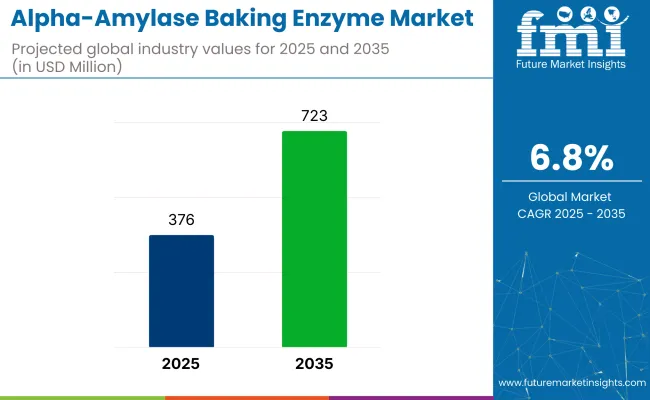

The alpha-amylase baking enzyme market is expected to grow from USD 376 million in 2025 to USD 723 million by 2035, registering a CAGR of 6.8% throughout the forecast period. Rising demand for consistent dough quality, improved shelf life, and energy-efficient baking processes is expected to support sustained growth. North America and Europe remain major consumption hubs, while emerging bakery sectors in Asia Pacific are gaining momentum.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 376 million |

| Projected Market Size in 2035 | USD 723 million |

| CAGR (2025 to 2035) | 6.8% |

In 2025, the alpha-amylase baking enzyme market holds a focused yet vital share across several broader ingredient and processing markets. Within the global food enzymes market, it accounts for approximately 8-10%, as alpha-amylase is widely used in bread and baked product formulations. In the baking ingredients market, its share is estimated at 5-7%, given its role in improving dough stability, volume, and shelf life.

Within the industrial enzymes market, it represents around 2-3%, as baking applications form a segment of overall enzyme use. In the processed food market, its contribution is more limited, about 0.5-1% since enzymes are one of many components. In the specialty ingredients market, alpha-amylase enzymes make up 1-2%, valued for their functional performance in bakery innovation.

Enzyme innovation has focused on thermostability and targeted activity under varying baking conditions. New enzyme strains are being developed for higher tolerance to extreme pH and temperature ranges, making them suitable for diverse bakery environments. As clean-label and additive-free product lines gain traction, alpha-amylase is increasingly marketed as a natural processing aid rather than a chemical additive. This dual functionality of performance and perception is positioning the enzyme as a critical component in modern baking solutions.

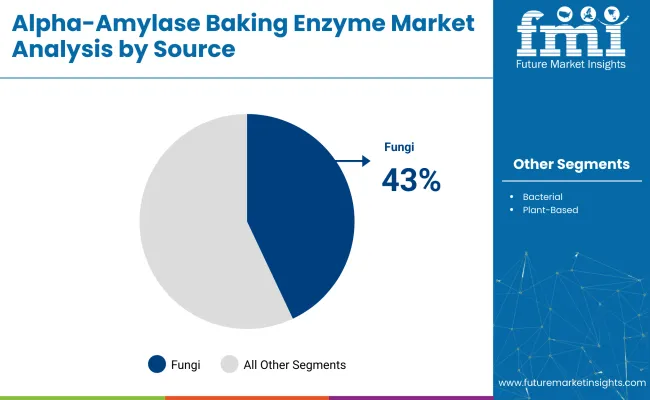

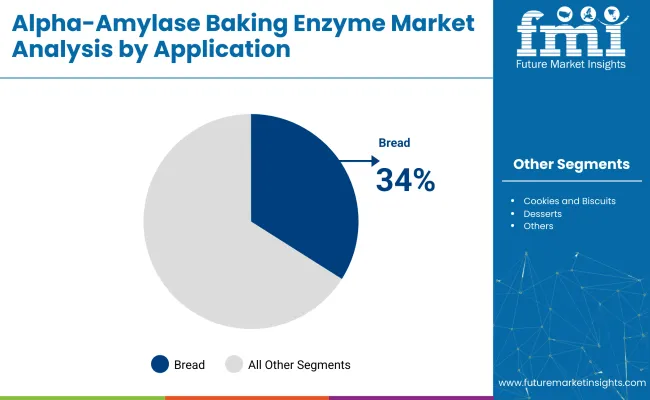

Fungal sources are projected to dominate the source segment with a 43% market share by 2025, while bread production is set to lead the application segment with a 34% share, supported by rising demand for improved dough handling and texture in bakery products.

Fungal-derived alpha-amylase is expected to account for 43% of the global market share by 2025, driven by its superior heat stability and suitability for high-temperature baking environments.

Bread applications are projected to lead the application segment, capturing 34% of the alpha-amylase baking enzyme market share by 2025.

The alpha-amylase baking enzyme market is growing steadily as bakery manufacturers seek improved dough performance, extended shelf life, and enhanced texture in finished products. Enzyme producers are innovating with targeted formulations for artisanal, industrial, and clean-label baking. Rising demand for enzyme-based solutions in bread, cakes, and pastries is driving global expansion.

Widespread Use in Breadmaking and Dough Conditioning

Alpha-amylase is widely used in baking to break down starches into simpler sugars, enhancing yeast fermentation and dough handling. Its use improves loaf volume, crumb softness, and crust color. Both commercial bakeries and industrial-scale producers rely on alpha-amylase to ensure consistency in high-speed production lines and frozen dough systems.

Rising Preference for Clean-Label and Enzyme-Based Alternatives

With growing consumer focus on clean-label ingredients, alpha-amylase is increasingly used as a natural alternative to chemical dough conditioners and preservatives. It is favored in formulations that exclude synthetic additives while maintaining shelf life and product quality. Organic and gluten-free baked goods also utilize alpha-amylase to support better texture and structural integrity.

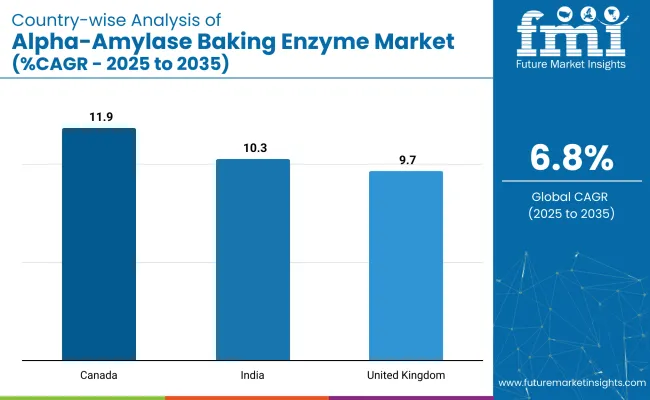

| Countries | CAGR (2025 to 2035) |

|---|---|

| Canada | 11.9% |

| India | 10.3% |

| United Kingdom | 9.7% |

The alpha-amylase baking enzyme market is experiencing strong growth globally as demand rises for natural dough improvers, clean-label baking ingredients, and shelf-life extending enzymes. The market is projected to expand steadily from 2025 to 2035, with Canada leading among key countries at 11.9% CAGR, followed by India at 10.3%, and the United Kingdom at 9.7%. These countries are deploying enzyme solutions across packaged bread, frozen bakery, and industrial baking systems.

OECD economies like Canada and the UK are focusing on clean-label innovation, advanced fermentation techniques, and regulatory compliance, while India, a BRICS nation, is scaling adoption through cost-effective baking processes and food processing expansion.

The report covers detailed insights from 40+ countries. The three below are highlighted for their market leadership and growth momentum.

Canada is expected to grow at a CAGR of 11.9%, the highest among leading countries, driven by strong innovation in clean-label baking and increased demand for frozen and packaged bakery goods. As an OECD and NAFTA/USMCA country, Canada is focusing on natural enzyme integration to meet evolving health standards and consumer expectations for minimally processed products.

Canadian food manufacturers are investing in enzymatic formulations to improve dough consistency, texture, and shelf life without additives. Domestic and cross-border demand for frozen bakery, gluten-free products, and artisan breads are creating fertile ground for alpha-amylase applications.

India’s alpha-amylase enzyme market is forecast to grow at a CAGR of 10.3%, fueled by the rapid expansion of the commercial baking sector, urban demand for packaged goods, and adoption of cost-efficient enzyme systems. As a BRICS and Emerging Market, India is increasing its enzyme imports and domestic production to support better dough stability, extended freshness, and volume enhancement in industrial-scale baking.

Demand is accelerating across quick-service restaurants, bread manufacturers, and regional bakery chains. Local food processors are incorporating enzymes to reduce additive dependence and optimize flour quality, especially in mass-produced sandwich loaves and buns.

The UK is projected to grow at a CAGR of 9.7%, reflecting a mature but steadily evolving baking industry that prioritizes ingredient transparency and functionality. As an OECD economy with strong food regulation, the UK is focused on enzyme-based alternatives to chemical emulsifiers and shelf-life extenders.

The clean-label movement, combined with rising demand for low-additive bread, is pushing commercial bakeries to adopt alpha-amylase for crumb softness, dough handling, and fermentation control. Artisan bakers and private-label supermarket brands are also leveraging enzyme technology to meet freshness and sensory expectations.

The alpha-amylase baking enzyme market is moderately consolidated, led by biotech and food ingredient giants focusing on enzymatic innovation and baking performance. Novozymes A/S and Koninklijke DSM N.V. dominate the space through advanced enzyme formulations that improve dough handling, crumb structure, and shelf life. DuPont (IFF Nutrition & Biosciences) and AB Enzymes GmbH also play pivotal roles by offering specialty baking enzymes tailored for both industrial bakeries and artisanal applications.

Hansen Holding A/S and BASF SE contribute with multifunctional enzymes for diverse baking processes, while firms like Advanced Enzyme Technologies and Amano Enzyme Inc. offer region-specific solutions for local baking industries. Emerging players such as Enzyme Development Corporation and Jiangsu Yiming Biological Technology Co., Ltd. are expanding their presence with competitive pricing and custom blends, further intensifying market competition.

Recent Alpha-Amylase Baking Enzyme Industry News

In May 2023, Novozymes launched a next-generation alpha-amylase enzyme designed to enhance texture and softness in white bread and sweet baked goods, targeting North American and European markets.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 376 million |

| Projected Market Size (2035) | USD 723 million |

| CAGR (2025 to 2035) | 6.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for market value |

| Sources Analyzed (Segment 1) | Fungi-Based, Bacterial-Based, Plant-Based |

| Applications Analyzed (Segment 2) | Bread, Cookies & Biscuits, Desserts, Other Bakery Applications |

| Regions Covered | North America, Latin America, Asia Pacific, Middle East & Africa, Europe |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Japan, China, India, South Korea, Brazil |

| Key Players | Novozymes A/S, Koninklijke DSM N.V., Puratos Group N.V., DuPont (IFF Nutrition & Biosciences), DSM Nutritional Products, AB Enzymes GmbH, Hansen Holding A/S, BASF SE, Advanced Enzyme Technologies, Amano Enzyme Inc., Enzyme Development Corporation, Specialty Enzymes & Probiotics, Jiangsu Yiming Biological Technology Co., Ltd. |

| Additional Attributes | Dollar sales by application and source, increasing adoption in bread and cookie formulations, demand for clean-label enzymes, and expanding industrial bakery production across emerging economies. |

The Alpha-Amylase Baking Enzyme market, by source, includes fungi-based, bacterial-based, and plant-based enzymes.

By application, the market is segmented into bread, cookies and biscuits, desserts, and other bakery applications.

Industry analysis has been conducted across key regions, including North America, Latin America, Asia Pacific, the Middle East & Africa, and Latin America.

The market is expected to reach USD 723 million by 2035.

The market size is projected to be USD 376 million in 2025.

The market is expected to grow at a CAGR of 6.8% from 2025 to 2035.

Bread production is projected to dominate the application segment with a 34% market share in 2025.

Canada is anticipated to grow at the highest CAGR of 11.9% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Baking and Cooking Paper Market Size and Share Forecast Outlook 2025 to 2035

Baking Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Baking Molds And Trays Market Size and Share Forecast Outlook 2025 to 2035

Baking Tools Market Size and Share Forecast Outlook 2025 to 2035

Baking Soda Substitute Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Market Share Breakdown of the Baking and Cooking Paper Market

Baking Paper Market

Home Baking Ingredients Market Growth - Consumer Trends 2025 to 2035

Enzymes for Laundry Detergent Market Size and Share Forecast Outlook 2025 to 2035

Enzymes Market Size and Share Forecast Outlook 2025 to 2035

Enzymes for Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Enzyme Protectants Market Size and Share Forecast Outlook 2025 to 2035

Enzyme-Enabled Cold-Brew Concentrates Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Enzyme Replacement Therapy Market Insights - Size & Forecast 2025 to 2035

Enzyme Substrates Market – Growth & Forecast 2025 to 2035

Enzyme Inhibitors Market

Coenzyme Q10 Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bioenzyme Fertilizer Market Size, Growth, and Forecast 2025 to 2035

Sea Enzyme Products Market Size and Share Forecast Outlook 2025 to 2035

Meat Enzyme Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA