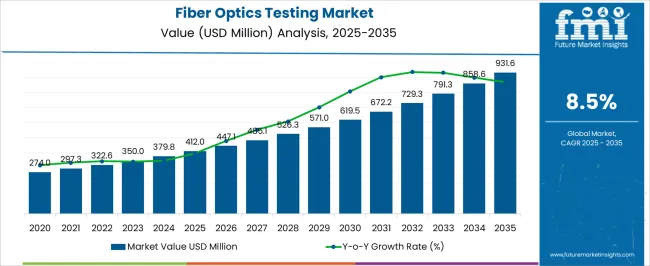

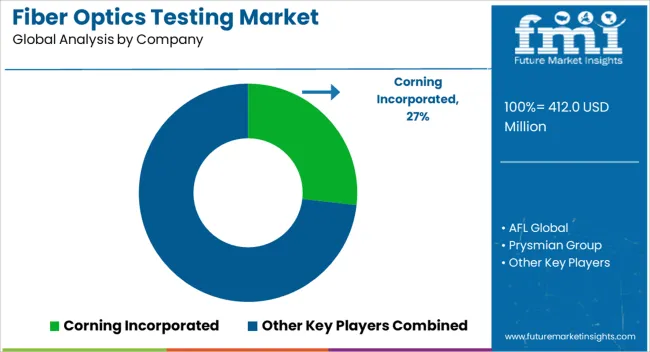

The fiber optics testing market is estimated to be valued at USD 412.0 million in 2025 and is projected to reach USD 931.6 million by 2035, registering a compound annual growth rate (CAGR) of 8.5% over the forecast period. A year-on-year (YoY) growth analysis shows steady acceleration and consistent growth throughout the forecast period. Between 2025 and 2030, the market grows from USD 412.0 million to USD 619.5 million, contributing USD 207.5 million in growth, with a CAGR of 9.0%. This early-phase growth is driven by the increasing demand for high-quality fiber optic cables for applications in telecommunications, data centers, and industrial automation.

The expansion of 5G networks, increasing internet bandwidth requirements, and advancements in cloud computing drive the need for effective fiber optic testing solutions. From 2030 to 2035, the market continues its growth trajectory, moving from USD 619.5 million to USD 931.6 million, contributing USD 312.1 million in growth, with a slightly lower CAGR of 7.9%. This deceleration indicates the market maturing as fiber optic testing solutions become more standardized and widespread. However, growth remains strong due to the ongoing adoption of fiber optics in emerging technologies like the Internet of Things (IoT), smart cities, and high-speed broadband. The YoY analysis highlights consistent growth driven by technological advancements, with stronger initial growth followed by stable expansion as the market matures and becomes more integrated into mainstream communication infrastructures.

| Metric | Value |

|---|---|

| Fiber Optics Testing Market Estimated Value in (2025 E) | USD 412.0 million |

| Fiber Optics Testing Market Forecast Value in (2035 F) | USD 931.6 million |

| Forecast CAGR (2025 to 2035) | 8.5% |

The fiber optics testing market is expanding steadily due to the rapid deployment of high-speed broadband networks, increased investments in 5G infrastructure, and the growing demand for data center interconnectivity. With rising expectations for seamless connectivity and low latency, network operators are prioritizing accurate testing to ensure the performance and reliability of fiber optic systems.

Advancements in testing equipment, such as optical time domain reflectometers and automated inspection tools, have enabled faster fault detection and maintenance. Additionally, as governments and private players invest heavily in rural broadband expansion and smart city projects, the need for comprehensive fiber testing services is becoming increasingly critical.

The outlook remains robust as service providers, telecom operators, and enterprises continue to scale fiber networks to meet the exponential growth in data consumption.

The fiber optics testing market is segmented by fiber mode, service type, offering, application, and geographic regions. By fiber mode, the fiber optics testing market is divided into single-mode and multimode. In terms of service type, the fiber optics testing market is classified into Testing services, Inspection services, Certification services, and Other services.

Based on offering, the fiber optics testing market is segmented into In-house services and Outsourced Services. By application, the fiber optics testing market is segmented into Telecommunication, Cable television, Military and aerospace, Railway, Oil & gas, Energy & power, and Others. Regionally, the fiber optics testing industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

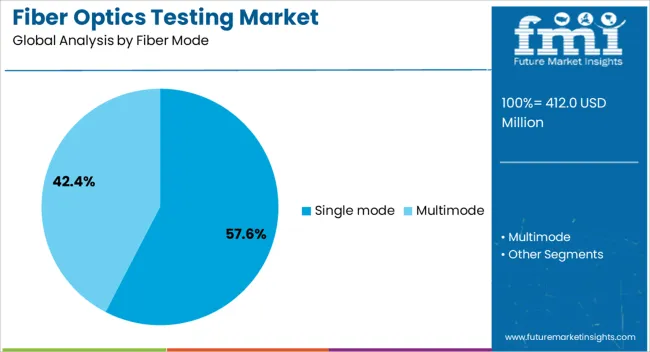

The single mode fiber segment is projected to account for 57.60% of total market revenue by 2025 within the fiber mode category, making it the dominant choice. This growth is supported by its superior performance over long distances, lower signal attenuation, and higher bandwidth capacity, making it well-suited for telecommunications, long-haul data transmission, and metropolitan area networks.

With the ongoing deployment of 5G and hyperscale data centers, single-mode fibers are preferred for backbone infrastructure that demands low latency and high efficiency.

The increasing adoption of cloud computing and edge computing applications is further reinforcing demand for single-mode fibers, positioning this segment as the industry standard in high-performance network environments.

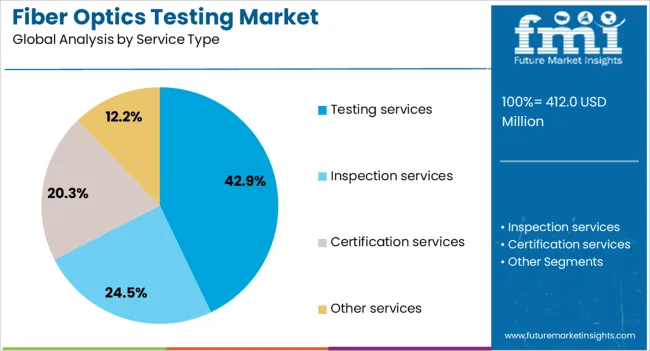

The testing services segment is anticipated to represent 42.90% of the total market share by 2025 within the service type category. The growing need for precise validation, certification, and maintenance of fiber optic installations in new and existing networks drives this.

Third-party service providers and specialized testing companies are being engaged to perform fault detection, power measurement, continuity testing, and system verification. The complexity of fiber networks in multi-vendor environments and the demand for SLA compliance are further encouraging outsourced testing.

As fiber deployment intensifies across telecommunications and enterprise infrastructure, the role of professional testing services is expanding, ensuring performance reliability and regulatory alignment.

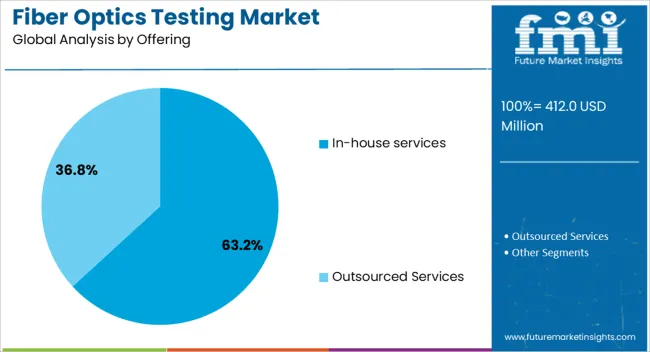

The in house services segment is expected to capture 63.20% of the market by 2025 under the offering category, indicating its dominance. This trend is being led by large telecom providers, data center operators, and network integrators who are investing in internal capabilities to perform continuous monitoring and rapid issue resolution.

Having in house testing infrastructure allows greater control, faster turnaround, and tailored diagnostics aligned with specific network configurations. The emphasis on network uptime, scalability, and customized performance benchmarks has made in house services a strategic priority.

Organizations with long-term fiber expansion plans are opting for internal teams to handle testing operations, reinforcing this segment’s leadership position.

Fiber optic cables are widely used for data transmission due to their high bandwidth and reliability. As industries such as telecommunications, IT, and healthcare increasingly adopt fiber optic technology for faster and more secure data transfer, the need for reliable testing equipment grows. The market is also benefiting from advancements in fiber optic testing technologies, which offer improved accuracy, speed, and efficiency in network installation and maintenance.

The growing need for high-speed internet and reliable data connectivity is a significant driver for the fiber optics testing market. As digital transformation accelerates across industries and the reliance on cloud computing grows, fiber optic networks are critical for transmitting large amounts of data at faster speeds. The global expansion of 5G networks further boosts the demand for fiber optics, as these technologies rely on fiber optic infrastructure to ensure high data throughput and low latency. Fiber optic cables are crucial for secure and efficient data transfer, benefiting both businesses and consumers. This growing demand for fast and reliable internet connections drives the need for accurate and efficient fiber optic testing solutions, ensuring these networks operate at their peak performance.

The fiber optics testing market faces challenges, including high initial investment costs and technical complexities associated with testing fiber optic systems. Advanced testing equipment can be costly, limiting access for smaller businesses and network operators, particularly in regions with budget constraints. Moreover, the technical expertise required for fiber optic testing is another barrier, as accurate results depend on skilled technicians. The complexity of testing fiber optic systems, especially in large-scale network deployments, can result in time-consuming processes. This makes it difficult to implement efficient testing solutions across all projects, slowing down market adoption. These factors, including the need for specialized equipment and personnel, can impact the growth and widespread use of fiber optic testing systems in various industries.

The fiber optics testing market presents significant opportunities due to advancements in testing technologies and automation. Innovations in testing equipment, such as portable, handheld devices, are making it easier for companies to deploy fiber optic systems and obtain faster, more accurate results. The rise of automation in testing allows for streamlined processes, reducing labor costs and increasing operational efficiency. As industries rely more on high-performance networks for communication and data transfer, the demand for automated testing solutions is growing. This creates opportunities for the development of smarter, more efficient testing tools, integrating capabilities like real-time diagnostics and predictive maintenance, ensuring that fiber optic systems maintain optimal performance throughout their lifecycle, further propelling market expansion.

A significant trend in the fiber optics testing market is the growing adoption of testing solutions for 5G networks. As telecommunications companies expand their 5G infrastructure, fiber optics is becoming even more integral due to its ability to handle high data volumes and support low-latency communications. Fiber optic testing ensures the performance and reliability of these advanced networks, which are crucial for the efficient functioning of 5G systems. As 5G networks continue to roll out globally, the demand for specialized testing solutions that can support the deployment and maintenance of fiber optic infrastructure is rising. This trend highlights the need for high-quality, efficient testing technologies that can meet the growing demands of 5G connectivity and ensure seamless communication across all devices and platforms.

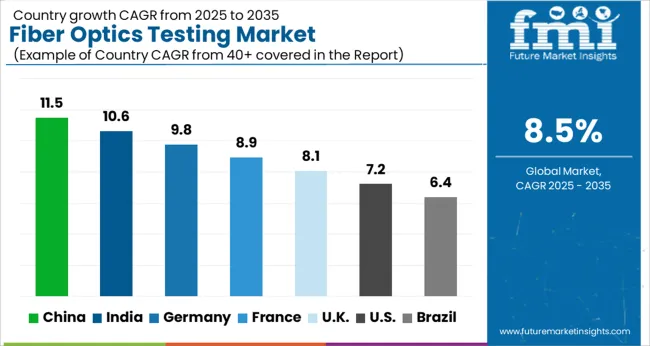

The global fiber optics testing market is projected to grow at a CAGR of 8.5% from 2025 to 2035. China leads at 11.5%, followed by India at 10.6%, and France at 8.9%. The United Kingdom records 8.1%, and the United States posts 7.2%. Investments in fiber optic infrastructure and telecommunications networks are increasing in China and India. In contrast, more mature markets, such as the United States and the United Kingdom, are experiencing more moderate growth due to their established infrastructure. The analysis includes over 40+ countries, with the leading markets detailed below.

Demand for fiber optics testing in China is growing at an 11.5% CAGR through 2035. China’s significant investments in telecommunications infrastructure, particularly in 5G and broadband networks, are driving the growth of the fiber optics testing market. The increasing use of fiber optic cables in various sectors such as telecommunications, IT infrastructure, and transportation is also contributing to market growth. The rise in demand for high-speed internet and the expansion of smart city projects further accelerate the market for fiber optics testing solutions. The growing number of data centers and cloud computing infrastructure in China also increases the need for reliable testing solutions.

The fiber optics testing market in India is projected to grow at a 10.6% CAGR through 2035. India is rapidly developing its telecommunications infrastructure, particularly in rural and underserved areas. As the country rolls out 4G and 5G networks, the need for efficient and reliable fiber optics testing solutions is rising. The adoption of fiber optic cables in various industries, including healthcare, IT, and education, further supports market growth. India’s increasing focus on digital transformation in public and private sectors, alongside a growing number of internet users, is significantly contributing to the demand for fiber optics testing technologies.

Demand for fiber optics testings in France is projected to grow at a CAGR of 8.9% through 2035. France’s commitment to improving its telecommunications infrastructure, particularly with 5G technology, is driving the demand for fiber optics testing solutions. The growing adoption of fiber optics in broadband networks and IT infrastructure further supports market expansion. Additionally, the French government’s plans to modernize public and private sector networks and promote high-speed internet access across the country are contributing to the increased need for fiber optic testing technologies. France’s push for advanced industrial automation and IoT solutions also drives demand for fiber optics testing.

The UK fiber optics testing market is expected to grow at an 8.1% CAGR through 2035. The UK’s investment in 5G and fiber optic broadband infrastructure is driving the demand for fiber optics testing solutions. The growing use of fiber optics in various sectors, including telecommunications, healthcare, and automotive, is further accelerating market growth. The UK’s focus on smart grid technologies and autonomous systems also contributes to the increased need for efficient and reliable fiber optics testing. Additionally, the expansion of data centers and cloud computing in the country plays a role in boosting the market for fiber optic testing technologies.

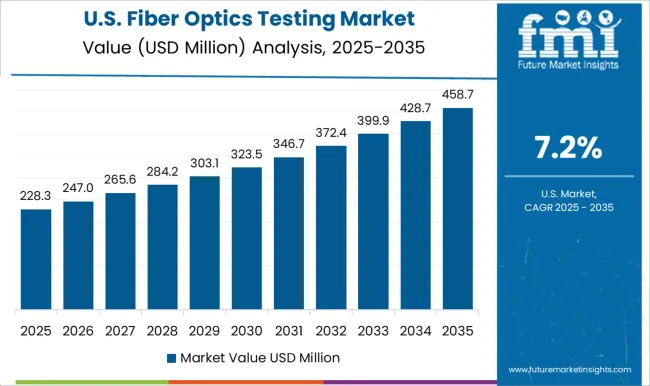

Demand for fiber optics testing in the USA is projected to grow at a 7.2% CAGR through 2035. The USA is experiencing a growing demand for fiber optics testing solutions driven by the expansion of broadband networks, the deployment of 5G technology, and increasing data center development. As fiber optic cables continue to be implemented in various industries, including telecommunications, healthcare, and manufacturing, the need for efficient testing solutions rises. The rapid growth of IoT applications and smart technologies in the USA further contributes to the market’s growth. Government initiatives to expand internet access and support infrastructure modernization are also driving the demand for fiber optics testing solutions.

Demand is fueled by 5G transport fronthaul and backhaul, FTTx rollouts, DWDM upgrades, and high core count cable deployments that require faster turn-up with documented performance. AFL and Sumitomo Electric enhance their strength through splicing, cleaving, and inspection ecosystems, which shorten installation time and reduce rework. Prysmian, Corning, and Furukawa contribute through low-loss fibers, ribbonized cables, and connector systems that set acceptance targets but are not primary test OEMs. Lumentum, Coherent, and Finisar drive transceiver technology that influences test needs at 100G through 800G and above.

Buyer priorities include ease of use, automated pass-fail criteria, cloud-based results management, and compatibility with contractor workflows. Growth favors modular platforms, MPO and ribbon-aware testing, coherent optical analysis, and field-hardened microscopes that prevent contamination-driven insertion loss. Service models now bundle calibration, training, and fleet analytics subscriptions.

| Item | Value |

|---|---|

| Quantitative Units | USD 412.0 Million |

| Fiber Mode | Single mode and Multimode |

| Service Type | Testing services, Inspection services, Certification services, and Other services |

| Offering | In-house services and Outsourced Services |

| Application | Telecommunication, Cable television, Military and aerospace, Railway, Oil & gas, Energy & power, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Corning Incorporated, AFL Global, Prysmian Group, Finisar Corporation, Furukawa Electric Co., Ltd., Sumitomo Electric Industries, and Lumentum Holdings Inc. |

| Additional Attributes | Dollar sales by product type (fiber optic testers, inspection tools, splicing and fusion splicing equipment, OTDR, power meters, light sources) and end-use segments (telecom, data centers, enterprise networks, industrial applications). Demand dynamics are driven by the increasing deployment of fiber optic networks for high-speed internet and data transmission, growth in cloud computing, and the rising demand for 5G connectivity. Regional trends show strong growth in North America, Europe, and Asia-Pacific, driven by the expansion of fiber optic networks and the increasing focus on broadband infrastructure. Innovation trends focus on enhancing testing accuracy, supporting higher data speeds, and integrating advanced technologies such as IoT for real-time monitoring and diagnostic solutions. Environmental considerations include reducing electronic waste and promoting energy-efficient testing equipment. |

The global fiber optics testing market is estimated to be valued at USD 412.0 million in 2025.

The market size for the fiber optics testing market is projected to reach USD 931.6 million by 2035.

The fiber optics testing market is expected to grow at a 8.5% CAGR between 2025 and 2035.

The key product types in fiber optics testing market are single mode and multimode.

In terms of service type, testing services segment to command 42.9% share in the fiber optics testing market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fiber Based Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fiber Lid Market Forecast and Outlook 2025 to 2035

Fiberglass Tanks Market Size and Share Forecast Outlook 2025 to 2035

Fiber Sorter Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Polymer Panel and Sheet Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Tester Market Size and Share Forecast Outlook 2025 to 2035

Fiber Laser Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Market Size and Share Forecast Outlook 2025 to 2035

Fiber Spinning Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Plastic (FRP) Panels & Sheets Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Fabric Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Connectivity Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Collimating Lens Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Duct Wrap Insulation Market Size and Share Forecast Outlook 2025 to 2035

Fiber-Based Blister Pack Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fiber Laser Coding System Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Polymer (FRP) Rebars Market Size and Share Forecast Outlook 2025 to 2035

Fiber Supplements Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Filters Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Test Equipment Market Outlook - Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA