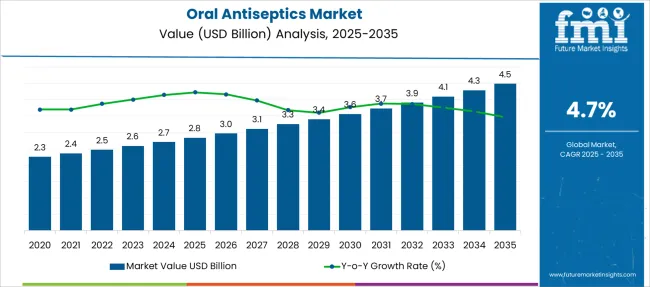

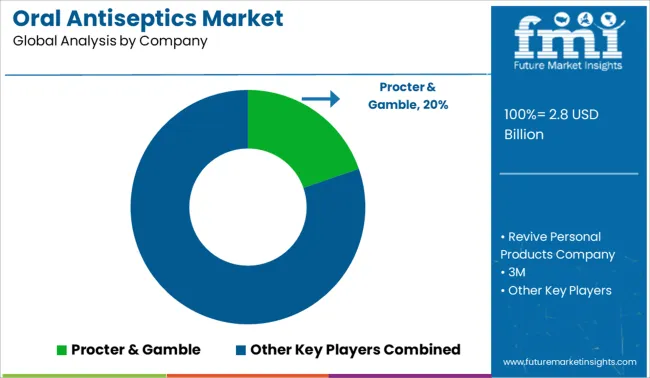

The Oral Antiseptics Market is estimated to be valued at USD 2.8 billion in 2025 and is projected to reach USD 4.5 billion by 2035, registering a compound annual growth rate (CAGR) of 4.7% over the forecast period.

| Metric | Value |

|---|---|

| Oral Antiseptics Market Estimated Value in (2025 E) | USD 2.8 billion |

| Oral Antiseptics Market Forecast Value in (2035 F) | USD 4.5 billion |

| Forecast CAGR (2025 to 2035) | 4.7% |

The oral antiseptics market is growing steadily, driven by increasing awareness of oral hygiene and the importance of infection prevention in daily care routines. Healthcare professionals have emphasized the role of antiseptic products in reducing oral microbial load and preventing dental diseases.

Consumer preferences have shifted toward formulations that offer effective antimicrobial action with minimal side effects. The market has benefited from rising demand in both emerging and developed regions as oral health education improves.

Retail expansion and easy product availability in supermarkets and hypermarkets have increased consumer access. The trend toward preventive oral care and increased focus on maintaining fresh breath have supported product adoption. Future growth is expected to be propelled by innovation in formulation and expanding distribution channels. Segment growth is anticipated to be led by Cetylpyridinium Chloride-based oral antiseptics as the favored product type and supermarkets/hypermarkets as the primary distribution channel.

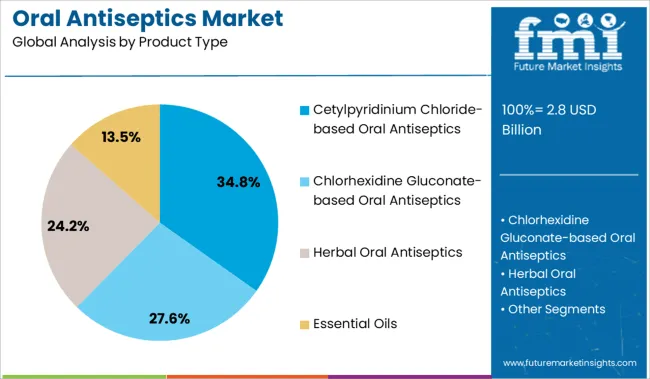

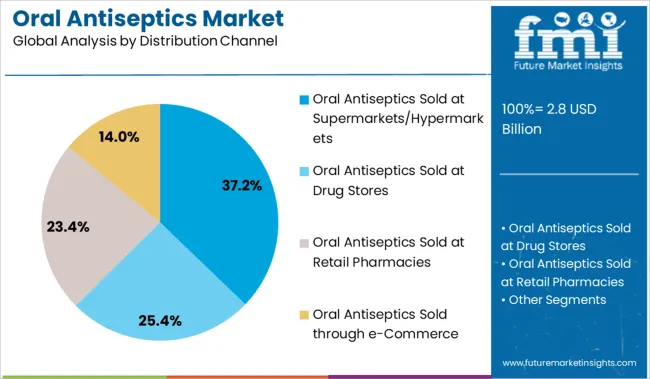

The market is segmented by Product Type and Distribution Channel and region. By Product Type, the market is divided into Cetylpyridinium Chloride-based Oral Antiseptics, Chlorhexidine Gluconate-based Oral Antiseptics, Herbal Oral Antiseptics, and Essential Oils. In terms of Distribution Channel, the market is classified into Oral Antiseptics Sold at Supermarkets/Hypermarkets, Oral Antiseptics Sold at Drug Stores, Oral Antiseptics Sold at Retail Pharmacies, and Oral Antiseptics Sold through e-Commerce. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Cetylpyridinium Chloride-based oral antiseptics segment is projected to hold 34.8% of the market revenue in 2025, maintaining its position as the leading product type. The segment’s growth has been supported by the proven antimicrobial efficacy of cetylpyridinium chloride in controlling plaque and gingivitis. It has been preferred by consumers due to its broad-spectrum activity and relative safety profile compared to other antiseptic agents.

Formulations containing cetylpyridinium chloride have been widely adopted in mouthwashes and oral rinses, offering convenience and ease of use. Additionally, the ingredient’s compatibility with various flavor profiles and formulations has allowed manufacturers to innovate with different product variants.

Increased consumer education about oral health benefits and product accessibility have further contributed to the segment’s expansion. As demand for effective and safe oral care products continues, this segment is expected to sustain its market leadership.

The oral antiseptics sold at supermarkets and hypermarkets segment is expected to account for 37.2% of the market revenue in 2025, remaining the dominant distribution channel. Growth in this segment has been driven by the convenience offered to consumers purchasing oral care products alongside regular groceries and household items.

Supermarkets and hypermarkets provide wide geographic coverage and frequent promotional activities, attracting a broad consumer base. Retailers have expanded shelf space for personal care and oral hygiene products, facilitating easy discovery and impulse buying.

Additionally, the presence of trusted brands in these retail channels has reinforced consumer confidence and loyalty. The segment benefits from consumers’ preference for one-stop shopping experiences and competitive pricing available in organized retail formats. As consumer demand for accessible and affordable oral antiseptics grows, supermarkets and hypermarkets are expected to maintain their leading role in product distribution.

| Particulars | Details |

|---|---|

| H1, 2024 | 4.65% |

| H1, 2025 Projected | 4.66% |

| H1, 2025 Outlook | 4.36% |

| BPS Change - H1, 2025 (O) – H1, 2025 (P) | (-) 30 ↓ |

| BPS Change – H1, 2025 (O) – H1, 2024 | (-) 29 ↓ |

The variation between the BPS values observed within this market in H1, 2025 - outlook over H1, 2025 projected reflects a decline of 30 BPS units. However A positive BPS growth in H1-2025 over H1-2024 by 29 Basis Point Share (BPS) is demonstrated by the oral antiseptics market.

The market observed a decline in the BPS values owed to the reduced patient in-flow for standards medical procedures, such as dentistry, which employs the use of oral antiseptics on a routine basis. The decreased procedural adoption rate was owed to the shut-down of several private and independent clinics in lieu of the advent of the COVID-19 pandemic.

However, with the development of oral antiseptic formulations with properties to target antimicrobial resistant bacteria will be likely to present a positive outlook towards growth of the market over the forecast period.

The key developments in the market include the introduction of oral antiseptics with rapid antiviral action for the management of the SARS-CoV-2 infection. The market is subject to aspects concerning drug regulations and licensing, as per the macroeconomic and industry dynamics.

Increasing instances of oral infections and oral diseases are majorly driving demand for oral medications, oral vaccines, oral antibiotics, etc. From 2013 to 2024, demand for oral antiseptics rose at a CAGR of 4.3%.

Topical antiseptics for mouth infections such as canker sores, ulcers, etc., are anticipated to see an increase in demand as focus on oral hygiene bolsters. Chlorhexidine dental solutions and other antiseptic oral cleansers are expected to see an increasing demand from dental professionals.

Increasing awareness for oral hygiene, changing consumer preferences, increasing awareness of preventive healthcare, rising healthcare spending and expenditure, increasing instances of oral diseases, poor dental hygiene of population, etc., are major factors that influence oral antiseptic sales.

Antiseptics for mouth ulcers, antiseptics for canker sores, etc., are anticipated to see increase in demand as lifestyle habits deteriorate and cause oral infections. Consumption of oral antiseptics is anticipated to rise at a CAGR of 4.7% from 2025 to 2035.

Rising Consumer Preference for Natural Oral Antiseptics

Consumers and patients across the world are leaning towards organic and natural medication as they refrain from intake of chemicals. Natural antiseptics for the mouth are being developed by multiple oral antiseptics manufacturers. Observed discomfort from chlorhexidine oral solutions and hexetidine oral solutions are expected to further bolster demand for natural oral antiseptics.

Consumption of Oral Antiseptics to See Hike across Emerging Economies

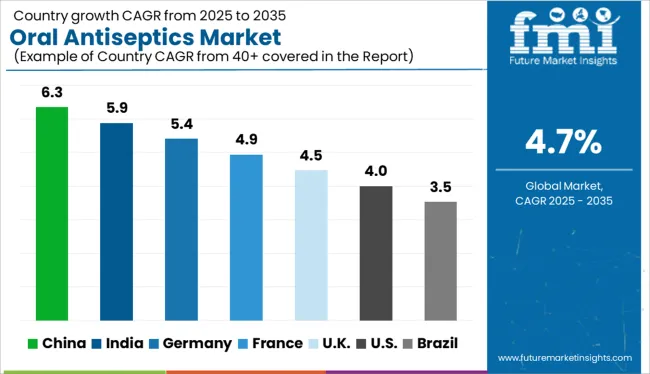

Market scrutiny for regions such as North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa (MEA) has been discussed in detail in this oral antiseptics research report by FMI.

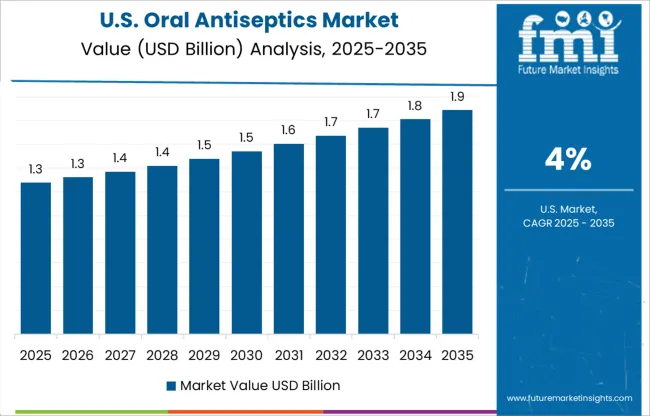

Mouth antiseptics are anticipated to see high demand from dental practitioners in the North American region. Increasing focus on dental hygiene and the prevalence of oral diseases are expected to be major trends influencing oral antiseptic consumption in this region.

Oral antiseptic solutions are estimated to see high demand in Europe as a focus on oral care bolsters. Increasing awareness about the side effect of chemicals is expected to propel the demand for natural oral antiseptic solutions.

Increasing focus on healthcare, rising oral infections, increasing geriatric population, and rising per capita disposable income are some factors that influence sales of oral antiseptics in regions such as East Asia, South Asia, and MEA. Oral antiseptic consumption is predicted to be high in emerging economies such as India and China.

Demand for oral antiseptics is anticipated to rise at a moderate pace across Latin America and MEA due to lack of awareness about oral care and less healthcare spending potential. By the end of the forecast period, as healthcare expenditure increases, oral antiseptic manufacturers can focus on these regions and benefit from the untapped market potential.

Increasing Use of Topical Antiseptic Solutions by Dental Professionals

The USA is known for its well-established healthcare infrastructure and is a highly lucrative market for sales of all kinds of healthcare products. Topical oral antiseptic solutions are expected to see a rise in demand as instances of mouth infections increase substantially. Chlorhexidine dental solutions and antiseptic oral cleansers are expected to see high demand from dental professionals in the USA.

Increasing Healthcare Awareness to Drive Demand for Topical Antiseptics for Mouth Infections

The Indian healthcare infrastructure has seen substantial developments in the past few years and this has fostered demand for oral antiseptic solutions. Increasing disposable income, rising focus on oral care, increasing consumer preference for natural antiseptic solutions, and the declining popularity of chlorhexidine oral solutions due to their side effects are anticipated to influence market potential in India.

Antiseptics for mouth ulcers, antiseptics for mouth infections, and antiseptics for canker sores are projected to see high demand as awareness regarding oral care increases across India.

Sales via Supermarkets & Hypermarkets Expected to Have a Dominant Outlook

Oral antiseptic solutions do not require medical prescriptions and are easily accessible to the general population via multiple distribution channels. The majority of sales are through supermarkets and hypermarkets which cumulatively account for 43.6% of the global oral antiseptic demand.

Drug stores account for 30.2% of the global sales of oral antiseptics in 2025. Distribution via retail pharmacies and e-commerce channels holds a market share of 19.5% and 6.7% respectively at present.

Oral antiseptic suppliers are investing in the research & development of natural oral antiseptics as their preference rises among the general population. Oral antiseptic companies are also adopting multiple organic and inorganic marketing strategies to boost their sales across multiple regions.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2013 to 2024 |

| Market Analysis | USD Million for Value |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia & Pacific; Middle East & Africa (MEA) |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, UK, France, Spain, Italy, China, Japan, South Korea, India, Indonesia, Malaysia, Singapore, Australia, New Zealand, Turkey, South Africa, and GCC Countries |

| Key Market Segments Covered | Product Type, Distribution Channel, Region |

| Key Companies Profiled | Procter & Gamble; Revive Personal Products Company; 3M; Colgate-Palmolive; Johnson & Johnson; Dentaid SL; ICPA Health Products; Cipla Inc.; Church & Dwight Inc.; Dentsply Sirona |

| Pricing | Available upon Request |

The global oral antiseptics market is estimated to be valued at USD 2.8 billion in 2025.

The market size for the oral antiseptics market is projected to reach USD 4.5 billion by 2035.

The oral antiseptics market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in oral antiseptics market are cetylpyridinium chloride-based oral antiseptics, chlorhexidine gluconate-based oral antiseptics, herbal oral antiseptics and essential oils.

In terms of distribution channel, oral antiseptics sold at supermarkets/hypermarkets segment to command 37.2% share in the oral antiseptics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oral Solid Dosage Pharmaceutical Formulation Market Size and Share Forecast Outlook 2025 to 2035

Oral Dosing Cup Market Forecast AND Outlook 2025 to 2035

Oral Care Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oral Irrigator Market Size and Share Forecast Outlook 2025 to 2035

Oral Food Challenge Testing Market Analysis Size and Share Forecast Outlook 2025 to 2035

Oral Care Market Growth – Demand, Trends & Forecast 2025–2035

Oral Dosage Powder Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Oral Clinical Nutrition Desserts Market Analysis - Size, Growth, and Forecast 2025 to 2035

Oral Dose Packaging Market Trends & Growth Forecast 2025 to 2035

Oral Immunostimulant Market – Demand, Growth & Forecast 2025 to 2035

Oral Clinical Nutritional Cream and Pudding Market Analysis by Product Type and Distribution Channel Through 2035

Competitive Breakdown of Oral Clinical Nutrition Supplements

Market Share Insights for Oral Care Providers

Key Companies & Market Share in the Oral Dosage Powder Packaging Machines Sector

Oral Controlled Release Drug Delivery Technology Market Trends – Growth & Forecast 2025-2035

Oral Clinical Nutrition Supplement Market Trends - Growth & Forecast 2025

Oral Syringe Market

Oral Rinse Market

Oral Anticoagulants Market

Oral Screening Systems Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA