The AC Air Purifier Market is estimated to be valued at USD 1.7 billion in 2025 and is projected to reach USD 3.7 billion by 2035, registering a compound annual growth rate (CAGR) of 7.8% over the forecast period. The market growth curve shows a steady increase, with an initial gradual rise from USD 1.2 billion in 2025 to USD 1.7 billion by 2029. This early phase is driven by increasing awareness of air quality and rising concerns over pollution, prompting consumers to adopt air purifiers for home and office use. The steady growth during these years reflects a growing shift towards air purification solutions in response to worsening air quality in urban environments. Between 2029 and 2031, the curve shows moderate acceleration, reaching USD 2.0 billion in 2031, driven by the expanding adoption of advanced features such as smart connectivity, HEPA filters, and UV-C technology in air purifiers.

As consumers become more conscious of health and wellness, the demand for efficient air purifiers in homes, workplaces, and healthcare environments continues to grow. From 2031 to 2035, the market experiences a sharper growth phase, reaching USD 3.7 billion. This surge is attributed to increasing urbanization, stricter air quality regulations, and the growing need for air purifiers in emerging markets. The growth curve reflects sustained demand as the technology matures, and consumers increasingly prioritize indoor air quality and environmental health.

| Metric | Value |

|---|---|

| AC Air Purifier Market Estimated Value in (2025 E) | USD 1.7 billion |

| AC Air Purifier Market Forecast Value in (2035 F) | USD 3.7 billion |

| Forecast CAGR (2025 to 2035) | 7.8% |

Urbanization, rising construction activity, and increased time spent indoors have amplified demand for air purification solutions that can effectively target allergens, particulate matter, and airborne pathogens. Regulatory initiatives advocating clean indoor air standards and increasing adoption of energy-efficient, low-noise appliances have supported the market’s expansion.

Technological advancements in filtration systems, real-time monitoring sensors, and smart connectivity features are further boosting consumer interest, particularly in residential and small-office segments. The transition toward modular and adaptable systems that align with evolving lifestyle preferences is expected to reshape product design and functionality across all regions.

As consumer health consciousness and disposable incomes rise, the market is expected to benefit from a growing preference for personalized and efficient purification solutions. The integration of purification systems into broader smart home ecosystems is also projected to enhance long-term market scalability.

The AC air purifier market is segmented by type, technology, room coverage range, end use, distribution channel, and geographic regions. By type, the AC air purifier market is divided into Portable air purifiers and Fixed air purifiers. In terms of technology, the AC air purifier market is classified into HEPA filters, Activated carbon filters, Ionic filters, UV filters, and Others. Based on room coverage range, the AC air purifier market is segmented into Medium space (500 - 1000 sq. ft), Small space (under 500 sq. ft), Large space (1000 - 1500 sq. ft), and Extra-large (above 1500 sq. ft).

By end use, the AC air purifier market is segmented into Residential and Commercial. By distribution channel, the AC air purifier market is segmented into Online and Offline. Regionally, the AC air purifier industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Portable air purifiers are projected to hold 57.4% of the total revenue share in the AC air purifier market in 2025, reflecting their continued dominance across both residential and small commercial settings. This leading position is supported by the segment’s flexibility, user convenience, and ease of deployment without requiring permanent installation. The compact size and mobility of portable air purifiers have allowed users to target specific areas of concern, especially in homes, offices, and healthcare environments.

Increasing consumer preference for plug-and-play solutions, combined with rising concerns over respiratory issues and allergen control, has favored the demand for portable formats. These devices also tend to incorporate advanced filtration technologies and smart features at competitive prices, making them accessible to a broader customer base.

The ability to scale usage across different room sizes and relocate the units based on seasonal needs or occupancy patterns has strengthened their relevance As urban living spaces become more dynamic, portable air purifiers are expected to retain their market leadership.

HEPA filters are anticipated to account for 37.8% of the total revenue share in the AC air purifier market in 2025, driven by their proven effectiveness in capturing fine particulates and allergens. Stringent air quality regulations and consumer preference for certified filtration performance have influenced the widespread adoption of HEPA-based systems. Their ability to trap particles as small as 0.3 microns with high efficiency has made them essential in residential, healthcare, and educational settings.

The rising incidence of respiratory disorders and airborne infections has increased demand for dependable purification solutions, and HEPA filters are often selected for their consistent performance over extended periods. Manufacturers have increasingly integrated HEPA filtration into smart air purifiers, enhancing their appeal to tech-savvy consumers.

Additionally, HEPA filters have gained favor for their compatibility with activated carbon filters and UV sterilization modules, offering comprehensive air treatment As health awareness intensifies globally, HEPA-based air purifiers are expected to sustain strong market growth.

The medium space room coverage segment, representing spaces between 500 to 1000 square feet, is expected to contribute 41.6% of the total revenue share in the AC air purifier market in 2025. This growth is attributed to the rising installation of purifiers in medium-sized living rooms, bedrooms, and workspaces where air quality optimization is increasingly prioritized. Consumers are seeking devices that balance coverage efficiency with cost-effectiveness, and medium-range purifiers offer an ideal solution for typical urban home layouts.

The segment’s rise is also being supported by property developers and commercial facilities adopting purification systems tailored to mid-sized spaces. Manufacturers have responded by offering models with optimized CADR ratings, multi-stage filtration, and noise-reduction features suited to such areas.

The ability to deliver high air change rates without excessive power consumption has made this segment particularly attractive. As awareness around zone-specific purification grows, demand for units targeting medium coverage is anticipated to remain strong across residential and light commercial end uses.

The AC air purifier market is witnessing significant growth as consumers and businesses increasingly seek solutions for improving indoor air quality. These devices, designed to remove pollutants and allergens from the air, are essential in both residential and commercial spaces, especially in urban areas with high levels of pollution. The rising awareness of the health impacts of poor air quality, coupled with the increasing prevalence of respiratory diseases and allergies, is driving the demand for air purifiers. Additionally, innovations in filtration technologies and smart features are contributing to the market's expansion, offering more efficient and user-friendly solutions for air purification.

The growth of the AC air purifier market is driven by the increasing awareness of the health impacts caused by poor air quality. As air pollution becomes a significant concern, particularly in densely populated urban areas, consumers are seeking ways to improve indoor air quality. Poor air quality is associated with various health issues, including respiratory diseases, allergies, and asthma, prompting individuals to invest in air purifiers for their homes and workplaces. The COVID-19 pandemic has heightened awareness of the importance of clean air in reducing the spread of airborne viruses. These factors continue to drive the demand for AC air purifiers, particularly among health-conscious consumers and businesses looking to provide safe environments for employees and customers.

Despite the market's growth, the AC air purifier market faces challenges related to the high initial cost and maintenance requirements. High-quality air purifiers, especially those with advanced filtration systems such as HEPA or activated carbon filters, can be expensive to purchase, which may limit adoption among price-sensitive consumers. Air purifiers require regular maintenance, including filter replacement and occasional servicing, adding to the long-term cost of ownership. These ongoing expenses may deter some customers from purchasing air purifiers, particularly in markets where consumer spending is constrained. Manufacturers must focus on making air purifiers more affordable and reducing maintenance costs to make them accessible to a broader consumer base.

The AC air purifier market presents significant opportunities through technological innovations and the integration of smart features. Advances in filtration technologies, such as the development of more efficient HEPA filters, ultraviolet (UV) light sterilization, and ionization, are making air purifiers more effective at removing a wider range of contaminants, including bacteria, viruses, and volatile organic compounds (VOCs). The growing adoption of smart home devices is driving the demand for air purifiers with smart capabilities, such as Wi-Fi connectivity, air quality sensors, and remote control via mobile apps. These innovations allow users to monitor and control their air purifier from anywhere, improving convenience and enhancing the overall user experience. As these technologies evolve, the market for AC air purifiers is expected to continue expanding.

A significant trend in the AC air purifier market is the increasing integration with smart home systems and the development of multi-functional features. Consumers are seeking devices that not only purify the air but also integrate seamlessly into their connected homes. Many modern air purifiers now come with Wi-Fi connectivity, allowing users to control and monitor air quality through mobile apps or voice assistants like Amazon Alexa or Google Assistant . Multi-functional air purifiers that combine air purification with features like cooling, heating, or humidity control are becoming more popular, offering added value to consumers. As consumers continue to seek more convenience and better control over their indoor environment, the demand for smart, multi-functional air purifiers is expected to grow.

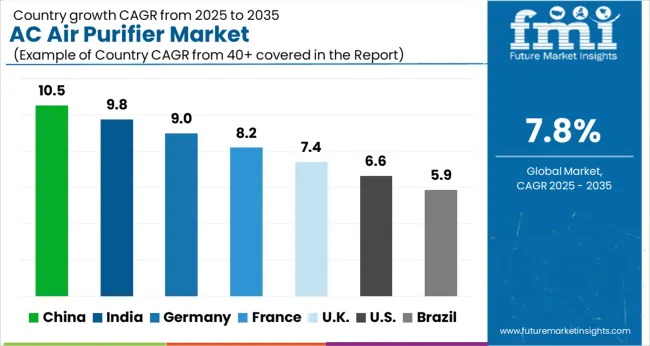

| Countries | CAGR |

|---|---|

| China | 10.5% |

| India | 9.8% |

| Germany | 9.0% |

| France | 8.2% |

| UK | 7.4% |

| USA | 6.6% |

| Brazil | 5.9% |

The global AC air purifier market is projected to grow at a global CAGR of 7.8% from 2025 to 2035. China leads the market with a growth rate of 10.5%, followed by India at 9.8%. France records a growth rate of 8.2%, while the UK shows 7.4% and the USA follows at 6.6%. The market is primarily driven by rising concerns about air quality, increasing pollution levels, and growing consumer awareness of the health benefits of clean air. China and India are leading the growth, driven by rapid urbanization, increasing industrial activity, and rising awareness of indoor air pollution. Developed markets like France, the UK, and the USA are witnessing steady growth, fueled by advances in air purification technology and an increasing focus on health and wellness. The analysis spans over 40+ countries, with the leading markets shown below.

The AC air purifier market in China is expanding at a 10.5% CAGR, driven by the rising levels of air pollution in major cities and growing consumer awareness of the health risks associated with poor indoor air quality. With urbanization and industrialization accelerating, air quality has become a significant concern, leading to a surge in demand for air purifiers. The Chinese government’s initiatives to combat pollution and improve public health are further fueling market growth. The increasing disposable income and growing focus on health and wellness in China are driving the adoption of advanced AC air purifiers that offer better filtration and energy efficiency.

The AC air purifier market in India is expected to grow at a 9.8% CAGR, supported by increasing air pollution levels and growing awareness of indoor air quality. As cities like Delhi, Mumbai, and Bangalore face severe air pollution challenges, there is a rising demand for efficient air purification solutions. The increasing middle class, higher disposable incomes, and concerns over health are driving consumers to invest in air purifiers. The government’s focus on improving air quality, coupled with rising awareness of the benefits of clean indoor air, is further accelerating market growth. The demand for energy-efficient, user-friendly air purifiers is expected to rise in the coming years.

The AC air purifier market in France is projected to grow at an 8.2% CAGR, driven by increasing consumer awareness of air pollution and its impact on health. France has a growing focus on health and wellness, and consumers are increasingly seeking solutions to improve indoor air quality. The rise in respiratory diseases, allergies, and other health conditions related to air pollution is boosting demand for air purifiers. The French government’s regulations and initiatives aimed at improving air quality and reducing pollution are further supporting the growth of the market. Moreover, consumers are looking for eco-friendly, energy-efficient air purifiers, contributing to market innovation.

The UK’s AC air purifier market is expected to grow at a 7.4% CAGR, driven by the increasing focus on improving indoor air quality and rising concerns about pollution. The UK government’s ongoing efforts to tackle air pollution and improve public health are contributing to the adoption of air purifiers. Additionally, the growing awareness of allergies and respiratory issues linked to poor air quality is fueling demand for air purifiers in residential and commercial spaces. As the market shifts toward more energy-efficient and effective filtration systems, consumers are opting for advanced air purifiers to improve their indoor environments.

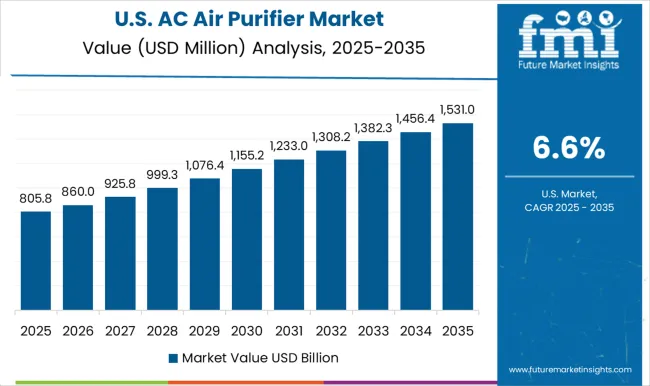

The USA AC air purifier market is expected to grow at a 6.6% CAGR, supported by growing concerns over indoor air quality and the rising prevalence of air pollution in urban areas. With increasing awareness of the health risks posed by poor air quality, consumers are investing in air purifiers for homes, offices, and healthcare facilities. The USA government’s efforts to promote air quality and health-focused regulations also contribute to market growth. Technological advancements, such as smart air purifiers with Wi-Fi connectivity and real-time air quality monitoring, are driving consumer interest and adoption.

Dyson is a prominent player, known for its innovative air purifiers that combine advanced filtration technology with sleek designs, providing effective air cleaning for homes and offices. Honeywell offers a wide range of air purifiers equipped with HEPA filters and smart technology, focusing on high efficiency and ease of use in residential and commercial spaces.

Sharp specializes in air purifiers featuring its Plasmacluster technology, which is designed to purify air by removing allergens, viruses, and bacteria, making it a popular choice for both home and office use. Daikin, a global leader in air conditioning, provides energy-efficient air purifiers that combine advanced filtration with their renowned HVAC systems for cleaner indoor environments. Blueair offers high-performance air purifiers, especially in the premium segment, with a focus on cutting-edge filtration and air quality monitoring for residential and commercial applications. Whirlpool is recognized for its cost-effective air purifiers with multi-stage filtration, designed to improve indoor air quality for homes. LG Electronics provides a variety of air purifiers that combine innovative features such as smart connectivity and efficient filtration systems, catering to both residential and commercial markets. SharkNinja is known for offering air purifiers that combine efficiency and affordability, targeting households seeking reliable and accessible air cleaning solutions. Versuni Holding offers innovative air purifiers with smart features and high performance, focusing on meeting the needs of customers looking for advanced yet user-friendly air quality solutions.

WINIX provides high-performance air purifiers designed for larger spaces, emphasizing energy efficiency and advanced filtration systems. AprilAire offers air purifiers primarily used in homes, focusing on improved filtration and air quality control, especially for those with allergies or respiratory issues. Medify Air manufactures air purifiers with medical-grade HEPA filtration technology, catering to health-conscious consumers and medical environments. Krug & Priester provides premium air purifiers with advanced filtration systems and sleek designs for higher-end residential and office use. Airocide Europe focuses on air purifiers that target biological contaminants, offering a unique approach to air purification. AIRTH is recognized for its high-quality, eco-friendly air purifiers that ensure clean, fresh air in residential and commercial environments.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.7 Billion |

| Type | Portable air purifier and Fixed air purifier |

| Technology | HEPA filters, Activated carbon filters, Ionic filters, UV filters, and Others |

| Room Coverage Range | Medium space (500 - 1000 sq. ft), Small space (under 500 sq. ft), Large space (1000 - 1500 sq. ft), and Extra-large (above 1500 sq. ft) |

| End Use | Residential and Commercial |

| Distribution Channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Dyson, Honeywell, Sharp, Daikin, Blueair, Whirlpool, LG Electronics, SharkNinja, Versuni Holding, WINIX, AprilAire, Medify Air, Krug & Priester, Airocide Europe, and AIRTH |

| Additional Attributes | Dollar sales by product type (HEPA air purifiers, ionizers, UV air purifiers, hybrid models) and end-use segments (residential, commercial, healthcare). Demand dynamics are driven by the increasing awareness of indoor air pollution, rising health concerns, and growing consumer preference for cleaner air, particularly in urban areas. Regional trends show strong growth in North America, Europe, and Asia-Pacific, with innovations in filtration technology, smart connectivity, and energy efficiency driving market expansion. |

The global AC air purifier market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the AC air purifier market is projected to reach USD 3.7 billion by 2035.

The AC air purifier market is expected to grow at a 7.8% CAGR between 2025 and 2035.

The key product types in AC air purifier market are portable air purifier and fixed air purifier.

In terms of technology, hepa filters segment to command 37.8% share in the AC air purifier market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Activated Carbon for Sugar Decolorization Market Size and Share Forecast Outlook 2025 to 2035

Acetate Silicone Sealant Market Size and Share Forecast Outlook 2025 to 2035

Active, Smart, and Intelligent Packaging Market Size and Share Forecast Outlook 2025 to 2035

Acetone Market Size and Share Forecast Outlook 2025 to 2035

Activated Alumina Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Fibre Market Size and Share Forecast Outlook 2025 to 2035

Acetoacetanilide Market Size and Share Forecast Outlook 2025 to 2035

Acetylacetone Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Emulsions Market Size and Share Forecast Outlook 2025 to 2035

AC Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

AC Power Source Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Polymer Market Size and Share Forecast Outlook 2025 to 2035

Activated Carbon Fiber Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Resin Market Size and Share Forecast Outlook 2025 to 2035

AC Electromagnetic Brakes Market Size and Share Forecast Outlook 2025 to 2035

Acid Coil Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Actinic Keratosis Treatment Market Size and Share Forecast Outlook 2025 to 2035

Access Control as a Service Market Size and Share Forecast Outlook 2025 to 2035

Acetophenone Market Size and Share Forecast Outlook 2025 to 2035

Account-Based Advertising Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA