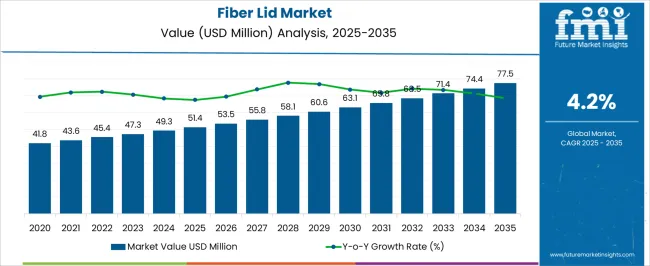

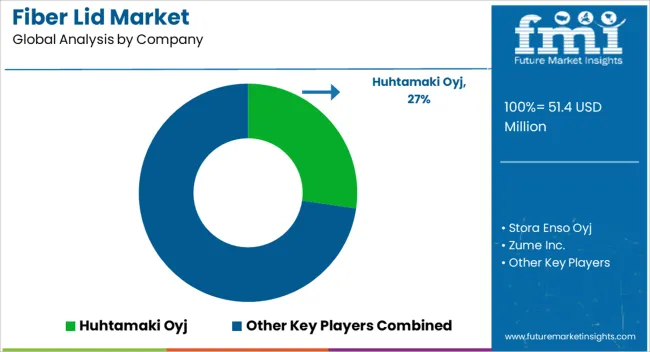

The Fiber Lid Market is estimated to be valued at USD 51.4 million in 2025 and is projected to reach USD 77.5 million by 2035, registering a compound annual growth rate (CAGR) of 4.2% over the forecast period.

The Fiber Lid market is experiencing strong growth driven by the increasing adoption of sustainable and eco-friendly packaging solutions across commercial and consumer segments. The market is influenced by the rising global awareness regarding environmental impact and single-use plastic reduction, prompting businesses to shift towards renewable and biodegradable alternatives. Fiber lids, produced from natural fibers, are gaining preference due to their compostable nature and compatibility with various beverage containers.

Growing demand from the foodservice and hospitality sectors has further accelerated market expansion, as companies seek to align with sustainability initiatives and meet consumer expectations. Technological advancements in fiber processing and lid manufacturing have enhanced product durability, water resistance, and aesthetic appeal, making them more practical for large-scale commercial use.

In addition, regulatory frameworks promoting eco-friendly packaging and corporate commitments to sustainability are creating new opportunities for fiber lid adoption As environmental consciousness continues to rise globally, the Fiber Lid market is projected to sustain its growth trajectory, with increasing investments from commercial establishments and innovative product offerings.

| Metric | Value |

|---|---|

| Fiber Lid Market Estimated Value in (2025 E) | USD 51.4 million |

| Fiber Lid Market Forecast Value in (2035 F) | USD 77.5 million |

| Forecast CAGR (2025 to 2035) | 4.2% |

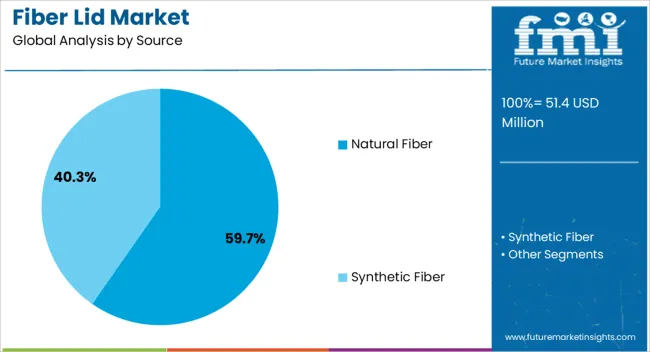

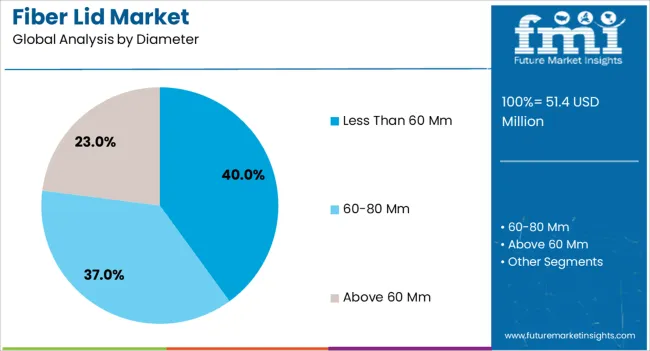

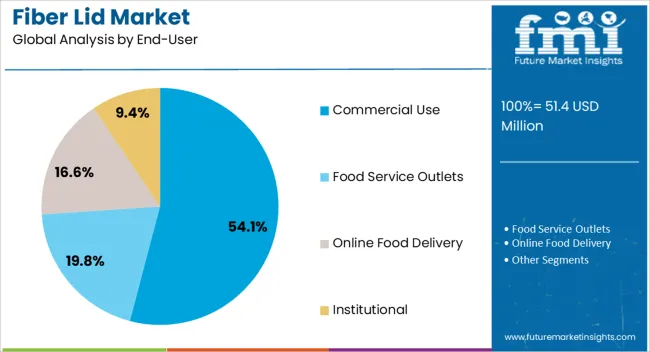

The market is segmented by Source, Diameter, and End-User and region. By Source, the market is divided into Natural Fiber and Synthetic Fiber. In terms of Diameter, the market is classified into Less Than 60 Mm, 60-80 Mm, and Above 60 Mm. Based on End-User, the market is segmented into Commercial Use, Food Service Outlets, Online Food Delivery, and Institutional. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The natural fiber source segment is projected to hold 59.70% of the Fiber Lid market revenue share in 2025, establishing it as the leading source. This dominance is attributed to the eco-friendly and biodegradable nature of natural fibers, which aligns with consumer demand for sustainable packaging.

The segment has benefited from advancements in fiber processing technologies that improve strength, water resistance, and overall functionality. Increasing adoption by commercial foodservice providers and retail chains has further reinforced the preference for natural fiber lids.

The ability to produce lids that are both environmentally responsible and cost-effective has strengthened this segment’s position Moreover, the growing emphasis on reducing plastic waste and compliance with sustainability regulations has accelerated the shift toward natural fiber options, making it the primary choice for businesses seeking responsible packaging solutions.

The less than 60 mm diameter segment is expected to account for 40.00% of the Fiber Lid market revenue share in 2025, positioning it as the leading diameter category. The growth of this segment is driven by the prevalence of smaller beverage containers in commercial and retail applications, particularly in cafes and fast-food outlets.

Lids of this size offer ease of use, secure fitting, and compatibility with standard cup dimensions, supporting widespread adoption. Enhanced manufacturing capabilities have improved the precision and consistency of smaller lids, increasing their appeal among commercial end-users.

The segment’s prominence is further reinforced by operational efficiency, as these lids minimize material usage while meeting functional requirements The rising preference for compact and convenient packaging in urban and on-the-go consumption scenarios continues to drive the growth of the less than 60 mm diameter segment.

The commercial end-user segment is anticipated to account for 54.10% of the Fiber Lid market revenue in 2025, making it the leading end-use category. This growth is fueled by increasing demand from cafes, restaurants, and quick-service establishments seeking sustainable packaging alternatives.

Fiber lids provide these commercial users with environmentally responsible solutions that support corporate sustainability goals and enhance brand image. The ability to integrate fiber lids with existing cup systems while maintaining product functionality has reinforced their adoption.

Additionally, operational benefits such as ease of handling, stackability, and consistent fit have contributed to the widespread use of fiber lids in commercial settings As businesses face growing regulatory and consumer pressure to reduce plastic usage, the commercial segment continues to drive the overall market growth, positioning fiber lids as a preferred packaging solution in the industry.

Market Trends and Drivers for Fiber Lids

The fiber lid manufacturers are using eco-friendly packaging to stand out in the fiber lid market and improve their brand image. By choosing fiber lids, the vendors position themselves as environment-friendly sustainable, and socially aware, resulting in boosting customer loyalty and optimistic brand exposure.

Consumer choices are moving towards products that are seen as healthier and more earth-aware. Fiber lids are free from toxins and derived from organic substances, fulfilling these preferences. The consumers favor brands that exhibit corporate social responsibility, spurring the demand for fiber lids.

Challenges in the Fiber Lids Industry

Though fiber lids are renewable and compostable, the unit for collection, classifying, and recycling of fiber-based packaging substances is primitive or inadequate in a few areas. This impedes the broad adoption of fiber lids and constrains the potency of end-of-life disposal alternatives, resulting in a higher amount of waste or adverse influence on the environment.

Despite the ascending consciousness of environmental concerns, consumers prefer the ease of use and proficiency with plastic over fiber lids. Persuading consumers to adopt fiber lids needs education and promotional campaigns to accentuate the advantages of sustainability and discover concerns regarding the practicality of fiber-based packaging. This factor inhibits the fiber lid market growth.

Growth Opportunities in the Fiber Lid Market

There is a significant opportunity for fiber lid manufacturers to make consumers, and retailers aware of the advantages of fiber lids and other environmentally aware packaging activities.

By amplifying awareness and accentuating the ecological and convivial influence of adopting fiber lids, the producers pursue a more advantageous impression of their products and strengthen the demand for fiber lids.

The global fiber lid market recorded sales of USD 41.8 million in 2020. The fiber lid industry experienced a 3.1% HCAGR between 2020 and 2025. The fiber lid ecosystem acquired a revenue of USD 51.4 million in 2025.

The fiber lid industry experienced significant growth ushered by surging consumer awareness concerning environmental friendliness and the growing traction of carbon-neutral packaging solutions. The demand for fiber lids is amplified in industries like food and beverage, cosmetics, and pharmaceuticals as producers look for alternatives to conventional plastic lids.

Between 2025 and 2035, the adoption of fiber lids thrives, strengthened by strict government regulations to minimize plastic adoption and encourage sustainable packaging. Factors like heightening environmental issues, transforming consumer alternatives towards eco-friendly products, and innovations in fiber lid production are likely to intensify the market expansion.

The elevated focus on CSR initiatives and carbon footprint reduction steps propels the adoption of fiber lids globally. As disposable lid manufacturers seek sustainable packaging solutions to cater to the shifting consumer choices and regulatory approval, the fiber lid sector experiences robust growth during the forecast period.

The fiber lid vendors need to innovate and widen their product portfolio to satisfy the shifting requirements of various end-users. The partnerships, investments in research and development, and growth into developing economies are instrumental in cashing on the proliferating opportunities within the global fiber lid market.

The following subsection sketches the anticipated trends for the disposable cups and lids market across diverse countries. It comprises insights into considerable countries in various regions like North America, Asia Pacific, Europe, and others.

The United States takes precedence in North America, with a CAGR of 2.7% through 2035. In Asia Pacific, India is projected to witness a CAGR of 6.2% through 2035, leaving behind China at 5.9%.

| Countries | CAGR 2025 to 2035 |

|---|---|

| United States | 2.7% |

| Spain | 3.2% |

| China | 5.9% |

With an amplifying focus on sustainability, the demand is boosted by consumer preferences for sustainable fiber lids packaging. Innovations in compostable fiber lids solutions and the pervasiveness of takeaway ramp up the adoption of fiber lids in the United States.

The strict regulations on disposable plastic products elevate the demand for fiber lids in diverse sectors, facilitating a lucrative landscape. The proximity of producers' funding in research and development activities escalates the growth of fiber lid technologies, satisfying consumer choices.

The heightened awareness regarding the adverse impacts of plastic pollution spurs the shift towards fiber lids as an eco-friendly alternative in the United States.

Spain has dynamic food and beverage sector catapults the demand for fiber lids, escalated by a cultural shift towards eco-conscious and quality. The upsurge of sustainable consumerism in Spain sustains a choice for products packaged with eco-friendly substances such as fiber lids, encouraging purchasing decisions.

Government schemes encouraging eco-conscious packing solutions prompt the adoption of fiber lids in Spain producers, determining an environment-friendly ecosystem. The dedication of Spain to curbing plastic waste aligns with the gaining traction of fiber lids as a promising alternative, aiding sustainable packaging solutions.

The ambitious ecological preservation and efforts in China to fight plastic pollution surge the adoption of fiber lids as a resource-friendly alternative. The urbanization and shifting consumer lifestyles in China escalated the demand for efficient and sustainable solutions such as fiber lids.

The E-commerce upsurge in China strengthens the demand for potent and greener packaging solutions, situating fiber lids as an ideal alternative in online commerce. Government incentives and subsidies for sustainable schemes propel producers to invest in production, catapulting the fiber lid industry growth.

The section contains a fiber lid market analysis of the leading segments. In terms of source category, the natural fiber lids segment is estimated to account for a share of 59.7% by 2035. By end-use category, the commercial use segment is projected to dominate by holding a share of 54.1% in 2035.

| Segment | Natural Fiber |

|---|---|

| Value Share (2035) | 59.7% |

The industry trends reflect an evolution towards greener packaging solutions, promoting the growth of the natural fiber lid market. The elevated consumer choice for greener alternatives escalates the demand for natural fiber lids.

Eco-friendly concerns usher vendors to choose natural fiber products over synthetic products. The spurring cognizance among consumers about the ecological effect of synthetic materials assists organic fiber lids.

Natural fiber lids present biodegradability linked with soaring environmental rules. The producer's cash on the perceived superior quality and sustainable image related to natural fiber lids.

| Segment | Commercial Use |

|---|---|

| Value Share (2035) | 54.1% |

Commercial end-users need mass orders, escalating higher volume purchases of fiber lids. The productivity in storage and distribution channels favors fiber lids for the operational requirement of commercial activities.

The providers seek economical and durable products, making fiber lids a perfect alternative for commercial adoption. Augmented brand awareness and user satisfaction thrust commercial firms to invest in high-end packaging such as fiber lids.

Commercial end uses demand flexible packaging solutions, where fiber lids present versatility across diverse usages. Regulatory adherence and sanitary norms in commercial settings proliferate the adoption of fiber lids.

The industry is bifurcated into natural fiber and synthetic fiber.

The industry is trifurcated into less than 60 mm, 60-80 mm, and above 60 mm.

Key end users present in the industry include commercial use, food service outlets, online food delivery, and institutional.

Analysis of the industry has been carried out in key countries of North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, and the Middle East and Africa.

The global fiber lid market is estimated to be valued at USD 51.4 million in 2025.

The market size for the fiber lid market is projected to reach USD 77.5 million by 2035.

The fiber lid market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in fiber lid market are natural fiber and synthetic fiber.

In terms of diameter, less than 60 mm segment to command 40.0% share in the fiber lid market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

1550nm LiDAR Pulsed Fiber Laser Market Forecast and Outlook 2025 to 2035

Fiber Based Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Tanks Market Size and Share Forecast Outlook 2025 to 2035

Fiber Sorter Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Polymer Panel and Sheet Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Tester Market Size and Share Forecast Outlook 2025 to 2035

Fiber Laser Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Market Size and Share Forecast Outlook 2025 to 2035

Fiber Spinning Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Plastic (FRP) Panels & Sheets Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Fabric Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Connectivity Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Collimating Lens Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Duct Wrap Insulation Market Size and Share Forecast Outlook 2025 to 2035

Fiber-Based Blister Pack Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fiber Optics Testing Market Size and Share Forecast Outlook 2025 to 2035

Fiber Laser Coding System Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optics Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Polymer (FRP) Rebars Market Size and Share Forecast Outlook 2025 to 2035

Fiber Supplements Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA