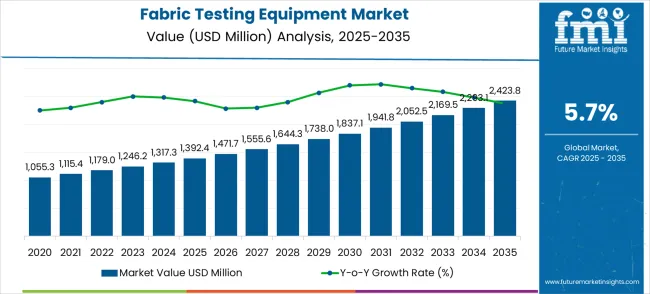

The fabric testing equipment market is valued at USD 1,392.4 million in 2025 and is anticipated to grow to USD 2,423.8 million by 2035, recording a CAGR of 5.7%. In the early phase from 2021 to 2025, the market sees incremental growth, moving from USD 1,055.3 million to USD 1,392.4 million, with intermediate increases through USD 1,115.4 million, 1,179.0 million, 1,246.2 million, and 1,317.3 million. This growth phase reflects strong demand driven by advancements in textile quality control and rising standards in the apparel industry, as well as growing focus on fabric durability and performance testing.

Between 2026 and 2030, the market continues to show a steady upward trajectory, expanding from USD 1,392.4 million to USD 1,738.0 million, with intermediate increases through USD 1,471.7 million, 1,555.6 million, 1,644.3 million, and 1,738.0 million. During this period, market share is gained by companies that innovate in automated testing solutions and expand their product portfolios to meet regulatory standards. The increasing demand for efficient fabric production processes and the need for specialized testing equipment in the fast-evolving fashion and textile sectors contribute to this growth. By the 2031-2035 period, the market continues its expansion, reaching USD 2,423.8 million, with intermediate values progressing through USD 1,837.1 million, 1,941.8 million, 2,052.5 million, and 2,169.5 million.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1,392.4 million |

| Forecast Value in (2035F) | USD 2,423.8 million |

| Forecast CAGR (2025 to 2035) | 5.7% |

The textile industry leads the market, accounting for 40-45%, as fabric testing equipment is essential for ensuring the quality and durability of fabrics used in clothing, upholstery, and industrial applications. These tools help assess various properties such as strength, colorfastness, and shrinkage, ensuring compliance with industry standards. The apparel industry contributes 25-30%, with fabric testing being crucial for maintaining high-quality standards in garments. Tests are conducted to evaluate fabric performance under conditions like washing, exposure to light, and mechanical stress.

The automotive industry also plays a significant role, contributing around 15-18%, as fabric testing is used for evaluating seat covers, upholstery, and other interior materials in vehicles, particularly for wear resistance, flame retardancy, and durability. The home textiles and upholstery sector adds 10-12%, with fabric testing ensuring that materials used in furniture, bedding, and curtains are durable, fire-resistant, and colorfast. The research and development segment contributes 5-8%, where fabric testing equipment is used in academia and testing laboratories for the development of new materials and improvement of existing products.

The fabric testing equipment market represents a compelling growth opportunity driven by increasing quality consciousness in textile manufacturing and stringent regulatory compliance requirements. Valued at USD 1.39 billion in 2025 and projected to reach USD 2.42 billion by 2035 (CAGR 5.7%), this market is experiencing transformation through digital integration, automation, and precision engineering advances.

Rising textile production in emerging markets, coupled with heightened consumer safety expectations and regulatory standards in developed regions, creates multiple revenue streams. Manufacturers are increasingly recognizing testing equipment not merely as compliance tools but as strategic assets for brand differentiation, quality assurance, and operational efficiency enhancement.

Pathways focusing on digital transformation, geographic expansion, and application diversification offer substantial margin uplift opportunities. The integration of IoT, AI-driven analytics, and automated systems promises to revolutionize traditional testing methodologies while creating premium pricing opportunities for technology leaders.

Modern textile manufacturers demand real-time quality monitoring and data-driven insights. Companies developing IoT-enabled testing equipment with cloud connectivity, predictive analytics, and automated reporting can command premium pricing. Digital systems reduce manual intervention, enhance accuracy, and provide comprehensive quality documentation for regulatory compliance. Expected revenue pool: USD 450-650 million.

The shift toward automated testing protocols and artificial intelligence for pattern recognition and defect detection represents significant opportunity. Advanced systems that combine machine learning algorithms with precision measurement can reduce testing time by 40-60% while improving accuracy. This appeals particularly to high-volume manufacturers seeking operational efficiency. Revenue opportunity: USD 380-520 million.

China (7.7% CAGR) and India (7.1% CAGR) lead global growth, driven by expanding textile manufacturing and export ambitions. Establishing local manufacturing, service networks, and partnerships with regional textile hubs can capture substantial market share. Localized products addressing specific regional textile varieties and manufacturing practices enhance penetration. Expected upside: USD 600-850 million.

Beyond traditional single-parameter testing, integrated systems measuring multiple fabric properties simultaneously (stiffness, permeability, flammability, shrinkage) reduce testing cycles and improve efficiency. These comprehensive platforms appeal to large textile manufacturers seeking standardized quality control across diverse product lines. Pool: USD 420-600 million.

Investment in cutting-edge measurement technologies, enhanced sensor accuracy, and advanced calibration systems creates differentiation opportunities. Markets demanding high-precision testing (technical textiles, automotive, aerospace applications) willingly pay premiums for superior accuracy and reliability. Revenue lift: USD 350-480 million.

Expanding into emerging applications including technical textiles, medical textiles, geotextiles, and smart fabrics opens new revenue streams. These specialized markets often require customized testing protocols and command higher margins due to stringent performance requirements. Opportunity: USD 320-450 million.

Transitioning from equipment sales to service-based models including equipment-as-a-service, remote diagnostics, predictive maintenance, and training programs creates recurring revenue streams. This approach particularly appeals to smaller manufacturers unable to invest in expensive equipment outright. Pool: USD 280-400 million.

As global textile safety standards become more stringent, companies positioning themselves as compliance experts and developing testing equipment specifically for emerging regulations (REACH, OEKO-TEX, CPSIA) can capture premium markets. This includes specialized testing for consumer safety and environmental compliance. Expected revenue: USD 250-350 million.

Market expansion is being supported by the increasing global demand for high-quality textiles and the corresponding need for comprehensive testing solutions that can ensure fabric performance, durability, and safety standards across various textile applications. Modern textile manufacturers are increasingly focused on implementing testing solutions that can reduce quality issues, minimize product recalls, and provide consistent performance validation in fabric production processes. Fabric testing equipment's proven ability to deliver precise measurements, comprehensive analysis, and regulatory compliance makes it an essential tool for contemporary textile manufacturing and quality assurance operations.

The growing focus on textile safety and regulatory compliance is driving demand for fabric testing equipment that can support industry standards, ensure product safety, and enable comprehensive quality documentation. Textile processors' preference for equipment that combines accuracy with operational efficiency and cost-effectiveness is creating opportunities for innovative fabric testing implementations. The rising influence of eco-conscious manufacturing trends and quality assurance demands is also contributing to increased adoption of fabric testing equipment that can provide comprehensive performance analysis without compromising production efficiency.

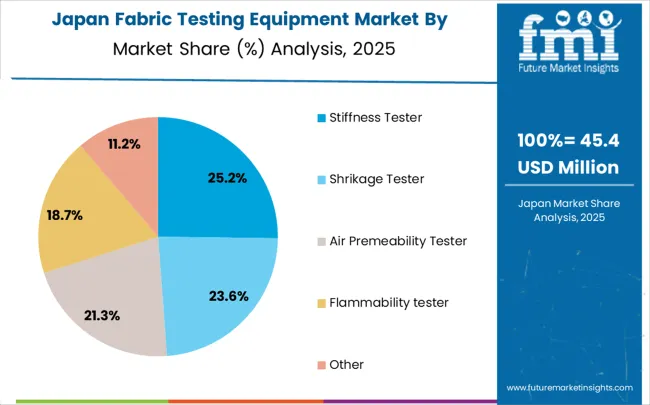

The market is segmented by tester type, application, and region. By tester type, the market is divided into stiffness testers, shrinkage testers, air permeability testers, flammability testers, and others. Based on application, the market is categorized into ensuring quality, consumer safety, compliance with regulations, product development, and other key areas. Regionally, the market is divided into Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa.

The stiffness tester segment is projected to maintain its leading position in the fabric testing equipment market in 2025, capturing 25% of the market share. Textile manufacturers increasingly rely on stiffness testers for their high accuracy in measuring fabric rigidity, comprehensive analysis capabilities, and critical role in quality control for garments, home textiles, industrial fabrics, and technical textiles. The advanced measurement capabilities of stiffness testing technology directly address the need for reliable fabric characterization and quality assurance in large-scale textile production. As a fundamental component of textile quality control, stiffness testers offer versatility and consistency, making them central to modern textile testing strategies. Investments in precision measurement systems continue to drive their adoption, ensuring high standards in fabric performance and product quality across various textile production sectors.

The ensuring quality application segment is projected to represent the largest share of fabric testing equipment demand in 2025, with 30% of the market. Quality assurance remains the primary driver for the adoption of fabric testing equipment across textile manufacturing operations. Manufacturers prefer these tools for their cost-effectiveness, comprehensive analysis capabilities, and ability to enhance product reliability while minimizing defects and customer complaints. Fabric testing equipment is essential for modern textile quality control, providing operational advantages and supporting product consistency. Continuous innovation in testing methodologies, along with the growing use of automated systems, further improves the efficiency and accuracy of quality assessment. With increasing demand for regulatory compliance and higher manufacturing efficiency, the ensuring quality application segment will continue to lead the market, supporting the drive for improved textile quality and operational excellence.

The fabric testing equipment market is advancing rapidly due to increasing demand for quality assurance in textile manufacturing and growing adoption of automated testing systems that provide enhanced accuracy and efficiency across diverse textile testing applications. The market faces challenges, including high equipment costs, the need for skilled operators, and technical complexity in advanced testing procedures. Innovation in digital testing technologies and IoT-enabled systems continues to influence product development and market expansion patterns.

The growing adoption of digital measurement systems and computerized testing equipment is enabling textile manufacturers to achieve superior testing accuracy, enhanced data management, and comprehensive quality documentation capabilities. Digital testing systems provide improved measurement precision while allowing more efficient testing processes and consistent results across various fabric types and testing parameters. Manufacturers are increasingly recognizing the competitive advantages of digital testing capabilities for quality differentiation and operational efficiency.

Modern fabric testing equipment manufacturers are incorporating Internet of Things connectivity and automated testing protocols to enhance testing efficiency, enable real-time quality monitoring, and ensure consistent quality delivery to textile production facilities. These technologies improve manufacturing efficiency while enabling new applications, including remote monitoring and predictive maintenance capabilities. Advanced automation integration also allows manufacturers to support high-volume testing requirements and quality assurance beyond traditional manual testing operations.

| Country | CAGR (2025-2035) |

|---|---|

| China | 7.7% |

| India | 7.1% |

| Germany | 6.6% |

| Brazil | 6.0% |

| USA | 5.4% |

| UK | 4.8% |

| Japan | 4.3% |

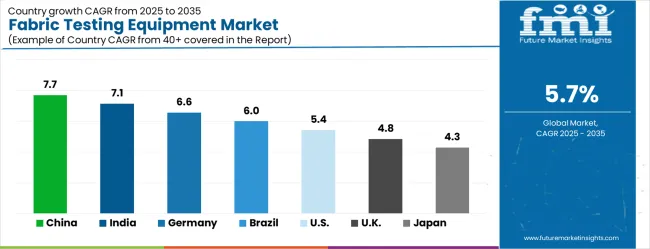

The fabric testing equipment market is experiencing strong growth globally, with China leading at a 7.7% CAGR through 2035, driven by the expanding textile manufacturing industry, growing export capabilities, and significant investment in textile quality control infrastructure development. India follows at 7.1%, supported by large-scale textile production, growing domestic demand for quality testing equipment, and increasing focus on textile exports. Germany shows growth at 6.6%, emphasizing technological innovation and precision testing equipment development. Brazil records 6.0%, focusing on textile industry modernization and quality improvement initiatives. The USA demonstrates 5.4% growth, supported by advanced textile technologies and stringent quality standards. The UK exhibits 4.8% growth, emphasizing quality control and compliance with international standards. Japan shows 4.3% growth, supported by precision manufacturing and advanced testing technologies.

The report covers an in-depth analysis of 40+ countries, with top-performing countries highlighted below.

The fabric testing equipment market in China is expected to grow at a CAGR of 7.7% from 2025 to 2035. As a global leader in textile production, China has a robust demand for fabric testing equipment, particularly in its large manufacturing sector. The country is home to a rapidly expanding textile industry, and the need for high-quality, durable fabrics in various sectors such as fashion, automotive, and home textiles is driving the adoption of fabric testing equipment. China’s push toward technological advancements in the textile industry is supporting the growth of automated and precise testing solutions. Increased focus on quality control and compliance with international textile standards further propels the market. The growing demand for smart textiles and performance fabrics is expected to further amplify the need for testing equipment that can assess various characteristics such as durability, elasticity, and fire resistance.

The fabric testing equipment market in India is forecasted to grow at a CAGR of 7.1% from 2025 to 2035. India is a prominent player in the global textile market, and the demand for fabric testing equipment is growing alongside its textile manufacturing sector. The country’s government initiatives promoting textile exports and the increased focus on producing high-quality fabrics are key factors driving market growth. The Indian textile industry is expanding its focus on performance fabrics for applications in the automotive, sports, and medical sectors, all of which require rigorous testing. Advancements in textile technology and rising consumer expectations for fabric quality are pushing manufacturers to adopt more advanced testing equipment. With India’s increasing participation in international trade and the demand for high-quality textiles, the need for fabric testing solutions is expected to continue growing.

The fabric testing equipment market in Germany is expected to expand at a CAGR of 6.6% from 2025 to 2035. Known for its high-quality manufacturing across various sectors, Germany’s textile industry demands advanced fabric testing equipment. The country has a strong focus on precision and reliability, which drives the need for equipment that ensures textiles meet stringent quality standards. Germany’s automotive, fashion, and industrial fabric sectors require sophisticated testing solutions for durability, safety, and performance. The rise of smart textiles and the growing use of fabrics in non-traditional applications such as wearable technology are propelling demand for advanced testing systems. The market is also supported by Germany’s commitment to innovation, with manufacturers constantly upgrading testing equipment to meet evolving industry standards.

The fabric testing equipment market is anticipated to expand at a CAGR of 6.0% from 2025 to 2035. Brazil is one of the largest textile producers in Latin America, and its textile sector continues to grow rapidly, especially in the fashion and home textiles markets. As the country’s textile manufacturers aim to meet international quality standards, the demand for reliable fabric testing equipment is expected to increase. Brazil’s growing participation in the global textile trade requires advanced testing to ensure the fabrics meet specific requirements for export markets. The market growth is also supported by the increasing consumer preference for high-performance fabrics used in various industries such as sports and healthcare.

The fabric testing equipment market in the USA is anticipated to grow at a CAGR of 5.4% from 2025 to 2035. The United States is a major player in the global textile industry, with a strong focus on advanced testing technologies to ensure fabric quality and safety. The demand for fabric testing equipment is driven by industries such as fashion, automotive, and medical textiles, where high-performance fabrics are critical. The rising trend of green textiles and eco-friendly production processes is contributing to the need for testing equipment that can assess the environmental impact of fabrics. The USA's commitment to maintaining stringent quality control standards in textile manufacturing continues to support market growth.

The fabric testing equipment market in the UK is expected to grow at a CAGR of 4.8% from 2025 to 2035. The UK’s textile industry is increasingly focusing on high-quality manufacturing for both local and export markets, which is driving demand for advanced fabric testing solutions. The need for testing in the fashion and home textiles sectors, as well as the growing demand for performance fabrics in industries such as automotive and healthcare, is contributing to market growth. Additionally, the UK is witnessing rising demand for eco-friendl fabrics, which are subject to more rigorous testing standards. Manufacturers in the UK are also embracing digital and automated solutions to improve efficiency and meet the evolving market demands.

The fabric testing equipment market in Japan is expected to grow at a CAGR of 4.3% from 2025 to 2035. The country’s textile industry is highly advanced and places great importance on ensuring the quality and performance of fabrics. Japan’s automotive, sports, and fashion sectors demand high-quality fabrics, which are driving the need for advanced testing solutions. The country is also seeing a rise in demand for technical textiles, such as smart and functional fabrics, which require specialized testing. Japan’s focus on innovation and technology in manufacturing processes ensures that fabric testing equipment continues to evolve and meet the high standards set by the industry.

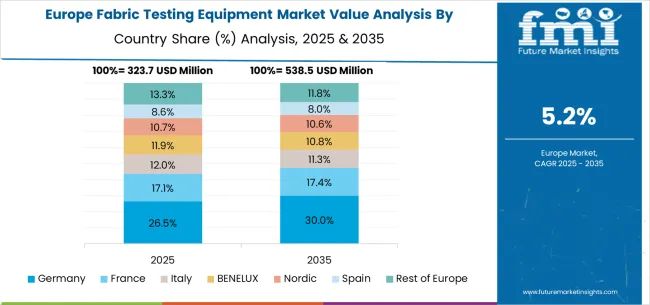

The fabric testing equipment market in Europe is projected to grow from USD 323.7 million in 2025 to USD 538.5 million by 2035, registering a CAGR of 5.2% over the forecast period. Germany is expected to remain the largest national market with 26.5% share in 2025, rising to 30.0% by 2035, supported by its advanced textile technology sector, testing equipment manufacturing base, and comprehensive quality control standards. The United Kingdom follows with 17.1% in 2025, maintaining 17.4% by 2035 as demand for advanced textile quality assurance solutions expands. France accounts for 12.0% in 2025, dipping slightly to 11.3% by 2035 as testing modernization continues across technical textiles.

Italy holds 11.9% in 2025, moderating to 11.3% by 2035 with steady adoption in its textile and apparel manufacturing hubs. Spain represents 10.1% in 2025, softening to 10.0% by 2035, supported by increasing demand for functional and smart fabrics requiring precision testing. BENELUX countries contribute 8.6% in 2025, easing to 8.6% by 2035, while the Nordic region accounts for 8.6% in 2025, dipping to 8.0% by 2035 as testing technology adoption stabilizes. The rest of Europe (Eastern Europe and emerging textile clusters) collectively accounts for 13.3% in 2025, moderating to 11.8% by 2035, reflecting textile modernization and testing adoption growth in emerging regional markets compared with maturity in Western European sectors.

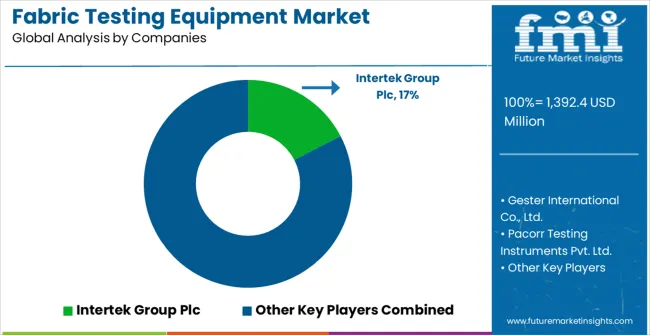

he fabric testing equipment market is characterized by competition among established testing equipment manufacturers, specialized textile technology providers, and integrated measurement system suppliers. Companies are investing in advanced testing technology research, precision engineering, quality control innovation, and comprehensive product portfolios to deliver accurate, reliable, and cost-effective fabric testing solutions. Innovation in digital measurement systems, automated testing protocols, and IoT-enabled equipment is central to strengthening market position and competitive advantage.

Gester International Co., Ltd. leads the market with comprehensive fabric testing solutions, offering advanced testing equipment with a focus on precision measurement and quality assurance applications. Pacorr Testing Instruments Pvt. Ltd. provides specialized testing equipment with an focus on reliability and comprehensive testing capabilities. Ningbo Textile Instrument Factory delivers innovative testing solutions with a focus on textile industry applications and measurement accuracy. Haida Equipment Co., Ltd. specializes in advanced testing technologies for fabric analysis and quality control. Swiss Textile Testing Ltd. focuses on precision measurement and certification services. Ametek Inc. offers comprehensive testing and measurement solutions with an focus on industrial applications and quality assurance.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1,392.4 million |

| Tester Type | Stiffness Tester, Shrinkage Tester, Air Permeability Tester, Flammability Tester, Others |

| Application | Ensuring Quality, Consumer Safety, Compliance with Regulation, Product Development, and Others |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, the United States, the United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | Gester International Co., Ltd., Pacorr Testing Instruments Pvt. Ltd., Ningbo Textile Instrument Factory, Haida Equipment Co., Ltd., Swiss Textile Testing Ltd., and Ametek Inc. |

| Additional Attributes | Dollar sales by tester type and application category, regional demand trends, competitive landscape, technological advancements in testing systems, digital integration, precision measurement development, and quality control optimization |

The global fabric testing equipment market is estimated to be valued at USD 1,392.4 million in 2025.

The market size for the fabric testing equipment market is projected to reach USD 2,423.8 million by 2035.

The fabric testing equipment market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in fabric testing equipment market are stiffness tester, shrikage tester, air premeability tester, flammability tester and other.

In terms of application, ensuring quality segment to command 30.0% share in the fabric testing equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fabric Spreading Machine Market Forecast Outlook 2025 to 2035

Fabric Freshener Market Forecast and Outlook 2025 to 2035

Fabric Inspection Machine Market Size and Share Forecast Outlook 2025 to 2035

Fabric Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Fabric Toys Market Size and Share Forecast Outlook 2025 to 2035

Fabric Softener Sheet Market Size and Share Forecast Outlook 2025 to 2035

Fabric Filter System Market Size & Forecast 2025 to 2035

Fabric Softener Market Analysis by Nature, Product Type, End Use, Sales Channel & Region from 2025 to 2035

Fabric Care Market Analysis - Trends, Growth & Forecast 2025 to 2035

Fabric Odor Eliminator Market – Trends, Growth & Forecast 2025 to 2035

Fabric Stain Remover Market Growth – Trends, Demand & Innovations 2025-2035

Global Fabric Cutting Machine Market Share Analysis – Trends & Forecast 2025–2035

Fabric Starch Market

Prefabricated Track Surfaces Market Size and Share Forecast Outlook 2025 to 2035

Prefabricated Composite Sandwich Panels Market Size and Share Forecast Outlook 2025 to 2035

Prefabricated Bathroom Pods Market Size and Share Forecast Outlook 2025 to 2035

Prefabricated Building System Market Growth - Trends & Forecast 2025 to 2035

Mesh Fabric Market Size and Share Forecast Outlook 2025 to 2035

Data Fabric Market Analysis - Trends, Size & Forecast 2025 to 2035

Metal Fabrication Fluid Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA