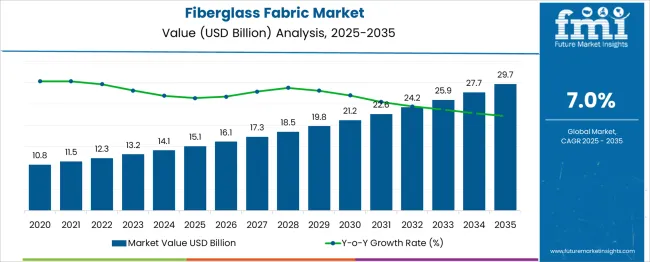

The global fiberglass fabric market is likely to grow from USD 15.1 billion in 2025 to approximately USD 29.7 billion by 2035, recording an absolute increase of USD 14.59 billion over the forecast period. This translates into a total growth of 96.7%, with the market forecast to expand at a compound annual growth rate (CAGR) of 7% between 2025 and 2035. The overall market size is expected to grow by nearly 1.97X during the same period, supported by increasing demand from construction and aerospace industries, growing adoption in renewable energy applications, and rising focus on lightweight composite materials.

Between 2025 and 2030, the fiberglass fabric market is projected to expand from USD 15.1 billion to USD 21.2 billion, resulting in a value increase of USD 6.1 billion, which represents 42.2% of the total forecast growth for the decade. This phase of growth will be shaped by rising demand from construction and infrastructure development, increasing adoption in aerospace and defense applications, and growing penetration of fiberglass fabrics in wind energy projects. Manufacturing companies are expanding their production capacities to address the growing demand for high-performance composite materials.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 15.1 billion |

| Forecast Value in (2035F) | USD 29.7 billion |

| Forecast CAGR (2025 to 2035) | 7% |

From 2030 to 2035, the market is forecast to grow from USD 21.2 billion to USD 29.7 billion, adding another USD 8.4 billion, which constitutes 57.8% of the overall ten-year expansion. This period is expected to be characterized by expansion of renewable energy infrastructure, integration of advanced manufacturing technologies, and development of next-generation composite materials. The growing adoption of sustainable construction practices and lightweight automotive components will drive demand for high-performance fiberglass fabrics with enhanced strength-to-weight ratios.

Between 2020 and 2025, the fiberglass fabric market experienced steady expansion, driven by increasing infrastructure development in emerging economies and growing demand for lightweight materials in transportation sectors. The market developed as manufacturers recognized the need for durable, cost-effective composite reinforcement materials. Government initiatives supporting renewable energy projects and green building standards began emphasizing the importance of fiberglass fabrics in modern construction and manufacturing applications.

Market expansion is being supported by the increasing demand for lightweight, high-strength materials across various industries and the corresponding need for efficient composite reinforcement solutions. Modern manufacturers are increasingly focused on materials that can provide superior mechanical properties while reducing overall weight and cost. Fiberglass fabric's proven performance in structural applications, corrosion resistance, and versatility makes it a preferred choice in construction, aerospace, and automotive applications.

The growing emphasis on sustainable construction and renewable energy infrastructure is driving demand for fiberglass fabrics in wind turbine manufacturing and green building projects. Industry preference for materials that combine durability with cost-effectiveness is creating opportunities for innovative fabric constructions. The rising influence of government regulations promoting energy-efficient buildings and the expansion of offshore wind energy projects are also contributing to increased product adoption across different industrial sectors and geographical markets.

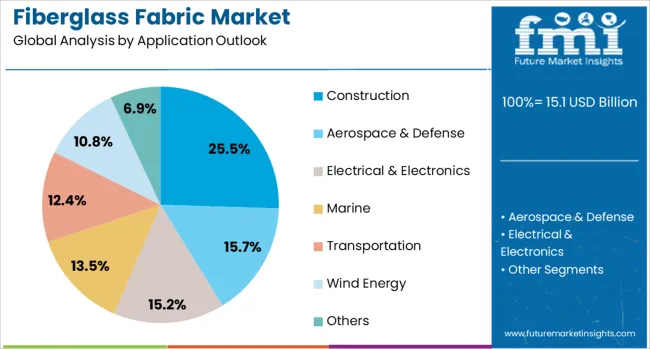

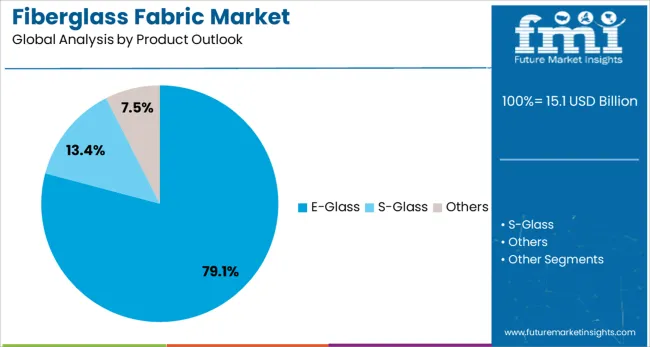

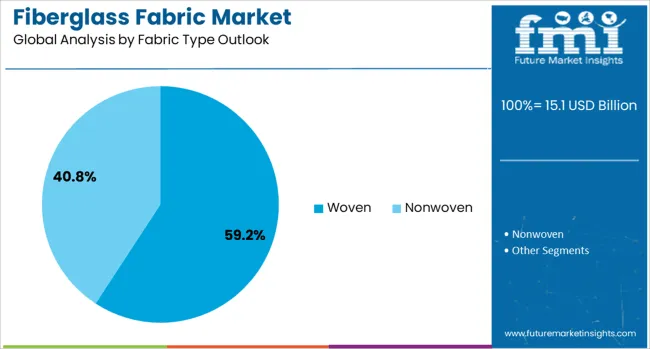

The market is segmented by application, product outlook, fabric type, and region. By application, the market is divided into construction, aerospace & defense, electrical & electronics, marine, transportation, wind energy, and others. Based on product outlook, the market is categorized into E-Glass, S-Glass, and others. In terms of fabric type, the market is segmented into woven and nonwoven. Regionally, the market is divided into China, India, Germany, France, UK, USA, Brazil, and other regions.

The construction application is projected to account for 25.5% of the fiberglass fabric market in 2025, reaffirming its position as the category's leading end-use sector. The construction industry increasingly relies on fiberglass fabrics for reinforcement applications in concrete structures, architectural panels, and roofing systems. The material's excellent corrosion resistance, dimensional stability, and cost-effectiveness make it ideal for both residential and commercial construction projects.

This application forms the foundation of market demand, as construction activities continue to expand globally, particularly in emerging economies. Government infrastructure spending and urban development projects are driving consistent demand for fiberglass reinforcement materials. The growing focus on sustainable building practices and energy-efficient construction methods aligns with fiberglass fabric properties, ensuring continued dominance in this segment.

E-Glass is projected to represent 79.1% of fiberglass fabric demand in 2025, underscoring its role as the dominant glass fiber type for general-purpose applications. E-Glass offers excellent balance of mechanical properties, chemical resistance, and cost-effectiveness, making it suitable for a wide range of industrial applications. Its proven performance in construction, electrical, and general composite applications has established it as the industry standard.

The segment benefits from well-established manufacturing processes, reliable supply chains, and extensive application knowledge across industries. While specialty glass types like S-Glass offer superior performance for specific applications, E-Glass remains the preferred choice for volume applications where cost-effectiveness is crucial. The continued expansion of construction and general industrial applications will maintain E-Glass dominance in the fiberglass fabric market.

The woven fabric type is forecasted to contribute 59.2% of the fiberglass fabric market in 2025, reflecting its superior mechanical properties and versatility in structural applications. Woven fiberglass fabrics provide excellent tensile strength, dimensional stability, and handling characteristics that are essential for demanding applications in construction, aerospace, and marine industries.

Woven fabrics offer better drapeability and conformability compared to nonwoven alternatives, making them preferred for complex geometric applications and hand lay-up processes. The segment benefits from established weaving technologies and the ability to customize fabric constructions for specific performance requirements. Advanced weaving techniques continue to improve fabric performance while maintaining cost competitiveness in volume applications.

The fiberglass fabric market is advancing steadily due to increasing infrastructure development, growing demand for lightweight composite materials, and expanding renewable energy applications. However, the market faces challenges including raw material price volatility, competition from alternative reinforcement materials, and environmental concerns related to glass fiber production. Innovation in fabric constructions and sustainable manufacturing practices continue to influence product development and market expansion patterns.

The growing development of wind energy projects globally is creating substantial demand for fiberglass fabrics used in wind turbine blade manufacturing. Offshore wind installations require high-performance fabrics that can withstand harsh marine environments while providing the structural integrity necessary for large turbine designs. Government initiatives supporting renewable energy targets are driving consistent demand for specialized fiberglass fabric constructions.

Modern fiberglass fabric manufacturers are incorporating advanced weaving technologies, automated quality control systems, and digital monitoring to enhance product consistency and production efficiency. These technologies improve fabric uniformity while reducing manufacturing costs and enabling customization for specific application requirements. Investment in Industry 4.0 technologies is enabling better supply chain integration and customer service capabilities.

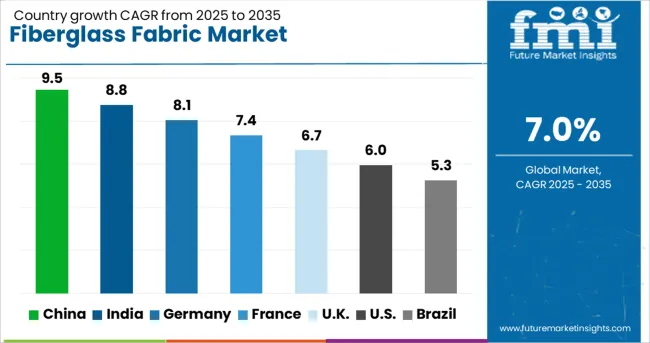

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 8.8% |

| China | 9.5% |

| Germany | 8.1% |

| France | 7.4% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

The fiberglass fabric market is experiencing robust growth globally, with China leading at a 9.5% CAGR through 2035, driven by massive infrastructure projects, manufacturing expansion, and government support for renewable energy development. India follows closely at 8.8%, supported by urbanization, industrial growth, and increasing adoption of composite materials. Germany shows steady growth at 8.1%, emphasizing high-performance applications in automotive and aerospace sectors. France records 7.4%, focusing on aerospace applications and wind energy projects. The UK shows 6.7% growth, prioritizing marine and offshore applications. The USA demonstrates 6.0% growth, driven by infrastructure renewal and aerospace demand. The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from fiberglass fabric in China is projected to exhibit strong growth with a CAGR of 9.5% through 2035, driven by massive infrastructure development programs, expanding manufacturing capabilities, and government support for renewable energy projects. The country's position as a global manufacturing hub creates substantial demand for fiberglass reinforcement materials across construction, automotive, and industrial applications. Major domestic and international manufacturers are expanding production capacities to serve both domestic and export markets.

Revenue from fiberglass fabric in India is expanding at a CAGR of 8.8%, supported by rapid urbanization, infrastructure modernization, and growing manufacturing sector development. The country's expanding construction industry and increasing adoption of composite materials in automotive and aerospace applications are driving demand for high-quality fiberglass fabrics. International manufacturers and domestic companies are establishing production facilities to serve the growing market demand.

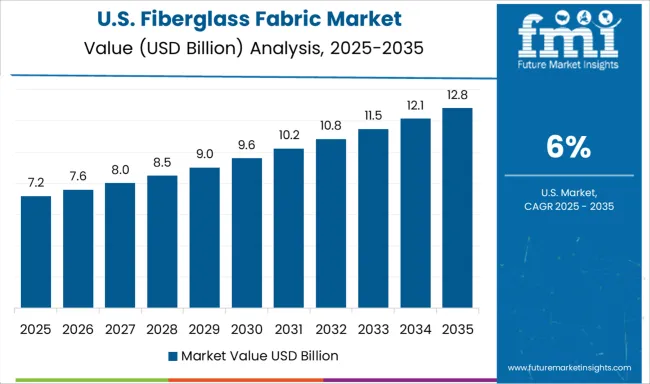

Demand for fiberglass fabric in the USA is projected to grow at a CAGR of 6.0%, supported by infrastructure modernization programs, aerospace industry requirements, and renewable energy development. American manufacturers are increasingly focused on high-performance applications that require specialized fabric constructions and superior quality standards. The market is characterized by strong demand for aerospace-grade materials and advanced composite solutions.

Revenue from fiberglass fabric in Germany is projected to grow at a CAGR of 8.1% through 2035, driven by the country's strong automotive industry, aerospace applications, and leadership in wind energy technology. German manufacturers consistently demand high-quality materials that deliver superior performance while meeting stringent environmental and safety standards.

Revenue from fiberglass fabric in France is projected to grow at a CAGR of 7.4% through 2035, supported by strong aerospace industry presence, wind energy development, and advanced manufacturing capabilities. French manufacturers value high-performance materials that meet demanding application requirements while supporting sustainable development goals.

Revenue from fiberglass fabric in the UK is projected to grow at a CAGR of 6.7% through 2035, supported by strong marine industry presence, offshore wind development, and advanced composite manufacturing capabilities. British manufacturers emphasize materials that can perform in demanding marine environments while meeting strict safety and environmental standards.

Revenue from fiberglass fabric in Brazil is projected to grow at a CAGR of 5.3% through 2035, supported by infrastructure development, construction industry growth, and expanding industrial manufacturing capabilities. The country's growing economy and urbanization trends are creating opportunities for fiberglass reinforcement applications across multiple sectors.

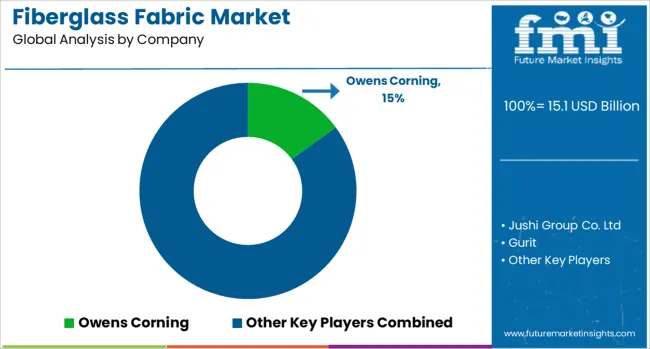

The fiberglass fabric market is characterized by competition among established glass manufacturers, specialty textile companies, and emerging composite material suppliers. Companies are investing in advanced manufacturing technologies, product innovation, global distribution networks, and technical support services to deliver high-performance, reliable, and cost-effective fiberglass fabric solutions. Brand reputation, technical expertise, and supply chain capabilities are central to strengthening market position and customer relationships.

Owens Corning, USA-based, leads the market with 15.0% global value share, offering comprehensive fiberglass fabric solutions with focus on construction, industrial, and specialty applications. Jushi Group Co. Ltd, China-based, provides cost-effective glass fiber products with emphasis on volume production and competitive pricing. Gurit, Switzerland-based, delivers specialized composite materials for aerospace, automotive, and wind energy applications. Hexcel Corporation, USA-based, focuses on advanced composite materials for aerospace and defense applications.

BGF Industries Inc., USA-based, provides technical textile solutions with emphasis on custom fabric constructions and specialized applications. Other significant players include Saint-Gobain, Nippon Electric Glass, Taiwan Glass, and CPIC, operating globally to provide comprehensive fiberglass fabric solutions across multiple price points and application requirements.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 15.1 billion |

| Application | Construction, Aerospace & Defense, Electrical & Electronics, Marine, Transportation, Wind Energy, Others |

| Product Outlook | E-Glass, S-Glass, Others |

| Fabric Type | Woven, Nonwoven |

| Regions Covered | China, India, Germany, France, UK, USA, Brazil, Rest of World |

| Countries Covered | China, India, Germany, France, United Kingdom, United States, Brazil, Japan, South Korea, Italy, Canada and 40+ countries |

| Key Companies Profiled | Owens Corning, Jushi Group Co. Ltd, Gurit, Hexcel Corporation, BGF Industries Inc., Saint-Gobain, Nippon Electric Glass, Taiwan Glass, CPIC, Taishan Fiberglass |

| Additional Attributes | Dollar sales by glass type and fabric construction, regional demand trends, competitive landscape, application-specific performance requirements, integration with composite manufacturing processes, innovations in weaving technologies, sustainable production practices, and advanced material developments |

The global fiberglass fabric market is estimated to be valued at USD 15.1 billion in 2025.

The market size for the fiberglass fabric market is projected to reach USD 29.7 billion by 2035.

The fiberglass fabric market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in fiberglass fabric market are construction, aerospace & defense, electrical & electronics, marine, transportation, wind energy and others.

In terms of product outlook, e-glass segment to command 79.1% share in the fiberglass fabric market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fiberglass Tanks Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Duct Wrap Insulation Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Filters Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Light Poles Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Electrical Enclosure Market Analysis - Size, Share & Forecast 2025 to 2035

Fiberglass Cloth Market

High Temperature Fiberglass Filter Media Market Size and Share Forecast Outlook 2025 to 2035

Fabric Spreading Machine Market Forecast Outlook 2025 to 2035

Fabric Freshener Market Forecast and Outlook 2025 to 2035

Fabric Inspection Machine Market Size and Share Forecast Outlook 2025 to 2035

Fabric Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Fabric Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fabric Toys Market Size and Share Forecast Outlook 2025 to 2035

Fabric Softener Sheet Market Size and Share Forecast Outlook 2025 to 2035

Fabric Filter System Market Size & Forecast 2025 to 2035

Fabric Softener Market Analysis by Nature, Product Type, End Use, Sales Channel & Region from 2025 to 2035

Fabric Care Market Analysis - Trends, Growth & Forecast 2025 to 2035

Fabric Odor Eliminator Market – Trends, Growth & Forecast 2025 to 2035

Fabric Stain Remover Market Growth – Trends, Demand & Innovations 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA