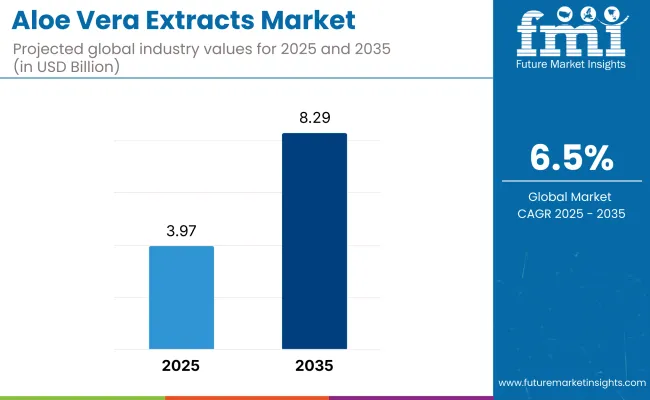

The global aloe vera extracts market is estimated to be worth USD 3.97 billion by 2025 and is projected to reach a value of USD 8.29 billion by 2035, reflecting a CAGR of 6.5% over the assessment period 2025 to 2035.

This growth trajectory underscores the steady rise in demand for plant-based and natural wellness ingredients, especially those positioned at the intersection of therapeutic efficacy and cosmetic applications. Aloe vera extract has continued to hold an indispensable place in both personal care and nutraceutical sectors due to its anti-inflammatory, moisturizing, and antioxidant properties, which have been validated through various peer-reviewed dermatological studies.

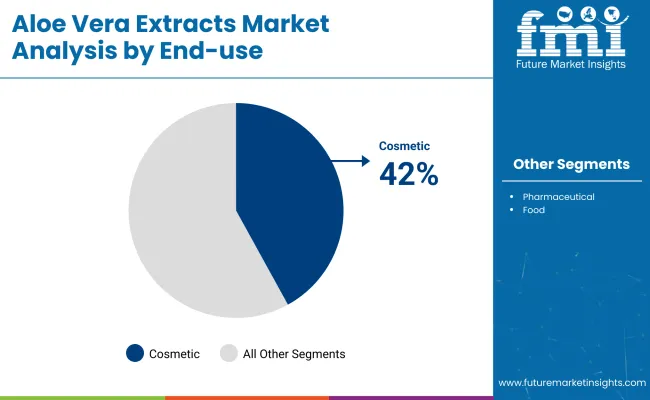

The cosmetics segment is anticipated to maintain its dominant share throughout the forecast period, as consumer preference shifts increasingly toward clean-label skincare formulations free from synthetic additives and chemicals.

Growth in the personal care sector is being amplified by the inclusion of aloe vera in products such as gels, lotions, sunscreens, face masks, and herbal cleansers. This demand is reinforced by wellness-focused consumer behavior and regulatory encouragement for plant-based actives in North America, Europe, and select Asia-Pacific markets.

Furthermore, aloe vera’s usage has extended into the functional food and beverage sector, where it is incorporated into fortified drinks, dietary supplements, and even confectionery. In the food processing industry, aloe vera extract is valued not only for its health benefits but also for its role as a natural preservative and stabilizer. While the demand in food and beverages is rising, the segment still trails cosmetics due to higher formulation complexities and region-specific approvals.

From a supply-side perspective, global manufacturers continue to invest in high-purity extraction technologies and sustainable cultivation practices. Key players such as Lily of the Desert and Terry Laboratories have demonstrated leadership in vertical integration-from certified organic aloe cultivation to advanced extraction and product formulation. These strategies ensure quality traceability and competitive differentiation, especially important in B2B export markets.

Looking ahead, expansion in the market is expected to be further propelled by strategic collaborations between cosmetic brands and aloe extract processors, alongside innovations in encapsulation technologies that improve aloe’s bioavailability and stability. The entry of premium wellness brands is also projected to boost the value of high-grade, food- and cosmetic-compliant aloe vera extracts.

The below table presents a comparative assessment of the variation in CAGR over six months for the base year 2024 and current year 2025 for global aloe vera extracts industry. This analysis reveals crucial shifts in performance and indicates revenue realization patterns, thus providing stakeholders with a better vision about the growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 | 15.4% (2024 to 2034) |

| H2 | 16.0% (2024 to 2034) |

| H1 | 16.3% (2025 to 2035) |

| H2 | 17.0% (2025 to 2035) |

The above table presents the expected CAGR for the global aloe vera extracts space over semi-annual period spanning from 2025 to 2035. In the first half (H1) of the year 2024, the business is predicted to surge at a CAGR of 15.4%, followed by a slightly higher growth rate of 16.0% in the second half (H2) of the same year.

Moving into year 2025, the CAGR is projected to increase slightly to 16.3% in the first half and remain relatively moderate at 17.0% in the second half. In the first half (H1 2025) the industry witnessed a decrease of 16 BPS while in the second half (H2 2025), it witnessed an increase of 34 BPS.

The cosmetics segment accounted for over 42% of the global aloe vera extracts market in 2025 and is expected to grow at a CAGR of 6.9% through 2035. This dominance is supported by the compound’s multifunctionality, clean-label positioning, and scientific validation in topical formulations.

Aloe vera extract has been increasingly positioned as a strategic natural ingredient within premium and mass-market skincare ranges, driven by consumer expectations for transparency, efficacy, and botanical integrity.

Its bioactive compounds, including polysaccharides, glycoproteins, and antioxidants, have been clinically associated with anti-inflammatory and skin-soothing benefits-making it especially attractive for acne-prone, sensitive, or aging skin categories. The growth of the cosmetics segment is further enabled by rising awareness of wellness-oriented routines and the declining consumer tolerance for synthetic additives.

Manufacturers are expected to deepen vertical integration efforts to ensure traceable sourcing and higher bioavailability of key aloe constituents. As dermocosmetic brands increasingly seek nature-derived actives backed by peer-reviewed data, aloe vera’s inclusion is expected to evolve from basic hydration claims to advanced skin barrier restoration and microbiome support functionalities.

The segment’s resilience will also be reinforced by regulatory frameworks encouraging plant-based actives and sustainability-linked innovation pipelines-factors that will continue to elevate aloe vera’s role in global cosmetic formulation strategies.

The functional beverage segment is projected to register a CAGR of 7.3% from 2025 to 2035, gradually expanding its share within the aloe vera extracts market due to consumer interest in holistic hydration and digestive wellness.

Aloe vera extract’s soluble fiber content and bioactive composition position it favorably for use in fortified beverage formulations that target gut health, immunity, and internal detoxification. Beverage formulators have increasingly leveraged aloe’s perceived therapeutic profile as a natural botanical aligned with wellness-driven consumption trends. Its inclusion in low-calorie, plant-based, or digestive-enhancing beverages is expected to gain momentum across both retail and hospitality channels.

Challenges persist in formulation consistency, as aloe vera extract can exhibit instability and sedimentation in liquid matrices. Nevertheless, advancements in processing technologies-such as nanoencapsulation, cold stabilization, and aseptic packaging-are expected to overcome these hurdles, allowing aloe-based drinks to maintain freshness, palatability, and active compound integrity.

As global regulatory acceptance of aloe in consumable formats expands, functional beverage brands are anticipated to prioritize aloe extract in SKUs positioned around clean-label immunity, hydration, and daily detox. Strategic partnerships between aloe processors and beverage innovators will be instrumental in unlocking further market scalability across health-conscious and lifestyle-oriented consumer bases worldwide

| Countries | Value (2035) |

|---|---|

| The USA | USD 676.9 million |

| The UK | USD 451.3 million |

| Germany | USD 361.0 million |

| China | USD 225.6 million |

| India | USD 90.3 million |

The USA Clean beauty trends, functional beverages, and wellness-driven nutraceuticals dominate the USA industry for botanical extracts. Organic skincare demand is growing as consumers seek chemical-free products in moisturizers, sunscreens, and anti-aging creams. Functional beverages with plant ingredients are gaining traction in gut health and immunity-promoting beverages.

Growth Drivers in the USA

| Key Drivers | Details |

|---|---|

| Rise in Clean Beauty Trends | Rise in organic, chemical-free skincare. |

| Rise in Demand for Herbal Skincare Alternatives | Demand for natural formulation. |

| Growth in Functional Beverages | Emerging uses in gut well-being beverages. |

| FDA Regulations for Safe Ingredients | Clean-label consumer personal care products bolstered by the formulas. |

| Nutraceutical Growth | Immunostimulating food supplements in which herbal extracts are used. |

The United Kingdom is experiencing rising consumer demand for organic, cruelty-free, and sustainable skincare solutions, making aloe vera extracts a high-demand ingredient in the beauty and personal care sector. British consumers are actively seeking eco-conscious and clean-label alternatives, leading to higher adoption of botanical and plant-based skincare products.

The functional beverage industry is expanding where vegetable health drinks and herbal detoxing drinks are increasingly popular.

Growth Drivers in the UK

| Key Drivers | Details |

|---|---|

| Sustainable Skincare Preference | High demand for organic, animal-free beauty products. |

| Tough Cosmetic Regulations | Compliance with CPR and UK REACH regulation. |

| Herbal Functional Beverages Growth | Surging demand for digestive well-being and detox beverages. |

| Need for Plant-Based Alternatives | Botanicals replacing the function of synthetic additives. |

| Expansion of Wellness & Sports Nutrition | Usage in sports and fitness hydration beverages. |

In Germany, the demand for aloe vera extracts is heavily influenced by the strong herbal pharmaceutical industry, functional food sector, and preference for organic skincare. Germany has a long-standing tradition of herbal medicine, with apothecaries and pharmaceutical companies integrating plant-based solutions into mainstream healthcare.

Aloe vera is widely used in dermatological treatments, wound care formulations, and digestive health supplements, making it a highly sought-after ingredient in pharmaceutical-grade herbal remedies. The functional beverage industry also uses botanical ingredients for probiotic beverages and herbal tea.

Growth Drivers in Germany

| Key Drivers | Details |

|---|---|

| Active Herbal Pharmaceutical Industry | Industry for plant extract-based therapeutic formulations. |

| Organic Food & Beverages Growth | Increased consumer demand for food and beverages free of GMOs and chemicals. |

| Functional Beverage & Supplement Development | Emergence of probiotic drinks and digestive health supplements. |

| Natural Cosmetics Demand | Use in anti-aging and dermatological treatments. |

| Clean-Label & Sustainability Shift | Movement towards sustainable, natural ingredients. |

China beta carotene industry is being fueled by its growing functional drink industry, heightened health awareness, and tough food safety regulations. During the post-pandemic period, immune system supplement consumption has grown significantly. It is also widely utilized in animal nutrition to enhance levels of nutrition.

Growth Drivers in China

| Key Drivers | Details |

|---|---|

| Growth in Functional Beverages | Growth in consumption of gut health and detox drinks. |

| Emergence in Herbal Medicine Market | TCM-based product extracts with plant extracts. |

| Natural Skincare Growth | Demand for herbal anti-aging and sun-protecting creams. |

| Health-Conscious Urban Consumers | Demand for natural remedies for immune system strength. |

| Strict Food & Cosmetic Regulation | Need for plant-based, safe ingredients. |

India's market for beta carotene is growing with its use in not only in Ayurveda, functional foods but also in dairy. Increased middle class and rising focus on preventive care have stimulated the use of supplements. Food processing industries are also adopting beta carotene as a natural coloring agent.

Growth Factors in India

| Key Drivers | Details |

|---|---|

| Ayurveda & Herbal Medicine Tradition | Inclusion in digestive and skin care products. |

| Emerging Nutraceutical Industry | Application in gut and immune supplements. |

| Increased Dairy & Functional Foods | Application in fortified milk and herbal beverages. |

| Government Appeal For Natural Ingredients | Boost for natural ingredient-based herbal preparations. |

| Higher Disposable Income | Growing expenditure on high-end herbal products. |

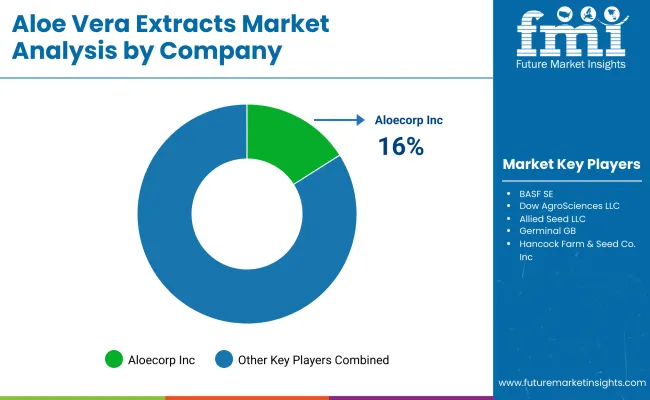

Aloecorp Inc. (16-20%)

Aloecorp is a global player for its raw materials in aloe vera, practicing sustainably as a culture as well as extracting advanced technologies for applications of high purity.

Forever Living Products (14-18%)

As one of the largest vertically integrated producers of aloe vera, it specializes in personal care and nutritional products through direct selling.

Herbalife Nutrition (10-14%)

The company is one of the top names in aloe-based dietary supplements and beverages, taking advantage of a strong global network distribution coverage with which they reach out to the wellness industry.

Terry Laboratories Inc. (8-12%)

Terry Laboratories specializes in premium-grade aloe vera extracts and supplies them to the food, cosmetic, and pharmaceutical sectors. Lily of the desert organic

Aloeceuticals (6-10%)

A pioneer in organic aloe vera products, Lily of the Desert emphasizes sustainability and enhanced bioavailability in its formulations.

By product, the industry is segmented into aloe vera gel extracts, aloe vera whole leaf extracts, and others.

By form, the market is categorized into gels, powders, capsules, drinks, and concentrates.

By end-use industry, the market is divided into pharmaceuticals, food, and cosmetics.

By region, the market is segmented into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

The market is estimated at a value of USD 3.97 billion in 2025.

The anticipated value of the market by 2035 is USD 8.29 billion.

The sales of the market are expected to increase at a CAGR of 6.5% between 2025 and 2035.

Forever Living Products, Aloe Farms Inc., Herbalife Nutrition Ltd., Lily of the Desert Organic Aloeceuticals, and Aloecorp Inc. are some of the leading manufacturers in this industry.

The Asia-Pacific region is projected to hold a revenue share of 29% over the forecast period, driven by high consumer demand for herbal skincare, functional beverages, and dietary supplements.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aloe Butter Market

Competitive Landscape of Aloe Vera Gel Providers

Aloe Vera Drinks Market Outlook – Growth, Size & Demand 2025-2035

Aloe Vera Gel Market Demand & Insights 2024 to 2034

Beverage Metal Can Market Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Market Size and Share Forecast Outlook 2025 to 2035

Beverage Carrier Market Size and Share Forecast Outlook 2025 to 2035

Beverage Cartoners Market Size and Share Forecast Outlook 2025 to 2035

Beverage Filter Paper Market Size and Share Forecast Outlook 2025 to 2035

Beverage Ingredients Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Beverage Clouding Agent Market Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Beverage Premix Market Size and Share Forecast Outlook 2025 to 2035

Beverage Acidulants Market Size and Share Forecast Outlook 2025 to 2035

Beverage Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

Beverage Tester Market Size and Share Forecast Outlook 2025 to 2035

Beverage Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Beverage Container Market Size and Share Forecast Outlook 2025 to 2035

Beverage Can Ends Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA