The Woodfree Paper market is experiencing steady growth driven by the increasing demand for high-quality printing and writing paper across commercial, educational, and publishing sectors. The future outlook for this market is influenced by the growing need for premium paper that offers superior opacity, smoothness, and printability. Rising awareness regarding environmental sustainability has encouraged the adoption of eco-friendly pulping and paper production practices, which further support market expansion.

Investments in advanced paper production technologies, including chemical pulping and high-efficiency bleaching processes, are enhancing product quality and production efficiency. Additionally, the increasing penetration of organized printing services and digital media industries in emerging economies is driving the demand for specialized woodfree paper types.

The market is also benefiting from innovations in coating technologies that improve print performance and durability As the demand for high-quality paper products continues to grow in commercial, educational, and publishing applications, the Woodfree Paper market is expected to witness sustained growth in both mature and developing regions.

| Metric | Value |

|---|---|

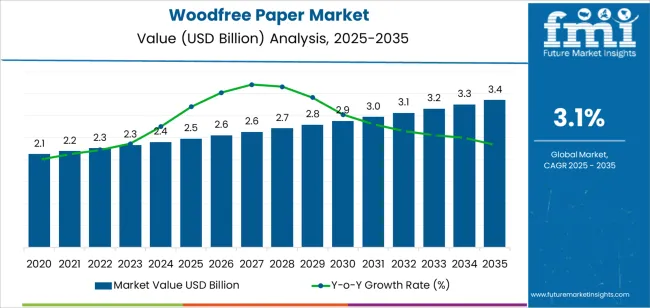

| Woodfree Paper Market Estimated Value in (2025 E) | USD 2.5 billion |

| Woodfree Paper Market Forecast Value in (2035 F) | USD 3.4 billion |

| Forecast CAGR (2025 to 2035) | 3.1% |

The market is segmented by Pulp Type, Source, Coating Type, and End Use and region. By Pulp Type, the market is divided into Softwood and Hardwood. In terms of Source, the market is classified into Cotton, Hemp, Linen, and Bamboo. Based on Coating Type, the market is segmented into Coated and Uncoated. By End Use, the market is divided into Printing and Packaging. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

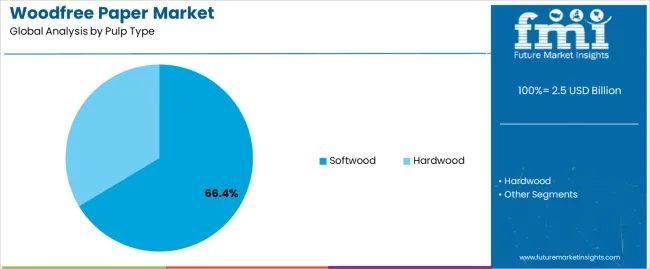

The softwood pulp segment is projected to hold 66.4% of the Woodfree Paper market revenue share in 2025, establishing it as the leading pulp type. This dominance is attributed to the long fiber structure of softwood, which provides superior strength, durability, and print quality for paper production. The segment has been driven by increasing demand for high-quality printing and writing papers, where paper performance and longevity are critical.

Softwood pulp is highly suitable for large-format printing, books, and premium stationery, supporting its widespread adoption. Additionally, improvements in pulping techniques and chemical treatments have enhanced the efficiency and quality of softwood pulp production.

The segment’s growth is further supported by the increasing focus on sustainable forestry practices and responsible sourcing, ensuring a consistent supply of high-quality raw material These factors collectively reinforce the leading position of softwood pulp in the Woodfree Paper market.

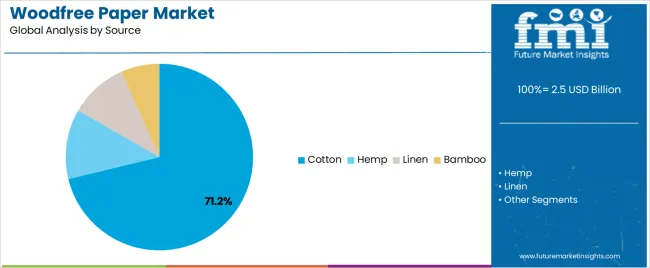

The cotton source segment is expected to account for 71.2% of the Woodfree Paper market revenue share in 2025, positioning it as the dominant source. Growth in this segment is driven by the superior quality and texture provided by cotton fibers, which enhance smoothness, durability, and print performance.

Cotton-based woodfree papers are preferred in high-end printing, fine art reproduction, and specialty stationery applications due to their premium feel and archival quality. The segment has also benefited from advancements in pulping and fiber treatment processes, which improve consistency and reduce production costs.

Furthermore, the increasing adoption of environmentally responsible sourcing and recycling practices has reinforced market confidence in cotton-based papers These combined factors contribute to the dominance of the cotton source segment and its continued growth in the Woodfree Paper market.

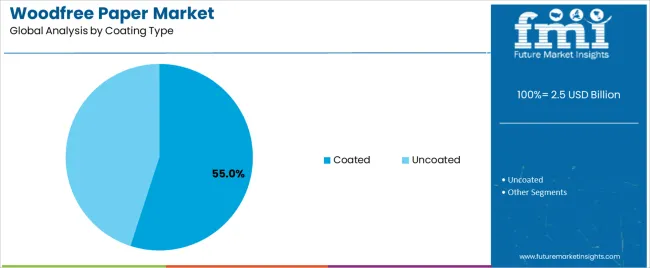

The coated paper segment is anticipated to hold 55.0% of the Woodfree Paper market revenue share in 2025, making it the leading coating type. This growth is driven by the enhanced printability and visual quality provided by coated surfaces, which support high-resolution imaging and vibrant color reproduction.

The segment is widely adopted in publishing, advertising, and commercial printing, where superior aesthetic quality is essential. Advancements in coating technologies, including chemical formulations and surface finishing processes, have improved the uniformity, brightness, and durability of coated papers.

Additionally, the demand for premium publications, brochures, and marketing materials has reinforced the adoption of coated woodfree paper These factors collectively support the dominant position of the coated paper segment in the market and highlight its critical role in meeting the evolving needs of high-quality printing applications.

The above table presents the expected CAGR for the global woodfree paper market over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) of the decade from 2025 to 2035, the business is predicted to surge at a CAGR of 3.4%, followed by a slightly lower growth rate of 2.8% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 3.4% (2025 to 2035) |

| H2 | 2.8% (2025 to 2035) |

| H1 | 2.9% (2025 to 2035) |

| H2 | 3.2% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase slightly to 2.9% in the first half and remain relatively moderate at 3.2% in the second half. In the first half (H1) the market witnessed a decrease of 50 BPS while in the second half (H2), the market witnessed an increase of 40 BPS.

Wide Applications of Wood free Paper

The rising application of woodfree paper in office stationery, envelopes, letterheads, and notebooks is supplementing the demand. Woodfree paper can meet the daily printing needs efficiently such as documents, invoices, reports, and presentations. The paper has high printability which makes the print clear and crisp which is ideal for printing purposes.

This paper is a must in printing education sector for printing different workbooks, and textbooks. The high-quality papers make the educational content highly intact and easily readable for a prolonged period. Woodfree paper is highly used for artistic purposes such as sketching, drawing, and painting driven by its increased opacity and smooth writing surface.

Wood-free paper is increasingly used in DIY and other art-related crafts, newsletters, print projects, etc. The paper is versatile which makes it handle numerous printing methods. It makes a reliable choice for creative works in the printing industry.

Sustainability & Eco-friendly Practices

Increasing demand for recycled materials and agriculture waste is creating traction in the woodfree paper industry. The use of recycled fibres and agricultural waste in producing woodfree paper is translating into the reduction of virgin pulp for raw materials. This has resulted in reducing the destruction of forests and carbon emissions.

Consumers are also inclined towards eco-friendly products and know the importance of a circular economy. Companies are moving towards using agricultural waste for paper production by innovating in product processes and technologies. This practice will result in a reduction of agricultural waste going into landfills and harming the environment.

It will provide an alternative raw material source for paper production. This shift towards using sustainable practices in the production process and manufacturing of woodfree paper impacts the market expansion.

Rising Paper Prices

The paper industry is experiencing an increase in prices which will impact both the consumers as well as manufacturers. The paper has been seeing the rise in the process over the past few years driven by raw material process fluctuations, supply chain disruptions, and rising demand. The price of different paper grades has increased by 10 to 20 percent in recent times.

This is impacting the industry using paper, such as printing, to packaging. As a result, companies are exploring new strategies to overcome this challenge and reassessing their product methods to reduce the impact of rising costs.

The global woodfree paper industry recorded a CAGR of 4.8% during the historical period between 2020 and 2025. The growth of the woodfree paper industry was positive as it reached a value of USD 2.5 million in 2025 from USD 2.1 million in 2020.

Increasing demand for recyclable paper materials and urgent need for environmentally friendly printing solutions are expected to push sales of white woodfree paper in the next decade. Besides, the surging need for efficient printing solutions for high-end catalogues and magazines is another factor that is projected to drive the requirement for wood-free printing paper.

Increasing utilization of woodfree printing paper in premium applications where durable, quality paper is needed is expected to boost the global market. Acid-free paper with little lignin is often used to preserve significant artworks and documents. Often, an alkaline buffer is added to prevent acid erosion.

Special acid-free archival paper is required when exceptional longevity is the top priority. Woodfree papers are made of cotton rag or similar pulp comprised of cellulose. Woodfree sticker papers help in providing the highest quality standards for finished products. Spurred by the aforementioned advantages, the woodfree paper market growth is projected to surge in the evaluation period.

The rising use of woodfree printing paper for archival printing owing to its ability to deliver excellent contrast quality and easy application of pigment-based inks is a vital factor that would spur the market. International companies are expected to invest huge sums in research activities to discover cutting-edge paper for the packaging of their products.

For instance, Ben & Jerry’s, a reputed manufacturer of ice creams, sorbet, and frozen yoghurt based in the USA, signed up for the Pack4Good initiative, which is specially designed to encourage companies to adopt circular feedstock.

The company’s Pack4Good policy mentioned that it will use FSC-certified wood, surge utilization of recycled next-generation fibres, lower material use by design innovation, and continue to be free of endangered or ancient forest fibre. Rising initiatives by key companies to increase sustainability by adopting coated woodfree paper are set to accelerate the market.

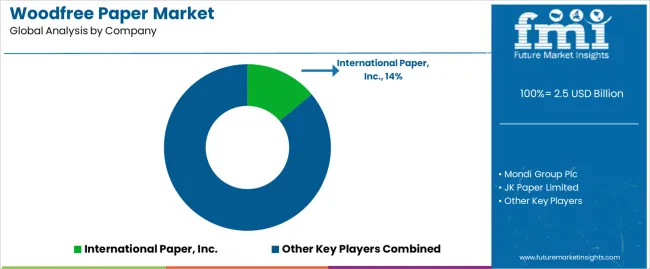

Tier 1 companies comprise market leaders with a market revenue of above USD 50 million capturing a significant market share of 10% to 20% in the global market. These market leaders are characterized by high production capacity and a wide product portfolio.

These players are distinguished by their extensive expertise in manufacturing across multiple products across different applications and a broad geographical reach, underpinned by a robust consumer base. They provide a wide range of products utilizing the latest technology and meeting the regulatory standards providing the highest quality.

Prominent companies within Tier 1 encompass Mondi Group Plc, JK Paper Limited, International Paper, Inc., PG Paper Company, and Smurfit Kappa Group PLC.

Tier 2 companies include mid-size players with revenue of USD 20 to 50 million having presence in specific regions and highly influencing the regional market. These are characterized by a limited international presence and well-maintained market knowledge. These market players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach.

Prominent companies in tier 2 include Drewsen Spezialpapiere GmbH & Co KG., Georgia-Pacific LLC, and TELE-PAPER (M) SDN. BHD., Imerys Kaolin Inc., Kobax Paper and Board, Nine Dragons Paper (Holdings) Limited, and Veritiv Corporation.

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche markets having revenue below USD 20 million. These companies are notably oriented towards fulfilling local market demands and are consequently classified within the tier 3 share segment.

They are small-scale players and have very limited geographical reach. Tier 3, within this context, is recognized as an unorganized market, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

The section below covers the industry analysis of the woodfree paper market for different countries. Market demand analysis on key countries in several regions of the globe, including North America, South Asia & Pacific, East Asia, Western Europe, Eastern Europe, and others, is provided. In Europe, Germany is anticipated to register a moderate growth at 1.9% through 2035.

In North America, Canada is an emerging country in woodfree paper projected to witness a growth rate of 3.0% by 2035 end.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 2.1% |

| Germany | 1.9% |

| UK | 3.4% |

| Canada | 3.0% |

| India | 6.1% |

| China | 5.2% |

| Japan | 2.6% |

| Thailand | 4.1% |

The India woodfree paper industry is anticipated to be expanding at a 6.1% growth rate through 2035. India Brand Equity Foundation (IBEF) stated that, India is one of the emerging markets for paper based packaging due to the rapid growth and industrialization in the country.

The Indian packaging sector uses paper as a major source and it is further expected that the demand for paper will rise continuously for ready-to-eat food and FMCG products. There is 55% packaging grade paper available in the paper produced in the paper and paperboard industry in India. The growth of the paper packaging industry will impact positively the woodfree paper market in the future.

Germany is experiencing exponential growth in the e-commerce industry due to the rise in number of online shoppers. The rising penetration of e-commerce led more companies to take the business via e-commerce platforms. Eurostat statistics have revealed that 70% of people are buying online products which will contribute to the use of woodfree paper.

Almost 44% of shoppers are buying clothes, shoes and accessories through online sales channel that mostly consumes woodfree paper for premium packaging. Online retailers require packaging materials, which is durable, sustainable, and cost-effective, and woodfree paper is an ideal choice for these applications. The woodfree paper industry in Germany is predicted to record a growth CAGR of 1.9% during the forecast period.

The section contains information about the leading segments in the industry. By pulp type, softwood is anticipated to capture 66.4% of value share through 2035. Among coating type, coated paper is projected to showcase significant growth at with 71.2% of market share through 2035.

| Pulp Type | Softwood Pulp |

|---|---|

| Value Share (2035) | 66.4% |

Softwood Pulp is dominating in woodfree paper industry with a value share of around 66% through assessment years. Softwood pulp is highly used in industry because it has long fibres which provide flexibility and strength to paper products. Woodfree paper demands these qualities especially when used in high-quality printing and writing.

Softwood pulp is easily available as the trees providing softwood are highly present in regions like Europe and North America. This results in the high production rate of paper using softwood pulp. Softwood pulp has superior qualities comparatively which is in high demand by consumers, especially for premium paper products which is resulting in its expansion.

Woodfree paper produced using softwood pulp has increasing use in advertising, publishing, and packaging industries as they demand paper with aesthetics and functional properties. All these factors collectively contribute in the growth of the target segment.

| Coating Type | Coated |

|---|---|

| Value Share (2035) | 71.2% |

The coated paper offers numerous excellent printing capabilities which result in its huge application in high-end printing. They are majorly used in high-quality printing such as brochures, magazines, and other advertising materials. This application requires smooth and glossy paper which has improved colour vibrancy and image clarity which is essential in premium products.

Coated paper is increasingly used in publishing, premium packaging, and advertising applications because of its visual appeal and even surface. Print quality is an important factor in the advertising and publishing industry which is impacting the woodfree paper demand. Coated paper is set to gain a 71.2% market share in the upcoming period.

Several prominent players in the woodfree paper market are significantly investing in innovation, research, and development to discover new applications and enhance their offerings. Leveraging technology, these companies prioritize safety, product quality, and customer satisfaction to expand their customer base.

Key manufacturers of woodfree paper are focusing on developing recycled material packaging and developing packaging solutions to meet sustainability demand. They are adopting a merger & acquisition strategy to expand their resources and are developing new products to meet customer needs.

Recent Industry Developments in Woodfree Paper Market

In terms of pulp type, the industry is divided into hardwood and softwood.

In terms of source, the industry is segregated cotton, hemp, linen, and bamboo.

The industry is classified by coating type as coated, and uncoated.

The industry is classified by end use as printing, and packaging.

Key countries of North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, and Middle East and Africa (MEA), have been covered in the report.

The global woodfree paper market is estimated to be valued at USD 2.5 billion in 2025.

The market size for the woodfree paper market is projected to reach USD 3.4 billion by 2035.

The woodfree paper market is expected to grow at a 3.1% CAGR between 2025 and 2035.

The key product types in woodfree paper market are softwood and hardwood.

In terms of source, cotton segment to command 71.2% share in the woodfree paper market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Paper Edge Protector Market Size and Share Forecast Outlook 2025 to 2035

Paper Cup Lids Market Size and Share Forecast Outlook 2025 to 2035

Paper Pallet Market Size and Share Forecast Outlook 2025 to 2035

Paper and Paperboard Packaging Market Forecast and Outlook 2025 to 2035

Paper Wrap Market Size and Share Forecast Outlook 2025 to 2035

Paper Cups Market Size and Share Forecast Outlook 2025 to 2035

Paper Core Market Size and Share Forecast Outlook 2025 to 2035

Paper Bags Market Size and Share Forecast Outlook 2025 to 2035

Paper Processing Resins Market Size and Share Forecast Outlook 2025 to 2035

Paper Tester Market Size and Share Forecast Outlook 2025 to 2035

Paper Napkin Converting Lines Market Size and Share Forecast Outlook 2025 to 2035

Paper Packaging Tapes Market Size and Share Forecast Outlook 2025 to 2035

Paper Napkins Converting Machines Market Size and Share Forecast Outlook 2025 to 2035

Paper Coating Binders Market Size and Share Forecast Outlook 2025 to 2035

Paper Core Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Paper Recycling Market Size and Share Forecast Outlook 2025 to 2035

Paper Release Liners Market Size and Share Forecast Outlook 2025 to 2035

Paper Coating Materials Market Size and Share Forecast Outlook 2025 to 2035

Paper Pigments Market Size and Share Forecast Outlook 2025 to 2035

Paper Honeycomb Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA