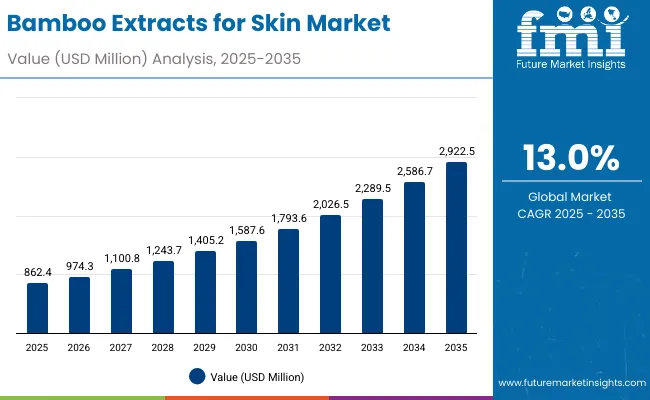

The Bamboo Extracts for Skin Market is expected to record a valuation of USD 862.4 million in 2025 and USD 2,922.5 million in 2035, with an increase of USD 2,060.1 million, which equals a growth of 193% over the decade. The overall expansion represents a CAGR of 13.0% and a near 3.4X increase in market size.

Bamboo Extracts for Skin Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 862.4 million |

| Market Forecast Value in (2035F) | USD 2,922.5 million |

| Forecast CAGR (2025 to 2035) | 13.0% |

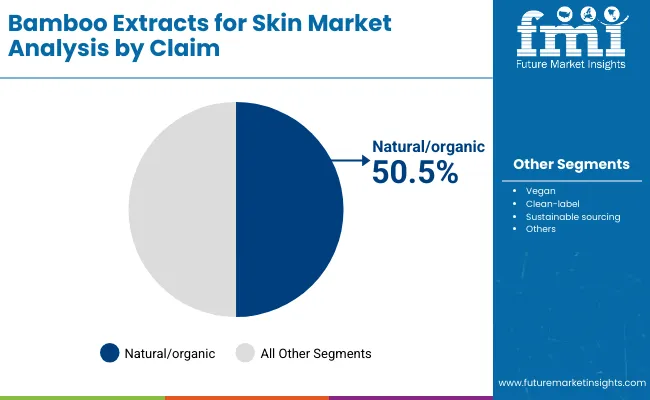

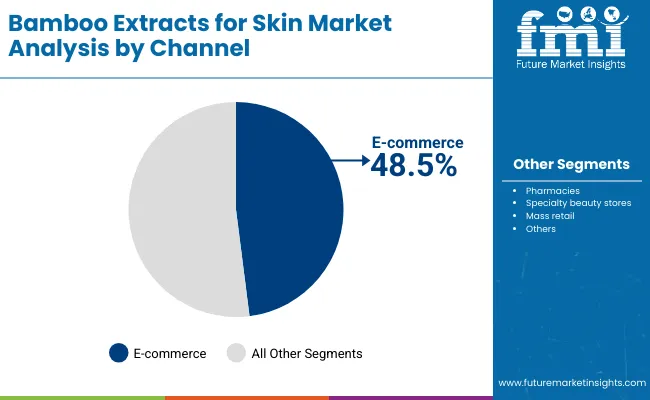

During the first five-year period from 2025 to 2030, the market rises from USD 862.4 million to USD 1,587.6 million, adding USD 725.2 million, which accounts for 35.2% of the total decade growth. This phase reflects steady consumer adoption across hydration, soothing, and anti-aging skincare functions, supported by rising demand for creams and lotions in daily-use segments. Natural and organic formulations dominate during this phase, capturing more than 50% of the claim-based sales value in 2025. E-commerce platforms remain crucial, accounting for nearly 48.5% of the distribution channel share in 2025.

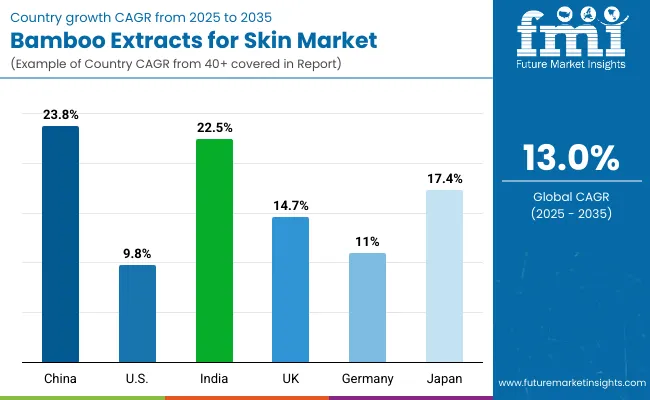

The second half from 2030 to 2035 contributes USD 1,334.9 million, equal to 64.8% of total growth, as the market jumps from USD 1,587.6 million to USD 2,922.5 million. This acceleration is driven by premiumization in skin brightening and anti-aging ranges, clean-label claims, and sustainable sourcing. Widespread adoption in mature markets such as the USA, Germany, and Japan is coupled with explosive growth in China and India, which record estimated CAGRs of 23.8% and 22.5% respectively. By the end of the decade, natural and organic positioning strengthens further, while e-commerce and specialty beauty stores consolidate their lead as the primary retail formats.

From 2020 to 2024, the Bamboo Extracts for Skin Market built momentum through increased consumer awareness of hydration, soothing, and anti-aging properties of bamboo-based formulations. Growth was primarily driven by creams, lotions, and serums positioned as natural or organic, with adoption strengthened by clean-label and sustainable sourcing claims. E-commerce channels gained prominence, outpacing mass retail and specialty stores in accessibility and convenience.

Demand for Bamboo Extracts for Skin is projected to reach USD 862.4 million in 2025, and accelerate further to USD 2,922.5 million in 2035. The revenue mix will increasingly shift toward natural and organic claims (50.5% share in 2025) and e-commerce sales (48.5% share in 2025), as consumers prioritize health-conscious and digitally enabled purchasing. Traditional leaders such as Innisfree and The Face Shop continue to hold market relevance, but face intensifying competition from niche entrants specializing in clean-label, vegan, and sustainable sourcing. Competitive advantage is now moving away from price-led competition alone to brand authenticity, supply-chain sustainability, and digital engagement strategies.

A critical driver is the increasing use of bamboo-derived silica in premium anti-aging and brightening skincare products. Silica extracted from bamboo enhances collagen synthesis, improves elasticity, and reduces wrinkle depth, making it a scientifically backed active. This aligns with consumer preference for botanical alternatives to synthetic peptides or retinol, especially in mature markets such as Japan and Germany. The clinical efficacy of bamboo silica positions it as a high-value differentiator, pushing growth across dermo-cosmetic brands.

Growth is strongly accelerated by the rapid penetration of bamboo extract-based skincare via e-commerce in Asia-Pacific, particularly China and India. Platforms like Tmall, Flipkart, and Nykaa are aggressively promoting clean-label bamboo formulations, often coupled with influencer-driven marketing. This has lowered entry barriers for niche brands while expanding consumer access to specialized hydration and soothing products. The ability to target consumers directly with subscription-based skincare kits further enhances volume growth and long-term customer stickiness in high-CAGR markets.

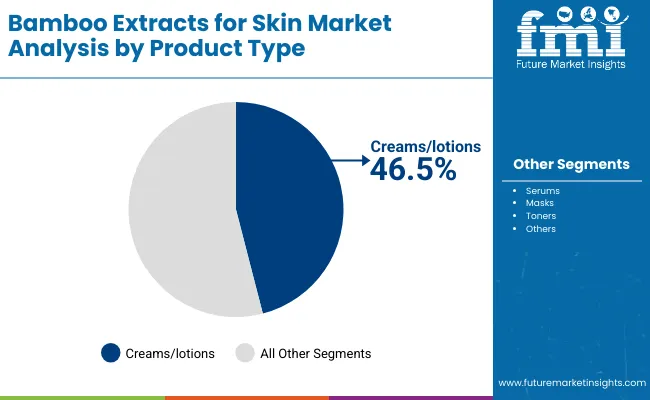

The Bamboo Extracts for Skin Market is segmented by function, product type, distribution channel, claim, and region. By function, the market spans hydration, soothing and calming, anti-aging, and brightening, with soothing and calming extracts accounting for the largest early value base due to strong adoption in formulations designed for sensitive skin. By product type, creams and lotions lead with 46.5% of 2025 sales, while serums, masks, and toners cater to targeted skincare routines and premium offerings.

Distribution channels are split between e-commerce (48.5% in 2025) and offline channels including pharmacies, specialty beauty stores, and mass retail, with online retail expanding faster through direct-to-consumer models. On the claim front, natural and organic products hold 50.5% of value share in 2025, supported by clean-label, vegan, and sustainable sourcing attributes gaining momentum across developed and emerging markets. Regionally, the USA, China, Japan, Germany, the UK, and India represent the primary demand centers, with the USA maintaining the largest absolute market size, while Asia’s contribution rises significantly through broader consumer penetration and expanding retail distribution.

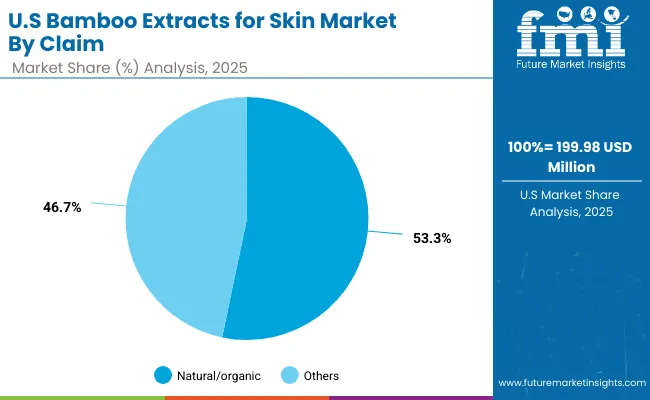

| Claim | Value Share% 2025 |

|---|---|

| Natural/organic | 50.5% |

| Others | 49.5% |

The natural/organic segment is projected to contribute 50.5% of the Bamboo Extracts for Skin Market revenue in 2025, maintaining its position as the leading claim category. Growth in this segment is underpinned by increasing consumer preference for plant-derived, chemical-free formulations that are positioned as safer alternatives to synthetic skincare ingredients. Bamboo extract’s natural silica and antioxidant properties align well with clean beauty trends, driving brand adoption in both premium and mass-market product lines.

The others category, with 49.5% share in 2025, represents a diverse mix of positioning claims including conventional formulations, where bamboo extracts are blended with synthetic actives. However, as awareness of ingredient transparency rises, brands with organic certifications and sustainability-led sourcing practices are capturing higher consumer trust. The natural/organic segment is expected to reinforce its dominance through deeper penetration in hydration, soothing, and anti-aging skincare ranges, making it the cornerstone of long-term market expansion.

| Channel | Value Share% 2025 |

|---|---|

| E-commerce | 48.5% |

| Others | 51.5% |

The e-commerce channel is expected to account for 48.5% of the Bamboo Extracts for Skin Market revenue in 2025, reflecting its growing role as a primary distribution medium for skincare products. Online platforms have enabled both global and regional brands to reach consumers directly, supported by influencer-driven marketing, subscription models, and product personalization. Digital storefronts have also reduced entry barriers for niche natural and organic labels, allowing them to compete with established multinational players.

The others category, representing 51.5% of sales in 2025, includes pharmacies, specialty beauty stores, and mass retail formats, which remain important in consumer trust-building and tactile product experiences. However, as younger consumers increasingly prioritize convenience, speed of delivery, and digital engagement, e-commerce is expected to steadily expand its share over the decade. The dominance of online platforms in fast-growing markets such as China and India underscores their role as the fastest-scaling sales channels for bamboo extract-based skincare.

| Product Type | Value Share% 2025 |

|---|---|

| Creams/lotions | 46.5% |

| Others | 53.5% |

The creams and lotions segment is projected to contribute 46.5% of the Bamboo Extracts for Skin Market revenue in 2025, establishing it as the leading product type. These formats dominate due to their versatility, daily usage patterns, and suitability for delivering bamboo extracts in hydration, soothing, and anti-aging applications. The segment benefits from strong consumer familiarity, ease of application, and the ability to integrate multiple claims such as natural/organic, clean-label, and sustainable sourcing.

The others category, with 53.5% of sales in 2025, includes serums, masks, and toners, which are increasingly popular in premium and targeted skincare routines. Serums gain traction in brightening and anti-aging use cases, while masks and toners appeal to younger demographics seeking multi-step skincare regimens. As personalization in skincare expands, these product formats are expected to accelerate, but creams and lotions will continue to anchor mass-market adoption and remain the most significant contributor to overall market revenues.

Functional Efficacy of Bamboo-Derived Actives

Bamboo extracts are increasingly valued for their high silica, antioxidants, and amino acid content, which support hydration, anti-aging, and skin barrier repair. These natural actives provide clinically relevant outcomes such as improved collagen synthesis and reduced oxidative stress positioning bamboo extracts as more than just a botanical marketing claim. Their efficacy is being leveraged in both premium anti-aging creams and mass-market soothing products, boosting cross-segment adoption and expanding the consumer base beyond niche herbal categories.

Expansion of E-commerce and Direct-to-Consumer Channels

Digital-first retail platforms are driving growth by lowering entry barriers for emerging bamboo skincare brands while expanding visibility for established players. In markets such as China and India, bamboo extract products are aggressively promoted on platforms like Tmall and Nykaa, often combined with influencer marketing and bundled subscription offerings. This distribution shift enhances consumer access, supports rapid brand scaling, and accelerates market penetration, particularly in regions where offline specialty stores have limited reach.

Limited Standardization in Extract Quality

The market faces challenges from inconsistent extraction methods and lack of global quality standards for bamboo-derived actives. Variability in silica concentration, antioxidant potency, and purity levels across suppliers often results in uneven product performance. This inconsistency undermines consumer trust, complicates regulatory compliance in stricter markets, and discourages premium pricing strategies. Without harmonized quality benchmarks, manufacturers face higher costs for testing and validation, which can slow large-scale adoption in international markets.

Shift Toward Sustainable and Traceable Ingredient Sourcing

A defining trend is the growing consumer and brand focus on sustainably sourced bamboo extracts, with traceability becoming a competitive differentiator. Companies are investing in transparent sourcing practices, eco-certifications, and closed-loop supply chains to align with clean-label positioning. Bamboo’s fast-regenerating nature is already a strong sustainability story, but brands are elevating it further by highlighting local sourcing initiatives and reduced environmental footprints. This aligns with consumer demand for eco-conscious beauty and strengthens brand equity in the premium skincare space.

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 23.8% |

| USA | 9.8% |

| India | 22.5% |

| UK | 14.7% |

| Germany | 11.0% |

| Japan | 17.4% |

The global Bamboo Extracts for Skin Market shows notable differences in adoption across key countries, shaped by consumer behavior, retail ecosystems, and brand penetration. China leads with 23.8% growth, fueled by strong demand for natural and organic skincare, the rapid rise of e-commerce platforms such as Tmall and JD.com, and the dominance of K-beauty-inspired routines. Influencer-driven promotions and affordable mass-market options have accelerated bamboo extract adoption in both hydration and brightening formulations. India follows with 22.5% growth, underpinned by rising disposable incomes, urban demand for clean-label products, and the positioning of bamboo-based skincare as both Ayurvedic and eco-conscious. Local and regional brands are leveraging direct-to-consumer models and online platforms like Nykaa to expand reach beyond metros into tier-2 and tier-3 cities.

Japan records 17.4% growth, supported by a sophisticated consumer base highly receptive to anti-aging and soothing skincare solutions. Bamboo extract’s collagen-enhancing properties align with Japan’s preference for functional botanical actives in premium creams, lotions, and serums. In Europe, Germany (11.0%) and the UK (14.7%) maintain steady growth, driven by strict sustainability preferences, regulatory emphasis on ingredient transparency, and consumer loyalty to clean-label cosmetics. Global players and niche natural brands are both expanding presence through specialty beauty stores and online channels.

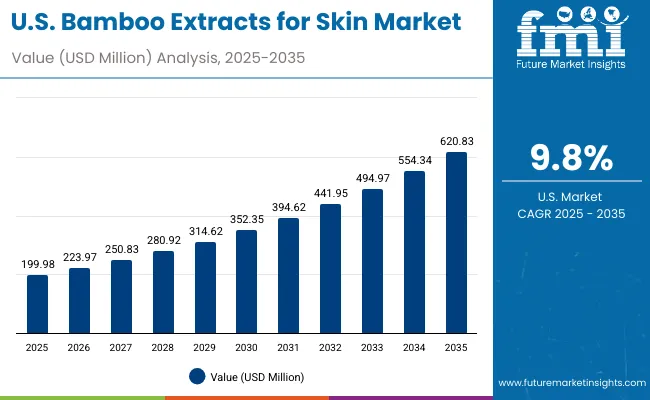

The USA shows moderate expansion at 9.8%, reflecting a more mature skincare market. Growth is concentrated in the natural/organic segment, with bamboo extract positioned alongside aloevera, green tea, and other plant-derived actives. E-commerce remains a key growth lever, with specialty brands promoting bamboo extracts through subscription kits and social media campaigns targeting younger consumers.

| Year | USA Bamboo Extracts for Skin Market (USD Million) |

|---|---|

| 2025 | 199.98 |

| 2026 | 223.97 |

| 2027 | 250.83 |

| 2028 | 280.92 |

| 2029 | 314.62 |

| 2030 | 352.35 |

| 2031 | 394.62 |

| 2032 | 441.95 |

| 2033 | 494.97 |

| 2034 | 554.34 |

| 2035 | 620.83 |

The Bamboo Extracts for Skin Market in the United States is projected to grow steadily from USD 199.98 million in 2025 to USD 620.83 million in 2035, reflecting strong consumer adoption of natural and plant-based skincare solutions. Growth is primarily supported by rising demand for natural/organic claims, which hold a 53.3% share in 2025, as USA consumers increasingly shift toward clean-label and eco-conscious formulations. Online retail and subscription-based platforms are accelerating penetration, particularly among younger demographics seeking hydration and anti-aging benefits.

Retailers are also expanding bamboo-based product assortments across creams, lotions, and serums, often positioned alongside established botanical actives such as aloevera and green tea. Premiumization is evident in anti-aging and brightening lines, while mass retail continues to anchor growth in hydration-focused formulations. Brand differentiation relies heavily on sustainable sourcing, ingredient transparency, and digital marketing, with both domestic and K-beauty-inspired international brands competing aggressively.

The Bamboo Extracts for Skin Market in the United Kingdom is expected to expand from 2025 through 2035, driven by rising consumer preference for natural and sustainable skincare solutions. The market benefits from strong traction in creams and lotions, supported by high consumer acceptance of hydration and soothing formulations. UK consumers are particularly responsive to clean-label and eco-conscious claims, aligning with the broader European demand for transparency in ingredient sourcing and sustainable packaging.

E-commerce and specialty beauty retailers play an increasingly central role in product availability, with both multinational and niche organic brands leveraging digital platforms to engage consumers. Retail growth is reinforced by subscription kits and social media campaigns that emphasize bamboo extract’s anti-aging and brightening benefits. The UK’s strong regulatory standards on cosmetics are also pushing brands toward compliance-led innovation, giving bamboo-based formulations an edge over synthetic alternatives.

India is witnessing rapid growth in the Bamboo Extracts for Skin Market, with sales expected to rise significantly through 2035. Expansion is fueled by rising disposable incomes, increased urbanization, and a cultural preference for herbal and plant-based skincare rooted in Ayurvedic traditions. Bamboo extracts are gaining traction in hydration and soothing formulations, while premium brands are introducing anti-aging and brightening ranges targeted at affluent urban consumers.

The adoption of bamboo-based skincare is no longer limited to metropolitan centers. Tier-2 and tier-3 cities are witnessing sharp growth due to the cost-effective pricing strategies of domestic players and aggressive distribution through e-commerce platforms such as Flipkart and Nykaa. Local brands are effectively positioning bamboo extracts as sustainable, eco-friendly, and compatible with Indian skin types, while international K-beauty-inspired brands are expanding their retail presence to capture aspirational buyers.

The Bamboo Extracts for Skin Market in China is projected to record the fastest growth among leading economies, with sales expanding rapidly from 2025 through 2035. This momentum is driven by the convergence of e-commerce dominance, rising middle-class consumption, and K-beauty-inspired routines that emphasize hydration, brightening, and anti-aging. Platforms such as Tmall and JD.com have become the primary growth engines, supported by livestream selling, influencer-driven campaigns, and subscription models.

Domestic brands are gaining traction by offering affordable bamboo-based skincare, while global players focus on premium positioning, clean-label claims, and sustainable sourcing to attract urban consumers. The category is also benefiting from younger demographics prioritizing plant-based and eco-conscious formulations, making bamboo extract a strong fit within the natural/organic beauty wave.

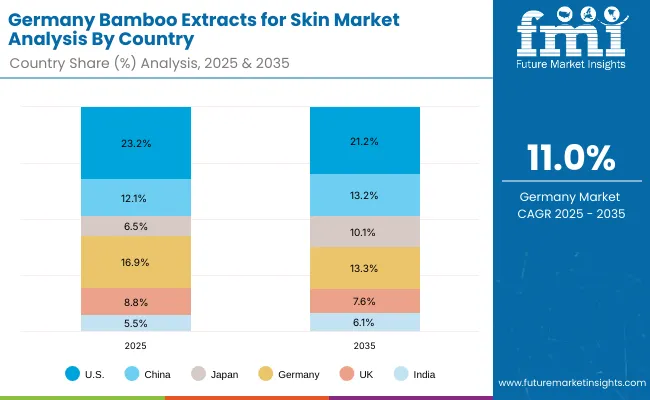

| Countries | 2025 Share (%) |

|---|---|

| USA | 23.2% |

| China | 12.1% |

| Japan | 6.5% |

| Germany | 16.9% |

| UK | 8.8% |

| India | 5.5% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 21.2% |

| China | 13.2% |

| Japan | 10.1% |

| Germany | 13.3% |

| UK | 7.6% |

| India | 6.1% |

Germany accounted for 16.9% of the global Bamboo Extracts for Skin Market in 2025, with its share projected to moderate to 13.3% by 2035 as faster growth is recorded in Asia-Pacific markets. Despite this relative shift, Germany remains one of Europe’s most important markets, supported by strong consumer preference for clean-label and sustainable skincare solutions. The country’s regulatory environment, emphasizing ingredient transparency and eco-friendly sourcing, positions bamboo extracts as an attractive botanical active in both premium and mid-range skincare lines.

German consumers show high responsiveness to hydration and anti-aging formulations, with creams and lotions being the most dominant product format. Specialty beauty stores and pharmacy chains play a pivotal role in retail distribution, while e-commerce continues to gain traction among younger, digitally engaged consumers. Multinational players such as Amorepacific and L’Oréal are expanding their bamboo extract offerings in Germany, while local natural cosmetic brands integrate bamboo-based actives into broader herbal product portfolios.

| USA by Claim | Value Share% 2025 |

|---|---|

| Natural/organic | 53.3% |

| Others | 46.7% |

The Bamboo Extracts for Skin Market in the United States is projected to reach USD 199.98 million in 2025, growing steadily to USD 620.83 million by 2035. Market growth is supported by rising consumer preference for natural skincare, with natural/organic claims accounting for 53.3% of total sales in 2025, compared with 46.7% for other claims. This highlights a clear shift toward ingredient transparency, plant-based formulations, and eco-friendly branding as key purchase drivers.

Consumer adoption is strongest in hydration and anti-aging product ranges, where bamboo extracts are positioned alongside established actives such as hyaluronic acid and green tea. E-commerce platforms and subscription-based beauty services are expanding access, especially among millennials and Gen Z, who drive demand for clean-label and cruelty-free products. Premium and mass-market players are both leveraging bamboo’s natural silica and antioxidant properties to reinforce functional efficacy and align with health-conscious beauty trends.

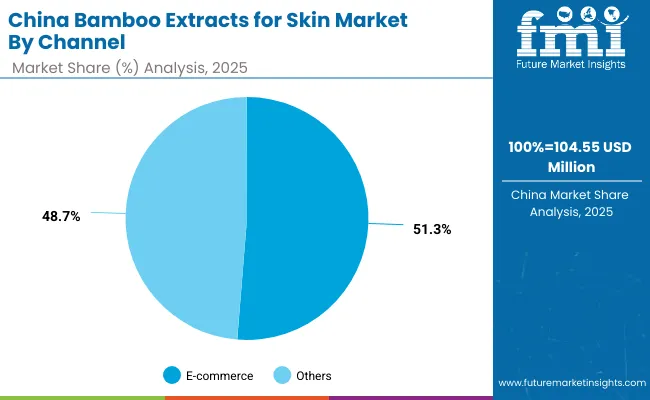

| China by Channel | Value Share% 2025 |

|---|---|

| E-commerce | 51.3% |

| Others | 48.7% |

In 2025, the Bamboo Extracts for Skin Market in China is heavily shaped by e-commerce channels, which account for 51.3% of sales, compared with 48.7% for offline formats. This dominance reflects the rapid digitalization of retail and the role of platforms like Tmall, JD.com, and Douyin, which have become essential for beauty and skincare brand scaling. The opportunity lies in leveraging livestream commerce, influencer partnerships, and subscription-based beauty boxes to deepen consumer engagement and build recurring revenue streams.

Another growth opportunity is tied to the younger consumer base, which is highly receptive to natural, vegan, and sustainable skincare products. Bamboo extracts, with their hydration, brightening, and anti-aging benefits, align perfectly with this demand. Local players are introducing affordable, mass-market bamboo skincare lines, while global brands are differentiating through premium positioning and sustainability narratives. This dual-track approach allows the market to serve both value-driven and aspirational consumers, expanding overall category penetration.

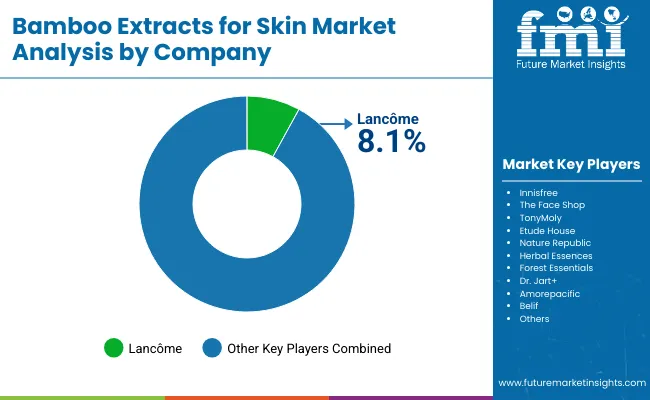

The Bamboo Extracts for Skin Market is moderately fragmented, with global leaders, regional players, and niche organic brands competing across hydration, soothing, anti-aging, and brightening categories. In 2025, Lancôme holds 8.1% of the global value share, while the remaining 91.9% is distributed across K-beauty giants, herbal specialists, and natural skincare innovators.

Global beauty leaders such as Lancôme and Amorepacific dominate the premium end of the market, leveraging strong distribution in department stores, specialty beauty retailers, and e-commerce platforms. Their strategies emphasize bamboo extracts in anti-aging creams and brightening serums, supported by aggressive marketing and sustainability-led branding. Mid-sized innovators including Innisfree, The Face Shop, and TonyMoly build competitive advantage through accessible price points and strong brand equity in Asia-Pacific. Their focus on natural and organic positioning has allowed them to scale rapidly across both online and offline channels. Niche-focused specialists such as Forest Essentials and Belif are capturing loyal consumer bases by combining bamboo actives with Ayurvedic or herbal blends. These brands emphasize clean-label formulations, vegan certifications, and eco-conscious packaging, appealing to younger demographics and ethical consumers.

Competitive differentiation is increasingly shifting from price and brand prestige to ingredient transparency, sustainability credentials, and digital engagement strategies. Brands that successfully integrate bamboo extract narratives with clean beauty and eco-friendly sourcing are expected to consolidate stronger market positions over the next decade.

Key Developments in Bamboo Extracts for Skin Market

| Item | Value |

|---|---|

| Quantitative Units | USD 862.4 Million |

| Function | Hydration, Soothing & calming, Anti-aging, Brightening |

| Product Type | Serums, Creams/lotions, Masks, Toners |

| Channel | E-commerce, Pharmacies, Specialty beauty stores, Mass retail |

| Claim | Natural/organic, Vegan, Clean-label, Sustainable sourcing |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Innisfree, The Face Shop, TonyMoly, Etude House, Nature Republic, Herbal Essences, Forest Essentials, Dr. Jart +, Amorepacific, Belif |

| Additional Attributes | Dollar sales by function and product type, adoption trends in hydration, soothing, anti-aging, and brightening skincare, rising demand for natural/organic and clean-label claims, sector-specific growth in e-commerce, pharmacies, specialty beauty stores, and mass retail, claim-based segmentation with emphasis on vegan and sustainable sourcing, integration of bamboo extracts into premium serums, creams/lotions, masks, and toners, regional trends shaped by Asia-Pacific expansion and European sustainability standards, and innovations in ingredient extraction, eco-friendly packaging, and digital-first retail strategies. |

The global Bamboo Extracts for Skin Market is estimated to be valued at USD 862.4 million in 2025.

The market size for the Bamboo Extracts for Skin Market is projected to reach USD 2,922.5 million by 2035.

The Bamboo Extracts for Skin Market is expected to grow at a 13.0% CAGR between 2025 and 2035.

The key product types in the Bamboo Extracts for Skin Market are serums, creams/lotions, masks, and toners. Among these, creams and lotions dominate with 46.5% share in 2025, making them the most significant product category.

In terms of product types, the creams/lotions segment is expected to command a leading share of the Bamboo Extracts for Skin Market in 2025, supported by daily usage patterns, strong consumer familiarity, and their suitability for hydration and anti-aging applications.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bamboo Straw Market Size and Share Forecast Outlook 2025 to 2035

Bamboo Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bamboo Apparel Market Size and Share Forecast Outlook 2025 to 2035

Bamboo Fiber Tableware and Kitchenware Market Size and Share Forecast Outlook 2025 to 2035

Bamboo Engineered Wood Market Size and Share Forecast Outlook 2025 to 2035

Bamboo Market Analysis - Demand, Trends & Industry Forecast 2024 to 2034

Bamboo Packaging Market Share, Growth & Trends 2025 to 2035

Bamboo Cups Market Analysis and Insights for 2025 to 2035

Bamboo Products Market Analysis – Trends & Growth 2025 to 2035

Market Share Insights for Bamboo Straw Providers

Bamboo Extracts for Anti-Aging Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Sustainable Bamboo Charcoal Market Size and Share Forecast Outlook 2025 to 2035

Extracts and Distillates Market

Meat Extracts Market Size and Share Forecast Outlook 2025 to 2035

Algae Extracts Market Size and Share Forecast Outlook 2025 to 2035

Maple Extracts Market Size and Share Forecast Outlook 2025 to 2035

Peony Extracts for Brightening Market Size and Share Forecast Outlook 2025 to 2035

Jujube Extracts Market Analysis by Type, End-Use, Distribution Channel, Region And Other Forms Through 2035

Coffee Extract Market Analysis by Nature, Product, End Use, Formulation, and Region through 2025 to 2035

Seaweed Extracts Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA