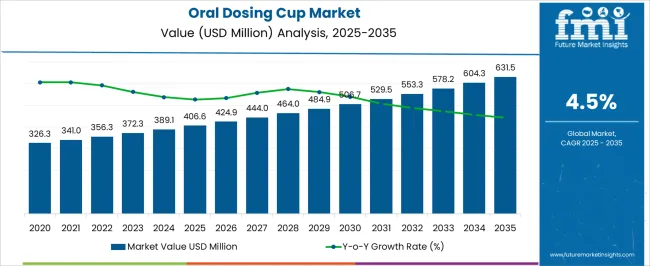

The oral dosing cup market, valued at USD 406.6 million in 2025 and projected to reach USD 631.5 million by 2035 at a CAGR of 4.5%, is being driven by multiple interconnected dynamics. The demand for accuracy and safety in medication delivery continues to grow, with hospitals, clinics, and home care providers prioritizing reliable dosing systems to reduce errors. Rising global awareness of the risks associated with misadministration of medicines has elevated the adoption of standardized cups that offer precision in measurement. This emphasis on patient safety is reinforced by regulatory frameworks that mandate accuracy in dosage tools across multiple healthcare systems, which is expected to further stimulate market penetration between 2025 and 2035.

The development of innovative designs with enhanced calibration accuracy and user-friendly formats plays a key role in driving adoption. Features such as clear gradation, ergonomic handling, and child-safe designs have improved compliance across patient groups. Moreover, healthcare providers are showing growing interest in reusable and sterilizable dosing cups, as infection control and sustainability emerge as priority areas. This has encouraged manufacturers to experiment with durable, medical-grade polymers and eco-compatible materials that maintain accuracy while supporting reusability. These trends are especially pronounced in regions with stringent hygiene requirements and advanced healthcare infrastructure, where demand for premium dosing solutions is increasing.

The oral dosing cup market expansion is further supported by the rising burden of chronic illnesses and the parallel growth of pharmaceutical consumption. As patient populations expand, particularly among aging demographics, the need for consistent and accurate dosing tools intensifies. Oral dosing cups are becoming standard components of medication management protocols, integrated not just in hospitals but also within home healthcare frameworks. At the same time, pharmaceutical companies are distributing pre-packaged medicines with dosing cups, ensuring both accuracy and convenience for end users.

Emerging economies are also playing a significant role, as investments in healthcare infrastructure bring structured medication administration systems into practice. Affordable dosing cups are being introduced in these markets to cater to a growing middle-class population that seeks accessible yet reliable medical products. With rising investments in healthcare digitization and modernization, oral dosing cups are poised to remain indispensable in medication delivery. The industry’s trajectory reflects an intersection of safety regulations, patient compliance needs, and material innovation, positioning the oral dosing cup market for sustained growth during the 2025 to 2035 period.

| Metric | Value |

|---|---|

| Oral Dosing Cup Market Estimated Value in (2025 E) | USD 406.6 million |

| Oral Dosing Cup Market Forecast Value in (2035 F) | USD 631.5 million |

| Forecast CAGR (2025 to 2035) | 4.5% |

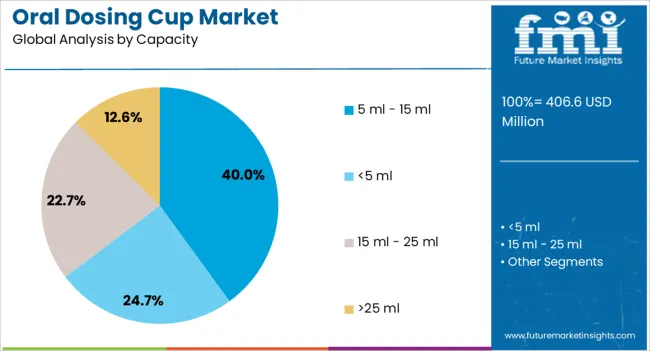

The oral dosing cup market is segmented by Product Type, Capacity, and End User and region. By Product Type, the oral dosing cup market is divided into Reusable and Disposable. In terms of Capacity, the oral dosing cup market is classified into 5 ml - 15 ml, <5 ml, 15 ml - 25 ml, and >25 ml. Based on End User, the oral dosing cup market is segmented into Hospital, Clinics, Retail Pharmacy, Pharmaceuticals, and Others. Regionally, the oral dosing cup market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

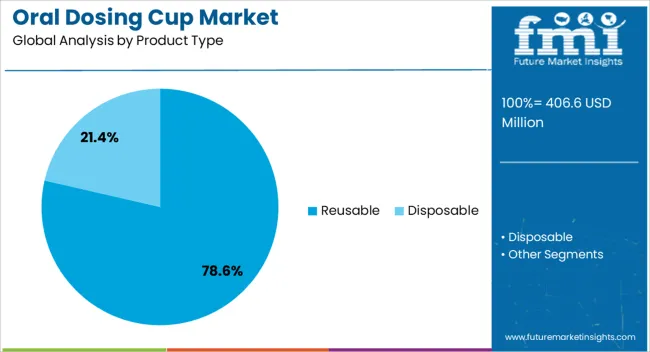

The reusable product type is projected to hold 78.60% of the Oral Dosing Cup market revenue share in 2025, making it the leading segment. This dominance is primarily driven by the cost-effectiveness, durability, and environmental benefits associated with reusable cups.

The ability to sterilize and reuse these cups multiple times reduces waste and ensures consistent dosing accuracy, which is crucial in healthcare settings. Their robust design and compatibility with various liquid medications have enhanced adoption in hospitals and clinics.

Moreover, the growing focus on sustainability in medical products and the need for long-term, reliable solutions have reinforced the prominence of reusable dosing cups The availability of reusable cups in multiple capacities and the ability to integrate with existing hospital procedures further support their leading position in the oral dosing cup market.

The 5 ml - 15 ml capacity segment is expected to account for 40.00% of the Oral Dosing Cup market revenue share in 2025. This segment has grown due to its suitability for administering precise doses of liquid medications, which is critical for patient safety.

The compact size ensures ease of handling by healthcare providers and patients, reducing the risk of dosing errors. Its widespread compatibility with commonly prescribed medication volumes has further contributed to adoption.

Hospitals and clinics prefer this capacity range as it balances accurate dosing with operational efficiency, minimizing medication waste The segment is also supported by growing awareness of dosing accuracy and patient compliance, particularly in pediatric and geriatric care, where precise liquid medication administration is vital.

The hospital end-user segment is anticipated to account for 48.60% of the Oral Dosing Cup market revenue in 2025, establishing it as the leading end-use segment. Growth is driven by the high demand for standardized dosing tools that ensure safe and accurate medication administration in clinical settings.

Hospitals prioritize reusable cups due to their durability, sterilization capability, and cost-effectiveness, making them suitable for repeated use in high-volume environments. The adoption is further supported by increasing patient volumes, regulatory mandates for medication safety, and the need to minimize dosing errors.

Hospitals benefit from the ability to integrate dosing cups into daily medication routines, ensuring consistency and reliability Additionally, the emphasis on patient compliance, workflow efficiency, and infection control measures reinforces the prominence of this segment in the oral dosing cup market.

Oral Dosing Cups are in High Demand across Healthcare Sectors

The growth of the oral dosing cup industry can be attributed to the rising demand for such cups in hospitals, clinics, retail pharmacies, pharmaceutical industries, and other applications worldwide. These dosing cups are mainly used for administering fluid medication dosages. The oral cups market is classified into three forms based on their volume capacity. This classification helps distinguish between these dosing cups, thus increasing the manufacturing demand.

Healthcare Professionals Advocate Oral Dosing Cups for Accurate Dosage Administration

Oral dosing cups are simple tools used for accurately administering medication dosages, especially in liquid form. Healthcare professionals recommend using these cups for precise medication intake, either with liquid doses or alongside medicine, as needed, to ensure effective treatment. The future outlook is highly positive, driven by the rising incidence of chronic diseases and the increasing aging population globally. This, in turn, boosts the demand for liquid medication and accurate dosage administration tools like oral dosing cups.

Tech Innovations Revolutionize Oral Dosing Cups for Enhanced Medication Accuracy

Advancements in healthcare technologies lead to the innovation and development of more efficient and user-friendly oral dosing cups suitable for all age groups. Manufacturers aim to produce cups with advanced features such as easy-to-read markings, child-resistant caps, and spill-proof designs, all crucial for accurate medication intake.

Also, the growing awareness among the population regarding the importance of precise medication dosage is likely to contribute to the increasing industry revenue. These factors are expected to drive the adoption of oral dosing cups in clinical and homecare settings.

Comparing the sector's position in 2020 to 2025, the oral dosing cup market was not very developed but showed signs of development with ongoing advancements. The valuation for 2020 was USD 406.6 million, and for 2025, it was 326.3 million. A CAGR of 3.3% from 2020 to 2025 indicates the adoption of various developments in the oral dosing cup sector.

From 2025 to 2035, a 4.5% CAGR in industrial growth is expected to reach a high due to manufacturers moving towards research and development and improving product quality with highly advanced benefits. The increasing demand for oral dosing cups in various sectors is fueling the growth rate of the sector. Companies are focusing on formulating sustainable and safe products and adhering to quality standards.

Diversification of the product is another main strategy, with reusable and disposable solutions being promoted. Disposable oral dosing cups address hygienic concerns, while reusable cups are targeting sales in various countries. The popularity of disposable cups is high as they are proven to eliminate medication errors and other risks, showing high sales in the oral dosing cup market.

The following section presents a few countries that indicate the growth of the oral dosing cup market in terms of CAGR from 2025 to 2035. It provides detailed information on the main countries in several parts of the globe, including various regions like North America, Asia Pacific, and Europe. The table below shows moderate growth in the Asia Pacific region compared to others, with certain countries exhibiting the highest growth revenue, such as India with a CAGR of 6.7%.

| Countries | CAGR 2025 to 2035 |

|---|---|

| United State | 3.5% |

| Canada | 3.1% |

| Germany | 3% |

| United Kingdom | 3.8% |

| Italy | 2.9% |

| Spain | 4.5% |

| France | 2.8% |

| China | 6.1% |

| Japan | 3.6% |

| South Korea | 4.2% |

| India | 6.7% |

| Thailand | 5.7% |

The oral dosing cup market in the United States is anticipated to register a CAGR of 3.5% through 2035, driven by the demand for precise dosage and the wide adoption of liquid medication. These factors contribute to industry expansion. Pediatric patients require accurate dosing, and liquid medication is generally prescribed for children for ease of administration.

Manufacturers are focusing on this demand by designing these dosing cups to meet patients' needs. Hospitals and pharmaceutical industries are utilizing these cups as efficient units of dosing. Also, overcoming the risk of contamination is influencing the sector's growth in the United States.

China’s oral dosing cup market is projected to showcase a CAGR of 6.1% during the forecast period. The huge population and enhanced healthcare infrastructure have fueled significant demand for healthcare products, including these dosing cups. Personnel in healthcare and caregivers are becoming more aware of medication safety, with these dosing cups playing a crucial role in reducing errors and ensuring dosage accuracy.

The pharmaceutical sector in China is competitive, with the formulation of these dosing cups happening at both local and international levels. Industries are aiming for continuous innovation to enhance features, contributing to the continued expansion and magnification of industrial.

India's oral dosing cup market is set to experience significant growth with a CAGR of 6.7% through 2035. The rising prevalence of diseases related to oral infections has led governmental agencies and healthcare services professionals to invest in research and development to innovate new products.

Companies in India must adhere to governmental guidelines to ensure product quality and safety. Manufacturers are focusing on customer satisfaction by producing products under these rules, which helps build trust in the industry and improve brand and product portfolios. These activities are expanding the growth rate of the oral dosing cup industry.

Reusable dosing cups lead the oral dosing cup industry. This segment is expected to create an incremental opportunity of 78.6% industry share in 2025. Hospitals are the primary end users of the oral dosing cup industry, with the segment anticipated to hold around 48.6% of industry share in 2025.

| Segment | Reusable (By Product) |

|---|---|

| Value Share (2025) | 78.6% |

Along with the rising demand for reliable and accurate drug measuring instruments, there is a growing demand for reusable oral dosing cups. These cups exhibit excellent properties and benefits as they are easy to handle, lightweight, and low-cost, making them highly popular in hospitals, clinics, and home care settings.

Industrialists designed these cups for multipurpose use, making them ideal solutions for patients with long-term medication needs. The reusable dosage cups are poised to lead the industry due to their cost-effectiveness and reliability for drug administration.

| Segment | Hospitals (By End Users) |

|---|---|

| Value Share (2025) | 48.6% |

Oral dosing cups play a key role in patient care in hospitals, helping manage chronic infections and providing low-cost treatment options. These cups administer medications to a diverse patient population, addressing both acute and chronic conditions. They are efficient and extremely helpful tools in hospitals, enabling healthcare professionals to treat a wide range of patients effectively.

Hospitals prioritize solid oral dosage forms to optimize resource utilization, relying heavily on solid dosages like tablets for drug administration. For children, hospitals primarily use liquid medication administered through these dosing cups on a large scale.

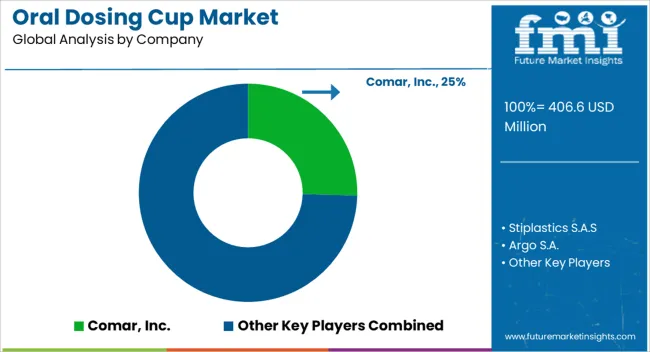

Key players in the oral dosing cup market undertake various activities to stay ahead in the industry. Several industries invest in research and development to develop new applications or products. Some industries engage in strategic collaborations with small-scale industries to reduce competition and generate new product ideas through collaboration. Competitors are mostly evaluated based on the products and services they offer. In the following section, several companies are explained in depth, playing a leading role in the industry.

Comar, Inc. is a key player in the sector, with a rich history starting from the establishment of plastic packaging options. The industry has since experienced exponential growth, expanding its product portfolio and capturing a significant industry share. They offer personalized, high-quality oral dose cups that comply with regulatory standards. Comar's cups are widely used in the healthcare and consumer industries, including the pharmaceutical sector.

The origin of pharma packaging is renowned for manufacturing packaging solutions for pharmaceutical products, including oral dose cups. The sector produces high-quality, well-designed products at competitive prices. It is experiencing significant growth, adopting a customer-centric approach, and focusing primarily on sustainability.

Industry Updates

Based on product type, the industry is bifurcated into disposable and reusable

Depending on the capacity, the industry is categorized into <5 ml, 5 ml - 15 ml, 15 ml - 25 ml, >25 ml.

Key end user present in the industry are hospital, clinics, retail pharmacy, pharmaceuticals, and others.

Regional analysis of the industry include key countries of North America, Latin America, Asia Pacific, Middle East and Africa, and Europe.

The global oral dosing cup market is estimated to be valued at USD 406.6 million in 2025.

The market size for the oral dosing cup market is projected to reach USD 631.5 million by 2035.

The oral dosing cup market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in oral dosing cup market are reusable and disposable.

In terms of capacity, 5 ml - 15 ml segment to command 40.0% share in the oral dosing cup market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oral Bone Implant Material Market Size and Share Forecast Outlook 2025 to 2035

Cupcake Box Market Size and Share Forecast Outlook 2025 to 2035

Oral Solid Dosage Pharmaceutical Formulation Market Size and Share Forecast Outlook 2025 to 2035

Cup Filling Machines Market Forecast and Outlook 2025 to 2035

Oral Care Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oral Irrigator Market Size and Share Forecast Outlook 2025 to 2035

Cupcake Liner Market Size and Share Forecast Outlook 2025 to 2035

Oral Antiseptics Market Size and Share Forecast Outlook 2025 to 2035

Oral Food Challenge Testing Market Analysis Size and Share Forecast Outlook 2025 to 2035

Oral Care Market Growth – Demand, Trends & Forecast 2025–2035

Cupcake Containers Market Size and Share Forecast Outlook 2025 to 2035

Dosing Bottles Market Size and Share Forecast Outlook 2025 to 2035

Cupcake Wrappers Market Size and Share Forecast Outlook 2025 to 2035

Cup Holder Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Oral Dosage Powder Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Oral Clinical Nutrition Desserts Market Analysis - Size, Growth, and Forecast 2025 to 2035

Cup Fill and Seal Machine Market by Automation Level from 2025 to 2035

Cup Carriers Market Size, Share & Trends 2025 to 2035

Cup Sleeves Market Growth - Demand, Trends & Forecast 2025 to 2035

Oral Dose Packaging Market Trends & Growth Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA