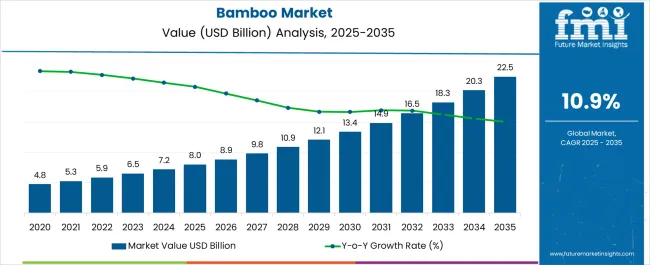

The global bamboo market is projected to grow from USD 8 billion in 2025 to approximately USD 22.5 billion by 2035, recording an absolute increase of USD 14.5 billion over the forecast period. This translates into a total growth of 181.3%, with the market forecast to expand at a compound annual growth rate (CAGR) of 10.9% between 2025 and 2035. The overall market size is expected to grow by nearly 2.81X during the same period, supported by the rising demand for sustainable materials across multiple industries and increasing consumer preference for eco-friendly alternatives to traditional materials.

Between 2025 and 2030, the bamboo market is projected to expand from USD 8 billion to USD 13.8 billion, resulting in a value increase of USD 5.8 billion, which represents 40.0% of the total forecast growth for the decade. This phase of growth will be shaped by rising penetration of sustainable material applications in global manufacturing sectors, increasing regulatory support for renewable resource utilization, and growing awareness among manufacturers about the environmental benefits of bamboo-based products. Industrial manufacturers are expanding their bamboo sourcing capabilities to address the growing demand for sustainable raw materials across construction, textile, and paper industries.

From 2030 to 2035, the market is forecast to grow from USD 13.8 billion to USD 22.5 billion, adding another USD 8.7 billion, which constitutes 60.0% of the overall ten-year expansion. This period is expected to be characterized by expansion of innovative bamboo processing technologies, integration of advanced manufacturing systems for bamboo products, and development of standardized quality protocols across different bamboo applications. The growing adoption of circular economy principles and sustainable manufacturing practices will drive demand for more sophisticated bamboo-based solutions and specialized processing expertise.

Between 2020 and 2025, the bamboo market experienced rapid expansion, driven by increasing environmental consciousness and growing regulatory emphasis on sustainable material requirements. The market developed as manufacturing companies recognized the potential of bamboo as a renewable alternative to traditional materials across various industrial applications. Environmental agencies and industry associations began promoting proper sustainability standards and processing procedures to maintain product quality and environmental compliance.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 8.0 billion |

| Projected Value (2035F) | USD 22.5 billion |

| CAGR (2025 to 2035) | 10.9% |

Market expansion is being supported by the rapid increase in sustainable material adoption across global industries and the corresponding need for renewable alternatives to traditional raw materials in manufacturing processes. Modern industrial applications rely on environmentally responsible sourcing and sustainable production methods to ensure proper functioning of supply chains including construction materials, textile fibers, and paper production. Even minor shifts toward sustainable materials can require comprehensive supply chain modifications to maintain optimal product performance and environmental compliance.

The growing complexity of environmental regulations and increasing consumer demand for eco-friendly products are driving demand for bamboo-based solutions from certified suppliers with appropriate processing capabilities. Manufacturing companies are increasingly requiring comprehensive sustainability documentation and environmental compliance to maintain market position and regulatory approval. Green manufacturing standards and industry specifications are establishing standardized bamboo processing requirements that demand specialized cultivation expertise and proven sustainability performance.

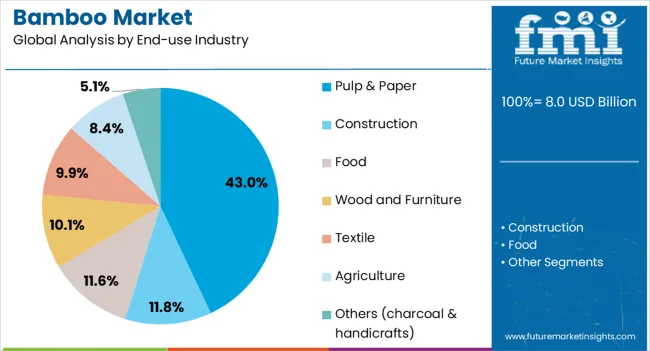

The market is segmented by end-use industry and region. By end-use industry, the market is divided into pulp and paper, construction, food, wood and furniture, textile, agriculture, and others including charcoal and handicrafts. Regionally, the market is segmented into North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, and Middle East and Africa. .

Pulp and paper applications are projected to account for 43% of the bamboo market in 2025. This leading share is supported by the widespread adoption of bamboo fiber in sustainable paper production and the established processing capabilities for bamboo-based pulp manufacturing. Bamboo provides rapid growth characteristics and high fiber yield using proven pulping processes, making it the preferred renewable alternative for most paper manufacturing applications. The segment benefits from comprehensive environmental regulations and established market demand for sustainable paper products.

The bamboo market is advancing rapidly due to increasing environmental consciousness and growing demand for sustainable alternatives across multiple industries. However, the market faces challenges including limited processing infrastructure in developing regions, high initial investment requirements for advanced processing facilities, and quality standardization issues across different bamboo species. Supply chain development and cultivation scalability continue to influence market expansion patterns while regulatory support varies significantly across regions.

The growing deployment of sophisticated bamboo processing technologies including engineered bamboo manufacturing, cross-laminated bamboo panel production, and automated fiber extraction is enabling more efficient conversion of raw materials into high-quality finished products. These technologies provide superior product consistency that enhances performance characteristics and enables standardized quality specifications based on density, strength, and durability requirements for construction and industrial applications.

Modern supply chains are incorporating sustainable bamboo cultivation practices, organic farming methods, and comprehensive certification protocols to create transparent sustainability profiles that ensure long-term resource availability. Integration of traceability systems, environmental monitoring, and quality assurance provides documentation that meets international standards while appealing to environmentally conscious manufacturers and consumers seeking verified sustainable materials across diverse end-use applications.

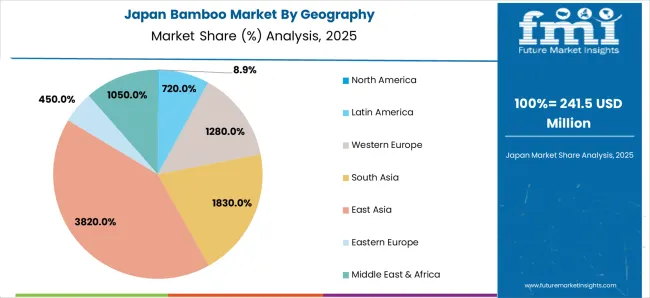

The bamboo market globally is projected to grow from USD 8 billion in 2025 to USD 22.5 billion by 2035, registering a CAGR of 10.9% over the forecast period. East Asia is expected to maintain its leadership with a 38.2% regional share, supported by its extensive bamboo cultivation infrastructure and established processing ecosystem.

South Asia region is projected to contribute 18.3% to market growth, attributed to rising sustainable material adoption and expanding bamboo cultivation programs. Western Europe will account for 12.8% market share, while Middle East and Africa shows emerging potential with 10.5% contribution due to expanding agricultural diversification and growing industrial applications.

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 11.7% |

| China | 11.4% |

| USA | 10.2% |

| Brazil | 8.6% |

| Indonesia | 8.5% |

| UK | 5.4% |

| Japan | 3.4% |

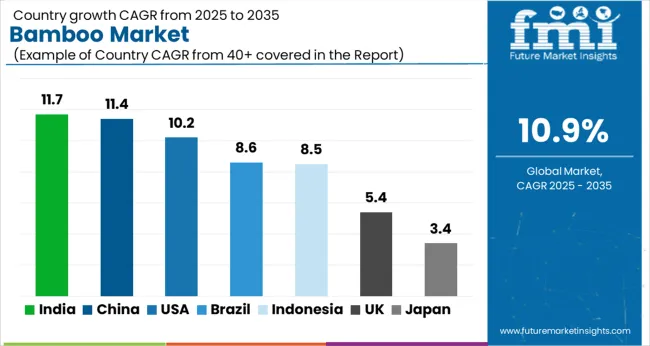

The bamboo market is growing rapidly worldwide, with India leading at an 11.7% CAGR through 2035, driven by government sustainability initiatives, traditional bamboo knowledge, and expanding industrial applications across multiple sectors. China follows at 11.4%, supported by comprehensive bamboo processing infrastructure and increasing integration of bamboo products into manufacturing supply chains. The USA grows steadily at 10.2%, emphasizing sustainable construction materials and eco-friendly product development. Brazil records 8.6%, focusing on sustainable forestry alternatives and agricultural diversification programs. Indonesia and the UK show moderate growth at 8.5% and 5.4% respectively, while Japan maintains steady expansion at 3.4%. Overall, India and China emerge as the leading drivers of global bamboo market expansion.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

Revenue from bamboo in India is projected to exhibit the highest growth rate with a CAGR of 11.7% through 2035, driven by extensive government support for bamboo cultivation and increasing integration of traditional bamboo knowledge into modern industrial applications. The country's established bamboo growing regions and expanding processing infrastructure are creating significant demand for diverse bamboo-based products. Major agricultural cooperatives and processing companies are establishing comprehensive bamboo value chains to support the growing population of sustainable manufacturing applications across textile, construction, and paper sectors.

Revenue from bamboo in China is expanding at a CAGR of 11.4%, supported by comprehensive bamboo processing infrastructure and growing integration of bamboo products into manufacturing supply chains across multiple industries. The country's established bamboo cultivation expertise and advanced processing capabilities are driving demand for high-quality bamboo materials. Manufacturing companies and processing facilities are gradually establishing capabilities to serve the growing population of sustainable material applications and export market requirements.

Revenue from bamboo in the USA is growing at a CAGR of 10.2%, driven by increasing sustainable construction material adoption and growing emphasis on eco-friendly building solutions across residential and commercial sectors. The country's developing bamboo import infrastructure is gradually incorporating advanced bamboo products to serve evolving construction and consumer goods applications. Building material suppliers and specialty manufacturers are investing in bamboo product development and distribution systems to address growing environmental compliance demands.

Revenue from bamboo in Brazil is projected to grow at a CAGR of 8.6%, supported by the country's emphasis on agricultural diversification and expanding bamboo cultivation programs across suitable growing regions. Brazilian agricultural producers are implementing comprehensive bamboo cultivation capabilities that support sustainable agriculture objectives and export market development. The market is characterized by focus on cultivation efficiency, processing development, and integration with comprehensive agricultural sustainability initiatives.

Demand for bamboo in Indonesia is expanding at a CAGR of 8.5%, driven by traditional bamboo cultivation knowledge and growing recognition of bamboo product potential in modern manufacturing applications. Indonesian bamboo growers and processors are establishing comprehensive production capabilities to serve diverse market requirements. The market benefits from favorable growing conditions and increasing emphasis on sustainable resource development following environmental conservation initiatives.

Revenue from bamboo in the UK is growing at a CAGR of 5.4%, characterized by sophisticated consumer awareness regarding sustainable materials and increasing adoption of bamboo products across construction, furniture, and consumer goods sectors. The British market demonstrates strong preference for certified sustainable products with transparent supply chains and proven environmental benefits. Market growth is supported by established import infrastructure, comprehensive retail distribution networks, and consumer willingness to invest in premium sustainable alternatives.

Revenue from bamboo in Japan is expanding at a CAGR of 3.4%, driven by cultural appreciation for bamboo craftsmanship and increasing integration of bamboo products into modern lifestyle applications. The Japanese market demonstrates sophisticated consumer preferences for high-quality bamboo products with proven durability and aesthetic appeal. Market development is characterized by emphasis on traditional craftsmanship combined with modern manufacturing techniques and quality standards.

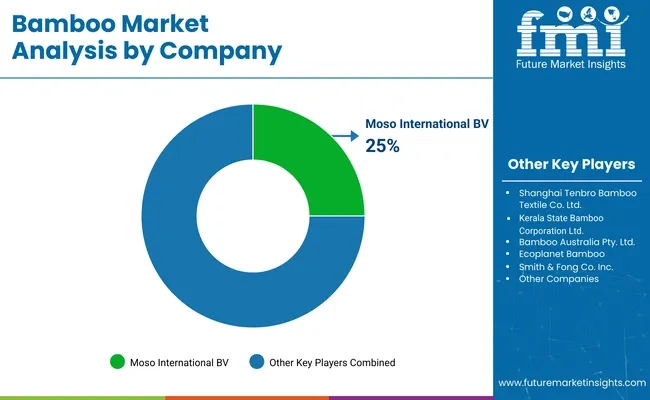

The bamboo market is defined by competition among specialized bamboo companies, agricultural cooperatives, and sustainable material suppliers. Companies are investing in advanced cultivation techniques, sustainable processing capabilities, quality standardization procedures, and technical expertise to deliver reliable, high-quality, and environmentally responsible bamboo solutions. Strategic partnerships, technological innovation, and geographic expansion are central to strengthening product portfolios and market presence.

Moso International BV, Netherlands-based, offers comprehensive bamboo product solutions with a focus on quality, sustainability, and international market development. Shanghai Tenbro Bamboo Textile Co. Ltd, China, provides specialized bamboo textile processing integrated with sustainable fiber production and textile applications. Kerala State Bamboo Corporation Ltd, India, delivers government-supported bamboo development with standardized procedures and comprehensive cultivation support. Bamboo Australia Pty. Ltd., Australia, emphasizes sustainable bamboo cultivation and processing technologies.

EcoPlanet Bamboo, internationally operating, offers bamboo solutions integrated into comprehensive sustainable forestry operations. These companies provide cultivation expertise, standardized quality procedures, and market development across global and regional networks, focusing on sustainability excellence, quality compliance, and environmental stewardship practices.

| Item | Value |

|---|---|

| Quantitative Units | USD 22.5 billion |

| End-use Industry | Wood and Furniture (Timber Substitute, Plywood, Mat Boards, Flooring, Furniture, Outdoor Decking), Construction (Scaffolding, Housing, Roads), Food, Pulp & Paper, Textile, Agriculture, and Others (charcoal & handicrafts) |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Moso International BV, Shanghai Tenbro Bamboo Textile Co. Ltd, Kerala State Bamboo Corporation Ltd, Bamboo Australia Pty. Ltd., Ecoplanet Bamboo, Smith & Fong Co. Inc., Jiangxi Kangda Bamboo Ware Group Co. Ltd., Fujian Jianou Huayu Bamboo Industry Co. Ltd., Jiangxi Shanyou Industry Co. Ltd., Tengda Bamboo-Wood Co. Ltd., Higuera Hardwoods LLC, Dasso Industrial Group Co. Ltd., Xingli Bamboo Products Company, China Bamboo Textile Company Ltd., Bamboo Bio Composites Sdn Bhd, Southern Bamboo Inc., Jiangxi Feiyu Industry Co. Ltd., Terragreen LLC, and Anji Tianzhen Bamboo Flooring Co. Ltd. |

| Additional Attributes | Dollar sales by end-use industry and geography, regional demand trends across Asia-Pacific, North America, and Europe, competitive landscape with established players and emerging sustainable material companies, buyer preferences for certified versus conventional bamboo products, integration with sustainable processing technologies and quality certification systems, innovations in bamboo cultivation capabilities and advanced processing protocols, and adoption of traceability solutions with sustainability monitoring, quality assurance, and environmental compliance features for enhanced supply chain transparency. |

The global bamboo market is estimated to be valued at USD 8.0 billion in 2025.

The market size for the bamboo market is projected to reach USD 22.5 billion by 2035.

The bamboo market is expected to grow at a 10.9% CAGR between 2025 and 2035.

The key product types in bamboo market are north america, latin america, western europe, south asia, east asia, eastern europe and middle east & africa.

In terms of end-use industry, pulp & paper segment to command 43.0% share in the bamboo market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bamboo Straw Market Size and Share Forecast Outlook 2025 to 2035

Bamboo Extracts for Anti-Aging Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Bamboo Extracts for Skin Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Bamboo Apparel Market Size and Share Forecast Outlook 2025 to 2035

Bamboo Fiber Tableware and Kitchenware Market Size and Share Forecast Outlook 2025 to 2035

Bamboo Engineered Wood Market Size and Share Forecast Outlook 2025 to 2035

Bamboo Market Analysis - Demand, Trends & Industry Forecast 2024 to 2034

Bamboo Packaging Market Share, Growth & Trends 2025 to 2035

Bamboo Cups Market Analysis and Insights for 2025 to 2035

Bamboo Products Market Analysis – Trends & Growth 2025 to 2035

Market Share Insights for Bamboo Straw Providers

Sustainable Bamboo Charcoal Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA