%Bamboo cups market is anticipated to grow to USD 62.2 million in 2025 and further reach USD 168.9 million by 2035. Sales are projected to grow at a CAGR of 10.5% over the forecast period from 2025 to 2035.

Bamboo cups are quickly picking up momentum in foodservice and retail industries because of their eco-friendly, reusable, and biodegradable status. The businesses will account for more than 60.4% of the sustainable drinkware industry share by 2035 due to rising regulatory backing for alternatives to plastic and consumer interest in environmentally friendly solutions.

This momentum is further accelerated by innovations in design and manufacturing that make bamboo cups more durable, microwave-safe, and aesthetically aligned with modern consumer preferences.

Within product types, reusable bamboo cups are likely to lead with a industry share of over 70%. Bamboo drinkware is generally in demand because it is durable, light in weight, and can be used as a substitute for single-use plastics in uses like coffee cups, travel mugs, and daily use drinkware. Other uses, such as disposable bamboo cups, are also seeing growing usage.

Bamboo Cups Industry Forecast

| Metric | Key Insights |

|---|---|

| Industry Size (2025E) | USD 62.2 million |

| Industry Value (2035F) | USD 168.9 million |

| CAGR (2025 to 2035) | 10.5% |

Growing Demand for Sustainable and Reusable Drink ware Fuels Market

Growth The escalating demand for eradicating single-use plastics has forced consumers and enterprises to opt for bamboo-based drinkware options. The supportive administration policies of promoting green materials are further enhancing the industrial growth.

Focus on Renewable and Biodegradable Materials Enhances Market

Adoption Drinking made out of bamboo is also getting recognition because of its biodegradable composition, which melts down naturally and causes less abuse to the environment. The foodservice sector is primarily moving forward and adapting bamboo coffee cups, travel mugs, and bio-degradable replacements.

Challenges in Cost and Large-Scale Production

The bamboo cups industry is confronted with higher production expenses over plastic materials. Furthermore, securing a reliable supply chain for bamboo-based materials continues to be the primary issue of concern. Nonetheless, continuous technology improvement in manufacturing and investments in green packaging products are likely to alleviate these problems.

| Key Investment Area | Why It’s Critical for Future Growth |

|---|---|

| Advanced Biodegradable Coatings | To improve durability and moisture resistance while remaining compostable. |

| Automation & AI in Bamboo Cup Production | To make it cheaper, more efficient and also increase the scale of manufacturing to meet global demand." |

| Premium & Customization Capabilities | To provide branded sustainable products to high-end beverage, hospitality, and lifestyle industries. |

| Circular Economy & Compostable Packaging | As regulators and consumers demand reusable and fully compostable bamboo-based solutions. |

| Government Collaboration & Compliance | Getting approvals done more quickly to ensure every single piece of packaging meets international sustainability regulations. |

During the time period of 2020 to 2024, the global bamboo cups industry witnessed a CAGR of 8.2%, with its growth surging from USD 38.1 million in 2020 to USD 52.22 million in 2024. The earlier year’s growth was anticipated because of the increasing consumer awareness related to green materials and prohibition on single-use plastic cups.

The sales for the bamboo reusable cups escalated as sustainability emerged as a top priority among consumers and companies. Government policies backing biodegradable and reusable packaging also helped in leading the adoption of these substances.

In the coming years, 2025 and 2035 the industry of bamboo cups is projected to experience a wide expansion with an estimated CAGR of 10.5% as these eco-friendly replacements will become the core point. With manufacturers exploring the hybrid materials including bamboo composites to improve the product performance and durability will also boost the industry growth.

With the upcoming developments in technologies, the AI-backed material optimization and concise manufacturing process will enhance product quality, advanced coating will improve waterproofing and thermal insulation will make the bamboo cups more versatile and long-lasting.

The industry will further flourish pushing the traditional segments, and lifting corporate gifting, travel and high-quality lifestyle brands. Customization features will become the industry standard incorporating high-quality digital printing and custom-molded branding.

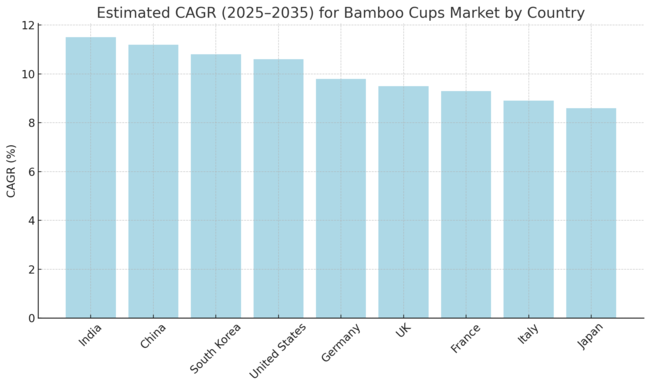

The United States is witnessing steady growth in the bamboo cups market, driven by increasing legislative restrictions on single-use plastics and a consumer shift toward sustainable alternatives. Retail giants and QSR (Quick Service Restaurant) chains are adopting biodegradable drinkware in response to both ESG mandates and consumer pressure.

Urban millennial and Gen Z populations, known for prioritizing sustainability in purchasing decisions, are propelling demand across both online and offline channels. While bamboo cups remain a niche within the broader drinkware segment, their adoption in office spaces, cafeterias, and lifestyle brands is expected to scale steadily over the forecast period.

India is set to be one of the fastest-growing markets for bamboo cups, fueled by its vast population, growing environmental consciousness, and a surge in eco-conscious startups. With multiple Indian states banning single-use plastics and a strong push toward circular economy practices, both urban cafes and traditional food vendors are transitioning to compostable alternatives.

Moreover, domestic manufacturing of bamboo products has picked up under "Make in India" initiatives, lowering cost barriers. Tier-1 and Tier-2 cities, in particular, are showing high adoption rates driven by green-living influencers and rising income levels, making India a hotbed for sustainable drinkware innovation.

Germany's bamboo cups market is underpinned by its deeply entrenched recycling culture and the EU-wide push for plastic reduction. Consumers in Germany are willing to pay premium prices for environmentally responsible products, particularly in metropolitan areas such as Berlin, Munich, and Hamburg.

Supermarkets and organic retailers prominently feature bamboo-based alternatives, and stringent waste management laws are encouraging widespread B2B adoption across hospitality and corporate catering services. However, growth remains moderately paced due to saturation in some eco-product segments and cautious consumer vetting of product certifications and origins

China is emerging as both a major producer and consumer of bamboo cups. The country’s abundant bamboo resources, coupled with government support for biodegradable product industries, make it an ideal ecosystem for market expansion. Domestic brands are increasingly exporting bamboo cups globally, while demand at home is surging due to rising urban affluence and tightening plastic regulations.

E-commerce platforms like JD.com and Taobao are playing a pivotal role in boosting visibility and access. As China's middle class grows, bamboo cups are becoming part of a broader “green lifestyle” movement that integrates health, sustainability, and design

The market is segmented by product type into single wall and double wall variants; by capacity, it includes up to 8 oz, 9 to 12 oz, 13 to 16 oz, and above 17 oz; by end-use, the market caters to industrial, commercial, and institutional sectors; by sales channel, it is distributed through both online and offline platforms; and by region, it spans North America, Latin America, Western Europe, Eastern Europe, Asia Pacific excluding Japan (APEJ), Japan, and the Middle East & Africa (MEA).

The market for bamboo cups will grow enormously between 2025 and 2035, with single-wall and double-wall both picking up. Single-wall bamboo cups will continue to be the popular choice for lightweight, day-to-day usage, especially at home and for everyday dining. Its low price point and sleek simplicity will appeal to environmentally aware customers seeking environmentally friendly alternatives to throwaway plastic and paper cups.

At the same time, double-wall bamboo cups will experience greater use in high-end and business environments, providing better insulation for hot and cold drinks. Their durability and temperature retention for longer periods will make them a standard in cafes, corporate offices, and travel-friendly beverage collections.

Bamboo cups in different sizes will meet changing consumer tastes and market needs. Small sizes up to 8 oz will target espresso enthusiasts and individuals looking for small, light, and easy-to-carry cups for speedy drinks. Variants of medium size, 9 to 12 oz, will lead the market since they match the regular coffee and tea serving sizes and are thus suited for mass consumption in cafeterias, offices, and for personal use.

In the lighter end drinks 13 to 16 oz has become widely used by consumers, who prefer to have longer drinks and appropriate for travel mugs and other on the go drinks. Demand for 17 oz. cups and above will continue to rise with the introduction of larger, multi-use bamboo tumblers for smoothies, iced drinks and all-day hydration needs.

With industrial, commercial and institutional end-segments, bamboo cups will facilitate a leading expansion. As a part of their employee welfare initiatives, corporate social responsibility, and innovative schemes by cafeteria the industrial segment will rapidly incorporate bamboo drinkware.

The commercial establishment, featuring restaurants, café outlets, and hotels adopt the bamboo cups as their mainstream solution to plastic and ceramic drinkware that also aligns with the rigid regulatory frameworks and the evolving consumers’ desire. Additionally, institutional consumers like schools, universities and corporate offices will buy bamboo drinkware as a part of zero-waste policies, providing biodegradable and non-toxic alternatives to students, employees, and visitors.

Both offline and online sales channels will drive the extensive reach of bamboo cups throughout the forecasting period. Online marketplaces will take over the market as direct-to-consumer companies use sustainability-based marketing campaigns and doorstep delivery services, which are convenient for customers.

Online shopping will provide clients with access to bespoke bamboo cups, limited runs, and special eco-friendly collections. Offline sales will also flourish, especially in specialty eco-shops, supermarkets, and specialty departments in large retail chains. Lifestyle stores, corporate resellers, and coffee houses will keep widening their bamboo cup presence, so customers can experience great quality eco-friendly drinkware at retail locations.

Tier 1 firms are industry leaders that have a substantial market share in the global bamboo cups market. Tier 1 firms possess extensive production capacities and a wide range of products. They are known for their competency in producing several varieties of bamboo-based beverage ware, such as reusable cups and travel mugs, and holding a strong international presence, underpinned by a strong customer base. Some of the leading businesses in tier 1 are Ecoffee Cup, Bamboovement, Huskup, Bambaw, and Pandoo.

Tier 2 firms are medium-sized players with good regional presence and high influence in the local industry. The firms possess decent technological abilities and compliance to regulation but do not possess superior technology and worldwide reach of tier 1 players. They serve niche applications and customized solutions for bamboo cups. Major firms in tier 2 are Zuperzozial, Chicmic, Jungle Culture, Green Island, and Ecoffee Cup UK.

Tier 3 consists of small enterprises at a local level, catering to local region needs. These are mainly interested in serving local industry requirements and belong to an unorganized sector in contrast to the organized operations of tier 1 and tier 2 firms.

Competitive Landscape Comparison of 2020 to 2024 with 2025 to 2035

| Manufacturer | Future Priorities |

|---|---|

| Bambu | Expanding into premium and reusable bamboo cup offerings for retail. |

| Ecoffee Cup | Enhancing heat resistance and durability while maintaining biodegradability. |

| Bamboo Cup (Chic Mic) | Scaling production for corporate gifting and large-scale commercial use. |

| Eco Bamboo Ware | Investing in advanced coatings for improved liquid resistance. |

| Go Zero Waste | Strengthening partnerships with coffee chains and sustainable brands. |

| BioGo | Expanding into heat-sealed bamboo cup lids and leak-proof designs. |

| Huski Home | Scaling up production for wholesale and bulk distribution globally. |

| Green cup | Targeting the corporate and events industry with branded bamboo cups. |

| Sustaina Cup | Introducing dishwasher-safe bamboo cups that also provide long-lasting reusability. |

| EKOBO | Investing in improved manufacturing processes for high-end bamboo cups. |

| The Other Straw | Expanding into packaging-free retail sales for zero-waste initiatives. |

| Company Strategy | Development |

|---|---|

| Product Launch | Ecoffee Cup came up with the innovative range of bamboo fiber cups with improved durability and heat-resistance, meeting with the increasing need for eco-friendly biodegradable replacements. |

| Partnership | Biopak collaborated with established coffee chains to supply compostable bamboo cups as part of their sustainability initiatives. |

| Acquisition | Stora Enso acquired a specialty bamboo packaging firm to expand its portfolio in renewable and biodegradable packaging solutions. |

| Certification | Circular&Co. became the first bamboo cup company in the world to achieve FSC® certification, which further demonstrates its commitment to responsibly sourced materials. |

| Product Innovation | KeepCup introduced a bamboo-based reusable coffee cup that comes with a bio-based lid, further decreasing its dependence on plastic. |

| Expansion | EcoSouLife expanded its production capacity to meet the increasing demand for bamboo-based drinkware in North America and Europe. |

| Manufacturer | Vendor Insights |

|---|---|

| Ecoffee Cup | Solidifies its industry presence with a new invention of dishwasher-safe bamboo cups. |

| Biopak | Increased sales through strategic partnerships with major coffee retailers. |

| Stora Enso | Expanded its product range in renewable drinkware solutions with bamboo-based materials. |

| Circular&Co. | Boosted industry credibility with FSC®-certified bamboo fiber cups. |

| Keep Cup | Introduced innovative bamboo-based lids to enhance product sustainability. |

| Eco SouLife | Focused on global expansion, particularly in North America and Europe. |

| Bamboo Cup | Gained traction with unique, artist-designed bamboo cups for premium markets. |

| Bobo&boo | Expanded its product portfolio with child-friendly bamboo drinking cups. |

Road Ahead: Future Considerations for Stakeholders

The industry is approximated to observe a CAGR of 10.5% between 2025 and 2035.

The industry is anticipated to reach USD 168.9 million by 2035.

Europe is most likely to be emerged as the leading player with the highest CAGR due to stringent environmental regulations and strong consumer demand for sustainable products.

Key players include Ecoffee Cup, Biopak, Stora Enso, and Circular&Co.

Table 1: Global Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 6: Global Volume (Units) Forecast by Capacity, 2018 to 2033

Table 7: Global Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 8: Global Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 9: Global Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 10: Global Volume (Units) Forecast by End Use, 2018 to 2033

Table 11: North America Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 14: North America Volume (Units) Forecast by Product Type, 2018 to 2033

Table 15: North America Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 16: North America Volume (Units) Forecast by Capacity, 2018 to 2033

Table 17: North America Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 18: North America Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 19: North America Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 20: North America Volume (Units) Forecast by End Use, 2018 to 2033

Table 21: Latin America Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: Latin America Volume (Units) Forecast by Product Type, 2018 to 2033

Table 25: Latin America Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 26: Latin America Volume (Units) Forecast by Capacity, 2018 to 2033

Table 27: Latin America Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 28: Latin America Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 29: Latin America Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 30: Latin America Volume (Units) Forecast by End Use, 2018 to 2033

Table 31: Europe Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Europe Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: Europe Volume (Units) Forecast by Product Type, 2018 to 2033

Table 35: Europe Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 36: Europe Volume (Units) Forecast by Capacity, 2018 to 2033

Table 37: Europe Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 38: Europe Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 39: Europe Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 40: Europe Volume (Units) Forecast by End Use, 2018 to 2033

Table 41: East Asia Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: East Asia Volume (Units) Forecast by Country, 2018 to 2033

Table 43: East Asia Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: East Asia Volume (Units) Forecast by Product Type, 2018 to 2033

Table 45: East Asia Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 46: East Asia Volume (Units) Forecast by Capacity, 2018 to 2033

Table 47: East Asia Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 48: East Asia Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 49: East Asia Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 50: East Asia Volume (Units) Forecast by End Use, 2018 to 2033

Table 51: South Asia Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia Volume (Units) Forecast by Country, 2018 to 2033

Table 53: South Asia Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 54: South Asia Volume (Units) Forecast by Product Type, 2018 to 2033

Table 55: South Asia Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 56: South Asia Volume (Units) Forecast by Capacity, 2018 to 2033

Table 57: South Asia Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 58: South Asia Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 59: South Asia Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 60: South Asia Volume (Units) Forecast by End Use, 2018 to 2033

Table 61: Oceania Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: Oceania Volume (Units) Forecast by Country, 2018 to 2033

Table 63: Oceania Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 64: Oceania Volume (Units) Forecast by Product Type, 2018 to 2033

Table 65: Oceania Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 66: Oceania Volume (Units) Forecast by Capacity, 2018 to 2033

Table 67: Oceania Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 68: Oceania Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 69: Oceania Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 70: Oceania Volume (Units) Forecast by End Use, 2018 to 2033

Table 71: MEA Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: MEA Volume (Units) Forecast by Country, 2018 to 2033

Table 73: MEA Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 74: MEA Volume (Units) Forecast by Product Type, 2018 to 2033

Table 75: MEA Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 76: MEA Volume (Units) Forecast by Capacity, 2018 to 2033

Table 77: MEA Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 78: MEA Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 79: MEA Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 80: MEA Volume (Units) Forecast by End Use, 2018 to 2033

Figure 1: Global Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Value (US$ Million) by Capacity, 2023 to 2033

Figure 3: Global Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 4: Global Value (US$ Million) by End Use, 2023 to 2033

Figure 5: Global Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 11: Global Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 12: Global Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 13: Global Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 14: Global Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 15: Global Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 16: Global Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 17: Global Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 18: Global Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 19: Global Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 20: Global Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 21: Global Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 22: Global Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 23: Global Volume (Units) Analysis by End Use, 2018 to 2033

Figure 24: Global Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 25: Global Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 26: Global Attractiveness by Product Type, 2023 to 2033

Figure 27: Global Attractiveness by Capacity, 2023 to 2033

Figure 28: Global Attractiveness by Sales Channel, 2023 to 2033

Figure 29: Global Attractiveness by End Use, 2023 to 2033

Figure 30: Global Attractiveness by Region, 2023 to 2033

Figure 31: North America Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: North America Value (US$ Million) by Capacity, 2023 to 2033

Figure 33: North America Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 34: North America Value (US$ Million) by End Use, 2023 to 2033

Figure 35: North America Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 41: North America Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 42: North America Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 43: North America Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 44: North America Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 45: North America Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 46: North America Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 47: North America Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 48: North America Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 49: North America Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 50: North America Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 51: North America Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 52: North America Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 53: North America Volume (Units) Analysis by End Use, 2018 to 2033

Figure 54: North America Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 55: North America Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 56: North America Attractiveness by Product Type, 2023 to 2033

Figure 57: North America Attractiveness by Capacity, 2023 to 2033

Figure 58: North America Attractiveness by Sales Channel, 2023 to 2033

Figure 59: North America Attractiveness by End Use, 2023 to 2033

Figure 60: North America Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Latin America Value (US$ Million) by Capacity, 2023 to 2033

Figure 63: Latin America Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 64: Latin America Value (US$ Million) by End Use, 2023 to 2033

Figure 65: Latin America Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 71: Latin America Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 72: Latin America Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 73: Latin America Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 74: Latin America Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 75: Latin America Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 76: Latin America Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 77: Latin America Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 78: Latin America Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 79: Latin America Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 80: Latin America Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 81: Latin America Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 82: Latin America Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 83: Latin America Volume (Units) Analysis by End Use, 2018 to 2033

Figure 84: Latin America Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 85: Latin America Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 86: Latin America Attractiveness by Product Type, 2023 to 2033

Figure 87: Latin America Attractiveness by Capacity, 2023 to 2033

Figure 88: Latin America Attractiveness by Sales Channel, 2023 to 2033

Figure 89: Latin America Attractiveness by End Use, 2023 to 2033

Figure 90: Latin America Attractiveness by Country, 2023 to 2033

Figure 91: Europe Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: Europe Value (US$ Million) by Capacity, 2023 to 2033

Figure 93: Europe Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 94: Europe Value (US$ Million) by End Use, 2023 to 2033

Figure 95: Europe Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Europe Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 101: Europe Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 102: Europe Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 103: Europe Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 104: Europe Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 105: Europe Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 106: Europe Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 107: Europe Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 108: Europe Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 109: Europe Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 110: Europe Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 111: Europe Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 112: Europe Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 113: Europe Volume (Units) Analysis by End Use, 2018 to 2033

Figure 114: Europe Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 115: Europe Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 116: Europe Attractiveness by Product Type, 2023 to 2033

Figure 117: Europe Attractiveness by Capacity, 2023 to 2033

Figure 118: Europe Attractiveness by Sales Channel, 2023 to 2033

Figure 119: Europe Attractiveness by End Use, 2023 to 2033

Figure 120: Europe Attractiveness by Country, 2023 to 2033

Figure 121: East Asia Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: East Asia Value (US$ Million) by Capacity, 2023 to 2033

Figure 123: East Asia Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 124: East Asia Value (US$ Million) by End Use, 2023 to 2033

Figure 125: East Asia Value (US$ Million) by Country, 2023 to 2033

Figure 126: East Asia Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: East Asia Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: East Asia Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: East Asia Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: East Asia Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 131: East Asia Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 132: East Asia Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 133: East Asia Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 134: East Asia Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 135: East Asia Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 136: East Asia Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 137: East Asia Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 138: East Asia Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 139: East Asia Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 140: East Asia Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 141: East Asia Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 142: East Asia Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 143: East Asia Volume (Units) Analysis by End Use, 2018 to 2033

Figure 144: East Asia Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 145: East Asia Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 146: East Asia Attractiveness by Product Type, 2023 to 2033

Figure 147: East Asia Attractiveness by Capacity, 2023 to 2033

Figure 148: East Asia Attractiveness by Sales Channel, 2023 to 2033

Figure 149: East Asia Attractiveness by End Use, 2023 to 2033

Figure 150: East Asia Attractiveness by Country, 2023 to 2033

Figure 151: South Asia Value (US$ Million) by Product Type, 2023 to 2033

Figure 152: South Asia Value (US$ Million) by Capacity, 2023 to 2033

Figure 153: South Asia Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 154: South Asia Value (US$ Million) by End Use, 2023 to 2033

Figure 155: South Asia Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: South Asia Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 161: South Asia Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 162: South Asia Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 163: South Asia Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 164: South Asia Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 165: South Asia Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 166: South Asia Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 167: South Asia Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 168: South Asia Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 169: South Asia Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 170: South Asia Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 171: South Asia Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 172: South Asia Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 173: South Asia Volume (Units) Analysis by End Use, 2018 to 2033

Figure 174: South Asia Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 175: South Asia Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 176: South Asia Attractiveness by Product Type, 2023 to 2033

Figure 177: South Asia Attractiveness by Capacity, 2023 to 2033

Figure 178: South Asia Attractiveness by Sales Channel, 2023 to 2033

Figure 179: South Asia Attractiveness by End Use, 2023 to 2033

Figure 180: South Asia Attractiveness by Country, 2023 to 2033

Figure 181: Oceania Value (US$ Million) by Product Type, 2023 to 2033

Figure 182: Oceania Value (US$ Million) by Capacity, 2023 to 2033

Figure 183: Oceania Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 184: Oceania Value (US$ Million) by End Use, 2023 to 2033

Figure 185: Oceania Value (US$ Million) by Country, 2023 to 2033

Figure 186: Oceania Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: Oceania Volume (Units) Analysis by Country, 2018 to 2033

Figure 188: Oceania Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: Oceania Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: Oceania Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 191: Oceania Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 192: Oceania Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 193: Oceania Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 194: Oceania Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 195: Oceania Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 196: Oceania Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 197: Oceania Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 198: Oceania Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 199: Oceania Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 200: Oceania Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 201: Oceania Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 202: Oceania Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 203: Oceania Volume (Units) Analysis by End Use, 2018 to 2033

Figure 204: Oceania Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 205: Oceania Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 206: Oceania Attractiveness by Product Type, 2023 to 2033

Figure 207: Oceania Attractiveness by Capacity, 2023 to 2033

Figure 208: Oceania Attractiveness by Sales Channel, 2023 to 2033

Figure 209: Oceania Attractiveness by End Use, 2023 to 2033

Figure 210: Oceania Attractiveness by Country, 2023 to 2033

Figure 211: MEA Value (US$ Million) by Product Type, 2023 to 2033

Figure 212: MEA Value (US$ Million) by Capacity, 2023 to 2033

Figure 213: MEA Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 214: MEA Value (US$ Million) by End Use, 2023 to 2033

Figure 215: MEA Value (US$ Million) by Country, 2023 to 2033

Figure 216: MEA Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: MEA Volume (Units) Analysis by Country, 2018 to 2033

Figure 218: MEA Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: MEA Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: MEA Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 221: MEA Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 222: MEA Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 223: MEA Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 224: MEA Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 225: MEA Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 226: MEA Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 227: MEA Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 228: MEA Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 229: MEA Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 230: MEA Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 231: MEA Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 232: MEA Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 233: MEA Volume (Units) Analysis by End Use, 2018 to 2033

Figure 234: MEA Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 235: MEA Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 236: MEA Attractiveness by Product Type, 2023 to 2033

Figure 237: MEA Attractiveness by Capacity, 2023 to 2033

Figure 238: MEA Attractiveness by Sales Channel, 2023 to 2033

Figure 239: MEA Attractiveness by End Use, 2023 to 2033

Figure 240: MEA Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bamboo Straw Market Size and Share Forecast Outlook 2025 to 2035

Bamboo Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bamboo Extracts for Anti-Aging Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Bamboo Extracts for Skin Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Bamboo Apparel Market Size and Share Forecast Outlook 2025 to 2035

Bamboo Fiber Tableware and Kitchenware Market Size and Share Forecast Outlook 2025 to 2035

Bamboo Engineered Wood Market Size and Share Forecast Outlook 2025 to 2035

Bamboo Market Analysis - Demand, Trends & Industry Forecast 2024 to 2034

Bamboo Packaging Market Share, Growth & Trends 2025 to 2035

Bamboo Products Market Analysis – Trends & Growth 2025 to 2035

Market Share Insights for Bamboo Straw Providers

Sustainable Bamboo Charcoal Market Size and Share Forecast Outlook 2025 to 2035

Foam Cups Market Size and Share Forecast Outlook 2025 to 2035

Paper Cups Market Size and Share Forecast Outlook 2025 to 2035

Leading Providers & Market Share in Paper Cups Industry

Sippy Cups Market Analysis – Size, Growth & Trends to 2033

Edible Cups Market Size and Share Forecast Outlook 2025 to 2035

Dosage Cups Market Size and Share Forecast Outlook 2025 to 2035

Vending Cups Market Size and Share Forecast Outlook 2025 to 2035

Pre-Made Cups Market Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA