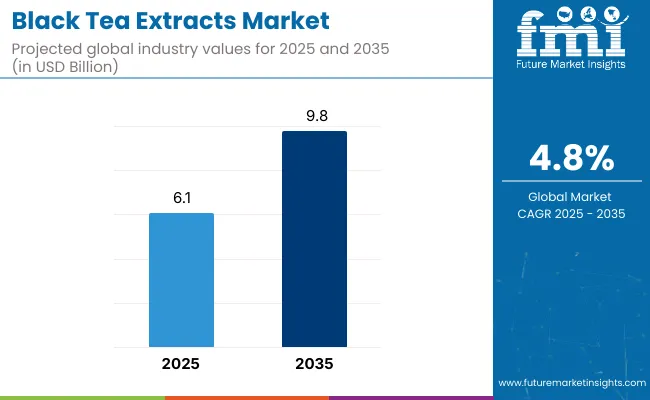

The black tea extracts market will grow from USD 6.1 billion in 2025 to USD 9.8 billion by 2035 at a CAGR of 4.8% during the forecast period, driven by increasing consumer demand for functional ingredients in food and beverages.

The hot water soluble extracts segment is expected to maintain its leadership, with 65% of the market share expected in 2025. Furthermore, the demand for functional food applications is expected to continue expanding, as black tea extracts are valued for their health benefits, such as antioxidants.

| Metrics | Values |

|---|---|

| Industry Size (2025) | USD 6.1 billion |

| Industry Value (2035) | USD 9.8 billion |

| CAGR (2025 to 2035) | 4.8% |

The market is expected to be influenced by the rising popularity of health-conscious, natural, and plant-based ingredients in food products. India and China are expected to contribute significantly to market growth, while developed regions such as the United States are expected to see rising demand for these functional ingredients.

The black tea extracts market, valued at USD 6.1 billion in 2025, forms a significant niche within several broader markets. It accounts for approximately 40-45% of the global tea extracts market, owing to its dominant use in functional beverages and supplements. Within the functional ingredients market, valued at over USD 100 billion, black tea extracts represent around 5-6%, driven by their antioxidant, anti-inflammatory, and energy-boosting benefits.

In the beverage ingredients market, their share is estimated at 2-3%, with demand rising from ready-to-drink teas and low-caffeine formulations. As part of the nutraceutical ingredients sector, they contribute 1-2%, especially in metabolism-support and heart health products. Within the food additives and ingredients market, black tea extracts hold a modest share of under 1%.

With the rising demand for functional foods, companies such as Tata Consumer Products and Kemin Industries are expected to play a key role in expanding the black tea extract product portfolio. In January 2023, Synthite Industries revealed plans to expand its black tea extract production capacity. This strategic move aims to address the increasing demand for natural and functional ingredients across various sectors, including food, beverages, and dietary supplements, aligning with market trends favoring healthier, functional products.

The table below reflects the continental difference in the CAGR variation across six months for the base year (2024) and current year (2025) for the global industry. This analysis highlights key performance changes and sheds light on the patterns of revenue recognition, thus giving stakeholders more perspective on the growth trajectory throughout the year. So H1 or the first half of the year is January to June. The latter half of the year, H2, encompasses the months July through December.

| Particular | Value CAGR |

|---|---|

| (H1) 2024 to 2034 | 4.6% |

| (H2) 2024 to 2034 | 4.8% |

| (H1) 2025 to 2035 | 4.7% |

| (H2) 2025 to 2035 | 4.9% |

During the first half (H1) of the period 2025 to 2035, the industry is estimated to grow at a CAGR of 4.8% and then in the second half (H2) of the decade at a slightly higher CAGR of 4.9%. Transitioning into the next period, H1 2025 to H2 2035, the CAGR is estimated to rise to 5.0% during the first half and stay flat at 4.8% during the second half. During the first half (H1), the industry saw a growth of 30 BPS, whereas during the second half (H2), it saw a decline of 20 BPS.

The black tea extracts market is growing with liquid extracts holding a 45% market share in 2025. Hot water soluble extracts dominate at 65%, while functional food applications account for 30%. The market is driven by increasing demand for health-oriented ingredients in food and beverages.

Liquid forms of black tea extracts are expected to dominate the market in 2025, accounting for 45% of the market share. This form is widely preferred due to its versatility in application, especially in beverages, functional foods, and dietary supplements. Liquid extracts are easier to incorporate into drinks, capsules, and powders, providing a convenient option for consumers seeking health benefits. Companies like Synthite Industries and Tata Consumer Products are investing heavily in liquid extract production to meet the growing demand. The popularity of liquid forms is driven by:

Hot water soluble extracts are projected to dominate the black tea extract market, representing 65% of the market share in 2025. These extracts are highly favored for their ease of use and solubility, particularly in beverages like tea and ready-to-mix drinks. Hot water soluble extracts are preferred by both manufacturers and consumers for their ability to dissolve quickly, providing consistency and uniformity in product formulations. Leading players such as Martin Bauer Group and Cymbio Pharma Pvt Ltd are expanding their hot water soluble offerings, driven by:

Functional food applications are expected to account for 30% of the market share by 2025. The market is driven by the increasing consumer demand for health-focused products. Black tea extracts are highly valued for their antioxidant properties and health benefits, such as improving heart health and supporting weight management. Companies like Kemin Industries and AVT Natural Products are focusing on expanding the use of black tea extracts in functional foods, targeting health-conscious consumers. This segment’s growth is fueled by:

Rising Demand for Functional and Adaptogenic Beverages

The increasing consumer preference for functional drinks that offer both energy and wellness benefits has significantly impacted the industry. Black tea extract, known for its high polyphenol and theaflavin content, is being widely incorporated into functional beverages, including energy drinks, herbal infusions, and gut-health-supporting drinks. Consumers are shifting away from artificially caffeinated products, favoring natural energy boosters with antioxidant and cognitive-enhancing properties.

Manufacturers are responding by introducing ready-to-drink black tea-based energy beverages, nootropic tea blends, and adaptogenic tea formulations. Additionally, the demand for cold-brewed and carbonated black tea is increasing as consumers seek low-sugar, clean-label alternatives to conventional soft drinks.

The expansion of personalized health drinks and bioactive ingredient formulations is further driving investment in customized extracts that cater to specific health needs, ensuring steady industry growth in functional beverage applications.

Expansion of High-Quality Extracts for Premium Cosmetic and Skincare Formulations

Black tea extract is gaining traction in the cosmetic and personal care industry, particularly in anti-aging, anti-pollution, and skin-rejuvenating formulations. With a growing awareness of the impact of oxidative stress and environmental damage on skin health, consumers are actively seeking natural antioxidant-rich skincare products.

Black tea extract’s polyphenol content, which helps in reducing fine lines, improving skin elasticity, and neutralizing free radicals, has positioned it as a high-value ingredient in serums, creams, and facial masks. Manufacturers are launching fermented extracts, which enhance the bioavailability of active compounds for better skin absorption.

Additionally, major skincare brands are developing black tea-based cleansing oils, moisturizers, and under-eye treatments to meet the demand for premium, naturally sourced beauty solutions. The segment is also benefiting from cross-industry collaborations, with beverage brands expanding into the skincare sector using their proprietary extracts.

Shift Toward Instant and Water-Soluble Tea Extracts for Food and Beverage Innovation

The demand for instant, water-soluble, and concentrated tea extracts is surging as food and beverage companies seek convenient, flavor-stable, and highly bioavailable tea formulations. Black tea extract is increasingly used in bakery, confectionery, dairy, and alcoholic beverages, offering rich flavor and health benefits. The rise of high-end tea-infused culinary creations, including black tea-based syrups, sauces, and chocolates, is further driving industry expansion.

Manufacturers are developing high-solubility extracts that dissolve instantly in cold and hot liquids, catering to RTD tea brands, bubble tea chains, and specialty beverage producers. The ability to customize tea strength and flavor profiles using standardized extracts has made them a preferred choice in premium blended teas and functional food products. The growing trend of fusion beverages, such as black tea-infused cocktails and functional milk tea lattes, is also contributing to the demand for flavor-optimized and shelf-stable extracts.

Growing Consumer Preference for L-Theanine-Enriched Extracts for Stress and Mood Support

As mental wellness and relaxation become priorities for global consumers, the demand for the product enriched with L-theanine is increasing. L-theanine, a naturally occurring compound in black tea, is known for its calming, stress-reducing, and cognitive-enhancing properties. Consumers looking for natural anxiety relief and improved focus are opting for black tea-infused products that provide sustained energy without the jitters associated with coffee.

Manufacturers are capitalizing on this trend by producing standardized extracts with higher L-theanine concentrations and integrating them into functional teas, mood-enhancing beverages, and mental clarity supplements. The rise of sleep-supportive herbal teas and nootropic-enhanced drinks is also boosting the inclusion of black tea extract in relaxation-focused formulations.

The trend aligns with the broader wellness movement, where consumers seek holistic, plant-based solutions to manage daily stress and cognitive performance, driving the long-term demand for specialized extracts.

Among the major threats hanging over the industry is climate vulnerability and farm volatility. Tea, as a crop, is highly susceptible to climate disruption, soil quality, and plant altitude. Hot weather, irregular precipitation patterns, droughts, and insects can induce yield losses that in turn lead to supply adjustments and increased raw material prices.

Another serious difficulty is the disturbances in the supply chain. These products are mainly obtained from the tea-growing areas rainforests dealers such as China, India, Sri Lanka, and Kenya. Geopolitical issues, trade restrictions, or inadequate logistics in those regions can break the supply chain and result in postponed delivery of the products, which in turn can affect global availability and cost.

On the other hand, the competition in the industry and the issue of product identity in almost all spaces is a notable risk due to a large number of suppliers that are active in the area. The existence of cheap, fake extracts at the expense of genuine ones can erode the confidence of both consumers and the company.

The interchange of customer preferences and demand variations can have an impact on the market's steadiness too. The growing requirement of functional drinks, products with no-labels, and plant-based ingredients advantages the industry, however, economic recessions or health trends may have a negative effect on sales.

| Countries | CAGR (2025 to 2035) |

|---|---|

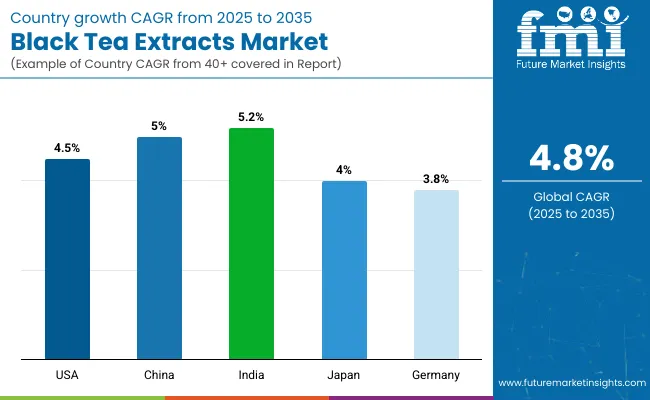

| USA | 4.5% |

| China | 5.0% |

| India | 5.2% |

| Japan | 4.0% |

| Germany | 3.8% |

As per research conducted by FMI, the USA black tea extracts market is set to grow at CAGR of 4.5% during 2025 to 2035. Increased consumer interest in natural and health-supportive products has driven black tea extract demand across industries such as beverages, dietary supplements, and cosmetics.

The USA industry is marked by high innovation, with producers launching ready-to-consume black tea drinks and black tea extract functional foods. The growing consciousness about the antioxidant nature of black tea has also increased its inclusion in skincare and personal care products. The presence of major industry players and a developed distribution network is also a reason for the growth of the industry in the nation.

Growth Drivers in the USA

| Key Drivers | Details |

|---|---|

| Health-Conscious Consumers | Rise in demand for natural, functional, and organic drinks |

| Product Development Innovation | Rise in RTD tea drinks and black tea extract food |

| Rising Demand in Personal Care | Growing use of these products in skincare and cosmetics |

| Strong Industry Position | Installed base of leading tea companies and well-developed distribution network |

According to FMI, the Chinese industry is set to grow at CAGR of 5.0% during the study period. Being one of the global leaders in the production and consumption of tea, China's strong tea culture significantly impacts the industry trends. Traditional tea drinking drives the domestic industry, along with a growing trend for health and wellness products.

Chinese producers are targeting the extension of their product line to include black tea extract-fortified beverages, nutraceuticals, and cosmetics. Government support to the tea sector and efforts toward promoting tea exports have also driven industry growth. In addition, increasing demand for functional beverages among young people is likely to drive the market's further expansion.

Growth Drivers in China

| Key Drivers | Details |

|---|---|

| Rising Domestic Consumption | Domestic tea consumption drives extracts demand |

| Growing Health Consciousness | Increasing demand for functional health and wellness drinks |

| Export Growth | Government efforts to increase global exports of tea |

| Product Innovation | Emergence of nutraceuticals and cosmetics based on these products |

India's industry is poised to register 5.2% CAGR during the forecast period, cites FMI. Having been among the world's largest tea-producing nations, India has a colossal home industry for allied and tea products. Growing health awareness among consumers has created a huge demand for these products, primarily in urban regions.

Applications range from food and beverages, medicine, to cosmetics. Companies are riding the wave by introducing new products, from health drinks, supplements to cosmetics based on black tea extract. The government efforts in increasing the tea production and exports and increasing R&D investments will continue to contribute to the expansion of the industry in the years to come.

Growth Drivers in India

| Key Drivers | Details |

|---|---|

| Robust Tea Industry | India ranks among the highest tea-producing countries with strong local demand |

| Government Support | Policies in favor of tea cultivation and export |

| Health-Oriented Consumers | Surging demand for black tea extract in wellness products |

| Diversification in Usage | Penetration into nutraceuticals, cosmetics, and food supplements |

The black tea extract market in Japan is expected to grow at a CAGR of 4.0%, states FMI. The passion for quality, functional beverages in Japan has spurred the demand for these products in nutraceuticals, RTD teas, and specialty beverages.

Also, Japan's aging population has been driving the demand for antioxidant-enriched beverages and supplements. Japanese companies focus on technological advancement in tea extraction technology to achieve maximum purity and functionality of these products.

Growth Drivers in Japan

| Key Drivers | Details |

|---|---|

| Aging Population | Demand for antioxidant-enriched products in functional beverages |

| Innovation in RTD Drinks | Mature industry for ready-to-drink black tea products |

| High Consumer Preference for Quality | Focus on premium black tea extract formulations |

| Advanced Extraction Technologies | Use of state-of-the-art techniques for purity and efficacy |

The German industry is estimated to grow at a CAGR of 3.8% during the forecast period, cites FMI. The clean-label and organic trend is driving the use of these products in functional foods, beverages, and cosmetics.

High purity extraction and environmentally friendly sourcing is encouraged by Germany's requirements for food safety and quality standards. Moreover, the increasing popularity of organic and herbal tea products is driving steady industry growth.

Growth Drivers in Germany

| Key Drivers | Details |

|---|---|

| Organic Product Preference | Rising demand for clean-label tea extracts |

| Stringent Regulatory Standards | Meeting EU food safety and quality standards |

| Growing Functional Beverage Industry | Black tea extracts in herbal and wellness drinks |

| Sustainability Focus | More emphasis on sustainable tea farming and extraction |

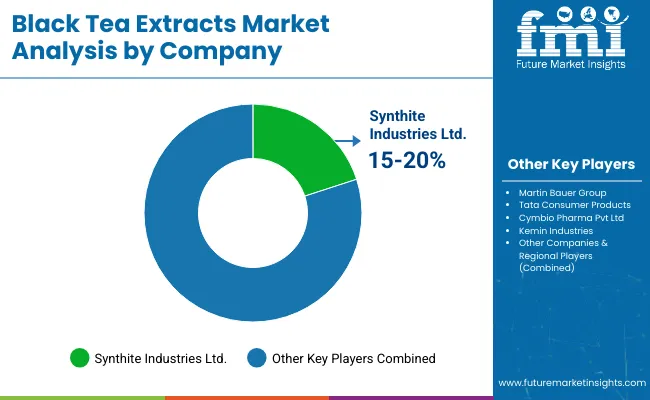

The global black tea extracts market features a competitive landscape with dominant players, key players, and emerging players. Dominant players such as Synthite Industries Ltd., Martin Bauer Group, and Tata Consumer Products lead the market with extensive product portfolios, strong R&D capabilities, and robust distribution networks across food, beverage, nutraceutical, and cosmetic sectors.

Key players including Cymbio Pharma Pvt. Ltd., Kemin Industries, and Finlay offer specialized formulations tailored to specific applications and regional markets. Emerging players, such as Amax NutraSource Inc., AVT Natural Products Ltd., and Blue Sky Botanics Ltd., focus on innovative extraction technologies and cost-effective solutions, expanding their presence in the global market.

Black tea extracts are becoming increasingly popular in functional foods and beverages for their antioxidant properties. These extracts are linked to several health benefits, including reduced risk of cardiovascular disease, improved gut health, and enhanced mental clarity. The growing shift toward caffeine alternatives in energy drinks is creating new opportunities for black tea extracts. Rich in polyphenols and theaflavins, these extracts are valued for their antioxidant benefits, making them an ideal choice for health-conscious consumers.

Synthite Industries Ltd. (15-20%)

A global leader in plant-based extracts, Synthite excels in producing high-quality tea extracts for multiple industries.

Martin Bauer Group (12-16%)

Known for its extensive herbal extracts portfolio, the company supplies premium extracts to health and wellness brands.

Tata Consumer Products (10-14%)

A major player in the tea industry, Tata is expanding into functional tea extracts to meet consumer demand for health-focused products.

Cymbio Pharma Pvt Ltd (8-12%)

Focuses on developing high-potency extracts for nutraceutical and cosmeceutical applications.

Kemin Industries (6-10%)

Specializes in innovative tea extract formulations with a strong emphasis on food preservation and functional benefits.

Other Key Players (30-40% Combined)

The industry is segmented into liquid, encapsulated, and powder forms.

These products are used in functional food, beverages, cosmetics, beauty supplements, dietary supplements, and herbal/natural medicine.

The industry includes hot water soluble and cold water soluble extracts.

The industry spans North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

The industry is slated to witness USD 6.1 billion in 2025.

The market is projected to reach USD 9.8 billion by 2035.

Key companies include Synthite Industries Ltd., Martin Bauer Group, Tata Consumer Products, Cymbio Pharma Pvt Ltd, Kemin Industries, Finlay, Amax NutraSource Inc., AVT Natural Products Ltd., Blue Sky Botanics Ltd., and FutureCeuticals.

India, slated to exhibit 5.2% CAGR during the study period, is poised for fastest growth.

Liquid extracts are widely used.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Blackout Fabric Laminate Market Size and Share Forecast Outlook 2025 to 2035

Blackcurrant Seed Oil Market Size and Share Forecast Outlook 2025 to 2035

Black Maca Extract Market Size and Share Forecast Outlook 2025 to 2035

Blackcurrant Powder Market Size and Share Forecast Outlook 2025 to 2035

Black Treacle Market Size and Share Forecast Outlook 2025 to 2035

Black Friday Packaging Market Size and Share Forecast Outlook 2025 to 2035

Black Pepper Market Analysis - Size, Share & Forecast 2025 to 2035

Black & Wood Pellets Industry Analysis in Europe Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Blackstrap Molasses Market Historical Analysis and Forecasts 2025 to 2035

Blackout Fabric Market Analysis – Trends, Growth & Forecast 2025 to 2035

Market Share Insights for Black Friday Packaging Providers

Examining Market Share Trends in the Black Pepper Industry

Market Share Distribution Among Black Seed Oil Suppliers

Black Start Generator Market

Black Friday Sale Market Analysis – Growth & Trends 2024-2034

Blackcurrant Concentrate Market

Carbon Black Content Tester Market Size and Share Forecast Outlook 2025 to 2035

Carbon Black Market Size, Growth, and Forecast 2025 to 2035

Carbon Black for Packaging Market Growth & Trends 2025 to 2035

Smoked Black Pepper Market Trends - Flavor Innovation & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA