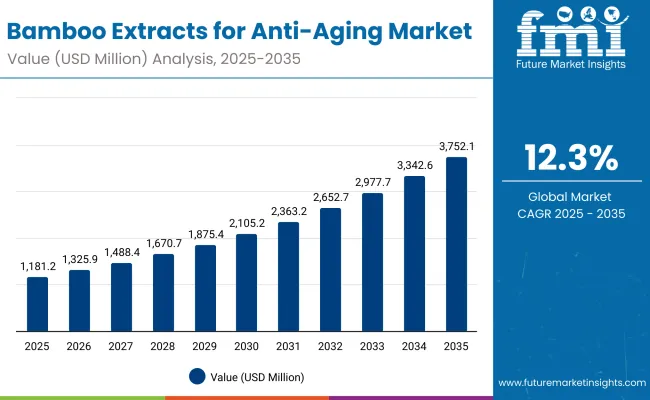

The Bamboo Extracts for Anti-Aging Market is expected to record a valuation of USD 1,181.2 million in 2025 and USD 3,752.1 million in 2035, with an increase of USD 2,570.9 million, which equals a growth of 193% over the decade. The overall expansion represents a CAGR of 12.3% and a 2X+ increase in market size.

Bamboo Extracts for Anti-Aging Market Key Takeaways

| Metric | Value |

|---|---|

| Bamboo Extracts for Anti-Aging Market Estimated Value in (2025E) | USD 1,181.2 million |

| Bamboo Extracts for Anti-Aging Market Forecast Value in (2035F) | USD 3,752.1 million |

| Forecast CAGR (2025 to 2035) | 12.3% |

During the first five-year period from 2025 to 2030, the market increases from USD 1,181.2 million to USD 2,105.2 million, adding USD 924 million, which accounts for 36% of the total decade growth. This phase records steady adoption in anti-aging & wrinkle reduction solutions and serum-based product formats, driven by consumer demand for visible results. Bamboo leaf extract dominates this period as it caters to over 45% of functional applications, especially in premium skincare formulations.

The second half from 2030 to 2035 contributes USD 1,647 million, equal to 64% of total growth, as the market jumps from USD 2,105.2 million to USD 3,752.1 million. This acceleration is powered by clean-label innovations, natural/organic claims, and wider e-commerce adoption across Asia and North America. By the end of the decade, serums and creams combined capture over 95% share in product formats. Regionally, China and India emerge as fastest-growing markets with CAGR rates of 16.3% and 18.3% respectively, while the USA sustains steady growth at 6.8% CAGR.

From 2020 to 2024, the bamboo extract-based skincare market expanded steadily as natural and plant-derived ingredients gained traction in anti-aging formulations. Growth was driven by rising consumer demand for organic and clean-label beauty products, with East Asia leading innovation and adoption. During this phase, serums and creams dominated usage, together contributing nearly all revenues, while distribution leaned toward pharmacies and specialty beauty retail before shifting online.

By 2025, demand is set to reach USD 1,181.2 million, with the revenue mix expected to shift more toward e-commerce and functional claims such as natural/organic and vegan. Competitive differentiation is moving away from purely botanical sourcing toward value-added formulations, including anti-aging serums, wrinkle-reduction creams, and hydration-focused blends. Established brands like Innisfree and Amorepacific face rising competition from digital-first, niche clean-label entrants that leverage AI-driven product personalization, online subscription models, and influencer-based marketing. The competitive advantage is increasingly tied to sustainability credentials, brand transparency, and ecosystem strength across online and offline channels, rather than extract innovation alone.

The high content of natural silica in bamboo extracts has positioned it as a preferred ingredient for skin regeneration and collagen synthesis. Unlike synthetic anti-aging compounds, bamboo silica strengthens connective tissues, making it particularly effective for wrinkle reduction and skin elasticity. This science-backed advantage is accelerating adoption in premium anti-aging serums and creams, where consumers are willing to pay a premium for clinically proven, naturally sourced alternatives.

China and India’s rapidly growing e-commerce ecosystems are fueling demand for bamboo extract products marketed as natural, vegan, and clean-label. Platforms such as Tmall, Nykaa, and Amazon are offering direct-to-consumer channels for niche brands to penetrate urban and semi-urban markets. This shift bypasses traditional retail bottlenecks, enabling faster consumer adoption. The transparency and traceability features on digital platforms also resonate strongly with younger buyers, accelerating bamboo extract’s growth trajectory in anti-aging skincare.

The Bamboo Extracts for Anti-Aging Market is segmented by extract type, function, product type, distribution channel, claim, and geography. Extract types include bamboo leaf extract, bamboo stem extract, bamboo sap/silica, and fermented bamboo extract, which form the core basis of anti-aging formulations. Functional categories cover anti-aging & wrinkle reduction, skin firming & elasticity, hydration, and soothing & calming.

By product type, the market spans serums, creams/lotions, masks, and ampoules, reflecting varied consumer preferences. Distribution channels include e-commerce, pharmacies, specialty beauty retail, and mass retail. Claims driving product positioning comprise natural/organic, vegan, clean-label, and Ayurvedic-inspired formulations. Geographically, the market is analyzed across North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa, with China, India, the USA, Japan, Germany, and the UK as key growth contributors.

| Extract Type | Value Share% 2025 |

|---|---|

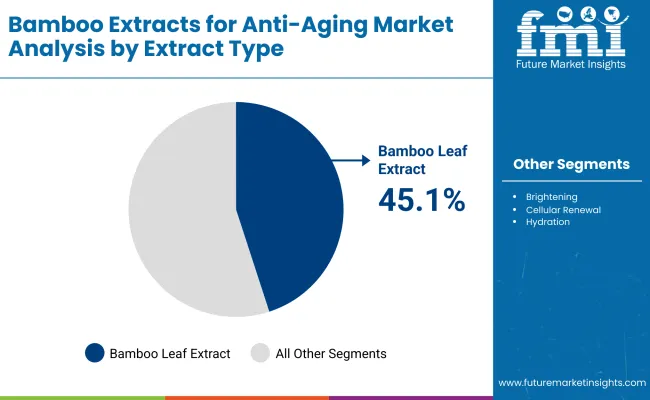

| Bamboo leaf extract | 45.1% |

| Others | 54.9% |

The bamboo leaf extract segment is projected to contribute 45.1% of the Bamboo Extracts for Anti-Aging Market revenue in 2025, maintaining its lead as the dominant extract category. This is driven by its rich silica content, which boosts collagen synthesis and enhances skin elasticity, making it a core ingredient in anti-aging and wrinkle-reduction formulations. The segment’s growth is also supported by its strong positioning in premium skincare products, particularly serums and lotions targeted toward early-aging consumers.

As clean-label and natural product claims continue to shape consumer preference, bamboo leaf extract is being widely adopted in both mass and luxury product lines. Its versatility across formulations from hydration to skin-firming further strengthens its demand. With expanding clinical validation and growing consumer trust in plant-derived actives, the bamboo leaf extract segment is expected to retain its position as the backbone of bamboo-based anti-aging solutions.

| Function | Value Share% 2025 |

|---|---|

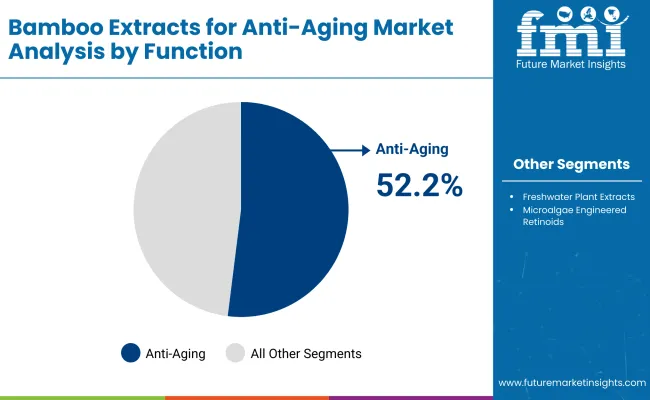

| Anti-aging | 52.2% |

| Others | 47.8% |

The skin firming & elasticity segment is forecasted to hold 54.9% of the market share in 2025, making it the leading functional application in the Bamboo Extracts for Anti-Aging Market. This demand is propelled by the extract’s ability to stimulate collagen production and enhance skin strength, addressing consumer concerns about sagging and loss of elasticity. The segment has become particularly popular in daily-use creams and lotions, which appeal to both younger demographics focused on preventive skincare and older groups seeking restorative benefits.

Its leadership is further reinforced by the integration of bamboo extracts with other bioactives such as hyaluronic acid and peptides, enhancing multi-functional performance. The trend toward natural, clean-label cosmetics amplifies the preference for bamboo-based firming solutions, especially in Asia-Pacific and European markets. With consumer awareness shifting toward holistic anti-aging approaches, the skin firming & elasticity function is expected to retain its dominance, while also complementing the growing demand for targeted wrinkle-reduction products.

| Product Type | Value Share% 2025 |

|---|---|

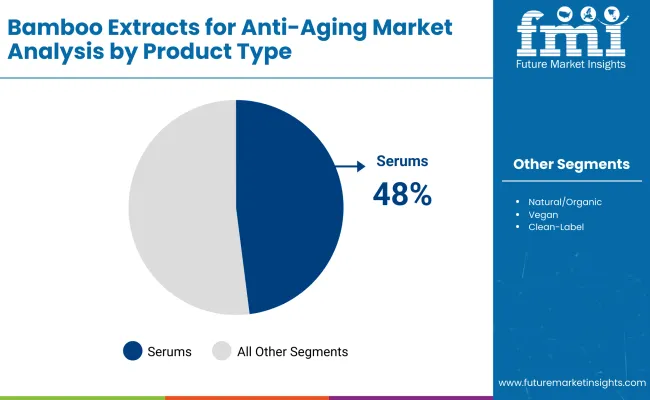

| Serums | 48% |

| Others | 52.5% |

The serums segment is projected to account for 52.2% of the Bamboo Extracts for Anti-Aging Market revenue in 2025, establishing it as the leading product type. Serums are favored for their lightweight texture, high concentration of bamboo silica and antioxidants, and their ability to deliver rapid visible results in wrinkle reduction and skin-firming. Their popularity is reinforced by their suitability across age groups, with younger consumers adopting serums preventively and older demographics relying on them for corrective skincare.

This segment’s strength is also driven by its positioning in premium skincare lines, often marketed with natural and clean-label claims that resonate strongly in Asia-Pacific, Europe, and North America. The ease of integration into multi-step skincare routines has further boosted serum adoption in both online and offline retail channels. With continuous innovations in formulation, such as fast-absorbing ampoules and multi-functional blends, the serums category is expected to maintain its dominance as the preferred format for bamboo extract-based anti-aging solutions.

Rising Demand for Natural and Clean-Label Skincare

Growing consumer preference for natural, sustainable, and chemical-free formulations is propelling demand for bamboo extracts in anti-aging products. Rich in silica and antioxidants, bamboo-based actives align with the clean-label movement, gaining traction in both mature and emerging markets. Brands leveraging natural claims are achieving stronger market penetration, particularly in Asia and Europe. This trend not only drives adoption among health-conscious consumers but also enhances brand positioning, ensuring bamboo extracts remain central to premium anti-aging skincare solutions.

Expansion of E-Commerce Beauty Retail

The rapid rise of e-commerce platforms such as Amazon, Tmall, and Nykaa has reshaped skincare distribution, making bamboo extract-based anti-aging solutions more accessible. Digital-first channels allow niche and emerging brands to market directly to consumers with targeted, personalized campaigns. Subscription models, online exclusives, and influencer-driven promotions further enhance visibility. With e-commerce now a mainstream sales channel, the accessibility of bamboo-based serums and creams has grown substantially, contributing to accelerated adoption across younger demographics and urban populations globally.

Limited Clinical Validation in Global Markets

Despite growing demand, the market faces restraint from limited large-scale clinical validation studies on bamboo extracts’ efficacy compared to established anti-aging actives like retinol or hyaluronic acid. This creates hesitancy among dermatologists and conservative consumer groups, particularly in North America and Europe, slowing premium adoption. Regulatory frameworks that demand robust evidence also challenge brand claims. Unless expanded research and transparent clinical trials are widely publicized, bamboo extract-based products may face skepticism, limiting their penetration in highly regulated beauty markets.

Hybrid Formulations with Multi-Functional Benefits

A key trend shaping the market is the development of hybrid formulations combining bamboo extracts with other active ingredients such as peptides, ceramides, and hyaluronic acid. These blends deliver multi-functional benefits like wrinkle reduction, hydration, and barrier repair in a single product. Such innovations resonate strongly with time-conscious consumers seeking simplified skincare routines. The hybridization trend also boosts brand competitiveness, as multifunctional bamboo-based serums and creams offer greater value propositions, thereby attracting both premium and mass-market consumer segments.

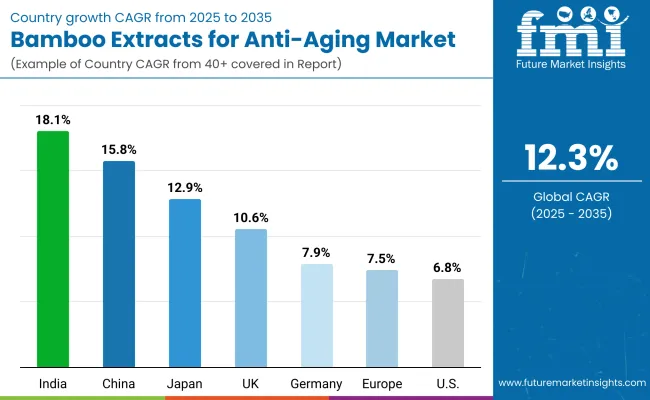

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 15.8% |

| USA | 6.8% |

| India | 18.1% |

| UK | 10.6% |

| Germany | 7.9% |

| Japan | 12.9% |

The Bamboo Extracts for Anti-Aging Market reveals clear differences in growth momentum across major economies, largely shaped by consumer preferences, regulatory frameworks, and skincare adoption trends. Asia-Pacific dominates growth, with India (18.1% CAGR) and China (15.8% CAGR) leading due to expanding middle-class populations, rising disposable incomes, and accelerated adoption of natural and clean-label beauty products. India’s growth is strongly tied to Ayurvedic-inspired formulations, while China’s market benefits from e-commerce expansion and government support for sustainable cosmetics.

Japan (12.9% CAGR) remains another high-growth market, where demand is fueled by advanced beauty rituals and strong consumer trust in natural actives. In Europe, countries like the UK (10.6% CAGR) and Germany (7.9% CAGR) continue to record steady progress, driven by sustainability-led regulations and consumer preference for eco-certified cosmetics. Meanwhile, the USA (6.8% CAGR) shows moderate but steady expansion, as demand shifts toward vegan and plant-based anti-aging solutions supported by digital-first distribution strategies. Overall, Asia-Pacific is expected to contribute the majority of incremental market value, while Europe sustains a strong premium skincare base.

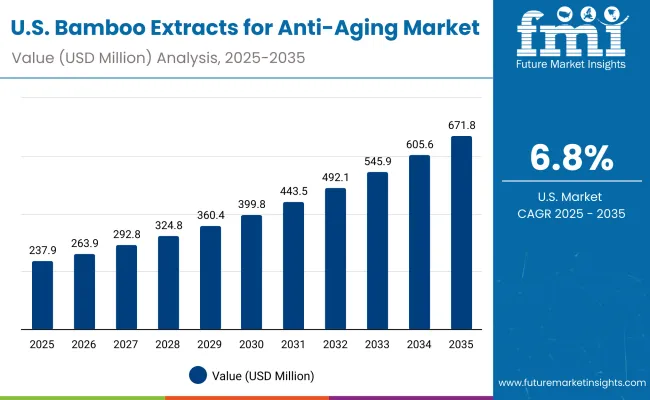

| Year | USA Bamboo Extracts for Anti-Aging Market (USD Million) |

|---|---|

| 2025 | 237.95 |

| 2026 | 263.98 |

| 2027 | 292.86 |

| 2028 | 324.89 |

| 2029 | 360.42 |

| 2030 | 399.85 |

| 2031 | 443.58 |

| 2032 | 492.10 |

| 2033 | 545.92 |

| 2034 | 605.64 |

| 2035 | 671.88 |

The Bamboo Extracts for Anti-Aging Market in the United States is projected to grow from USD 237.95 million in 2025 to USD 671.88 million by 2035, expanding at a CAGR of 6.8%. Growth is driven by strong consumer inclination toward vegan, natural, and plant-based skincare supported by clean-label positioning. Premium brands are leveraging bamboo extracts in serums and creams targeted at anti-aging and hydration benefits, while mass-market adoption is encouraged through pharmacy and e-commerce channels. Rising awareness of preventive skincare among younger demographics and the influence of digital-first marketing campaigns also contribute to market expansion.

The Bamboo Extracts for Anti-Aging Market in the United Kingdom is expected to grow at a CAGR of 10.6% from 2025 to 2035, driven by rising demand for Ayurvedic-inspired and clean-label skincare formulations. British consumers are increasingly prioritizing sustainability, cruelty-free claims, and transparency in sourcing, making bamboo extracts an attractive active in anti-aging serums and creams. Growth is further supported by the premium positioning of natural cosmetics in the UK retail sector, where both pharmacies and specialty beauty retailers highlight botanical-based anti-aging products. Online platforms amplify this expansion, offering niche and luxury brands wider reach.

India is set to be one of the fastest-growing markets for bamboo extract-based anti-aging products, forecast to expand at a CAGR of 18.1% from 2025 to 2035. Growth is strongly influenced by the country’s deep-rooted Ayurvedic heritage, where bamboo extracts are positioned as natural, safe, and efficacious skincare solutions. Rising disposable incomes and increasing urbanization in tier-2 and tier-3 cities are fueling demand for premium serums and creams, while e-commerce platforms such as Nykaa and Flipkart are democratizing access to clean-label, plant-based anti-aging formulations. The emphasis on natural actives resonates with younger demographics seeking preventive care and older consumers aiming for restorative benefits.

The Bamboo Extracts for Anti-Aging Market in China is expected to grow at a CAGR of 15.8% from 2025 to 2035, the fastest among leading economies. This momentum is driven by surging demand for natural and organic skincare products, amplified by consumer preference for clean-label, plant-derived actives. E-commerce platforms such as Tmall and JD.com have become powerful enablers, giving both domestic and global brands direct access to China’s vast consumer base. Younger demographics are especially fueling demand for serums and creams enriched with bamboo extracts, citing transparency, sustainability, and efficacy as key purchase drivers.

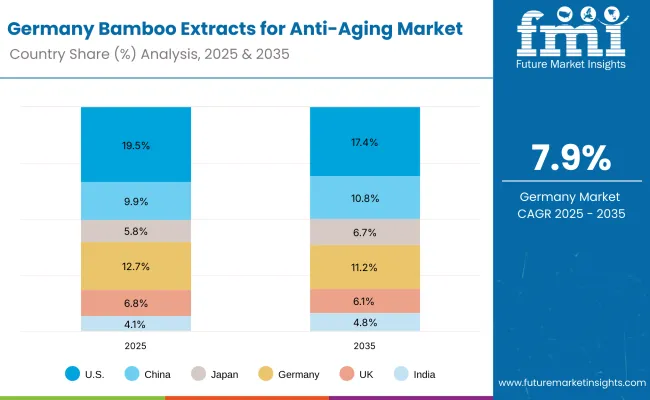

| Countries | 2025 Share (%) |

|---|---|

| USA | 19.5% |

| China | 9.9% |

| Japan | 5.8% |

| Germany | 12.7% |

| UK | 6.8% |

| India | 4.1% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 17.4% |

| China | 10.8% |

| Japan | 6.7% |

| Germany | 11.2% |

| UK | 6.1% |

| India | 4.8% |

The Bamboo Extracts for Anti-Aging Market in Germany is projected to grow at a CAGR of 7.9% between 2025 and 2035, supported by rising demand for sustainable, eco-certified cosmetics. German consumers demonstrate strong loyalty to clean-label, organic, and vegan skincare, which positions bamboo extracts as an appealing active ingredient in anti-aging serums and creams. Domestic and European brands are prioritizing bamboo for its natural silica content, aligning with EU regulatory emphasis on safety and sustainability. Although Germany holds a significant global share in 2025, its proportion declines slightly by 2035 as faster-growing markets in Asia expand more aggressively.

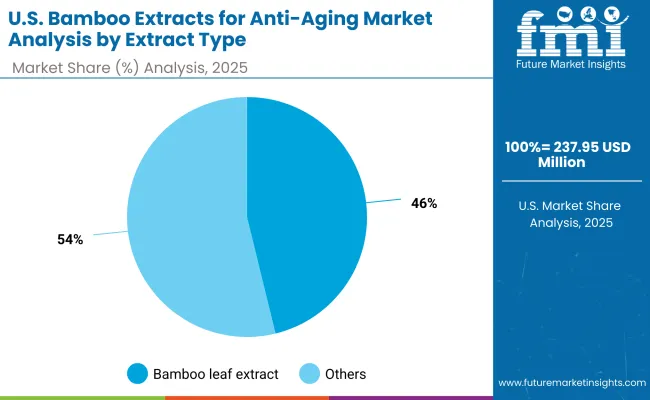

| USA By Extract Type | Value Share% 2025 |

|---|---|

| Bamboo leaf extract | 46.2% |

| Others | 53.8% |

The Bamboo Extracts for Anti-Aging Market in the United States is projected to expand at a CAGR of 6.8% between 2025 and 2035, growing from USD 237.95 million in 2025 to USD 671.88 million by 2035. Growth is underpinned by the rising popularity of vegan, clean-label, and plant-derived skincare, where bamboo extracts are being incorporated into premium anti-aging serums and creams. While bamboo leaf extract contributes 46.2% of the USA market in 2025, other extract formsincluding stem and sap dominate due to their wider application in hydration and skin-firming products.

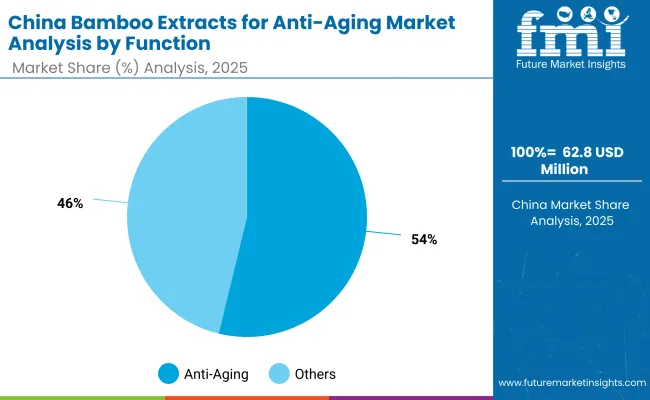

| China By Function | Value Share% 2025 |

|---|---|

| Anti-aging | 53.8% |

| Others | 46.2% |

The Bamboo Extracts for Anti-Aging Market in China presents one of the strongest growth opportunities globally, expanding at a CAGR of 15.8% (2025-2035). With anti-aging and wrinkle reduction accounting for 53.8% of the market in 2025, consumer demand is clearly oriented toward visible, results-driven skincare. E-commerce platforms such as Tmall, JD.com, and Douyin are accelerating adoption by enabling both international and domestic brands to reach urban and rural markets at scale. Younger consumers, particularly millennials and Gen Z, are adopting preventive skincare earlier, which supports long-term market expansion.

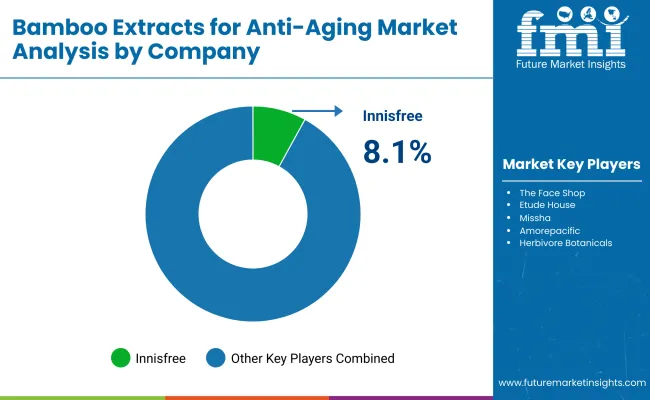

The Bamboo Extracts for Anti-Aging Market is moderately fragmented, featuring a mix of global beauty houses, regional specialists, and emerging clean-label brands. Innisfree leads with 8.1% of the global market share in 2025, leveraging its strong presence in East Asia and premium positioning in natural skincare. Alongside, brands such as The Face Shop, Etude House, Missha, Amorepacific, Herbivore Botanicals, Origins, Kora Organics, Shiseido, and Forest Essentials compete actively across geographies, each differentiating through product innovation and brand storytelling.

Competitive strategies are shifting toward clean-label claims, sustainable sourcing, and transparency in formulations. Regional brands are capitalizing on Ayurvedic and herbal traditions in markets like India, while global players emphasize eco-certifications and vegan positioning in Europe and North America. Digital-first brands are also gaining traction through direct-to-consumer channels and influencer-driven marketing, challenging traditional players. The market is moving away from product commoditization toward ecosystem strength anchored in brand authenticity, omnichannel distribution, and innovative product launches.

Key Developments in Bamboo Extracts for Anti-Aging Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,181.2 Million |

| Extract Type | Bamboo leaf extract, Bamboo stem extract, Bamboo sap/silica, Fermented bamboo extract |

| Function | Anti-aging & wrinkle reduction, Skin firming & elasticity, Hydration, Soothing & calming |

| Product Type | Serums, Creams/lotions, Masks, Ampoules |

| Channel | E-commerce, Pharmacies, Specialty beauty retail, Mass retail |

| Claim | Natural/organic, Vegan, Clean-label, Ayurvedic -inspired |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Innisfree, The Face Shop, Etude House, Missha, Amorepacific, Herbivore Botanicals, Origins, Kora Organics, Shiseido, Forest Essentials |

| Additional Attributes | Dollar sales by extract type and function are a core attribute, highlighting the dominance of bamboo leaf extract in anti-aging and wrinkle reduction applications. Adoption trends in serums and creams underscore their role as leading product types, while growing demand through e-commerce reflects a shift in consumer buying patterns. Sector-specific growth is evident in Ayurvedic -inspired, vegan, and clean-label claims, resonating with both premium and mass-market consumers. Regional trends are shaped by Asia’s rapid uptake of plant-based skincare and Europe’s regulatory focus on sustainability. Innovations in extraction methods, eco-friendly formulations, and hybrid product launches further enhance competitiveness across the global market. |

The global Bamboo Extracts for Anti-Aging Market is estimated to be valued at USD 1,181.2 million in 2025.

The market size for the Bamboo Extracts for Anti-Aging Market is projected to reach USD 3,752.1 million by 2035.

The Bamboo Extracts for Anti-Aging Market is expected to grow at a 12.3% CAGR between 2025 and 2035.

The key product types in the Bamboo Extracts for Anti-Aging Market are serums, creams/lotions, masks, and ampoules.

In terms of product type, the serums segment is projected to command the largest share in 2025, holding 52.2% of market value.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bamboo Straw Market Size and Share Forecast Outlook 2025 to 2035

Bamboo Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bamboo Apparel Market Size and Share Forecast Outlook 2025 to 2035

Bamboo Fiber Tableware and Kitchenware Market Size and Share Forecast Outlook 2025 to 2035

Bamboo Engineered Wood Market Size and Share Forecast Outlook 2025 to 2035

Bamboo Market Analysis - Demand, Trends & Industry Forecast 2024 to 2034

Bamboo Packaging Market Share, Growth & Trends 2025 to 2035

Bamboo Cups Market Analysis and Insights for 2025 to 2035

Bamboo Products Market Analysis – Trends & Growth 2025 to 2035

Market Share Insights for Bamboo Straw Providers

Bamboo Extracts for Skin Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Sustainable Bamboo Charcoal Market Size and Share Forecast Outlook 2025 to 2035

Extracts and Distillates Market

Meat Extracts Market Size and Share Forecast Outlook 2025 to 2035

Algae Extracts Market Size and Share Forecast Outlook 2025 to 2035

Maple Extracts Market Size and Share Forecast Outlook 2025 to 2035

Peony Extracts for Brightening Market Size and Share Forecast Outlook 2025 to 2035

Jujube Extracts Market Analysis by Type, End-Use, Distribution Channel, Region And Other Forms Through 2035

Coffee Extract Market Analysis by Nature, Product, End Use, Formulation, and Region through 2025 to 2035

Seaweed Extracts Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA