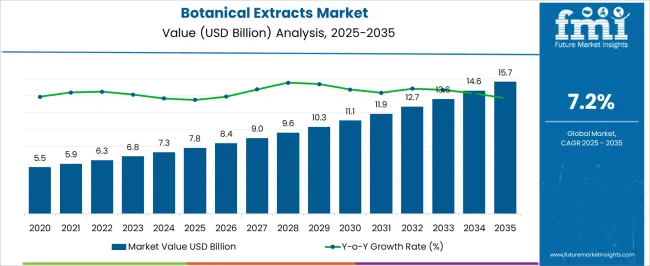

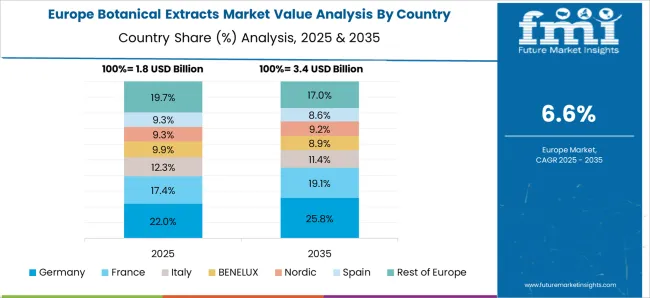

The botanical extracts market is estimated to be valued at USD 7.8 billion in 2025 and is projected to reach USD 15.7 billion by 2035, registering a compound annual growth rate (CAGR) of 7.2% over the forecast period. Analysis of regional growth imbalance shows clear variations in expansion patterns between Asia Pacific, Europe, and North America over the forecast period. Asia Pacific demonstrates the strongest momentum, supported by the abundance of raw material resources and expanding applications across nutraceuticals, cosmetics, and pharmaceuticals.

The region benefits from a robust supply chain and lower production costs, which allow manufacturers to scale operations. Growth in the Asia Pacific is expected to outpace the global average, with local demand and export-oriented production both fueling expansion. Europe follows with steady advancement, underpinned by stringent regulations on natural ingredients in food, beverages, and personal care.

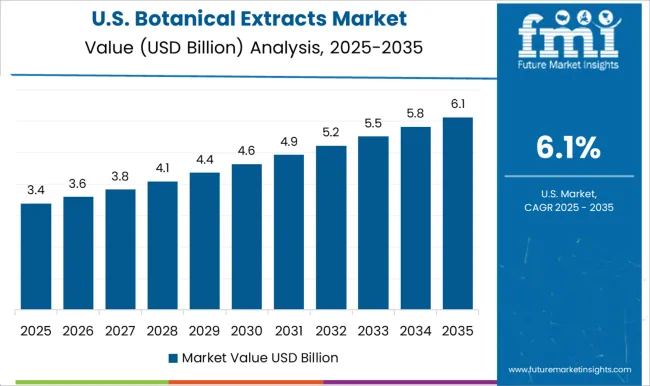

The region exhibits strong demand for traceable and clean-label botanical extracts, but its growth trajectory remains moderate due to higher operational costs and limited cultivation capacity. North America displays consistent yet slightly slower growth relative to the Asia Pacific, driven primarily by dietary supplements and functional food sectors. Regulatory frameworks support natural ingredient adoption, but dependence on imports constrains scalability. This imbalance illustrates Asia Pacific as the growth engine, while Europe and North America maintain stable but comparatively slower trajectories, positioning the market for differentiated regional strategies.

| Metric | Value |

|---|---|

| Botanical Extracts Market Estimated Value in (2025 E) | USD 7.8 billion |

| Botanical Extracts Market Forecast Value in (2035 F) | USD 15.7 billion |

| Forecast CAGR (2025 to 2035) | 7.2% |

Increased health awareness and demand for clean-label products have positioned botanical extracts as a preferred choice in formulations for food, beverages, nutraceuticals, and personal care applications. Regulatory support for the use of botanical ingredients, along with a rising trend toward preventive healthcare and holistic wellness, is creating sustained momentum in the market.

Press releases from ingredient manufacturers and annual investor briefings highlight the role of technological advancements in extraction processes, which have improved the purity, potency, and functional benefits of botanical extracts. Furthermore, the shift toward sustainable sourcing and ethical supply chains is reinforcing their demand globally.

As companies continue to diversify their product portfolios with botanical-based alternatives, the market is expected to experience steady growth, especially in developing economies where awareness and disposable incomes are rising.

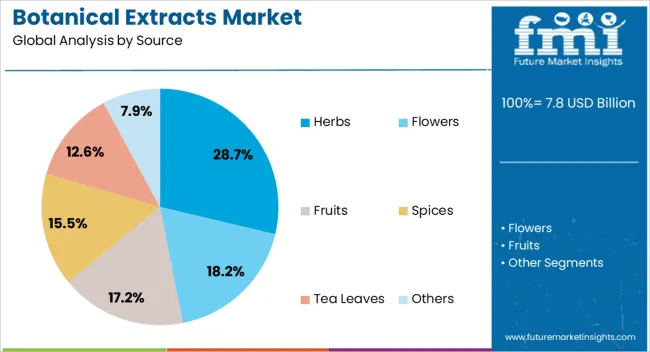

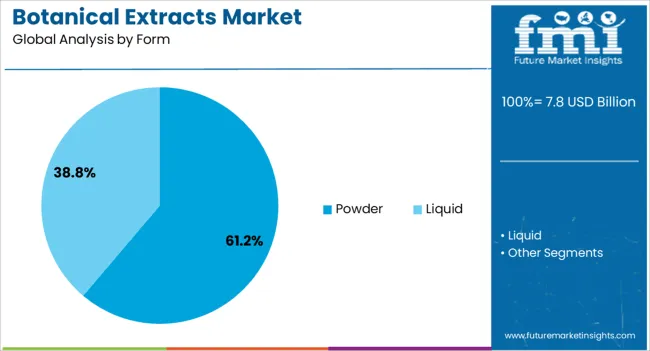

The botanical extracts market is segmented by source, form, application, and geographic regions. By source, the botanical extracts market is divided into Herbs, Flowers, Fruits, Spices, Tea Leaves, and Others. In terms of form, the botanical extracts market is classified into Powder and Liquid.

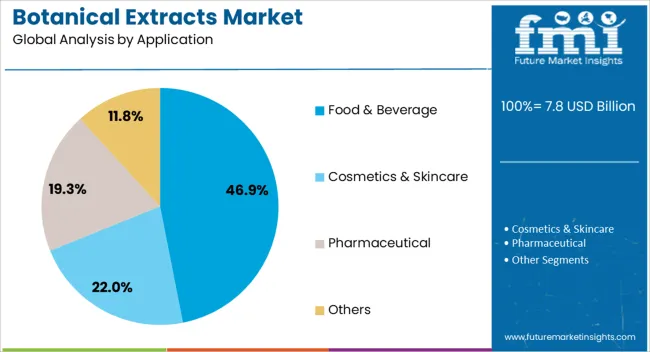

Based on application, the botanical extracts market is segmented into Food & Beverage, Cosmetics & Skincare, Pharmaceutical, and Others. Regionally, the botanical extracts industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The herbs segment is projected to account for 28.7% of the Botanical Extracts market revenue share in 2025, making it the leading source category. The widespread availability, rich phytochemical profiles, and broad therapeutic applications of herbs in both traditional and modern product formulations have supported this dominance. Herbs have been widely utilized due to their established efficacy and recognition in various regional pharmacopeias.

Their compatibility with multiple extraction technologies and formulations has enabled manufacturers to deliver high-value products targeting immunity, digestion, and cognitive health. Corporate sustainability reports and product announcements have emphasized that consumer trust in herbal ingredients has been instrumental in driving their demand across food, beverage, and supplement industries.

The segment's growth has also been supported by increasing product launches that focus on organic and ethically sourced herbs, aligning with global consumer values. As wellness-driven consumption continues to rise, herbs are expected to retain their dominant share within the Botanical Extracts market.

The powder segment is expected to represent 61.2% of the Botanical Extracts market revenue share in 2025, holding the largest portion among all form types. This leadership position has been driven by the segment’s high stability, ease of storage, and versatility across a wide range of end-use applications.

Powdered botanical extracts are favored for their extended shelf life, cost efficiency in transportation, and compatibility with diverse delivery formats such as capsules, tablets, drink mixes, and cosmetics. Industry news sources and technical bulletins have noted that the powdered form allows for more precise dosing and consistent bioactive concentrations, which are critical in functional and fortified product development.

In addition, their lower moisture content makes them less susceptible to microbial growth, improving product safety. These functional and economic benefits have made powder extracts a top choice for manufacturers seeking scalable and high-quality ingredients, resulting in their continued dominance in the global Botanical Extracts market.

The food and beverage segment is forecasted to capture 46.9% of the Botanical Extracts market revenue share in 2025, making it the leading application area. This growth has been fueled by rising consumer demand for functional foods and naturally flavored beverages that offer health benefits alongside taste. Food innovation platforms and brand communications have emphasized a shift toward clean-label and plant-based ingredients, where botanical extracts are seen as both health-enhancing and appealing to label-conscious consumers.

Extracts from herbs, fruits, and spices are increasingly being incorporated into teas, health drinks, baked goods, and dairy alternatives due to their antioxidant, antimicrobial, and adaptogenic properties. Annual reports from beverage and food companies have indicated a steady increase in new product development featuring botanical extracts as key ingredients.

Additionally, the ability to align with dietary trends such as veganism, keto, and immunity-boosting diets has reinforced the segment’s leadership in the market. As product personalization grows, botanical extracts are expected to remain integral to food and beverage innovation globally.

The market has been expanding due to their growing use across food and beverages, pharmaceuticals, nutraceuticals, and personal care industries. Extracts derived from plants such as herbs, spices, fruits, and flowers are widely utilized for their bioactive properties, natural flavors, and functional benefits. Advancements in extraction techniques such as supercritical fluid extraction, ultrasonic processing, and solvent-free technologies have enhanced product quality and purity. Rising demand for clean label ingredients, natural remedies, and herbal formulations has supported the continuous adoption of botanical extracts worldwide.

The food and beverage sector has been one of the largest consumers of botanical extracts due to their natural flavoring, coloring, and preservative properties. Extracts of vanilla, green tea, turmeric, ginger, rosemary, and pepper are widely integrated into bakery, confectionery, dairy, and beverage products. Consumers have increasingly preferred natural and plant-derived ingredients over artificial additives. Innovative formulation techniques have allowed extracts to maintain stability, solubility, and bioavailability in diverse food matrices. Botanical extracts have also been used in functional foods and fortified beverages offering health benefits. This expansion has reinforced their role as essential ingredients that deliver both sensory appeal and functional value, further stimulating demand across mainstream and premium product categories in global markets.

The pharmaceutical and nutraceutical industries have been key drivers for botanical extract adoption due to their therapeutic and preventive health properties. Plant-derived bioactive compounds such as polyphenols, alkaloids, flavonoids, and terpenes have been extensively studied for their antioxidant, antimicrobial, and anti-inflammatory benefits. Botanical extracts have been incorporated into dietary supplements, herbal medicines, and wellness products targeting immunity, cardiovascular health, and digestive function. The emphasis on preventive healthcare has accelerated the demand for natural ingredients that provide functional support without synthetic additives. Technological advances in extraction and encapsulation have improved the potency, stability, and targeted delivery of botanical actives. This demand from healthcare-related applications has positioned botanical extracts as reliable natural alternatives in both traditional and modern medicinal practices worldwide.

The development of innovative extraction technologies has significantly influenced the quality and efficiency of botanical extracts. Conventional methods such as solvent extraction and steam distillation have been complemented by advanced techniques including supercritical CO₂ extraction, microwave-assisted processing, and ultrasonic-assisted extraction. These methods have enhanced yield, maintained bioactive compound integrity, and reduced solvent residues. The focus on green processing and environmentally friendly methods has gained traction, improving sustainability in production. Automation and process optimization have further ensured scalability and consistent quality across batches. This evolution in technology has enabled manufacturers to develop high-purity, customized extracts suited for pharmaceutical, nutraceutical, and cosmetic industries. Such advancements have provided opportunities for differentiation and innovation, strengthening the global market presence of botanical extracts across diverse applications.

Cosmetics and personal care industries have increasingly adopted botanical extracts due to their natural bioactive properties and skin-enhancing effects. Extracts from aloe vera, chamomile, lavender, ginseng, and tea tree have been integrated into skincare, haircare, and personal hygiene products. These ingredients are valued for their antioxidant, anti-aging, anti-inflammatory, and moisturizing functions. Formulations with plant-derived actives have been favored for offering natural alternatives to synthetic compounds. Innovation in encapsulation and nanotechnology has further improved the bioavailability and delivery of botanical extracts in topical products. The preference for natural formulations with therapeutic benefits has positioned botanical extracts as critical components in cosmetic and dermatological product development. This trend has strengthened the market potential by aligning with growing consumer preference for plant-based personal care solutions.

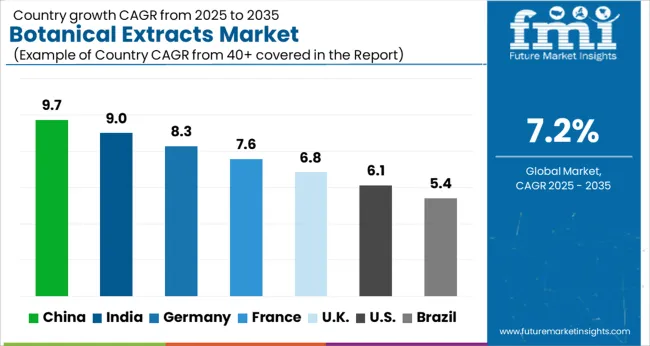

The market is projected to record a CAGR of 7.2% between 2025 and 2035, supported by growing use across pharmaceuticals, nutraceuticals, cosmetics, and food applications. China leads with a 9.7% CAGR, driven by large-scale herbal cultivation, domestic demand, and rising export capacity. India follows at 9.0%, supported by its strong Ayurveda foundation and increasing utilization in dietary supplements. Germany, with 8.3% growth, benefits from established natural cosmetics and herbal medicine industries. The UK, at 6.8%, is witnessing adoption in plant-based functional foods and wellness products, while the USA, growing at 6.1%, reflects consumer preference for clean-label, natural health solutions. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is set to register a CAGR of 9.7% between 2025 and 2035, influenced by the widespread use of plant-based ingredients in pharmaceuticals, nutraceuticals, and cosmetics. Increasing investments in extraction technologies such as supercritical CO₂ and ultrasonic extraction are improving yield and purity. Rising demand for functional foods and herbal remedies is creating consistent growth opportunities. Partnerships between local firms and international players are enhancing product development and export capabilities. Strong domestic production capacity and consumer preference for natural ingredients will continue to strengthen market expansion.

India is expected to achieve a CAGR of 9% in the market from 2025 to 2035, supported by a strong supply base of medicinal plants and rising demand for natural formulations. The integration of extracts into pharmaceuticals, dietary supplements, and beauty products is gaining momentum. Government-backed initiatives for herbal product promotion are stimulating domestic and international trade. Manufacturers are increasingly adopting advanced extraction and standardization technologies to maintain consistency. Export potential is strengthening, especially toward Europe and North America.

Germany is forecast to grow at 8.3% CAGR in the market during 2025 to 2035, driven by the popularity of herbal supplements and natural active ingredients in cosmetics. The country’s established pharmaceutical and nutraceutical industries are integrating high-quality botanical extracts into product formulations. Stringent regulations and quality assurance standards are shaping demand for standardized and certified extracts. Increasing consumer preference for plant-based wellness products is further supporting growth. Research partnerships with international firms are also enhancing innovation in herbal formulations.

The industry in the United Kingdom is projected to expand at a CAGR of 6.8% from 2025 to 2035, led by rising demand for herbal supplements, skincare products, and fortified foods. Local manufacturers are investing in advanced extraction technologies to ensure purity and efficiency. The growing preference for natural alternatives in pharmaceuticals and functional beverages is contributing to demand growth. Collaborations between universities and manufacturers are enhancing research into novel applications of extracts. Regulations favoring safety and standardization are further shaping industry development.

The United States market is anticipated to grow at a CAGR of 6.1% between 2025 and 2035, fueled by demand for clean-label products in dietary supplements, cosmetics, and beverages. Increased focus on natural wellness solutions is pushing manufacturers to develop advanced plant-based formulations. Adoption of cutting-edge extraction methods such as cold-press and solvent-free techniques is ensuring quality improvement. Rising collaborations between nutraceutical firms and botanical suppliers are supporting product innovation. The shift toward preventive healthcare and organic formulations is creating stable opportunities for growth.

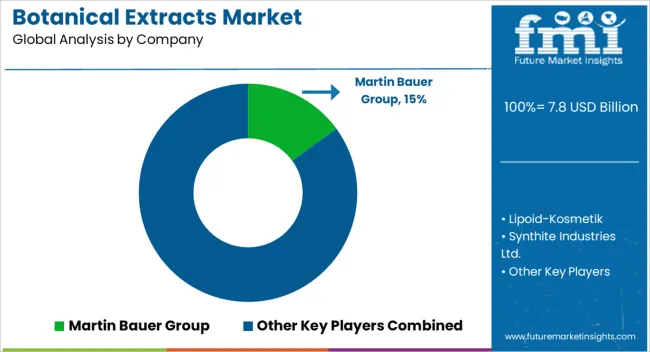

The market is driven by rising applications in food, beverages, pharmaceuticals, cosmetics, and nutraceuticals, where natural ingredients are increasingly preferred. Companies focus on producing extracts with consistent bioactive profiles, purity, and safety. Martin Bauer Group is recognized for its broad portfolio of plant-based extracts for teas, supplements, and functional foods. Lipoid-Kosmetik provides botanical actives specifically tailored for cosmetic and personal care formulations. Synthite Industries Ltd. holds a strong position in spice oleoresins and natural extracts, supplying global food and beverage brands. Bell Flavors & Fragrances, Synergy Flavors, and International Flavors & Fragrances Inc. emphasize flavor enhancement and aroma solutions derived from botanicals.

Companies like Nektium, Berkem, and Nutra Green Biotechnology focus on standardized herbal extracts for nutraceutical and pharmaceutical applications. Döhler GmbH delivers botanical ingredients for beverages and functional nutrition, while Kalsec Inc. specializes in natural colorants and antioxidants. The market is highly fragmented with established global players and regionally active producers. Competitive advantage is shaped by raw material sourcing, extraction technologies such as supercritical CO₂ and solvent-free methods, and compliance with safety and regulatory standards. Increasing R&D toward novel botanical actives and expanding applications in clean-label and plant-based products are central strategies adopted by manufacturers.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.8 Billion |

| Source | Herbs, Flowers, Fruits, Spices, Tea Leaves, and Others |

| Form | Powder and Liquid |

| Application | Food & Beverage, Cosmetics & Skincare, Pharmaceutical, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Martin Bauer Group, Lipoid-Kosmetik, Synthite Industries Ltd., Bell Flavors & Fragrances, Nektium, Nutra Green Biotechnology Co., Ltd., Ambe NS Agro Products Pvt. Ltd., Berkem, Botanica, Blue Sky Botanics Ltd., Synergy Flavors, Ransom Naturals Ltd., Kalsec Inc., Döhler GmbH, Kuber Impex Ltd., Native Extracts, International Flavors & Fragrances Inc., and Mb-Holding GmbH & Co. Kg |

| Additional Attributes | Dollar sales by extract type and end-use application, demand dynamics across pharmaceuticals, nutraceuticals, food and beverage, and cosmetics sectors, regional trends in botanical cultivation and extraction practices, innovation in extraction technologies such as supercritical CO₂ and ultrasonic-assisted processes, environmental impact of large-scale raw material sourcing and sustainability challenges, and emerging use cases in plant-based supplements, functional foods, clean-label cosmetics, and herbal therapeutics. |

The global botanical extracts market is estimated to be valued at USD 7.8 billion in 2025.

The market size for the botanical extracts market is projected to reach USD 15.7 billion by 2035.

The botanical extracts market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in botanical extracts market are herbs, flowers, fruits, spices, tea leaves and others.

In terms of form, powder segment to command 61.2% share in the botanical extracts market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Botanical CO2 Extracts Market Analysis by Cranberry Seed, Blackcurrant, Oat, Carrot, and Rice Bran through 2035.

Botanical Flavors Market Size and Share Forecast Outlook 2025 to 2035

Botanical Bioactives Market Size and Share Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Botanical Ingredient Business

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Botanical Sugar Market Analysis by product type, application and by region - Growth, trends and forecast from 2025 to 2035

Botanical Packaging Market Analysis & Future Outlook 2024 to 2034

Food Botanicals Market Outlook – Growth, Demand & Forecast 2024 to 2034

Fermented Botanicals for Anti-Aging Market Size and Share Forecast Outlook 2025 to 2035

Extracts and Distillates Market

Meat Extracts Market Size and Share Forecast Outlook 2025 to 2035

Peony Extracts for Brightening Market Size and Share Forecast Outlook 2025 to 2035

Algae Extracts Market Size and Share Forecast Outlook 2025 to 2035

Maple Extracts Market Size and Share Forecast Outlook 2025 to 2035

Bamboo Extracts for Anti-Aging Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Bamboo Extracts for Skin Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Jujube Extracts Market Analysis by Type, End-Use, Distribution Channel, Region And Other Forms Through 2035

Coffee Extract Market Analysis by Nature, Product, End Use, Formulation, and Region through 2025 to 2035

Seaweed Extracts Market Size and Share Forecast Outlook 2025 to 2035

Ginseng Extracts Market Analysis by Product Type, Form and Application Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA