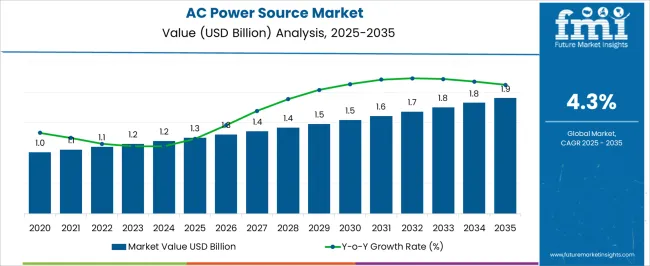

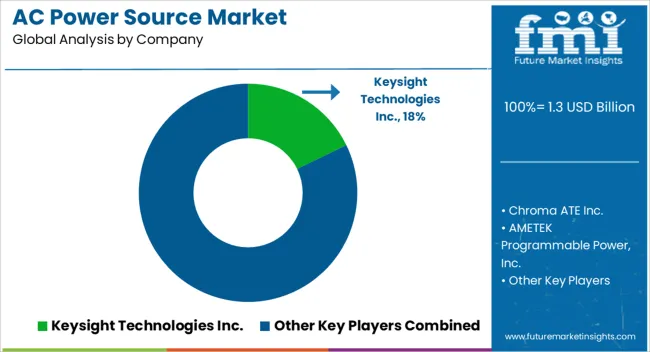

The AC Power Source Market is estimated to be valued at USD 1.3 billion in 2025 and is projected to reach USD 1.9 billion by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period.

| Metric | Value |

|---|---|

| AC Power Source Market Estimated Value in (2025 E) | USD 1.3 billion |

| AC Power Source Market Forecast Value in (2035 F) | USD 1.9 billion |

| Forecast CAGR (2025 to 2035) | 4.3% |

The AC power source market is witnessing significant growth, supported by the expanding electronics industry, rising demand for testing equipment, and increasing reliance on renewable energy systems. These power sources are essential for simulating grid conditions, testing electrical devices, and ensuring compliance with global standards.

The market is benefiting from rapid advancements in semiconductor technologies, enabling improved efficiency, compact design, and programmable output control. Current demand is concentrated in consumer electronics, automotive, and aerospace sectors, where precise voltage and frequency regulation are critical.

With the increasing penetration of smart devices and electronic testing requirements, demand for reliable AC power sources is expected to strengthen further. Future outlook remains positive, with innovations in modular systems and integration with digital control interfaces reinforcing long-term adoption.

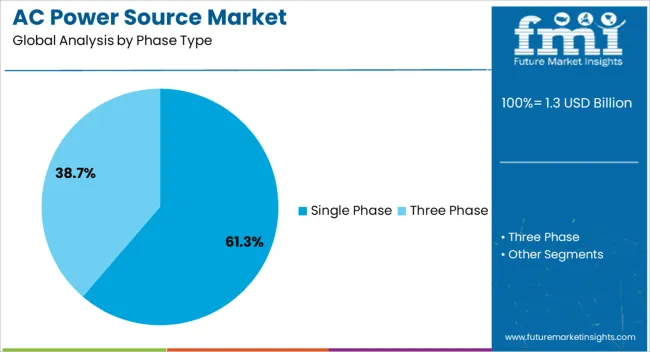

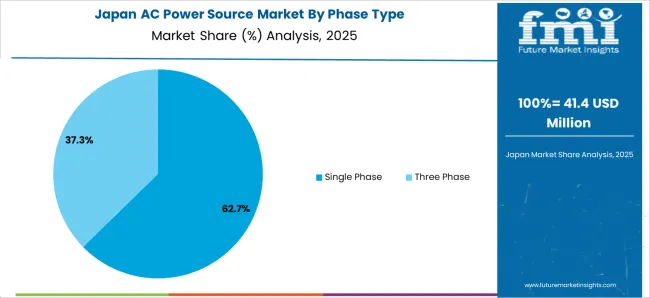

The single phase segment holds approximately 61.30% share in the phase type category, reflecting its widespread adoption across residential, commercial, and light industrial applications. Single phase AC power sources are cost-effective, compact, and easy to install, making them suitable for low to medium power testing environments.

Their dominance is reinforced by increasing use in consumer electronics and home appliance testing, where consistent voltage stability is essential. With ongoing advancements in digital monitoring and programmable control, single phase power sources are achieving higher precision and reliability.

Given their affordability and broad compatibility, the segment is expected to remain a leading choice across end-user industries.

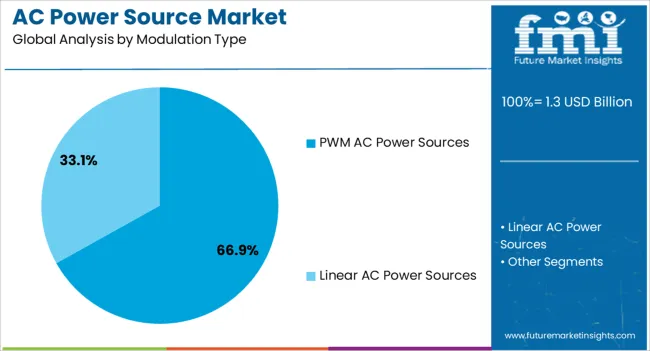

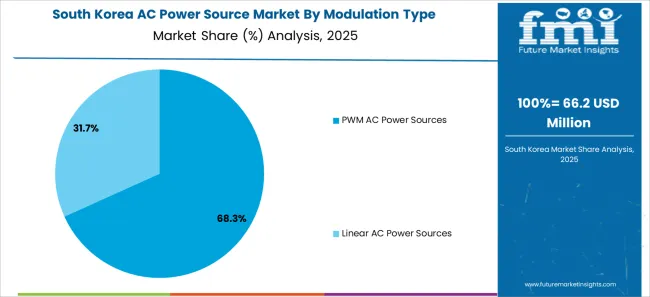

The PWM AC power sources segment dominates the modulation type category with approximately 66.90% share, driven by its ability to provide precise control of voltage and frequency with high efficiency. Pulse width modulation technology ensures stable power output, enabling accurate simulation of real-world grid conditions for sensitive device testing.

Adoption has been accelerated by the growing demand for renewable energy integration, electric vehicle charging systems, and advanced electronic testing. The segment also benefits from reduced harmonic distortion, enhancing compatibility with modern electronics.

With continuous development in digital control algorithms and semiconductor power devices, PWM-based AC power sources are expected to strengthen their leadership position.

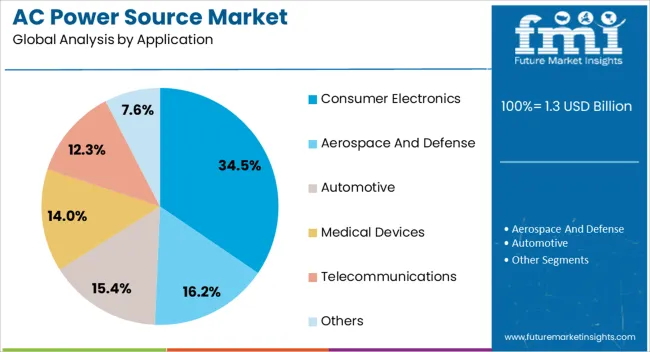

The consumer electronics segment accounts for approximately 34.50% share in the application category, highlighting its pivotal role in driving AC power source demand. The segment benefits from the proliferation of smartphones, laptops, smart appliances, and connected devices that require rigorous testing for safety and performance compliance.

Manufacturers rely on AC power sources to simulate varying grid conditions and ensure global compatibility of consumer devices. Rising disposable incomes and urbanization have further fueled electronics demand, indirectly boosting the need for power testing equipment.

With the consumer electronics sector projected to expand steadily, this application segment is expected to remain at the forefront of market growth.

| Attributes | Details |

|---|---|

| AC Power Source Market Value (2020) | USD 1 billion |

| Market Value (2025) | USD 1.3 billion |

| Historical CAGR (2020 to 2025) | 6.00% |

The AC power source market registered a CAGR of 6.00% from 2020 to 2025. The market reached USD 1.3 billion in 2025, from USD 1 billion in 2020. The increasing global population and rapid urbanization indirectly contributed to the market during the historical period.

A noticeable shift toward renewable energy sources like wind and solar power is stimulating market growth. Other factors that are fueling the market are as follows:

In upcoming years, investments in renewable energy sources are projected to increase, thus creating demand for reliable and efficient AC power sources for energy storage and conversion. Regionally, Asia Pacific is predicted to witness an influx of top players who wish to capitalize on the significant economic growth of the region.

The market is expected to increase from USD 1.3 billion in 2025 to USD 1.9 billion by 2035. The market is expected to expand at a consistent CAGR of 4.30% over the forecast period.

| Country | CAGR (2025 to 2035) |

|---|---|

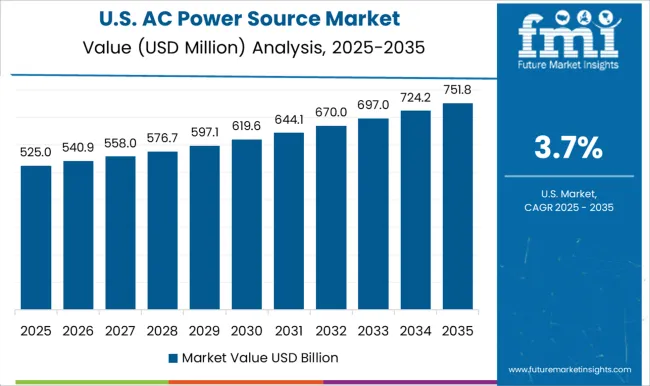

| United States | 4.50% |

| United Kingdom | 5.60% |

| China | 4.70% |

| Japan | 5.10% |

| South Korea | 6.10% |

The consumption of AC power sources in the United States in different application sectors is increasing at a pace of 4.50% through 2035. The factors responsible for this growth are as follows:

The use of AC power sources is projected to increase in the United Kingdom at a CAGR of 5.60% through 2035. The factors driving the market growth are as follows:

The demand for AC power sources is increasing in China, with a projected CAGR of 4.70% through 2035. Emerging patterns in the China market are as follows:

The Japan AC power source market is assessed to register a CAGR of 5.10% through 2035. The deployment of AC power sources is increasing on account of the following:

Key players are significantly investing in South Korea, as the country is offering greater growth opportunities than its counterparts. Through 2035, South Korea is projected to expand at a CAGR of 6.10%, driven by the following factors:

| Leading Phase Type | Single Phase |

|---|---|

| CAGR (2025 to 2035) | 4.1% |

The single phase segment is a substantially preferred phase type. The following factors back the adoption of single phase AC power sources:

| Leading Modulation Type | Linear AC Power Sources |

|---|---|

| CAGR (2025 to 2035) | 3.9% |

The linear AC power sources segment is anticipated to find significant adoption based on the modulation type. Top factors that are spurring the segment growth are:

Key players are adding advanced features to their AC power sources to increase their appeal among end users. Additionally, industry leaders are concentrating on certain niche applications like aerospace testing, renewable energy integration, or electric vehicle charging to serve unique market needs effectively.

Market contenders also provide customizable power source solutions as they take a customer-centric approach and develop stronger relationships.

Leading vendors are collaborating with complementary companies from the power industry to increase their reach and gain access to new customer segments. Market players are expanding geographically via partnerships, acquisitions, or by establishing local production to increase brand visibility and customer base.

Key players are further focusing on targeted marketing campaigns to raise awareness about the brands’ unique selling propositions.

Recent Developments

The global AC power source market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the AC power source market is projected to reach USD 1.9 billion by 2035.

The AC power source market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in AC power source market are single phase and three phase.

In terms of modulation type, pwm AC power sources segment to command 66.9% share in the AC power source market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Accounting Software Market Size and Share Forecast Outlook 2025 to 2035

Active Wear Market Size and Share Forecast Outlook 2025 to 2035

Acid Resistant Pipe Market Forecast and Outlook 2025 to 2035

Activated Carbon for Sugar Decolorization Market Forecast and Outlook 2025 to 2035

Acrylic Paint Market Forecast and Outlook 2025 to 2035

Acetate Silicone Sealant Market Size and Share Forecast Outlook 2025 to 2035

Active, Smart, and Intelligent Packaging Market Size and Share Forecast Outlook 2025 to 2035

Acetone Market Size and Share Forecast Outlook 2025 to 2035

Activated Alumina Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Fibre Market Size and Share Forecast Outlook 2025 to 2035

Acetoacetanilide Market Size and Share Forecast Outlook 2025 to 2035

Acetylacetone Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Emulsions Market Size and Share Forecast Outlook 2025 to 2035

AC Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Polymer Market Size and Share Forecast Outlook 2025 to 2035

Activated Carbon Fiber Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Resin Market Size and Share Forecast Outlook 2025 to 2035

AC Electromagnetic Brakes Market Size and Share Forecast Outlook 2025 to 2035

Acid Coil Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Actinic Keratosis Treatment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA