The oral solid dosage pharmaceutical formulation market is experiencing strong growth driven by its widespread applicability, patient compliance, and cost-effectiveness in drug manufacturing. Current market dynamics are influenced by advancements in formulation technologies, evolving regulatory standards, and the expansion of generic drug production. Manufacturers are focusing on improving bioavailability, stability, and patient-centric designs to enhance therapeutic outcomes.

The market is also benefiting from the scalability of oral dosage manufacturing and the integration of automation and continuous processing techniques. Increasing prevalence of chronic diseases and the rising need for long-term medication have further reinforced the importance of oral solid formulations in global healthcare.

The future outlook is supported by innovation in controlled and targeted release technologies, growing investments in research and development, and the continued expansion of pharmaceutical distribution networks across emerging economies These factors collectively position the market for sustained revenue growth and broader accessibility across therapeutic areas.

| Metric | Value |

|---|---|

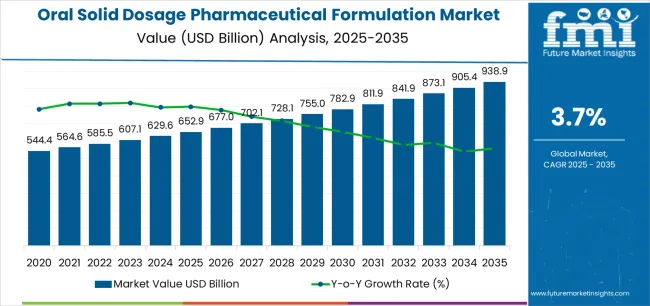

| Oral Solid Dosage Pharmaceutical Formulation Market Estimated Value in (2025 E) | USD 652.9 billion |

| Oral Solid Dosage Pharmaceutical Formulation Market Forecast Value in (2035 F) | USD 938.9 billion |

| Forecast CAGR (2025 to 2035) | 3.7% |

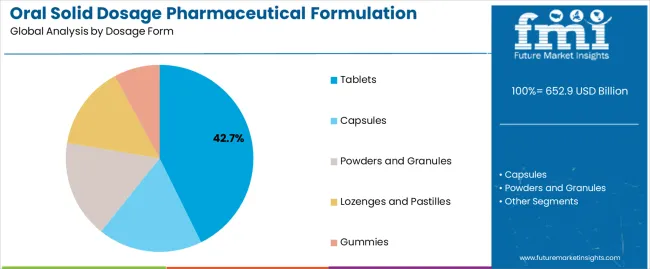

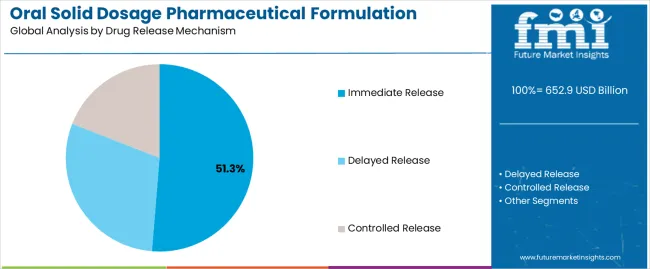

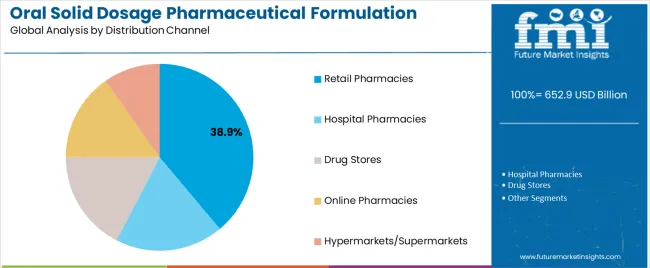

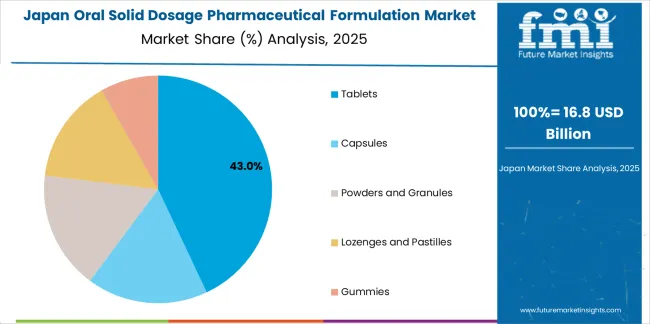

The market is segmented by Dosage Form, Drug Release Mechanism, and Distribution Channel and region. By Dosage Form, the market is divided into Tablets, Capsules, Powders and Granules, Lozenges and Pastilles, and Gummies. In terms of Drug Release Mechanism, the market is classified into Immediate Release, Delayed Release, and Controlled Release. Based on Distribution Channel, the market is segmented into Retail Pharmacies, Hospital Pharmacies, Drug Stores, Online Pharmacies, and Hypermarkets/Supermarkets. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The tablets segment, accounting for 42.7% of the dosage form category, has remained dominant due to its versatility, ease of administration, and favorable manufacturing economics. Tablets offer advantages such as precise dosing, extended shelf life, and compatibility with various drug delivery technologies.

Their continued leadership is supported by strong demand from both branded and generic pharmaceutical producers. Technological improvements in coating, granulation, and compression processes have enhanced tablet uniformity and performance.

The segment’s growth has also been reinforced by regulatory approval efficiencies and consumer preference for convenient, non-invasive dosage forms Ongoing innovation in orally disintegrating and modified-release tablets is expected to strengthen market penetration, ensuring the category’s sustained prominence within the oral solid dosage pharmaceutical formulation market.

The immediate release segment, holding 51.3% of the drug release mechanism category, has achieved leading market share due to its critical role in enabling rapid therapeutic action and simplified formulation development. Its dominance is being maintained by the high prevalence of acute conditions requiring fast symptom relief and widespread adoption across therapeutic classes.

The segment benefits from reduced development time, lower production costs, and ease of patient adherence. Formulation technologies enhancing dissolution rates and bioavailability have further supported its adoption.

Market growth is also being propelled by the continued reliance on immediate release systems for over-the-counter medications and high-volume prescription drugs Future expansion will be guided by incremental innovation in excipient design and process optimization aimed at improving performance consistency and stability.

The retail pharmacies segment, representing 38.9% of the distribution channel category, has emerged as the leading channel due to its extensive accessibility, trusted distribution network, and central role in consumer medication delivery. Its leadership is reinforced by widespread presence in both urban and rural markets, ensuring consistent patient access to prescribed and over-the-counter oral dosage products.

Strong relationships between pharmaceutical manufacturers and retail chains have enhanced inventory management and product availability. Increasing healthcare expenditure and the expansion of pharmacy chains in emerging economies are contributing to sustained channel growth.

Digital integration and e-prescription systems are further optimizing supply efficiency Continued investment in retail pharmacy infrastructure and patient-centered service models is expected to maintain the segment’s leading position over the forecast period.

Continuous developments in pharmaceutical production technology, such as novel equipment and methods, aid in the creation of oral solid dosage formulations that are more economical and efficient.

These developments accelerate oral solid dosage pharma formulation market expansion by improving the pharmaceutical products' quality, safety, and repeatability.

Market dynamics are influenced by patients' preference for oral drugs, which are motivated by familiarity with and convenience in usage. Consumers are accepting oral solid dosage forms, which fosters oral solid dosage pharmaceutical formulation industry expansion.

The aging of the global population is increasing the prevalence of chronic illnesses. The pharmaceutical industry is expanding due to a growing demand for oral solid dosage forms that address chronic diseases.

| Attributes | Details |

|---|---|

| Market Value for 2020 | USD 6,29,582.6 million |

| Market Value for 2025 | USD 6,29,582.6 million |

| Market CAGR from 2020 to 2025 | 2.8% |

Complex facilities, sophisticated machinery, and knowledgeable workers are required to produce oral solid dosage forms. Smaller pharmaceutical companies are barriers to entry due to high initial capital investment and continuous operating costs associated with production facilities.

Government policies that support generic replacement and cost-cutting efforts in healthcare systems negatively impact the oral solid dose pharmaceutical formulation market. Policies that require or reward generic replacement pressure prices and diminish the market share of branded goods.

The segmented oral solid dosage pharmaceutical formulation market analysis is included in the following subsection. Based on comprehensive research, the immediate release sector is controlling the drug release mechanism category, and the tablets segment dominates the dosage form category.

| Segment | Immediate Release |

|---|---|

| Share (2025) | 43.30% |

Immediate release drugs are more convenient and increase patient compliance, which boosts sales of oral solid dosage pharmaceutical formulations. Evident in prescribers' general preference for first-line therapies is the dominance of immediate release segment.

Given their applicability across a range of therapeutic domains, the immediate release segment continues to enjoy substantial demand for oral solid dosage pharmaceutical formulation.

Easy administration and flexible dosage schedules are two factors supporting immediate release formulations' ongoing prominence in the oral solid dose pharmaceutical formulation market.

| Segment | Tablets |

|---|---|

| Share (2025) | 48.90% |

Due to their affordability, patient familiarity, and manufacturing convenience, tablets account for the majority of sales of oral solid dosage pharmaceutical formulation. Even with many alternatives, the oral solid dosage pharmaceutical formulation industry favors tablets as a reliable, effective, and commonly recognized dosage form.

Then, follow capsules, which are more adaptable and have better drug stability, making them suitable for various formulations. Powders and granules, particularly in formulations for children and the elderly, are prevalent for individualized dosing.

Pastilles and lozenges target specific therapeutic areas and are prized for their targeted distribution and ability to increase patient compliance. Gummies are a growing trend that draws consumers looking for new and tasty substitutes, propelling the nutraceutical industry's growth.

The oral solid dosage pharmaceutical formulation market can be observed in the subsequent tables, which focus on the leading regions in North America, Europe, and Asia Pacific.

A comprehensive evaluation demonstrates that Asia Pacific has enormous market opportunities for oral solid dosage pharmaceutical formulation.

Oral Solid Dosage Pharma Formulation Opportunities in Asia Pacific

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 7.2% |

| South Korea | 6.8% |

| Japan | 3.3% |

Given its size and changing regulatory environment, China offers many opportunities for oral solid dosage pharmaceutical formulations. The increasing emphasis on healthcare accessibility and the rising demand for oral solid dosage forms promote China's pharmaceutical industry's rapid expansion.

Advancements in manufacturing and new technology are fostering China's oral solid dosage pharma formulation market expansion.

The market is expanding owing to the South Korean government's encouraging policies and investments in research and development facilities. South Korea is a desirable center for the regional manufacture and export of oral solid dosage formulations due to its advantageous location and robust intellectual property protection.

Technology and manufacturing process developments are continually raising the productivity and competitiveness of the South Korean oral solid dosage pharmaceutical formulation industry.

Innovation in oral solid dosage pharmaceutical formulations is in high demand in Japan due to the country's aging population and rising rates of chronic diseases. Oral solid dose forms are developed under the influence of Japan's pharmaceutical industry, distinguished by an emphasis on tailored medicines and precision medicine.

Japan's oral solid dose pharmaceutical formulation market experiences innovation caused by ongoing investment in research and development and advances in manufacturing technology.

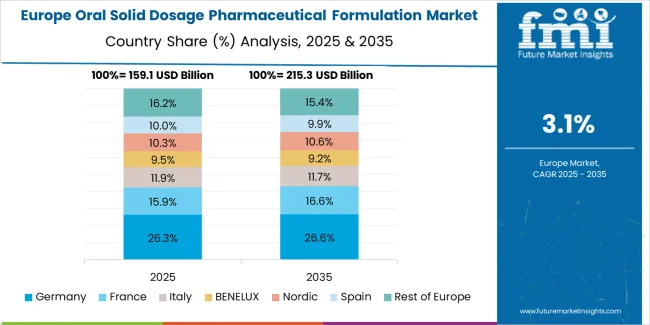

Market Growth Analysis of Oral Solid Dosage Pharma Formulation in Europe

| Countries | CAGR (2025 to 2035) |

|---|---|

| France | 4.6% |

| Italy | 3.8% |

| Spain | 2.7% |

| United Kingdom | 2.1% |

| Germany | 1.6% |

Strict laws controlling oral solid dose pharmaceuticals result from the French market's emphasis on quality and safety standards. Specialized oral solid dose formulations suited to geriatric healthcare needs are in high demand due to France's aging population.

The French government's healthcare policies aim to ensure that oral solid dosage pharmaceuticals are widely available to the general public.

Naturally occurring oral solid dose formulations are strongly affected by the rich history of herbal therapy that Italy's pharmaceutical industry has enjoyed. Italians place a high priority on preventative healthcare, which ignites the oral solid dosage pharma formulation market that addresses illnesses related to lifestyle, like metabolic disorders.

Producers of oral solid dosage pharmaceutical formulation prioritize cost-effective oral solid dosage formulations without sacrificing quality in the Spanish market, where pricing is an integral factor. Spain's regulatory framework supports environmentally sustainable approaches in the manufacturing of oral solid doses.

Collaborative efforts between Spanish pharmaceutical companies and research institutions facilitate the creation of innovative oral solid dose formulations for rare illnesses.

The development of customized oral solid dosage formulations based on genetic profiles is stimulated by the United Kingdom pharmaceutical market's emphasis on personalized medicine. To meet healthcare demands at a reasonable cost, the National Health Service (NHS) in the United Kingdom is a major influence on developments in oral solid dose formulation.

Sustained-release formulations and other innovative oral solid dose formulation technologies are made possible by Germany's substantial expenditure on research and development.

The German healthcare system has influenced the creation of user-friendly oral solid dosage formulations with clear dosing instructions, which promotes patient education and self-management.

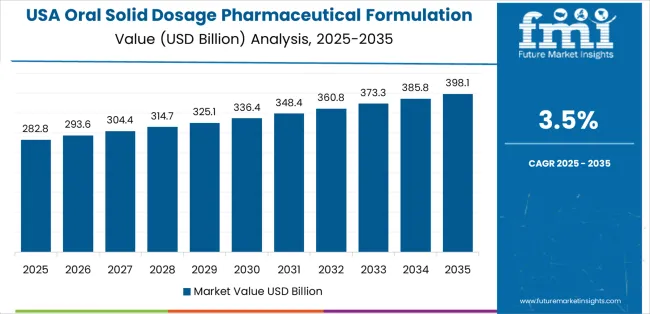

Market Dynamics of Oral Solid Dosage Pharmaceutical Formulation in North America

| Countries | CAGR (2025 to 2035) |

|---|---|

| Canada | 2.8% |

| United States | 1.7% |

In the United States, advances in oral solid dosage pharmaceutical formulations are stimulated by the rising need for generic medications and the growing emphasis on individualized therapy. The United States' oral solid dosage pharmaceutical production landscape is changing due to the emergence of contract manufacturing organizations, or CMOs.

The Canada oral solid dosage pharmaceutical formulations market witnessed an increased demand for user-friendly formulations due to consumers' growing preference for over-the-counter pharmaceuticals.

In Canada, particularly in rural areas, the rise of e-pharmacies and telemedicine is opening up fresh pathways for oral solid dosage pharmaceutical delivery and accessibility.

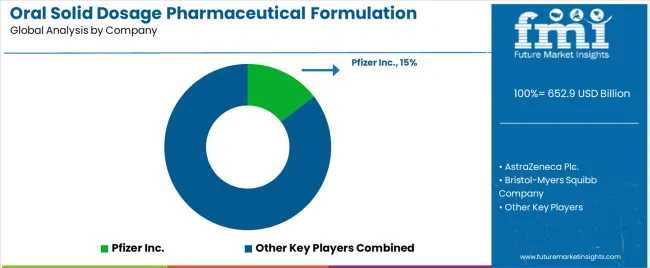

With their knowledge and inventiveness, key oral solid dosage pharmaceutical formulation vendors rule the market in the fiercely competitive field. These oral solid dosage pharmaceutical formulation producers advance the development of pharmaceutical formulations by contributing various strengths.

Pfizer, Novartis, and AstraZeneca are renowned for their broad product lines and dedication to innovation.

Merck, Eli Lilly, and AbbVie are proficient in particular therapeutic domains, augmenting the market's products. Johnson & Johnson and Teva Pharmaceuticals are important contributors to the accessibility and affordability of oral solid dosage pharmaceutical formulations.

In this highly competitive environment, oral solid dosage pharmaceutical formulation providers constantly strive to bring novel formulations, better drug delivery systems, and improve patient outcomes through ongoing research and development activities.

Supply chain management, quality control, and regulatory compliance are still essential for preserving the market competitiveness of oral solid dosage pharmaceutical formulation.

The dynamic competition in the market compels oral solid dosage pharmaceutical formulation manufacturers to innovate, provide high-quality products and services, and prioritize accessibility in response to changing healthcare requirements.

Latest Advancements

| Company | Details |

|---|---|

| Catalent | In February 2025, Catalent paid USD 475 million to purchase Metrics Contract Services to increase its production capacity for oral solid dose and high-potency pharmaceuticals. |

| Pfizer | In March 2025, Pfizer introduced Lyrica (pregabalin) in a new extended-release tablet format for the treatment of neuropathic pain. |

| Eli Lilly & Company | Eli Lilly & Company announced the release of Trulicity, a novel bilayer tablet formulation intended to treat type 2 diabetes, in April 2025. |

| Farxiga | The new once-daily oral tablet version of Farxiga for the treatment of type 2 diabetes and heart failure with maintained ejection fraction was announced by AstraZeneca plc in May 2025. |

| Novartis AG | Novartis AG announced in June 2025 the launch of its new extended-release Vytorin tablet formulation for treating high cholesterol. |

The global oral solid dosage pharmaceutical formulation market is estimated to be valued at USD 652.9 billion in 2025.

The market size for the oral solid dosage pharmaceutical formulation market is projected to reach USD 938.9 billion by 2035.

The oral solid dosage pharmaceutical formulation market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in oral solid dosage pharmaceutical formulation market are tablets, conventional/immediate release, modified release, chewable tablets, effervescent tablets, capsules, hard gelatin capsules, soft gelatin capsules, others, powders and granules, lozenges and pastilles and gummies.

In terms of drug release mechanism, immediate release segment to command 51.3% share in the oral solid dosage pharmaceutical formulation market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oral Dosing Cup Market Forecast AND Outlook 2025 to 2035

Oral Care Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oral Irrigator Market Size and Share Forecast Outlook 2025 to 2035

Oral Antiseptics Market Size and Share Forecast Outlook 2025 to 2035

Oral Food Challenge Testing Market Analysis Size and Share Forecast Outlook 2025 to 2035

Oral Care Market Growth – Demand, Trends & Forecast 2025–2035

Oral Clinical Nutrition Desserts Market Analysis - Size, Growth, and Forecast 2025 to 2035

Oral Dose Packaging Market Trends & Growth Forecast 2025 to 2035

Oral Immunostimulant Market – Demand, Growth & Forecast 2025 to 2035

Oral Clinical Nutritional Cream and Pudding Market Analysis by Product Type and Distribution Channel Through 2035

Competitive Breakdown of Oral Clinical Nutrition Supplements

Market Share Insights for Oral Care Providers

Oral Controlled Release Drug Delivery Technology Market Trends – Growth & Forecast 2025-2035

Oral Clinical Nutrition Supplement Market Trends - Growth & Forecast 2025

Oral Syringe Market

Oral Rinse Market

Oral Anticoagulants Market

Oral Screening Systems Market

Oral Dosage Powder Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Key Companies & Market Share in the Oral Dosage Powder Packaging Machines Sector

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA