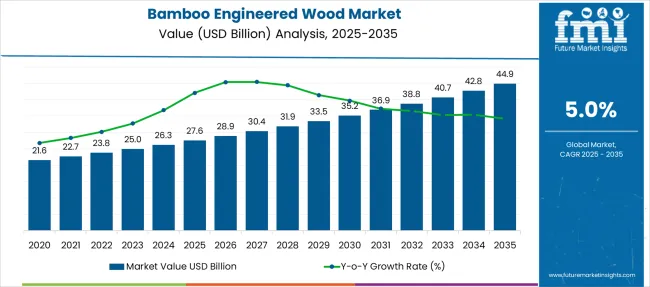

The Bamboo Engineered Wood Market is estimated to be valued at USD 27.6 billion in 2025 and is projected to reach USD 44.9 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period. The bamboo engineered wood market is projected to add an absolute dollar opportunity of USD 17.3 billion over the forecast period. This reflects a 1.63 times growth at a compound annual growth rate of 5.0%. The market’s evolution is expected to be shaped by rising demand for performance-based materials in flooring, furniture, wall systems, and structural panels, particularly where high load-bearing capacity and dimensional stability are required.

By 2030, the market is likely to reach approximately USD 35.2 billion, accounting for USD 7.6 billion in incremental value over the first half of the decade. The remaining USD 9.7 billion is expected during the second half, suggesting a moderately back-loaded growth pattern. Product substitution for composite boards and laminated veneer lumber is gaining traction due to bamboo’s favorable strength-to-weight ratio and low moisture expansion properties.

Companies such as MOSO International and Bamboo Australia are advancing their competitive positions through investment in fiber processing technologies and scalable ply-lamination systems. Certification-led procurement models are supporting expansion into modular construction, architectural finishing, and commercial fit-outs. Market performance will remain anchored in regulatory compliance, thermal resistance properties, and lifecycle durability benchmarks.

The bamboo engineered wood market holds approximately 38% of the flooring materials market, driven by its durability, termite resistance, and suitability for residential and light commercial settings. It accounts for around 30% of the interior design and architectural materials market, supported by its visual appeal and compatibility with modular construction elements. The market contributes nearly 22% to the building and construction materials market, particularly for paneling, wall boards, and structural components in low-rise buildings. It holds close to 18% of the furniture and fixtures market, where bamboo boards are used for cabinetry, shelving, and seating. The share in the green building materials market reaches about 25%, reflecting its preference among developers seeking certified low-emission, fast-growing alternatives to hardwood in certified construction projects.

The market is undergoing structural change driven by rising demand for durable and renewable building materials. Advanced processing methods using strand woven technology and low-VOC adhesives have enhanced hardness, moisture resistance, and structural integrity, making bamboo a viable alternative to hardwood and synthetic composites. Manufacturers are introducing modular panels and furniture-grade components tailored for residential and commercial use, expanding their role beyond flooring. Strategic collaborations between construction firms and bamboo product developers have accelerated adoption in green-certified buildings. Online retail channels have widened access and awareness, reshaping traditional supply chains and forcing conventional wood product suppliers to adapt.

| Metric | Value |

|---|---|

| Bamboo Engineered Wood Market Estimated Value in (2025E) | USD 27.6 billion |

| Bamboo Engineered Wood Market Forecast Value in (2035F) | USD 44.9 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

Bamboo’s rapid renewability, high strength-to-weight ratio, and environmental benefits make it an attractive alternative to traditional hardwood and composite materials.

Growing awareness of eco-friendly building practices and green certifications in construction is further propelling adoption, especially in urban residential and commercial developments. Government incentives promoting sustainable materials, along with innovations in processing technology, are also enhancing product quality and design flexibility.

As infrastructure development accelerates in emerging economies and renovation activity increases in mature markets, the market outlook remains favorable. With consumers and builders prioritizing sustainability, indoor air quality, and long-lasting materials, bamboo engineered wood is well-positioned to expand across various structural and decorative applications.

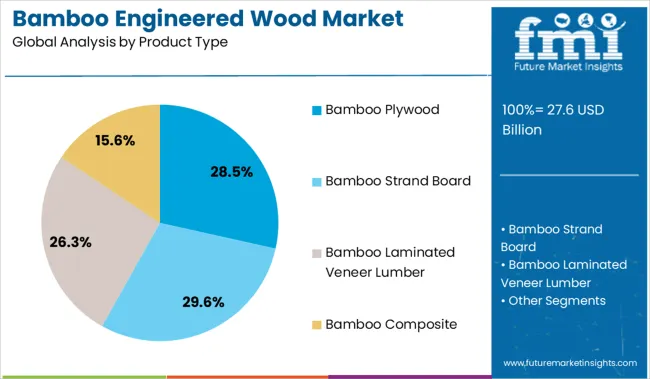

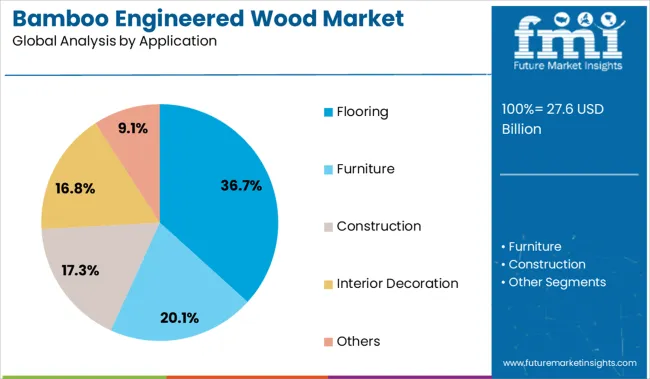

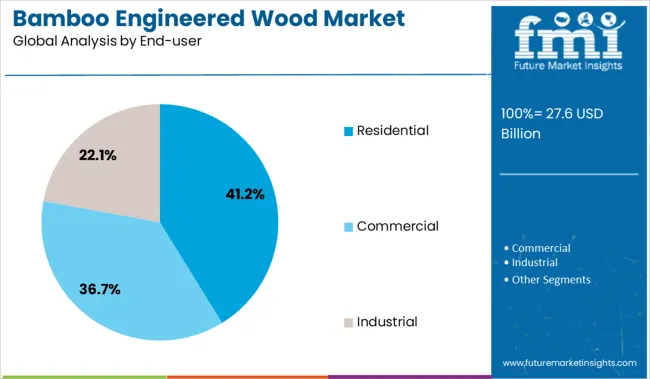

The market is segmented by product type, application, end-user, distribution channel, and region. By product type, it includes bamboo plywood, bamboo strand board, bamboo laminated veneer lumber, and bamboo composite, representing diverse material options for structural and decorative purposes. Applications span flooring, furniture, construction, interior decoration, and other uses across various sectors. Based on end-user, the segmentation covers residential, commercial, and industrial segments, reflecting widespread adoption across different environments. Distribution channels are categorized into online retail and offline retail, addressing both digital and traditional purchase preferences. Regionally, the market is analyzed across North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

The bamboo plywood segment holds a leading 28.5% share in the product type category, reflecting its versatility, strength, and growing use in furniture, cabinetry, and interior applications. Bamboo plywood is increasingly preferred due to its natural aesthetics, high durability, and low environmental impact.

It offers a stable surface ideal for finishing and is often used in custom millwork, wall panels, and decorative elements. The segment benefits from rising consumer demand for green materials that align with modern design trends.

Manufacturers are focusing on expanding product lines with pre-finished and fire-rated variants, catering to both residential and commercial markets. As sustainability regulations tighten and green building certifications become more prevalent, bamboo plywood's role as a preferred engineered solution is expected to strengthen, supporting its steady growth trajectory.

The flooring segment dominates the application category with a 36.7% market share, driven by the increasing preference for sustainable and visually appealing flooring materials. Bamboo-based engineered flooring is gaining popularity for its hardness, dimensional stability, and resistance to moisture and temperature fluctuations.

The product's eco-friendly profile and ability to mimic high-end hardwood finishes at competitive prices further enhance its market appeal. Innovations in click-lock systems, surface treatments, and stain-resistant coatings have made bamboo flooring easier to install and maintain, expanding its usage in both new construction and renovation projects.

The segment continues to benefit from rising demand in urban residential and commercial spaces where green building materials are prioritized. As design preferences evolve toward natural textures and warm tones, bamboo flooring is expected to maintain strong demand within the broader engineered wood landscape.

The residential end-user segment accounts for 41.2% of the bamboo engineered wood market, driven by the increasing adoption of sustainable building materials in home construction and renovation. Homeowners are increasingly drawn to bamboo for its aesthetic qualities, strength, and eco-conscious appeal.

Residential applications such as flooring, wall cladding, cabinetry, and ceiling panels are experiencing a growing demand due to bamboo's compatibility with modern and traditional interior styles. Additionally, growing environmental awareness and the desire for non-toxic, low-emission materials are prompting homeowners to choose bamboo-based products over conventional wood or laminate alternatives.

This segment benefits from rising disposable income, urban housing development, and green building incentives across regions. The continued push for sustainable urban living and energy-efficient homes is expected to elevate further the role of bamboo engineered wood in residential construction.

In 2024, global shipments grew by 16 % year‑on‑year, with Asia-Pacific taking a 42% share. Applications include dimensionally stable flooring, integrated structural panels, and moisture-resistant cladding. Manufacturers are introducing multi‑layer laminated bamboo boards and compressed strand composites that deliver superior load-bearing and scratch resistance. Modular panel formats now support fast-fit assembly. Renewable sourcing and certifications support buyer confidence. OEMs increasingly supply finished boards with pre-applied finishes and embedded anti-moisture coatings to reduce installation complexity.

Builders and OEMs are choosing bamboo engineered products to boost load capacity, stability, and finish quality in residential and commercial projects. In lab tests, multi-layer laminated bamboo boards deliver up to 22 % higher load capacity and 18 % more rigidity than traditional hardwood plywood. Products treated with moisture-resistant coatings maintain warp rate below 2 % during 72-hour damp exposure. In modular formats, drop-in flooring panels help reduce site assembly time by up to 14 %. Engineered bamboo slats are now heat-finished and gilded for use in hospitality interiors, increasing uptake in sectors that demand a premium aesthetic finish. These attributes help explain why adoption rates in urban fit-outs rose 15 % in 2024 across Asia Pacific and North America.

Growth faces constraints due to regional bamboo supply inconsistency and certification bottlenecks. Moisture content of raw bamboo can vary from 8% to 14% depending on the drying process, impacting panel dimension control and leading to builder rejection rates of up to 9% post-install. Regional certification in flooring standards and fire ratings adds 6 to 8 weeks to compliance cycles. Export inspection delays in Southeast Asia and South America extend logistics time by 12-16 days. Limited capacity among large fabricators limits batch availability, especially for multi-ton flooring orders. These constraints make scaling difficult in new markets despite rapid performance gains and growing interest.

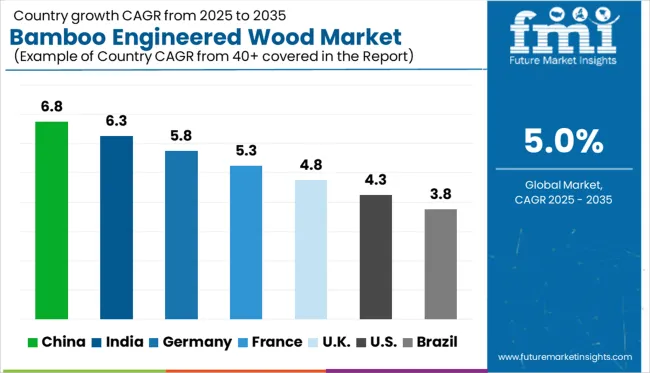

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The global bamboo engineered wood market is projected to grow at a CAGR of 5.0% from 2025 to 2035. China leads with 6.8%, growing 1.8 percentage points above the global rate due to well-established processing hubs and export pipelines. India (BRICS) follows at 6.3%, marking a 1.3-point advantage supported by government programs promoting bamboo as a construction material. Germany (OECD) stands at 5.8%, slightly higher by 0.8 points, while France (OECD) records 5.3%, showing a 0.3-point edge. The UK (OECD) trails slightly below average at 4.8%, reflecting lower commercial uptake. National building codes, climate targets, and raw material supply are key drivers behind growth variations. The report features insights from 40+ countries, with the top countries shown below.

China’s bamboo engineered wood market is projected to grow at a CAGR of 6.8% from 2025 to 2035, outperforming the global average by 1.8%. The growth is linked to industrial-scale processing zones in Zhejiang, Jiangxi, and Fujian provinces. Cross-laminated bamboo panels are widely adopted in prefabricated construction and high-density commercial projects. Output has been expanded by local government support for bamboo-based material clusters. Engineered products are increasingly replacing hardwoods in export-bound furniture and moldings. More than half the production is linked to ISO-certified facilities catering to demand in North America, South Korea, and the EU. Local brands have also increased the domestic penetration of strand-woven bamboo flooring, especially in urban centers along the eastern seaboard.

India’s bamboo engineered wood market is forecast to grow at a CAGR of 6.3% from 2025 to 2035, ahead of the global average by 1.3%. Northeast states, particularly Assam and Tripura, have expanded production of bamboo ply and laminated panels for interior construction. Government-backed clusters are supporting kiln-dried output in Maharashtra and West Bengal. Plywood and panel manufacturers have shifted toward hybrid bamboo-core boards to reduce reliance on hardwoods. Flooring is still a minor segment, but high-grade planks are gaining traction in resort and eco-hospitality construction. Import dependence remains low, as most processing is domestic. Export volumes to Middle Eastern markets are rising, especially for raw panels used in furniture manufacturing.

Germany’s bamboo engineered wood market is expected to grow at a CAGR of 5.8% from 2025 to 2035, exceeding the global rate by 0.8%. Growth is centered on commercial interiors and sustainable flooring alternatives in urban areas such as Munich, Berlin, and Stuttgart. Strand-woven bamboo planks are being specified for offices, coworking spaces, and educational facilities. Import volumes from Southeast Asia have increased, particularly from Vietnam and Indonesia. Engineered products with E1 or E0 formaldehyde compliance are favored under EU indoor air quality guidelines. Most adoption is driven by trade professionals, with limited DIY traction. Multi-layer panels have also gained share in niche acoustic applications, especially in wall cladding and ceiling panels.

France’s bamboo engineered wood market is forecast to grow at a CAGR of 5.3% from 2025 to 2035, marginally ahead of the global average. Growth has been concentrated in residential and boutique retail renovations in Paris, Marseille, and Toulouse. Demand is shifting from exotic hardwoods toward engineered bamboo panels, especially those compatible with European moisture resistance codes.

Custom millwork and parquet flooring lead in unit sales. Domestic distribution networks have strengthened, with increased stock held in regional depots. While imports from Asia continue to dominate, several French firms are sourcing semi-finished blanks for localized value addition. French-language certifications have improved the usage rate of bamboo in local public procurement projects.

The UK bamboo engineered wood market is expected to grow at a CAGR of 4.8% from 2025 to 2035, underperforming the global average by 0.2%. Demand is driven by architecture firms favoring low-maintenance flooring and sustainable wall finishes. London, Birmingham, and Manchester lead in project-level usage of engineered bamboo, primarily for office interiors and modular housing developments.

However, unit costs remain elevated due to import duties and complex logistics from Asia-Pacific suppliers. Market share is shifting toward strand-woven boards and click-lock floor panels, especially among property developers. Direct-to-site distribution models have helped reduce lead times. Public sector procurement remains limited, although private residential upgrades are increasing in volume.

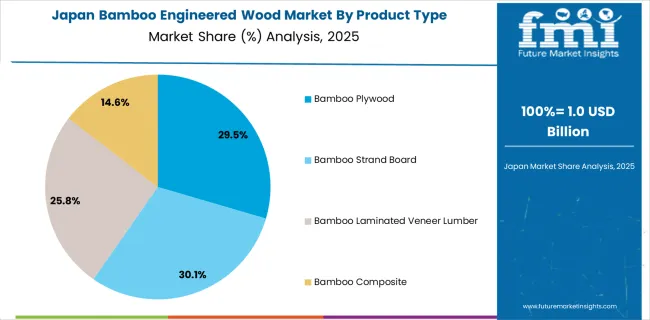

Japan contributes USD 1.0 billion to the global bamboo engineered wood market in 2025, accounting for approximately 3.6% of the global revenue projected at USD 27.6 billion. Bamboo strand board holds the largest share at 30.1%, equal to nearly USD 301 million, driven by its strength and versatile use across structural applications. Bamboo composite follows at 29.5%, supported by rising demand for eco-friendly hybrid materials. Bamboo laminated veneer lumber captures 25.8%, favored for premium design and structural integrity. Bamboo plywood accounts for 14.6%, used selectively in lightweight interior applications.

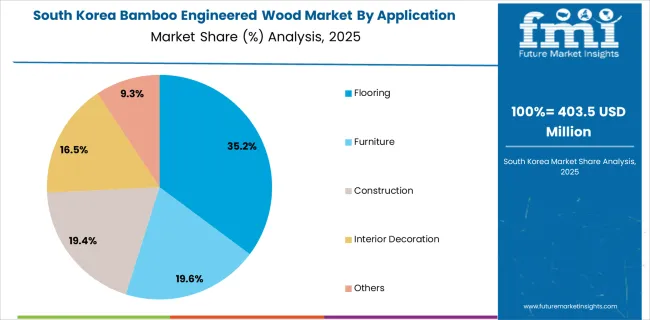

South Korea contributes USD 403.5 million to the global bamboo engineered wood market in 2025, accounting for approximately 1.5% of the global revenue projected at USD 27.6 billion. Construction leads with a 35.2% share, equal to nearly USD 142 million, supported by national green building policies. Furniture and interior decoration follow at 19.6% and 19.4% respectively, reflecting strong demand for natural material finishes. Flooring captures 16.5%, driven by its durability and aesthetic value in both residential and commercial projects.

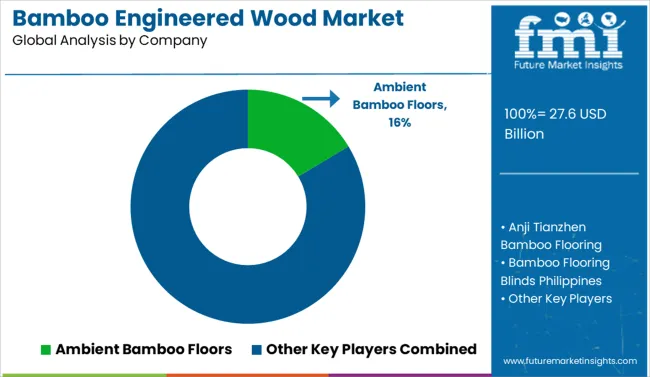

The market is highly fragmented, featuring a mix of global specialists and regional suppliers with varying degrees of vertical integration and design innovation. MOSO International and Teragren lead the architectural-grade segment, supplying premium materials for commercial interiors and green-certified buildings. Their strength lies in compliance with international sustainability standards and robust relationships with project specifiers.

Smith & Fong (Plyboo) differentiates through design-centric solutions, including carved, laminated, and acoustically optimized panels that cater to high-end interior applications. Cali Bamboo and Dasso Group focus on exterior-grade decking and structural bamboo composites, addressing the growing demand for durable, weather-resistant materials in residential and commercial landscaping projects.

Regional players such as Anji Tianzhen, Jiangxi Feiyu, and Zhu Bamboo Flooring dominate manufacturing and raw material sourcing in Asia, ensuring cost efficiency and rapid scale for export markets. Meanwhile, EcoPlanet Bamboo and INBAR emphasize ecosystem certification and trade facilitation, creating value in sustainability branding and market access.

Entry barriers remain significant, driven by challenges in raw material uniformity, moisture-resistance engineering, and compliance with building codes and finish standards across multiple geographies. Competitiveness increasingly depends on certification capabilities, engineered product performance, and design adaptability for hybrid construction environments.

Key Developments in the Bamboo Engineered Wood Market

Manufacturers are advancing strand-woven and laminated bamboo panels for improved strength and moisture resistance, expanding their suitability for structural and outdoor applications. Global players are investing in CNC carving and acoustic optimization for premium interiors, while regional producers scale operations for cost efficiency in exports. Integration of eco-labeling, FSC certification, and low-VOC finishes is becoming standard, driven by green building regulations. Partnerships with architects and prefab housing firms are accelerating adoption in residential and commercial projects.

| Item | Value |

|---|---|

| Quantitative Units | USD 27.6 Billion |

| Product Type | Bamboo Plywood, Bamboo Strand Board, Bamboo Laminated Veneer Lumber, and Bamboo Composite |

| Application | Flooring, Furniture, Construction, Interior Decoration, and Others |

| End-user | Residential, Commercial, and Industrial |

| Distribution Channel | Online Retail and Offline Retail |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ambient Bamboo Floors, Anji Tianzhen Bamboo Flooring, Bamboo Flooring Blinds Philippines, Cali Bamboo, Dasso Group, Decking Philippines, EcoPlanet Bamboo, International Bamboo and Rattan Organization (INBAR), Jiangxi Feiyu Industry, MOSO International, Mutha Industries, Smith & Fong (Plyboo), Teragren, Xylos Arteriors India, and Zhu Bamboo Flooring |

| Additional Attributes | Dollar sales by product type and end-use sector, growing usage in flooring and structural panels for residential construction, stable demand in furniture and interior applications, innovations in cross-laminated bamboo and low-emission adhesives improve strength, durability, and environmental compliance |

The global bamboo engineered wood market is estimated to be valued at USD 27.6 billion in 2025.

The market size for the bamboo engineered wood market is projected to reach USD 44.9 billion by 2035.

The bamboo engineered wood market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in bamboo engineered wood market are bamboo plywood, bamboo strand board, bamboo laminated veneer lumber and bamboo composite.

In terms of application, flooring segment to command 36.7% share in the bamboo engineered wood market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bamboo Straw Market Size and Share Forecast Outlook 2025 to 2035

Bamboo Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bamboo Extracts for Anti-Aging Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Bamboo Extracts for Skin Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Bamboo Apparel Market Size and Share Forecast Outlook 2025 to 2035

Bamboo Fiber Tableware and Kitchenware Market Size and Share Forecast Outlook 2025 to 2035

Bamboo Market Analysis - Demand, Trends & Industry Forecast 2024 to 2034

Bamboo Packaging Market Share, Growth & Trends 2025 to 2035

Bamboo Cups Market Analysis and Insights for 2025 to 2035

Bamboo Products Market Analysis – Trends & Growth 2025 to 2035

Market Share Insights for Bamboo Straw Providers

Sustainable Bamboo Charcoal Market Size and Share Forecast Outlook 2025 to 2035

Engineered Cell Therapy - Market Trends & Forecast 2025 to 2035

Engineered Wood Market

Tissue Engineered Skin Substitute Market Size and Share Forecast Outlook 2025 to 2035

Wood Recycling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Woodfree Paper Market Size and Share Forecast Outlook 2025 to 2035

Wooden Crate Market Forecast and Outlook 2025 to 2035

Wood Plastic Composite Market Forecast and Outlook 2025 to 2035

Wood-Polymer Bottle Molders Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA