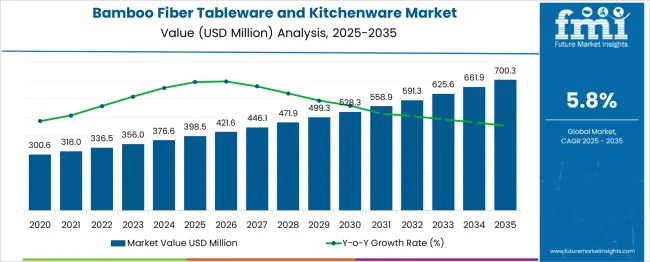

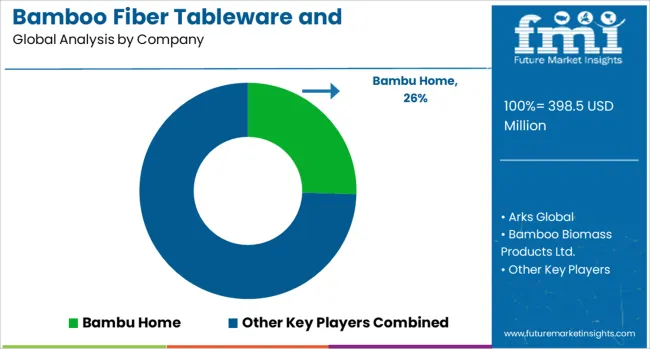

The Bamboo Fiber Tableware and Kitchenware Market is estimated to be valued at USD 398.5 million in 2025 and is projected to reach USD 700.3 million by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period. From 2025 to 2030, the market is projected to increase from USD 398.5 million to USD 528.3 million, indicating consistent growth driven by rising demand for durable and eco-friendly alternatives to plastic-based products.

Year-on-year analysis shows incremental gains, reaching USD 421.6 million in 2026 and USD 446.1 million in 2027, supported by greater retail availability and consumer preference for stylish, functional kitchenware made from renewable resources. By 2028, the market is expected to hit USD 471.9 million, followed by USD 499.3 million in 2029 and USD 528.3 million in 2030. This growth trajectory is anticipated to be strengthened by innovation in composite materials that improve heat resistance and durability without compromising biodegradability.

Expansion in foodservice sectors and increasing online retail penetration are likely to amplify product adoption globally. Competitive strategies will revolve around quality enhancement, diversified designs, and pricing efficiency. These dynamics position bamboo fiber tableware and kitchenware as a significant category in the shift toward sustainable dining solutions for both residential and commercial applications.

| Metric | Value |

|---|---|

| Bamboo Fiber Tableware and Kitchenware Market Estimated Value in (2025 E) | USD 398.5 million |

| Bamboo Fiber Tableware and Kitchenware Market Forecast Value in (2035 F) | USD 700.3 million |

| Forecast CAGR (2025 to 2035) | 5.8% |

The bamboo fiber tableware and kitchenware market holds a small but rapidly expanding share within its broader parent markets. In the eco-friendly tableware market, it represents nearly 18–20%, as bamboo fiber products have become a preferred alternative to plastics and melamine. Within the kitchenware and cookware market, its share is relatively low, around 4–5%, since metal, ceramic, and plastic dominate this category.

The sustainable packaging and dining products market sees a contribution of about 6–7%, as bamboo-based solutions align with demand for biodegradable options. In the home and dining accessories market, its share stands at approximately 3–4%, as the segment covers a wide range of decorative and functional products. For the foodservice disposables market, bamboo fiber tableware accounts for roughly 5–6%, primarily through its use in catering and quick-service establishments. Market growth is fueled by a rising shift toward durable, lightweight, and compostable materials, coupled with increasing bans on single-use plastics in several regions.

Consumers are prioritizing natural aesthetics and environmentally responsible choices, which further supports bamboo fiber adoption in household and commercial dining applications. With advances in manufacturing, enhanced durability, and broader distribution, this segment is expected to increase its penetration across these parent markets in the coming years.

The bamboo fiber tableware and kitchenware market is witnessing strong growth as sustainability, aesthetic appeal, and health-conscious consumer trends drive demand for eco-friendly alternatives to plastic and ceramic products. The increasing awareness of the environmental impact of disposable and non-biodegradable kitchenware has positioned bamboo fiber as a preferred material due to its renewable nature and minimal carbon footprint.

Rising disposable incomes, growing urbanization, and evolving lifestyle preferences have further contributed to the adoption of bamboo fiber products, especially in premium and wellness-oriented households.

Future growth is expected to be supported by innovation in designs, improved durability through material enhancements, and broader retail penetration, which are collectively paving the way for mass-market adoption and diversification across both developed and emerging economies.

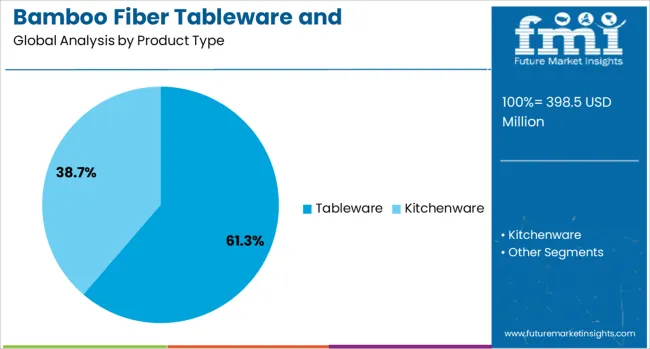

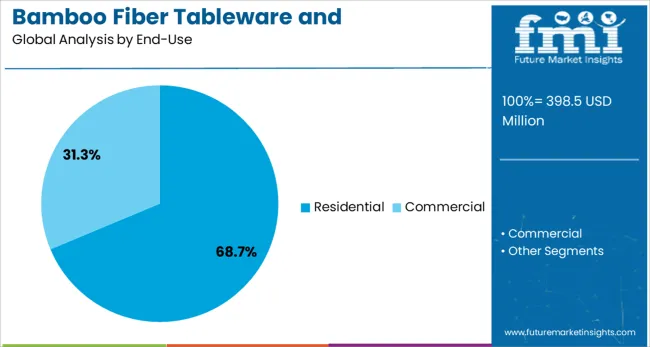

The bamboo fiber tableware and kitchenware market is segmented by product type, end-use, and distribution channel and geographic regions. The bamboo fiber tableware and kitchenware market is divided by product type into Tableware and Kitchenware. The end-use of the bamboo fiber tableware and kitchenware market is classified into Residential and Commercial.

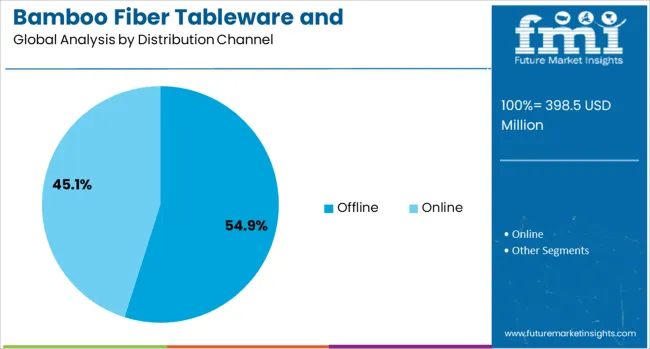

The distribution channel of the bamboo fiber tableware and kitchenware market is segmented into Offline and Online. Regionally, the bamboo fiber tableware and kitchenware industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by product type, tableware is projected to hold 61.30% of the total market revenue in 2025, making it the leading product segment. The high frequency of use has driven this dominance, the need for aesthetically pleasing and functional dining solutions, and the growing cultural emphasis on sustainable dining practices.

Tableware made from bamboo fiber has been increasingly chosen for its lightweight, non-toxic, and biodegradable properties that align with consumer values around health and the environment. Manufacturers have focused on offering diverse designs and color options, making bamboo fiber tableware an attractive choice for both daily use and special occasions.

The ability to combine durability with a premium feel has further strengthened its appeal among households and hospitality establishments, reinforcing its leadership within the product landscape.

Segmented by end use, the residential segment is expected to account for 68.70% of the market revenue in 2025, maintaining its position as the leading consumer group. This predominance has been supported by growing consumer awareness about sustainable living, increasing willingness to invest in eco-friendly products, and the suitability of bamboo fiber kitchenware for everyday household needs.

Residential consumers have increasingly adopted bamboo fiber products as part of a broader lifestyle shift toward reducing plastic usage and embracing natural materials. The availability of affordable options across both online and offline retail channels has made it accessible to a wide demographic. Premium designs have appealed to high-income households seeking unique and responsible dining solutions.

This combination of environmental consciousness and aesthetic demand has firmly positioned residential consumers as the primary driver of market growth.

When segmented by distribution channel, offline sales are projected to capture 54.90% of the market revenue in 2025, establishing themselves as the leading channel. This leadership has been influenced by consumer preference for physically examining product quality, texture, and design before purchase, which is particularly important for kitchenware and tableware.

Retailers and specialty stores have strategically allocated prominent shelf space to eco-friendly products, supported by in-store promotions and visual merchandising that effectively communicate the sustainability narrative. Additionally, offline channels such as home goods stores and supermarkets have cultivated trust and convenience through immediate product availability and personalized service.

This tangible shopping experience has continued to appeal to consumers despite the growth of e-commerce, maintaining offline’s strong foothold in the market.

The bamboo fiber tableware and kitchenware market is experiencing steady growth as demand for biodegradable alternatives to plastic products rises. In 2024, consumer and commercial sectors increasingly adopted bamboo-based plates, bowls, and utensils due to environmental concerns and changing regulations.

By 2025, hospitality and foodservice industries expanded their use of bamboo fiber products to align with eco-conscious branding and waste-reduction goals. Manufacturers offering durable, food-safe bamboo fiber solutions designed for both retail and professional applications are well positioned to capture this market shift.

Regulatory restrictions on single-use plastics have significantly influenced the uptake of bamboo fiber tableware and kitchenware. In 2024, many markets in Europe and North America shifted toward bamboo-based alternatives in restaurants and catering services. By 2025, hotels and hospitality brands widely adopted bamboo utensils, plates, and cups to comply with environmental standards while appealing to sustainability-conscious consumers.

These developments show that compliance and functional quality are shaping adoption trends. Manufacturers delivering certified bamboo fiber products with durability and compostability are likely to maintain a strong position in the market.

Rising use in commercial foodservice is creating major opportunities for bamboo fiber products. In 2024, catering companies and cafés integrated bamboo dinnerware to reinforce environmentally friendly practices. By 2025, large hospitality chains and quick-service restaurants embraced reusable bamboo sets to reduce reliance on plastic while improving brand value.

This transition illustrates that bamboo fiber can become a mainstream material in large-scale dining operations. Suppliers offering customizable, bulk-ready bamboo products with consistent quality and appealing designs are poised to benefit from these expanding opportunities.

Production of bamboo fiber tableware involves intensive processing, including fiber extraction and molding with natural binders, which adds cost pressure. Manufacturers in 2024 and 2025 faced difficulties in balancing premium pricing against consumer expectations for affordability. Retailers have reported slower adoption in price-sensitive regions where alternatives such as melamine or plastic remain dominant.

Margins have been further affected by rising labor expenses and raw material fluctuations. These pricing constraints have restricted market penetration, especially for small and medium producers unable to leverage economies of scale. Without strategic optimization in sourcing and manufacturing, price competitiveness remains an unresolved challenge.

The market in 2024 and 2025 observed an emphasis on customization for bamboo fiber kitchenware, with brands launching patterned collections for premium dining and hospitality sectors. Retailers introduced thematic sets and seasonal editions, responding to the preference for personalized dining aesthetics in high-end households and boutique restaurants. Enhanced color retention techniques and textural variety have been adopted, making bamboo fiber items visually competitive with ceramic and glassware.

Market response has been positive in online retail channels where curated designs are marketed as exclusive collections. This trend positions design-oriented strategies as a strong differentiator for companies aiming at higher-margin consumer segments.

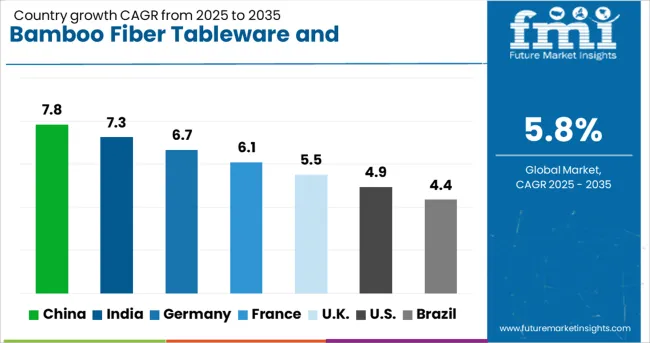

| Country | CAGR |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| France | 6.1% |

| UK | 5.5% |

| USA | 4.9% |

| Brazil | 4.4% |

The global bamboo fiber tableware and kitchenware market is projected to grow at a CAGR of 5.8% from 2025 to 2035. China leads with 7.8%, followed by India at 7.3% and Germany at 6.7%. France records 6.1%, while the United Kingdom posts 5.5%. Growth is driven by rising adoption of eco-friendly tableware, increasing consumer preference for biodegradable alternatives, and regulatory emphasis on reducing plastic waste. China and India dominate due to robust manufacturing ecosystems and domestic demand for sustainable products. Germany focuses on premium bamboo designs, while France and the UK emphasize aesthetics and safety compliance in food-contact materials.

China is projected to grow at 7.8%, supported by large-scale production capacity and high domestic demand for eco-friendly kitchen products. Manufacturers innovate with durable bamboo fiber composites to replace single-use plastics. Integration of vibrant designs enhances consumer appeal in export markets. Growing e-commerce penetration accelerates the adoption of sustainable kitchenware in households.

India is forecast to grow at 7.3%, fueled by urban lifestyle changes and government initiatives promoting biodegradable products. Affordable bamboo-based kitchenware dominates demand in middle-income households. Local manufacturers focus on scaling production while maintaining cost efficiency. Rising popularity of eco-friendly gifting trends further boosts market penetration.

Germany is projected to grow at 6.7%, driven by strong consumer preference for sustainable lifestyle products. Premium bamboo kitchenware integrated with minimalist designs dominates high-end markets. Manufacturers invest in BPA-free, food-safe coatings to meet EU compliance standards. Retail chains expand offerings of biodegradable tableware aligned with zero-waste movements.

France is forecast to grow at 6.1%, supported by growing demand for eco-luxury products and zero-plastic kitchen solutions. Manufacturers introduce microwave-safe bamboo fiber products for convenience-focused consumers. Rising café culture promotes adoption of sustainable tableware in foodservice establishments. Design innovation combining modern aesthetics with functionality attracts premium buyers.

The UK is projected to grow at 5.5%, driven by strong demand for biodegradable products in the retail and HoReCa sectors. Eco-certified bamboo fiber kitchenware dominates sustainable product lines. Manufacturers invest in vibrant, customizable designs targeting home décor enthusiasts. Growing e-commerce penetration and private-label offerings fuel broader adoption.

The bamboo fiber tableware and kitchenware market is fragmented, with multiple established and emerging players driving competition through innovation and eco-focused product portfolios. Bambu Home holds a notable position with its premium-quality, sustainable tableware collections designed for durability and style.

The brand’s emphasis on certified organic bamboo and handcrafted products enhances its market leadership among environmentally conscious consumers. Key players include Arks Global, Bamboo Biomass Products Ltd., Bamboo India, Bamboo Studio, Bamboovement, Better Earth Eco Products, ChopValue Manufacturing Ltd., Ecolife Innovations Ltd., EcoSouLife, Ekobo, Green Pioneer, HUSK’SWARE, Lysas Eco Products Co. Ltd., and Natural Home Brands, each offering diverse bamboo-based products such as plates, bowls, cups, cutlery, and storage solutions.

These companies differentiate through unique design aesthetics, heat-resistant materials, and biodegradable product lines tailored for residential and commercial applications. Market growth is driven by increasing consumer preference for sustainable and reusable alternatives to plastic, combined with the rising adoption of eco-friendly products in hospitality and foodservice sectors. Brands are focusing on product innovation, including dishwasher-safe designs, modern styling, and enhanced durability.

Additionally, the expansion of e-commerce platforms and partnerships with retail chains are creating new opportunities for global reach. Emerging players are entering niche segments, offering customizable and premium bamboo kitchenware targeting luxury and gifting markets, thereby intensifying competition in this fast-growing category.

| Item | Value |

|---|---|

| Quantitative Units | USD 398.5 Million |

| Product Type | Tableware and Kitchenware |

| End-Use | Residential and Commercial |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bambu Home, Arks Global, Bamboo Biomass Products Ltd., Bamboo India, Bamboo Studio, Bamboovement, Better Earth Eco Products, ChopValue Manufacturing Ltd., Ecolife Innovations Ltd., EcoSouLife, Ekobo, Green Pioneer, HUSK’SWARE, Lysas Eco Products Co. Ltd., and Natural Home Brands |

| Additional Attributes | Dollar sales by product segment (tableware vs kitchenware), regional demand trends, competitive landscape, consumer preference for biodegradable & sustainable materials, integration with hospitality/retail chains, innovations in eco‑resin blends and premium finishes. |

The global bamboo fiber tableware and kitchenware market is estimated to be valued at USD 398.5 million in 2025.

The market size for the bamboo fiber tableware and kitchenware market is projected to reach USD 700.3 million by 2035.

The bamboo fiber tableware and kitchenware market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in bamboo fiber tableware and kitchenware market are tableware, _plates, _bowls, _cups and mugs, _trays, _others (cutlery, etc), kitchenware, _cooking utensils, _storage containers, _cutting boards and _others (mixing bowls, etc).

In terms of end-use, residential segment to command 68.7% share in the bamboo fiber tableware and kitchenware market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bamboo Straw Market Size and Share Forecast Outlook 2025 to 2035

Bamboo Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bamboo Extracts for Anti-Aging Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Bamboo Extracts for Skin Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Bamboo Apparel Market Size and Share Forecast Outlook 2025 to 2035

Bamboo Engineered Wood Market Size and Share Forecast Outlook 2025 to 2035

Bamboo Market Analysis - Demand, Trends & Industry Forecast 2024 to 2034

Bamboo Packaging Market Share, Growth & Trends 2025 to 2035

Bamboo Cups Market Analysis and Insights for 2025 to 2035

Bamboo Products Market Analysis – Trends & Growth 2025 to 2035

Market Share Insights for Bamboo Straw Providers

Sustainable Bamboo Charcoal Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Probe Hydrophone (FOPH) Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Centrifugal Fan Market Size and Share Forecast Outlook 2025 to 2035

Fiber to the Home Market Size and Share Forecast Outlook 2025 to 2035

Fiber Based Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fiber Lid Market Forecast and Outlook 2025 to 2035

Fiberglass Tanks Market Size and Share Forecast Outlook 2025 to 2035

Fiber Sorter Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Tester Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA