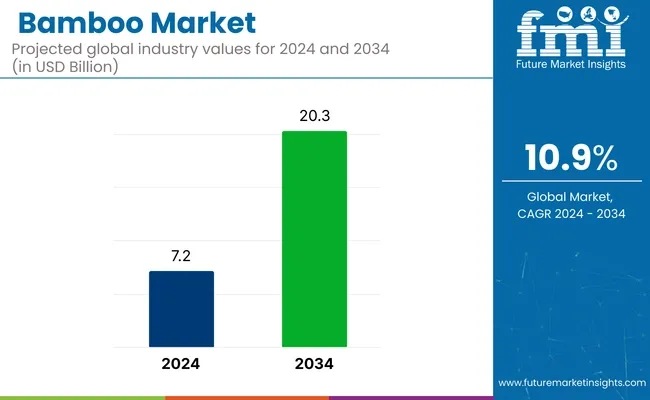

The bamboo market is expected to reach a valuation of USD 6,533.5 million by 2023. The market is expected to show a y-o-y growth of 10.2% in 2024 and reach USD 7.2 billion. Growing at a CAGR of 10.9% between 2024 and 2034, demand in the bamboo market is likely to reach USD 20.3 billion by 2034

According to the most recent data included in the Global Forest Resources Assessment 2020 by the Food and Agriculture Organization of the United Nations (FRA), bamboo covers an area of approximately 35 million hectares across Africa, Asia, and the Americas. The product is primarily found in tropical and subtropical areas, as well as in some milder temperate regions. They are also abundant in East and Southeast Asia, as well as on islands in the Indian and Pacific Oceans.

Ambo is used for building houses, manufacturing furniture, making clothes, producing paper, and many other purposes. It is highly in demand due to its fast growth rate and the fact that its use is environmentally friendly. Its biggest producers include Asian countries such as China and India. However, its use is also becoming increasingly common in other parts of the world, especially as the number of people adopting green practices is increasing rapidly.

Bamboo is used to produce biodegradable goods and as a fuel source. New technologies improve the quality of wooden products. However, many people still perceive it as a cheap material; it has increased in popularity, thus setting the stage for the material’s progress throughout the next decade.

The material is increasingly finding its place in the upscale market, as many luxury brands are incorporating it into stylish home decor, high-end furniture, and fashion accessories. The shift is transforming the image of bamboo from being a cheap product to a high-end material symbolizing sophistication.

It is used in furniture, decorative items, and flooring in home decor to add a sense of natural beauty while keeping homes modern. For furniture, high-quality bamboo is transformed into sleek and durable pieces that enhance the luxury of interiors. The material is slowly making its mark in the fashion line, as designer accessories and other clothes display bamboo fibers for their distinctive look and eco-friendly appeal.

Per capita bamboo demand varies significantly across regions due to differences in cultural use, climate, and material substitution. While countries in Asia have traditionally used bamboo extensively for structural and daily household applications, the USA and Europe have seen a rise in demand.

In India, bamboo remains an integral part of rural life. People use it for housing, furniture, fencing, and utensils. The per capita demand is higher in northeastern and tribal regions, where bamboo is harvested locally from forests or community groves. Here, usage is functional and tied to cultural habits, especially in states like Assam, Nagaland, and Odisha.

In the United States, bamboo demand is primarily market-driven and concentrated in urban, eco-friendly segments. Consumers favor bamboo for flooring, toothbrushes, reusable cutlery, and textile fibers. While the per capita volume is lower than in Asia, demand is increasing due to its reputation as a sustainable alternative to plastic and wood.

In Europe, bamboo sales per person are concentrated in Western and Northern countries. The use is largely centered on imported finished goods such as furniture, paper products, and bio-based textiles. Germany, the Netherlands, and Scandinavian countries lead in retail bamboo product adoption. European consumers typically associate bamboo with environmental consciousness and circular design principles.

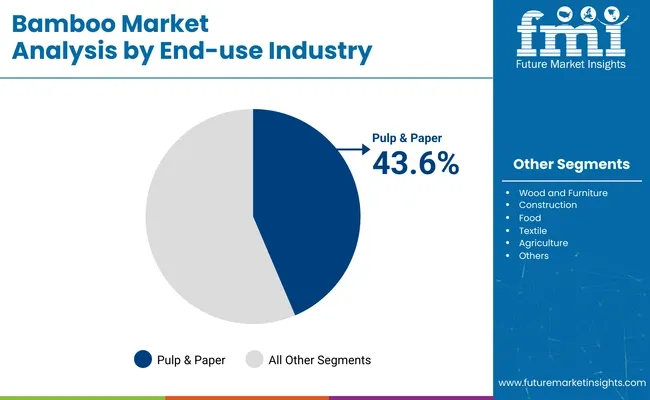

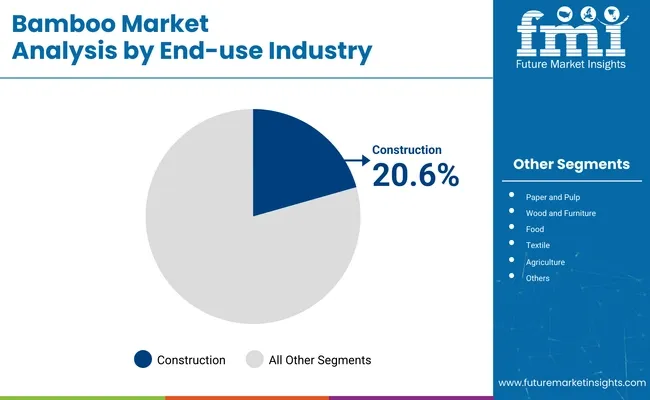

The pulp and paper segment primarily drives the bamboo market. This sector leads due to the growing preference for sustainable and eco-friendly materials. The Construction industry is also a major consumer of bamboo, using it for scaffolding, housing, and road infrastructure. The Textile sector is expanding rapidly as demand rises for bamboo-based fabrics and fibers in clothing and home textiles.

Regionally, East Asia dominates the market thanks to its vast bamboo resources and established manufacturing base. South Asia is experiencing steady growth, supported by government initiatives. North America and Western Europe are key markets that focus on innovation and sustainability. At the same time, Latin America, Eastern Europe, the Middle East and Africa represent emerging regions with an increasing adoption of bamboo products.

The increasing global demand for sustainable paper products drives the growth of bamboo pulp as an eco-friendly raw material.

Growing interest in eco-friendly building materials is leading to the increasing adoption of bamboo in the construction sector.

The report provides a detailed analysis of the bamboo market, focusing on key drivers such as increasing demand across the construction and pulp and paper sectors. It highlights challenges such as supply chain issues and regulatory barriers. Opportunities lie in emerging markets, while threats include competition from alternative materials. It also covers trends like growing product innovation and eco-conscious consumer behavior.

Bamboo Emerging as a Fast-Growing, Eco-Friendly Solution, a Green Choice for the Future.

The product is gaining increasing popularity among individuals and organizations that are seriously considering methods of going green. Primary among the reasons is that the plant grows rapidly, making it a renewable resource that can be harvested regularly without causing significant harm to the environment. Unlike traditional wood, bamboo doesn't require replanting after harvest because it naturally regrows from its roots.

Fast-growing bamboo contributes to a reduction in deforestation. Several value-added products can be manufactured from it, including furniture, building materials, textiles, and even stationery. As more people seek sustainable alternatives, the material becomes increasingly essential in the pursuit of an eco-friendly future.

Technological Advances Transforming Bamboo Products

Recent technological advancements are rapidly expanding the range of applications and enhancing the quality of bamboo products. Improved processing methods have enabled the manufacture of far more sophisticated and highly functional products, such as bamboo-based composites. These combine bamboo fibers with other materials to make hardwearing and durable panels for use in construction and to make furniture. Composites offer the same strength as traditional materials while being more sustainable.

The material has been utilized in the production of bioplastics, serving as a greener alternative to traditional plastics. Bioplastics decompose into the environment much faster than conventional plastics, hence reducing plastic waste. The technological advancement enables high-performance textiles using these fibers to be produced.

These are soft and fully breathable fabrics with natural antibacterial properties, hence ideal for clothing and home textiles. These technological advancements are expanding the scope of the bamboo market and making it a more attractive option for sustainable products across various industries.

Competition from Alternative Sustainable Materials

The product faces high competition from other sustainable materials, including recycled plastics and engineered wood, which negatively impacts the bamboo market. For example, recycled plastics are significantly cheaper and more feasible to work with; hence, many companies prefer them in manufacturing packaging and construction materials. Consequently, such plastics have an advantage, with well-established recycling systems and technologies, which often result in a lower environmental impact than the conventional production of plastics.

Other tough competitors include engineered woods, such as plywood and MDF. It is made by using wood fibers or particles bonded by adhesives, which makes the product durable and versatile. Engineered wood also benefits from established production methods and a long history of use in various applications. Given the competition between bamboo and other materials, stakeholders need to emphasize the unique advantages of its rapid growth and renewability.

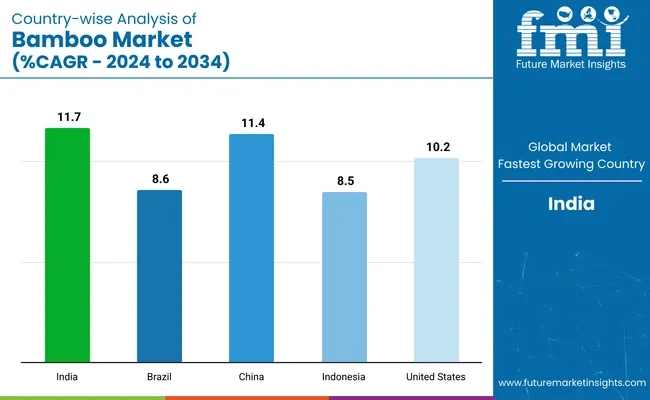

In a country-wise analysis, detailed insights and comprehensive information will be provided regarding potential investments in the bamboo sector. Market trends, growth opportunities, and key drivers for each country will be thoroughly examined, offering valuable guidance for businesses seeking investment opportunities in these emerging markets.

The Indian bamboo market is expected to grow at a CAGR of 11.7% from 2024 to 2034.

Demand for bamboo in China is projected to grow at a CAGR of 11.4% from 2024 to 2034.

The bamboo market in the United States is expected to grow at a CAGR of 10.2% from 2024 to 2034.

The bamboo market in Brazil is projected to grow at a compound annual growth rate (CAGR) of 8.6% from 2024 to 2034.

The bamboo industry in Indonesia is likely to grow at a CAGR of 8.5% from 2024 to 2034.

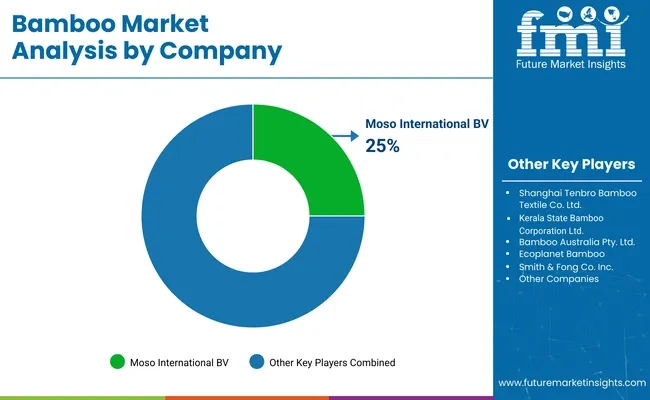

The bamboo market is becoming increasingly competitive, with key players adopting strategies such as innovation, geographic expansion, partnerships, and market diversification to maintain and expand their market share.

Recent Bamboo Industry News

In terms of the End-use Industry, the sector is divided into Wood and Furniture, (Timber Substitute, Plywood, Mat Boards, Flooring, Furniture, Outdoor Decking) Construction, (Scaffolding, Housing, Roads), Food, Pulp & Paper, Textile, Agriculture, and Others (charcoal & handicrafts).

Key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, Middle East and Africa (MEA), have been covered in the report.

The global market was valued at USD 6,533.5 million in 2023.

The global market is set to reach USD 7.2 billion in 2024.

Global demand is anticipated to rise at 10.9% CAGR.

The industry is projected to reach USD 20.3 billion by 2034.

Teragreen LLC and Anji Tianzhen Bamboo Flooring Co. Ltd. are two prominent companies.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bamboo Straw Market Size and Share Forecast Outlook 2025 to 2035

Bamboo Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bamboo Extracts for Anti-Aging Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Bamboo Extracts for Skin Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Bamboo Apparel Market Size and Share Forecast Outlook 2025 to 2035

Bamboo Fiber Tableware and Kitchenware Market Size and Share Forecast Outlook 2025 to 2035

Bamboo Engineered Wood Market Size and Share Forecast Outlook 2025 to 2035

Bamboo Packaging Market Share, Growth & Trends 2025 to 2035

Bamboo Cups Market Analysis and Insights for 2025 to 2035

Bamboo Products Market Analysis – Trends & Growth 2025 to 2035

Market Share Insights for Bamboo Straw Providers

Sustainable Bamboo Charcoal Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA