-run manufacturing. SMEs are adopting phased automation programs supported by financing tools and reliable local fixture supply. Stringent food and life sciences standards have elevated demand for validated traceable systems, which positions advanced assembly machines as an essential upgrade for compliance.

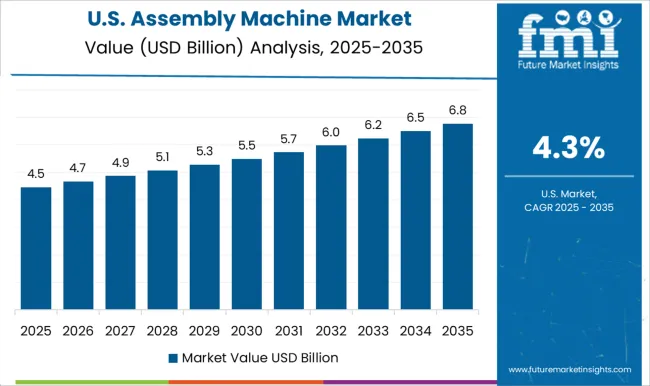

The United States is projected at 4.3% CAGR during 2025–2035, lower than the global 5.0% path, compared to about 3.9% during 2020–2024. Earlier growth reflected cautious replacement spending and selective automation in high-value sectors. The outlook improves as reshoring initiatives and labor shortages drive wider adoption across aerospace, industrial equipment, and medical technology. Assembly machines with predictive maintenance, torque traceability, and modular PLC interfaces are being adopted to ensure compliance and efficiency. Packaging facilities are prioritizing shorter changeover times, cap torque analytics, and inline leak testing. Vendors with strong spare parts logistics and remote diagnostics are gaining advantage, as uptime and after-sales support remain critical factors in buyer decisions.

FANUC Corporation and Kawasaki Heavy Industries, Ltd. dominate with advanced robotics and automated assembly platforms designed for high-volume automotive and electronics production. EMAG GmbH & Co. KG and Bystronic AG contribute with integrated machining and assembly systems suited for metalworking and precision industries. Mondragon Assembly and A UNO TEC S.R.L. strengthen their presence through turnkey assembly solutions, particularly in renewable energy components and medical devices.

Gefit Group and Norwalt Design Inc. are known for high-speed custom automation, catering to packaging, personal care, and pharmaceutical applications. Humard Automation SA and Haumiller emphasize precision assembly for complex industrial processes, while RNA Automation Limited focuses on feeding and handling systems that complement assembly lines. Isthmus Engineering & Manufacturing, and Intec Automation, Inc. are cooperative and custom integrators, providing modular solutions for varied manufacturing needs.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Type of Assembly Machine | Automated Assembly Machines, Manual Assembly Machines, and Semi-Automated Assembly Machines |

| Industry Application | Automotive Industry, Electronics and Electrical Appliances, Consumer Goods, Pharmaceuticals, and Aerospace |

| Machine Type | Robotic Segment, Linear Segment, and Rotary Segment |

| Level of Automation | Fully Automated Systems, Partially Automated Systems, and Non-Automated Systems |

| End-User Size | Large Enterprises, Medium Enterprises, and Small Enterprises |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | FANUC Corporation, Kawasaki Heavy Industries, Ltd., EMAG GmbH & Co. KG, Bystronic AG Mondragon Assembly, A UNO TEC S.R.L., Gefit Group, Norwalt Design Inc., Humard Automation SA, Haumiller, RNA Automation Limited, Isthmus Engineering & Manufacturing, Intec Automation, Inc., Extol, Inc., and Hindustan Automation |

| Additional Attributes | Dollar sales, share, regional growth hotspots, competitor strategies, adoption by automotive, electronics, and medical sectors, technology integration trends, regulatory shifts, and future expansion opportunities. |

The global assembly machine market is estimated to be valued at USD 9.1 billion in 2025.

The market size for the assembly machine market is projected to reach USD 14.9 billion by 2035.

The assembly machine market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in assembly machine market are automated assembly machines, manual assembly machines and semi-automated assembly machines.

In terms of industry application, automotive industry segment to command 34.2% share in the assembly machine market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Assembly Fastening Tools Market Size and Share Forecast Outlook 2025 to 2035

Assembly Trays Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Assembly Trays Manufacturers

Assembly Automation Systems Market

Semiconductor Assembly & Testing Service Market Trends – Growth & Forecast 2024-2034

Industrial Hose Assembly Market Size and Share Forecast Outlook 2025 to 2035

Automotive Tie Rod Assembly Market

Automotive Air Vent Assembly Market

Automotive Tube Bending & Assembly Parts Market

Printed Circuit Board (PCB) Assembly Market Size and Share Forecast Outlook 2025 to 2035

Automotive Transmission Synchronizer Assembly Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Market Size and Share Forecast Outlook 2025 to 2035

Machine Vision Camera Market Size and Share Forecast Outlook 2025 to 2035

Machine Tool Oils Market Size and Share Forecast Outlook 2025 to 2035

Machine Vision System And Services Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Machine Tool Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Machine Tool Touch Probe Market Analysis - Size, Growth, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA