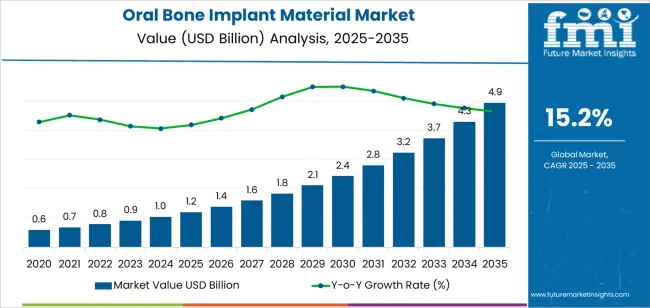

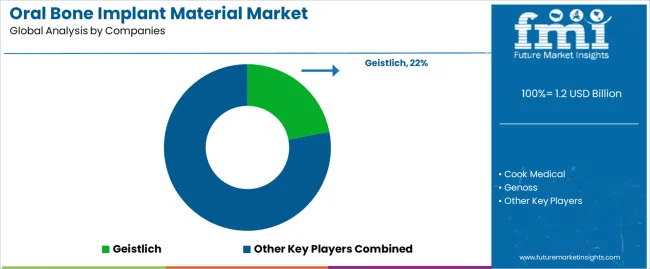

The oral bone implant material market is valued at USD 1.2 billion in 2025 and is expected to reach USD 5.0 billion by 2035, expanding at a CAGR of 15.2%. Growth is driven by the rising prevalence of dental implant procedures, increasing awareness of oral rehabilitation, and advancements in regenerative biomaterials designed for bone grafting and tissue integration. Expanding access to dental care in emerging economies and growing adoption of implant-based restorations in aesthetic dentistry continue to reinforce market expansion.

Autologous bone remains the leading material type due to its superior biocompatibility, osteogenic potential, and natural integration with host tissue. It is widely preferred for complex implant surgeries requiring high structural stability and predictable regeneration outcomes. Allograft, xenograft, and synthetic substitutes are gaining traction as secondary options, providing versatility in clinical applications while reducing donor-site morbidity. Continuous research into bioactive ceramics, collagen matrices, and hybrid biomaterials is further enhancing graft performance and healing efficiency.

Asia Pacific leads global market growth, supported by expanding dental infrastructure and rising demand for reconstructive implant procedures in China and India. Europe and North America maintain steady adoption through established clinical practices and innovation in biomaterial technology. Major companies include Geistlich, Cook Medical, Genoss, Zimmer Biomet, Zhenghai Bio-Tech, and Botiss Biomaterials, focusing regenerative performance, material purity, and long-term clinical outcomes.

Peak-to-trough analysis indicates distinct phases of expansion and short correction intervals as the market evolves through innovation cycles and clinical adoption rates. Between 2025 and 2028, the market will experience its first strong growth peak driven by rising dental implant procedures, improvements in bone graft substitutes, and increased acceptance of alloplastic and xenograft materials. This early acceleration will be supported by growing clinical emphasis on bone regeneration and faster recovery outcomes.

A moderate trough is expected between 2029 and 2031 as pricing pressures and standardization across developed markets create temporary growth slowdowns. This stabilization phase will coincide with competitive consolidation and increased production efficiency. Post-2031, the market is projected to enter a renewed upward cycle as bioactive and nanostructured implant materials achieve wider regulatory approval and integration into dental reconstruction practices. The peak-to-trough pattern demonstrates a healthy, cyclical expansion supported by sustained innovation, clinical validation, and global adoption of advanced biomaterials in restorative dentistry.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.2 billion |

| Market Forecast Value (2035) | USD 5.0 billion |

| Forecast CAGR (2025-2035) | 15.2% |

The oral bone implant material market is expanding as dental implant procedures and bone regeneration treatments increase globally. Materials that support jawbone augmentation and repair before or during implant placement are essential for ensuring stability and success in implantology. Rising incidence of tooth loss, dental disorders, and demand for aesthetic dental care drive adoption of implant materials. Advances in synthetic grafts, allografts, xenografts, and bioactive membranes improve osseointegration, biocompatibility, and clinical outcomes, expanding treatment options and market reach.

Manufacturers offer a variety of material types, autologous bone, natural donor bone, and synthetic substitutes, to match different clinical needs and price sensitivities, leading to segmentation across material and application settings (hospital, dental clinic). Emerging regions with increasing disposable income and technological access are witnessing heightened demand. Regulatory acceptance and innovation in guided bone regeneration protocols accelerate material usage in dental surgeries. Constraints include the cost of premium biomaterials, variability in regulatory frameworks across geographies, and challenges in matching material performance to patient-specific anatomy and health conditions.

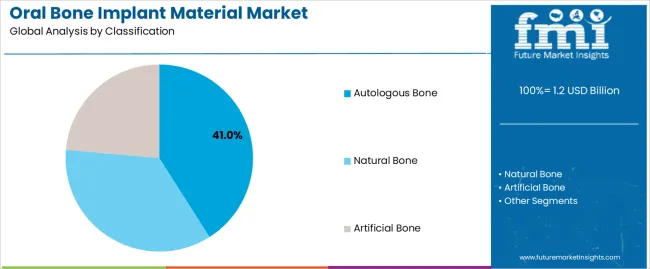

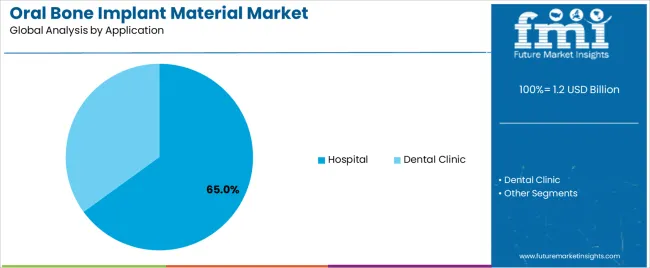

The oral bone implant material market is segmented by classification and application. By classification, the market is divided into autologous bone, natural bone, and artificial bone materials. Based on application, it is categorized into hospitals and dental clinics. Regionally, the market is divided into Asia Pacific, Europe, North America, and other key regions.

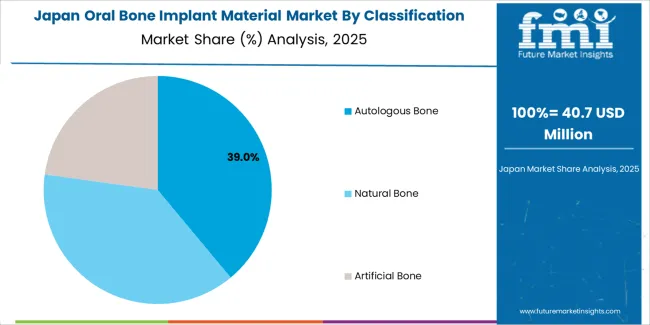

The autologous bone segment holds the leading position in the oral bone implant material market, representing approximately 41.0% of the total share in 2025. Autologous bone grafts, harvested from the patient’s own body, remain the clinical standard due to their superior osteogenic, osteoinductive, and osteoconductive properties. These grafts integrate naturally with the host tissue, minimizing immune response and enhancing long-term implant stability.

This segment’s dominance is supported by strong clinical outcomes in complex dental reconstruction procedures, including sinus lifts, ridge augmentation, and socket preservation following tooth extraction. Despite the requirement for an additional surgical site, autologous bone continues to be favored for its biological compatibility and predictability of regeneration. The natural bone segment, typically derived from allograft or xenograft sources, follows in usage due to its ease of availability and reduced surgical invasiveness. The artificial bone category, comprising synthetic materials such as hydroxyapatite and tricalcium phosphate, is growing gradually due to material innovation and reduced donor-site limitations.

Key factors supporting the autologous bone segment include:

The hospital segment accounts for approximately 65.0% of the oral bone implant material market in 2025. Hospitals dominate due to their capacity to perform advanced maxillofacial and reconstructive dental procedures requiring bone grafting and implant placement under controlled clinical conditions. These facilities have access to specialized surgical equipment, imaging technologies, and multidisciplinary expertise essential for managing complex bone regeneration cases.

The dental clinic segment follows, driven by increasing adoption of artificial and natural bone graft substitutes in routine implantology and minor augmentation procedures. The expanding number of implant-focused dental clinics equipped with regenerative technologies is gradually contributing to this segment’s growth, though hospital-based procedures continue to account for the majority of high-complexity cases.

Primary dynamics driving demand from the hospital segment include:

Ageing population, rising dental implant demand, and advances in graft materials stimulate market growth.

The oral bone implant material market is expanding because of increasing tooth loss and periodontal disorders in ageing and middle-aged populations. Growing patient acceptance of implantology and cosmetic dental treatments raises demand for jaw-bone augmentation solutions. Continuous innovation in synthetic bone grafts, growth factor delivery systems, and resorbable membranes improves outcomes for bone regeneration procedures. Enhanced awareness of oral health and accessibility to advanced dental care in emerging markets further support uptake of bone implant materials in hospital and clinic settings.

High regulatory scrutiny, cost sensitivity, and variability in biomaterial performance restrict adoption.

The development and approval of bone implant materials involve complex regulatory pathways, which raise time-to-market and production expenses. The relative cost of premium graft materials limits adoption in price-sensitive regions or among low-income patients. Some autologous or biologic graft options require donor harvesting or immunological matching, affecting patient willingness and complicating logistics. Variability in osseointegration and healing outcomes associated with different material types also constrains uniform adoption across geographies.

Growth of synthetic and hybrid graft materials, digital-guided regenerative procedures, and expansion in Asia-Pacific markets define industry trajectory.

Manufacturers increasingly offer artificial bone substitutes with enhanced biocompatibility and design options to overcome limitations of natural grafts. Digital imaging and 3D-guided surgical planning facilitate precise placement of bone implant materials, improving predictability and procedure efficiency. The Asia-Pacific region shows robust growth due to rising disposable income, improving dental infrastructure, and heightened demand for aesthetic and restorative dental services.

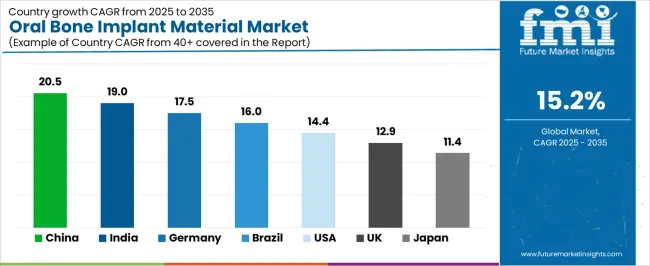

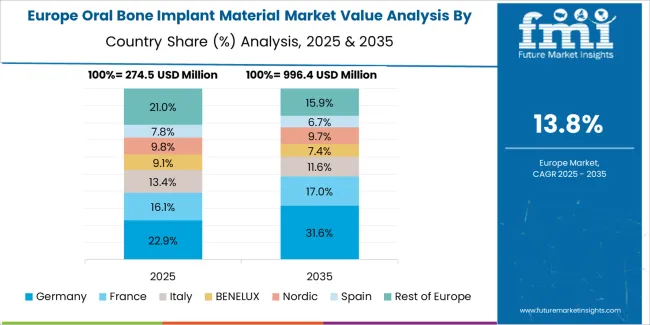

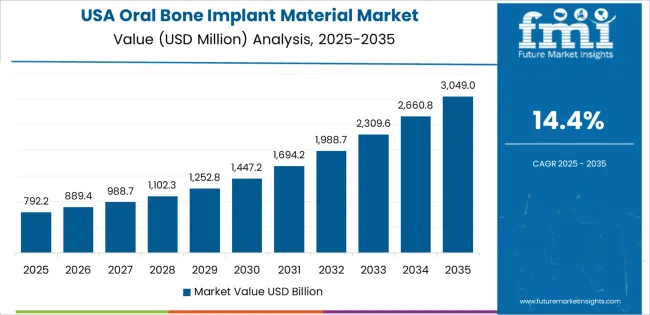

The global oral bone implant material market is expanding rapidly through 2035, supported by increasing dental implant adoption, rising prevalence of periodontal diseases, and advancements in regenerative biomaterials. China leads with a 20.5% CAGR, followed by India at 19.0%, reflecting strong dental infrastructure development and growing healthcare accessibility. Germany grows at 17.5%, driven by research leadership in bone graft substitutes and biomaterial engineering. Brazil’s 16.0% growth stems from private dental practice expansion and implant procedure affordability. The United States records 14.4%, supported by innovation in synthetic grafts and advanced regeneration technologies, while the United Kingdom (12.9%) and Japan (11.4%) maintain steady growth through precision manufacturing and clinical innovation.

| Country | CAGR (%) |

|---|---|

| China | 20.5 |

| India | 19.0 |

| Germany | 17.5 |

| Brazil | 16.0 |

| USA | 14.4 |

| UK | 12.9 |

| Japan | 11.4 |

China’s market grows at 20.5% CAGR, supported by increased demand for dental implants, advanced healthcare policies, and domestic biomaterial manufacturing. Local producers are scaling up the supply of alloplastic bone graft materials, including hydroxyapatite (HA) and β-tricalcium phosphate (β-TCP), to meet clinical demand. The Healthy China 2030 initiative is expanding oral healthcare infrastructure and dental implant awareness. Universities and biotechnology firms are collaborating on nanostructured and bioresorbable scaffolds to improve osseointegration. The growing middle-class population and access to affordable dental services continue to strengthen long-term market prospects.

Key Market Factors:

India’s market grows at 19.0% CAGR, driven by the expanding dental implant base, growth in regenerative medicine, and domestic biomaterial innovation. The Make in India and National Oral Health Programme initiatives are improving production and distribution of bone graft substitutes. Indian dental manufacturers are introducing cost-effective xenograft and alloplastic materials for implant restoration. Collaborations with global dental suppliers support technology transfer and clinical standardization. Rising demand for aesthetic dental restoration, coupled with the rapid growth of private clinics, is increasing consumption of biocompatible implant materials across major metropolitan areas.

Market Development Factors:

Germany’s market grows at 17.5% CAGR, supported by advancements in tissue engineering, material research, and clinical innovation. German dental and biomaterial manufacturers lead in developing synthetic and xenogeneic bone grafts with optimized pore structures and bioactivity. The integration of digital implant planning and guided regeneration protocols enhances surgical precision. Research institutions are developing bioactive coatings and growth factor-embedded scaffolds for improved osseointegration. Regulatory alignment under the EU Medical Device Regulation (MDR) ensures consistent product quality and clinical reliability. Demand remains strong across both private and institutional dental practices.

Key Market Characteristics:

Brazil’s market grows at 16.0% CAGR, supported by expanding dental implant adoption, local biomaterial manufacturing, and medical tourism. Domestic dental suppliers are producing deproteinized bovine bone grafts and synthetic substitutes tailored for implant restoration. Collaboration with international dental firms enhances clinical training and product quality. The government’s support for oral healthcare accessibility under Brazil Smiles Program increases demand for affordable graft materials. Universities and research institutions are advancing studies on bone regeneration using collagen composites and calcium phosphate systems. Growing aesthetic dentistry awareness and private clinic networks contribute significantly to market expansion.

Market Development Factors:

The United States grows at 14.4% CAGR, supported by technological innovation, clinical research, and high implant adoption rates. Manufacturers are introducing next-generation synthetic and allogeneic bone grafts featuring bioactive glass and nanohydroxyapatite compositions. The integration of growth factor-based regenerative materials enhances osseointegration and recovery time. FDA-approved products are expanding clinical confidence in tissue regeneration applications. Increasing demand for minimally invasive bone augmentation procedures and improved surgical outcomes drives continued investment in R&D. The market benefits from established distribution networks and adoption across dental clinics and surgical centers nationwide.

Key Market Factors:

The United Kingdom’s market grows at 12.9% CAGR, supported by the expansion of regenerative dental procedures, research investment, and digital implant planning adoption. British dental clinics are integrating bioresorbable xenografts and alloplastic bone substitutes in implant procedures. Government-funded research programs through Innovate UK are supporting bioengineering advancements in calcium phosphate composites and collagen scaffolds. Collaboration between dental institutions and biomaterial firms enhances clinical training and product standardization. The growing trend toward aesthetic restoration and long-term treatment durability supports steady demand for advanced oral bone implant materials.

Market Development Factors:

Japan’s market grows at 11.4% CAGR, reflecting technological advancement, dental expertise, and clinical quality standards. Domestic firms are producing precision-engineered synthetic bone grafts using bioceramic and collagen-based matrices. Research under the Green Innovation Fund promotes green material development with high bioactivity and structural stability. Universities are exploring stem-cell-assisted bone regeneration and nanomaterial coating techniques to enhance bone integration. The aging population’s rising need for restorative dentistry drives demand for biocompatible grafting materials. Japan’s regulatory alignment with ISO and PMDA guidelines ensures consistent product performance and safety.

Key Market Characteristics:

The oral bone implant material market is moderately consolidated, with approximately fifteen major global and regional manufacturers active in dental regenerative biomaterials and implant dentistry. Geistlich holds the leading position with an estimated 22.0% global market share, supported by its extensive expertise in collagen-based xenografts and proven clinical outcomes in guided bone regeneration (GBR) and sinus lift procedures. Its leadership is reinforced by consistent research collaborations and a strong global presence across dental education and surgical training networks.

Zimmer Biomet, Dentsply Sirona, and Cook Medical follow as prominent competitors, leveraging vertically integrated implant portfolios and advanced bioresorbable material technologies. Their competitive advantage lies in comprehensive regenerative solutions that combine scaffolding, grafting, and barrier functions for predictable bone healing. Botiss Biomaterials, Genoss, and ACE Surgical serve as mid-tier manufacturers focusing on synthetic and composite bone substitutes designed for improved biocompatibility and structural integrity.

Asian producers such as Zhenghai Bio-Tech, RESHINE-BIO, and Beijing Datsing Bio-Tech strengthen regional supply capabilities through cost-effective production, expanding R&D, and localization of clinical support. European participants including Bioteck, Dentegris, and Keystone Dental maintain stable positions through standardized product quality and regulatory compliance.

Competition in this market is primarily defined by material biocompatibility, resorption rate, and osteoconductive performance. Demand growth is driven by increased adoption of regenerative implant techniques, with manufacturers focusing next-generation biomaterials that enhance bone integration, reduce healing time, and align with international dental safety standards.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Classification | Autologous Bone, Natural Bone, Artificial Bone |

| Application | Hospital, Dental Clinic |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | India, China, USA, Germany, South Korea, Japan, Italy, and 40+ countries |

| Key Companies Profiled | Geistlich, Cook Medical, Genoss, Zimmer Biomet, Zhenghai Bio-Tech, Botiss Biomaterials, Dentsply Sirona, ACE Surgical, OraPharma, Neoss Limited, Keystone Dental, Bioteck, Dentegris, ALLGENS MEDICAL, Pashionbio, RESHINE-BIO, Beijing Datsing Bio-Tech |

| Additional Attributes | Dollar sales by classification and application categories; regional adoption trends across Asia Pacific, Europe, and North America; competitive landscape of bone graft and implant biomaterial manufacturers; advancements in synthetic and natural bone graft substitutes; integration with oral surgery, implantology, and regenerative dental applications. |

The global oral bone implant material market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the oral bone implant material market is projected to reach USD 4.9 billion by 2035.

The oral bone implant material market is expected to grow at a 15.2% CAGR between 2025 and 2035.

The key product types in oral bone implant material market are autologous bone, natural bone and artificial bone.

In terms of application, hospital segment to command 65.0% share in the oral bone implant material market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oral Solid Dosage Pharmaceutical Formulation Market Size and Share Forecast Outlook 2025 to 2035

Oral Dosing Cup Market Forecast AND Outlook 2025 to 2035

Oral Care Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oral Irrigator Market Size and Share Forecast Outlook 2025 to 2035

Oral Antiseptics Market Size and Share Forecast Outlook 2025 to 2035

Oral Food Challenge Testing Market Analysis Size and Share Forecast Outlook 2025 to 2035

Oral Care Market Growth – Demand, Trends & Forecast 2025–2035

Oral Dosage Powder Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Oral Clinical Nutrition Desserts Market Analysis - Size, Growth, and Forecast 2025 to 2035

Oral Dose Packaging Market Trends & Growth Forecast 2025 to 2035

Oral Immunostimulant Market – Demand, Growth & Forecast 2025 to 2035

Oral Clinical Nutritional Cream and Pudding Market Analysis by Product Type and Distribution Channel Through 2035

Competitive Breakdown of Oral Clinical Nutrition Supplements

Market Share Insights for Oral Care Providers

Key Companies & Market Share in the Oral Dosage Powder Packaging Machines Sector

Oral Controlled Release Drug Delivery Technology Market Trends – Growth & Forecast 2025-2035

Oral Clinical Nutrition Supplement Market Trends - Growth & Forecast 2025

Oral Syringe Market

Oral Rinse Market

Oral Anticoagulants Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA