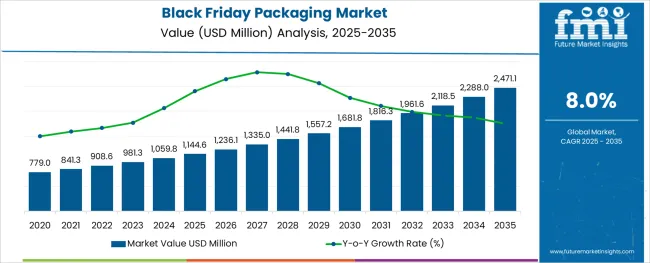

The Black Friday Packaging Market is estimated to be valued at USD 1144.6 million in 2025 and is projected to reach USD 2471.1 million by 2035, registering a compound annual growth rate (CAGR) of 8.0% over the forecast period.

The alginic acid market is undergoing consistent growth, propelled by rising demand from food processing, pharmaceutical formulations, and cosmetic applications. A growing focus on natural and sustainable ingredients in manufacturing processes has positioned alginic acid as a preferred biopolymer across industries.

The market is further supported by its diverse functional benefits, including water retention, gelling, and stabilizing properties, which make it indispensable in high-performance formulations. Increased regulatory acceptance of alginates as safe additives and the push towards cleaner labeling in food and personal care products have reinforced their adoption.

Ongoing innovation in extraction technologies and the utilization of algae as a renewable resource are paving the way for cost-effective production and expanded applications, ensuring sustained market expansion in the coming years.

The market is segmented by Material, Packaging Type, and Distribution Channels and region. By Material, the market is divided into Paper & Paperboard, Plastic, Fabric, Metal, and Glass. In terms of Packaging Type, the market is classified into Customized Boxes and Containers, Customized Bags and Pouches, Customized Labels, and Customized Cans.

Based on Distribution Channels, the market is segmented into Online Sales, Hyper and Super Markets, and Specialty Stores. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Material, Packaging Type, and Distribution Channels and region. By Material, the market is divided into Paper & Paperboard, Plastic, Fabric, Metal, and Glass. In terms of Packaging Type, the market is classified into Customized Boxes and Containers, Customized Bags and Pouches, Customized Labels, and Customized Cans.

Based on Distribution Channels, the market is segmented into Online Sales, Hyper and Super Markets, and Specialty Stores. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by salts, sodium alginate is expected to command 27.5 % of the market revenue in 2025, marking it as the leading subsegment in this category. This leadership has been driven by its superior solubility, ease of incorporation into formulations, and versatility in a wide range of applications.

Its ability to form stable gels and maintain viscosity under varying conditions has made it highly sought after in both food and pharmaceutical sectors. Manufacturers have prioritized sodium alginate due to its consistent performance, cost-effectiveness, and regulatory acceptance, which have collectively strengthened its position.

The segment’s prominence has also been enhanced by its adaptability to evolving consumer preferences for plant-derived and sustainable ingredients, reinforcing its market share.

Segmented by end user industry, the food industry is projected to hold 33.0 % of the market revenue in 2025, positioning it as the most prominent sector. This dominance has been shaped by the industry’s increasing reliance on alginic acid and its derivatives to deliver desirable textures, stabilize emulsions, and improve shelf life of processed foods.

As consumer demand for clean label and natural additives has intensified, the food sector has responded by integrating alginates into bakery, dairy, and confectionery products. Enhanced production efficiency and compliance with food safety standards have further encouraged widespread use.

The segment’s leadership has also been supported by product differentiation strategies where alginates contribute to premium quality and innovation, securing their role in modern food formulations.

When analyzed by functionality, thickening agents are forecast to account for 29.0 % of the market revenue in 2025, establishing themselves as the dominant functional category. This preeminence has been underpinned by the growing need for consistent texture and viscosity in a wide array of end products.

Alginic acid’s natural origin and high efficiency in creating uniform, stable thickness without altering taste or color have solidified its appeal. The demand for thickeners in both edible and topical applications has expanded, with manufacturers leveraging its rheological properties to meet performance and regulatory requirements.

The functionality’s leading share has also been reinforced by the ability to deliver cost savings through lower dosages and its compatibility with other ingredients, securing its position as an indispensable component in formulation strategies.

The global black Friday packaging market witnessed a CAGR of 7.0% during the historical period from 2020 to 2024 and reached USD 1059.8 Million in 2024. However, with the rapid growth of e-commerce platforms, especially across developed and developing regions, the overall sales of black Friday packaging are expected to rise at 8% CAGR through 2035.

Black Friday falls after Thanksgiving, which signifies the start of Christmas and the new-year shopping season. Black Friday isn't just a consumer shopping fest for retailers and brands, but consumers also enjoy price savings on the day.

Black Friday fever has gone global, and more people have started shopping online. Online shopping is quick, easy, and remote. Prearranged global e-commerce sales are growing at around 20% annual rate, and this shift toward online shopping for black Friday is not surprising because black Friday initially did not exist in non-American markets. Growing demand for online shopping will therefore continue to augment the sales of black Friday packaging during the forecast period.

Similarly, the growing popularity of eco-friendly black Friday packaging and innovations in black Friday packaging is expected to boost the global Friday packaging market over the next ten years.

Robust Growth of E-Commerce to Boost Black Friday Packaging Sales

The shopper demographic moved after the distribution channel focus shifted to e-commerce. The e-commerce gush during black Friday is likely to drive up the demand for packaging, as retailers seek to protect their products during shipping.

Online retailing makes the product offering more attractive, and the interface is more user-friendly and less time-consuming. By providing a platform for retailers to sell their products on the web, e-commerce platforms like Amazon and eBay have made it easier for consumers to find and purchase items on black Friday. In addition, e-commerce platforms have also made it easier for retailers to track consumer behavior and target their marketing efforts accordingly.

As the trends are studied and observed over several past years, consumer electronics and FMCG products are expected to lead the black Friday market. Earpods, mobile phones, and smart TVs were some of the key selling products on black Friday in 2024. Packaging companies are focused on providing sustainable and safe packaging of electronic products since they require extra protection during shipping. As a result, black Friday packaging has become more sophisticated and efficient in recent years.

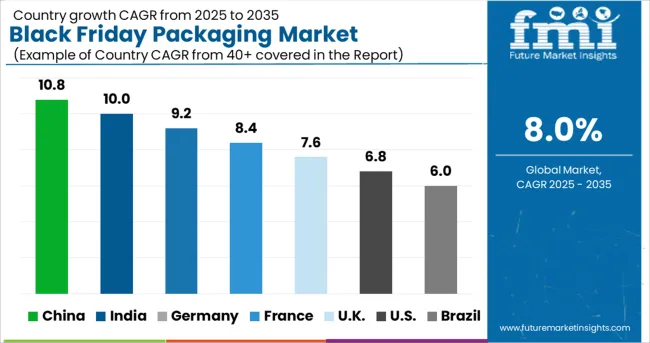

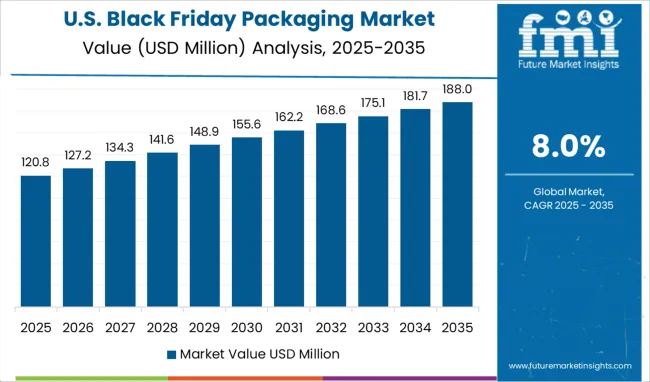

Increasing Penetration of E-commerce Platforms Spurring Growth in the USA Market

The USA leads the market for black Friday packaging due to a large customer base, high per-capita spending rate, and growing trend of black Friday shopping. Similarly, the rapid penetration of e-commerce platforms is expected to elevate the demand for black Friday packaging solutions during the forecast period.

The Census Bureau of the Department of Commerce announced that e-commerce sales in the second quarter of 2025 summed up to 14.5% of total retail sales. The USA customer base is slowly shifting to online mediums of shopping to avoid long queues and hassles during store shopping.

Perks like shopping internationally, bulk buying, and safer modes of payment are further fuelling the growth of online shopping in the USA The bulk order for packaging placed by e-commerce websites like Amazon, eBay, and Target is being observed by packaging companies in the country before the holiday season. This will continue to boost the USA black Friday packaging market during the forecast period.

Growing Trend of Black Friday Shopping to Aid the Sales of Black Friday Packaging Products

According to FMI, the United Kingdom accounts for a sizable portion of the Europe black Friday packaging market and the trend is likely to continue during the forecast period. This can be attributed to the rising popularity of black Friday shopping and the strong presence of leading packaging companies and brands in the country.

Packaging companies are using different strategies to stand out in the United Kingdom market during the black Friday season. For example, shifting stock is an efficient way to get rid of outdated inventory and make room for new Christmas packaging.

Black Friday discounts are becoming increasingly popular with consumers in Europe, and the holiday shopping mania has driven up demand for packaging for these sales. But in the United Kingdom, black Friday shopping wasn't always a custom. Many years before it reached the country, it debuted in the USA and quickly became a major hit. The day didn't become popular in the United Kingdom until 2010 when Amazon started offering significant online discounts to British customers.

Labor strikes and layoffs at some major packaging companies in the United Kingdom are expected to affect the black Friday packaging market in 2025. However, FMI predicts the United Kingdom to remain a lucrative market for packaging companies during the black Friday sale due to increased customer demand and the presence of e-commerce companies.

Paper & Paperboard to Remain Highly-Sought After Material Among Manufacturers

As per FMI, the paper and paperboard segment currently dominates the global black Friday packaging market and it is anticipated to account for around 46% market share by 2035. This can be attributed to the rising end-user preference for safe and more sustainable packaging solutions.

Paper and paperboard contribute to shipper boxes, bags and pouches, and labels, among other formats used for packaging. Paper shredding, paper mesh, and wrapping paper are also used for cushioning and decorating purposes. Not only is paper more sustainable than plastic, but it is also easier to unwrap and dispose of. However, fabric bags and ribbons have observed an upward trajectory in recent years due to the re-usability factor.

Demand to Remain High for Customized Boxes and Containers

The customized boxes and containers segment is expected to hold a value market share of almost 39% of the global black packaging market by the end of 2025. This can be attributed to the rising popularity of customized boxes and containers among consumers.

Packaging manufacturers can easily customize boxes and containers for the end user brand. Customized boxes for black Friday packaging often include customizations like black-colored packaging, Christmas-themed packaging, and personalized gift wrapping for customers. A sense of exclusivity and branding makes products stand out for customers, and brands are working on this aspect for the holiday season.

Patterns, colors, themes, and designs are commonly used to complement them. Print effects such as foil engraving, spot UV printing, and beautification are also available in customization. Additions like ribbons, stickers, and tapes further add to the customization aspect.

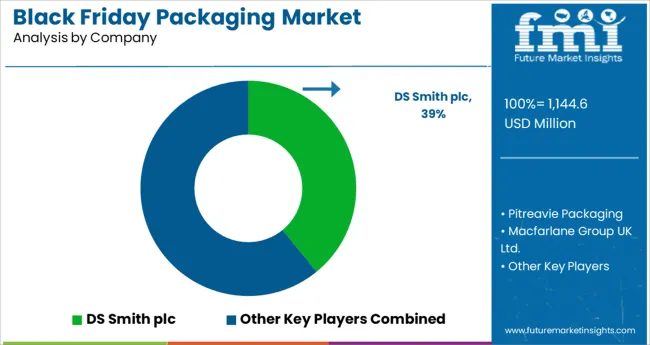

Key packaging manufacturers engaged in black Friday packaging have been trying to expand black friday packaging market share during the holiday season by using the internet wisely and offering their products on the web.

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 1144.6 million |

| Projected Market Size (2035) | USD 2471.1 million |

| Anticipated Growth Rate (2025 to 2035) | 8% CAGR |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in million, Volume in Units, and CAGR from 2025 to 2035 |

| Segments Covered | Material, Packaging Type, Distribution Channels, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Middle East and Africa (MEA); Oceania |

| Key Countries Covered | USA, Canada, Mexico, Brazil, Germany, United Kingdom, France, Italy, Spain, Russia, China, Japan, India, GCC countries, Australia |

| Key Companies Profiled | DS Smith plc; Pitreavie Packaging; Macfarlane Group UK Ltd. |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

The global black friday packaging market is estimated to be valued at USD 1,144.6 million in 2025.

It is projected to reach USD 2,471.1 million by 2035.

The market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types are paper & paperboard, plastic, fabric, metal and glass.

customized boxes and containers segment is expected to dominate with a 53.2% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Insights for Black Friday Packaging Providers

Blackout Fabric Laminate Market Size and Share Forecast Outlook 2025 to 2035

Blackcurrant Seed Oil Market Size and Share Forecast Outlook 2025 to 2035

Black Maca Extract Market Size and Share Forecast Outlook 2025 to 2035

Blackcurrant Powder Market Size and Share Forecast Outlook 2025 to 2035

Black Treacle Market Size and Share Forecast Outlook 2025 to 2035

Black Tea Extracts Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Black Pepper Market Analysis - Size, Share & Forecast 2025 to 2035

Black & Wood Pellets Industry Analysis in Europe Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Blackstrap Molasses Market Historical Analysis and Forecasts 2025 to 2035

Blackout Fabric Market Analysis – Trends, Growth & Forecast 2025 to 2035

Examining Market Share Trends in the Black Pepper Industry

Market Share Distribution Among Black Seed Oil Suppliers

Black Start Generator Market

Blackcurrant Concentrate Market

Black Friday Sale Market Analysis – Growth & Trends 2024-2034

Carbon Black Content Tester Market Size and Share Forecast Outlook 2025 to 2035

Carbon Black Market Size, Growth, and Forecast 2025 to 2035

Smoked Black Pepper Market Trends - Flavor Innovation & Demand 2025 to 2035

Carbon Black for Packaging Market Growth & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA