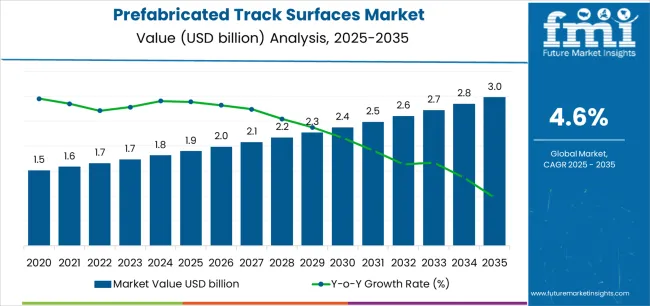

The global prefabricated track surfaces market is valued at USD 1.9 billion in 2025 and is projected to reach USD 3.0 billion by 2035, expanding at a CAGR of 4.6%. Beginning from an estimated USD 1.6 billion in 2021, rolling CAGR analysis indicates consistent mid-term acceleration, supported by the modernization of sports infrastructure and the replacement of aging athletic surfaces with engineered, prefabricated alternatives. The market’s evolution reflects a shift toward controlled production environments that ensure uniform thickness, shock absorption, and surface texture.

Manufacturers are developing modular designs that allow rapid installation with minimal site disruption, meeting growing demand from schools, municipalities, and professional venues. Advancements in polyurethane and rubber compound formulations have improved weather resistance and traction while extending lifecycle durability. Prefabrication also reduces maintenance variability and enhances recyclability, aligning with evolving sustainability requirements for materials. Regional trends show strong adoption in Europe and North America, where regulatory specifications for sports safety and surface certification are firmly established. Asia Pacific continues to gain share through new stadium construction and investment in athletic infrastructure. Raw material pricing, polymer quality control, and logistics coordination remain key determinants of project cost and completion efficiency across the forecast horizon to 2035.

Between 2025 and 2030, the Prefabricated Track Surfaces Market is projected to expand from USD 1.9 billion to USD 2.4 billion, recording a 26.3% increase and accounting for 46.0% of the decade’s overall growth. This period will be driven by rising investments in sports infrastructure, increasing global participation in athletics, and growing adoption of modular, high-performance track systems. Technological improvements in surface materials, including polyurethane and rubber composites, are enhancing durability, shock absorption, and weather resistance. Manufacturers are focusing on sustainable production processes and eco-friendly formulations to align with evolving construction and environmental standards.

From 2030 to 2035, the market is forecast to grow from USD 2.4 billion to USD 3.0 billion, reflecting a 25.0% increase and contributing 54.0% of the decade’s total expansion. Growth during this phase will be propelled by the modernization of school, community, and professional sports facilities across emerging economies. The integration of smart surface technologies for monitoring wear, traction, and performance will redefine design standards. Strategic partnerships between material developers, sports federations, and urban planners will enhance innovation and accelerate project delivery, positioning prefabricated track surfaces as a sustainable and high-performance solution in global athletic infrastructure development.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.9 billion |

| Market Forecast Value (2035) | USD 3.0 billion |

| Forecast CAGR (2025 to 2035) | 4.6% |

The prefabricated track surfaces market is expanding as sports facility operators and urban planners seek durable, low-maintenance athletic surfaces that provide consistent performance and quick installation. Prefabricated systems, typically composed of vulcanized rubber or polyurethane-based materials, offer uniform shock absorption, enhanced traction, and weather resistance, making them suitable for both professional and community-level applications. These surfaces are manufactured in controlled environments and delivered in ready-to-install rolls or panels, reducing on-site variability and construction time.

Rising investment in athletic infrastructure, particularly in schools, stadiums, and municipal recreation projects, drives steady market demand. The increasing global focus on sports participation, health programs, and event readiness further supports adoption. Manufacturers continue to refine polymer composition and bonding techniques to enhance UV stability, surface elasticity, and recyclability, aligning with sustainability requirements and international athletic standards such as those set by World Athletics. The ability to customize color, thickness, and friction properties also appeals to designers seeking performance-specific configurations. Despite higher upfront costs compared to traditional poured-in-place systems, reduced downtime and predictable installation quality improve long-term value. As modernization and renovation of sports venues accelerate, prefabricated track surfaces remain integral to efficient, high-performance athletic infrastructure development worldwide.

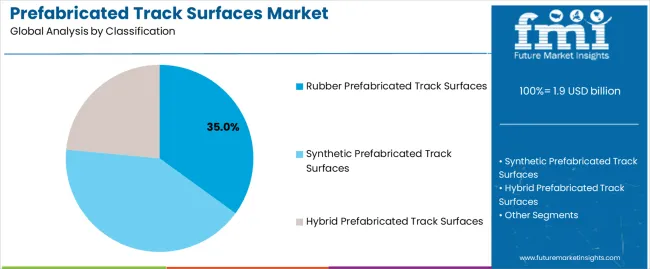

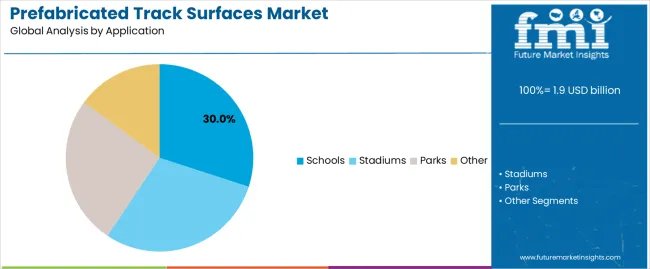

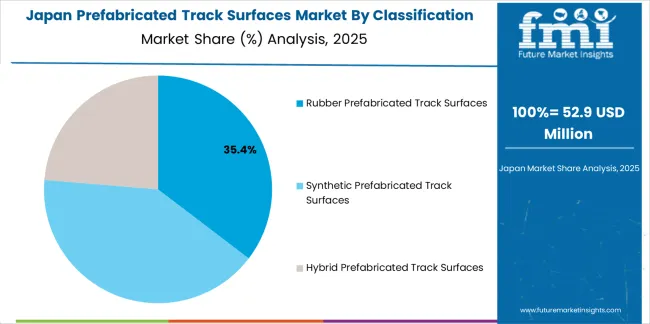

The prefabricated track surfaces market is segmented by classification, application, and region. By classification, the market is divided into rubber prefabricated track surfaces, synthetic prefabricated track surfaces, and hybrid prefabricated track surfaces. Based on application, it is categorized into schools, stadiums, parks, and others. Regionally, the market is segmented into North America, Europe, East Asia, South Asia, Latin America, and the Middle East & Africa. These segments define product material composition, installation environments, and usage trends across institutional and recreational infrastructure projects worldwide.

The rubber prefabricated track surfaces segment accounts for approximately 35.0% of the global prefabricated track surfaces market in 2025, making it the leading classification category. This dominance reflects the segment’s extensive use in educational and community sports facilities that prioritize safety, comfort, and cost efficiency. Rubber-based surfaces offer high impact absorption, durability under repetitive use, and stable traction, supporting consistent athletic performance across training and recreational environments.

These surfaces are typically composed of vulcanized rubber sheets pre-manufactured for easy installation and uniformity, reducing site preparation time. Their resilience against temperature variations and UV degradation enhances lifespan, making them suitable for both indoor and outdoor use. The segment benefits from widespread acceptance in public sector projects and school installations, where maintenance simplicity and environmental compliance influence material selection. Manufacturers continue refining production techniques to improve elasticity, surface uniformity, and recyclability of rubber materials. The rubber prefabricated track surface segment remains integral to the market due to its balance of performance, affordability, and durability, sustaining its position as the preferred choice for institutional and community-level athletic infrastructure worldwide.

The schools segment represents about 30.0% of the total prefabricated track surfaces market in 2025, establishing it as the largest application category. This leadership is driven by the consistent demand for safe and standardized sports infrastructure within educational institutions. Schools adopt prefabricated track surfaces for their uniform quality, easy installation, and reduced maintenance requirements compared to traditional poured-in-place systems. These features make prefabricated materials suitable for multi-purpose athletic fields and running tracks in primary and secondary education facilities.

Government and private education sectors invest in durable track solutions to support physical education programs and ensure long-term cost efficiency. The segment’s growth is particularly notable in East Asia and Europe, where policy-driven upgrades to school infrastructure promote sustainable and student-safe materials. Rubber and hybrid prefabricated tracks are favored for their anti-slip properties and shock absorption, which minimize injury risk during athletic activities. The schools segment continues to dominate overall market demand as educational institutions increasingly prioritize standardized sports surfaces that meet environmental and safety certifications while offering consistent performance over extended use. Its steady procurement base ensures ongoing contribution to global market growth across both developed and emerging regions.

The prefabricated track surfaces market is expanding as sports venue developers and institutional clients increasingly adopt pre-manufactured systems that reduce installation time and improve quality consistency. Prefabricated surfaces often rubber or synthetic modules manufactured off-site provide predictable performance and less disruption during installation compared with traditional poured-in-place tracks. Growth is supported by rising investment in athletic infrastructure, especially in schools and stadiums. At the same time, higher material costs, logistics challenges and competition from alternative surfacing methods remain constraints. A key trend is the shift toward modular, rapid-install systems and expanded global adoption in emerging markets.

Growth is largely driven by increasing demand for upgraded athletic and recreational facilities worldwide. Governments, educational institutions and private sports operators are allocating budgets for new and refurbished tracks to meet performance standards and shorten project timelines. Prefabricated track systems enable faster installation, less site labour, and better control of material quality under factory conditions. The emphasis on safety, durability and compliance with international certification standards supports increased uptake across track surface projects in stadiums, schools and public parks.

The market is restrained by the relatively high cost of prefabricated modules and the logistics involved in transporting large surface panels to site. Manufacturing such surfaces requires specialised materials, strict quality control and dedicated production facilities, which raise unit cost. In many projects, site-prepared sub-bases and existing infrastructure may not align with prefabricated system requirements, leading to compatibility challenges. Additionally, competition from lower-cost on-site poured systems and local materials may limit adoption in budget-constrained environments or regions with limited import capability.

One key trend is the evolution of prefab track surfaces toward more modular, adaptable formats with improved installation flexibility and sustainability. Manufacturers are developing roll-out panels or interlocking modules with standard dimensions, making transport, storage and installation more efficient. Digitally aided manufacturing, pre-certified design profiles and enhanced materials (such as higher-grade synthetics with improved wear resistance) are becoming more common. Growth is particularly strong in emerging regions where sports infrastructure investment is accelerating and project timelines favour prefab solutions.

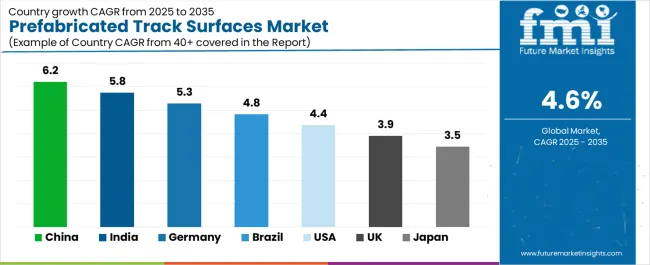

| Country | CAGR (%) |

|---|---|

| China | 6.2% |

| India | 5.8% |

| Germany | 5.3% |

| Brazil | 4.8% |

| USA | 4.4% |

| UK | 3.9% |

| Japan | 3.5% |

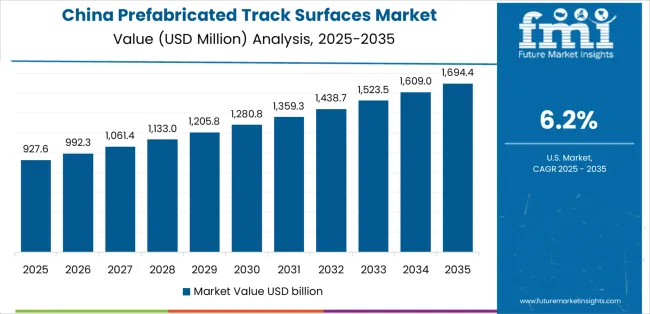

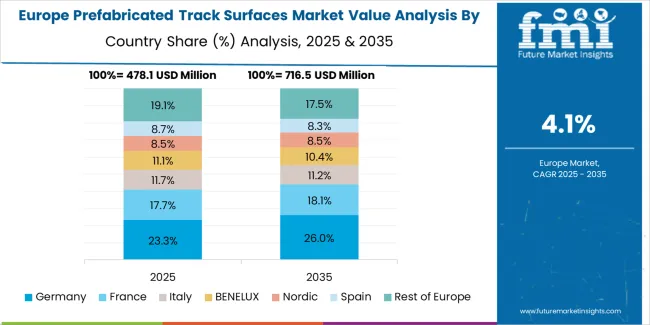

The Prefabricated Track Surfaces Market is growing steadily worldwide, with China leading at a 6.2% CAGR through 2035, supported by large-scale sports infrastructure projects, urban development initiatives, and growing interest in athletic facilities. India follows at 5.8%, fueled by expanding school and public sports programs and government-backed infrastructure spending. Germany records 5.3%, driven by advanced material engineering and high-quality synthetic surface production. Brazil, at 4.8%, benefits from increasing sports participation and facility modernization. The USA posts a 4.4% CAGR, supported by strong institutional and community-level investments, while the UK (3.9%) and Japan (3.5%) maintain stable growth, emphasizing sustainability, durability, and innovation in prefabricated athletic and recreational track surface materials.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

Revenue from prefabricated track surfaces in China is projected to grow at a CAGR of 6.2% through 2035, supported by rapid expansion in sports facility construction and public fitness infrastructure. Government investment in athletic complexes, schools, and stadiums is driving large-scale installations of prefabricated surfaces. Domestic manufacturers are improving polymer formulations and installation efficiency to meet durability standards. Rising participation in athletics and sports education is sustaining consistent demand for high-performance track materials.

Revenue from prefabricated track surfaces in India is increasing at a CAGR of 5.8%, driven by national sports infrastructure programs and rising interest in athletics. Installation of synthetic and modular tracks across educational institutions and municipal facilities continues to expand. Government initiatives under sports development schemes promote procurement of prefabricated surfaces meeting international standards. Manufacturers are focusing on cost-effective materials and rapid installation techniques suited to diverse climatic conditions.

Revenue from prefabricated track surfaces in Germany is advancing at a CAGR of 5.3%, supported by the country’s focus on material engineering and adherence to athletic performance standards. Manufacturers are prioritizing product consistency, shock absorption, and resistance to environmental wear. Sports associations and municipal authorities are investing in facility upgrades to align with global specifications. Research in sustainable surface materials continues to enhance product lifecycle and recyclability.

Revenue from prefabricated track surfaces in Brazil is projected to grow at a CAGR of 4.8%, supported by urban development projects and increased investment in public sports infrastructure. Demand is rising across municipal athletic fields and recreation centers. Government programs promoting youth sports participation are driving consistent procurement. Partnerships with international surface manufacturers are improving access to certified prefabricated materials.

Revenue from prefabricated track surfaces in the United States is increasing at a CAGR of 4.4%, supported by renovation of aging athletic infrastructure and steady demand for high-performance sports surfaces. Educational institutions and municipalities are upgrading tracks to improve safety and performance standards. Manufacturers are emphasizing UV resistance, impact durability, and ease of installation. Ongoing investments in collegiate and community athletics continue to support replacement cycles.

Revenue from prefabricated track surfaces in the United Kingdom is growing at a CAGR of 3.9%, supported by modernization of sports infrastructure and standardization of athletic facility design. Investments in training centers and community stadiums maintain consistent installation demand. Manufacturers are focusing on sustainable materials and modular construction methods to meet environmental objectives. Government-backed programs for youth sports development continue to reinforce utilization.

Revenue from prefabricated track surfaces in Japan is projected to grow at a CAGR of 3.5%, supported by technological precision, infrastructure maintenance, and sports development initiatives. Manufacturers emphasize materials with improved elasticity, drainage performance, and climatic resilience. Demand from schools, universities, and public sports facilities remains steady due to continuous renovation programs. Research in polymer technology supports durability and energy return characteristics.

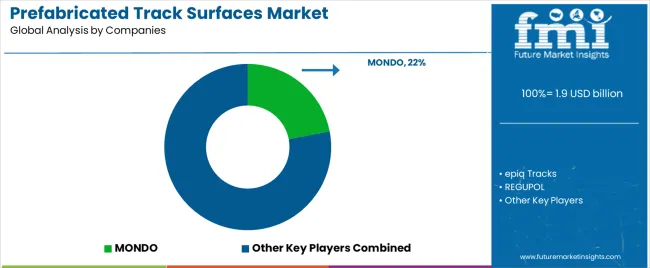

The global prefabricated track surfaces market is moderately consolidated, led by established manufacturers of synthetic sports flooring and specialized rubberized surfacing systems. MONDO holds a leading position with an estimated 22% market share, supported by its long-standing presence in athletic infrastructure and extensive deployment across international stadiums and competition venues. The company’s strength lies in polymer engineering, shock absorption optimization, and consistent surface performance under varied climatic conditions. epiQ Tracks and REGUPOL follow as significant competitors, offering polyurethane-based and recycled rubber systems emphasizing durability and compliance with international athletic standards.

Novotrack and Rekortan maintain solid positions through integrated product development and track system customization for school and professional athletics. Sansu Sports, Wegi Sports Inc, and Jracesports provide cost-effective prefabricated solutions targeting regional markets in Asia and the Middle East. huadongtrack, Guangzhou Tongxin Sports Industry Group, and Foshan Flystep Rubber Sports Floor Manufacturing Co., Ltd contribute to large-scale manufacturing output, emphasizing environmental performance and installation efficiency.

Huantengxiangsu, Shengli Sports, and Ecore operate across diverse flooring segments, extending their product reach into sports infrastructure and modular surface applications. Competition across this market is influenced by material formulation, traction consistency, and compliance with World Athletics certification standards. Strategic differentiation increasingly depends on sustainable raw material sourcing, surface recyclability, and installation precision, while long-term advantage is determined by performance longevity and ongoing innovation in prefabricated elastomeric track technology.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1.9 billion |

| Type (Classification) | Rubber Prefabricated Track Surfaces, Synthetic Prefabricated Track Surfaces, Hybrid Prefabricated Track Surfaces |

| Application | Schools, Stadiums, Parks, Others |

| Regions Covered | North America, Europe, East Asia, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, USA, Germany, Brazil, UK, Japan, and 40+ countries |

| Key Companies Profiled | MONDO, epiQ Tracks, REGUPOL, Novotrack, Rekortan, Sansu Sports, Wegi Sports Inc, Jracesports, huadongtrack, Guangzhou Tongxin Sports Industry Group, Foshan Flystep, Ecore |

| Additional Attributes | Dollar sales by classification and application; regional adoption trends (notably East Asia and Europe); compliance with World Athletics standards; material formulation (polyurethane, vulcanized rubber), modular installation formats (rolls, panels, interlocking modules); lifecycle cost analysis, installation time savings, logistics/sub-base compatibility issues, sustainability and recyclability initiatives, and warranty/maintenance frameworks. |

The global prefabricated track surfaces market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the prefabricated track surfaces market is projected to reach USD 3.0 billion by 2035.

The prefabricated track surfaces market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in prefabricated track surfaces market are rubber prefabricated track surfaces, synthetic prefabricated track surfaces and hybrid prefabricated track surfaces.

In terms of application, schools segment to command 30.0% share in the prefabricated track surfaces market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Prefabricated Composite Sandwich Panels Market Size and Share Forecast Outlook 2025 to 2035

Prefabricated Bathroom Pods Market Size and Share Forecast Outlook 2025 to 2035

Prefabricated Building System Market Growth - Trends & Forecast 2025 to 2035

Modular & Prefabricated Construction Market Size and Share Forecast Outlook 2025 to 2035

Track Geometry Measurement System Market Size and Share Forecast Outlook 2025 to 2035

Track and Trace Solutions Market Trends - Growth & Forecast 2025 to 2035

Track and Trace Packaging Market Report – Trends & Innovations 2025-2035

Market Share Breakdown of Track And Trace Packaging Manufacturers

Track Laying Equipment Market

Track Mounted Gangway Market

Eye Tracking System Market Forecast and Outlook 2025 to 2035

GPS Tracker Market Growth – Trends & Forecast 2024-2034

Eye Tracking Solutions Market

Mini Track Machinery Market Size and Share Forecast Outlook 2025 to 2035

Solar Tracking Module Market Size and Share Forecast Outlook 2025 to 2035

Sleep Tracking and Optimization Products Market Size and Share Forecast Outlook 2025 to 2035

Solar Tracker for Power Generation Market Size and Share Forecast Outlook 2025 to 2035

Laser Trackers Market - Growth, Demand & Forecast 2025 to 2035

Solar Trackers Market Trends & Forecast 2025 to 2035

Tumor Tracking Systems Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA