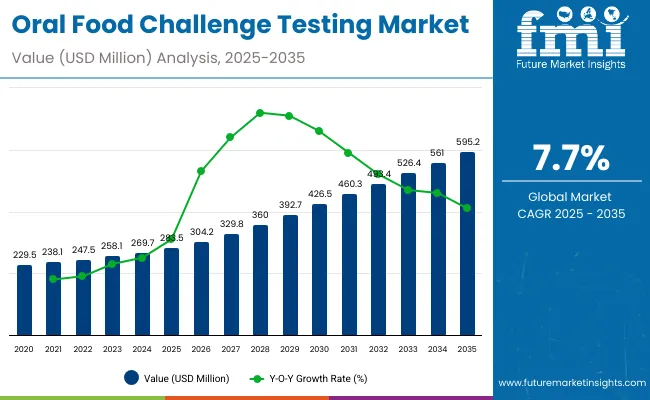

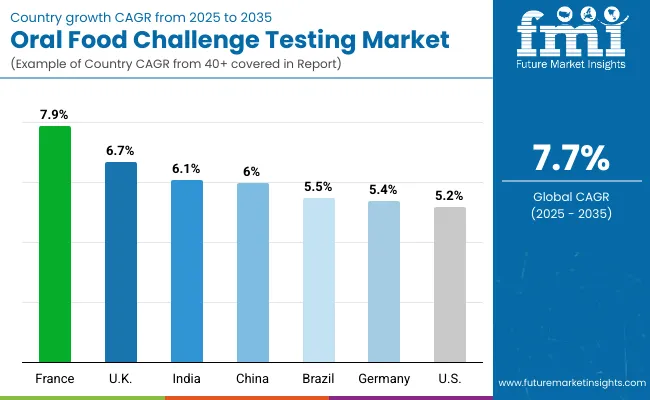

The global Oral Food Challenge (OFC) Testing Market is projected to reach a valuation of USD 283.5 million by 2025 and USD 595.2 million by 2035. This indicates a decade-long increase of USD 311.7 million between 2025 and 2035. The market is expected to expand at a compound annual growth rate (CAGR) of 7.7%, representing a 2.1X increase over the ten-year period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 283.5 million |

| Industry Value (2035F) | USD 595.2 million |

| CAGR (2025 to 2035) | 7.7% |

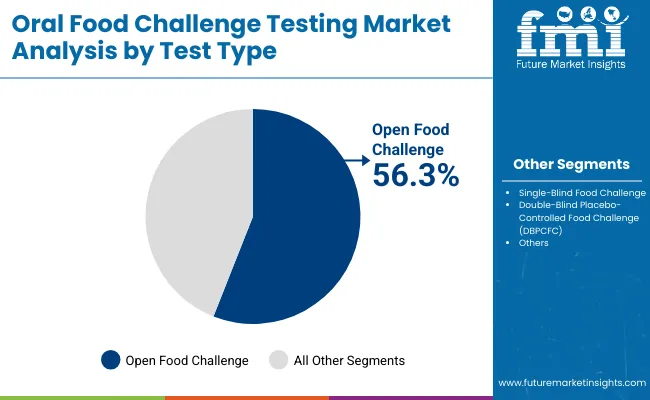

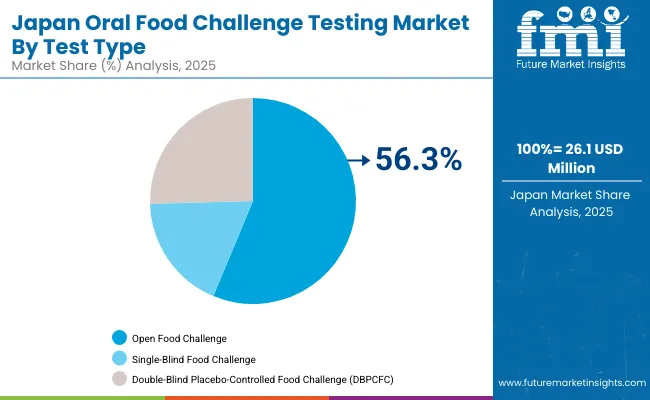

During the first five-year period from 2025 to 2030, the total market value is projected to expand from USD 283.5 million to USD 426.5 million, adding USD 143.0 million, which contributes to 45.9% of the total decade growth. The Open Food Challenge segment will remain dominant, holding around 56.3% share of the category by 2030, driven by its wide adoption in pediatric allergy diagnosis due to easier administration. The Double-Blind Placebo-Controlled Food Challenge (DBPCFC) segment will increase steadily, moving toward 27.4% share by 2035, while the Single-Blind Food Challenge segment will moderate at around 16.3% share.

The second half from 2030 to 2035 contributes USD 168.7 million, which is equal to 54.1% of the total growth, as the market expands from USD 426.5million to USD 595.2 million. This acceleration is powered by the growing adoption of OFC as the gold-standard confirmatory test for food allergies in both institutional and specialized clinic settings.

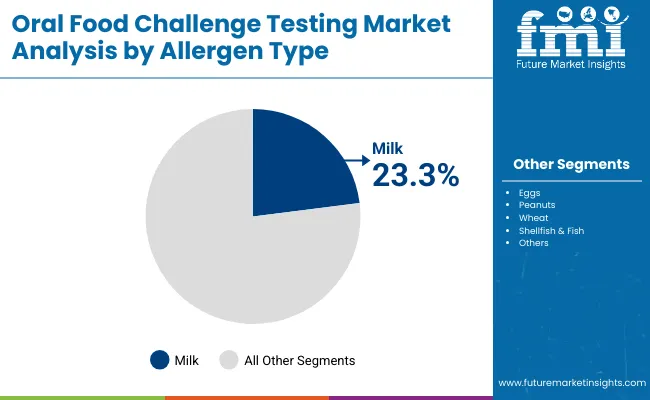

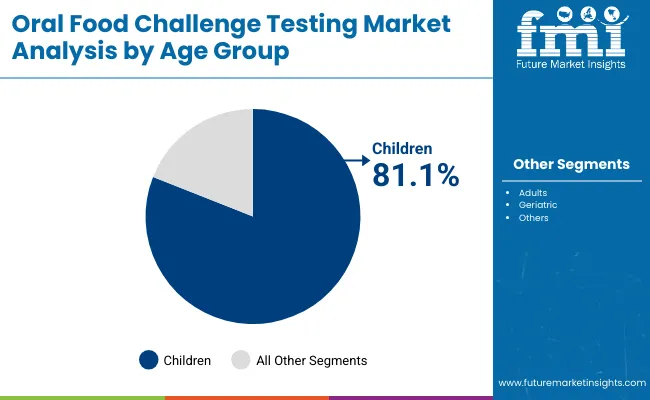

By the end of the decade, Open Food Challenges and DBPCFCs together capture above 83.0% share, consolidating their importance in clinical practice. Allergen-specific tests led by peanuts and milk further strengthen the market growth outlook with a cumulative share of 49.7%, particularly in pediatric populations that account for nearly 79.0% of total OFC tests by 2035.

From 2020 to 2024, the overall Oral Food Challenge (OFC) Testing Market grew from USD 229.5million to USD 269.7 million. Leading institutions and companies such as Reacta Healthcare, Mount Sinai (NY), UMC Utrecht, and Aimmune together account for more than 72.0% of global revenue, with Reacta Healthcare alone contributing a dominant share of 72.3% in 2024. Key strategies deployed by these players include advancing standardized challenge protocols, investing in controlled dosing platforms, and forming partnerships with academic centers to validate real-world testing outcomes.

In 2025, the Oral Food Challenge Testing market is expected to reach a value of approximately USD 283.5 million, driven by its positioning as the gold-standard confirmatory tool for food allergy diagnosis. Growth will be propelled by rising prevalence of pediatric food allergies, greater reliance on confirmatory tests before introducing oral immunotherapy (OIT), and alignment with international clinical practice guidelines from AAAAI, EAACI, and NIAID.

Hospitals and specialty allergy clinics are increasingly adopting structured OFC programs, including Open Food Challenge accounting for 56.3% share and Double-Blind Placebo-Controlled Food Challenge holding 25.4% share, to enhance diagnostic accuracy, minimize false positives from IgE or skin-prick testing, and improve patient safety through standardized emergency response protocols.

The Oral Food Challenge (OFC) Testing Market is witnessing strong growth because allergy care providers worldwide face mounting pressure to accurately diagnose food allergies, reduce misdiagnosis from IgE and skin-prick tests, and improve patient safety. Major drivers include rising prevalence of pediatric food allergies, stricter clinical guidelines that recommend OFC as the gold standard, and the growing adoption of oral immunotherapy (OIT), which requires confirmatory testing before initiation. Innovations such as standardized dosing platforms, blinded protocols, and emergency-ready clinical workflows are reducing risk, minimizing false results, and enhancing reproducibility across centers.

The post-pandemic focus on immune health amplified demand for validated allergy diagnostics, accelerating adoption of structured OFC programs in hospitals and specialty clinics. As healthcare budgets increasingly prioritize evidence-based allergy management, providers who deliver reliable challenge protocols, safety monitoring, and patient-centric testing environments are seeing robust uptake. In countries with expanding pediatric allergy services, particularly in the USA, Europe, and Asia Pacific, the establishment of new allergy centers and guideline-driven upgrades is further fueling demand.

The Oral Food Challenge (OFC) Testing Market is segmented by test type, allergen type, age group, and sales channel, each highlighting the critical dimensions influencing adoption. Test type segmentation covers Open Food Challenge, Single-Blind Food Challenge, and Double-Blind Placebo-Controlled Food Challenge (DBPCFC), reflecting the varying levels of diagnostic rigor and clinical use. Allergen type classification includes milk, eggs, peanuts, wheat, shellfish & fish, and others, underscoring the broad range of allergen triggers necessitating standardized confirmatory testing.

Based on age group, the market is divided into children, adults, and geriatric populations, with pediatric cases dominating due to the higher prevalence of childhood food allergies. In terms of sales channel, the market is categorized into institutional sales driven by hospitals and specialty allergy clinics and retail sales, which are gradually expanding through outpatient and private practice settings.

| By Test Type | Market Share (%) |

|---|---|

| Open Food Challenge | 56.3% |

| Single-Blind Food Challenge | 18.3% |

| Double-Blind Placebo-Controlled Food Challenge (DBPCFC) | 25.4% |

Open Food Challenge is expected to retain a dominant position, contributing 56.3% in 2025, owing to its simpler administration, wider physician familiarity, and suitability for pediatric populations where most allergy cases are concentrated. Its adoption has been driven by the growing global emphasis on confirmatory testing as the gold standard in food allergy diagnosis. Preference has been increasingly shown for open protocols due to their ease of execution, reduced resource requirements compared to blinded formats, and ability to provide quick, actionable outcomes in clinical settings.

The use of open challenges has also been encouraged by clinical practice guidelines that recommend stepwise validation of suspected allergens before initiating oral immunotherapy (OIT). These factors have collectively contributed to the sustained demand for Open Food Challenge protocols, particularly across hospitals and specialty allergy clinics handling high patient volumes.

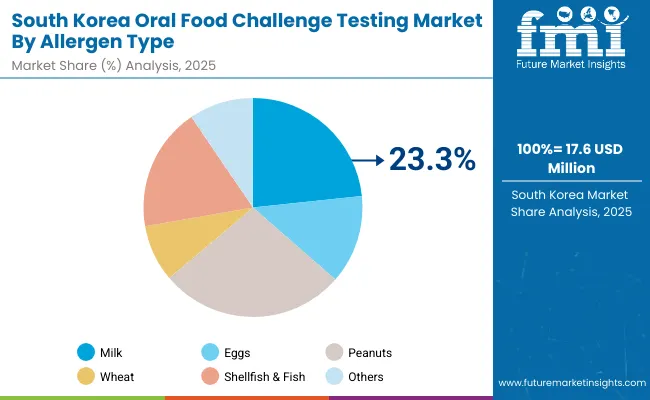

| By Allergen Type | Market Share (%) |

|---|---|

| Milk | 23.3% |

| Eggs | 13.1% |

| Peanuts | 27.4% |

| Wheat | 8.4% |

| Shellfish & Fish | 18.2% |

| Others | 9.5% |

Peanut allergy testing has emerged as the leading allergen type and is projected to hold around 27.4% share in 2025, making it the most commonly evaluated trigger in Oral Food Challenge (OFC) protocols. The dominance of peanut challenges stems from the high prevalence and severity of peanut-induced allergic reactions, which are a major cause of anaphylaxis in children and young adults. Clinical guidelines from organizations such as AAAAI and EAACI highlight the importance of confirmatory peanut challenges to establish diagnosis before recommending avoidance strategies or initiating oral immunotherapy (OIT).

As a result, specialty allergy clinics and hospitals are increasingly standardizing peanut OFCs under closely monitored conditions, supported by emergency preparedness protocols. Additionally, the growth in peanut immunotherapy products has further boosted demand for confirmatory testing, ensuring that patients are accurately diagnosed before treatment begins. Collectively, these factors have positioned peanut OFCs as the cornerstone of allergen-specific diagnostic testing, surpassing other common allergens such as milk, eggs, and shellfish.

| By Age Group | Market Share (%) |

|---|---|

| Children | 81.1% |

| Adults | 13.2% |

| Geriatric | 5.6% |

Children are expected to remain the largest age group segment, contributing around 81.1% in 2025, owing to the high prevalence of pediatric food allergies globally. Most suspected food allergy cases are identified during early childhood, prompting the need for confirmatory Oral Food Challenges (OFCs) before dietary restrictions or therapeutic interventions are prescribed. Pediatric dominance is reinforced by clinical guidelines that emphasize OFC as the gold-standard diagnostic method in children to avoid over-diagnosis from IgE or skin-prick testing alone.

Investments in pediatric allergy centers, school-based food allergy programs, and specialized hospital units have resulted in widespread adoption of OFC protocols in this segment. Demand is further supported by the growing pipeline of oral immunotherapies (OIT) targeting pediatric patients, for which OFC is a prerequisite step. Collectively, these factors ensure that children will remain the dominant group undergoing OFC testing, with adults (13.2%) and geriatric patients (5.7%) representing smaller but steadily growing segments.

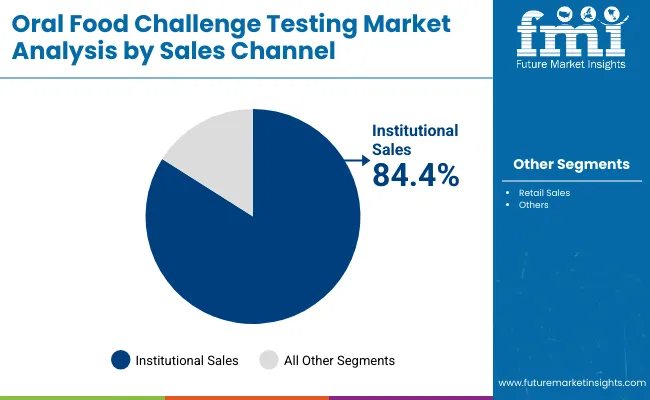

| By Sales Channel | Market Share (%) |

|---|---|

| Institutional Sales | 84.4% |

| Retail Sales | 15.6% |

Institutional sales are expected to remain the dominant distribution channel, contributing around 84.4% in 2025, due to the high concentration of Oral Food Challenge (OFC) procedures in hospitals, university medical centers, and specialty allergy clinics. Most OFCs require controlled environments with emergency preparedness, trained staff, and standardized monitoring protocols, making institutional setups the preferred location for testing. Demand is reinforced by clinical guidelines recommending that OFCs be performed under strict supervision to mitigate risks of severe allergic reactions.

Investments in pediatric allergy units, dedicated food allergy centers, and academic research programs have further strengthened institutional adoption. While retail sales including private allergy practices and outpatient clinicsrepresent 15.6% in 2025, this channel is gradually expanding as more specialized clinics adopt structured OFC programs to improve accessibility. Collectively, these dynamics ensure that institutional testing settings will continue to dominate OFC market revenues, while retail-based adoption steadily broadens the testing landscape.

Rising Adoption of OFC as the Gold-Standard Diagnostic Driver

One of the most significant growth drivers in the Oral Food Challenge (OFC) Testing Market is its establishment as the gold-standard confirmatory diagnostic method for food allergies. Unlike skin-prick testing or serum-specific IgE assays, which often present false positives due to sensitization without clinical reactivity, OFCs provide a definitive determination of tolerance. This makes them indispensable for accurate diagnosis, particularly in pediatric populations, which account for over 80% of the testing volume.

Clinical guidelines from organizations such as the American Academy of Allergy, Asthma & Immunology (AAAAI) and the European Academy of Allergy and Clinical Immunology (EAACI) mandate OFC prior to introducing strict dietary avoidance or beginning oral immunotherapy (OIT). In the USA and Europe, insurers increasingly recognize OFC as medically necessary, improving reimbursement access.

With food allergies continuing to rise globally affecting nearly 10% of children in some developed markets the reliance on OFC testing to avoid unnecessary restrictions, improve quality of life, and guide therapeutic decisions is accelerating institutional adoption. This regulatory endorsement, coupled with growing real-world evidence of cost-effectiveness in avoiding misdiagnosis, is fueling steady demand growth across hospitals and specialized allergy clinics.

High Operational Risk and Resource Intensiveness as a Barrier

While OFCs are indispensable for accurate diagnosis, they remain underutilized due to their inherent clinical and operational risks. Conducting a challenge requires specialized infrastructure, including allergen-specific dosing materials, standardized protocols, and immediate access to emergency interventions such as epinephrine and advanced resuscitation.

The risk of inducing severe anaphylaxis during testing is a constant barrier, making hospitals and tertiary allergy centers the primary testing hubs. Smaller clinics and community practices often avoid offering OFCs due to liability concerns, shortage of trained allergists, and absence of controlled environments. Furthermore, the test is highly resource-intensive, often requiring half a day to conduct under continuous patient observation, which strains staffing availability.

From a cost perspective, the operational burden including personnel, equipment, and safety preparedness discourages scaling OFCs outside major centers. These limitations restrict the market’s ability to expand into retail or outpatient segments, reinforcing dependence on institutional adoption. As healthcare systems push toward decentralization of diagnostics, the inability of OFCs to scale easily due to safety risks remains a critical restraint on broader market penetration.

Integration of OFCs into OIT Treatment Pathways as a Key Trend

A transformative trend reshaping the OFC market is the integration of oral food challenges into oral immunotherapy (OIT) pathways. With regulatory approvals for peanut immunotherapy (e.g., Palforzia in the USA and Europe), OFCs are increasingly required at multiple stages of patient management initial diagnosis, baseline reactivity measurement, therapy eligibility confirmation, and post-treatment tolerance assessment. This shift elevates OFCs from being a one-time diagnostic to a longitudinal monitoring tool embedded in therapeutic journeys.

Providers in the USA and Europe are designing dedicated OFC units within allergy centers, ensuring continuity between diagnostic evaluation and OIT initiation. Academic institutions are conducting clinical trials that rely heavily on DBPCFCs (Double-Blind Placebo-Controlled Food Challenges) as validated outcome measures, further reinforcing standardization.

Beyond immunotherapy, OFCs are gaining traction in nutritional reintroduction programs, particularly in cases of suspected tolerance development in children with milk or egg allergies. The convergence of diagnostics with therapeutics is creating new revenue opportunities, as OFCs transition from being reactive confirmatory tools to proactive components of personalized allergy management. This integration trend is expected to accelerate adoption globally, particularly as new OIT products targeting multiple allergens progress through late-stage pipelines.

Asia Pacific is emerging as the fastest-growing region in the Oral Food Challenge (OFC) Testing Market, with India projected to expand at a CAGR of 6.1% and China at 6.0% between 2025 and 2035. Growth in India is supported by a surge in pediatric allergy prevalence, expansion of tertiary care hospitals, and increased adherence to standardized allergy testing protocols recommended by IAP. China is witnessing rapid growth driven by rising peanut and milk allergy cases, large-scale investments in pediatric care infrastructure, and public sector initiatives to strengthen allergy testing capacity in Tier 1 and Tier 2 cities. Collectively, government-backed healthcare modernization and increasing demand for guideline-based confirmatory testing are propelling adoption of OFC across Asia Pacific.

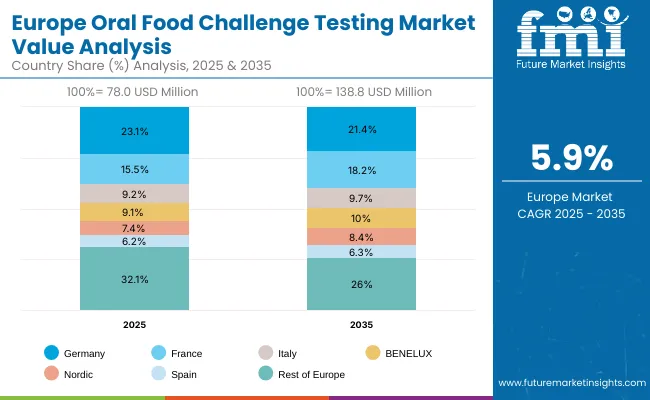

Europe is expected to grow steadily at a CAGR of 7.3% through 2035. Germany is projected to grow at 5.4% CAGR, supported by structured reimbursement for DBPCFC testing and integration into pediatric allergy centers. France is estimated at 7.9% CAGR, driven by public hospital investments and national reforms expanding access to food allergy diagnostics. The UK is forecast at 6.7% CAGR, fueled by NHS modernization projects and growing demand for OIT-linked OFCs. Harmonized EAACI guidelines, expansion of pediatric allergy units, and strong clinical trial activity utilizing OFC as a primary endpoint are reinforcing Europe’s position as a key growth region.

North America remains a mature but innovation-driven market, with the USA projected to grow at 5.2% CAGR between 2025-2035. Growth is led by the replacement of informal diagnostic practices with structured OFC protocols in academic and specialty clinics. Increasing insurance recognition of OFC as a reimbursable service, rising pediatric allergy prevalence, and the requirement of OFC prior to initiating peanut oral immunotherapy (OIT) are major drivers. Academic centers such as Mount Sinai (NY) and leading providers are standardizing blinded and multi-allergen protocols, ensuring innovation and improved patient safety.

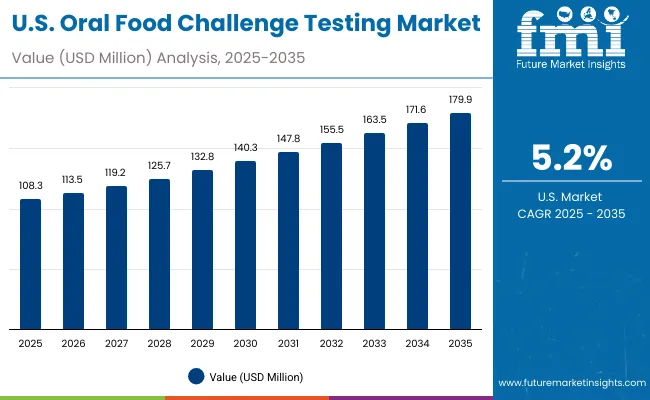

The Oral Food Challenge Testing market in the USA is forecasted to grow at a 5.2% CAGR between 2025-2035, reaching nearly USD 179.9 million by 2035. Growth is being driven by rising prevalence of pediatric peanut and milk allergies, combined with guideline-based mandates from AAAAI and NIAID positioning OFC as the gold standard before oral immunotherapy (OIT). Hospitals and specialty allergy centers are formalizing OFC programs with standardized safety protocols, emergency preparedness, and blinded formats. Increasing payer recognition of OFC as a reimbursable diagnostic service is also expanding access.

The Oral Food Challenge Testing market in the UK is projected to grow at a 6.7% CAGR through 2035, supported by NHS initiatives to expand pediatric allergy services. Investments under national health modernization plans are accelerating the establishment of specialized allergy clinics with capacity for blinded OFCs. Increasing emphasis on reducing misdiagnosis and unnecessary food avoidance is reinforcing OFC adoption, particularly for peanuts, eggs, and milk.

The Oral Food Challenge Testing market in Germany is forecasted to grow at a 5.4% CAGR between 2025-2035, driven by rising food allergy prevalence and strong reimbursement alignment for standardized testing. Germany’s healthcare system, known for rigorous clinical protocols, is accelerating the transition from reliance on IgE blood testing to confirmatory OFCs in pediatric and adult populations. Federal hospital reforms and investments under modernization programs are facilitating expansion of dedicated allergy centers capable of performing DBPCFCs.

The Oral Food Challenge (OFC) Testing market in India is expected to grow at a CAGR of 6.1% between 2025 and 2035, making it one of the fastest-growing globally. Growth is supported by a sharp rise in pediatric food allergy prevalence and the establishment of tertiary pediatric hospitals across Tier 1 and Tier 2 cities. National guidelines from the Indian Academy of Pediatrics (IAP) are increasing standardization of OFC protocols, while awareness campaigns are reducing diagnostic delays. Private hospital groups are investing in structured OFC programs as part of dedicated pediatric allergy centers.

The Oral Food Challenge Testing market in China is projected to grow at a CAGR of 6.0% through 2035, driven by rising incidence of food allergies, particularly among children in urban centers. The Healthy China 2030 policy has prioritized allergy prevention and diagnosis, boosting investments in pediatric allergy units. Class A hospitals are scaling DBPCFC (Double-Blind Placebo-Controlled Food Challenges) capacity, while regional hospitals are adopting open challenges as entry-level diagnostics. Domestic players are also aligning with government programs to expand allergy testing infrastructure in secondary cities.

The Oral Food Challenge Testing market in Japan is projected to reach USD 26.1 million by 2025, expanding at a 5.6% CAGR through 2035. Japan’s market is unique, with Open Food Challenges accounting for 58.2% of testing in 2025, followed by single-blind with 18.3%and DBPCFC holding 25.4%. The Ministry of Health, Labour and Welfare continues to support allergy centers in pediatric hospitals, prioritizing safety protocols. Rising demand for milk and egg allergy confirmation is reinforcing adoption, while DBPCFC remains concentrated in academic and research centers.

The Oral Food Challenge Testing market in South Korea is estimated at USD 17.6 million in 2025 and projected to grow at a 6.3% CAGR through 2035. Allergen-specific segmentation shows peanut testing is estimated to hold 27.4%and milk testing contributing around 24.1% as the leading categories, reflecting Korea’s dietary allergy burden. Government-led programs to enhance pediatric allergy care are strengthening institutional adoption of OFC in university hospitals and large pediatric centers. Despite dominance of open challenges, there is a gradual shift toward DBPCFC for clinical validation in specialty clinics.

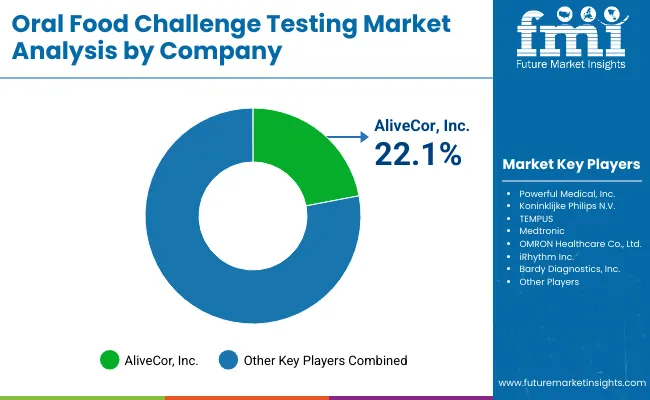

The Oral Food Challenge (OFC) Testing market is moderately concentrated, with global leaders, academic institutions, and specialized biopharma firms shaping the competitive landscape. Reacta Healthcare holds a dominant share of the market, supported by its proprietary standardized OFC dosing solutions and partnerships with leading hospitals across Europe and North America. Its strategy focuses on providing validated challenge kits that reduce variability, improve patient safety, and enable reproducibility across multi-center studies. By offering pre-measured allergen doses and clinical support services, Reacta is setting benchmarks in standardized OFC adoption.

Other players include Beckman Coulter Life Science who is set to play a critical role in advancing research-driven protocols and clinical best practices. Mount Sinai is recognized for its leadership in multi-allergen OFC trials and integration of blinded protocols into pediatric allergy centers, while UMC Utrecht continues to drive innovation in European OFC research, contributing to evidence-based practice standardization.Biopharma firms like Aimmune integrate OFC testing into broader oral immunotherapy (OIT) programs, making OFCs a key part of their therapeutic pathway strategy. This approach positions OFC not only as a diagnostic tool but also as a prerequisite for treatment eligibility and long-term monitoring.

Emerging players and regional institutions (Others) are contributing to OFC expansion by piloting simplified open challenge protocols, expanding access to underserved geographies, and engaging in pediatric-focused research collaborations. As the market matures, competitive differentiation is increasingly shifting toward protocol standardization, integration of OFC with OIT programs, and improved patient safety frameworks.

Key Developments:

| Item | Value |

|---|---|

| Market value (2025) | USD 283.5 million |

| Test type | Open Food Challenge, Single-Blind Food Challenge, and Double-Blind Placebo-Controlled Food Challenge (DBPCFC) |

| Allergen type | milk, eggs, peanuts, wheat, shellfish & fish, and others |

| Age group | children, adults, and geriatric populations |

| Sales channel | institutional sales, retail sales |

| Regions Covered | North America, Latin America, Western & Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | USA, Brazil, China, India, Germany, France, UK etc. |

| Key Companies Profiled | Reacta Healthcare, Beckman Coulter Life Science, UMC Utrecht, Aimmune, Others |

| Additional Attributes | Dollar sales by allergen type and regions, adoption trends of Double-Blind Placebo-Controlled Food Challenges (DBPCFC), rising demand in pediatric allergy diagnosis, growing utilization across hospitals, specialty allergy clinics, and academic research centers. |

The global Oral Food Challenge Testing market is estimated to be valued at USD 283.5 million in 2025.

The market size for Oral Food Challenge Testing is projected to reach USD 594.8 million by 2035.

The Oral Food Challenge Testing market is expected to grow at a CAGR of 7.7% during this period.

Key test types include Open Food Challenge, Single-Blind Food Challenge, and Double-Blind Placebo-Controlled Food Challenge (DBPCFC).

Peanut allergy testing is projected to command 27.4% of the market in 2025, making it the largest allergen segment, followed by milk and shellfish.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oral Bone Implant Material Market Size and Share Forecast Outlook 2025 to 2035

Oral Solid Dosage Pharmaceutical Formulation Market Size and Share Forecast Outlook 2025 to 2035

Oral Dosing Cup Market Forecast AND Outlook 2025 to 2035

Oral Care Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oral Irrigator Market Size and Share Forecast Outlook 2025 to 2035

Oral Antiseptics Market Size and Share Forecast Outlook 2025 to 2035

Oral Care Market Growth – Demand, Trends & Forecast 2025–2035

Oral Dosage Powder Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Oral Clinical Nutrition Desserts Market Analysis - Size, Growth, and Forecast 2025 to 2035

Oral Dose Packaging Market Trends & Growth Forecast 2025 to 2035

Oral Immunostimulant Market – Demand, Growth & Forecast 2025 to 2035

Oral Clinical Nutritional Cream and Pudding Market Analysis by Product Type and Distribution Channel Through 2035

Competitive Breakdown of Oral Clinical Nutrition Supplements

Market Share Insights for Oral Care Providers

Key Companies & Market Share in the Oral Dosage Powder Packaging Machines Sector

Oral Controlled Release Drug Delivery Technology Market Trends – Growth & Forecast 2025-2035

Oral Clinical Nutrition Supplement Market Trends - Growth & Forecast 2025

Oral Syringe Market

Oral Rinse Market

Oral Anticoagulants Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA