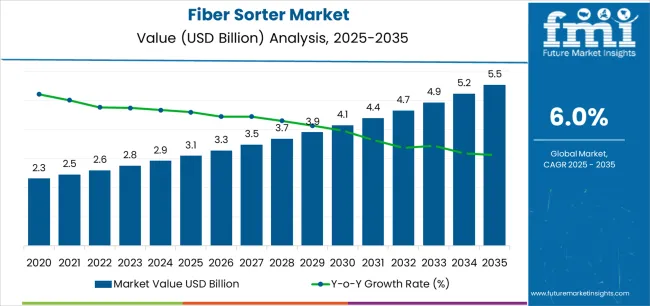

The Fiber Sorter Market is estimated to be valued at USD 3.1 billion in 2025 and is projected to reach USD 5.5 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period.

The fiber sorter market is expanding steadily as industries increasingly prioritize automated sorting systems to enhance operational efficiency, reduce waste, and ensure product quality. Growing demand from textiles, recycling, and food processing sectors is supporting adoption across global markets.

Technological advancements in imaging sensors, machine learning, and material recognition are enabling faster and more accurate fiber separation, thereby improving throughput and reliability. The current scenario reflects rising integration of intelligent automation and smart sorting technologies that optimize production lines and minimize human error.

The future outlook is marked by strong investment in innovation and sustainable processing systems, with manufacturers focusing on developing compact, energy-efficient solutions adaptable to diverse industrial requirements Growth rationale is built upon the rising need for high-precision sorting systems, regulatory emphasis on sustainable resource management, and expanding industrial automation across emerging economies, positioning the market for consistent performance improvements and long-term value creation.

| Metric | Value |

|---|---|

| Fiber Sorter Market Estimated Value in (2025 E) | USD 3.1 billion |

| Fiber Sorter Market Forecast Value in (2035 F) | USD 5.5 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

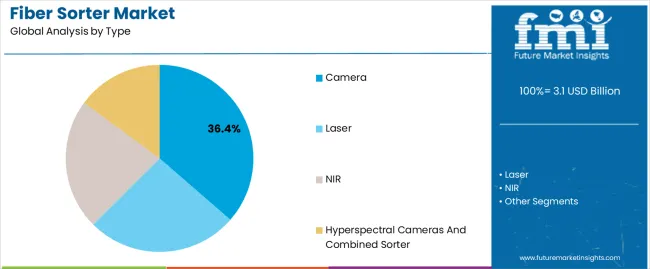

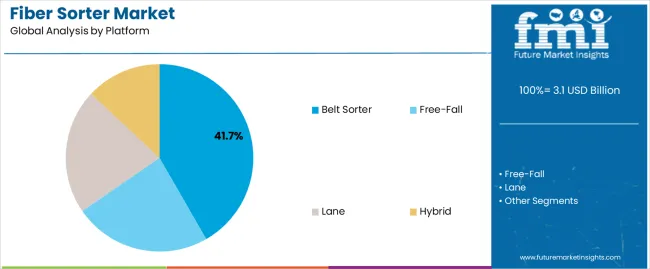

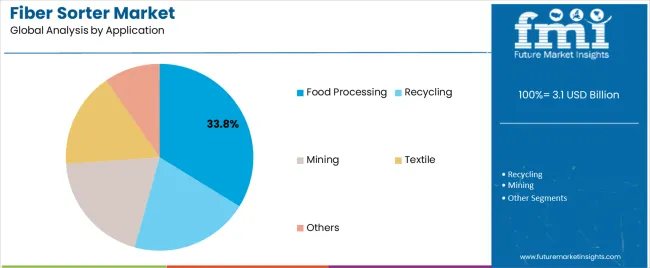

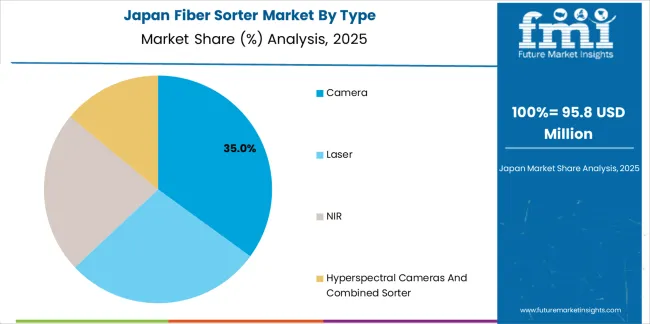

The market is segmented by Type, Platform, and Application and region. By Type, the market is divided into Camera, Laser, NIR, and Hyperspectral Cameras And Combined Sorter. In terms of Platform, the market is classified into Belt Sorter, Free-Fall, Lane, and Hybrid. Based on Application, the market is segmented into Food Processing, Recycling, Mining, Textile, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The camera segment, accounting for 36.40% of the type category, has emerged as the leading segment due to its superior capability in detecting color, texture, and fiber composition with high accuracy. Its dominance is supported by advancements in high-resolution imaging and sensor calibration that enhance sorting precision and speed.

Market acceptance has been reinforced by integration into both industrial and commercial sorting lines, offering reliable performance and minimal downtime. The use of camera-based systems has significantly reduced manual intervention and operational costs, contributing to overall efficiency gains.

Ongoing improvements in image processing algorithms and real-time data analysis are further strengthening the segment’s value proposition As manufacturers continue investing in AI-powered vision systems, the camera-based fiber sorter segment is expected to maintain its competitive edge and drive substantial market growth through enhanced accuracy and adaptability.

The belt sorter segment, holding 41.70% of the platform category, has maintained its leading position owing to its adaptability for high-volume sorting operations and ability to handle diverse material types efficiently. Its robust mechanical design and consistent throughput have made it a preferred choice across industries such as textiles, food, and recycling.

The segment’s market strength is reinforced by continuous technological upgrades in belt speed control, load management, and real-time defect detection. Cost efficiency and reduced maintenance requirements have further supported adoption in large-scale industrial environments.

The growing integration of automation and modular system configurations has enabled flexible operation and scalability As production facilities prioritize continuous processing and higher accuracy, the belt sorter platform is expected to sustain its share through ongoing innovations that enhance reliability, performance, and system intelligence.

The food processing segment, representing 33.80% of the application category, has emerged as a dominant area due to the increasing need for quality control and contamination detection in food manufacturing. Rising regulatory standards and consumer expectations for product safety have driven adoption of advanced sorting technologies in the sector.

Fiber sorters are being utilized to remove impurities, ensure uniformity, and enhance product appeal. The integration of vision-based and sensor-driven sorting systems has improved operational precision, reducing waste and optimizing resource utilization.

The segment’s growth is also supported by increasing automation across processing facilities and the demand for hygienic, contact-free sorting methods With the global focus on food safety and production efficiency, the food processing segment is expected to continue its upward trajectory, reinforcing its leading position in the fiber sorter market.

Fiber Sorter Market to Expand Nearly 1.7X through 2035

The fiber sorter market is predicted to expand around 1.7X through 2035, accompanied by a 3.2% increase in the expected CAGR compared to the historical one. Fiber sorters are set to enable precise separation and classification of fibers.

The novel systems are anticipated to improve manufacturing processes, product quality, and resource utilization. From textiles to recycling, fiber sorters ensure optimal performance, driving advancements in diverse sectors. The fiber sorter industry is set to reach USD 5,369.2 million by 2035.

East Asia to be the Future of Automated Fiber Sorting Technology

East Asia is expected to hold around 28.9% of the global fiber sorter market share in 2035. This is attributed to the following factors:

Presence of a Large Textile Industry: As the world’s largest exporter of textiles, China is at the forefront with state-of-the-art facilities and a large workforce. Known for its technological innovations, Japan focuses on high-end clothing and fashion.

South Korea excels in advanced yarn processing and textile technology. Collectively, these countries contribute significantly to global textile production.

The countries are providing a wide range of products, from textiles to industrial garments. The region’s strategic investments, skilled labor, and technological prowess make East Asia an important player in the global textile industry.

Rapid Industrialization: East Asia is witnessing rapid industrialization, LED by powerful economies such as China, Japan, and South Korea. As a leading manufacturing hub, China plays an important role in regulating industries.

Japan’s technological equity boom contributes significantly, while South Korea’s technological prowess expands into areas such as electronics and automotive. This technological boom not only expands the region’s economy but also its supply chain. Rising industrialization underscores the region’s transformation into an economic powerhouse.

Research & Development and Partnerships: East Asia has seen a remarkable increase in research & development activities, with China, Japan, and South Korea promoting innovation. Investments in science and technology are set to stimulate growth in several sectors.

Collaborations between academia, government, and industry are flourishing, creating a dynamic research & development ecosystem. Joint ventures, partnerships, and international cooperation underscore the region’s commitment to knowledge-driven growth.

As East Asia increasingly becomes a global innovation hub, collaborative efforts, and research & development programs are important to drive advancements. These are likely to shape the future of the industry and contribute to the region’s economic growth.

The fiber sorter market value grew at a CAGR of 3.1% between 2020 and 2025. Total market revenue reached about USD 2,824.2 million in 2025. In the forecast period, the fiber sorter industry is set to thrive at a CAGR of 6.3%.

| Historical CAGR (2020 to 2025) | 3.1% |

|---|---|

| Forecast CAGR (2025 to 2035) | 6.3% |

The fiber sorter industry witnessed moderate growth between 2020 and 2025. It was attributed to economic growth in emerging markets, which LED to the expansion of the textile and food industries.

Fiber Sorter Market Forecast

High Demand for Contamination-free Products in Textile Industry

Growing Awareness of Product Quality and Safety Standards

Regulatory Concerns are Affecting the Fiber Sorter Market

Lack of Awareness is a Crucial Concern for Market Growth

The table below shows the estimated growth rates of several countries in the global fiber sorter market. India, China, and Turkiye are set to record high CAGRs of 5.9%, 3.7%, and 2.8% respectively, through 2035.

| Countries | Projected Fiber Sorter Market CAGR (2025 to 2035) |

|---|---|

| India | 5.9% |

| China | 3.7% |

| Turkiye | 2.8% |

| Mexico | 2.1% |

| Canada | 1.7% |

The section below shows the food processing segment dominating based on application. It is forecast to thrive at 6.7% CAGR between 2025 and 2035.

Based on type, the laser segment is anticipated to hold a dominant share through 2035. It is set to exhibit a CAGR of 6.9% during the forecast period.

| Top Segment (Application) | Food Processing |

|---|---|

| Predicted CAGR (2025 to 2035) | 6.7% |

| Top Segment (Type) | Laser |

|---|---|

| Projected CAGR (2025 to 2035) | 6.9% |

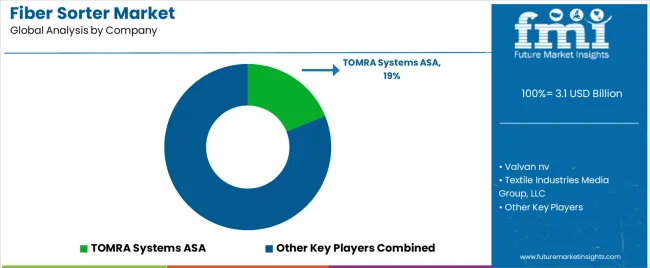

The fiber sorter market is fairly consolidated, with leading players accounting for about 60% to 65% share. Valvan NV, Textile Industries Media Group, Jingwei Textile Machinery Co., Ltd, Suzhou Deedo Machinery Co., Ltd, ALLGAIER WERKE GmbH, AsmSrl, Binder+Co, Bühler AG, A/S Cimbria, CP Manufacturing, Inc., EMS Turnkey Waste Recycling Solutions, Fowler Westrup, Key Technology, NATIONAL RECOVERY TECHNOLOGIES, LLC., Newtec A/S, and TOMRA Systems ASA are the leading manufacturers and suppliers of fiber sorter market listed in the report.

Key companies operating in the global fiber sorting machine market are focusing on launching state-of-the-art products to attract more customers. They are mainly using machine learning and artificial intelligence (AI) in their sorters to introduce innovative features and gain momentum in the market.

Recent Developments in the Fiber Sorter Market

| Attribute | Details |

|---|---|

| Estimated Fiber Sorter Market Size (2025) | USD 2,914.6 million |

| Projected Fiber Sorter Market Size (2035) | USD 5,369.2 million |

| Anticipated Growth Rate (2025 to 2035) | 6.3% CAGR |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Value (USD million) and Volume (tons) |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Fiber Sorter Market Segments Covered | Type, Platform, Application, Region |

| Key Countries Covered | North America; Latin America; Western Europe; Eastern Europe; East Asia; South Asia Pacific; Middle East & Africa |

| Key Companies Profiled | Valvan nv; Textile Industries Media Group, LLC; Jingwei Textile Machinery Co., Ltd.; Suzhou Deedo Machinery Co., Ltd; Zhengzhou Textile Machinery; ALLGAIER WERKE GmbH; AsmSrl; Binder+Co; Bühler AG; A/S Cimbria; CP Manufacturing Inc.; EMS Turnkey Waste Recycling Solutions; Fowler Westrup; Key Technology; NATIONAL RECOVERY TECHNOLOGIES, LLC; Newtec A/S; TOMRA Systems ASA |

The global fiber sorter market is estimated to be valued at USD 3.1 billion in 2025.

The market size for the fiber sorter market is projected to reach USD 5.5 billion by 2035.

The fiber sorter market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in fiber sorter market are camera, laser, nir and hyperspectral cameras and combined sorter.

In terms of platform, belt sorter segment to command 41.7% share in the fiber sorter market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fiberglass Tanks Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Polymer Panel and Sheet Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Tester Market Size and Share Forecast Outlook 2025 to 2035

Fiber Laser Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Market Size and Share Forecast Outlook 2025 to 2035

Fiber Spinning Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Plastic (FRP) Panels & Sheets Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Fabric Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Connectivity Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Collimating Lens Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Duct Wrap Insulation Market Size and Share Forecast Outlook 2025 to 2035

Fiber-Based Blister Pack Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fiber Optics Testing Market Size and Share Forecast Outlook 2025 to 2035

Fiber Laser Coding System Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optics Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Polymer (FRP) Rebars Market Size and Share Forecast Outlook 2025 to 2035

Fiber Supplements Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Filters Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Test Equipment Market Outlook - Size, Share & Forecast 2025 to 2035

Fiberglass Light Poles Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA