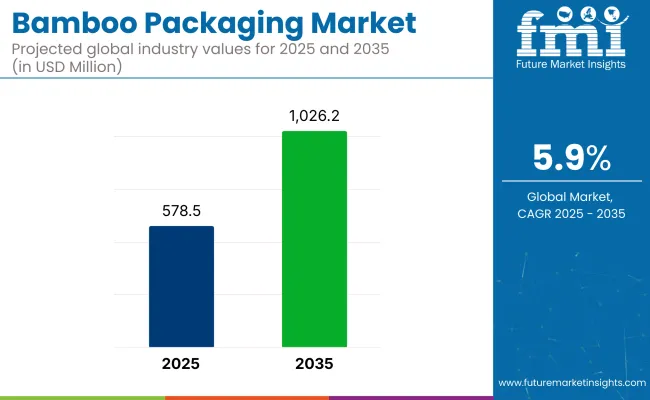

The bamboo packaging market is projected to grow from USD 578.5 million in 2025 to USD 1,026.2 million by 2035, registering a CAGR of 5.9% during the forecast period. Sales in 2024 reached USD 546.2 million. This growth has been attributed to increasing corporate and consumer demand for packaging solutions in electronics, food and beverage, and personal care sectors.

Regulatory pressures and plastic reduction initiatives have further driven adoption of bamboo-based products. The natural strength, renewability, and biodegradability of bamboo have positioned it as a premium alternative, while innovations in processing have improved barrier properties and design flexibility.

In October 2024, Southwest Airlines Co. introduced a new bamboo cup for inflight cold beverages and a wood stir stick with the carrier's iconic Heart branding. Both the new cup and stir stick are part of the carrier's ongoing work toward its goal to eliminate, where feasible, single-use plastics from inflight service by 2030.

"We expect our new bamboo cold cup, wood stir stick, and other initiatives to exceed our goal to reduce plastics from inflight service by 50% by weight by 2025, and we're excited to continue collaborating with our suppliers to work toward our goal of fully eliminating, where feasible, single-use plastics from inflight service by 2030," said Helen Giles, Managing Director of Environmental Sustainability at Southwest Airlines.

"It's been a year of work since we announced our Nonstop to Net Zero strategy, including our initiatives to tackle single-use plastics in our inflight service. Today's announcement celebrates the hard work and dedication of many Teams across Southwest to meet these goals."

Manufacturers have increasingly adopted antimicrobial bamboo coatings, water-based adhesives, and FSC-certified sources to enhance composability and hygiene. Advancements in 3D moulding, AI-enhanced quality control, and precision forming have enabled the production of complex container shapes and thin yet durable components.

Energy-efficient processing lines, solar drying systems, and reduced chemical processing have contributed to lower carbon footprints. Products meeting composability and recyclability standards are now being integrated into circular packaging strategies.

Bamboo packaging is being portrayed as a strategic solution to plastic reduction, regulatory compliance, and brand differentiation through eco-credentials. Continued investment in R&D, material certification, and cross-industry collaborations is expected to reinforce leadership in the packaging landscape.

The bamboo packaging market is expected to maintain strong momentum, supported by rising environmental policies and brand-level initiatives. Overall, regulatory support for plastic alternatives and increased e‑commerce packaging needs are expected to propel continued growth.

The market is segmented based on pulp type, packaging format, distribution channel, end use industry, and region. By pulp type, the market is divided into recycled pulp and virgin pulp. In terms of packaging format, the market includes cups & straws, bottles & jars, boxes & cartons, cutlery, trays, wrapping paper, packaging fillers, and others.

By distribution channel, the market is segmented into manufacturers bricks & mortar stores, including hypermarkets, supermarkets, discount stores, and other retail-distributors, and online platforms. In terms of end use industry, the market encompasses foods & beverages, healthcare, cosmetics & personal care, electrical & electronics, fashion and accessories, home and lifestyle, e-commerce, automotive, and agriculture. Regionally, the market is analyzed across North America, Latin America, Europe, South Asia, East Asia, the Middle East & Africa, and Oceania

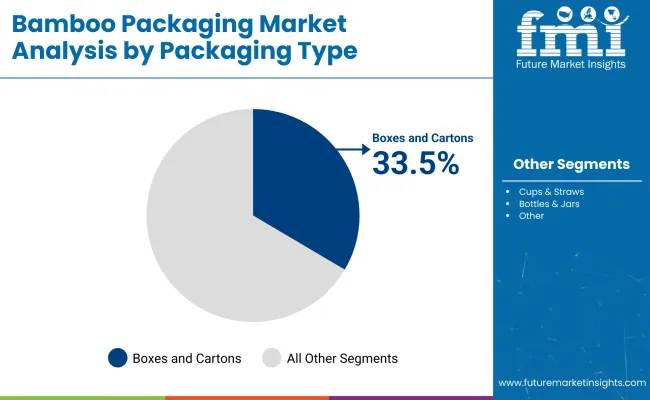

Boxes and cartons are projected to hold 33.5% of the bamboo packaging market by 2025, owing to their high structural integrity, ease of customization, and visual appeal. These formats have been increasingly preferred for primary and secondary packaging in personal care, health, and consumer goods categories.

Smooth surfaces and printable textures have enabled detailed branding and labeling with eco-conscious messaging, without requiring plastic coatings or synthetic treatments. Die-cut shapes, foldable structures, and interlocking tabs have been widely used to meet varying product size and protection requirements. Minimalist and luxury-oriented packaging has also been enhanced through bamboo cartons.

Bamboo’s antibacterial and moisture-resistant properties have supported the packaging of sensitive items, including skincare, cosmetics, and wellness products. Growing consumer demand for recyclable and biodegradable packaging has reinforced the adoption of bamboo cartons among premium and mid-range brands.

Global compliance with sourcing and disposal guidelines has further encouraged investment. As more companies shift from plastic and virgin paperboard toward renewable alternatives, bamboo boxes and cartons are expected to remain the cornerstone of eco-friendly product presentation. Expansion in e-commerce and direct-to-consumer delivery formats is likely to further solidify this segment’s dominance in both protective and display packaging.

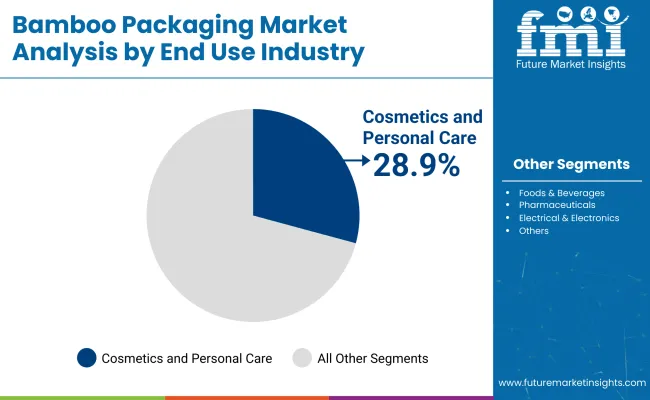

The cosmetics and personal care industry is expected to contribute 28.9% of total bamboo packaging demand by 2025, driven by pledges from global beauty brands and increased consumer awareness of eco-packaging. Bamboo’s natural texture, renewable origin, and biodegradability have made it a favored material for skincare, fragrance, and personal hygiene products.

Companies have utilized bamboo-based jars, caps, sleeves, and cartons to replace acrylic and plastic formats while retaining a premium look and tactile experience. Limited-edition product lines and gift sets have increasingly featured bamboo packaging to align with clean-label and organic branding strategies. The material has also been used in refillable and modular container designs.

Shelf appeal, product storytelling, and environmental compliance have all been enhanced through bamboo packaging formats that allow brand differentiation and low carbon footprints. Many start-ups and luxury labels have positioned bamboo as a central branding element, contributing to both aesthetics and ethics in packaging.

As regulations tighten and beauty consumers gravitate toward environmentally friendly solutions, bamboo packaging in the cosmetics and personal care segment is expected to rise steadily. Market expansion is anticipated in Asia Pacific, Europe, and North America, where ethical sourcing and packaging transparency are growing in importance.

High Costs and Regulatory Complexities

Various market factors affect the bamboo packaging market, such as its high production expenses, environmental directive mandates, and supply chain restrictions. Environmental scientists use renewable bamboo resources to create sustainable packaging materials, but expertise in making bamboo products durable leads to manufacturing expenses, which increase costs.

The market faces additional difficulty in obtaining sustainability certifications that include both the Forest Stewardship Council (FSC) and the European Union’s Packaging and Packaging Waste Directive. Companies must invest in processing technologies that deliver both reasonable prices and sustainable materials sourcing while providing scalable production methods to achieve cost-effective solutions that balance compliance with affordability.

Limited Consumer Awareness and Market Penetration

Many users show growing interest in sustainable packaging, but bamboo packaging remains unfamiliar in various parts of the market. Most businesses, along with consumers, remain undecided about bamboo's long-term advantages over conventional packaging materials, including plastic, glass, and metal.

Businesses that are reluctant to make the shift to bamboo packaging mention concerns about durability and moisture resistance as well as bamboo’s availability. Overcoming these barriers includes educating consumers, increasing product accessibility, and working closely with retailers to position bamboo packaging as a sustainable and long-term solution.

Rising Demand for Sustainable and Biodegradable Packaging

With a growing emphasis on reducing plastic usage and opting for sustainable packaging solutions, bamboo-based packaging offers a substantial opportunity. To push slightly further, a steadily growing number of sectors, from food & beverage to personal care and cosmetics, are switching to biodegradable and compostable packaging options to satisfy consumer demand and regulatory pressure. Therefore, companies focusing on high-quality bamboo processing, durable packaging innovation,s and aesthetically pleasing designs will attract environmentally conscious consumers and gain a competitive edge in the market.

Advancements in Bamboo Packaging Technologies and Circular Economy Initiatives

New applications for bamboo in the packaging sector are emerging, including engineered bamboo composites, water-resistant coatings, and biodegradable adhesives. Furthermore, the market is being driven by circular economy initiatives that promote recyclability and waste reduction.

As companies adopt smart packaging technologies, including QR-coded sustainability tracking and AI-enhanced supply chain monitoring, they will be able to engage consumers better and provide product insights at the same time. Companies that invest in closed-loop recycling systems and sustainable manufacturing technologies will be in charge of the growing green packaging industry.

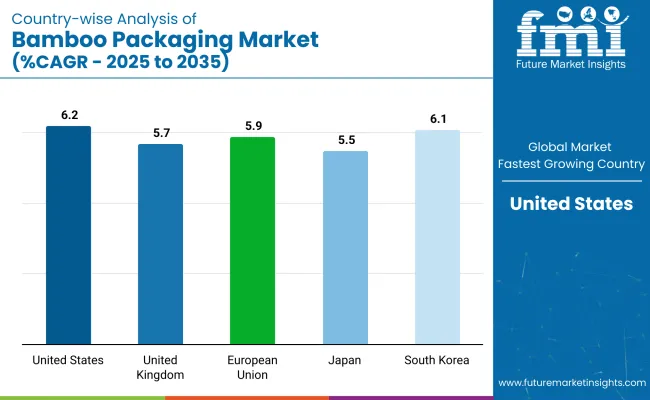

The USA bamboo packaging industry is growing due to rising consumer demand for sustainable and biodegradable packaging alternatives. Industry growth is being propelled by the demand for sustainable products in food and beverages and personal care.

Regulatory guidelines implemented by the governments in favour of minimizing the usage of plastic waste is expected to accelerate the usage of bamboo-based packaging. Owing to that, big retailers and brands are keeping bamboo packaging to support their sustainability efforts while improving brand image.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.2% |

The growing susceptibility of consumers towards environmental issues in the United Kingdom, coupled with stringent policies on plastic packaging, is driving the UK bamboo packaging market. More companies in food service, cosmetics, and e-commerce are integrating bamboo-focused solutions to achieve sustainability targets.

Sustainable branding and eco-conscious consumerism also increase the demand for bamboo packaging. Further supporting market growth are government incentives advocating for biodegradable packaging solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.7% |

The bamboo packaging market is expanding rapidly in the European Union, with Germany, France, and the Netherlands being the key economies. Stricter EU regulations around reducing plastic materials and sustainable packaging are driving businesses to turn towards bamboo alternatives.

Food and beverage is the primary industry for food packaging products, which are being gradually replaced with biodegradable and compostable counterparts. Moreover, innovation in bamboo-based packaging for retail and logistics applications is attributed to an even greater expansion of the market opportunities.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.9% |

Considering Japan's long history of adopting bamboo in traditional packaging, and the rising demand for modern sustainable solutions, the market for bamboo in Japan is growing, steadily, one of the many nations where eco-friendly development is becoming the norm. Market growth is benefiting from the burgeoning bamboo-based packaging across the cosmetics, food, and electronics industries.

Governments across the globe, meanwhile, are promoting green packaging and reducing plastic waste, further accelerating the adoption of bamboo alternates. Furthermore, continuous technological developments for durable and flexible bamboo packaging products are making these products more appealing.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.5% |

Driven by the increasing demand for sustainable packing solutions such as bamboo packaging from the cosmetics and skin care industry, the South Korean bamboo packaging market is growing. As sustainable K-beauty trends pull hard, this is boosting demand for biodegradable and refillable bamboo packaging.

Efforts to drive green manufacturing and corporate sustainability goals are also helping fuel the adoption of bamboo packaging in the country. Moreover, rising expenditure on packaging research and development and innovations in reusable bamboo-based materials are further driving the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.1% |

Industry Overview

The global Bamboo packaging market is experiencing positive growth, and it is attributed to the increasing consumer preference towards sustainable packaging, eco-friendly packaging, biodegradable, and also food-grade packaging. Bamboo is recognized as a highly-renewable source material that provides both strong and lightweight qualities; as such, it is seeing growth in food & beverage packaging, personal care packaging, electronics packaging, and e-commerce applications.

As governments and corporations are seeking sustainable alternatives to plastic, bamboo packaging is becoming a preferred option in different sectors. The prominent players in the industry are emphasizing biodegradable coatings, custom solutions, and innovative molding techniques to reduce environmental impact while enhancing product function.

The overall market size for Bamboo Packaging Market was USD 578.5 Million in 2025.

The Bamboo Packaging Market expected to reach USD 1,026.2 Million in 2035.

The demand for the bamboo packaging market will grow due to increasing consumer preference for sustainable and eco-friendly packaging, rising government regulations on plastic waste, growing adoption in food and beverage industries, and advancements in biodegradable packaging solutions.

The top 5 countries which drives the development of Bamboo Packaging Market are USA, UK, Europe Union, Japan and South Korea.

Cosmetics & Personal Care lead market growth to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bamboo Straw Market Size and Share Forecast Outlook 2025 to 2035

Bamboo Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bamboo Extracts for Anti-Aging Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Bamboo Extracts for Skin Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Bamboo Apparel Market Size and Share Forecast Outlook 2025 to 2035

Bamboo Fiber Tableware and Kitchenware Market Size and Share Forecast Outlook 2025 to 2035

Bamboo Engineered Wood Market Size and Share Forecast Outlook 2025 to 2035

Bamboo Market Analysis - Demand, Trends & Industry Forecast 2024 to 2034

Bamboo Cups Market Analysis and Insights for 2025 to 2035

Bamboo Products Market Analysis – Trends & Growth 2025 to 2035

Market Share Insights for Bamboo Straw Providers

Sustainable Bamboo Charcoal Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA