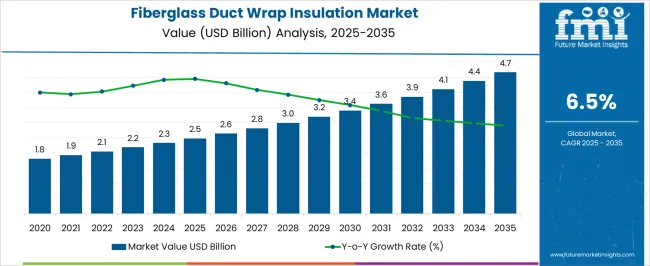

The fiberglass duct wrap insulation market is estimated to be valued at USD 2.5 billion in 2025 and is projected to reach USD 4.7 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

The breakpoint analysis highlights significant stages of growth as the market transitions through distinct phases. From 2021 to 2025, the market grows from USD 1.8 billion to 2.5 billion, passing through intermediate values of USD 1.9 billion, 2.1 billion, and 2.2 billion. This early period sees gradual, steady growth, driven by the increasing demand for energy-efficient and sustainable building materials. The market begins to gain momentum as industries and construction sectors adopt fiberglass insulation for its thermal and acoustic performance benefits. Between 2026 and 2030, the market accelerates from USD 2.5 billion to 3.6 billion, with intermediate values of USD 2.6 billion, 2.8 billion, 3.0 billion, and 3.2 billion.

This phase marks a critical breakpoint where growth accelerates due to stricter building codes, a heightened focus on energy efficiency, and increasing adoption in both residential and commercial sectors. Technological advancements in manufacturing and product innovation also play a role in driving this rapid growth. From 2031 to 2035, the market continues its upward trajectory, growing from USD 3.4 billion to 4.7 billion, passing through USD 3.6 billion, 3.9 billion, and 4.1 billion. The market enters a mature phase where growth is sustained by ongoing demand in energy-efficient infrastructure and green building initiatives.

The fiberglass duct wrap insulation market is driven by five key parent markets that collectively define its growth, demand, and application across the construction, industrial, and energy sectors. The insulation materials market contributes the largest share, about 30-35%, as fiberglass duct wrap insulation is widely used in heating, ventilation, and air conditioning (HVAC) systems to improve thermal performance, reduce energy loss, and enhance overall system efficiency.

The construction and building materials market adds approximately 20-24%, as fiberglass duct wraps are critical for improving energy efficiency in residential, commercial, and industrial buildings by providing effective insulation for ductwork and ventilation systems. The HVAC systems and equipment market contributes around 15-18%, as duct wrap insulation helps in reducing energy consumption by preventing heat transfer in HVAC ducts, ensuring optimal temperature control and indoor air quality.

The energy efficiency and sustainability market accounts for roughly 12-15%, as building owners and operators increasingly prioritize insulation solutions that meet energy codes, reduce operational costs, and contribute to environmental sustainability. The industrial machinery and equipment market represents about 8-10%, as fiberglass duct wraps are also employed in industrial facilities to insulate air handling units, exhaust systems, and other mechanical components, enhancing operational efficiency and worker safety.

| Metric | Value |

|---|---|

| Fiberglass Duct Wrap Insulation Market Estimated Value in (2025 E) | USD 2.5 billion |

| Fiberglass Duct Wrap Insulation Market Forecast Value in (2035 F) | USD 4.7 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The fiberglass duct wrap insulation market is experiencing steady growth, driven by heightened energy efficiency requirements, stricter building codes, and rising awareness of indoor climate control benefits. Industry sources and construction sector updates have emphasized the growing use of duct insulation to reduce thermal losses in HVAC systems, thereby improving energy performance in both new builds and retrofits.

Advances in manufacturing have led to higher-performance fiberglass wraps with improved thermal resistance, moisture control, and fire safety ratings, enhancing their suitability for diverse climate conditions. Government incentives promoting sustainable building practices have further encouraged adoption across residential, commercial, and industrial sectors.

Additionally, the construction boom in emerging markets, coupled with renovation activity in developed economies, has expanded demand for insulation materials. Over the forecast period, the market is expected to remain influenced by the demand for products with superior facing options and by strong uptake in residential projects as consumers and developers prioritize energy cost savings and environmental compliance.

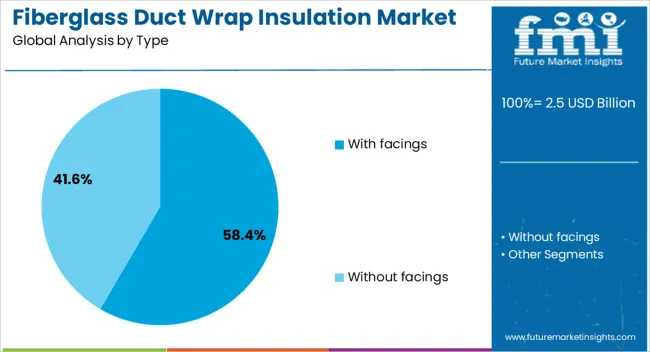

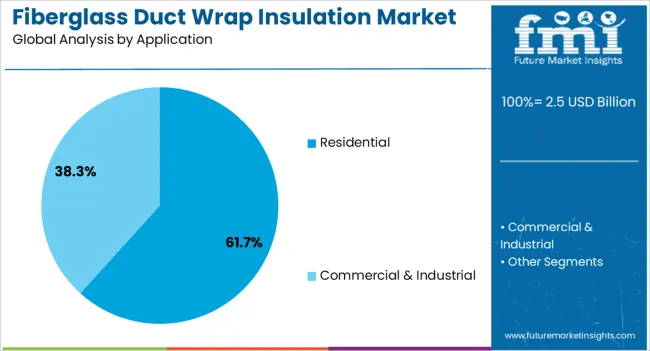

The fiberglass duct wrap insulation market is segmented by type, application, and geographic regions. By type, fiberglass duct wrap insulation market is divided into with facings and without facings. In terms of application, fiberglass duct wrap insulation market is classified into residential and commercial & industrial. Regionally, the fiberglass duct wrap insulation industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The with facings segment is projected to account for 58.4% of the fiberglass duct wrap insulation market revenue in 2025, maintaining its lead due to the enhanced performance and protection benefits it offers. Faced insulation incorporates vapor retarders, reflective surfaces, or reinforced materials that improve durability, moisture control, and thermal efficiency.

These attributes have been valued by contractors and builders for ensuring long-term system integrity, especially in environments where humidity control is critical. Industry feedback has also highlighted that faced wraps facilitate easier handling and installation, reducing labor time and minimizing the risk of damage during application.

Additionally, compliance with fire safety and building code requirements has been easier to achieve with certain facing types, further supporting demand. As energy efficiency standards become increasingly stringent, faced fiberglass duct wrap insulation is expected to remain the preferred choice for projects requiring both functional performance and compliance assurance.

The residential segment is projected to contribute 61.7% of the fiberglass duct wrap insulation market revenue in 2025, underscoring its dominance in application demand. This leadership has been driven by growing residential construction activity, rising retrofitting projects, and homeowner interest in reducing energy bills through improved HVAC efficiency.

Residential properties benefit significantly from duct insulation by minimizing heat loss or gain, leading to consistent indoor comfort and lower operational costs. Building industry reports have noted a rise in insulation specification for single-family and multi-unit dwellings, particularly in regions with extreme seasonal temperatures.

The availability of lightweight, easy-to-install fiberglass duct wraps has further encouraged adoption in residential projects, including DIY installations. In addition, government-backed energy efficiency programs and incentives for sustainable housing have reinforced the inclusion of duct insulation as a standard component in home construction. With the combination of cost savings, comfort enhancement, and environmental benefits, the residential segment is expected to maintain its leading position in the market.

The fiberglass duct wrap insulation market is growing due to rising demand for energy-efficient solutions in the construction industry, driven by energy conservation efforts and stricter regulations. It offers significant health and comfort benefits by improving indoor air quality and reducing noise. Challenges include raw material costs, sustainability concerns, and performance in extreme conditions. Opportunities exist in green building certifications and smart technologies, as fiberglass insulation helps achieve energy savings and meets eco-friendly building standards. Innovations in product features, including moisture-resistant coatings and integration with smart technologies, are shaping the market's future.

The fiberglass duct wrap insulation market is growing as the construction industry increasingly focuses on energy-efficient solutions. With rising energy costs and stricter building codes globally, energy-saving products like fiberglass duct wrap insulation are in high demand. This insulation helps reduce energy loss in HVAC systems by preventing heat transfer, leading to lower heating and cooling costs. In North America and Europe, where energy conservation is a top priority, builders are opting for energy-efficient materials to meet green building standards such as LEED and BREEAM. Companies like Owens Corning and Johns Manville are leading the market with advanced fiberglass insulation products designed to improve HVAC efficiency and meet environmental goals.

Despite its many benefits, the fiberglass duct wrap insulation market faces challenges related to raw material costs, performance, and market competition. The production of fiberglass insulation requires significant energy, and concerns over the cost of raw materials such as glass fibers and binders can impact overall pricing. Additionally, while fiberglass insulation is effective in improving energy efficiency, it may not perform as well in extreme temperature environments compared to newer materials like spray foam or cellulose. Manufacturers are working to address these issues by exploring cost-effective production methods and focusing on performance enhancements to make fiberglass duct wrap a competitive option.

The rise in building certifications and the growing focus on smart building technologies present key opportunities for fiberglass duct wrap insulation. As the construction industry strives to meet energy goals, there is a rising demand for insulation materials that contribute to energy savings and carbon reduction. Fiberglass duct wrap insulation’s ability to improve HVAC performance and energy efficiency positions it as a valuable product for LEED-certified buildings and other green construction projects. Furthermore, the integration of smart building systems, which optimize energy consumption and enhance environmental control, creates opportunities for advanced fiberglass insulation products to be incorporated into modern, energy-efficient structures.

The fiberglass duct wrap insulation market is evolving with innovations in product features and technology. Manufacturers are introducing fiberglass insulation products with advanced moisture-resistant coatings, improved fire resistance, and higher R-values to enhance their thermal performance. Additionally, the integration of fiberglass insulation with smart technology, such as sensors to monitor temperature and air quality, is gaining traction. These innovations help optimize energy efficiency, reduce costs, and improve building performance. As smart building technologies become more integrated into construction projects, the demand for advanced, high-performance fiberglass duct wrap insulation will continue to rise, meeting the needs of modern building designs.

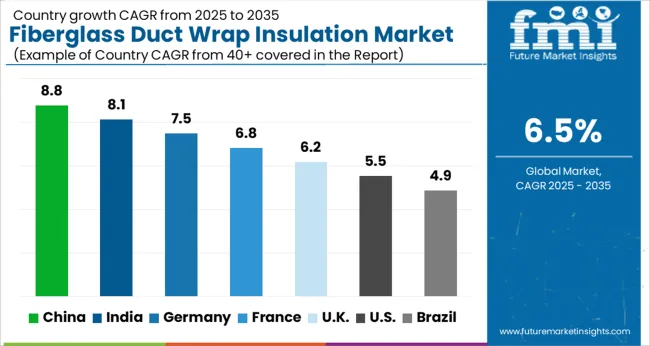

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

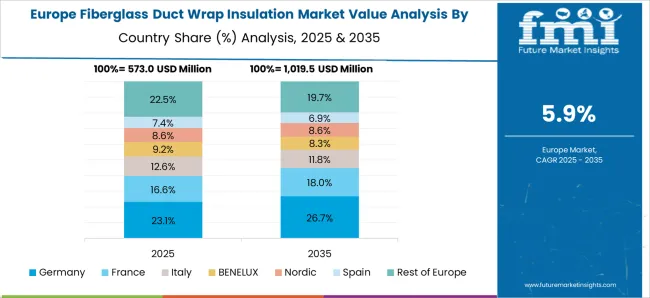

The global fiberglass duct wrap insulation market is projected to grow at a CAGR of 6.7% from 2025 to 2035. China leads with a CAGR of 8.8%, followed by India at 8.1% and Germany at 7.5%. The UK and the USA show more moderate growth at 6.2% and 5.5%, respectively. The growth trends reflect various regional catalysts: China and India’s rapid urbanization and industrialization, Germany's strong energy efficiency regulations, and the UK and USA's increased demand for energy-saving building solutions. The demand for fiberglass duct wrap insulation is driven by factors such as the expansion of HVAC systems, energy conservation efforts, and the need for thermal and sound insulation in residential and commercial buildings. The analysis spans over 40+ countries, with the leading markets shown below.

The fiberglass duct wrap insulation marketin China is projected to grow at a CAGR of 8.8% from 2025 to 2035. As the construction and infrastructure sectors continue to expand in the country, the demand for energy-efficient and cost-effective insulation solutions is on the rise. The adoption of fiberglass duct wrap insulation is driven by its excellent thermal and acoustic properties, which make it an ideal choice for heating, ventilation, and air conditioning (HVAC) systems. China's growing urbanization, coupled with stringent building regulations focused on energy efficiency, supports the demand for such insulation products. Additionally, the rapid development of industrial and commercial spaces further contributes to the increased use of fiberglass insulation in ducts. The country's growing awareness of energy conservation and reducing carbon footprints has made fiberglass duct wrap insulation a popular choice.

The fiberglass duct wrap insulation market in India is expected to grow at a CAGR of 8.1% from 2025 to 2035. The demand for fiberglass duct wrap insulation in India is primarily driven by rapid urbanization and the increasing construction activities in residential, commercial, and industrial sectors. With a growing focus on energy efficiency and sustainable building practices, the adoption of thermal and acoustic insulation products such as fiberglass duct wraps is rising. The Indian government's push for energy conservation and the development of green building standards further boost market growth. As the HVAC industry grows in line with the construction boom, demand for high-performance insulation materials like fiberglass duct wraps increases. The growing focus on air conditioning and refrigeration systems in commercial buildings, coupled with the need for improved indoor air quality, is another important driver.

The fiberglass duct wrap insulation market in Germany is projected to grow at a CAGR of 7.5% from 2025 to 2035. The market in Germany is driven by the country's commitment to reducing energy consumption and meeting sustainability targets. As part of its green building initiatives, Germany is increasingly adopting energy-efficient solutions for both residential and commercial buildings. Fiberglass duct wrap insulation is gaining popularity due to its superior thermal insulation properties, acoustic control, and environmental benefits. Germany’s robust construction industry, along with its extensive industrial and HVAC sectors, continues to drive the demand for insulation products. In addition, stringent building codes and regulations aimed at improving energy efficiency and reducing carbon emissions are pushing the market for fiberglass duct wrap insulation. The country’s well-established infrastructure and the presence of key manufacturers further enhance market growth.

The fiberglass duct wrap insulation market in the UK is expected to grow at a CAGR of 6.2% from 2025 to 2035. The demand for fiberglass duct wrap insulation in the UK is being driven by stringent energy efficiency regulations and the government's commitment to reducing carbon emissions. As part of its sustainability initiatives, the UK is increasingly adopting energy-saving materials and insulation solutions for both new and retrofitted buildings. The market is also being supported by the expanding HVAC sector, as building owners and contractors seek ways to improve thermal comfort and reduce heating and cooling costs. The growing awareness among consumers about the environmental impact of energy consumption, coupled with the need for superior sound insulation in residential and commercial buildings, is boosting the demand for fiberglass duct wrap insulation.

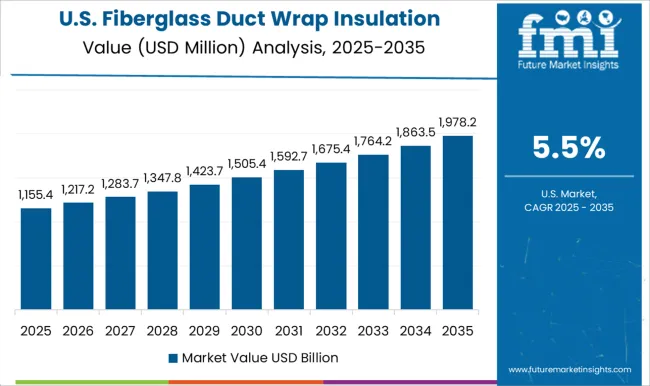

The fiberglass duct wrap insulation market in the USA is projected to grow at a CAGR of 5.5% from 2025 to 2035. The USA market is driven by the increasing demand for energy-efficient solutions in both residential and commercial buildings. As the country focuses on reducing energy consumption and enhancing building performance, fiberglass duct wrap insulation is gaining popularity due to its ability to improve HVAC system efficiency. The rising awareness of energy conservation, along with the implementation of stricter building codes and standards, is supporting the demand for high-performance insulation products. The growth of the HVAC industry in the USA, driven by the need for climate control in commercial and industrial spaces, is further increasing the need for fiberglass duct wraps. The USA market is also seeing increased adoption of eco-friendly building materials, further pushing the demand for energy-efficient insulation solutions like fiberglass duct wrap insulation.

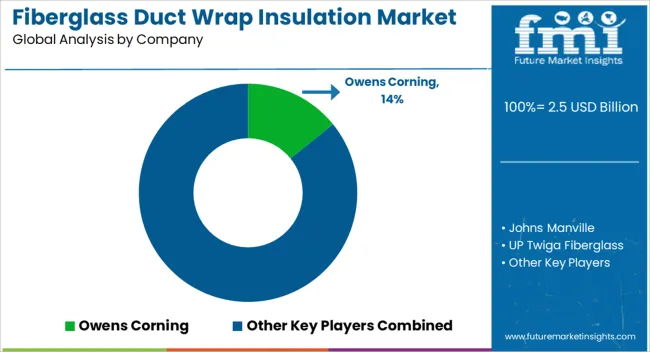

Competition in the fiberglass duct wrap insulation market is driven by product performance, insulation efficiency, and the ability to meet the growing demand for energy-efficient building solutions. Owens Corning leads the market by offering a wide range of high-performance fiberglass insulation products, with brochures highlighting their superior thermal and acoustic properties. The company differentiates itself through innovative manufacturing techniques, strong environmental credentials, and a commitment to sustainability.

Johns Manville competes with its advanced fiberglass duct wrap insulation solutions, emphasizing enhanced R-value, moisture resistance, and easy installation. Their product brochures focus on the reliability and durability of their insulation, making it ideal for commercial and industrial applications. UP Twiga Fiberglass focuses on producing affordable and effective fiberglass duct insulation for large-scale commercial projects. Their product brochures emphasize the cost-effectiveness and performance of their insulation, showcasing its role in reducing energy consumption and improving HVAC efficiency. Mag-Isover, part of the Saint-Gobain Group, offers premium fiberglass insulation solutions with a focus on reducing heat loss, energy savings, and soundproofing. Their brochures emphasize the flexibility of their insulation products, suitable for both residential and commercial applications.

CertainTeed and Knauf Insulation also cater to the growing demand for high-performance insulation, highlighting features such as eco-friendly materials, moisture control, and superior sound absorption. Manson Insulation and Thermaire specialize in providing fiberglass duct wrap insulation for industrial and commercial HVAC systems. Their brochures highlight durability, ease of installation, and compliance with industry standards. Frost King, Lamtec Corporation, and GAF offer more budget-friendly insulation solutions, emphasizing ease of use, fast installation, and adequate performance for residential and light commercial applications. Quietflex targets noise-sensitive applications, with its brochures focusing on the acoustic properties of its fiberglass duct wrap insulation products. Kimmco Duct Insulation (KDI) and AFICO focus on the Middle Eastern market, offering high-quality fiberglass duct insulation solutions that meet regional standards. Their brochures highlight the benefits of energy efficiency and moisture control, addressing the specific needs of hot and humid climates.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.5 billion |

| Type | With facings and Without facings |

| Application | Residential and Commercial & Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Owens Corning, Johns Manville, UP Twiga Fiberglass, Mag-Isover, CertainTeed, Knauf Insulation, Manson Insulation, Thermaire, Frost King, Lamtec Corporation, GAF, Quietflex, Kimmco Duct Insulation (KDI), and AFICO |

| Additional Attributes | Dollar sales by product type (fiberglass duct wraps, mineral wool wraps, reflective wraps), application (residential, commercial, industrial), and insulation properties (thermal, acoustic, fire-resistant). Demand in this market is driven by the increasing need for energy-efficient building materials, government regulations promoting sustainability, and the rising adoption of green building practices. Regional trends highlight growth in North America, Europe, and Asia-Pacific, with strong investments in energy-efficient infrastructure, retrofitting of old buildings, and the development of new, eco-friendly commercial and residential buildings. |

The global fiberglass duct wrap insulation market is estimated to be valued at USD 2.5 billion in 2025.

The market size for the fiberglass duct wrap insulation market is projected to reach USD 4.7 billion by 2035.

The fiberglass duct wrap insulation market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in fiberglass duct wrap insulation market are with facings and without facings.

In terms of application, residential segment to command 61.7% share in the fiberglass duct wrap insulation market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fiberglass Tanks Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Fabric Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Filters Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Light Poles Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Electrical Enclosure Market Analysis - Size, Share & Forecast 2025 to 2035

Fiberglass Cloth Market

High Temperature Fiberglass Filter Media Market Size and Share Forecast Outlook 2025 to 2035

Duct Integrity Tester (DIT) Market Size and Share Forecast Outlook 2025 to 2035

Ductile and Grey Iron Casting Products Market Size and Share Forecast Outlook 2025 to 2035

Ductless Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Ducted Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Ductless Heating & Cooling Systems Market Size and Share Forecast Outlook 2025 to 2035

Duct Fans Market Growth – Trends & Forecast 2025 to 2035

Key Players & Market Share in Duct Tape Industry

Duct Tape Market Forecast by Removable and Professional Grade Tapes for 2024 to 2034

Induction Cooktop Market Forecast and Outlook 2025 to 2035

Inductive Arc Position Sensor Market Size and Share Forecast Outlook 2025 to 2035

Inductance Meters Market Size and Share Forecast Outlook 2025 to 2035

Induction Furnace Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA