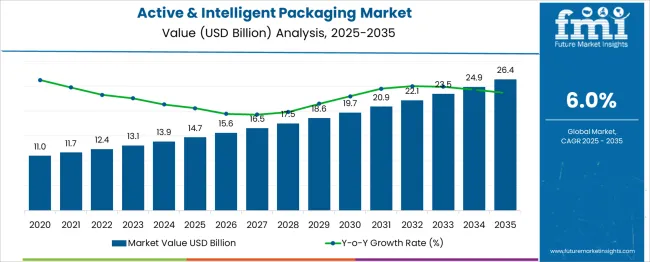

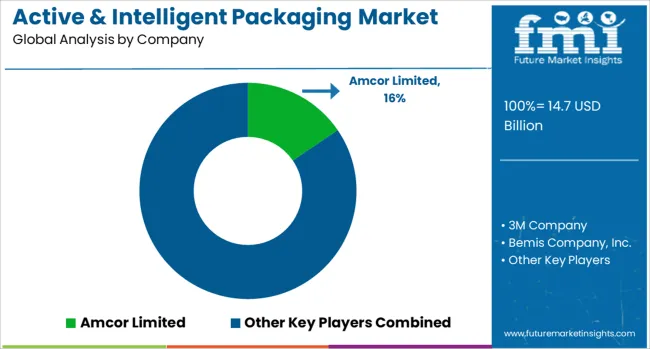

The Active & Intelligent Packaging Market is estimated to be valued at USD 14.7 billion in 2025 and is projected to reach USD 26.4 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period. Between 2025 and 2030, the market expands from USD 14.7 billion to USD 17.5 billion, contributing USD 2.8 billion in growth, with a CAGR of 6.0%.

This early growth is driven by the increasing demand for packaging solutions that enhance product shelf life, maintain quality, and provide real-time information to consumers. The market benefits from the rising focus on consumer safety, convenience, and product traceability in the food and beverage, healthcare, and pharmaceutical sectors.

From 2030 to 2035, the market continues its expansion, growing from USD 17.5 billion to USD 26.4 billion, contributing USD 8.9 billion in growth, with a slightly higher CAGR of 6.3%. This phase sees a sharper increase in demand driven by advancements in smart packaging technologies, such as RFID, sensors, and moisture-regulating materials.

The USD 11.7 billion absolute dollar opportunity highlights the growing adoption of innovative packaging solutions that not only extend product life but also enhance the consumer experience through improved interaction with packaging.

| Metric | Value |

|---|---|

| Active & Intelligent Packaging Market Estimated Value in (2025 E) | USD 14.7 billion |

| Active & Intelligent Packaging Market Forecast Value in (2035 F) | USD 26.4 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The Active & Intelligent Packaging market is experiencing significant growth as industries increasingly seek solutions that enhance product safety, quality, and sustainability. This growth is being propelled by the rising demand for packaging that actively interacts with its contents or environment to extend shelf life, monitor freshness, and ensure authenticity.

Corporate press releases and industry news have highlighted the growing adoption of smart materials and sensors integrated into packaging, driven by stringent food safety regulations and consumer preferences for transparency. Investor presentations and annual reports from leading packaging firms indicate that advancements in nanotechnology, antimicrobial coatings, and printed electronics are expanding the functionality and appeal of such solutions.

Future growth is expected to be shaped by increasing investments in sustainable materials and regulatory support for reducing food waste. The combination of technological innovation, regulatory compliance needs, and heightened consumer awareness is creating robust opportunities for this market to continue its upward trajectory globally.

The active & intelligent packaging market is segmented by technology type, end-user industry, functionality, packaging material, and geographic regions. By technology type, the active & intelligent packaging market is divided into Active packaging and Intelligent packaging. In terms of end-user industry, the active & intelligent packaging market is classified into Food & beverages, Pharmaceuticals & healthcare, Personal care & cosmetics, Consumer electronics, Logistics & supply chain, and Others.

The functionality of the active & intelligent packaging market is segmented into Shelf-life extension, Quality assurance, Traceability & safety, and Consumer engagement. The packaging material of the active & intelligent packaging market is segmented into Plastics, Paper & paperboard, Glass, Metals, and Biodegradable materials.

Regionally, the active & intelligent packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

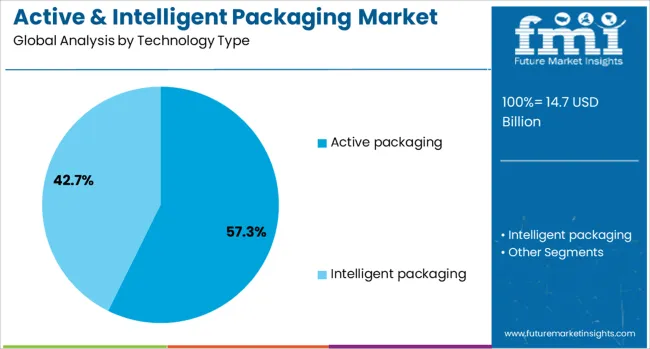

The active packaging segment is projected to hold 57.3% of the Active & Intelligent Packaging market revenue share in 2025, establishing it as the leading technology type. This dominance is being attributed to its ability to enhance food safety and extend product shelf life by actively interacting with packaged goods, as highlighted in technical whitepapers and company announcements.

Adoption has been supported by the integration of oxygen scavengers, moisture regulators, and antimicrobial agents, which address critical concerns of spoilage and contamination. According to industry journals, manufacturers have increasingly preferred active packaging for its capacity to maintain product integrity during extended storage and transportation.

Corporate communications have emphasized that the segment benefits from its compatibility with various materials and formats, making it versatile for diverse applications. These advantages, coupled with rising consumer demand for fresher and safer products, have reinforced active packaging’s leadership in the market for 2025.

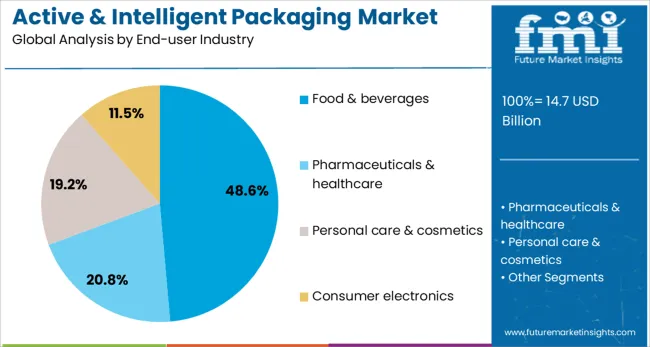

The food and beverages end-user industry is expected to contribute 48.6% of the Active & Intelligent Packaging market revenue share in 2025, making it the dominant end-use segment. This position has been reinforced by the sector’s critical need to ensure product quality, compliance with food safety standards, and reduction of food waste, as noted in government initiatives and corporate strategy updates.

Industry publications have highlighted how producers in this sector are adopting intelligent indicators and active components to address consumer expectations for freshness, traceability, and authenticity. Annual reports from packaging companies have underscored that the segment benefits from continuous innovation in coatings, sensors, and smart labels designed specifically for food and beverage applications.

Increased demand from retail and e-commerce channels, which require extended shelf stability and transparency, has further supported its prominence. These factors have collectively secured the food and beverages segment’s leading role in driving market revenue in 2025.

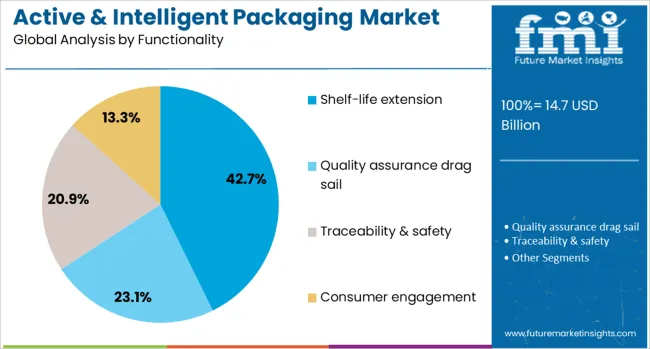

The shelf-life extension functionality segment is anticipated to capture 42.7% of the Active & Intelligent Packaging market revenue share in 2025, confirming its position as the foremost functionality segment. Its prominence is being supported by growing pressures on manufacturers and retailers to minimize product waste and improve inventory management, as discussed in sustainability-focused reports and press statements.

Technical journals have observed that innovations in antimicrobial films, oxygen absorbers, and ethylene scavengers are effectively addressing perishability challenges, particularly in food, pharmaceuticals, and cosmetics. Companies have communicated through product announcements that shelf-life extension solutions have gained preference due to their ability to maintain product freshness and appeal throughout distribution and storage.

Moreover, regulatory bodies’ increasing focus on reducing food waste and ensuring consumer safety has driven investments in this functionality. These drivers have collectively strengthened the segment’s dominance in the overall market landscape in 2025.

The active and intelligent packaging market is experiencing significant growth due to increasing consumer demand for longer shelf life, improved product quality, and real-time monitoring of food and beverage items. Active packaging solutions, which involve the use of materials that interact with the product to extend freshness, and intelligent packaging systems, which monitor and communicate product conditions, are gaining popularity in the food, pharmaceutical, and logistics sectors. Despite challenges like high production costs and regulatory hurdles, advancements in materials technology and the growing preference for smart packaging solutions present key opportunities for market expansion.

The demand for active and intelligent packaging is primarily driven by the growing need for extended shelf life and enhanced product quality, particularly in the food and beverage industry. As consumer preferences shift towards fresher products with minimal preservatives, active packaging technologies that regulate moisture, oxygen, and ethylene are becoming more desirable. In addition, the increasing demand for transparency in product conditions, particularly in pharmaceuticals and perishable goods, is pushing the growth of intelligent packaging systems. These systems provide real-time monitoring of temperature, humidity, and other factors, ensuring that products remain fresh and safe throughout the supply chain. This increasing emphasis on freshness, quality, and consumer safety is fueling the market’s growth.

A major challenge in the active and intelligent packaging market is the high production costs associated with these advanced packaging solutions. The integration of sensors, advanced materials, and interactive technologies into packaging requires significant investment in research, development, and manufacturing. These packaging solutions are often more expensive than traditional packaging, which can limit adoption, particularly in cost-sensitive industries. The compliance with complex regulatory standards for food and pharmaceutical packaging presents additional challenges for manufacturers. These regulations require careful consideration of safety, environmental impact, and product integrity, which can slow the adoption process and increase operational costs. Overcoming these challenges will require innovations to reduce production costs and streamline regulatory compliance.

The active and intelligent packaging market offers significant opportunities in the e-commerce, pharmaceutical, and food industries. The rise of online shopping has led to an increasing need for packaging that can ensure product safety during shipping, especially for perishable items. Active packaging solutions that extend shelf life and intelligent packaging systems that provide real-time tracking are becoming crucial for e-commerce businesses. In the pharmaceutical industry, intelligent packaging plays a key role in ensuring that medications are stored and transported under optimal conditions, improving patient safety. The growing consumer demand for transparency and convenience in the food industry is pushing for innovative packaging solutions. These trends are driving the growth of the active and intelligent packaging market, particularly in emerging markets where packaging innovation is gaining traction.

A significant trend in the active and intelligent packaging market is the integration of smart technologies and the use of sustainable materials. Manufacturers are incorporating sensors, RFID tags, and data-collecting systems into packaging to provide real-time monitoring and traceability, enhancing the consumer experience and ensuring product safety. Furthermore, there is a growing trend toward using biodegradable and recyclable materials in active and intelligent packaging solutions, responding to consumer demand for eco-friendly products. The packaging companies are innovating with new materials that provide the same benefits as traditional packaging while reducing environmental impact. The continued development of eco-friendly, smart packaging solutions is expected to shape the future of the market, catering to both consumer preferences and regulatory demands.

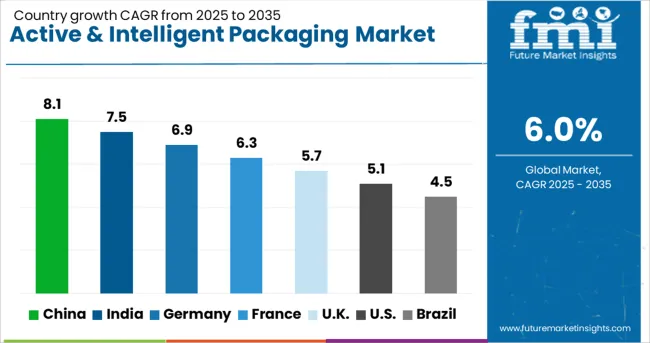

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

The Active & Intelligent Packaging market is projected to grow at a global CAGR of 6.0% from 2025 to 2035, with China leading at 8.1%, followed by India at 7.5%. France shows a growth rate of 6.3%, while the United Kingdom is expected to grow at 5.7%, and the United States at 5.1%. China and India are leading due to rapid urbanization, industrial growth, and rising demand for residential construction. In OECD nations like France, the UK, and the USA, growth is steady, driven by modernization, technological advancement in electrical systems, and increasing focus on residential safety standards. The analysis spans 40+ countries, with the leading markets shown below.

China is projected to grow at a CAGR of 8.1% through 2035, supported by the country’s expanding residential and commercial sectors. The rapid urbanization and industrial growth in China, along with a shift towards smarter cities, are major factors driving the demand for Active & Intelligent Packaging. The Chinese government’s commitment to energy efficiency fuels the adoption of advanced electrical systems. As China becomes a global leader in high-tech manufacturing, the demand for reliable, energy-efficient packaging continues to rise. The market is further boosted by government subsidies and incentives for residential construction projects.

India is projected to grow at a CAGR of 7.5% through 2035, driven by rapid urbanization and industrial growth. The residential construction boom is fueling demand for modern electrical systems like Active & Intelligent Packaging. India’s focus on improving electricity access and energy efficiency is significantly boosting market demand. Government initiatives aimed at providing affordable housing are further promoting the adoption of advanced electrical systems. The growth of the middle class and increasing residential, commercial, and industrial building projects will continue to support the demand for reliable, energy-efficient switchgear solutions in India.

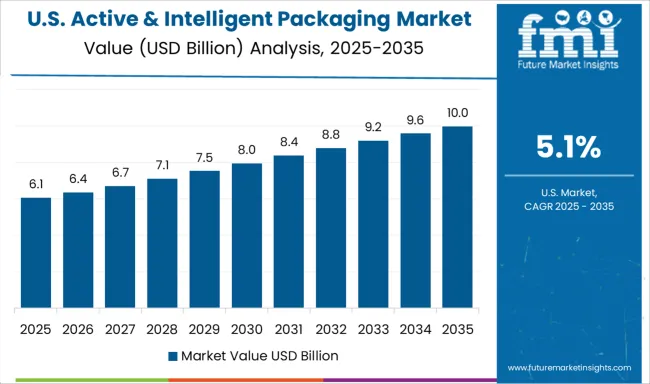

The United States is projected to grow at a CAGR of 5.1% through 2035, with demand driven by infrastructure modernization and growing focus on electrical safety. As the USA continues to modernize its aging electrical infrastructure, the need for Active & Intelligent Packaging to meet increased safety standards and energy efficiency demands grows. The rise in energy-efficient buildings, the adoption of smart home technologies, and stricter safety regulations further contribute to the market expansion. The increase in residential and commercial construction projects, along with the growing need for renewable energy integration, will continue to drive demand for advanced packaging solutions in the USA

Germany is projected to grow at a CAGR of 6.3% through 2035, with market growth driven by increasing demand for energy-efficient electrical systems. Germany’s commitment to reducing carbon emissions and the rise of renewable energy sources are fueling demand for Active & Intelligent Packaging. The country’s focus on smart grids, energy-efficient housing, and sustainable living is driving the need for advanced electrical solutions. As Germany’s residential, commercial, and industrial sectors continue to adopt greener technologies, the demand for modern electrical systems, including switchgear, is expected to rise.

The United Kingdom is projected to grow at a CAGR of 5.7% through 2035, with demand for Active & Intelligent Packaging driven by ongoing investments in infrastructure and energy efficiency. As the UK transitions to cleaner energy and prioritizes smart home technology, the adoption of energy-efficient electrical systems, including modern switchgear, is rising. Government regulations requiring enhanced electrical safety and the increasing demand for reliable, durable electrical infrastructure in residential properties further drive the market growth. The rise of electric vehicle adoption in the UK, supported by government incentives and environmental policies, also fuels the demand for switchgear solutions.

The active and intelligent packaging market is driven by companies specializing in innovative packaging solutions that enhance product preservation, quality monitoring, and consumer engagement. Amcor Limited is a market leader, offering a range of active and intelligent packaging solutions such as temperature-sensitive packaging and freshness indicators, focusing on food, pharmaceuticals, and consumer goods.

3M Company and Bemis Company, Inc. also lead the market, providing intelligent packaging systems designed to monitor environmental factors, such as temperature and humidity, to ensure product safety and quality. Dupont Teijin Films and Mondi Group contribute to the market by offering innovative active packaging materials, including moisture-absorbing and oxygen-scavenging films, which help extend shelf life and improve product quality.

Sealed Air Corporation is well-known for its smart packaging solutions, which integrate sensors and RFID technologies to track and monitor the freshness of food and pharmaceuticals throughout the supply chain. Sonoco Products Company focuses on intelligent packaging technologies, offering solutions that allow manufacturers to enhance consumer experience and improve product protection through real-time monitoring.

Competitive differentiation in this market is driven by the integration of smart sensors, material innovation, and the ability to cater to diverse industries, including food, beverages, pharmaceuticals, and cosmetics. Barriers to entry include high R&D costs, technology development, and regulatory compliance. Strategic priorities include advancing sustainability, expanding into emerging markets, and further enhancing packaging technology to meet growing consumer demand for smart, environmentally friendly solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 14.7 Billion |

| Technology Type | Active packaging and Intelligent packaging |

| End-user Industry | Food & beverages, Pharmaceuticals & healthcare, Personal care & cosmetics, Consumer electronics, Logistics & supply chain, and Others |

| Functionality | Shelf-life extension, Quality assurance drag sail, Traceability & safety, and Consumer engagement |

| Packaging Material | Plastics, Paper & paperboard, Glass, Metals, and Biodegradable materials |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amcor Limited, 3M Company, Bemis Company, Inc., Company, Dupont Teijin Films, Mondi Group, Sealed Air Corporation, and Sonoco Products Company |

| Additional Attributes | Dollar sales by packaging type (smart packaging, active packaging, modified atmosphere packaging) and end-use segments (food, beverages, pharmaceuticals, cosmetics). Demand dynamics are driven by the increasing consumer demand for products with extended shelf life, the growing popularity of e-commerce, and the need for improved supply chain visibility. Regional trends show strong growth in North America and Europe due to the adoption of advanced packaging technologies, while Asia-Pacific is witnessing rapid expansion due to the rise of the middle class and increasing industrialization. |

The global active & intelligent packaging market is estimated to be valued at USD 14.7 billion in 2025.

The market size for the active & intelligent packaging market is projected to reach USD 26.4 billion by 2035.

The active & intelligent packaging market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in active & intelligent packaging market are active packaging, _oxygen scavengers, _moisture absorbers, _ethylene absorbers, _antimicrobial agents, _temperature control packaging, _flavor/odor absorbers, intelligent packaging, _time-temperature indicators (ttis), _rfid tags and qr codes, _freshness indicators, _gas sensors, _smart labels and _interactive packaging.

In terms of end-user industry, food & beverages segment to command 48.6% share in the active & intelligent packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Active Wear Market Size and Share Forecast Outlook 2025 to 2035

Active Charcoal Complexes Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Active Network Management Market Analysis by Component, End Users, and Region Through 2025 to 2035

Active Oxygens Market Analysis by Product Type, Application and Region: Forecast for 2025 to 2035

Active Optical Cable Market Insights - Growth & Forecast 2025 to 2035

Active Spoiler Market Growth - Trends & Forecast 2025 to 2035

Active Humidifier Devices Market - Demand & Forecast 2025 to 2035

Active Damping Smartphone Case Market Growth - Demand & Trends 2025 to 2035

Market Share Insights for Active Packaging Providers

Active Packaging Market Analysis - Demand, Growth & Future Outlook 2024 to 2034

Competitive Overview of Active and Modified Atmospheric Packaging Companies

Active & Modified Atmospheric Packaging Market Trends & Forecast 2024-2034

Active, Smart, and Intelligent Packaging Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Active, Smart, and Intelligent Packaging Manufacturers

Reactive Brominated Flame Retardants Market Size and Share Forecast Outlook 2025 to 2035

Reactive Hot Melt Adhesive Market Forecast Outlook 2025 to 2035

Reactive Arthritis Treatment Market Size and Share Forecast Outlook 2025 to 2035

Reactive Tire Bladder Release Agent Market Size and Share Forecast Outlook 2025 to 2035

Inactive Dried Yeast Market Analysis – Demand, Growth & Forecast 2025 to 2035

Reactive Diluents Market Growth – Trends & Forecast 2022 to 2032

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA