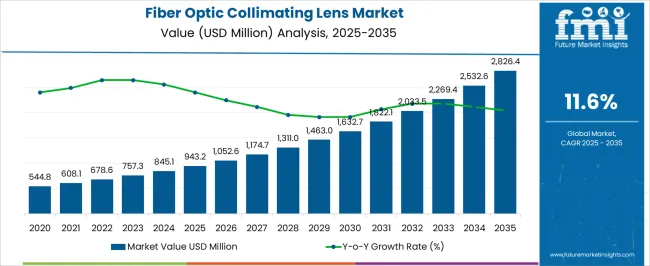

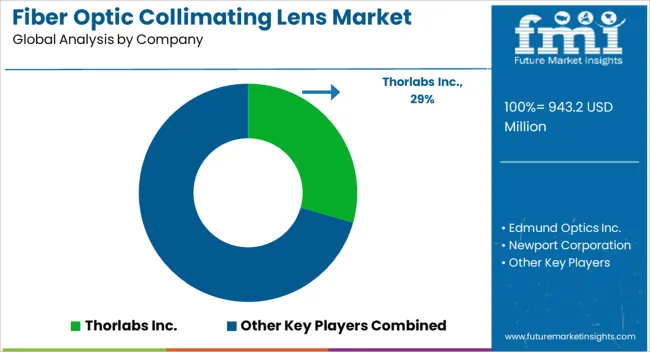

The Fiber Optic Collimating Lens Market is estimated to be valued at USD 943.2 million in 2025 and is projected to reach USD 2826.4 million by 2035, registering a compound annual growth rate (CAGR) of 11.6% over the forecast period.

| Metric | Value |

|---|---|

| Fiber Optic Collimating Lens Market Estimated Value in (2025 E) | USD 943.2 million |

| Fiber Optic Collimating Lens Market Forecast Value in (2035 F) | USD 2826.4 million |

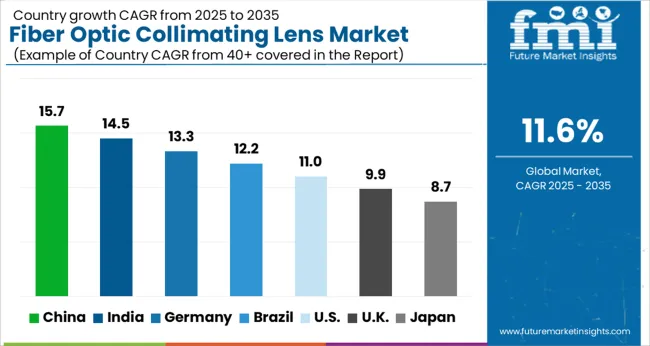

| Forecast CAGR (2025 to 2035) | 11.6% |

The fiber optic collimating lens market is experiencing steady momentum due to the rapid expansion of optical communication networks, rising demand for high speed data transfer, and increasing integration of fiber optics in industrial automation, healthcare imaging, and defense systems. Advancements in photonics technology, coupled with the growing deployment of 5G and cloud infrastructure, are strengthening the adoption of precision optical components.

The need for efficient light coupling, improved beam shaping, and enhanced optical alignment has accelerated investments in collimating lenses that ensure minimal signal loss and optimized performance. Regulatory emphasis on energy efficiency and quality standards is further shaping innovation in lens design and material development.

The market outlook remains positive as manufacturers focus on scalability, wavelength adaptability, and cost effective solutions to support expanding applications across telecommunications, medical diagnostics, and aerospace.

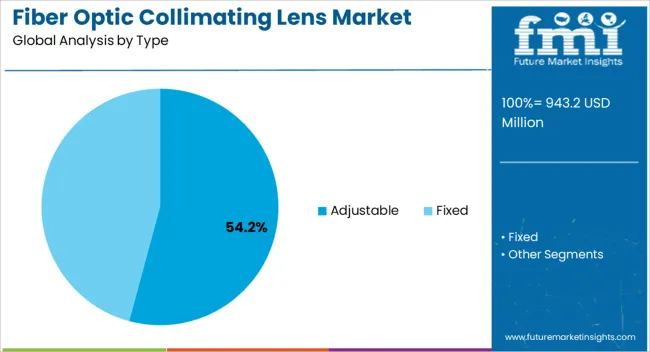

The adjustable segment is expected to represent 54.20% of the total revenue by 2025 within the type category, positioning it as the leading segment. This dominance is driven by its flexibility in beam alignment, adaptability to diverse system requirements, and ability to accommodate variations in optical pathways.

Industries have increasingly favored adjustable collimating lenses due to their precision in minimizing aberrations and optimizing transmission efficiency.

The segment’s ability to enhance customization and deliver reliable performance in both laboratory and field conditions has reinforced its growth trajectory.

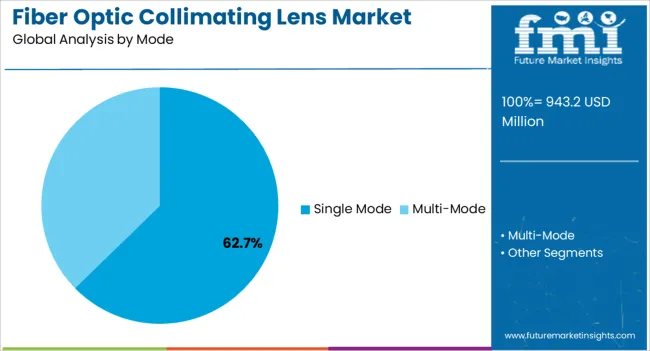

The single mode segment is projected to account for 62.70% of market revenue by 2025 under the mode category, making it the dominant segment. This growth is fueled by its superior ability to transmit light with minimal dispersion, enabling high bandwidth and long distance data transfer.

Adoption has been strengthened by the growing demand for seamless connectivity across telecom networks, data centers, and defense communication systems.

Single mode lenses have also been increasingly utilized in precision sensing and medical devices, reflecting their high efficiency and signal quality advantages.

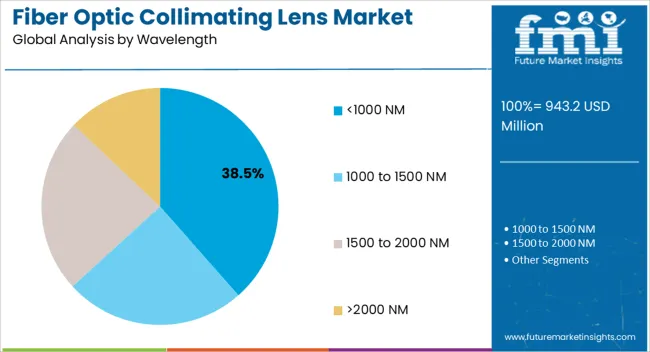

The below 1000 NM wavelength segment is estimated to hold 38.50% of total market revenue by 2025 within the wavelength category. Its leadership is supported by the widespread use of short wavelength lasers in spectroscopy, biomedical imaging, and material processing applications.

The segment benefits from its effectiveness in enabling accurate detection, high resolution imaging, and compact device design.

Increasing adoption of fiber optic technologies in healthcare diagnostics and industrial laser systems has further enhanced demand for lenses operating at this wavelength range, establishing its prominence in the wavelength segment.

Increasing Awareness about the Benefits Offered by Aspheric Lenses over Conventional Lenses to Escalate the Market Growth

The advantages of using aspheric lenses over conventional spherical lenses in optic systems are the key factors driving the market during the forecast period. Aspheric lenses are used to eliminate spherical aberrations in a wide sphere of applications. These lenses are uniquely shaped which allows them to deliver enhanced optical performance against the traditional spherical lenses.

The surging investment in fiber optics is expected to boost the demand for fiber components, including fiber collimating lenses. For instance, broadband providers in North America are expected to invest more than USD 60 billion in fiber-to-the-home (FTTH) projects in the coming five years. Sectors such as healthcare, BFSI, and telecommunications are likely to grow in demand for fiber optic collimating lenses.

The advent of 5G networks is anticipated to offer new revenue avenues for players offering fiber-optic collimating lenses. Various players are slow to cash in on market opportunities for 5G networks. AT&T Intellectual Property has rolled out a 400-gigabit network connection between Dallas and Atlanta to cater to the AR, gaming, and other 5G needs of consumers. In another instance, Verizon Communications introduced a long-haul data session by offering 800 Gbps across the long-distance fiber.

The manufacturing processes of aspheric lenses have gone through various developments over the past few years. The manufacturing cost of aspheric lenses is high than that of traditional spherical lenses. In the aspheric lenses case, the lenses are not defined by a single radius curvature.

That is why smack sub-apertures are used with varying radii of curvature at different points along with the surface. It creates a need for different manufacturing techniques to address these sub-apertures in various ways, as the usage of a single large tool is not suitable.

Magnetorheological finishing (MRF) and computer numerical control (CNC), grinding, and polishing are mostly used to offer control over the surface during manufacturing. CNC techniques are expensive since these techniques are developed for metal production applications. That is why, high material and manufacturing costs are impeding the market growth of the aspheric lens market, which is expected to affect the growth of the fiber optics collimating lens market.

The logistics and manufacturing sectors are likely to be benefitted from fiber optics owing to their operations and services, which are dependent on high-speed bandwidth. The sector demands heavy data for purposes such as several products manufactured, and raw materials received, among others.

Fibers offer scalability, therefore, during rapid expansion, the organization can access the near-unlimited bandwidth easily, without incurring additional monthly fees. Besides, reliability, network latency, and long-term costs are other benefits. Fibers are a highly secured network and it is privately owned and operated by the lease owners. Therefore, it is not easy for an external entity to track or record the data and information being transmitted through the fiber.

The usage of traditional internet wires is projected to be a significant challenge to the market. Traditional internet wires are made up of copper, which is a cheap and widely used component for network devices’ connections.

Owing to the high initial cost of deploying fiber optics in regions such as Latin America and Africa, these regions are yet not completely fiber-based and demand aggressive investments to transform the internet ecosystem. However, with the rising advancements in networking infrastructure, the deployment of fiber cables is expected to grow in the coming time.

| Attributes | Details |

|---|---|

| Fiber Optic Collimating Lens Market Share (2025) | USD 677.4 million |

| Fiber Optic Collimating Lens Market Share (2025) | USD 757.3 million |

| Fiber Optic Collimating Lens Market Share (2035) | USD 2,394.5 million |

| Fiber Optic Collimating Lens Market Share (2025 to 2035) | 11.6% |

| Fiber Optic Collimating Lens Market Attraction | Increasing global demand for computer networking propels the need for free-space communication, thereby, bolstering the fiber optics collimating lenses market. |

The global fiber optic collimating lens market size expanded at a CAGR of 9.9% from 2020 to 2025. In 2020, the global market size stood at USD 943.2 million. In the following years, the market experienced significant growth, accounting for USD 677.4 million in 2025.

Internet users have significantly increased in recent years, widening the demand for high-speed internet. To address the rising demand for high-speed internet access in the residential, business, and industrial sectors, fiber optic networks are being widely implemented. For these networks to provide the best data transmission over long distances, collimating lenses are necessary to accurately regulate and shape the light beams within the optical fibers.

Beyond telecommunications, a wide number of industries, including the medical, aerospace, defense, sensing, and industrial sectors, are discovering uses for fiber optic technology. For accurate measurements, laser-based therapies, remote sensing, and other uses, collimating lenses are frequently needed in these applications. The growing demand from increasing end-use industries is likely to bolster market growth in the coming years.

The global fiber optic collimating lens market can be segmented into type, mode, wavelength, application, and lens type.

Based on type, the global fiber optic collimating lens market can be segmented into fixed and adjustable. According to the analysis, the fixed segment is anticipated to drive the market during the forecast period. The segment is likely to witness a 10.7% growth rate during the forecast period. In 2025, the fixed type segment captured 62.4% of the share in the global market.

Based on mode, the global fiber optic collimating lens market can be segmented into single-mode and multi-mode. According to the estimations, the single-mode segment is anticipated to expand at a CAGR of 11.3% during the forecast period.

Based on wavelength, the global fiber optic collimating lens market can be segmented into <1000 NM, 1000-1500 NM, 1500-2000 NM, and>2000 NM. As per the analysis, the 1000-1500 NM wavelength is anticipated to dominate the market during the forecast period.

The expansion of the market can be attributed to its growing demand in various end-use applications such as light & display and spectroscopy, among others. The <1000 NM wavelength segment is predicted to gain swift growth during the forecast period. In 2025, the <1000 NM segment garnered a 46.2% share of the global market.

Based on application, the global fiber optic collimating lens market can be segmented into communication, medical diagnostic & imaging, lasers and detectors, metrology, spectroscopy and microscopy, and others. Among all, the communication segment is projected to garner growth in the market. The growth of the segment can be attributed to the increasing demand for digitalization and the rising need for being connected.

Based on lens type, the global fiber optic collimating lens market can be segmented into GRIN Lenses, Aspheric lenses, and others. Between the two, the aspheric lenses segment is expected to lead the market during the forecast period. The expansion of the segment can be attributed to the benefits offered by aspheric lenses as compared to the other lenses.

The market in North America is expected to secure a lion’s share during the forecast period. According to FMI’s analysis, the market in the United States is expected to secure USD 943.2 million while recording a CAGR of 11.3% from 2025 to 2035. In 2025, the United States captured a 15.6% share of the global market.

The demand for a high-capacity network has motivated organizations to adopt optical fiber networks for mobile and fixed telephony systems. According to the Fiber Broadband Association and RVA, in 2020, fiber was deployed in nearly 544.8 million homes in the United States and has witnessed a 17% growth in fiber deployment since 2020.

The market in the United Kingdom is expected to secure USD 943.2 million while expanding at a CAGR of 10.7% during the forecast period. In 2025, the United Kingdom captured a 10.2% share of the global market. The growth of the market can be credited to the increasing demand for high bandwidth for communication and data services. The FTTH Council Europe is taking efforts to accelerate the availability of fiber-based high-speed networks to businesses and consumers.

The market in Asia Pacific is expected to gain swift growth during the forecast period. China is anticipated to account for the dominant market share. The analysis reveals that China is expected to garner USD 151.9 million and witness a CAGR of 11.1% during the forecast period. In 2025, China captured an 11.3% share of the global market.

The telecom operators in China have installed fiber in almost every telecom application from intra-city to mobile cellular systems. Besides, the advent of 5G is anticipated to increase the demand for fiber in the coming time in China. China’s large-scale industrialization and the expanding populace along with rising per capita income are projected to play a salient role in the assessment period.

Other notable Asia Pacific markets include Japan and South Korea. Japan is likely to secure USD 127.7 million and a 10.9% growth rate, while South Korea is estimated at USD 81.2 million, recording a 10.3% expansion rate. In 2025, Japan occupied a 7.8% share of the global market.

| Countries | CAGR Share in the Global Market (2025) |

|---|---|

| The United States | 15.6% |

| The United Kingdom | 10.2% |

| China | 11.3% |

| Japan | 7.8% |

What is the Competition Status in the Global Fiber Optic Collimating Lens Market?

Players in the market adopt various strategies to secure a forefront position in the market. Key players in the global fiber optic collimating lens market include IPG Photonics Corporation, AMS Technologies, Fabrinet, Coherent, Thorlabs, and others. The key players emphasize technological developments, new product launches, mergers, acquisitions, and other strategies to maximize their growth in the global market.

Recent Developments Observed by FMI:

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD million for Value |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; The Middle East & Africa (MEA) |

| Key Countries Covered | The United States, Canada, Germany, The United Kingdom, Nordic, Russia, BENELUX, Poland, France, Spain, Italy, Czech Republic, Hungary, Rest of EMEAI, Brazil, Peru, Argentina, Mexico, South Africa, Northern Africa, GCC Countries, China, Japan, South Korea, India, ASIAN, Thailand, Malaysia, Indonesia, Australia, New Zealand, Others |

| Key Segments Covered | Type, Mode, Wavelength, Application, Lens Type, Region |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Trend Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global fiber optic collimating lens market is estimated to be valued at USD 943.2 million in 2025.

The market size for the fiber optic collimating lens market is projected to reach USD 2,826.4 million by 2035.

The fiber optic collimating lens market is expected to grow at a 11.6% CAGR between 2025 and 2035.

The key product types in fiber optic collimating lens market are adjustable and fixed.

In terms of mode, single mode segment to command 62.7% share in the fiber optic collimating lens market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fiber Optic Probe Hydrophone (FOPH) Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Tester Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Connectivity Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optics Testing Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optics Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Test Equipment Market Outlook - Size, Share & Forecast 2025 to 2035

Fiber Optic Gyroscope Market Analysis - Size, Share & Forecast 2025 to 2035

Fiber Optic Gyroscope Industry Analysis in Western Europe - Trends & Forecast 2025 to 2035

Fiber Optic Labels Market Growth - Trends & Forecast 2025 to 2035

Fiber Optic Connectors Market Growth – Trends & Forecast through 2034

Fiber Optic Development Tools Market

Fiber Optic Switch Market

Fiber Optic Cables Market

Optical Fiber Cold Joint Market Size and Share Forecast Outlook 2025 to 2035

Optical Lens Materials Market Size and Share Forecast Outlook 2025 to 2035

Optical Fiber Market Size and Share Forecast Outlook 2025 to 2035

Optical Fiber Connectivity Market Size and Share Forecast Outlook 2025 to 2035

LC Fiber Optic Adapters Market Size and Share Forecast Outlook 2025 to 2035

Collimating Lens Market – Growth & Technology Trends 2025 to 2035

Optical Telephoto Lens Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA