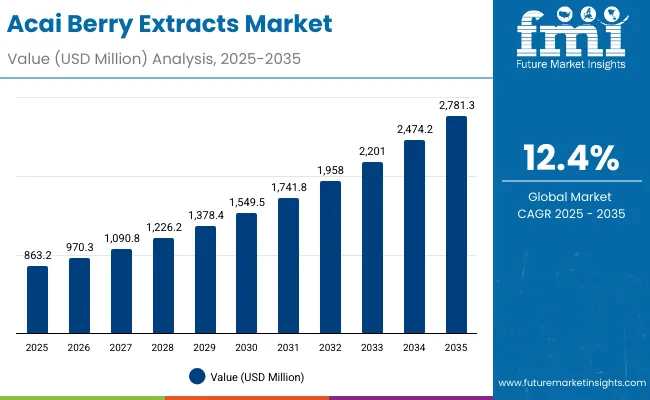

The Acai Berry Extracts Market is expected to record a valuation of USD 863.2 million in 2025 and USD 2,781.3 million in 2035, with an increase of USD 1,918.1 million, which equals a growth of over 193% over the decade. The overall expansion represents a CAGR of 12.4% and a 2X+ increase in market size.

Acai Berry Extracts Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 863.2 million |

| Market Forecast Value in (2035F) | USD 2,781.3 million |

| Forecast CAGR (2025 to 2035) | 12.4% |

During the first five-year period from 2025 to 2030, the market increases from USD 863.2 million to USD 1,549.5 million, adding USD 686.3 million, which accounts for 36% of the total decade growth. This phase records steady adoption in anti-aging serums, clean-label creams, and superfood-based supplements, driven by the need for natural antioxidants. Antioxidant & anti-aging functions dominate this period as they cater to over 42% of skincare and supplement applications requiring proven anti-aging efficacy.

The second half from 2030 to 2035 contributes USD 1,231.8 million, equal to 64% of total growth, as the market jumps from USD 1,549.5 million to USD 2,781.3 million. This acceleration is powered by widespread adoption of e-commerce channels, vegan/organic claims, and premium serums in Asia-Pacific markets. Supplements gain more traction, but serums and creams together still capture a larger share above 55% by the end of the decade. The clean-label and superfood-based claim categories expand rapidly, increasing their combined contribution beyond 50% in total value.

From 2020 to 2024, the Acai Berry Extracts Market grew steadily from an estimated USD 600 million to USD 840 million, driven by skincare and supplement adoption. During this period, the competitive landscape was dominated by established natural skincare brands controlling nearly 70% of revenue, with leaders such as The Body Shop, Trilogy, and Weleda focusing on clean-label antioxidant products. Competitive differentiation relied on natural sourcing, efficacy, and sustainability, while supplements were often positioned as auxiliary offerings rather than primary revenue streams. Service-based distribution models (like subscriptions) had limited traction, contributing less than 10% of the total market value.

Demand for acai berry extracts will expand to USD 863.2 million in 2025, and the revenue mix will shift as supplements and e-commerce channels grow to over 50% share. Traditional natural beauty leaders face rising competition from digital-first brands offering vegan, superfood-based, and ayurveda-inspired formulations. Major skincare companies are pivoting to hybrid models, integrating eco-friendly packaging, direct-to-consumer strategies, and multifunctional claims to retain relevance. Emerging entrants specializing in clean beauty positioning, AI-based personalization, and region-specific formulations are gaining share. The competitive advantage is moving away from brand heritage alone to ecosystem strength, digital agility, and cross-category expansion.

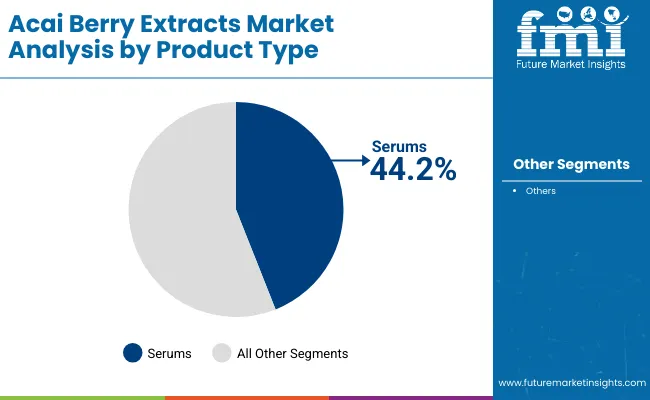

Advances in natural extraction technologies have improved the bioavailability of acai berry actives, allowing for more effective formulations across skincare and supplements. Serums have gained popularity due to their concentration of antioxidants and suitability for brightening and anti-aging routines. The rise of vegan and organic claims has contributed to trust-building and premium positioning. Industries such as personal care, cosmetics, and nutrition are driving demand for acai berry extracts that integrate seamlessly into daily health and wellness regimens.

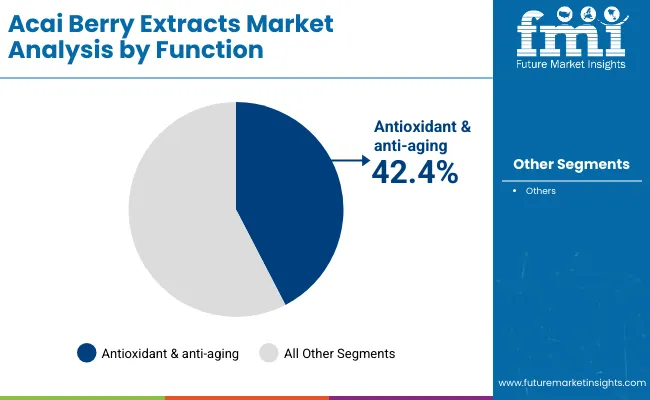

Expansion of clean-label beauty, plant-based supplements, and digital-first e-commerce distribution has fueled market growth. Innovations in eco-friendly packaging, functional claims (anti-aging + hydration), and multi-channel retail strategies are expected to open new growth opportunities. Segment growth is expected to be led by antioxidant & anti-aging in function categories, serums in product type, and e-commerce in channels, due to their precision targeting and adaptability to consumer lifestyles.

The market is segmented by function, product type, channel, claim, and geography. Functions include antioxidant & anti-aging, brightening & glow, hydration, and detoxifying, highlighting the wellness and skincare-driven adoption. Product types cover serums, creams & lotions, masks, and supplements, catering to diverse application preferences. Channels include e-commerce, pharmacies, mass retail, and specialty beauty/nutrition stores, representing omni-channel distribution. Claims include vegan, organic, clean-label, and superfood-based, reflecting consumer trust drivers. Regionally, the scope spans North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa, with country-level emphasis on the USA, China, India, Germany, UK, and Japan.

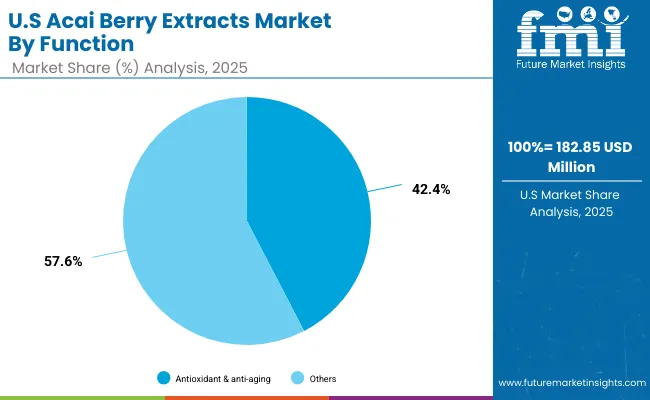

| Function Segment | Market Value Share, 2025 |

|---|---|

| Antioxidant & anti-aging | 42.4% |

| Others | 57.6% |

The antioxidant & anti-aging segment is projected to contribute 42.4% of the Acai Berry Extracts Market revenue in 2025, valued at USD 365.7 million, maintaining its lead as the dominant functional category. This dominance is primarily linked to the growing demand for anti-aging skincare routines among millennials and older demographics, as acai berry is widely recognized for its rich composition of polyphenols, anthocyanins, and flavonoids. The segment’s growth is further supported by a dual-use trend, where consumers adopt acai berry extracts in both topical skincare and oral supplements to achieve holistic wellness and visible results. Anti-aging positioning resonates strongly in North America and Europe, where skincare routines emphasize wrinkle reduction, firming, and hydration. In Asia-Pacific, the preference leans toward brightening + anti-aging hybrid claims, and acai fits well due to its antioxidant intensity.

As clean-label and vegan adoption expand, the antioxidant & anti-aging segment remains the anchor of innovation. Many leading brands are enhancing formulations by combining acai with complementary botanicals such as goji berry, resveratrol, and vitamin C, amplifying efficacy and marketing appeal. Over the forecast period, this segment is expected to remain at the core of acai berry extract adoption, driving both value and consumer loyalty.

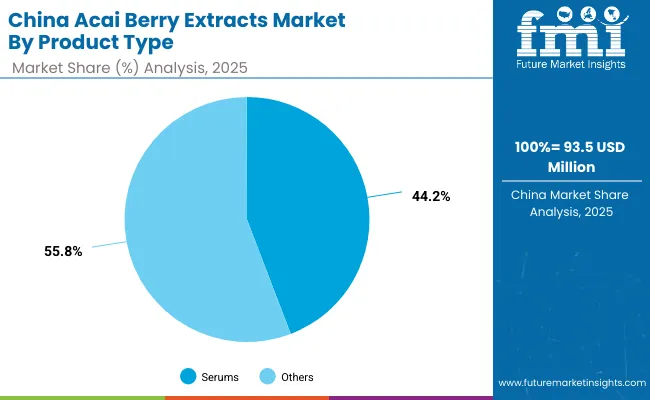

| Product Type Segment | Market Value Share, 2025 |

|---|---|

| Serums | 44.2% |

| Others | 55.8% |

The serum segment is forecasted to hold 44.2% of the market share in 2025, valued at USD 382.0 million, positioning itself as the most influential product type in the market. Serums are preferred due to their lightweight texture, higher active concentration, and ability to penetrate deeper skin layers compared to creams or lotions. Consumers increasingly associate serums with targeted problem-solving solutions whether it’s anti-aging, hydration, or brightening making them a premium staple in daily skincare routines.

The dominance of serums is reinforced by digital-first marketing strategies, where influencers and skincare communities highlight visible before-and-after results. E-commerce platforms often feature acai berry serums as hero products, capitalizing on trends like “superfood skincare” and “natural glow boosters.” This visibility drives higher engagement and repeat purchase behavior.

Additionally, global consumers are gravitating toward multi-functional serums that combine anti-aging with hydration or brightening benefits. Acai berry’s versatility allows brands to experiment with hybrid formulations (e.g., acai + hyaluronic acid or acai + niacinamide serums), further boosting consumer adoption. By 2035, serums are likely to strengthen their dominance as the fastest-growing category within topical applications.

| Channel Segment | Market Value Share, 2025 |

|---|---|

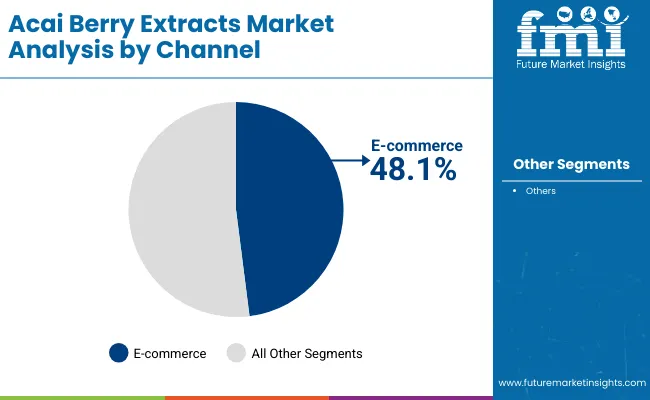

| E-commerce | 48.1% |

| Others | 51.9% |

The e-commerce segment is projected to contribute 48.1% of the Acai Berry Extracts Market revenue in 2025, valued at USD 414.8 million, establishing it as the leading distribution channel. Online platforms dominate because of the direct-to-consumer (D2C) revolution in beauty and supplements, where brands leverage subscription models, influencer campaigns, and social media engagement to capture younger, tech-savvy consumers.

E-commerce also enables cross-border accessibility, with Asia-Pacific consumers purchasing international clean-label brands and Western consumers experimenting with K-beauty or ayurvedic acai-based products. Platforms like Amazon, Sephora online, and niche wellness e-stores drive category visibility and provide easy comparison across claims (vegan, organic, clean-label).

A major advantage of e-commerce is the ability to showcase eco-friendly and story-driven packaging, which resonates with environmentally conscious shoppers. Personalized recommendation engines and AI-driven skincare quizzes further enhance conversion rates. As more consumers seek transparency, detailed ingredient stories and reviews online reinforce acai berry’s positioning as a trusted superfood. By 2035, e-commerce is expected to secure a majority share, supported by omni-channel integration where physical stores act as experience centers, while repeat purchases increasingly shift online. This makes e-commerce not just a channel of distribution but the central ecosystem for brand-consumer engagement in the acai berry extracts category.

Drivers

Rising Demand for Natural and Clean-label Skincare and Supplements

One of the strongest growth drivers is the global consumer shift toward natural, organic, and clean-label formulations. Acai berry extracts, marketed as a superfood ingredient, align perfectly with consumer expectations for authenticity, sustainability, and safety. The fruit’s high antioxidant concentration, omega fatty acids, and vitamins offer compelling benefits for anti-aging, hydration, and overall skin vitality. This makes it a natural fit for serums, creams, and even functional supplements.

Brands are increasingly highlighting ingredient transparency on product labels, which further strengthens acai berry’s positioning as a trusted botanical. In mature markets like the USA and Europe, clean-label products are seen as premium, while in fast-growth regions such as China and India, natural superfood positioning creates aspirational value. The rising influence of social media beauty communities and wellness influencers is amplifying demand, creating a strong pull for acai-based products across age groups and income segments.

Expansion of E-commerce and Direct-to-Consumer Distribution Models

E-commerce has emerged as the leading distribution channel for acai berry extracts, contributing nearly 48.1% of revenue in 2025. Online platforms provide global reach for niche and emerging clean beauty brands, allowing them to compete with legacy players without heavy retail investments. Direct-to-consumer strategies such as subscription kits, influencer collaborations, and loyalty programs are increasingly adopted by brands leveraging acai’s superfood appeal.

This channel expansion is particularly important for acai extracts because of the storytelling potential around origin, sustainability, and efficacy. Consumers want to trace ingredient sourcing, and online platforms allow brands to communicate such details effectively. As e-commerce penetration deepens in Asia-Pacific, South Asia, and Latin America, this driver will continue to fuel growth, making online-first adoption one of the market’s biggest accelerators through 2035.

Restraints

Supply Chain Volatility and Pricing Fluctuations

Acai berries are primarily sourced from the Amazon rainforest, particularly Brazil. This creates a dependency on specific geographies, exposing the supply chain to risks such as climate change, deforestation, political instability, and export barriers. Harvesting acai is labor-intensive and seasonal, leading to fluctuating prices and limited scalability for brands looking to expand rapidly.

Rising global demand, combined with finite supply, increases the risk of price inflation. Smaller brands may find it challenging to maintain competitive pricing, while larger players need to establish sustainable sourcing partnerships. Additionally, the need for cold storage and fast processing adds to logistical costs, limiting margins compared to synthetic or widely cultivated botanical alternatives.

Intense Competition from Alternative Botanicals and Synthetic Ingredients

Despite acai’s strong positioning, the market faces growing competition from other antioxidant-rich botanicals such as goji berry, blueberry, green tea, and pomegranate. These alternatives are often cheaper, more widely cultivated, and equally appealing to health- and beauty-conscious consumers. Synthetic ingredients with proven anti-aging efficacy, such as retinol, peptides, and hyaluronic acid, also compete strongly in the same functional space.

For acai berry extracts, the challenge lies in differentiating efficacy, authenticity, and consumer experience compared to both botanical and synthetic options. Unless supported by clinical claims and robust marketing, acai risks being perceived as a “trendy superfood” rather than a core ingredient, which can restrain adoption in the long run.

Key Trends

Convergence of Beauty and Nutrition (Nutricosmetics Growth)

A defining trend in this market is the rise of nutricosmetics, where acai berry extracts are consumed not just topically but also in supplement form for skin, hair, and overall wellness benefits. Consumers increasingly prefer a dual approach, combining acai serums with oral supplements for holistic anti-aging and detox benefits. This convergence reflects broader consumer behavior, where beauty is no longer limited to topical care but extends into inside-out wellness routines. Brands are innovating with capsules, powders, and functional beverages containing acai extracts, marketed alongside skincare products. This trend positions acai as a cross-category superfood, expanding its relevance across industries and boosting its growth trajectory over the next decade.

Premiumization Through Vegan, Organic, and Superfood-based Claims

The global clean beauty and wellness market is moving toward premium claims that justify higher price points. Acai berry extracts are ideally positioned in this trend due to their natural superfood halo. Premium brands are emphasizing vegan certification, organic sourcing, eco-friendly packaging, and sustainability stories to differentiate in competitive markets. For example, vegan and organic acai serums are marketed as luxury skincare items in Europe, while in Asia, “superfood glow” and “K-beauty-inspired natural formulations” are resonating with urban consumers. Superfood branding also helps acai extracts penetrate the supplement market, where claims around detoxification, hydration, and immunity enhancement are powerful. This premiumization trend is expected to reinforce acai berry extracts’ role as both a high-value skincare and wellness ingredient through 2035.

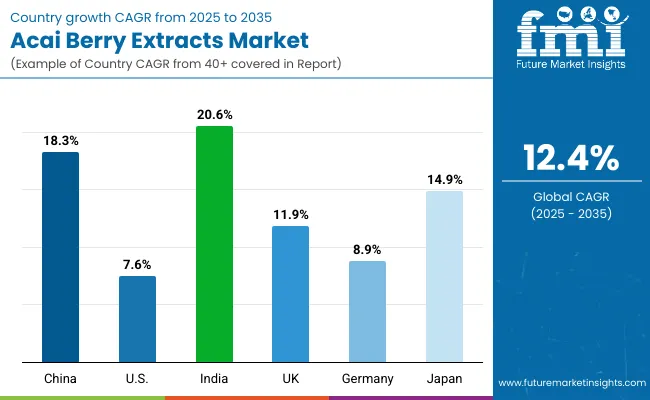

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 18.3% |

| USA | 7.6% |

| India | 20.6% |

| UK | 11.9% |

| Germany | 8.9% |

| Japan | 14.9% |

Between 2025 and 2035, India and China are expected to be the fastest-growing markets for acai berry extracts, with CAGRs of 20.6% and 18.3%, respectively. India’s growth is being fueled by the increasing penetration of superfood-based supplements and the rising popularity of clean-label skincare among its young, urban population. The wellness movement, coupled with growing disposable incomes and a strong shift toward vegan and organic products, is helping acai berry extracts capture share in both nutrition and personal care. In China, growth is led by the surge in premium skincare serums and the integration of superfood extracts into K-beauty and C-beauty product lines. The country’s advanced e-commerce ecosystem also plays a pivotal role in distributing international and local acai-based brands, strengthening its long-term position as a key growth engine.

Meanwhile, mature markets like the USA and Germany are projected to grow steadily at 7.6% and 8.9% CAGR, reflecting stable but slower expansion compared to Asia. The USA remains the largest single-country market in absolute value terms, driven by demand for anti-aging skincare and dietary supplements, though its growth rate is modest compared to emerging regions. The UK and Japan, with CAGRs of 11.9% and 14.9%, highlight strong adoption of premium beauty and wellness trends. In the UK, acai-based products align with the clean beauty and sustainable sourcing movement, while Japan’s emphasis on brightening and anti-aging skincare routines reinforces demand. Overall, the growth imbalance indicates that while North America and Europe will continue to anchor the global market in terms of size, the highest acceleration will come from Asia-Pacific, making it the epicenter of future expansion.

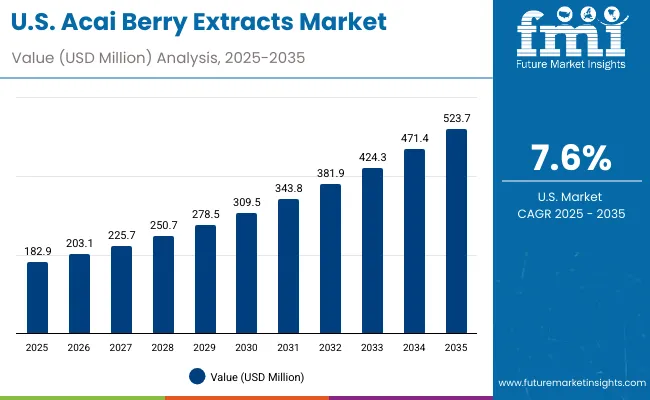

| Year | USA Acai Berry Extracts Market (USD Million) |

|---|---|

| 2025 | 182.9 |

| 2026 | 203.1 |

| 2027 | 225.7 |

| 2028 | 250.7 |

| 2029 | 278.5 |

| 2030 | 309.5 |

| 2031 | 343.8 |

| 2032 | 381.9 |

| 2033 | 424.3 |

| 2034 | 471.4 |

| 2035 | 523.7 |

The Acai Berry Extracts Market in the United States is projected to grow at a CAGR of 7.6%, led by strong demand for anti-aging serums and clean-label supplements. Premium skincare adoption continues to drive growth, particularly as USA consumers embrace superfood-based formulations with vegan and organic claims. The supplement category is gaining traction, with acai powders and capsules positioned as detoxifying and antioxidant-rich daily boosters. Retailers and e-commerce platforms are prioritizing acai berry-based products in natural skincare and functional nutrition shelves, reinforcing consumer awareness and loyalty.

The Acai Berry Extracts Market in the United Kingdom is expected to grow at a CAGR of 11.9%, supported by rising demand for vegan, clean-label, and sustainable skincare. Beauty and personal care brands are integrating acai berry into creams and serums marketed as “superfood skincare.” The UK’s mature retail ecosystem, combined with specialty organic stores and direct-to-consumer brands, has accelerated category visibility. Consumer interest in eco-friendly packaging and sustainable sourcing stories is driving premium positioning for acai-based products. In addition, nutrition companies are experimenting with functional beverages enriched with acai extracts, catering to holistic wellness preferences.

India is witnessing rapid growth in the Acai Berry Extracts Market, which is forecast to expand at a CAGR of 20.6% through 2035. Rising consumer awareness of superfoods, ayurveda-inspired beauty, and clean-label nutrition has accelerated adoption in both urban and semi-urban regions. Affordable product launches and strong online penetration are boosting category visibility, especially among younger consumers. The supplements segment, particularly acai capsules and detox powders, is gaining traction as consumers focus on wellness and preventive healthcare. Educational and wellness influencers are also popularizing acai-based skincare, bridging nutrition and personal care categories.

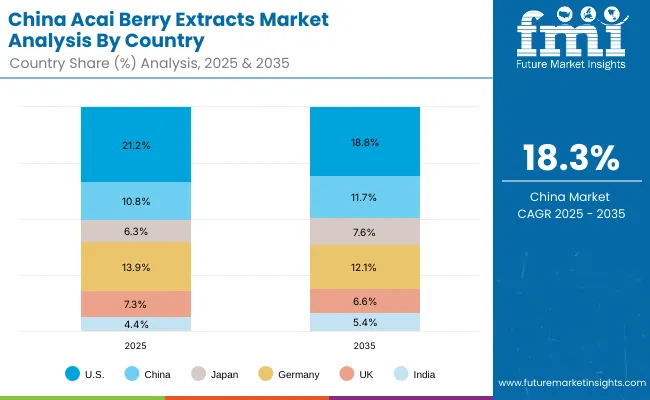

| Countries | 2025 Share (%) |

|---|---|

| USA | 21.2% |

| China | 10.8% |

| Japan | 6.3% |

| Germany | 13.9% |

| UK | 7.3% |

| India | 4.4% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 18.8% |

| China | 11.7% |

| Japan | 7.6% |

| Germany | 12.1% |

| UK | 6.6% |

| India | 5.4% |

The Acai Berry Extracts Market in China is expected to grow at a CAGR of 18.3%, among the highest worldwide. Growth is driven by the premium skincare boom, particularly in serums, where acai berry’s antioxidant properties resonate with consumer demand for brightening and anti-aging benefits. Cross-border e-commerce platforms and domestic clean beauty brands are rapidly expanding acai-based portfolios. Supplements are also gaining momentum, with acai positioned as a detox and energy-enhancing superfood in functional powders and drinks. Competitive domestic players are introducing affordable acai-infused skincare, enabling penetration into both mass and premium segments.

| Function Segment | Market Value Share, 2025 |

|---|---|

| Antioxidant & anti-aging | 42.4% |

| Others | 57.6% |

The Acai Berry Extracts Market in the United States is valued at USD 182.85 million in 2025, with antioxidant and anti-aging leading at 42.4%. Leadership of this function segment is a direct outcome of the country’s premium beauty and wellness mix, where consumers prioritize visible results, clean-label credentials, and science-backed actives. Acai’s high polyphenol and anthocyanin content aligns with anti-aging routines in serums and creams, while parallel uptake in capsules and powders supports inside-out regimens. Omni-channel availability across specialty retail and fast-growing e-commerce improves access, while dermatologist and influencer education accelerates repeat use.

This advantage positions antioxidant and anti-aging as the anchor for portfolio strategy and line extensions, including acai paired with vitamin C, niacinamide, and hyaluronic acid for multi-benefit positioning. Hydration and brightening claims continue to scale as companion benefits, but anti-aging remains the entry point for premium pricing and loyalty programs. As brands deepen traceability and sustainability narratives, the USA will see more refillable formats and subscription bundles that keep acai at the center of routine-based purchasing.

| Product Type Segment | Market Value Share, 2025 |

|---|---|

| Serums | 44.2% |

| Others | 55.8% |

The Acai Berry Extracts Market in China is valued at ~USD 93.5 million in 2025, with serums leading at 44.2%. Dominance of serums reflects China’s premium skincare cadence, where concentrated formats deliver fast visible outcomes for brightening and anti-aging. Live commerce, K- and C-beauty routines, and cross-border e-commerce elevate discovery and conversion for acai-based hero SKUs. Local clean beauty brands are expanding acai into multi-active stacks, pairing with vitamin C and peptides to meet demand for glow and firmness while maintaining vegan and clean-label cues.

This advantage positions serums as the spearhead for category trading-up and regimen building, with creams and masks adding layering opportunities and supplements extending benefits into wellness. Affordable domestic launches widen access beyond tier-one cities, while premium import lines continue to capture gifting and prestige demand. As ingredient literacy grows, brands that combine efficacy claims, origin storytelling, and clinical substantiation will consolidate share.

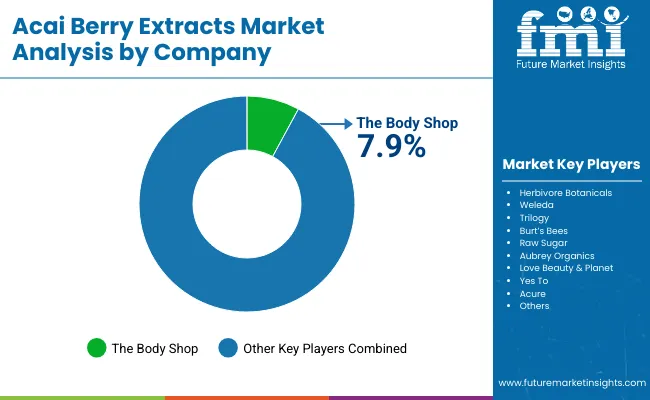

The market is moderately fragmented, with global natural beauty leaders, mid-sized clean-beauty innovators, and niche specialists competing across skincare and supplements. The Body Shop holds the largest single-brand share on the strength of superfood-positioned ranges and broad retail reach. Mid-sized brands such as Herbivore Botanicals, Weleda, Trilogy, Burt’s Bees, Raw Sugar, Aubrey Organics, Love Beauty & Planet, Yes To, and Acure accelerate adoption through vegan, organic, and clean-label portfolios that spotlight acai’s antioxidant intensity. Their strategies emphasize concentrated serums, eco-friendly packaging, and D2C engagement to build community and repeat purchase.

Specialized providers, including private-label manufacturers and contract extract suppliers, focus on cost-effective, application-specific solutions for creams, masks, and supplement formats. Their strength lies in customization, certification support, and rapid iteration rather than global brand scale. Competitive differentiation is shifting from single-ingredient storytelling to integrated ecosystems that combine ingredient traceability, third-party certifications, clinical claims, refillable packaging, and subscription models. Brands that tie these elements to personalized routines and seamless e-commerce experiences will gain share as the category matures through 2035.

Key Developments in Acai Berry Extracts Market

| Item | Value |

|---|---|

| Quantitative Units | USD 863.2 million |

| Function | Antioxidant & anti-aging, Brightening & glow, Hydration, Detoxifying |

| Product Type | Serums, Creams & lotions, Masks, Supplements |

| Channel | E-commerce, Pharmacies, Mass retail, Specialty beauty/nutrition stores |

| Claim | Vegan, Organic, Clean-label, Superfood-based |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | The Body Shop, Herbivore Botanicals, Weleda, Trilogy, Burt’s Bees, Raw Sugar, Aubrey Organics, Love Beauty & Planet, Yes To, Acure |

| Additional Attributes | Dollar sales by function and product type, adoption trends in anti-aging and brightening skincare, rising demand for vegan and organic supplements, segment-specific growth in serums and e-commerce, integration of clean-label and eco-friendly packaging, regional trends influenced by K-beauty and ayurvedic superfoods, and innovations in antioxidant-rich and detoxifying formulations. |

The Acai Berry Extracts Market is estimated to be valued at USD 863.2 million in 2025.

The market size for the Acai Berry Extracts Market is projected to reach USD 2,781.3 million by 2035.

The Acai Berry Extracts Market is expected to grow at a 12.4% CAGR between 2025 and 2035.

The key product types in the Acai Berry Extracts Market are serums, creams & lotions, masks, and supplements.

In terms of function, the antioxidant & anti-aging segment is projected to command a 42.4% share in the Acai Berry Extracts Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Acai Berry Market Size, Growth, and Forecast for 2025 to 2035

Organic Acai Juice Market Size and Share Forecast Outlook 2025 to 2035

Berry Core Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Mulberry Market

Blueberry Extract Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights for Blueberry Ingredient Providers

Elderberry Supplements Market Analysis by Form, End Use Industry, Distribution Channel and Region Through 2035

Strawberry Seed Oil Market Analysis by Application, End-use, Distribution channel and Region Through 2035

Boysenberry Market Size and Share Forecast Outlook 2025 to 2035

Haskap Berry Powder Market Size and Share Forecast Outlook 2025 to 2035

White Mulberry Leaves Extract Market Growth - Product Type & Form Insights

Organic Goji Berry Market

Rubus Idaeus (Raspberry) Seed Oil Market Analysis by Food, Pharmaceuticals and Medical, Personal care and Cosmetics and Others Through 2035

Rubus Idaeus (Raspberry) Seeds Market

Rubus Fructicosus (Blackberry) Seed Market Size and Share Forecast Outlook 2025 to 2035

Extracts and Distillates Market

Meat Extracts Market Size and Share Forecast Outlook 2025 to 2035

Peony Extracts for Brightening Market Size and Share Forecast Outlook 2025 to 2035

Algae Extracts Market Size and Share Forecast Outlook 2025 to 2035

Maple Extracts Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA