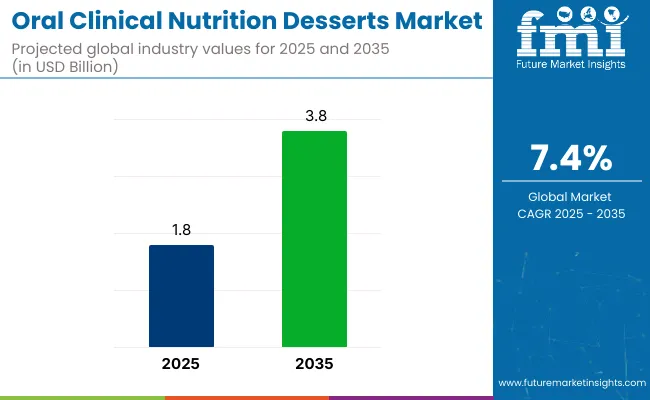

The global oral clinical nutrition desserts market is valued at USD 1.8 billion in 2025 and is expected to reach USD 3.8 billion by 2035, reflecting a CAGR of 7.4%. Growth is expected to be driven by the rising demand for specialized nutrition among elderly populations, patients recovering from surgery, and individuals suffering from chronic diseases. Moreover, increasing adoption of nutrient-dense formulations such as puddings, custards, and mousses is likely to sustain market expansion over the forecast period.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 1.8 billion |

| Projected Value (2035F) | USD 3.8 billion |

| CAGR (2025 to 2035) | 7.4% |

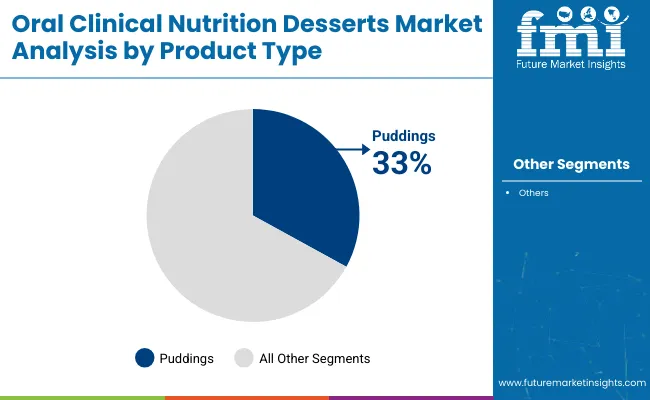

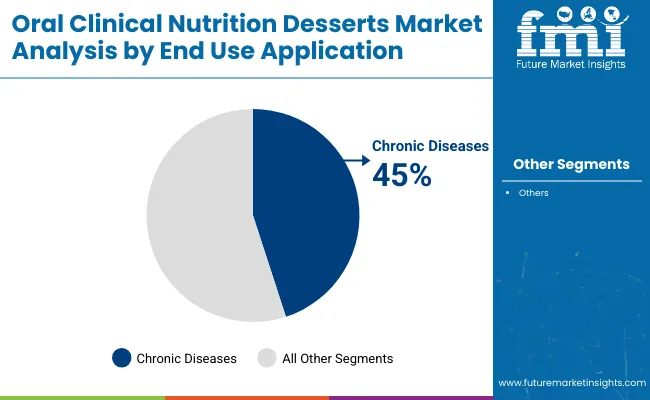

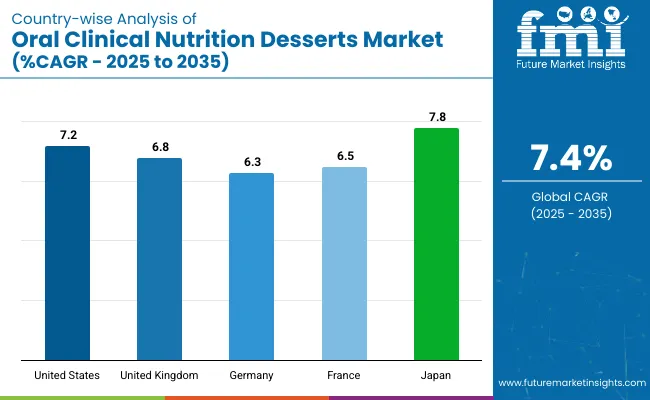

The market is anticipated to witness strong growth led by the USA, expanding at a CAGR of 7.2% and projected to maintain its dominant position with a prominent market share by 2035. Meanwhile, Japan is expected to grow at the highest CAGR of 7.8% during the forecast period, followed by the UK growing at a CAGR of 6.8%. Puddings are likely to remain the leading product type segment with a 33% share by 2035. Meanwhile, the chronic diseases segment accounts for the largest share of 45% in the end-use application.

The market accounts for approximately 6-8% of the broader clinical nutrition market, given its niche focus within oral nutrition supplements. Within the oral nutrition supplements market, it represents an estimated 12-15% share, driven by rising demand for dessert-based nutrient-dense products for elderly and chronic disease patients.

It forms a smaller portion, around 3-5% of the overall medical nutrition and FSMP markets, as these categories include enteral, parenteral, and other specialized feeds. Despite its smaller share, the segment is witnessing rapid growth due to innovation in textures, flavors, and personalized formulations, enhancing patient compliance.

The market is segmented by product type, end-use application, distribution channel, and region. By product type, it includes pudding, custard, gelatin, and mousse. By end-use application, it is segmented into malnutrition, chronic diseases, post-surgery recovery, and geriatric nutrition.

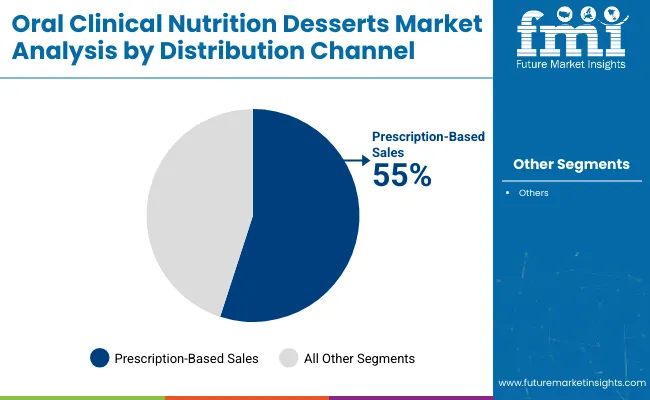

By distribution channel, it is segmented into prescription-based and over-the-counter (hospital pharmacies, retail pharmacies, specialty stores, online retail). By region, it covers North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, the Pacific, the Middle East and Africa.

Puddings are anticipated to remain the leading product type, driven by their smooth texture and ease of swallowing, making them suitable for patients with dysphagia and elderly consumers. This segment is projected to hold a 33% market share by 2035.

The chronic diseases segment is expected to dominate, accounting for a 45% market share by 2035, as patients with conditions like cancer, diabetes, and cardiovascular diseases require specialized nutrient-rich diets to manage symptoms and improve outcomes.

Prescription-based channels are projected to remain dominant due to the medical necessity of these products, especially for patients recovering from surgeries, managing chronic diseases, or malnutrition. This segment is expected to contribute over 55% of market revenue by 2035. Driven by doctor and dietitian prescriptions

Recent Trends in the Oral Clinical Nutrition Desserts Market

Challenges in the Oral Clinical Nutrition Desserts Market

Among the top five countries in the oral clinical nutrition desserts market, Japan is projected to witness the fastest growth with a CAGR of 7.8% from 2025 to 2035, driven by its rapidly ageing population and high health consciousness. The USA follows closely with a CAGR of 7.2%, supported by its advanced healthcare infrastructure and high chronic disease prevalence.

France and the UK are forecasted to grow at 6.5% and 6.8%, respectively, owing to robust public healthcare systems and rising elderly care demand. Germany records the slowest growth at 6.3% CAGR, despite strong health consciousness and regulatory standards.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The oral clinical nutrition desserts revenue in the USA is expected to grow at a CAGR of 7.2% from 2025 to 2035. Growth is expected to be driven by its advanced healthcare infrastructure, high healthcare spending, and a substantial ageing population requiring easy-to-consume, nutrient-dense products.

The market for oral clinical nutrition desserts in the UK is projected to expand at a CAGR of 6.8% from 2025 to 2035. Growth is anticipated due to increasing awareness of clinical nutrition's role in patient recovery, along with a robust public healthcare system promoting nutritional support for chronic disease management and elderly care.

The revenue from oral clinical nutrition desserts in Germany is forecasted to rise at a CAGR of 6.3% from 2025 to 2035. This growth is driven by a high burden of chronic diseases and an ageing population requiring specialized dietary interventions. Hospitals and geriatric care institutions remain key consumers of these products, especially puddings fortified with essential proteins and vitamins.

The sales of oral clinical nutrition desserts in France are projected to register a CAGR of 6.5% from 2025 to 2035. Growth is expected to be fueled by the increasing number of elderly individuals and patients undergoing post-surgery recovery, who require easy-to-consume, energy-dense desserts.

The oral clinical nutrition desserts market in Japan is anticipated to flourish at a CAGR of 7.8% from 2025 to 2035. Growth is driven by its rapidly ageing population, resulting in high demand for nutrient-dense, easy-to-swallow desserts such as puddings and custards. High health consciousness and a strong cultural emphasis on dietary management further fuel market expansion.

The market is moderately consolidated, with a few multinational corporations accounting for a substantial share alongside regional players. Companies such as Nestlé Health Science, Abbott Laboratories, Danone Nutricia, Fresenius Kabi, and Baxter International dominate due to their extensive product portfolios, strong R&D capabilities, and global distribution networks.

Competition is based on innovation in high-protein and low-sugar formulations, as well as taste and texture enhancements, and expanding market reach through strategic partnerships with hospitals and care facilities.

Top companies are increasingly focusing on product innovation by introducing personalised nutrition solutions, allergen-free and fortified formulations, and improved packaging for ease of consumption. Strategic acquisitions, expansion into emerging markets, and partnerships with healthcare providers continue to be key competitive strategies.

For instance, Nestlé Health Science has strengthened its nutritional portfolio through targeted acquisitions. At the same time, Danone Nutricia and Abbott Laboratories continue to invest in clinical trials to validate product efficacy and compliance. Fresenius Kabi and Baxter International focus on expanding their hospital-based distribution networks to reach critical care segments effectively.

Recent Oral Clinical Nutrition Desserts Market News

In May 2024, Bayer announced the acquisition of remaining 25% stake in Bayer Zydus Pharma Pvt Ltd to secure full ownership.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 1.8 billion |

| Projected Market Size (2035) | USD 3.8 billion |

| CAGR (2025 to 2035) | 7.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billion/Volume in Units |

| By Product Type | Pudding, Custard, Gelatin, Mousse |

| By End Use Application | Malnutrition, Chronic Diseases, Post-surgery Recovery, Geriatric Nutrition |

| By Distribution Channel | Prescription-based, Over-the-counter (Hospital Pharmacies, Retail Pharmacies, Specialty Stores, Online Retail) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, Pacific, Middle East and Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Nestlé Health Science, Abbott Laboratories, Danone Nutricia, Fresenius Kabi, Baxter International Inc., Pfizer Inc., Bayer AG, GlaxoSmithKline plc, Perrigo Nutritionals, Medifood International, Church & Dwight Co., Inc., Raisin Champion International, Geobres Nemean Currants and Sultana Raisins S.A., Mead Johnson Nutrition, B. Braun Melsungen AG. |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

As per Product Type, the industry has been categorized into Pudding, Custard, Gelatin, and Mousse.

As per End Use, the industry has been categorized into Malnutrition, Chronic Diseases, Post-surgery recovery, and Geriatric Nutrition.

As per Distribution Channel, the industry has been categorized into Prescription-based and Over-the-counter (Hospital Pharmacies, Retail Pharmacies, Specialty Stores, Online Retail).

Industry analysis has been carried out in key countries of North America, Latin America, Europe, East Asia, South Asia, Oceania, and Middle East & Africa.

The market size is valued at USD 1.8 billion in 2025.

The market is forecasted to reach USD 3.8 billion by 2035, reflecting a CAGR of 7.4%.

Pudding is expected to lead the market with a 33% share in 2025.

Chronic diseases are projected to hold a 45% share of the market in 2025.

Japan is anticipated to be the fastest-growing market with a CAGR of 7.8% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oral Care Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oral Irrigator Market Size and Share Forecast Outlook 2025 to 2035

Oral Antiseptics Market Size and Share Forecast Outlook 2025 to 2035

Oral Food Challenge Testing Market Analysis Size and Share Forecast Outlook 2025 to 2035

Oral Care Market Growth – Demand, Trends & Forecast 2025–2035

Oral Dosage Powder Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Oral Dose Packaging Market Trends & Growth Forecast 2025 to 2035

Oral Immunostimulant Market – Demand, Growth & Forecast 2025 to 2035

Market Share Insights for Oral Care Providers

Key Companies & Market Share in the Oral Dosage Powder Packaging Machines Sector

Oral Controlled Release Drug Delivery Technology Market Trends – Growth & Forecast 2025-2035

Oral Dosing Cup Market from 2024 to 2034

Oral Syringe Market

Oral Solid Dosage Pharmaceutical Formulation Market Analysis – Size, Share & Forecast 2024-2034

Oral Rinse Market

Oral Anticoagulants Market

Oral Screening Systems Market

Oral Clinical Nutritional Cream and Pudding Market Analysis by Product Type and Distribution Channel Through 2035

Competitive Breakdown of Oral Clinical Nutrition Supplements

Oral Clinical Nutrition Supplement Market Trends - Growth & Forecast 2025

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA