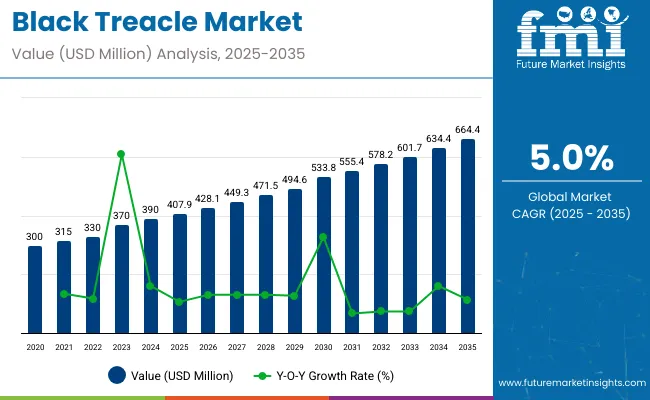

The black treacle market is estimated to be valued at USD 407.9 million in 2025 and is projected to reach USD 664.4 million by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 407.9 million |

| Projected Value (2035F) | USD 664.4 million |

| CAGR (2025 to 2035) | 5.0% |

The market is projected to add an absolute dollar opportunity of USD 256.5 million during the forecast period. This represents a 1.47 times growth at a compound annual growth rate of 5.0%. The market evolution is expected to be influenced by increasing demand for gluten-free and natural sweeteners, rising consumption of bakery products, and expanding applications in meat preparation and beverages.

By 2030, the market is projected to reach USD 533.8 million, representing an incremental value of USD 125.9 million over the first half of the decade (2025-2030) from an estimated USD 407.9 million in 2025. The remaining USD 130.6 million in growth is expected to occur during the second half of the decade (2030-2035), as the market reaches a forecasted USD 664.4 million by 2035. This pattern indicates a relatively balanced growth pace, driven by sustained demand across confectionery, bakery, and beverage applications.

Companies such as Tate & Lyle, Sun Agro Foods, Shepcote, Ragus, Chelsea Sugar, and Knorr are strengthening their competitive positions through investments in natural and organic product lines and expanding distribution networks. Focus on preservative-free formulations, innovation in product applications, and strategic partnerships are supporting growth in meat preparation, beverage, and bakery segments while catering to health-conscious consumer demands.

The market holds a distinct but niche position within its larger parent markets. In the vast global food ingredients market, black treacle constitutes a very small estimated fraction of less than 0.3%. Its share in the broader sweeteners market is also minimal, at 0.5%, where it competes with a wide array of other natural and artificial sweeteners. Within the more specific sugar and syrups market, it represents under 1% of the total value. However, its significance grows in the bakery ingredients market, where it holds a 2.2% share, reflecting its vital role in traditional baking applications.

The market is expanding steadily, driven by increasing adoption of organic, preservative-free variants and incorporation into gluten-free bakery and confectionery products. Rising health consciousness among consumers has accelerated the use of black treacle in natural beverages and marinated meat preparations. Innovations in formulation, new packaging solutions, and expansion of distribution channels are supporting market growth. Additionally, rising awareness regarding the nutritional benefits of black treacle and its use in traditional and modern recipes is contributing to sustained demand across key regions globally.

Black treacle’s unique flavor profile, natural sweetness, and gluten-free attributes are making it increasingly popular among health-conscious consumersand food manufacturers seeking versatile, natural sweeteners. Its application in bakery products, confectionery, and beverages allows for enhanced taste and nutritional benefits, supporting broad adoption across food segments.

Rising consumer preference for organic, preservative-free, and clean-label ingredients is further driving demand. Innovations in product formulations, such as inclusion in marinated meats, natural beverages, and health-oriented bakery items, are expanding its utility. Additionally, government support for healthier food options and increasing awareness of natural sweeteners’ benefits are fostering growth.

As lifestyle and dietary trends emphasize health, wellness, and natural ingredients, the market outlook for black treacle remains favorable. With manufacturers focusing on expanding product lines, distribution networks, and innovative applications, black treacle is poised to gain increased prominence across the bakery, beverage, and confectionery sectors globally.

The market is segmented by source, enduse, and region. By source, the market is bifurcated into sugarcane and sugar beet. Based on enduse, the market is categorized into food industry, bakery products, sauces and toppings, confectionery, brewery, and others (meat products). Regionally, the market spans across North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

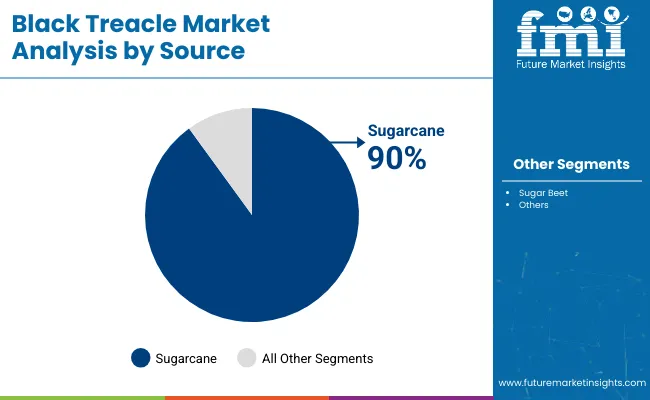

The sugarcane segment holds a dominant position with 90% of the market share in 2025, driven by the high availability of raw sugarcane and cost-efficient production of black treacle as a by-product of sugar refining. Sugarcane-derived black treacle provides consistent flavor, color, and viscosity, which is essential for bakery, confectionery, and beverage applications.

Manufacturers are leveraging advanced extraction and filtration technologies to maintain product quality and minimize impurities. Rising consumer demand for natural sweeteners and gluten-free products has reinforced the segment’s growth, particularly in developed markets such as North America and Europe. Sugarcane black treacle’s versatility in both industrial and artisanal food preparation underpins its strong adoption.

The segment is expected to maintain its leadership position, with expansions in production capacities, investment in responsible sourcing, and innovation in organic and preservative-free variants driving growth from 2025 to 2035.

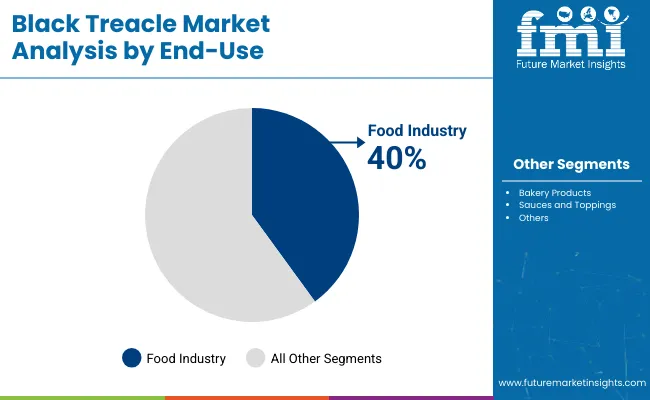

The food industry segment is the most lucrative end-use category with 40% of the market share in 2025. Black treacle is extensively applied in bakery products, sauces, ready meals, and confectionery, enhancing flavor, color, and functional properties such as moisture retention. Its gluten-free nature and mild sweetness make it a preferred ingredient for health-conscious consumers.

Producers are increasingly incorporating black treacle into value-added foods, including fruitcakes, scones, puddings, and sauces, to cater to rising demand for natural sweeteners. Growth is also supported by expanding industrial-scale bakery and confectionery production, particularly in the Asia-Pacific and North America.

Ongoing trends such as clean-label formulations, functional food innovation, and flavor diversification are expected to sustain the segment’s prominence. Companies are focusing on product quality, supply chain optimization, and customization for bakery and processed food manufacturers to capture new opportunities globally.

In 2025, global black treacle consumption is projected to grow steadily, with the food industry accounting for 40% of usage. Applications include bakery products, confectionery, sauces, and ready meals. Manufacturers are introducing high-quality, preservative-free, and gluten-free black treacle variants that deliver consistent flavor, color, and texture. Health-conscious consumers increasingly prefer natural sweeteners over refined sugar, supporting adoption. Technological innovations in extraction, filtration, and organic processing enhance product quality, shelf life, and functional versatility, allowing manufacturers to reduce formulation complexity while meeting clean-label demands.

Health and Wellness Trends Drive Black Treacle Adoption

Food and beverage producers are leveraging black treacle to enhance flavor profiles, nutritional value, and product differentiation. Its natural sweetness and antioxidant content make it ideal for gluten-free and organic baked goods, syrups, and beverages. Black treacle can replace artificial sweeteners in value-added foods, contributing up to 25% sugar reduction in some applications. Rising awareness of functional foods and consumer preference for natural ingredients have boosted adoption, particularly in North America and Europe. The segment’s growth is reinforced by increasing incorporation into sauces, meat preparations, and beverages where enhanced taste, aroma, and color are desired.

Supply Chain Challenges, Price Sensitivity, and Production Constraints Limit Growth

Despite strong demand, expansion faces constraints from fluctuations in sugarcane prices, seasonal availability, and processing capacity limitations. Raw sugarcane costs can vary by 8-12% annually, affecting black treacle production pricing. Specialized filtration and quality control processes increase manufacturing lead times by 3-5 weeks. Distribution challenges, including cold storage for premium or organic variants, raise logistics costs by 10-15%. Limited availability of processing facilities capable of producing high-purity, preservative-free black treacle also restricts large-scale adoption, particularly in price-sensitive regions. These factors temper growth despite increasing health-conscious consumption and product innovation trends globally.

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 7.2% |

| India | 6.5% |

| Brazil | 5.5% |

| USA | 5% |

| France | 4.4% |

| Germany | 4.2% |

| UK | 3.8% |

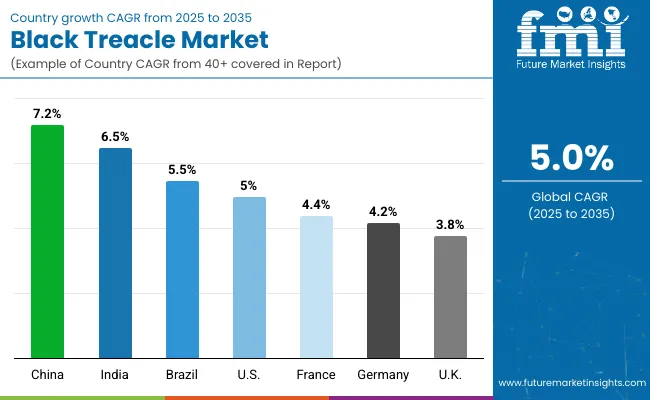

The market demonstrates significant variation in growth rates across major countries. China leads with a CAGR of 7.2%, driven by strong bakery, confectionery, and beverage production fueled by an abundant sugarcane supply. India follows at 6.5%, supported by sweet traditional output and rising urban demand. Brazil and the USA exhibit moderate growth at 5.5% and 5.0%, respectively, due to industrial-scale production and clean-label adoption. France and Germany grow steadily at 4.4% and 4.2%, supported by artisanal food consumption, while the UK lags at 3.8%, constrained by limited domestic production. Asia-Pacific countries clearly outperform Europe and North America in growth potential.

The report covers an in-depth analysis of 40+ countries; seven top-performing OECD countries are highlighted below.

The black treacle market in China is projected to expand at a CAGR of 7.2% from 2025 to 2035, driven by large-scale industrial bakery, confectionery, and beverage production, supported by the country high sugarcane output. Urbanization and rising disposable incomes are increasing demand for natural and gluten-free sweeteners. Manufacturers are launching preservative-free and organic black treacle to attract health-conscious consumers. Additionally, increased investment in production technology ensures consistent product quality and long shelf life, strengthening the market position in both commercial and retail segments.

Key Highlights

Revenue from black treacle in India is expected to grow at a CAGR of 6.5% from 2025 to 2035, driven by abundant sugarcane cultivation and high demand for traditional sweets, bakery products, and confectionery. Health-conscious consumption trends and gluten-free preferences are encouraging the adoption of natural sweeteners. Urban regions such as Delhi, Mumbai, and Bengaluru are driving commercial demand, while manufacturers focus on organic and preservative-free product lines. Expansion of distribution networks to Tier-2 and Tier-3 cities is further supporting market penetration across the country.

Key Highlights

Demand for black treacle in Brazil is projected to grow at a CAGR of 5.5% from 2025 to 2035, driven by abundant sugarcane production and strong adoption in confectionery and bakery products. Rising urban population and increasing health-conscious consumption contribute to steady demand. Manufacturers are investing in responsible sugarcane sourcing, organic black treacle, and clean-label product lines. Expansion of distribution channels to supermarkets, bakeries, and food processors enhances market penetration. Key sugarcane-producing states such as São Paulo, Minas Gerais, and Goiás remain critical for production and supply chain stability.

Key Highlights

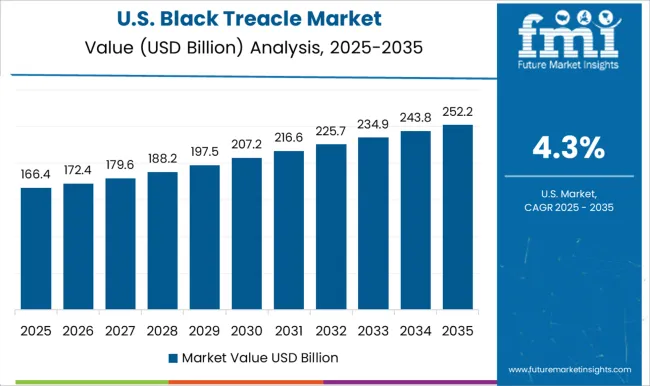

Revenue from black treacle in the USA is expected to grow at a CAGR of 5.0% from 2025 to 2035, supported by the industrial bakery, beverage, and confectionery sectors. Urban centers such as New York, California, and Texas show strong adoption of natural and preservative-free sweeteners. Health conscious and clean-label trends are encouraging manufacturers to introduce high-quality black treacle for both commercial and retail applications. Investment in processing technology and distribution networks strengthens supply chain efficiency and market presence across North America.

Key Highlights

Sales of black treacle in France are expected to grow at a CAGR of 4.4% from 2025 to 2035, supported by artisanal bakery, confectionery, and gourmet food applications. Growth is concentrated in urban centers such as Paris, Lyon, and Bordeaux, where demand for natural and organic sweeteners remains high. Manufacturers are introducing premium black treacle products for artisanal and health-focused markets. Collaboration with local bakeries and gourmet food producers enhances product visibility, while regulatory standards ensure safety and quality, facilitating steady adoption in premium food segments.

Key Highlights

Demand for black treacle in Germany is projected to grow at a CAGR of 4.2% from 2025 to 2035, driven by its increasing use in premium bakery, beverage, and meat preparation applications.Organic and preservative-free black treacle variants are increasingly preferred in functional and clean-label food segments. Regulatory compliance, including EU food safety and organic standards, supports market adoption. Industrial hubs such as Berlin, Hamburg, and Frankfurt are driving innovation, with manufacturers emphasizing responsible sourcing, high-quality production, and consistent flavor profiles, which cater to health conscious consumers and specialty food markets.

Key Highlights

The black treacle market in the UK is projected to grow at a CAGR of 3.8% from 2025 to 2035, driven by bakery, beverage, and confectionery applications, especially in London, Manchester, and Birmingham. Limited domestic production capacity and reliance on imports constrain market expansion. However, the rising preference for natural sweeteners, clean-label products, and premium offerings supports steady adoption. Manufacturers are focusing on organic variants, quality assurance, and expanding distribution channels to retail and industrial customers.

Key Highlights

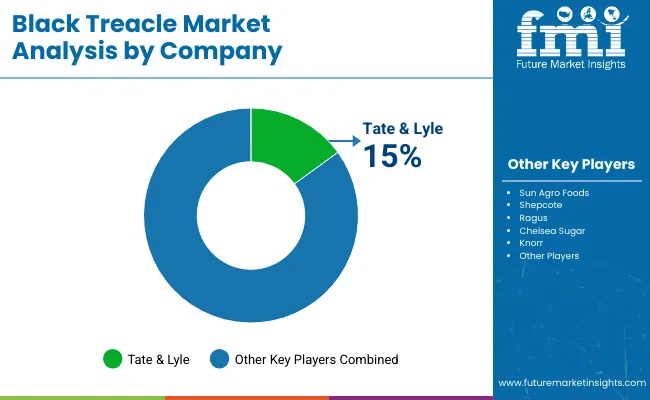

The market is moderately fragmented, comprising multinational sugar producers, regional syrup manufacturers, and specialty ingredient companies. Tate & Lyle, Sun Agro Foods, and Chelsea Sugar dominate the segment, leveraging their large-scale sugar refining operations, well-established distribution networks, and expertise in producing consistent, high-quality black treacle. These companies benefit from integrated supply chains, ensuring reliable sourcing of sugarcane and cost-effective production processes that maintain stable pricing for both industrial and retail customers.

Regional players such as Shepcote and Ragus differentiate through specialized offerings, including organic, preservative-free, and gluten-free black treacle. These companies focus on niche applications in bakery, confectionery, beverage, and gourmet products, meeting rising consumer demand for clean-label, natural, and health-conscious ingredients. Product innovation, quality consistency, and responsible sourcing initiatives, such as certified sugarcane supply and reduced emission practices, provide competitive advantages in local and export markets.

Entry barriers in the market are moderate, influenced by the need for sugarcane sourcing capabilities, processing infrastructure, and adherence to food safety regulations across multiple jurisdictions. Competitiveness increasingly relies on product differentiation through organic and natural formulations, clean-label certifications, and versatile application support for industrial and artisanal food production. Market leaders invest in research and development, scalable production facilities, and distribution expansion to strengthen presence in high-demand regions such as North America, Asia-Pacific, and Europe, while ensuring compliance with global food safety standards.

Key Developments in the Black Treacle Market

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 407.9 Million |

| Source | Sugarcane and Sugar Beet |

| End Use | Food Industry, Bakery Products, Sauces and Toppings, Confectionery, Brewery, and Others (Meat Products) |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, and Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa, and 40+ countries |

| Key Companies Profiled | Tate & Lyle, Sun Agro Foods, Shepcote, Ragus, Chelsea Sugar, and Knorr |

| Additional Attributes | Dollar sales by application and purity grade, regional demand trends, competitive landscape, consumer preferences for natural versus synthetic alternatives, integration with sustainable sourcing practices, innovations in extraction technology and quality standardization for diverse industrial applications |

The global black treacle market is estimated to be valued at USD 407.9 billion in 2025.

The market size for the black treacle market is projected to reach USD 664.4 billion by 2035.

The black treacle market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in black treacle market are sugarcane and sugar beet.

In terms of end use, food industry segment to command 47.6% share in the black treacle market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Blackcurrant Seed Oil Market Size and Share Forecast Outlook 2025 to 2035

Black Maca Extract Market Size and Share Forecast Outlook 2025 to 2035

Blackcurrant Powder Market Size and Share Forecast Outlook 2025 to 2035

Black Friday Packaging Market Size and Share Forecast Outlook 2025 to 2035

Black Tea Extracts Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Black Pepper Market Analysis - Size, Share & Forecast 2025 to 2035

Black & Wood Pellets Industry Analysis in Europe Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Blackstrap Molasses Market Historical Analysis and Forecasts 2025 to 2035

Blackout Fabric Market Analysis – Trends, Growth & Forecast 2025 to 2035

Market Share Insights for Black Friday Packaging Providers

Market Share Distribution Among Black Seed Oil Suppliers

Examining Market Share Trends in the Black Pepper Industry

Blackout Fabric Laminate Market Growth & Applications 2024-2034

Black Start Generator Market

Black Friday Sale Market Analysis – Growth & Trends 2024-2034

Blackcurrant Concentrate Market

Carbon Black Content Tester Market Size and Share Forecast Outlook 2025 to 2035

Carbon Black Market Size, Growth, and Forecast 2025 to 2035

Carbon Black for Packaging Market Growth & Trends 2025 to 2035

Smoked Black Pepper Market Trends - Flavor Innovation & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA