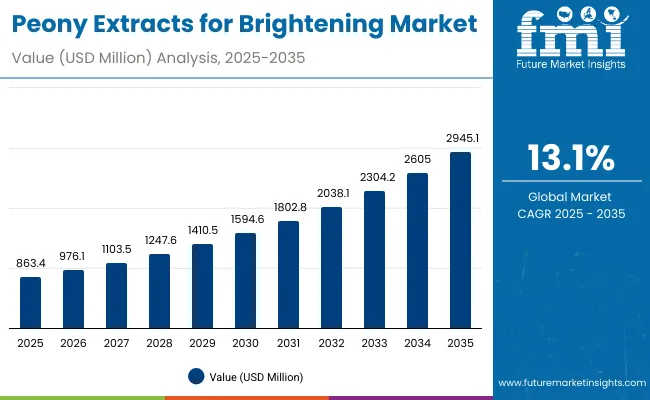

The Peony Extracts for Brightening Market is expected to record a valuation of USD 863.4 million in 2025 and USD 2,945.1 million in 2035, with an increase of USD 2,081.7 million, which equals a growth of 193% over the decade. The overall expansion represents a CAGR of 13.1% and a more than 2X increase in market size.

Peony Extracts for Brightening Market Key Takeaways

| Metric | Value |

|---|---|

| Peony Extracts for Brightening Market Estimated Value in (2025E) | USD 863.4 million |

| Peony Extracts for Brightening Market Forecast Value in (2035F) | USD 2,945.1 million |

| Forecast CAGR (2025 to 2035) | 13.1% |

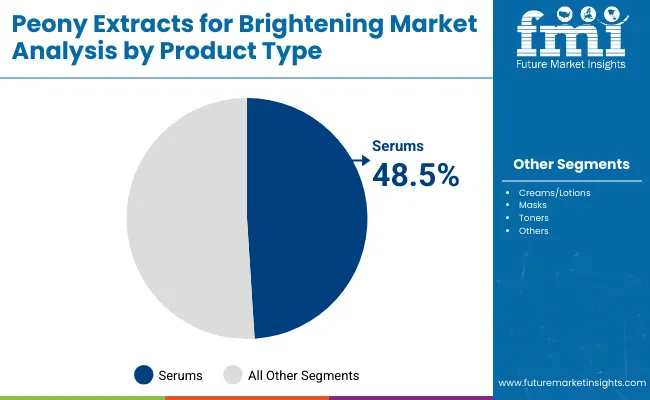

During the first five-year period from 2025 to 2030, the market increases from USD 863.4 million to USD 1,594.6 million, adding USD 731.2 million, which accounts for 35% of the total decade growth. This phase records steady adoption of peony extracts in brightening, anti-aging, and hydration skincare, driven by rising demand for herbal/natural and dermatologist-tested claims. Serums dominate this period with 48.5% share in 2025, reflecting consumer preference for concentrated formats.

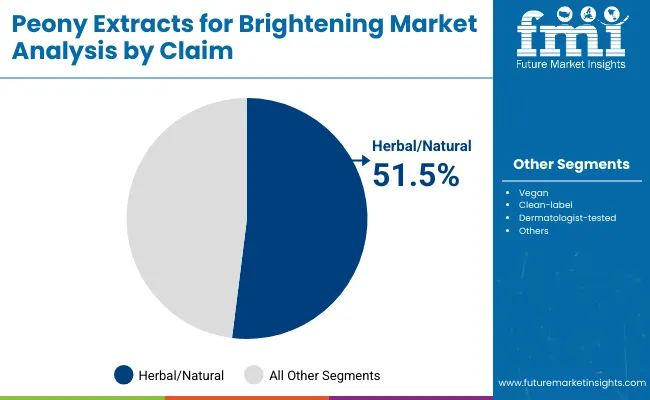

The second half from 2030 to 2035 contributes USD 1,350.5 million, equal to 65% of total growth, as the market jumps from USD 1,594.6 million to USD 2,945.1 million. This acceleration is powered by widespread deployment in premium skincare lines, AI-personalized beauty routines, and expansion in China and India, which register the highest CAGRs (23.6% and 23.8%). By the end of the decade, herbal/natural claims capture more than 51.5% of market share, and serums alongside creams/lotions continue to account for the bulk of global revenues.

From 2020 to 2024, the Peony Extracts for Brightening Market recorded strong growth as global demand for natural brightening skincare accelerated. During this period, the competitive landscape was shaped by Asian beauty brands and botanical-focused companies, with leading players controlling a significant share of revenues. Leaders such as Amorepacific, Shiseido, and L’Occitane drove brand differentiation through formulation expertise, natural positioning, and expansion into premium distribution channels. Competitive strength relied on heritage branding, clean-label claims, and multi-channel retail presence, while global ingredient suppliers such as DSM-Firmenich ensured consistent raw material quality. Service-based innovation was limited, with most companies focusing on finished formulations rather than ecosystem add-ons.

Demand for Peony Extracts for Brightening is projected to reach USD 863.4 million in 2025, and the revenue mix is shifting as herbal/natural claims (51.5%) and dermatologist-tested products capture larger market shares. Traditional brand leaders face rising competition from digital-first entrants like Glow Recipe and Forest Essentials, which emphasize direct-to-consumer channels, sustainability, and social media-driven engagement. The competitive advantage is moving away from product formulations alone to ecosystem strength, storytelling, sustainability, and recurring consumer loyalty models (subscription/D2C).

Consumers are increasingly shifting toward herbal and natural skincare products, and peony extracts align perfectly with this preference due to their botanical origin and proven brightening properties. The growing rejection of chemical-based cosmetics has fueled adoption of plant-derived actives. Markets such as China and India, where herbal/natural claims already command over 50% share, are driving momentum. This trend is expected to amplify global demand, especially as brands highlight clean-label and sustainable positioning.

Peony extracts offer dual benefits of brightening and anti-aging, making them a preferred ingredient for multi-functional skincare formulations. Consumers now expect products that deliver more than one benefit, particularly in premium categories like serums and creams. With anti-aging already leading at USD 863.4 million in 2025 and projected to triple by 2035, the synergy between brightening and wrinkle-reduction is creating strong adoption across age groups. This convergence is a core driver of long-term market expansion.

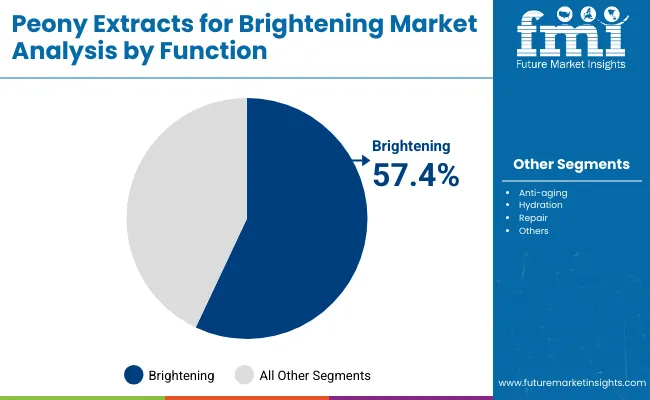

The market is segmented by function, product type, claim, distribution channel, and region. Functions include brightening, anti-aging, hydration, and repair, highlighting the diverse applications of peony extracts in skincare. Product type classification covers serums, creams/lotions, masks, and toners to address different consumer preferences and formulation needs. Based on claims, segmentation includes herbal/natural, vegan, clean-label, and dermatologist-tested products, reflecting rising demand for transparency and botanical formulations. In terms of distribution channel, categories encompass e-commerce, pharmacies, specialty beauty stores, and mass retail, with digital platforms playing an increasingly central role in adoption. Regionally, the scope spans North America, Europe, and Asia-Pacific, with strong momentum in markets such as the USA, China, India, Japan, Germany, and the UK.

| Function | Value Share% 2025 |

|---|---|

| Brightening | 57.4% |

| Others | 42.6% |

The brightening segment is projected to contribute the largest share of the Peony Extracts for Brightening Market revenue in 2025, maintaining its lead as the dominant functional category. This is driven by strong consumer demand for skin radiance, even tone, and botanical-based brightening solutions that align with clean-label preferences. Brightening benefits are often paired with anti-aging and hydration properties, reinforcing their role in multifunctional skincare products. The segment’s growth is also supported by the rising popularity of concentrated formulations like serums and masks. As natural ingredients and transparency gain prominence, brightening remains the anchor function of peony extract–based skincare and is expected to retain its position as the backbone of this market over the forecast period.

| Claim | Value Share% 2025 |

|---|---|

| Herbal/natural | 51.5% |

| Others | 48.5% |

The herbal/natural segment is forecasted to hold the majority share of the Peony Extracts for Brightening Market in 2025, driven by growing consumer preference for plant-based, clean-label skincare. These products are favored for their perceived safety, efficacy, and alignment with sustainability values, making them highly attractive to health-conscious buyers. Their strong positioning across premium and mass-market formats has facilitated widespread adoption in both online and offline channels. The segment’s growth is reinforced by rising demand in Asia-Pacific markets, where herbal claims are deeply rooted in beauty traditions. As global consumers increasingly seek natural alternatives over synthetic formulations, herbal/natural claims are expected to maintain their dominance in the market.

| Product Type | Value Share% 2025 |

|---|---|

| Serums | 48.5% |

| Others | 51.5% |

The serum segment is projected to account for the largest share of the Peony Extracts for Brightening Market revenue in 2025, establishing it as the leading product type. Serums are preferred for their high concentration of active ingredients and ability to deliver visible brightening and anti-aging results in a short period. Their lightweight texture, rapid absorption, and compatibility with multi-step skincare routines have made them a staple across global beauty markets. Innovation in formulations, such as combining peony extracts with other botanicals and advanced delivery systems, has further boosted consumer trust and brand differentiation. Given their balance of efficacy and versatility, serums are expected to maintain their leading role in the Peony Extracts for Brightening Market.

Rising Consumer Preference for Multi-Functional Skincare

The market is experiencing strong growth as consumers increasingly demand multi-functional skincare solutions that combine brightening with anti-aging and hydration benefits. Peony extracts naturally offer dual efficacy, addressing both uneven skin tone and signs of aging, making them highly desirable in premium serums and creams. This convergence of benefits reduces the need for multiple products, supporting adoption in cost-sensitive as well as luxury markets. The multifunctional positioning is expected to be a key driver in both mature and emerging regions.

Expansion of Herbal and Natural Claims in Asia-Pacific

Herbal and natural claims are becoming central to consumer purchasing decisions, especially in markets like China and India, where traditional botanical formulations carry cultural significance. Peony extracts, with their strong association with heritage beauty rituals, fit seamlessly into this demand shift. Growing consumer awareness around sustainability and clean-label transparency is accelerating adoption. As global brands localize products with herbal positioning, and regional players leverage botanical expertise, the preference for natural brightening ingredients is expected to be a major growth driver over the forecast decade.

Limited Clinical Evidence Compared to Synthetic Alternatives

Despite strong consumer interest, the market faces a restraint due to limited large-scale clinical validation of peony extracts compared to synthetic brightening agents like niacinamide or hydroquinone. While botanical claims resonate with consumers, efficacy data often relies on smaller studies or traditional knowledge, which may not always meet global regulatory or dermatological benchmarks. This creates hesitancy among certain consumer segments and retailers in highly regulated markets. Unless supported by stronger research and standardization, the reliance on perception-based marketing could limit adoption in stricter geographies.

Integration of Peony Extracts in Digital-First Beauty Brands

A growing trend in the market is the integration of peony extracts into formulations marketed by digital-first and direct-to-consumer (D2C) beauty brands. Companies such as Glow Recipe and Forest Essentials are capitalizing on social media storytelling and influencer-led campaigns to promote natural brightening solutions. These brands highlight transparency, sustainability, and visual results to attract younger consumers who value authenticity. With e-commerce emerging as a dominant distribution channel, the trend of botanical-focused, digitally marketed peony extract products is set to redefine consumer engagement and accelerate market penetration.

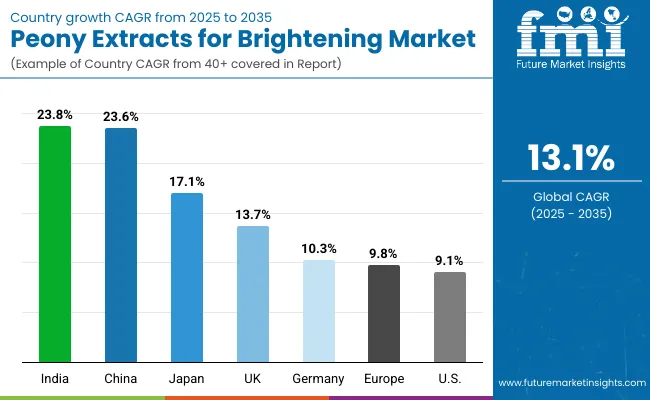

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 23.6% |

| USA | 9.1% |

| India | 23.8% |

| UK | 13.7% |

| Germany | 10.3% |

| Japan | 17.1% |

The global Peony Extracts for Brightening Market shows a pronounced regional disparity in adoption speed, strongly influenced by cultural beauty traditions, consumer preferences for natural skincare, and retail channel evolution. Asia-Pacific emerges as the fastest-growing region, anchored by India at 23.8% CAGR and China at 23.6% CAGR. This acceleration is driven by rising consumer demand for herbal/natural skincare, cultural affinity for botanical remedies, and aggressive adoption of serums and brightening formats. In China, the dominance of herbal/natural claims underlines the strength of traditional beauty preferences, while India’s trajectory reflects rapid premiumization in urban markets and expansion of D2C beauty startups.

Europe maintains a strong growth profile, led by Germany at 10.3% CAGR and the UK at 13.7% CAGR, supported by stringent cosmetic safety standards, transparency in labeling, and growing demand for clean-label brightening solutions. Regulatory frameworks and consumer activism in Europe continue to drive brands toward sustainable, plant-based ingredients, positioning peony extracts as a natural fit. Japan, with a 17.1% CAGR, illustrates rising preference for multi-functional skincare, where brightening and anti-aging benefits are combined in sophisticated formulations.

North America shows moderate expansion, with the USA at 9.1% CAGR, reflecting a mature skincare market where consumer expectations focus on dermatologist-tested efficacy and premium clean-label offerings. Growth in North America is more digitally driven, with increasing adoption through e-commerce and social media–led marketing, rather than mass-market retail.

| Year | USA Peony Extracts for Brightening Market (USD Million) |

|---|---|

| 2025 | 191.53 |

| 2026 | 215.17 |

| 2027 | 241.74 |

| 2028 | 271.58 |

| 2029 | 305.11 |

| 2030 | 342.77 |

| 2031 | 385.09 |

| 2032 | 432.63 |

| 2033 | 486.04 |

| 2034 | 546.04 |

| 2035 | 613.45 |

The Peony Extracts for Brightening Market in the United States is projected to grow at a CAGR of 9.1% from 2025 to 2035, supported by rising consumer demand for dermatologist-tested, clean-label skincare products. Adoption is particularly strong in the premium segment, where brightening and anti-aging claims are combined in serums and creams. The growth is also influenced by increased digital engagement, with direct-to-consumer and e-commerce platforms expanding market reach. Consumers are favoring transparent ingredient labeling and multifunctional formulations, positioning peony extracts as a trusted natural alternative in brightening routines.

The Peony Extracts for Brightening Market in the United Kingdom is expected to grow at a CAGR of The Peony Extracts for Brightening Market in the United Kingdom is expected to grow at a CAGR of 13.7%, supported by rising consumer interest in clean-label, herbal-based skincare products and strong demand for multifunctional brightening and anti-aging solutions. Premium positioning of serums and creams, coupled with regulatory emphasis on product safety and transparency, is shaping the market landscape. Increasing popularity of e-commerce and specialty beauty retail formats is accelerating brand visibility, while UK consumers continue to prioritize sustainability and ethical sourcing. Collaborative innovation between established global brands and indie startups is fueling competition and portfolio expansion.

India is witnessing rapid growth in the Peony Extracts for Brightening Market, which is forecast to expand at a CAGR of 23.8% through 2035. Rising disposable incomes, urbanization, and increased awareness of skincare benefits are driving adoption beyond metro cities into tier-2 and tier-3 markets. Herbal and natural positioning resonates strongly with Indian consumers, where traditional beauty rituals align with the use of peony extracts. E-commerce platforms, influencer marketing, and expanding D2C beauty startups are accelerating access and affordability, while global and domestic brands are investing in localized formulations tailored to Indian skin types and climate conditions.

The Peony Extracts for Brightening Market in China is expected to grow at a CAGR of 23.6%, the highest among leading economies. This momentum is fueled by strong consumer preference for herbal and natural skincare, cultural alignment with botanical remedies, and rapid adoption of premium brightening serums and creams. Domestic beauty brands are highly competitive, leveraging affordable formulations and localized marketing to capture mass adoption, while global players are expanding through cross-border e-commerce. Municipal emphasis on sustainability and clean-label regulations further strengthens consumer trust, positioning peony extracts as a central ingredient in China’s evolving beauty landscape.

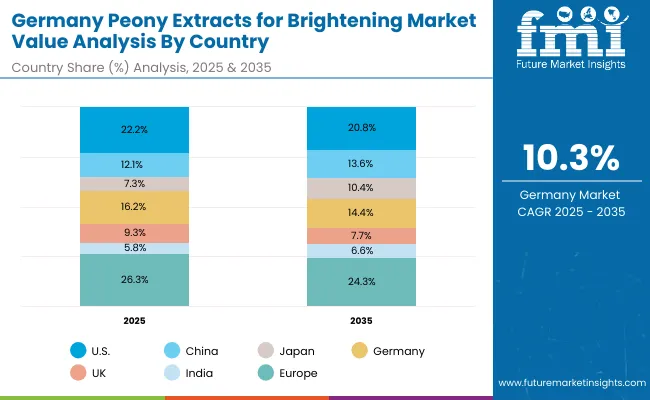

| Countries | 2025 Share (%) |

|---|---|

| USA | 22.2% |

| China | 12.1% |

| Japan | 7.3% |

| Germany | 16.2% |

| UK | 9.3% |

| India | 5.8% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 20.8% |

| China | 13.6% |

| Japan | 10.4% |

| Germany | 14.4% |

| UK | 7.7% |

| India | 6.6% |

The Peony Extracts for Brightening Market in Germany is projected to grow at a CAGR of 10.3%, reflecting steady but slower expansion compared to high-growth Asian markets. Germany’s position as one of Europe’s largest skincare markets is supported by strong regulatory compliance under EU cosmetic standards, which reinforces consumer trust in clean-label and dermatologist-tested products. Demand for multifunctional formulations that combine brightening and anti-aging benefits continues to rise, particularly in serums and creams marketed through pharmacies and specialty beauty stores. However, Germany’s share of the global market is expected to ease from 16.2% in 2025 to 14.4% in 2035, as faster-growing markets like China and India expand their influence.

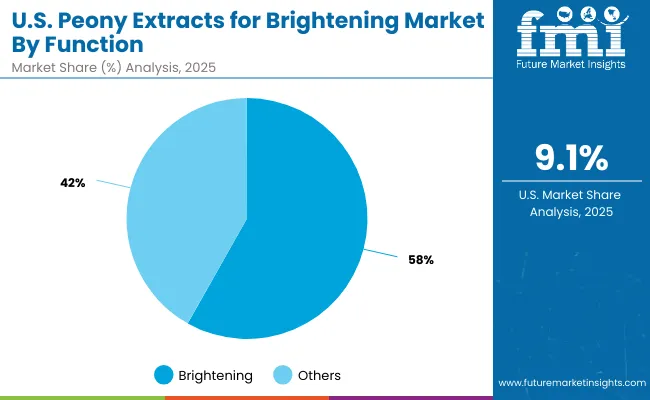

| USA by Function | Value Share% 2025 |

|---|---|

| Brightening | 58.2% |

| Others | 41.8% |

The Peony Extracts for Brightening Market in the United States is projected at USD 191.5 million in 2025, expanding steadily at a CAGR of 9.1% to reach USD 613.5 million by 2035. Brightening functions dominate with a 58.2% share, reflecting strong consumer interest in products that target skin radiance and tone correction. Demand is reinforced by growing trust in dermatologist-tested and clean-label formulations, which are increasingly positioned in premium serum and cream formats. Unlike fast-growth Asian markets, the USA shows a balanced expansion driven by e-commerce, specialty retail, and pharmacy channels rather than aggressive low-cost rollouts. Sustainability and transparency remain critical purchase drivers, shaping brand strategies across both domestic and global players.

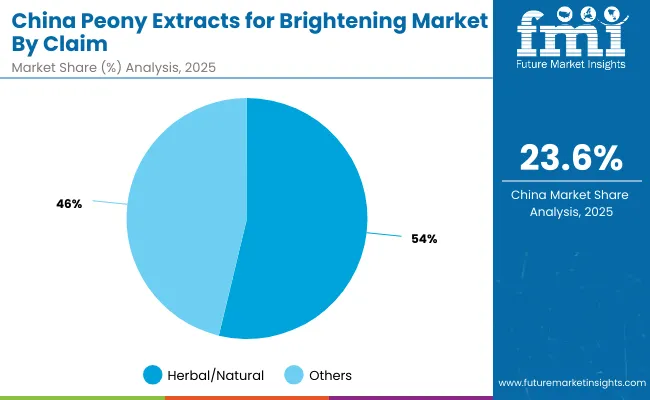

| China by Claim | Value Share% 2025 |

|---|---|

| Herbal/natural | 53.5% |

| Others | 46.5% |

The Peony Extracts for Brightening Market in China presents one of the strongest global opportunities, expanding at a CAGR of 23.6% through 2035. Herbal/natural claims lead with 53.5% share in 2025, reflecting deep cultural trust in botanical skincare traditions. This dominance is strengthened by consumer preference for safe, plant-based products and reinforced by regulatory policies encouraging clean-label and sustainable formulations. Domestic brands are highly competitive, leveraging affordability, heritage branding, and localized marketing, while global brands increasingly use cross-border e-commerce to tap into rising urban demand. Digital-first campaigns, influencer endorsements, and integration of herbal positioning into premium brightening serums are creating a robust growth trajectory.

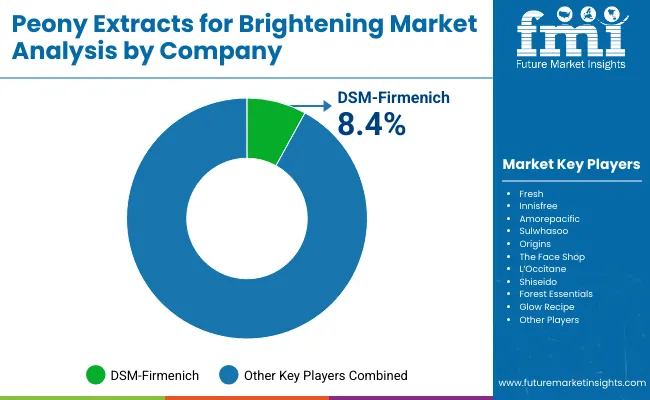

| Company | Global Value Share 2025 |

|---|---|

| DSM- Firmenich | 8.4% |

| Others | 91.6% |

The Peony Extracts for Brightening Market is moderately fragmented, with a mix of global ingredient suppliers, multinational beauty corporations, and niche botanical specialists competing across diverse segments. Global supplier DSM-Firmenich holds a leading position with 8.4% share, leveraging its expertise in active ingredients, standardized extracts, and partnerships with cosmetic brands. Its strategy focuses on delivering clinically supported formulations and securing regulatory compliance across international markets.

Multinational beauty players such as Amorepacific, Shiseido, L’Occitane, Sulwhasoo, Innisfree, and Origins dominate the finished product landscape, integrating peony extracts into premium serums, creams, and lotions. These companies are accelerating adoption through clean-label product launches, influencer-driven marketing, and strong presence across e-commerce and specialty retail channels. Niche-focused brands like Glow Recipe, Fresh, The Face Shop, and Forest Essentials differentiate by emphasizing herbal/natural claims, heritage positioning, and D2C-led consumer engagement. Their strength lies in creating cultural resonance and building loyal communities around authentic, plant-based skincare.

Competitive differentiation is shifting away from simple ingredient sourcing toward ecosystem strategies that combine clean-label positioning, sustainability certifications, and digital-first consumer engagement. As transparency, sustainability, and multifunctional efficacy become key purchase drivers, both global suppliers and brand-led innovators are intensifying competition to secure long-term market leadership.

Key Developments in Peony Extracts for Brightening Market

| Item | Value |

|---|---|

| Quantitative Units | USD 863.4 Million |

| Function | Brightening, Anti-aging, Hydration, Repair |

| Product Type | Serums, Creams/lotions, Masks, Toners |

| Channel | E-commerce, Pharmacies, Specialty beauty stores, Mass retail |

| Claim | Herbal/natural, Vegan, Clean-label, Dermatologist-tested |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Fresh, Innisfree, Amorepacific, Sulwhasoo, Origins, The Face Shop, L’Occitane, Shiseido, Forest Essentials, Glow Recipe |

| Additional Attributes | Dollar sales by function and product type, adoption trends in brightening and anti-aging skincare, rising demand for serums and premium concentrated formulations, sector-specific growth in pharmacies, e-commerce, and specialty beauty stores, revenue segmentation by herbal/natural and dermatologist-tested claims, integration with clean-label, vegan, and sustainability-focused innovations, regional trends influenced by cultural beauty traditions and regulatory standards, and innovations in formulation technologies, hybrid botanical blends, and advanced delivery systems. |

The global Peony Extracts for Brightening Market is estimated to be valued at USD 863.4 million in 2025.

The market size for the Peony Extracts for Brightening Market is projected to reach USD 2,945.1 million by 2035.

The Peony Extracts for Brightening Market is expected to grow at a 13.1% CAGR between 2025 and 2035.

The key product types in the Peony Extracts for Brightening Market are serums, creams/lotions, masks, and toners.

In terms of product type, the serums segment is expected to command the largest share in 2025, accounting for 48.5% of the market, driven by rising consumer demand for concentrated and effective brightening solutions.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Peony Extract Brightening Creams Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Extracts and Distillates Market

Meat Extracts Market Size and Share Forecast Outlook 2025 to 2035

Algae Extracts Market Size and Share Forecast Outlook 2025 to 2035

Maple Extracts Market Size and Share Forecast Outlook 2025 to 2035

Jujube Extracts Market Analysis by Type, End-Use, Distribution Channel, Region And Other Forms Through 2035

Coffee Extract Market Analysis by Nature, Product, End Use, Formulation, and Region through 2025 to 2035

Bamboo Extracts for Anti-Aging Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Bamboo Extracts for Skin Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Seaweed Extracts Market Size and Share Forecast Outlook 2025 to 2035

Ginseng Extracts Market Analysis by Product Type, Form and Application Through 2035

Glycerol Extracts Market

Pine Bark Extracts Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Chlorella Extracts Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Botanical Extracts Market Size and Share Forecast Outlook 2025 to 2035

Fermented Extracts Market Size and Share Forecast Outlook 2025 to 2035

Black Tea Extracts Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Aloe Vera Extracts Market Size, Growth, and Forecast for 2025 to 2035

Green Tea Extracts Market Analysis – Size, Share & Forecast 2025 to 2035

Chamomile Extracts for Soothing Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA