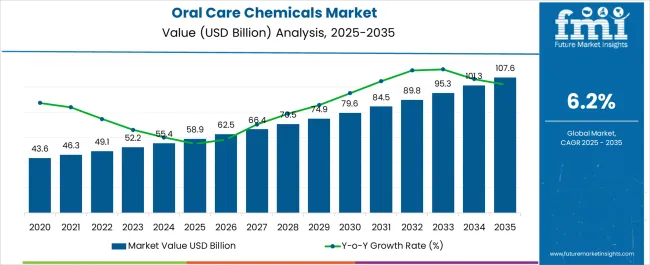

The Oral Care Chemicals Market is estimated to be valued at USD 58.9 billion in 2025 and is projected to reach USD 107.6 billion by 2035, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period.

| Metric | Value |

|---|---|

| Oral Care Chemicals Market Estimated Value in (2025 E) | USD 58.9 billion |

| Oral Care Chemicals Market Forecast Value in (2035 F) | USD 107.6 billion |

| Forecast CAGR (2025 to 2035) | 6.2% |

The Oral Care Chemicals market is witnessing robust growth, driven by rising consumer awareness about oral hygiene, increasing demand for specialized dental products, and the expansion of preventive healthcare practices. The growing prevalence of dental problems such as cavities, plaque, and gum disease has encouraged the widespread adoption of oral care solutions globally. Manufacturers are increasingly focusing on innovation in chemical formulations to enhance efficacy, improve taste, and deliver multifunctional benefits.

The trend toward natural and sustainable ingredients is also shaping product development, as consumers become more conscious of safety and eco-friendly solutions. Significant advancements in oral care chemistry, such as the use of actives for enamel strengthening, antibacterial protection, and whitening, are further driving market expansion.

Additionally, rising disposable incomes, expanding retail availability, and the growth of e-commerce platforms are making oral care products more accessible to a larger consumer base As oral hygiene becomes a key part of overall wellness, the Oral Care Chemicals market is expected to continue its steady growth, driven by innovation, personalization, and global health trends.

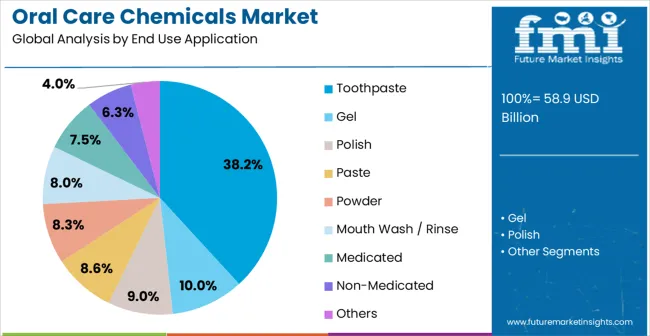

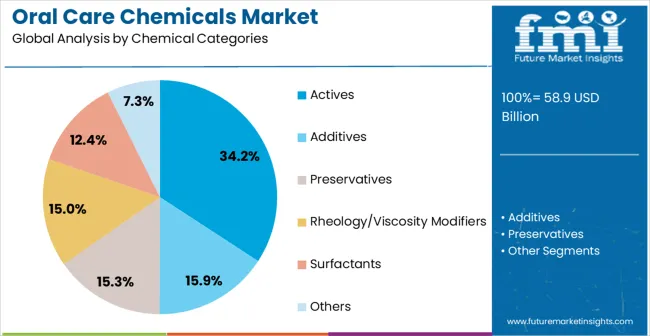

The oral care chemicals market is segmented by end use application, chemical categories, and geographic regions. By end use application, oral care chemicals market is divided into Toothpaste, Gel, Polish, Paste, Powder, Mouth Wash / Rinse, Medicated, Non-Medicated, and Others. In terms of chemical categories, oral care chemicals market is classified into Actives, Additives, Preservatives, Rheology/Viscosity Modifiers, Surfactants, and Others. Regionally, the oral care chemicals industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The toothpaste segment is expected to account for 38.2% of the Oral Care Chemicals market revenue share in 2025, positioning it as the leading end use application. This growth is being driven by the segment’s role as the most widely consumed oral care product, used daily by billions of individuals across the globe. Formulation advancements such as the inclusion of fluoride, whitening agents, herbal extracts, and antimicrobial compounds have increased both consumer trust and demand for toothpaste.

The convenience of packaging formats and the availability of toothpaste for specialized needs, including sensitive teeth, gum protection, and cavity prevention, further enhance its appeal. The rising awareness of oral hygiene, driven by government campaigns and dental associations, has significantly boosted consumption, especially in emerging economies.

Strong marketing efforts by leading brands and the influence of dentists in recommending toothpaste have further reinforced its position in the market With growing demand for premium and natural formulations, toothpaste is expected to retain its leadership as the most important category within oral care chemicals.

The actives segment is projected to capture 34.2% of the Oral Care Chemicals market revenue share in 2025, establishing it as the leading chemical category. This dominance is being supported by the critical role of actives in delivering therapeutic and preventive benefits in oral care products. Actives such as fluoride, triclosan alternatives, zinc compounds, and herbal agents provide key functionalities including cavity protection, enamel strengthening, antibacterial action, and whitening.

Growing consumer preference for targeted solutions, such as sensitivity relief or gum health improvement, is further driving demand for innovative actives. Continuous advancements in chemistry and biotechnology are enabling the development of new molecules that improve efficacy while maintaining safety standards. The shift toward natural and plant-based actives is also expanding opportunities within this segment, as eco-conscious consumers seek clean-label formulations.

The regulatory emphasis on product effectiveness and safety continues to shape this category, ensuring sustained investment and innovation As oral health awareness grows globally, actives are expected to remain at the forefront of chemical categories in the market.

In recent few years, the concern about personal care has increased very mush recently, personal care industry include hair care, skin care, oral care, cosmetic, etc. among all these segments oral care products are finding prominent use in day to day life of customers. Oral care is a practice of cleaning one’s mouth and free from dental diseases such as tooth decay (cavities, dental caries) and gum diseases.

Oral hygiene being a critical factor for overall health, the concern regarding oral health has grown among the people in recently and hence led to increase in demand of oral care products. With the development of technology and increasing awareness about dental hygiene and health have led to introduction of new attractive products in the market.

Furthermore, paradigm shift from traditional product usage towards modern usage is being observed. Oral care chemicals are used in several oral care products such as toothpaste, mouthwash, whitening and rinses. Toothpaste segment is expected to be dominating segment driving the oral care chemicals market.

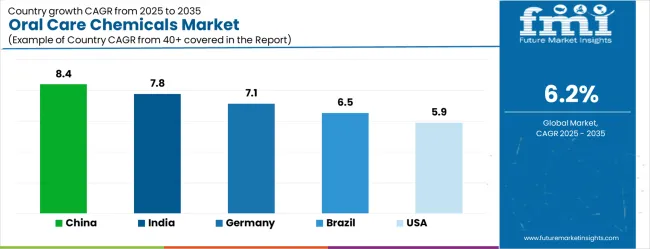

| Country | CAGR |

|---|---|

| China | 8.4% |

| India | 7.8% |

| Germany | 7.1% |

| Brazil | 6.5% |

| USA | 5.9% |

| UK | 5.3% |

| Japan | 4.7% |

The Oral Care Chemicals Market is expected to register a CAGR of 6.2% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 8.4%, followed by India at 7.8%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 4.7%, yet still underscores a broadly positive trajectory for the global Oral Care Chemicals Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 7.1%. The USA Oral Care Chemicals Market is estimated to be valued at USD 21.4 billion in 2025 and is anticipated to reach a valuation of USD 21.4 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 3.1 billion and USD 1.8 billion respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 58.9 Billion |

| End Use Application | Toothpaste, Gel, Polish, Paste, Powder, Mouth Wash / Rinse, Medicated, Non-Medicated, and Others |

| Chemical Categories | Actives, Additives, Preservatives, Rheology/Viscosity Modifiers, Surfactants, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

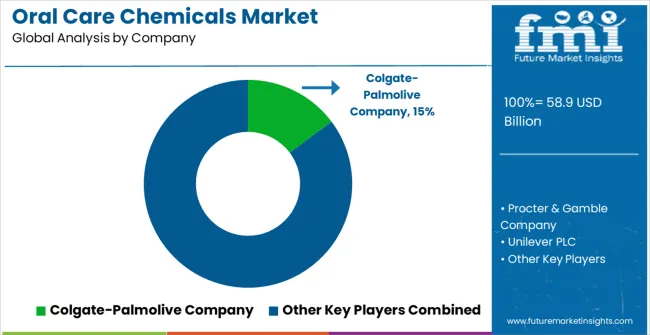

| Key Companies Profiled | Colgate-Palmolive Company, Procter & Gamble Company, Unilever PLC, Haleon plc, Church & Dwight Co. Inc., Kenvue Inc., Henkel AG & Co. KGaA, LG Household & Health Care Ltd., Lion Corporation, Sunstar Suisse SA, Koninklijke Philips N.V., and Panasonic Corporation |

The global oral care chemicals market is estimated to be valued at USD 58.9 billion in 2025.

The market size for the oral care chemicals market is projected to reach USD 107.6 billion by 2035.

The oral care chemicals market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in oral care chemicals market are toothpaste, gel, polish, paste, powder, mouth wash / rinse, medicated, non-medicated and others.

In terms of chemical categories, actives segment to command 34.2% share in the oral care chemicals market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oral Bone Implant Material Market Size and Share Forecast Outlook 2025 to 2035

Oral Solid Dosage Pharmaceutical Formulation Market Size and Share Forecast Outlook 2025 to 2035

Oral Dosing Cup Market Forecast AND Outlook 2025 to 2035

Oral Irrigator Market Size and Share Forecast Outlook 2025 to 2035

Oral Antiseptics Market Size and Share Forecast Outlook 2025 to 2035

Oral Food Challenge Testing Market Analysis Size and Share Forecast Outlook 2025 to 2035

Oral Dosage Powder Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Oral Clinical Nutrition Desserts Market Analysis - Size, Growth, and Forecast 2025 to 2035

Oral Dose Packaging Market Trends & Growth Forecast 2025 to 2035

Oral Immunostimulant Market – Demand, Growth & Forecast 2025 to 2035

Oral Clinical Nutritional Cream and Pudding Market Analysis by Product Type and Distribution Channel Through 2035

Competitive Breakdown of Oral Clinical Nutrition Supplements

Key Companies & Market Share in the Oral Dosage Powder Packaging Machines Sector

Oral Controlled Release Drug Delivery Technology Market Trends – Growth & Forecast 2025-2035

Oral Clinical Nutrition Supplement Market Trends - Growth & Forecast 2025

Oral Syringe Market

Oral Rinse Market

Oral Anticoagulants Market

Oral Screening Systems Market

Oral Care Market Growth – Demand, Trends & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA