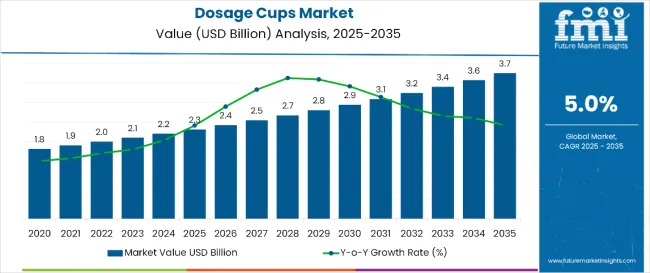

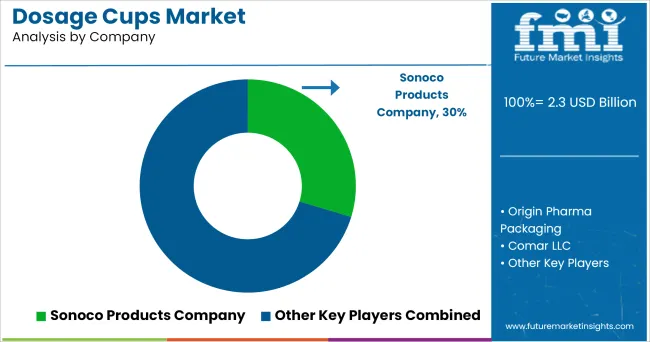

The global dosage cups market is valued at USD 2.3 billion in 2025 and is expected to reach USD 3.7 billion by 2035, registering a CAGR of 5%. Market expansion is driven by rising demand for precise liquid medication administration, increasing adoption of home healthcare solutions, and growth in over-the-counter pharmaceutical consumption.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 2.3 billion |

| Projected Value (2035F) | USD 3.7 billion |

| CAGR (2025 to 2035) | 5% |

Technological innovations in graduated measurement systems and enhanced material durability are also major contributing factors. The dosage cups market accounts for approximately 3.2% of the overall pharmaceutical packaging industry, supported by growth in liquid medication formulations and pediatric medicine applications. In home healthcare, it contributes around 8.4%, reflecting its widespread usage in self-administered treatments and elderly care facilities.

Within the hospital and clinical sector, it comprises about 5.1%, spurred by its increasing use in accurate dosing protocols and patient safety initiatives. In veterinary applications, dosage cups command nearly 4.7% of the market, reflecting their essential role in animal medication administration and pet care products.

Government regulations impacting the market focus on regulatory efforts to ensure measurement accuracy and promote safety standards in medical dosing devices, which have influenced product development trends. Recent innovations include antimicrobial surface coatings, ergonomic grip designs, and color-coded measurement systems with enhanced visibility.

Government-supported initiatives across North America and Europe promoting patient safety and medication adherence are also expected to spur market growth. Continuous advancements in medical device technology and sustainable materials will further unlock value across the dosage cups supply chain. Additionally, strategic collaborations between cup manufacturers and pharmaceutical companies are likely to accelerate customized product development and market penetration.

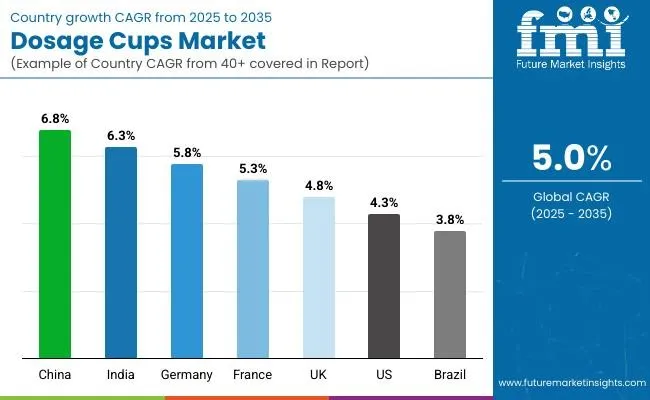

The China dosage cups market is projected to be the fastest-growing, expanding at a CAGR of 6.8% from 2025 to 2035. USA and Germany markets will also grow at CAGRs of 5.3% and 4.9%, respectively.

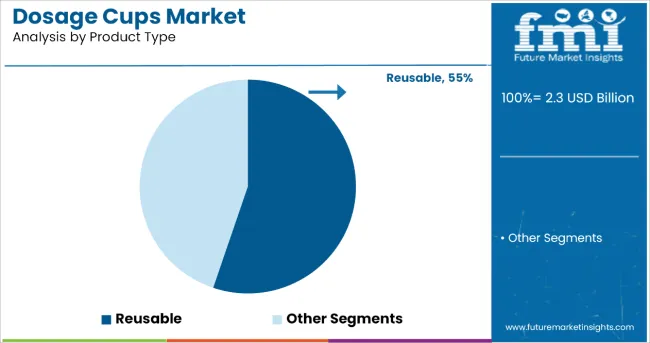

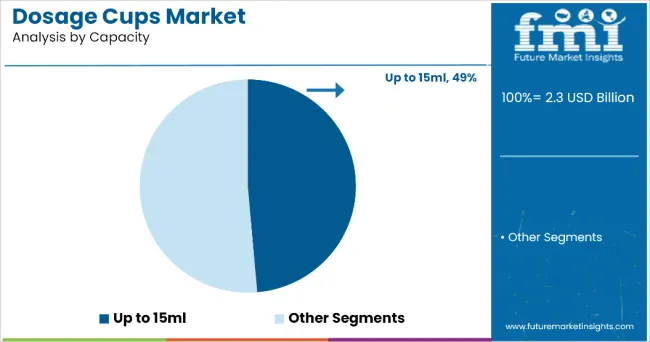

The dosage cups market is segmented by product type, capacity, printing type, and region. By product type, the market includes reusable and disposable dosage cups. Based on capacity, the market is segmented into up to 15ml, 15ml to 35ml, and above 35ml.

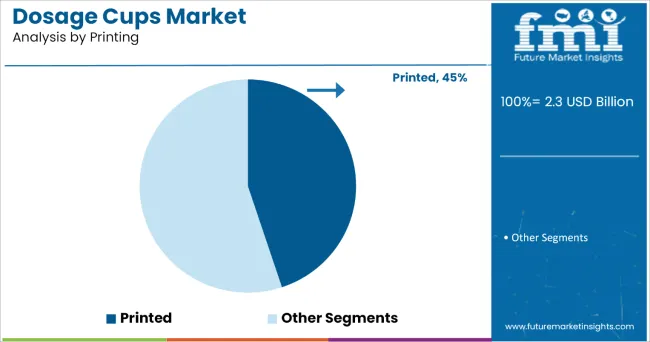

By printing type, the market is categorized into printed and non-printed dosage cups. Regionally, the market is classified into North America, Latin America, Western Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa.

Reusable dosage cups are expecetd to dominate the product type category, accounting for 55% of the global market share in 2025. Their environmental benefits, cost-effectiveness, and increasing adoption in both home and clinical settings are driving this growth. As healthcare providers and consumers push for sustainable solutions, reusable options stand out due to their reusability, durability, and compliance with medical standards.

Up to 15ml Cups are projected to lead the capacity segment, accounting for 49% of market share. These smaller sizes are widely used for pediatric and adult dosing in pharmaceutical and nutraceutical applications due to their precise measurement capability.

Printed dosage cups are expected to account for 45% of the global market in 2025. Their utility in improving dosing accuracy and enhancing brand visibility makes them highly favored across pharmaceutical companies.

The global dosage cups market has been experiencing steady growth, fueled by rising pharmaceutical consumption, increasing demand for unit-dose packaging, and growing emphasis on patient safety and medication compliance. As healthcare systems across both developed and emerging markets focus on reducing medication errors and improving treatment adherence, dosage cups are gaining widespread adoption in hospitals, clinics, and homecare settings.

Advancements in manufacturing, printing precision, and reusable material development are driving product innovation. Moreover, the growing elderly population, pediatric healthcare needs, and expansion of over-the-counter (OTC) drug usage are also contributing to the market’s expansion. Sustainability trends are encouraging a shift toward recyclable and reusable dosage cups, particularly in developed markets.

Recent Trends in the Market

Key Challenges in the Market

Dosing errors are significantly more common with dosage cups than with oral syringes. Multiple studies have found that parents and caregivers are more likely to make dosing errors when using cups compared to syringes, with error rates up to five times higher for cups.

Design of the dosage cup impacts accuracy: Cups with etched (rather than printed) markings may reduce errors, but both types are still associated with higher rates of significant (>20%) deviation from the prescribed dose.

Even with relatively experienced users, about 1 in 10 measured doses with a cup deviate by more than 10% from the intended volume4. This highlights the ongoing risk with cup usage, especially for pediatric medications.

Health literacy affects dosing accuracy: Limited health literacy increases the likelihood of dosing errors, regardless of the device used, but the cup’s design (e.g., clarity of markings, unit of measurement) can further exacerbate this risk.

(Sources: The Journal of Pediatrics, JAMA Network)

The USA, China, and Germany are leading the global dosage cups market in terms of production and consumption. The USA is known for its highly regulated healthcare system and preference for calibrated, printed dosage solutions. China’s growth is led by mass-scale production and pharmaceutical sector expansion. Germany serves both as a consumer and exporter of precision medical packaging products. Emerging production hubs include India, France, and South Korea, with growing emphasis on cost-effective manufacturing and export potential.

The China dosage cups market is projected to grow at a CAGR of 6.8% from 2025 to 2035. Growth is driven by the rising elderly population, expansion of pharmaceutical manufacturing, and the increasing popularity of liquid formulations. China’s large domestic healthcare market and government support for improving primary healthcare infrastructure are key enablers.

The France dosage cups market is forecast to grow at a CAGR of 5.3% from 2025 to 2035. The growth is led by its progressive pharmaceutical industry and government-backed initiatives for accurate medication distribution and sustainable packaging.

The USA dosage cups market is expected to grow at a CAGR of 4.3% from 2025 to 2035. Factors such as a high volume of prescription drug use, a mature OTC market, and stringent regulations for safe dosing tools contribute to market maturity and growth. The increasing need for unit-dose packaging in healthcare and the focus on reducing medication errors further drive demand.

The Germany dosage cups market is projected to grow at a CAGR of 5.8% from 2025 to 2035. As one of the most structured pharmaceutical markets in Europe, Germany offers high potential due to its focus on patient-centric care, elderly health, and pharmaceutical export capabilities.

The dosage cups market is moderately fragmented, with a mix of global packaging giants and specialized medical suppliers. Key players are focused on innovation, sustainability, and regulatory compliance. Companies such as Comar LLC, SGH Healthcaring, Gerresheimer AG, Adelphi Healthcare Packaging, Bormioli Pharma, Origin Pharma Packaging, and Qosina dominate the market through strong partnerships with pharmaceutical manufacturers and healthcare distributors.

Strategic investments in sustainable materials (e.g., bio-based plastics), customization (branding/printing), and product traceability are helping leading companies differentiate in a highly regulated market.

Recent Dosage Cups Market News

In May 2025, Gerresheimer AG launched its new range of recyclable, printed dosing cups designed for pediatric and elderly patient care. The new product line meets EU and FDA regulatory standards for single-use plastic reduction and is expected to enhance compliance rates through clear, embossed measurement markings.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 2.3 billion |

| Projected Market Size (2035) | USD 3.7 billion |

| CAGR (2025 to 2035) | 5.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billions/Volume in Units |

| By Product Type | Reusable and Disposable |

| By Capacity | Up to 15ml, 15ml-35ml, and Above 35ml |

| By Printing Type | Printed and non-printed |

| Regions Covered | North America, Latin America, Western Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Players | Comar LLC, SGH Healthcaring, Gerresheimer AG, Origin Pharma Packaging, Adelphi Healthcare Packaging, Qosina, Bormioli Pharma |

| Additional Attributes | Dollar sales by product type, share by functionality, regional demand growth, regulatory influence, clean-label trends, competitive benchmarking |

The global dosage cups market is estimated to be valued at USD 2.3 billion in 2025.

The market size for the dosage cups market is projected to reach USD 3.7 billion by 2035.

The dosage cups market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in dosage cups market are up to 15ml, 16ml to 35ml and above 35ml.

In terms of product type, reusable segment to command 54.6% share in the dosage cups market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dosage Unit Sampling Apparatus Market Size and Share Forecast Outlook 2025 to 2035

Dosage Spoon Market Analysis by Material, Capacity, and Region through 2025 to 2035

Dosage Cup & Spoon Market Trends & Industry Growth Forecast 2024-2034

Low dosage Hydrate Inhibitors Market - Demand, Growth & Industry Outlook 2025 to 2035

Foam Cups Market Size and Share Forecast Outlook 2025 to 2035

Oral Dosage Powder Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Key Companies & Market Share in the Oral Dosage Powder Packaging Machines Sector

Paper Cups Market Size and Share Forecast Outlook 2025 to 2035

Leading Providers & Market Share in Paper Cups Industry

Sippy Cups Market Analysis – Size, Growth & Trends to 2033

Edible Cups Market Size and Share Forecast Outlook 2025 to 2035

Bamboo Cups Market Analysis and Insights for 2025 to 2035

Sterile Dosage Form Market Size and Share Forecast Outlook 2025 to 2035

Vending Cups Market Size and Share Forecast Outlook 2025 to 2035

Pre-Made Cups Market Size, Share & Forecast 2025 to 2035

Beverage Cups Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Beverage Cups Companies

Menstrual Cups Market Growth - Trends & Forecast 2025 to 2035

Oral Solid Dosage Pharmaceutical Formulation Market Size and Share Forecast Outlook 2025 to 2035

Disposable Cups Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA