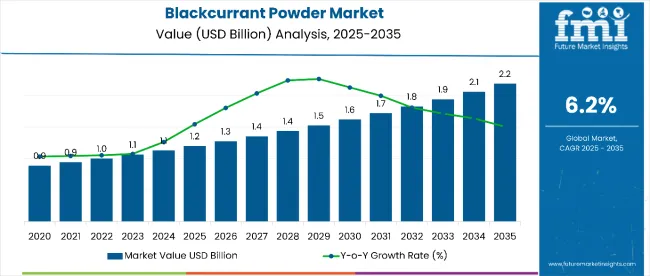

The blackcurrant powder market is estimated to be valued at USD 1.2 billion in 2025. It is projected to reach USD 2.2 billion by 2035, registering a CAGR of 6.2% over the forecast period. The market is set to generate an absolute dollar opportunity of USD 1.0 billion between 2025 and 2035, reflecting a 1.83 times growth.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1.2 billion |

| Forecast Value in (2035F) | USD 2.2 billion |

| Forecast CAGR (2025 to 2035) | 6.2% |

This upward trajectory is primarily driven by heightened consumer awareness around immunity-boosting ingredients, rising demand for clean-label products, and the expanding footprint of functional foods and beverages.

By 2030, the market is expected to reach approximately USD 1.66 billion, creating an incremental opportunity of USD 460 million during the first half of the forecast period. The remaining USD 540 million is likely to be generated between 2030 and 2035, reflecting robust and sustained demand.

The surge in demand for natural antioxidants, Vitamin C-rich ingredients, and botanical extracts is prompting food and beverage manufacturers to incorporate blackcurrant powder into juices, smoothies, dietary supplements, and personal care products.

Companies such as LOOV Food and FutureCeuticals are strengthening their positions through organic product launches and sustainable sourcing initiatives. LOOV Food introduced a new line of organic blackcurrant powders in 2024, while FutureCeuticals expanded its ethical supply chain practices, reflecting the market's evolution toward health-centric, environmentally conscious innovation.

Advancements in freeze-drying and microencapsulation technologies have enhanced shelf life and nutrient retention, reinforcing blackcurrant powder’s appeal across wellness, beauty, and cosmeceutical sectors. E-commerce platforms are widening product access, particularly in high-growth economies across Asia-Pacific.

The blackcurrant powder market constitutes approximately 5.2% of the global fruit powder market, driven by rising preference for antioxidant-dense, nutrient-rich ingredients. It accounts for nearly 3.8% of the functional food ingredients segment, particularly through beverage and dietary supplement formats. In the nutraceutical sector, it represents about 4.5% share, attributed to its health-promoting polyphenol and anthocyanin profile.

Its role in dietary supplements is also notable at 3.1%, while in natural food colors and superfood categories, it holds 2.6% and 4.9% respectively. The product’s botanical identity aligns well with the clean-label and plant-based movement, further elevating its position in health-forward consumer segments.

The market is undergoing structural transformation propelled by innovations in extraction methods, improved product traceability, and growing regulatory support for superfoods and organic ingredients. Strategic collaborations with organic farms and transparent sourcing are strengthening supply chains and building consumer trust.

The adoption of blackcurrant powder in beauty-from-within products, skincare supplements, and natural colorants for functional beverages is likely to broaden application diversity over the next decade.

The market is segmented by nature, end-use application, distribution channel, and region. By nature, the market is bifurcated into organic and conventional. Based on end-use application, the market includes food (bakery, dessert and ice-cream, sauces & seasonings, meat & egg replacement, beverages, flavoring & coatings, snacks & meals) and beverages (sports drinks, functional beverages, fruit juices).

In terms of distribution channel, the market is classified into direct sales and indirect sales (modern trade, convenience stores, independent grocery retailers, specialty food stores, online retail, other retail formats [such as vending machines, pop-up shops, and health expo stalls]). Regionally, the market is divided into North America, Latin America, Europe, East Asia, South Asia, Oceania, the Middle East and Africa.

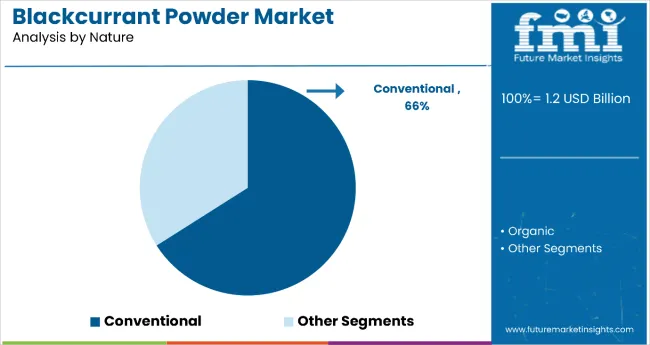

The conventional segment accounts for 66% of the nature category in the blackcurrant powder market, reflecting its dominant position in large-scale food and nutraceutical production. Conventional blackcurrant powder remains the preferred choice for manufacturers due to its affordability, wide availability, and established supply chains. It is extensively used in ready-to-drink (RTD) beverages, functional foods, and dietary supplements where volume efficiency and competitive pricing are critical.

Lower regulatory complexities compared to organic certifications further support its widespread adoption, especially in emerging markets. Mass-market consumer appeal and compatibility with industrial-scale formulations allow conventional variants to maintain a stronghold despite rising interest in clean-label and organic alternatives. As high-volume applications continue to drive demand, the conventional segment is expected to retain its leadership position through cost efficiency and operational scalability.

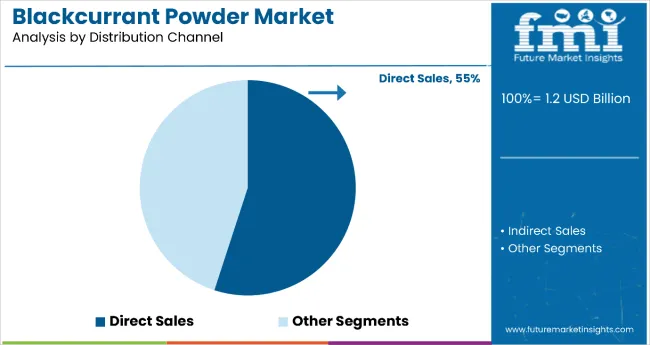

Direct sales dominate the distribution channel segment, accounting for 55% of the blackcurrant powder market in 2025. This route is favored by manufacturers for its ability to support bulk transactions with food processors, nutraceutical companies, and beverage brands. Direct sales offer pricing control, volume stability, and streamlined logistics, making it ideal for securing long-term B2B partnerships and private-label supply agreements.

Unlike retail-based distribution, direct sales channels enable tailored formulations and on-demand customization to meet the specific needs of commercial clients. This segment also enhances supply chain traceability and supplier-manufacturer integration. While online retail and specialty outlets are expanding rapidly, direct sales remain foundational for high-volume transactions and global supply agreements, securing their critical role in the value chain.

Blackcurrant powder’s rich antioxidant profile, high vitamin C content, and natural flavoring qualities make it an appealing ingredient for health-conscious consumers and manufacturers seeking plant-based nutritional and functional enhancement solutions.

Rising awareness of immune-boosting diets and antioxidant-rich foods is driving adoption, particularly in functional beverages, dietary supplements, sports nutrition, and confectionery sectors. Government and industry initiatives promoting natural fortification, coupled with advancements in drying and encapsulation technologies, are further improving product stability, nutrient retention, and formulation flexibility.

As demand for clean-label, plant-derived, and nutrient-dense ingredients continues to accelerate, the market outlook remains positive. With both consumers and manufacturers prioritizing natural sources of antioxidants, flavor, and health benefits, blackcurrant powder is well-positioned for growth across food, beverage, nutraceutical, and cosmetic applications.

In 2024, global demand for blackcurrant powder increased by 10.5% year-on-year, supported by rapid expansion in functional foods, wellness beverages, and dietary supplements. Asia-Pacific accounted for nearly 38% of new consumption, led by Japan and South Korea, where immunity-boosting and antioxidant-rich ingredients remain top consumer priorities.

Manufacturers are investing in freeze-drying and encapsulation technologies to preserve nutrient content and extend shelf life, while also introducing organic and ethically sourced variants for health-conscious and sustainability-driven markets.

Functional Nutrition and Clean-Label Movements Propel Market Growth

Consumer demand for natural, minimally processed, and functional ingredients is a primary driver of market expansion. Blackcurrant powder, rich in anthocyanins and vitamin C, is increasingly used in immunity-boosting products, sports nutrition, and anti-aging formulations. Clinical studies show that blackcurrant extract improves blood flow and reduces oxidative stress, supporting its integration in cardiovascular and cognitive health supplements.

The rise in plant-based dietary preferences and clean-label product lines has driven a 22% increase in demand across North America and Western Europe in 2024 alone. Ready-to-drink beverages and nutraceuticals represent the two largest contributors to this growth.

Seasonal Crop Dependency and Price Instability Pose Constraints

Despite rising demand, market growth is challenged by seasonal variability in blackcurrant harvests, limited cultivation zones, and climate-related yield risks. Blackcurrant crops are highly sensitive to frost and require specific temperate conditions, restricting production to a few regions like Poland, the UK, and New Zealand. This leads to supply concentration and price fluctuations of up to 18% per season. Additionally, organic variants require strict certification and extended lead times, creating challenges for rapid scalability.

Key Trends Include Cosmeceutical Applications and E-Commerce Expansion

Emerging trends include the incorporation of blackcurrant powder in cosmeceutical products and personalized nutrition formats. Online platforms now account for over 27% of global sales, providing visibility and access to specialty wellness consumers across developed and emerging markets.

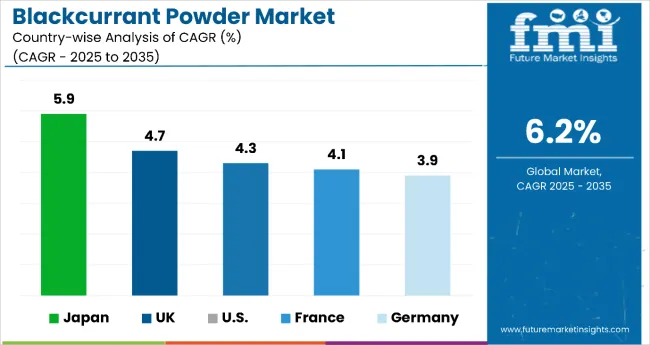

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.9% |

| UK | 4.7% |

| USA | 4.3% |

| France | 4.1% |

| Germany | 3.9% |

Among the top countries in the blackcurrant powder market, Japan leads with the highest CAGR of 5.9% from 2025 to 2035, driven by its aging population and strong demand for functional wellness products. The UK follows with 4.7%, supported by domestic cultivation and a preference for clean labels. The USA sees a 4.3% CAGR, fueled by rising functional food use.

France grows at 4.1%, influenced by beauty and gourmet applications, while Germany registers the slowest growth at 3.9%, despite a strong innovation ecosystem. Overall, Japan’s proactive health culture positions it as the fastest-growing market in this segment.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

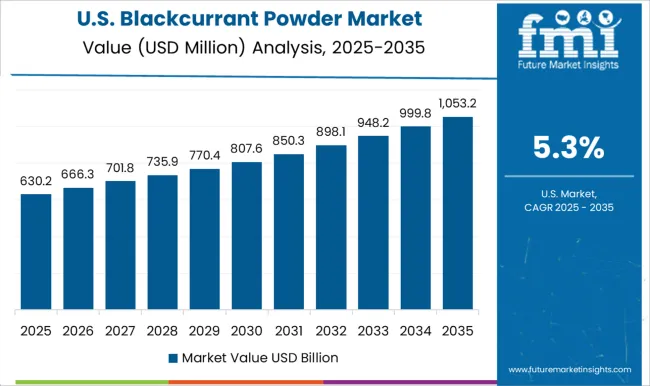

The revenue from blackcurrant powder in the USA is projected to grow at a CAGR of 4.3% from 2025 to 2035. This growth is driven by rising consumer interest in functional nutrition, especially among health-focused millennials and aging baby boomers. The product is increasingly used in dietary supplements, wellness beverages, and fortified snack bars. The lifting of historic cultivation bans is also enabling limited domestic production, creating new sourcing opportunities and boosting local supply chains.

The USA market benefits from strong retail and e-commerce distribution networks, facilitating broader access to clean-label, antioxidant-rich formulations. With ongoing investment in health-oriented food categories and personalized nutrition, blackcurrant powder is finding growing relevance across B2C and B2B applications.

The blackcurrant powder market in the UK is expected to expand at a CAGR of 4.7% between 2025 and 2035. The UK boasts a long-established blackcurrant cultivation base, particularly in Scotland and Northern England, which enables traceable, locally sourced product lines. Domestic brands are emphasizing origin-based marketing and organic certification to appeal to clean-label consumers.

Applications in the UK are broadening from traditional beverages to skincare formulations and wellness supplements, supported by premiumization trends in health food retail. Seasonality aligns with summer beverage launches and immune-boosting campaigns.

The blackcurrant powder market in Germany is projected to grow at a CAGR of 3.9% from 2025 to 2035. Known for food innovation and regulatory rigor, Germany’s market emphasizes quality and scientific substantiation in product development. Functional food and supplement companies are using blackcurrant powder in immune-boosting drinks, gummies, and clean-label capsules.

Germany’s pharma-grade supplement industry is also incorporating blackcurrant in cardiovascular and anti-fatigue formulas. With strict quality certifications and a focus on plant-based wellness, Germany is emerging as a stable growth market.

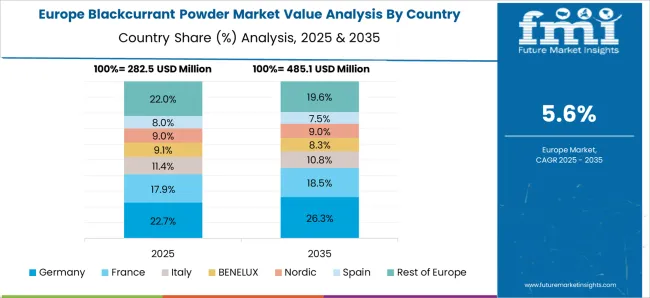

The blackcurrant powder market in France is expected to register a CAGR of 4.1% between 2025 and 2035. France’s deep-rooted culinary tradition and domestic Ribes nigrum cultivation, especially in Burgundy, support widespread use in gourmet applications. Blackcurrant powder is gaining traction in desserts, high-end beverages, and beauty nutrition products.

In parallel, nutraceutical companies are marketing it for skin health and anti-aging benefits, supported by local R&D capabilities. Wellness-focused branding around French botanical heritage is further strengthening its appeal among consumers who prioritize authenticity and traceability.

The blackcurrant powder market in Japan is anticipated to lead globally, growing at a CAGR of 5.9% from 2025 to 2035. The aging population and strong alignment with food-as-medicine traditions are key growth enablers. Japanese manufacturers are developing RTD drinks, functional jellies, and anti-aging supplements using blackcurrant powder, targeting both eldercare and beauty segments.

Innovation in product solubility, flavor enhancement, and bioavailability is enhancing consumer acceptance. Moreover, cultural familiarity with botanical wellness supports sustained demand across food, pharmaceutical, and cosmeceutical verticals.

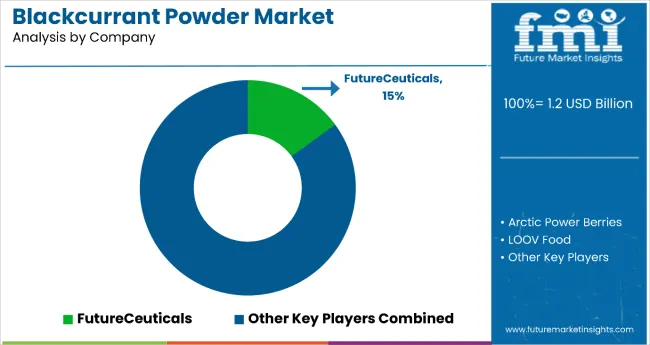

The blackcurrant powder market is fragmented, featuring a blend of large multinational players and specialized regional firms that contribute to a diverse and competitive environment. Leading companies such as FutureCeuticals, LOOV Food, and Arctic Power Berries command significant market presence through broad distribution networks, ongoing product innovation, and strategic acquisitions.

Mid-sized players like CurrantC LLC and Z Natural Foods focus on niche segments and clean-label consumer demands, leveraging direct-to-consumer approaches and collaborations within the functional food space. Pricing strategies and supply chain transparency remain critical competitive factors across this fragmented landscape.

FutureCeuticals has expanded its superfood ingredient portfolio through acquisitions, reinforcing its leadership in functional nutrition. LOOV Food is differentiating by emphasizing organic certifications and clean-label positioning to attract health-conscious consumers. Arctic Power Berries capitalizes on sustainable sourcing and Nordic purity narratives, establishing strong regional branding.

Additionally, companies like NutriCargo and Waitaki Bio prioritize traceability, premium sourcing, and nutraceutical-grade formulations to secure their foothold in B2B supply chains. Together, these strategies shape a dynamic competitive arena characterized by innovation, sustainability, and evolving consumer preferences.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.2 billion |

| Nature | Organic, Conventional |

| Application | Food (Bakery, Dessert and Ice-cream, Sauces & Seasonings, Meat & Egg Replacement, Beverages, Flavoring & Coatings, Snacks & Meals), Beverages (Sports Drinks, Functional Beverage, Fruit Juices) |

| Sales Channel | Direct Sales, Indirect Sales (Modern Trade, Convenience Stores, Independent Grocery Retailers, Specialty Food Stores, Online Retail, Other Retail Formats) |

| Regions Covered | North America, Latin America, Europe, Middle East & Africa, East Asia, South Asia, Oceania |

| Country Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Arctic Power Berries, LOOV Food, LYO FOOD Sp. z o.o, FutureCeuticals, CurrantC LLC, Z Natural Foods LLC, Active Micro Technologies, LLC (AMT), Waitaki Bio, ConnOils LLC, Northwest Wild Foods, Whitestone Mountain Orchard, NutriCargo, and Artemis Nutraceutical |

| Additional Attributes | Dollar sales by value, market share analysis by region, country-wise analysis, consumer preferences for organic versus conventional variants, innovations in processing technologies, competitive landscape analysis |

The global blackcurrant powder market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the blackcurrant powder market is projected to reach USD 2.2 billion by 2035.

The blackcurrant powder market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in blackcurrant powder market are organic and conventional.

In terms of end-use application, food segment to command 42.7% share in the blackcurrant powder market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Blackcurrant Seed Oil Market Size and Share Forecast Outlook 2025 to 2035

Blackcurrant Concentrate Market

Powdered Cellulose Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Powdered Soft Drinks Market Size and Share Forecast Outlook 2025 to 2035

Powder Packing Machine Market Size and Share Forecast Outlook 2025 to 2035

Powder Dispenser Market Analysis by Product Type, Size, Dispensing Mode, End-use Industry, and Region through 2025 to 2035

Analysis and Growth Projections for Powder Induction and Dispersion Systems Business

Leading Providers & Market Share in Powder Packing Machines

Key Players & Market Share in Powder Dispenser Manufacturing

Powder Injection Molding Market Growth – Trends & Forecast 2025 to 2035

Powdered Fats Market – Growth, Demand & Industrial Applications

Powdered Beverage Market Outlook – Growth, Demand & Forecast 2024-2034

Powder Feed Center Market

Powder Funnels Market

Powdered Hand Soap Market

Powder Coating Guns Market

Dry Powder Inhaler Market Size and Share Forecast Outlook 2025 to 2035

Egg Powder Market - Size, Share, and Forecast Outlook 2025 to 2035

Lip Powder Market Analysis by Form, End-User, Sales Channel and Region from 2025 to 2035

Dry Powder Refilling Machine Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA