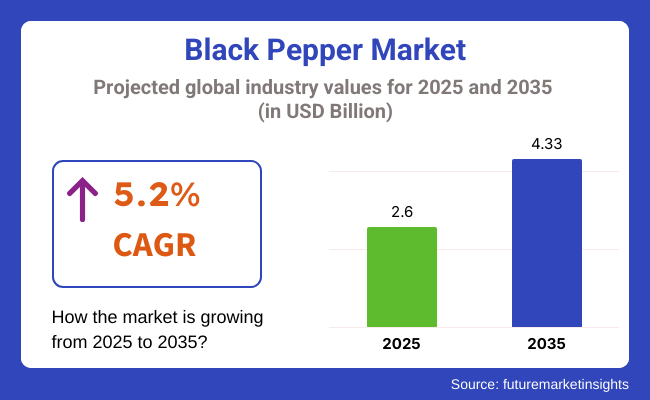

The global Black Pepper Market is poised to reach a value of USD 2.6 billion by 2025 and is projected to reach a value of USD 4.33 billion by 2035, reflecting a compound annual growth rate of 5.2% over the assessment period 2025 to 2035.

The usage of black pepper as a food spice has led to its increased popularity during the past decade. Its robust odor together with distinct taste creates a widespread use of this spice in various types of cooking. The black pepper market expanded because consumers demanded natural food flavors and understood such benefits as antioxidants and anti-inflammatory effects alongside antimicrobial qualities.

Black pepper production at a global scale originates from Vietnam because this country benefits from suitable environmental conditions and successful agricultural practices. The black pepper market shows an expected 5.2% annual growth rate (CAGR) through the years 2025 until 2035.

The market analysts project a USD 4325.07 million market value to occur by 2035. The market's expansion will result from various triggers including rising food applications of black pepper along with widespread health benefits knowledge and worldwide nutritional trends.

The rise of new retail platforms combined with intensifying online shopping will expand black pepper availability in the market. The market will gain momentum from sustainable cultivation of organic black pepper together with improved farming practices and streamlined supply chains while market potential increases due to consumer interest in health and environmentally friendly products

The black pepper market shows compelling signs for future growth because ethnic food trends strengthen while consumer knowledge about health advantages expands together with industrial applications of this product. The quality together with yield of black pepper crops will improve because of new agricultural methods and sustainable farming practices.

Market expansion will be stimulated by better access to black pepper globally due to the advancement of efficient trade and distribution systems. The black pepper market possesses favorable prospects for producers along with exporters and consumers.

Black pepper consumption is concentrated in a few major markets, where per‑capita usage far exceeds global averages. The United States accounts for one of the largest totals, averaging about 180 grams per person each year, reflecting widespread use in packaged foods and household cooking.

European markets such as Germany, the United Kingdom, and France also show strong per‑capita consumption, ranging between 160 and 200 grams per person annually, driven by culinary traditions and a mature packaged food sector.

Emerging economies consume black pepper at much lower per‑capita levels despite being major production or trade hubs. China averages about 45 grams per person each year, while India, despite being a key producer, averages around 35 grams per person as much of its harvest is exported.

Brazil, another major producer, records about 50 grams per person annually, with domestic demand focused on basic culinary applications. The rest of the world collectively consumes modest amounts, averaging between 30 and 50 grams per person annually depending on local cuisine preferences.

| Segment | Value Share (2025) |

|---|---|

| Organic (Nature) | 70% |

The international increase in demand for organic products has also impacted the black pepper sector dramatically. People have become more environmentally and health-aware and are preferring organically produced spices that contain no pesticides and fertilizers. This change in consumer trend has resulted in higher market demand for organic black pepper, and farmers have been compelled to go for organic farming.

Hence, such an activity not only improves the taste and quality of black pepper but also brings ecological sustainability by helping to retain the fertility of soil and curbing chemical run-off. Organic black pepper business is booming because buyers are prepared to pay more for products that are reflective of their health-conscious and environmentally friendly policies. As a result, the market is seeing more organic black pepper types available, fulfilling the growing demand and establishing a new benchmark for spice production globally.

| Segment | Value Share (2025) |

|---|---|

| Whole (Form) | 65% |

Whole black pepper continues to dominate the global market, and there are several reasons for this trend. Whole peppercorns are preferred by many consumers and chefs for their superior freshness and flavor compared to pre-ground pepper. Crushing or grinding whole peppercorns just before use ensures that the volatile oils and aromatic compounds are preserved, leading to a more intense and robust flavor in culinary applications.

Moreover, whole black pepper is highly versatile and can be used in a variety of dishes and cooking methods, from seasoning meats and vegetables to being a key ingredient in spice blends. This versatility has made whole pepper a staple in both home kitchens and professional settings around the world.

Additionally, the global supply chain favors whole peppercorns as they have a longer shelf life compared to ground pepper, reducing the risk of spoilage during transport and storage. As a result, the demand for whole black pepper remains strong, reinforcing its position as a dominant force in the global market

Increasing demand for organic and sustainably sourced black pepper

The rising consumer interest in organic sustainable black pepper production represents a bigger trend toward caring about world, well-being and finding happiness. Organic products gain increasing consumer popularity because people show more appreciation for food health effects combined with greater knowledge about intensified production methods' environmental destruction.

Organically grown black pepper does not receive any artificial pesticide, herbicides, or fertilizer chemicals during cultivation and such safety standards appeal to consumers who seek avoidance of toxic chemical consumption.

The demand power of sustainability represents a very strong force. Public awareness about product costs linked to social impact and environment keeps growing which drives consumers to prefer goods produced using sustainable environmental and social methods. Green black pepper production links to fair trade models that enable farmers to maintain fair prices which they then use for community development initiatives. Those consumers seeking moral satisfaction through their purchasing decisions find this desirable feature attractive.

To meet growing consumer, demand the food industry has intensified production of black pepper both organically and sustainably. Organic black pepper has experienced rising commercial production alongside increased retail display of sustainable spices by supermarkets. Rising product availability enables more consumers to discover black pepper products which in turn stimulates purchase demand.

Expansion of black pepper applications in the pharmaceutical industry

Pharmaceutical applications of black pepper emerge through the identification process of piperine as its bioactive substance which provides numerous therapeutic functions. Piperine stands as the major alkaloid compound present in black pepper which scientists have thoroughly researched for its antioxidant and anti-inflammatory mechanisms as well as antimicrobial properties and anticancer effects. The pharmacological advantages of black pepper establish it as a priceless substance which drug makers utilize to manage and avoid various types of illnesses.

The main medical utilization of black pepper involves increasing the availability of drugs within the body. Scientific studies have demonstrated that piperine helps improve drug absorption rates because it reduces enzyme activity in both the digestive tract and liver towards pharmacological substances.

Black pepper serves as a useful tool to maximize the absorbability of drugs such as curcumin, resveratrol and vitamin compounds that often exhibit low bioavailability. Black pepper extracts function as regular ingredients in dietary supplements alongside drug formulations because they enhance therapeutic potency.

Black pepper demonstrates anti-inflammatory properties as well as antioxidant abilities which positions it as a promising drug treatment solution for uncontrolled conditions such as arthritis and cardiovascular disorders and neurodegenerative diseases.

Through its piperine compound's inhibitory capacity the body becomes more resistant against disease symptoms and disease progression thus leading to slower disease development. The antimicrobial properties of black pepper are currently under evaluation as a natural antibiotic to fight fungal together with bacterial infections.

Development of innovative black pepper-based seasoning blends

The evolving taste patterns of consumers together with their demand for new flavorful items has created a trend in black pepper innovation for foods. Black pepper has become a popular familiar ingredient in kitchens because of its potent aromatic taste. New cooking trends currently show high levels of innovative and creative development which created suitable black pepper-flavored foods for different taste preferences.

The trend is highly driven by an increasing demand for international food products. Individuals are growing more daring in their culinary choices so black pepper joins a variety of foreign spices needed in spice blends.

The combination of these spices enables cooks to prepare traditional foreign flavors for example Indian garam masala, Middle Eastern za'atar, and Mexican adobo at their homes without leaving their kitchens. Black pepper enhances food strength when combined with many spices while simultaneously delivering depth and richness to the dish.

Its nutritional benefit for black pepper rapidly catches the attention one can observe when preparing fresh-blended spices. Black pepper contains natural piperine that enhances digestion and activates metabolism and makes nutrients more available in the body.

The market demand for nutritious food has increased as consumers seek both taste and wellness so these seasonings consisting of black pepper with turmeric and ginger or garlic attract more attention. Food combinations involving these ingredients deliver both better taste experience along with additional health benefits.

Growth in the use of black pepper in natural and organic cosmetics

The usage of black pepper in natural and organic cosmetics expands because consumers seek products that deliver effective clean sustainable beauty experiences. Black pepper contains piperine which shows multiple helpful properties that qualify it for potential use as an active compound in hair and skin care formulations.

Piperine demonstrates antioxidant behavior by defending against free radicals and slowing down skin oxidation for younger-looking skin. Black pepper stands as an outstanding component for anti-aging cosmetics that includes creams and serums and moisturizers to safeguard youthfulness and brightness in the skin.

Black pepper demonstrates antimicrobial properties and anti-inflammatory effects rendering it appropriate for treating many kinds of skin conditions. The components of black pepper effectively eliminate inflammatory conditions and redness thus making it appropriate for acne and psoriasis and eczema treatments in cosmetic products.

The antimicrobial function of black pepper serves to protect skin from bacterial infections and guarantees skin wellness. Black pepper attracts natural and organic skin care through its medical benefits and minor side effects because it provides a natural substitute for chemical ingredients which consumers increasingly look for.

Black pepper found its way into cosmetics because of increasing consumer interest in natural ingredients combined with worldwide wellness trends. People who use cosmetics now prioritize products that both match their environmental beliefs and health standards since they worry about artificial chemicals causing harm to their skin. Black pepper serves this philosophical approach because it derives from green vegetable origins.

Tier1: Major companies having established dominance and wide-ranging distribution networks control the Black Pepper Market at its highest level. Navitas Organics along with Acai Roots Inc. and Acai Frooty are the major companies operating within the market sector. These companies operate throughout all areas worldwide to deliver their full assortment of products including acai-based supplements powders and beverages.

Their robust marketing approach leads them to claim the leadership position in the Black Pepper Market. These consumer-facing companies earn credibility through environmentally sound practices and outstanding product quality thus attracting customers interested in health promotion.

Tier 2: The market expansion coupled with broader product offerings characterize the operations of upper mid-range companies in the Black Pepper industry. The second-tier segment of the black pepper market includes The Berry Company Limited, Amafruits together with Terrasoul Superfoods and PITAYA FOODS. The companies are advancing their market reach by starting new acai product lines and developing wider distribution channels.

These organizations direct their efforts toward segmenting their business toward specific consumer groups who seek organic and non-GMO food products. Smaller companies operating in the acai market do not carry the brand reputation of their competitors but demonstrate growing success in marketplace development.

Tier 3: Small firms with limited market share operate as Tier 3 businesses in the Black Pepper Market. The Black Pepper Market includes medium-scaled firms such as Nacttive Global A and Acai of America Inc. along with Ecuadorian Rainforest, LLC and KOS and Bare Organics®, Mountain Rose Herbs, Acai Exotic LLC, Açaí Express, Sunfood Superfoods, Naked Juice Company, New Acai Amazonas, Nativo Aca, The Açaí Lab, and Organique Acai.

Their operations will remain limited to local markets while offering a restricted selection of acai-based food products. These firms would select one special competence like artisanal processing or local sourcing to establish themselves as an original entity that separate from large corporations. The inability to achieve significant expansion lies in these businesses yet they grow Black Pepper Market depth and diversity.

The following table shows the estimated growth rates of the significant three geographies sales. USA and Germany are set to exhibit high consumption, recording CAGRs of 4.2% and 4.9% respectively, through 2035.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 4.2% |

| Germany | 4.9% |

| India | 6.1% |

The evolution of home cooking combined with a wider assortment of foods has extensively boosted black pepper market opportunities in the United States. American home cooks buy high-quality ingredients that provide versatility for their dining preparations as they eat most meals inside their homes. When it comes to all-purpose spices worldwide black pepper stands out as people love its ability to enhance numerous styles of food.

The versatile nature of black pepper makes it ideal for culinary use because it enhances the taste of many dishes during cooking so home cooks frequently choose it. Consumers interested in gourmet cooking seek high-end black pepper types which include organic black pepper and freshly ground black pepper products. The altered consumer behavior stream has led to market success for black pepper that emphasizes culinary creation combined with product excellence.

Due to strong consumer awareness about ethical sourcing practices in Germany they have significantly shaped the black pepper market. The public now understands better about the food origins and social and environmental effects derived from different purchasing activities. The increased market interest exists because of fair trade black pepper which offers farmers both fair pay and good working environments. Sustainable agriculture has become the central focus of ethical sourcing since it guarantees support for biodiversity alongside the environment.

People in Germany demonstrate willingness to pay higher prices for these types of products to demonstrate their values matter thus developing demand for supply chains with social accountability. This emerging trend supports black pepper farmers' economic stability while advancing moral business practices across producers that establish equal and sustainable farming practices.

India's traditional spice export business largely impacts the black pepper market. Well-known globally for its diverse and luxurious spice culture, India has emerged as the leading nation in the international spice market. India's good climate and fertile soil support high-quality production of black pepper which is greatly sought after in international markets. Indian government has implemented numerous schemes to aid spice farmers and maximize export potential through improved infrastructure, improved farming techniques, and quality initiatives.

Indian black pepper hence commands high demand among European countries, the United States of America, and Asian nations. Such export success not only expands the national economy but also ensures steady income for most farmers, motivating them to continue growing this precious crop. The lucrative export trade reconfirms India's position as a top-notch exporter of good quality black pepper, cementing its position in international spice commerce

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 2.6 billion |

| Projected Market Size (2035) | USD 4.33 billion |

| CAGR (2025 to 2035) | 5.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD billion |

| By Nature | Organic and Conventional |

| By Form | Whole, Ground, and Crushed |

| By End Use | Industrial, Food Service Provider, and Retail/household |

| By Distribution Channel | B2B and B2C |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

| Key Players | Baria Pepper, The British Pepper & Spice Co. Ltd., Catch, Everest Spices, McCormick, MDH, Agri-food Pacific, Akar Indo, Brazil Trade Business, DM AGRO |

| Additional Attributes | Dollar sales by value, market share analysis by region, country-wise analysis |

| Customization and Pricing | Available upon request |

This segment is further categorized into organic and conventional.

This segment is further categorized into Whole, Ground, and Crushed.

As per end use, the ecosystem has been categorized into Industrial, Food Service Provider, and Retail/household.

This segment is further categorized into B2B and B2C.

Industry analysis has been carried out in key countries of North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The market is expected to grow at a CAGR of 5.2% throughout the forecast period.

By 2035, the sales value is expected to be worth USD 4.33 billion.

Asia Pacific region is expected to dominate the global consumption.

Baria Pepper, The British Pepper & Spice Co. Ltd., Catch, Everest Spices.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Examining Market Share Trends in the Black Pepper Industry

Smoked Black Pepper Market Trends - Flavor Innovation & Demand 2025 to 2035

Demand for Black Pepper in EU Size and Share Forecast Outlook 2025 to 2035

Blackcurrant Seed Oil Market Size and Share Forecast Outlook 2025 to 2035

Black Maca Extract Market Size and Share Forecast Outlook 2025 to 2035

Blackcurrant Powder Market Size and Share Forecast Outlook 2025 to 2035

Black Treacle Market Size and Share Forecast Outlook 2025 to 2035

Black Friday Packaging Market Size and Share Forecast Outlook 2025 to 2035

Black Tea Extracts Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Black & Wood Pellets Industry Analysis in Europe Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Blackstrap Molasses Market Historical Analysis and Forecasts 2025 to 2035

Blackout Fabric Market Analysis – Trends, Growth & Forecast 2025 to 2035

Market Share Insights for Black Friday Packaging Providers

Market Share Distribution Among Black Seed Oil Suppliers

Blackout Fabric Laminate Market Growth & Applications 2024-2034

Black Start Generator Market

Black Friday Sale Market Analysis – Growth & Trends 2024-2034

Blackcurrant Concentrate Market

Carbon Black Content Tester Market Size and Share Forecast Outlook 2025 to 2035

Carbon Black Market Size, Growth, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA